deposit:

- $10

Trading platform:

- MT5

ECR Capitals Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of ECR Capitals Trading Company

The British broker ECR Capitals offers five real accounts, plus a demo account. Trading is available for currency pairs, metals, and CFDs (Contracts for Differences) on oil, and indices. The minimum deposit is $10. Leverage is up to 1:1000 depending on the account type and traded asset. The standard trade size ranges from 0.01 to 100 lots. The spread is either 0 or 1 pips, depending on the trader's chosen account, and accounts with raw spreads are available. The broker does not charge any trading commissions (except for the Elite account) or withdrawal fees. Trading is conducted through the MetaTrader 5 trading platform, with no restrictions on strategies and methods, and advisors can be used. The broker has implemented an integrated copy trading service, a standard referral program, and several bonus types, including a deposit bonus for the first replenishment. The ECR Capitals website contains educational materials, which are regularly updated. Additionally, there is an economic calendar, a table of National Holidays, online news with analytics, and much more.

👍 Advantages of trading with ECR Capitals:

- Intuitive interface, one of the most popular platforms (MT5), hundreds of assets from three different groups (currencies, metals, and CFDs).

- Minimum deposit is $10, registration takes a few minutes, and a demo account can be opened for free without funding.

- Traders work without limitations as hedging, scalping, and news trading are allowed. Also, variable leverage is available.

- ECR Capitals offers one of the lowest spreads, starting from 0 or 1 pips, depending on a selection of one of five accounts for individuals.

- The trade copying service is conveniently integrated into the platform, allowing investors to passively earn through the trades of more experienced colleagues.

- The broker's technical support operates 24/5, is multilingual, and is available through a call center, email, and online chat.

- The company provides good education materials for beginners, regularly conducts webinars, and publishes news daily.

👎 Disadvantages of ECR Capitals:

- The platform offers a considerable number of popular assets, but all are currency pairs and CFDs, plus some metals. Traders cannot work with stocks, indices, commodities, or other trading instruments.

- Client support is highly valued and responds even during the night, but only on weekdays. This means that traders won't be able to resolve any issues that arise during weekends and will have to wait until Monday.

- There are significant regional restrictions. Residents of European Union countries, the U.S., Canada, and countries listed in the FATF (Financial Action Task Force) blacklist cannot become clients of ECR Capitals broker.

Geographic Distribution of ECR Capitals Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

Many brokers offer their clients various investment options, and it's not necessarily limited to cryptocurrency staking or investing in partner startups. Copy trading services can also be considered a source of passive income. Sometimes referral programs are also included in this category, but such an approach is not entirely accurate. The thing is, referral programs require activity from the trader. If they don't have a popular blog or have limited interaction with colleagues online, the earnings from such a program will be insignificant.

Copy trading for profit and experience

A copy trading service is a platform where a trader can register as a signal provider or investor. The signal provider trades as usual, but their trades are open for investors to join. By joining, the investor automatically duplicates the provider's trades, but the investor can make adjustments, such as changing the trade amount from $10,000 to $1,000. If the trade is successful, everyone earns a profit according to their trades, and the provider charges a small commission to each investor. If the trade fails, everyone loses their bets but pays no fee to the signals provider. Besides passive income, copy trading provides an invaluable learning experience as investors can observe the signal provider's trades and strategies.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program for additional earnings

All referral programs work similarly: a trader receives a unique link and shares it on the internet. Users who follow the link become the trader's referees. The referee registers on the platform, explores the broker's offerings, and if he opens an account, he brings a bonus to the trader who invited him. In the case of ECR Capitals, the bonus is fixed at $5. From a single referral, this bonus can only be received once, but there is no limit to the number of referrals. The partnership program also extends further. For example, the trader receives a commission from all their referees when their trading volume reaches the standard lot size. This means that the partner's profit is not limited to a one-time bonus but is generated continuously as long as the referee trades on the platform.

Trading Conditions for ECR Capitals Users

When a broker offers multiple accounts, the minimum deposit usually depends on the account chosen. This rule applies to ECR Capitals as well. The smallest deposit for the Rookie account is $10. For the Elite account, traders are required to deposit a minimum of $10,000. Note that this is the smallest amount to activate the account conditions. In other words, when opening a Rookie account, a trader can deposit $100, $500, or $1,000, as long as it's not less than $10. This is important because certain bonuses are activated only with a specific deposit amount (for example, a 15% deposit bonus requires a deposit of at least $100). Trading Leverage depends on the account type and asset. The smallest leverage on Elite accounts is 1:200, while the highest on the Rookie account is 1:1000. The broker's client support is available in multiple languages and operates 24/5, including overnight. However, it is unavailable on weekends.

$10

Minimum

deposit

1:1000

Leverage

24/5

Support

| 💻 Trading platform: | MT5 |

|---|---|

| 📊 Accounts: | Rookie, Scalper, ECN, Elite, Islamic, and demo |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa/MC bank cards, online transfer systems |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0 pips |

| 🔧 Instruments: | Currency pairs, CFDs, metals |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

A demo and five real accounts; many assets (mostly currency pairs); one of the highest leverages and narrow spreads; no trading commission on most accounts; no withdrawal fees; available copy trading; a profitable referral program. |

| 🎁 Contests and bonuses: | Yes |

ECR Capitals Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Rookie | $10 | No |

| Scalper | $10 | No |

| ECN | $5 | No |

| Elite | $0 | No |

| Islamic | $10 | No |

Spreads and commissions provide a general overview of a broker's operations. However, the spread may be a variable value. Yes, some brokers offer fixed spreads, but they are quite rare, and ECR Capitals is not among them. That's why traders prefer to receive analytics, which includes comparing spreads and commissions of different brokers. This allows them to clearly see which platform is more advantageous to work with. Traders Union has saved you time. The table below provides data for ECR Capitals and two of its closest competitors.

| Broker | Average commission | Level |

| ECR Capitals | $7 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of ECR Capitals

ECR Capitals is one of the leading ECN brokers in its target regions. The company was launched by professional traders who received substantial investments at the start, giving them an advantage with a clear understanding of traders’ critical trading needs in the interbank market and the need to implement advanced technological solutions to enhance efficiency during trading. Like other leaders in the industry, ECR Capitals uses virtual servers, ultra-fast protocols, and well-established methods to protect funds and data (with SSL certification being just a small part of the matrix). As a result, clients of the broker have confidence that their trades are executed with a maximum speed (averaging 30 ms) and that their funds are securely protected by storing them separately from the broker’s funds. This client-oriented approach is complemented by the transparency of the broker's operations. For example, traders are always aware of all costs in advance.

ECR Capitals by the numbers:

-

Over 100 trading instruments.

-

The minimum deposit is $10.

-

Spreads start from 0 points.

-

Maximum leverage of 1:1000.

-

Trade sizes from 0.01 to 100 lots.

-

24/5 client support availability.

ECR Capitals is a platform for comfortably trading currencies, metals, and CFDs

Some brokers focus on a specific group of assets, such as offering hundreds of instruments, but all of them may be currency pairs. Sometimes they add stocks, indices, and cryptocurrencies. CFDs trading also have their advantages, which is why many companies exclusively deal with them (referred to as CFD brokers). ECR Capitals offers a wide range of currency pairs, including exotic ones that many brokers simply ignore. In addition to Forex, traders can also trade CFDs on indices and oil, allowing for significant diversification of the investment portfolio. Another group of assets represented is metals, including gold, silver, and palladium. Considering the narrow spreads, absence of commissions on most accounts, considerable leverage, and almost complete freedom of action, traders have excellent opportunities for effective risk management with maximum profit potential.

ECR Capitals analytical services:

-

Economic calendars. One of the main tools for traders, it displays important events that can impact asset prices. You can view the calendar for a period ranging from one day to one week.

-

National holidays. Another basic analytical tool related to major events that affect market quotes. The regularly updated table provides dates of holidays and the assets they will impact.

-

Online newsfeeds. The broker uses over 500 news providers. The analytical department filters the feeds, providing traders with a summary of the most significant events in the world of politics and economics that are relevant for forecasting.

Advantages:

Registration takes only a few minutes, and the minimum deposit is $10, indicating a low entry barrier.

Freedom of action and the ability to adapt to the market are ensured by a wide range of assets from three different groups and high leverage (up to 1:1000).

Clients of the broker can earn additional income through copy trading and a referral program. Copying trades provides invaluable experience, especially for beginners.

The company is officially registered and operates under the supervision of the FCA, which is one of the most reliable and respected regulators. Its activities are 100% legal and transparent.

Technical analysis tools and newsfeeds significantly facilitate trading for the broker's clients, making it more successful and increasing profit potential through well-informed forecasts.

Guide on how traders can start earning profits

Since ECR Capitals offers several account types, the first (and most important) step for a trader is to choose an account that’s best for him. Typically, novices opt for the Rookie account due to its low minimum deposit, competitive costs, and high leverage. However, experienced traders may also open a Rookie account. Professionals usually work with the Scalper or ECN accounts, depending on their preferred strategy. The Elite account is suitable for large-scale traders, as it requires a larger initial deposit of $10,000. Islamic accounts do not have swaps, making them suitable for traders who follow Islamic principles.

Account types:

Every client can open a demo account at any time. The demo account is suitable for exploring the platform's capabilities and practicing strategies. It is opened free of charge, and no deposit is required to trade on it. Trading on the demo account is done with virtual funds.

Investment Education Online

Traders are successful only when they trade regularly and engage in continuous learning. Examples of learning include reading trading books, participating in specialized courses and webinars conducted by experts, and studying articles on dedicated portals. Brokers understand this and often strive to help their clients progress. Their assistance can be in the form of detailed FAQs, comprehensive educational courses, and structured blogs. ECR Capitals offers quality education, presented through specialized articles in the corresponding section of the website. Additionally, the company has newsfeeds with analytics, and the platform's experts regularly conduct open webinars.

If you are just getting started in trading, ECR Capitals has a lot to offer you. Experienced market participants may not find something specifically tailored to them among the materials. However, the newsfeeds with analytics is recommended for all traders.

Security (Protection for Investors)

A broker can provide a trader with two significant guarantees. The first guarantee is official registration as a financial organization. The second guarantee is the possession of a license from an international or local regulator. ECR Capitals is registered in the United Kingdom and operates under its laws. The platform holds an FCA license, which speaks to the transparency of its operations. The regulator defends the interests of traders in case of disputes. It is precisely because of these security guarantees that clients of ECR Capitals have no concerns.

👍 Where can you go for help?

- To the broker’s technical support

- To the broker’s legal department

- To the FCA regulator

👎 There is no point in contacting

- The local financial control authorities, unless you are a UK resident

Withdrawal Options and Fees

-

If a trader opens a demo account, he works with market quotes but trade with virtual currency, therefore they do not earn real profits.

-

When a trader decides to open a real account, they enter the international market and trade with real funds, thus they can generate profits.

-

Withdrawal of funds is available at any time, and the minimum amount is determined by the withdrawal channel (often there are no specific requirements).

-

The broker's client can submit a withdrawal request through their user account and receive the payout via a bank card or electronic wallet.

-

The complete list of deposit/withdrawal channels can be found in the user account or obtained from customer support, and all requests are processed promptly.

Customer Support Service

Technical support exists in every broker, but often it fails to function as needed by the clients. This is particularly critical in the case of brokers because traders will inevitably encounter problems that they cannot solve on their own. It could be due to carelessness or insufficient knowledge, and no system is immune to glitches. In such cases, traders turn to technical support. If the support is slow to respond or lacks competence, the broker's clients may become disappointed with the platform and switch to a competitor. To prevent this from happening, ECR Capitals offers modern client support through a call center, live chat, and email. All channels are available 24/5, meaning that specialists work during the day and night without breaks, but only on weekdays.

👍 Advantages

- You don’t have to be a broker’s client to contact technical support

- Responses from the call center and LiveChat are characterized by increased speed

👎 Disadvantages

- On weekends, you won’t be able to resolve your issue with support, you will have to wait until Monday

If you intend to work with ECR Capitals or are already a client of this broker, you can contact support using the following methods:

-

Call center;

-

Email;

-

LiveChat on the website and in the trader’s user account.

Like many brokers, ECR Capitals is present on Facebook, YouTube, Instagram, and Twitter. You can subscribe to the company’s official communities to have quick access to its news.

Contacts

| Foundation date | 2022 |

| Registration address | 130 Old Street, London, England, EC1V 9BD |

| Official site | https://encorecapitals.com/ |

| Contacts |

Email:

admin@tradesbells.com,

Phone: +44 1273 80 7865 |

Review of the Personal Cabinet of ECR Capitals

To work with a broker, it is necessary to register on its website. Then, go through the verification process to confirm your personal information. After that, you can open a real account, make a deposit, and start trading. The process is usually straightforward, but TU has prepared a step-by-step guide to ensure you know exactly what to do.

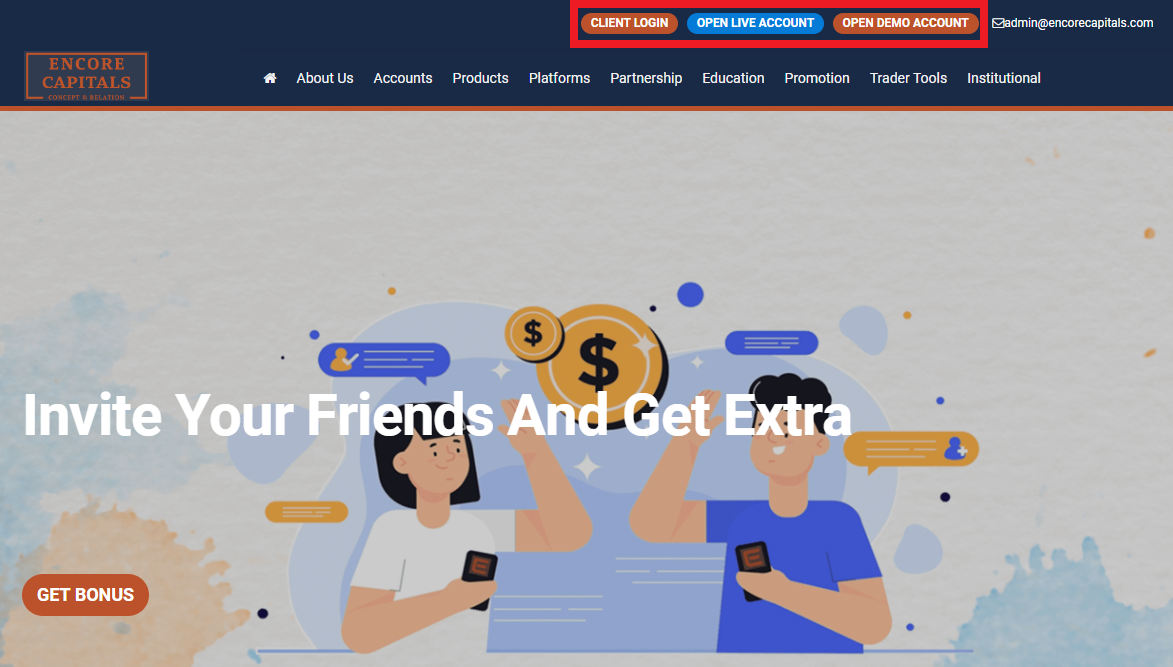

Go to the broker's website. If you are already a client, click on the "Client Login" button. If you want to register, click on "Open Live Account" or "Open Demo Account." The initial registration phase is the same for all account types.

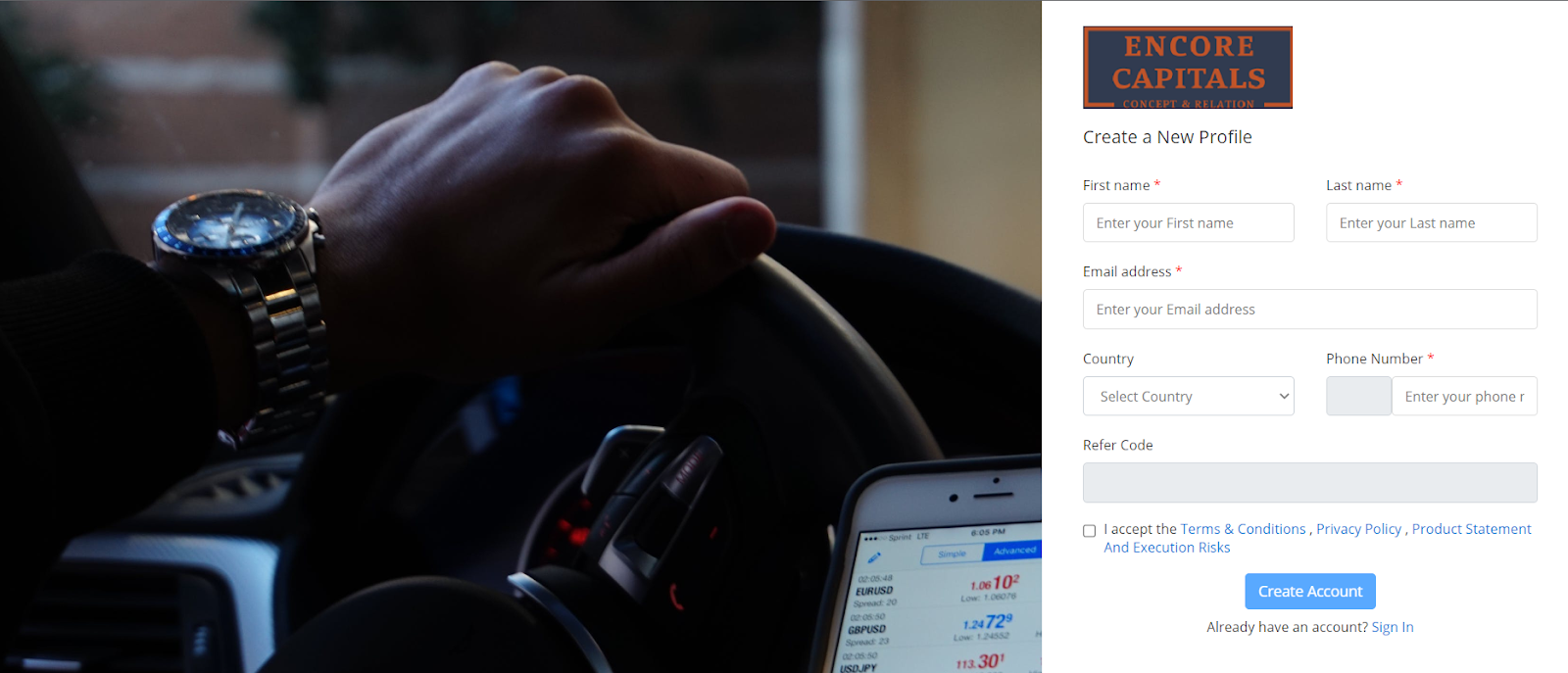

Enter your first name, last name, email address, country of residence, and phone number. If you have a referral code, enter it. Then, agree to the terms of service by checking the box and click on the "Create Account" button.

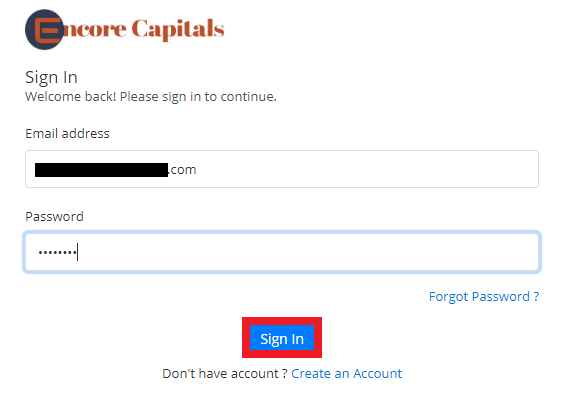

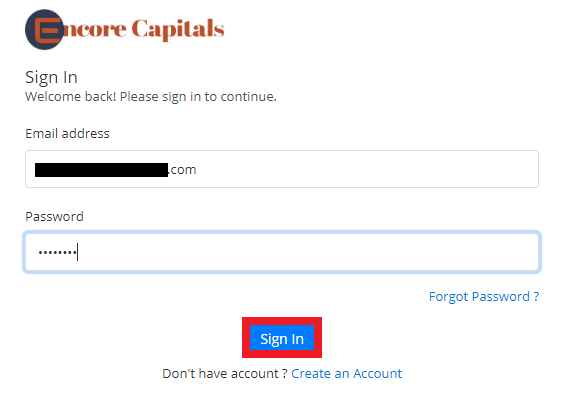

Check your email inbox. You will receive an email from the broker containing your login (your email address) and a generated password (which you can later change). Return to the website, enter your login and password, and click on the "Sign In" button.

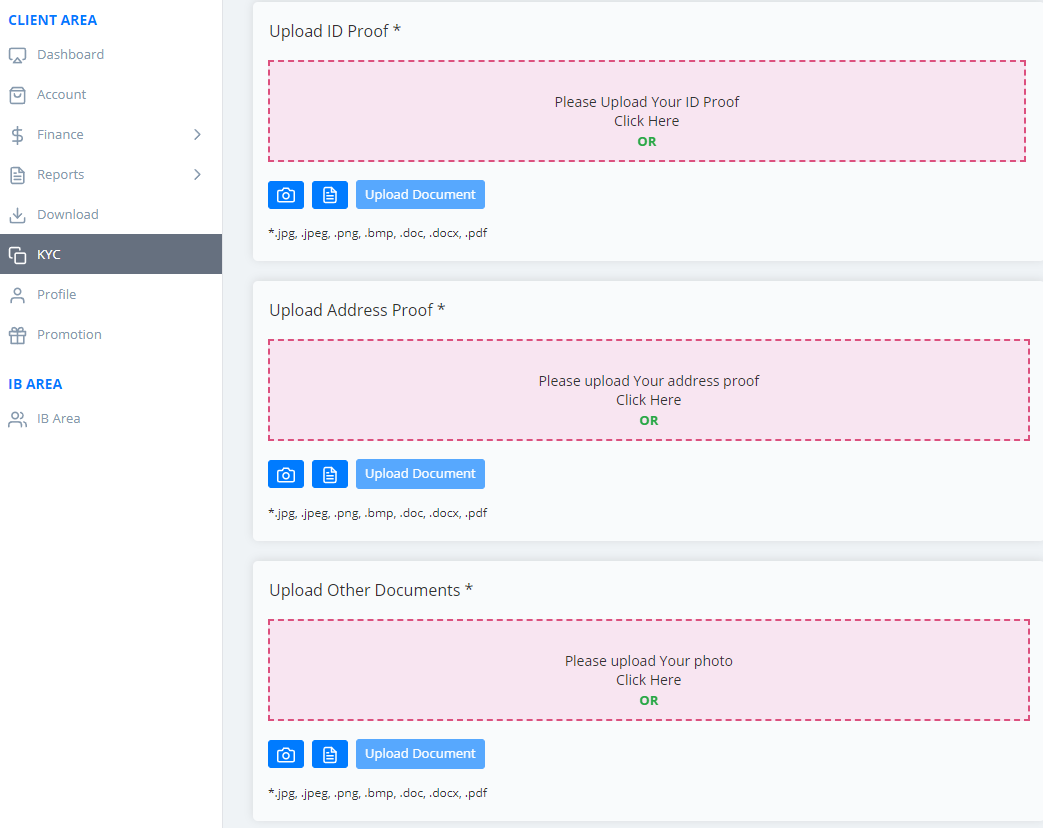

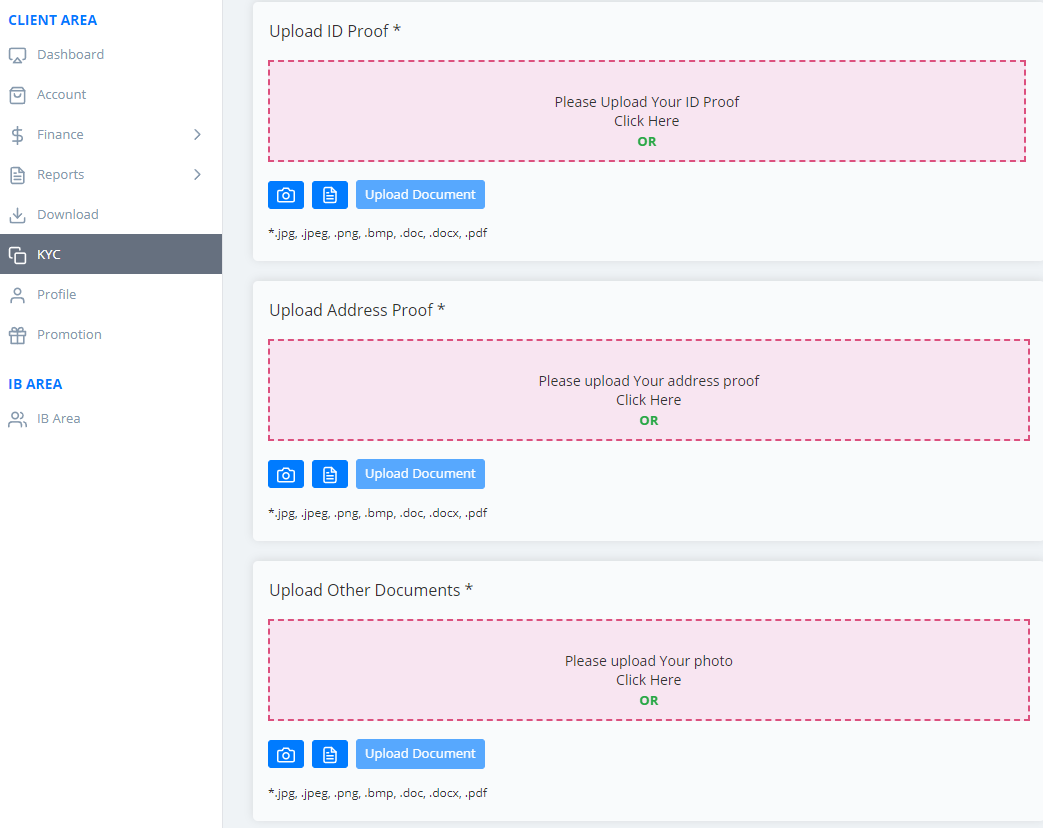

Upon logging into your user account for the first time, you will be directed to the verification page. Upload photos or scanned copies of the required documents to verify your identity and address of registration. Wait for the verification process to be completed.

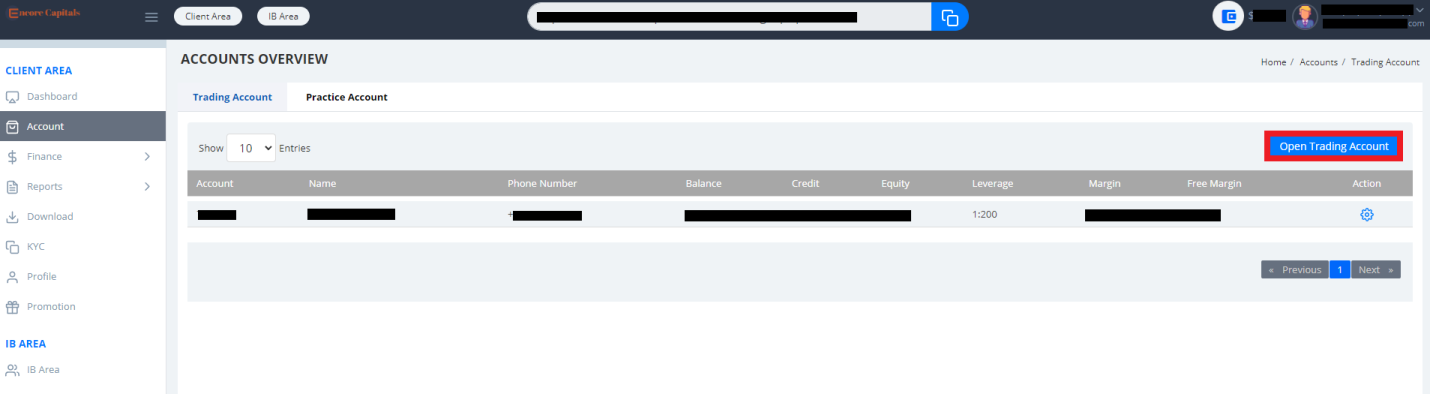

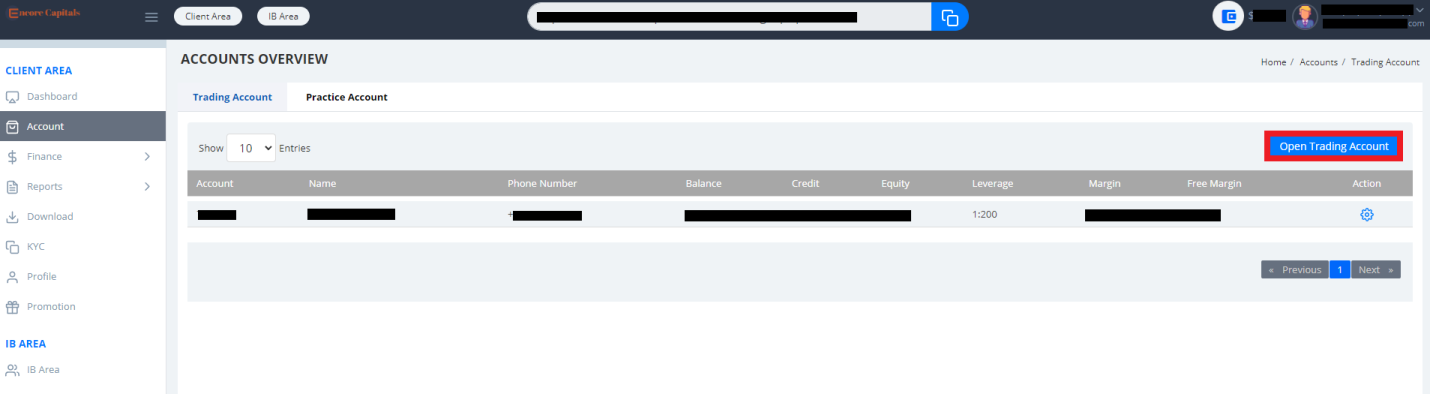

After a successful verification, click on the "Account" button in the left menu. Then, click on "Open Trading Account" and follow the on-screen instructions. Note that you can choose between opening a demo or a real account.

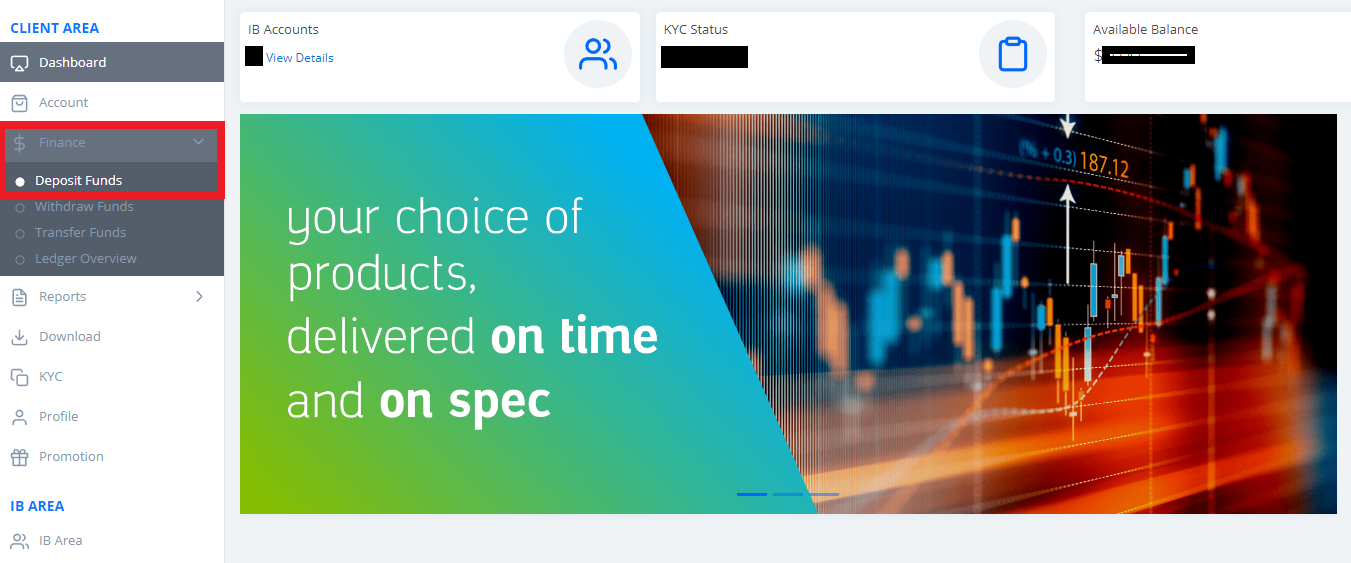

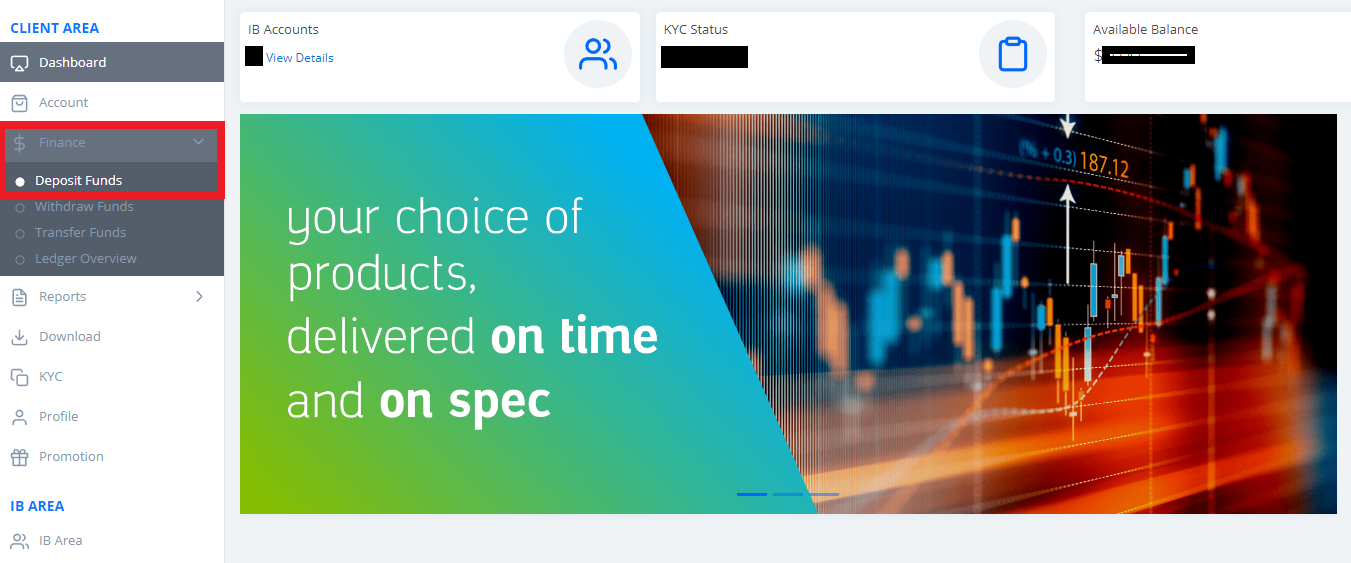

Once you have opened an account, you need to fund your balance (consider the minimum threshold for the account type selected). Click on the "Finance" button in the left menu, then click on "Deposit Funds" and follow the on-screen instructions. Once the transfer is complete, you can start trading through the MT5 trading platform. Monitor the status of your account in your new user account.

Your user account also provides access to:

Dashboard. The main section with aggregated data on the trader's accounts.

Account. Here, accounts can be opened and closed, as well as their parameters adjusted.

Finance. A section with functions for depositing, withdrawing, and transferring funds.

Reports. This is where transaction and commission reports are generated.

Download. Links for downloading the trading terminal are provided here.

KYC. (Know Your Customer) In this section, the trader uploads documents for verification purposes.

Profile. A section for entering personal data and making corrections to them.

Promotion. A section dedicated to the referral program.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has ECR Capitals been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against ECR Capitals by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of ECR Capitals is down, not updated or operates with clear errors and some features are not available;

• ECR Capitals has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if ECR Capitals got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why ECR Capitals got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from ECR Capitals?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if ECR Capitals is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.