The Trend Following, News Following, Fundamental Analysis and Hedging are the best Deriv strategies for beginners.

How to Trade Binary Options with Deriv

The article aims to illuminate the intriguing landscape of binary options trading for beginners, explicitly using the Deriv platform. This topic is critical as it gives novice traders insights into various trading strategies that can significantly augment their trading skills and potentially enhance profitability. By focusing on strategies tailored for beginners, the article aims to simplify the complex dynamics of the trading world, making it a more accessible venture for those eager to learn.

-

How can I identify trends on Deriv?

You can analyze charts and use technical indicators like moving averages to visually identify uptrends and downtrends in various assets.

-

What expiry times work best for trend trading?

Short-term expiries up to an hour tend to work well when trading intraday trends. End of day binaries align well with longer daily trends.

-

Which technical indicators are useful?

Common indicators like MAs, Bollinger Bands and candlestick patterns help generate buy/sell signals and act as trend confirmation filters.

-

How often should I review my strategy?

At minimum, review performance monthly and after significant market events to ensure your approach remains dynamically optimized for evolving conditions.

What Is a Deriv strategy?

A Deriv strategy is a defined set of rules guiding you when trading binary options on the Deriv platform. Stating what to trade and when helps make rational trading decisions, increasing the probability of successful trades.

Top Deriv strategies

The Trend Following strategy

The Trend Following strategy is a popular approach in binary options trading that involves identifying and aligning with market trends. If the market shows an upward trend, the strategy advocates for a “Call” option. On the other hand, if a downward trend is observed, a “Put” option is suggested. This strategy offers the advantage of simplicity, making it an excellent choice for novice traders.

The Trend Following strategy

Following the News strategy

The Following the News strategy emphasizes staying abreast with the latest news, as economic developments, corporate announcements, and geopolitical events can significantly impact market dynamics. Traders with this information can predict market trends, make informed trading decisions, and thus secure profitable trades.

Fundamental Analysis

Fundamental analysis is a method that involves evaluating an asset's intrinsic value based on a variety of economic, financial, and other pertinent factors. This analysis aids in determining whether the asset is overvalued or undervalued, thus enabling traders to make informed trading decisions.

The Hedging strategy

The Hedging strategy is designed to minimize risk by opening a second position that opposes the first one. For instance, if a trader has placed a “Call” option and the market begins to reverse, a “Put” option can mitigate potential losses.

The Straddle strategy

The Straddle strategy involves simultaneously placing a “Call” and a “Put” option on the same asset. This strategy thrives in volatile markets where price movements are unpredictable, offering opportunities for significant gains.

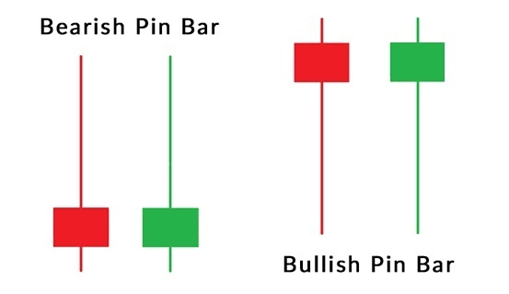

The Pinocchio strategy

The Pinocchio strategy identifies “Pin” bars or candles characterized by a small body and a long wick. These formations often indicate a potential price reversal in the market, presenting an excellent opportunity for traders to capitalize on these market shifts.

The Pinocchio strategy

The Strategy of Using Candlesticks

The Strategy of Using Candlesticks involves studying candlestick patterns to predict future price movements. These patterns provide vital information about potential trend continuations or reversals, making them invaluable for making informed trading decisions.

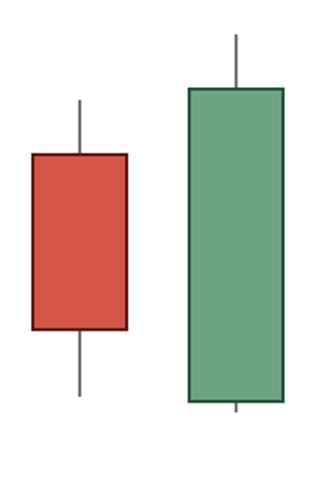

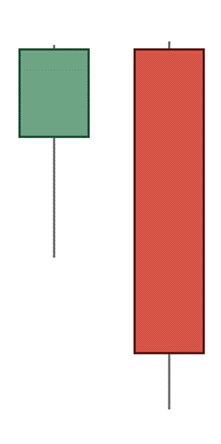

Bullish and Bearish engulfing are among the strongest reversal patterns.

Example of bullish engulfing:

Example of bullish engulfing

Example of bearish engulfing:

Example of bearish engulfing

Which is the best binary strategy for beginners?

The Trend Following and News Following strategies are excellent starting points for beginners. These strategies are not only simple to understand but also straightforward to execute. The Trend Following strategy involves aligning your trades with market momentum, while the News Following strategy requires you to stay updated with news events that drive market trends.

Both strategies lay a solid foundation for new traders, providing a structured approach to trading and the necessary flexibility to adapt to market changes. Additionally, by employing these strategies, beginners can start understanding market dynamics and gradually develop their unique trading styles.

Expert tips to improve your binary trading

Have a trading plan. An effective trading plan serves as the cornerstone of successful trading. This plan should include your trading goals, which must be realistic, measurable, and compatible with your risk tolerance. It should also specify the assets you wish to trade. These could range from stocks and commodities to Forex and cryptocurrencies. Identifying your assets will facilitate more informed decision-making.

Choose your strategy. Your plan should also delineate the trading strategy you intend to use. Whether it's trend-following, news trading, or any of the strategies discussed above, having a clear strategy enhances your odds of achieving your trading goals.

Risk management measures. The risk management measures you'll adopt are essential to any plan. These include setting stop-losses and take-profit levels to shield your capital from significant losses and secure profits when they materialize.

Patience is key. Successful trading is often a game of waiting. It's critical to bide your time for the right opportunities and abstain from making impulsive decisions that don't align with your trading plan. Understanding the market's cycles and exhibiting patience for optimal trading conditions can be a game-changer.

Practice risk management. Trading is naturally risky. However, these risks can be substantially mitigated with robust risk management practices. Tools like stop-loss and take-profit points can shield your capital from excessive losses and lock in profits.

Diversify your portfolio. The saying, "Don't put all your eggs in one basket," is true in trading. It's advisable to trade a variety of asset classes to distribute your risk effectively.

Regular performance reviews. Consistently reviewing and analyzing your trades is essential for trading success. It helps you discern what worked and what didn't, enabling you to refine your strategy and make requisite adjustments. This cycle of review and refinement promotes continuous learning and improvement, contributing to your growth as a trader.

Is binary trading risky?

Yes, binary trading is risky due to the volatile nature of financial markets. However, traders can substantially mitigate these risks by implementing structured trading strategies and effective risk management techniques. These practices, coupled with continuous learning and staying updated with market news, make trading potentially profitable.

Summary

Binary options trading on Deriv offers investors a straightforward way to potentially profit from market moves. While risks exist as with any trading, focusing on proven strategies and diligent risk management can support sustainability.

Beginners are well-served starting simply via trend-following and news-based strategies. With study over time, experience grows as one customizes approaches. Advanced analysts may supplement basics with technical indicators or hedging techniques.

Ongoing learning alongside any strategy chosen, paired with strict money management, positions traders well. Deriv's resources, tools and demo trading lower barriers to participation. Commitment to prudent yet open-minded trading generally leads to sound outcomes.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.