According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- MT5

- FINMA

- CySEC

- FSCA

- 2021

Our Evaluation of Eurotrader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Eurotrader is a moderate-risk broker with the TU Overall Score of 6.22 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Eurotrader clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Considering the overall factors, Eurotrader provides advantageous and competitive conditions. There is a wide range of assets, high leverage, acceptable spreads, and average-to-below-average commissions. The regulation ensures reliability and fulfillment of obligations to clients, while the intuitive interface, low entry threshold, and appealing bonuses attract interested traders. The conceptual advantage is the simple and convenient copy trading service, allowing beginners to passively earn and learn from professionals. Eurotrader offers quality education and practical tools for technical analysis.

Brief Look at Eurotrader

Eurotrader is a CFD broker that offers CFDs on currency pairs, cryptocurrencies, stocks, indices, and commodities. There are three account types, plus a demo account a(nd a non-deposit (Islamic) account. The minimum deposit is $50, spreads are from 0 to 1.2 pips depending on the account. There are no commissions for stocks or for currency pairs from $0 to $2.75, determined by the account type. The minimal trade is 0.01 lots, the maximum is 1000 lots, and the leverage is up to 1:500. Two bonuses are available, a trading bonus of 111% and a virtual private server (VPS). Clients can use either MT4 or MT5 trading platforms, and the platform has its own integrated copy trading service. Eurotrader offers many useful tools, including a currency converter, margin calculator, and risk calculator. The broker provides a powerful educational program, which includes video courses, e-books, articles, and a unique section for novices called “Trading 101”. There is no referral program.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low entry threshold, good bonuses, intuitive website interface, popular trading platforms.

- Wide range of CFDs to choose from, high leverage, no restrictions on trading methods and strategies imposed by the broker.

- Extensive pool of technical analysis tools, including special converters and calculators.

- Eurotrader offers competitive spreads and low commissions, minimizing trader costs.

- Multiple deposit/withdrawal options, with the broker covering many commissions (depending on the specific channel).

- The company is regulated by three international regulators: FINMA (Swiss Financial Market Supervisory Authority), CySEC (Cyprus Securities and Exchange Commission), and FSCA (Financial Sector and Conduct Authority in the U.K.).

- Built-in copy trading service allows passive traders of all levels to gain additional benefits.

- The broker offers an extensive pool of assets, but all of them are contracts for difference (CFDs), not actual trading instruments.

- Eurotrader does not work with residents of Russia, North Korea, Japan, Turkey, and some other countries.

- Technical support is rated relatively high, but all communication channels operate only on weekdays.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker started operating in 2018. Interestingly, its founder is not a professional trader. Ozan Ozerk, by education, is a doctor, but somehow he managed to establish one of the largest fintech companies in Northern Europe - OpenPayd, which specializes in backup as a service (BaaS) solutions, a cloud-based data backup and recovery tool. Therefore, when Ozerk decided to develop a brokerage platform, he had a unique experience and a strong financial and technological foundation.

With such background information, it's not surprising that Eurotrader has gained wide recognition since its launch. It has become one of the leaders in its segment, and as a CFD broker, it offers hundreds of assets from five groups: currencies, cryptocurrencies, stocks, indices, and commodities. This provides a standard list that allows for a diversified portfolio. There are several account types, including a free demo account for getting acquainted with the platform and practicing strategies. Eurotrader also offers swap-free Islamic accounts. Accounts differ in terms of minimum deposit, spreads, and trading commissions. Overall, the broker's commission policy is more favorable than that of many other representatives in this sector.

Eurotrader provides high-quality education that clients of the broker can take advantage of if they wish. User ratings are confirmed by expert research, and the materials are well-structured, free of irrelevant clutter, and useful for market participants. Unfortunately, the platform does not offer a referral program, but it does have PAMM accounts and its copy trading service for passive income.

A significant advantage is the wide range of tools such as various calculators, converters, and tables. Also, Eurotrader provides up-to-date analytics, allowing traders to have a solid tool box for technical and fundamental analyses. This greatly facilitates the trading lives of even professionals. The broker’s clients trade through the MT4 and MT5 platforms, which are valued for their adaptability and the ability to significantly expand functionality through a multitude of easily integrable plugins.

Regional restrictions are usually mentioned as a drawback, but they exist for all brokers. The support operates in a standard 24/5 mode, as very few companies offer 24/7 support. This CFD broker has many advantages, but if a trader wants to work with the actual assets themselves rather than CFDs, they will need a different platform.

Eurotrader Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Eurotrader Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, MT5 |

|---|---|

| 📊 Accounts: | Demo, Micro, Zero, Hero, Islamic |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Deposit / Withdrawal: | Visa/MasterCard bank cards; Skrill, Ozow, and bank transfers |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Free demo account, three standard accounts plus non-swap (Islamic), hundreds of CFDs on assets from five groups, free copying service in the form of mobile applications, there are PAMM, spreads and commissions below the market average, no withdrawal fees |

| 🎁 Contests and bonuses: | Yes (deposit bonuses, VPS, and rebates from TU) |

The minimum deposit depends on the account type, and this rule is true for almost all brokers. In the case of Eurotrader, the Micro account requires $50; for Zero, it’s $500; and for Hero, it’s $25,000. Trading leverage is also determined by the account type: up to 1:500 on Micro, up to 1:300 on Zero, and up to 1:200 on Hero. Leverage increases the profit potential, but also the risk increases significantly. Technical support is represented by all main communication channels: the call center, email, LiveChat, and tickets are on the website. Specialists work 24/5.

Eurotrader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start collaborating with the broker, you need to sign in and verify your account on their official website. TU experts have prepared a step-by-step guide on this process and the features of the Eurotrader user account.

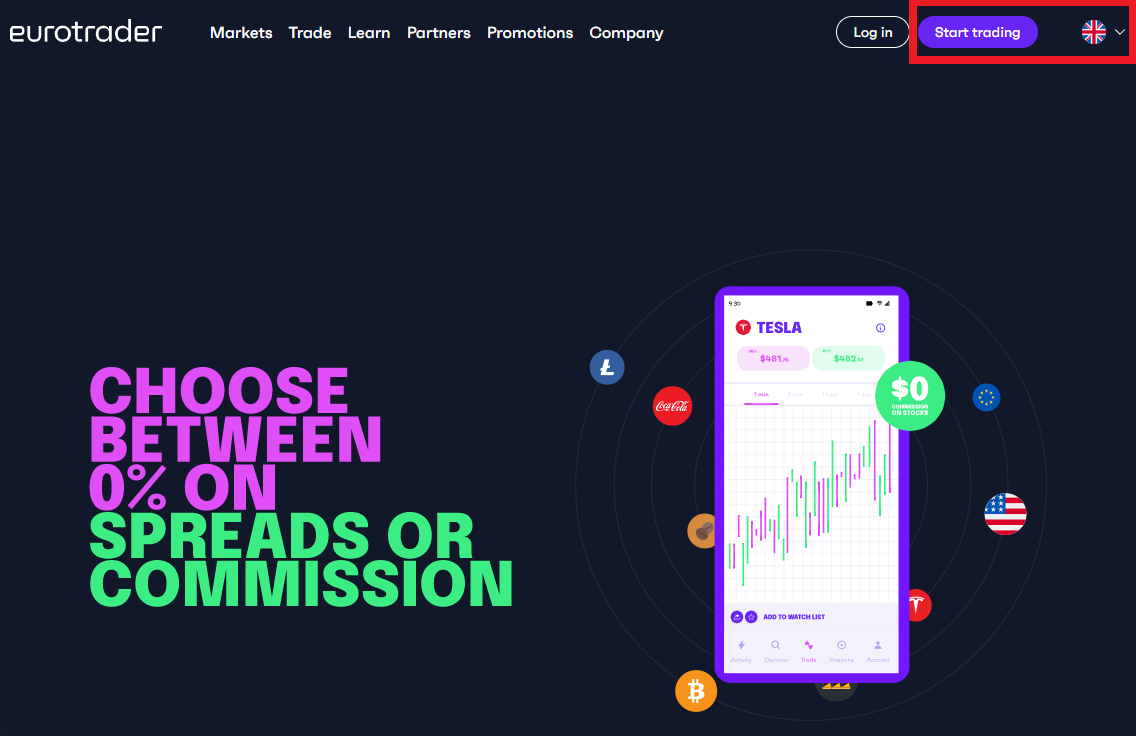

Go to the broker’s website, select the interface language in the upper right corner, and click on the “Start trading” button.

Select an appeal, and enter your first and last name, email address, phone number, and country of residence. Click “Next”.

Provide your date of birth, gender, and registered address with the postal code. Create a password, enter it twice, and click “Next”.

Answer a few questions to personalize your offer. Choose the account currency, trading platform, and account type. Agree to the platform’s terms by checking the boxes and click “Complete”.

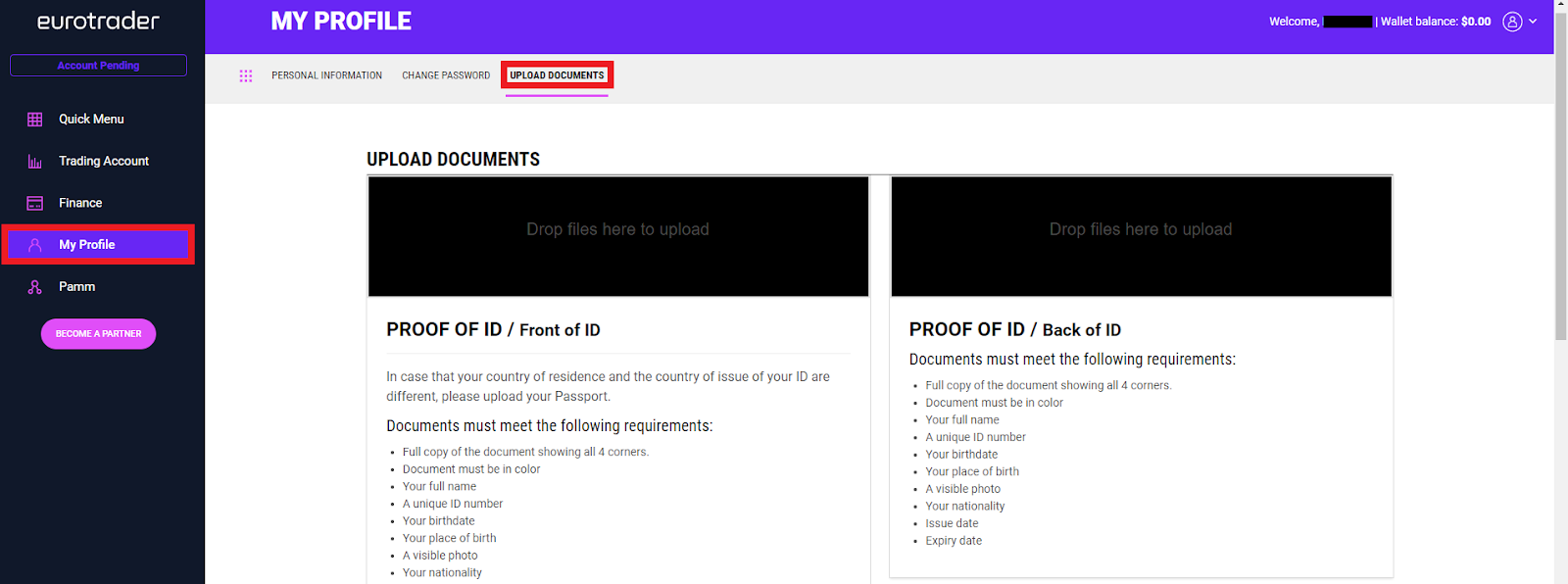

Once you are in the user account, go to the “My Profile” section. Select the “Upload Documents” tab. Follow the on-screen instructions to complete the verification process, and you will be able to open a real account.

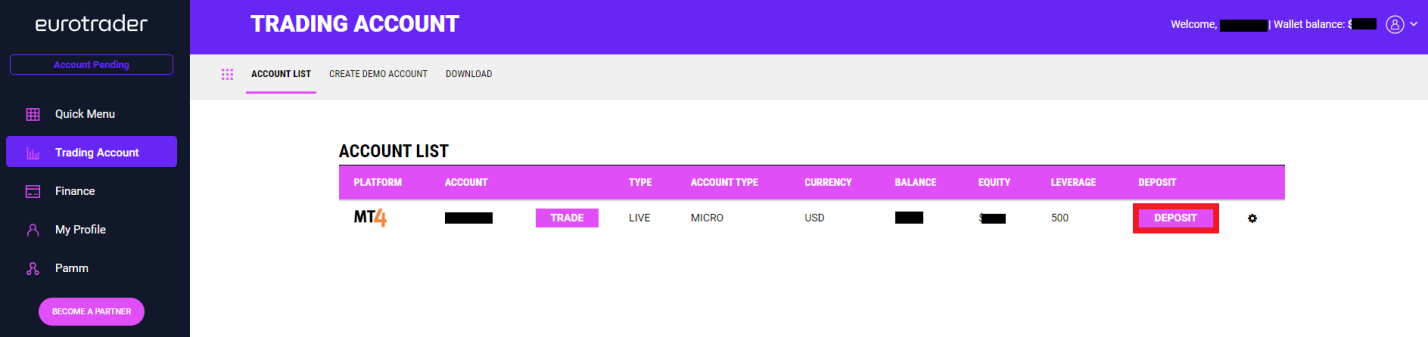

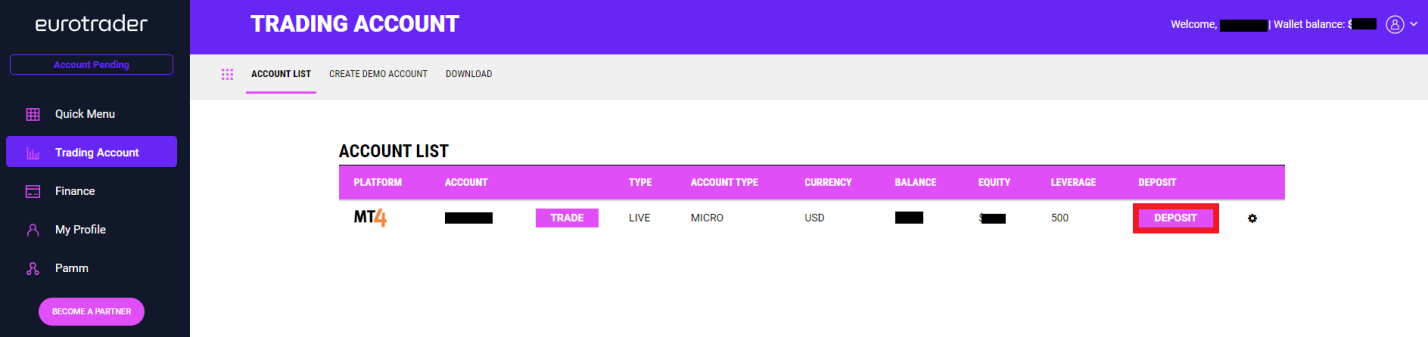

After completing the verification process, go to the “Trading Account” section. Select the “Account List” tab. Your new account will be displayed here. Click on the “Deposit” button in the account row and follow the on-screen instructions. Once the funds are on the balance, you can start trading through the selected trading platform.

Your Eurotrader user account also provides access to:

Quick Menu. This section contains links to the main features such as opening an account, depositing funds, withdrawing money, etc.

Trading account. In this section, the trader can open and close accounts, deposit funds, and view statistics.

Finance. This section is for deposits, withdrawals, and internal transfers. It also provides the option to link a card and view transaction history.

My profile. Here traders can enter and update personal information and security settings.

PAMM. This section allows traders to establish a joint account or connect to an existing account.

Regulation and safety

Eurotrader has a safety score of 8.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record of less than 8 years

Eurotrader Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Eurotrader Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Eurotrader have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Eurotrader with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Eurotrader’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Eurotrader Standard spreads

| Eurotrader | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Eurotrader RAW/ECN spreads

| Eurotrader | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Eurotrader. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Eurotrader Non-Trading Fees

| Eurotrader | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

When a broker offers multiple real accounts, it is important to choose the one that is best for you because the account type affects the trading conditions. With Eurotrader, you can open a Micro account with the smallest deposit and the highest leverage. There are no commissions on this account, but the spreads start from 1 pips. Micro accounts are usually chosen by novice traders. The Zero account is more versatile, with a higher deposit, moderate trading commissions, and lower spreads, but slightly lower maximum leverage. The Hero account is for larger traders, requiring a minimum of $25,000. This account offers average spreads, average commissions, and the lowest leverage. Therefore, traders should primarily consider their experience and trading style while also taking financial considerations into account. It's worth noting that the range of assets and additional features is not dependent on the account type.

Account types:

The broker also offers a demo account where traders can trade with real quotes but virtual currency. The demo account is ideal for familiarizing oneself with the platform and practicing strategies. Traders can also open an Islamic account, which operates without swaps.

Deposit and withdrawal

Eurotrader received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Eurotrader provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- No deposit fee

- Bank wire transfers available

- BTC payments not accepted

- Only major base currencies available

- BTC not available as a base account currency

What are Eurotrader deposit and withdrawal options?

Eurotrader provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill.

Eurotrader Deposit and Withdrawal Methods vs Competitors

| Eurotrader | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Eurotrader base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Eurotrader supports the following base account currencies:

What are Eurotrader's minimum deposit and withdrawal amounts?

The minimum deposit on Eurotrader is $50, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Eurotrader’s support team.

Markets and tradable assets

Eurotrader provides a standard range of trading assets in line with the market average. The platform includes 800 assets in total and 60 Forex currency pairs.

- Crypto trading

- Copy trading platform

- ETFs investing

- Futures not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Eurotrader with its competitors, making it easier for you to find the perfect fit.

| Eurotrader | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 800 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Eurotrader offers for beginner traders and investors who prefer not to engage in active trading.

| Eurotrader | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support is needed for situations in which traders are unable to figure out on their own. They need to be able to contact specialists promptly and obtain a solution. If managers take too long to respond or lack sufficient competence, traders often become disappointed in the broker and switch to a competitor. Eurotrader understands this and thus offers fast and high-quality customer support, which is available through a call center, LiveChat, email, and website tickets. All channels are accessible 24 hours a day but only on weekdays.

Advantages

- No need to be a registered user to contact support

- Traders can get help at any time, even at night

- The call center responds with maximum responsiveness

Disadvantages

- Managers are not available on weekends

If you intend to work with Eurotrader or are already a client of this broker, you can contact support using the following methods:

-

call center.

-

email.

-

LiveChat on-site and in the user account.

-

tickets on the website.

The official Eurotrader profiles are available on the following platforms: Facebook, Instagram, and Twitter. It is worth subscribing to them in order not to miss the latest news from the broker.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | 74 Walmer Street, Sydenham, Johannesburg, 2192, South Africa |

| Regulation | FINMA, CySEC, FSCA |

| Official site | https://www.eurotrader.com/ |

| Contacts |

+44 (0)20 8004 7430

|

Education

Traders must constantly improve their skills. They should read specialized literature, take educational courses, attend webinars with experts, and engage with colleagues on thematic forums. All of this provides invaluable knowledge and the opportunity to keep up with the market. Brokers often offer their clients educational programs. These can be comprehensive academies or rudimentary FAQs on trading basics. The Eurotrader website has an "Education" section that includes a complete course for beginners, as well as video courses and e-books for advanced traders. There is also a blog where analysis and expert advice are published.

Eurotrader provides a large volume of well-structured materials presented in various formats, ranging from video lessons to e-books. There is useful information available for beginners, intermediate-level traders, and professionals. There are few drawbacks, except that the education is primarily focused on CFDs, although other instruments are also covered, especially in the basic materials. Full access to education resources is only available to registered users.

Comparison of Eurotrader with other Brokers

| Eurotrader | Eightcap | XM Group | RoboForex | Vantage Markets | FBS | |

| Trading platform |

MT5, MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $50 | $100 | $5 | $10 | $50 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 1 point |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 40% / 20% |

| Order Execution | No | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of Eurotrader

Eurotrader has been operating in the industry for 5 years. During this time, there have been no recorded instances of failure to fulfill obligations to clients or fraud. The platform has never been hacked and utilizes advanced security measures, from SSL certificates to closed cryptographic solutions. The execution speed is 30-50 ms, which is competitive. The broker works with first-tier liquidity providers. Thanks to a well-thought-out technological stack, it can offer its partners several constructive advantages, such as a virtual private server (VPS) that ensures complete security, stability, and smooth 24/5 operation. Some other brokers offer a similar service, but almost none of them provide it for free like Eurotrader.

Eurotrader by the numbers:

-

The minimum deposit is $50.

-

There are 5 asset groups in the CFD format.

-

The commission for trading stocks is $0.

-

The maximum leverage is 1:500.

-

3 regulators supervise the platform.

Eurotrader is a comfortable CFD broker for risk diversification and self-education

Most brokers offering CFDs allow traders to work with various assets. This is necessary for several reasons. First, the more instruments available to a trader, the fewer limitations they must consider. In other words, they can use different strategies and trading methods. Second, diversity is the foundation of a risk-averse portfolio. With such a portfolio, a trader doesn't need to worry if one asset starts showing a negative trend because it can be compensated by stable and progressive positions in other assets. Eurotrader offers CFDs on currency pairs, cryptocurrencies, stocks, indices, and commodities. These are the most popular groups, and the broker allows trading with hundreds of instruments, including exotic currencies that are overlooked by many other platforms.

Eurotrader analytical services:

-

Eurosocial. The trade copying service is presented in the form of a simple and convenient mobile application. Users can register as signals providers or investors. Access is free, and the conditions are standard.

-

Profit & loss. A simple and useful calculator that allows calculating the optimal levels for setting stop-loss and take-profit within the current trade. The trader provides the necessary data and immediately receives an accurate calculation of the indicators.

-

Risk calculator. Another automated calculation service that determines the trade position size based on the specified risk. The trader needs to indicate the account currency, the traded asset, acceptable risk, and stop-loss, and in return, they will receive the lot size.

Advantages:

The broker offers a free demo account as well as three real accounts, including an Islamic account without swap fees.

The minimum deposit is only $50 (for the Micro account), with spreads and commissions below the market average, and no withdrawal fees.

CFDs are available in five asset groups, with leverage up to 1:500 and no restrictions on trading styles and strategies.

The trade copying service is free, allowing investors to earn while learning from professionals.

Technical support is available even at night, and users can contact them via chat, phone, or email.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i