How To Buy/Sell On Deriv: Tutorial

If you want to trade on Deriv, you need: create an account, select an asset, place a trade, complete the trade.

In this article, we provide a comprehensive guide on how to buy and sell on Deriv, a renowned international broker with over 20 years of experience in the trading industry. By the end of this tutorial, readers will gain insights into the trading instruments available on Deriv, understand the platform's features, and learn the step-by-step process of trading on Deriv.

Available trading instruments on Deriv

Many people ask: is Deriv a regulated broker or a scam? Deriv is a regulated and secure broker. Moreover, it's among the best binary options brokers in the world. Deriv, with its rich history spanning over two decades, has earned the trust of more than 2.7 million traders worldwide. One of the hallmarks of Deriv is its extensive range of trading instruments. Here's a detailed overview:

Currency pairs (Forex). Deriv offers a plethora of fiat currency pairs for trading.

Cryptocurrencies, Dive into the volatile world of cryptocurrencies for trading.

Commodities. Trade invaluable natural resources, including oil, gold, and other precious metals.

Indices. Access various global indices, including unique synthetic ones exclusive to Deriv.

CFDs. Engage in Contract for Difference trading, speculating on price movements without owning the actual asset.

Stocks. Get access to stock trading from major global markets.

Options. Engage in digital options trading, predicting asset price movements within a set timeframe.

Synthetic indices. Unique to Deriv, these indices mimic real-world market movements but are artificially generated.

Deriv also boasts several proprietary trading platforms like DTrader, DBot, and DMT5, each tailored to different trading needs. These platforms have tools and features catering to novice and expert traders. With low minimum deposit requirements and high-quality working conditions, Deriv emphasizes making trading accessible to all.

Platform & Features

Deriv offers multiple trading platforms, each designed to cater to specific trading needs:

SmartTrader. A beginner-friendly platform with a straightforward interface and tools to aid informed trading decisions.

DBot. Automate your trading strategies without coding. Create trading bots using a drag-and-drop function.

DTrader. An intuitive platform offering a wide range of financial instruments. Suitable for all trader levels.

Deriv MT5 (DMT5). An advanced platform offering multiple account types tailored to various trading styles. It provides access to a vast range of markets and instruments and offers high leverage, up to 1:1000 for certain assets.

Key features of Deriv include multiple trading platforms, a wide variety of instruments, stringent regulation, an affiliate program, and educational resources.

How much does it cost to trade on Deriv

Trading on Deriv involves certain costs. The spread size varies as Deriv offers both fixed commissions and floating spreads. The commission size can differ based on assets and account types. No account maintenance fees exist, but inactivity might incur a $25 charge. Deposits and withdrawals are free, but commissions set by payment agents may apply. The real account spread starts from $1, and the platform and payment system determine withdrawal commissions.

How to start trading with Deriv

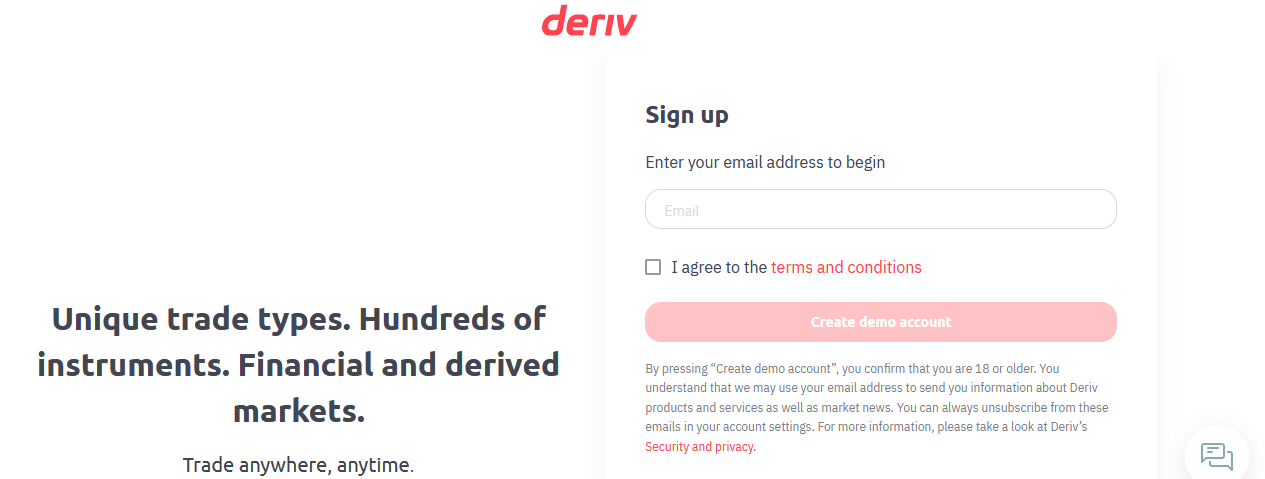

Create an account. Begin by registering on their platform using your email.

How to start trading with Deriv

Log in & set MT5 details. Choose between Synthetic (for synthetic indices) and Financial (for CFDs on commodities, Forex, and cryptocurrencies) accounts. Decide between a Demo or a Real account and set a trading password.

Fund your account. Deposit funds from the Deriv Dashboard to the MT5 dashboard for trading. Deriv minimum deposit is $10 from VISA and MasterCard.

Start trading. Use the web portal Deriv X or MT5 for trading.

How to trade binary options at Deriv

Account creation. Access the Deriv login page and begin binary trading on Deriv by setting up an account.

Choose commodities. Select from a range of commodities available for trading.

Price prediction. Anticipate the price trends of the chosen commodities.

Earnings & withdrawal. Make profits from your trades and withdraw your earnings.

How to trade Forex CFD on Deriv

Registration. Sign up on the Deriv platform to start your Forex CFD trading journey.

Deposit funds. Add funds to your account to facilitate trading.

Engage in trading. Dive into Forex CFD trading on Deriv.

Profit realization. As you make successful trades, realize your profits.

Withdrawal. Cash out your earnings from the platform.

Let's do an example of how to trade on Deriv

Trading on Deriv is a systematic and user-friendly process designed to cater to novice and experienced traders. Here's a step-by-step guide to help you navigate the process of buying or selling an asset on Deriv:

Setting up. The first step before diving into the trading world on Deriv X is to establish your presence on the platform. If you haven't already, sign up using a valid email address. This registration process is your gateway to the vast trading opportunities that Deriv offers.

Selecting an asset. Once logged in, the world of trading assets unfolds before you. Navigate to the Asset Class column and use the filter to sift through the various asset categories. Whether your interest lies in forex, commodities, or the ever-evolving cryptocurrencies, Deriv has covered you.

Placing a trade. With your asset in sight, it's time to make your move. Deriv X offers three intuitive methods to place your trade:

Watchlist method. Right-click on your chosen asset in the watchlist and decide whether to buy (if you anticipate the asset's price will rise) or sell (if you predict a fall).

Price method. Directly click on the Bid (if you're selling) or Ask (if you're buying) price in the watchlist.

Chart method. For those relying on visual cues, right-click the asset's chart and select Buy or Sell.

Finalizing the trade. You're almost there! A 'New Order' box will appear, guiding you through the final steps:

Order type. Choose from Market (current market price), Limit (specific price), Stop (triggered at a certain price), or OCO (One Cancels the Other).

Lot size. Determine the size of your trade.

Direction. Based on your market analysis, decide whether you're buying or selling.

Setting limits. Set your preferred price limit for Limit, Stop, or OCO orders.

Protection orders. Safeguard your investment by setting stop loss or take profit limits.

Send order. With all parameters set, click this to finalize your trade.

In essence, trading on Deriv X is a seamless journey from account setup to trade finalization, ensuring a smooth experience for all traders.

FAQs

How do you make money on Deriv?

Engage in trading on Deriv's platforms or earn through the Deriv affiliate program by referring others.

What is the minimum to trade on Deriv?

The minimum deposit on Deriv is $10 through VISA and Master Card.

What is the highest leverage in Deriv?

Deriv offers leverage of up to 1:1000.

How long does it take to withdraw from Deriv?

Withdrawals from Deriv typically take 1 working day.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.