deposit:

- $500

Trading platform:

- MT4

- MT5

- WebTrader

- Stock3

- 0%

JFD Brokers Review 2024

deposit:

- $500

Trading platform:

- MT4

- MT5

- WebTrader

- Stock3

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of JFD Brokers Trading Company

JFD Brokers is a high-risk broker with the TU Overall Score of 2.47 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by JFD Brokers clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. JFD Brokers ranks 367 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Since JFD Brokers started its operation in 2011 and is regulated by three organizations, its reliability is beyond doubt. Traders get universal competitive conditions, such as hundreds of assets from different groups, high leverage, several trading platforms, and no trading restrictions. The minimum trade size is 0.01 lots, also traders can buy and sell stocks at zero fees. There are withdrawal fees, which depend on the withdrawal channel and the asset. Third-party income options are not available. Experts emphasize high-quality comprehensive education.

JFD Brokers is the brand name of JFD Group Ltd, which provides brokerage services under the supervision of the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). Traders can open a demo or live accounts, and available currencies are USD, EUR, GBP, and CHF. The minimum deposit is $500, €500, £500, or ₣500. The broker offers over 1,500 trading instruments, including currency pairs, stocks, precious metals, ETFs (Exchange-Traded Funds), and CFDs (Contracts for Difference). CFDs on cryptocurrencies, stocks, indices, commodities, ETFs, and ETNs (Exchange-Traded Notes) are available. The maximum leverage is 1:400. Traders can work through the MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and Stock3 trading platforms. It is possible to install the StereoTrader extension for MT4 and MT5, which opens up new modes, order types, and useful features. The broker provides neither investment solutions nor referral programs.

| 💰 Account currency: | USD, EUR, GBP, and CHF |

|---|---|

| 🚀 Minimum deposit: | $500, €500, £500, or ₣500 |

| ⚖️ Leverage: | Up to 1:400 subject to the asset |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, stocks, precious metals, ETFs, and CFDs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with JFD Brokers:

- Intuitive interface of the user account, low entry threshold for traders of any level, and a demo account;

- There is only one trading account type with universal conditions, suitable for most traders due to tight spreads and high leverage;

- Traders can work with various trading platforms and their mobile versions, also installation of plugins and extensions is available;

- The broker does not set restrictions on trading styles and strategies, so traders can use bots and advisors, scalp, and hedge;

- Traders have the opportunity to buy stocks (not CFDs on stocks) without any fee. More than 600 assets are represented in this category and their number is growing;

- Clients’ funds are kept separately from the company's funds and traders can contact the compensation fund in case of emergency;

- Technical support is provided by several call centers, live chat, and email, and is available 24/5.

👎 Disadvantages of JFD Brokers:

- Traders are charged spreads and trading fees. This information is not transparent, it becomes available while trading;

- The broker does not provide passive investment options, there are no specialized solutions, referral programs, or copy trading;

- Despite the generally high quality of technical support, it is not available on weekends.

Evaluation of the most influential parameters of JFD Brokers

Geographic Distribution of JFD Brokers Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of JFD Brokers

JFD Group Ltd has been on the market for 12 years and is headquartered in Limassol (Cyprus). JFD Brokers has been operating all this time, it has never been restarted, but has gone through several rebrandings. Clients who have stayed with this broker for many years note that every year it progresses noticeably. New assets are added and the company's management listens to the opinions of the community. This is how a group of cryptocurrencies, new stocks, and currencies were added.

The analysis shows that JFD Brokers has no open conflicts with traders. The company fully complies with international financial legislation. Otherwise, it could not obtain licenses from three regulators at once. Regulation is a conceptual advantage, but traders should be aware that this does not guarantee absolute transparency. For example, you may not immediately know JFD Brokers’ spreads and trading fees. The broker does not publish this information anywhere, explaining that these are floating values, which vary greatly depending on the state of the market and the selected asset.

In general, JFD Brokers’ trading conditions are standard. There are currencies, cryptocurrencies, CFDs, and zero-fee stocks. Traders can form large and diversified portfolios. Spreads depend on the instrument, and their maximum value is 1:400, which is quite competitive. The minimum trade size of 0.01 lots is also typical. Note that JFD Brokers has a fairly high initial deposit, which is $500, €500, £500, or ₣500. There is only one live account type and a demo account.

Based on the sum of factors, expert evaluation allows for determining the broker's position as stable. Thousands of traders globally work with this broker. Separate advantages are the support of several trading platforms at once, multilingual client service, and a high-quality education system, which is also available to unregistered users.

Dynamics of JFD Brokers’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Some brokers offer their clients the opportunity to earn by passive trading. This can be a special program like cryptocurrency staking or a copy trading service, in which the decisions of the signal provider are duplicated on the account. PAMM, MAM, and other types of joint accounts are also often considered as an option for passive income. JFD Brokers has none of that. Sometimes this category includes a referral program (not to be confused with a partnership program for business). But a referral program is not a source of passive income, because in order to receive more or less significant profit, you need to be highly active on the internet and/or have a popular blog.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Why JFD Brokers does not offer passive income options:

All referral programs are similar, that is traders bring other traders by a personal link and receive a bonus in the form of a percentage of fees or a fixed payment, which is less common. The purpose of this action is to stimulate the influx of users to the platform. But if traders come by themselves and in large numbers, a referral program may not be needed. As for the above options for passive income (like buying dividend stocks), only some users need them. Most seek to make a profit through active trading. That is why JFD Brokers, like many other companies, does not provide such programs. Not all experts consider this a disadvantage, but the lack of investment is a feature that simply needs to be considered.

Trading Conditions for JFD Brokers Users

Usually, the minimum deposit depends on the account type, but JFD Brokers offers only one live account and a demo account, which does not require a deposit. Therefore, the minimum balance replenishment is fixed, it is $500, €500, £500, or ₣500. Keep in mind that this is the minimum level, so you can replenish the balance by a larger amount, say, $1,000 or $5,000. Leverage always depends on the asset. Its maximum for currency pairs is 1:400. You don't have to use leverage, but it does increase your profit potential. Finally, technical support is an important criterion that determines the quality of service. JFD Brokers offers multiple call centers by region, live chat, and email. All these channels operate 24 hours per day, excluding weekends and public holidays in Cyprus.

$500

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | MT4, MT5, WebTrader, and Stock3 |

|---|---|

| 📊 Accounts: | Demo and Standard |

| 💰 Account currency: | USD, EUR, GBP, and CHF |

| 💵 Replenishment / Withdrawal: | Bank transfer, Sofort, Payabl., Skrill, Neteller, and Nuvei |

| 🚀 Minimum deposit: | $500, €500, £500, or ₣500 |

| ⚖️ Leverage: | Up to 1:400 subject to the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currency pairs, stocks, precious metals, ETFs, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

One account type (demo account is also available); High leverage; Many financial instruments; Trading through different platforms is possible; Prompt technical support; High-quality education; No options for passive income |

| 🎁 Contests and bonuses: | Yes |

Comparison of JFD Brokers with other Brokers

| JFD Brokers | RoboForex | Pocket Option | Exness | Octa | IC Markets | |

| Trading platform |

MT4, MT5, WebTrader, Stock3 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, cTrader, MT5, TradingView |

| Min deposit | $500 | $10 | $5 | $10 | $25 | $200 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| JFD Brokers | RoboForex | Pocket Option | Exness | Octa | IC Markets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

JFD Brokers Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | 2$ | From 0.15% |

Typically, traders are interested in comparing the fees of different brokers. This is a rather complex task because it is influenced by many factors. First, they depend on the chosen financial instrument, the state of the market, and the region in which you are located (it determines the policy of a broker because each country has its own laws regarding trading). The comparative table below shows the approximate fees of JFD Brokers and its closest competitors.

| Broker | Average commission | Level |

| JFD Brokers | $2 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of JFD Brokers

JFD Brokers uses advanced technology such as virtual private servers (VPS) with increased stability. The company partners with international web hosting company Fozzy, which was one of the first to implement the Hyper-V visualization architecture. JFD Brokers is also an official partner of MyTradeHost. This allows the platform to provide exceptional speed in processing transactions and bringing them to the interbank market in the shortest possible time. Also, the user account is universal as there are no confusion or restrictions. Traders only need to register and install a suitable trading platform. And if they have any questions during the trading process that cannot be solved with the help of the FAQs, they can always contact technical support, which is rated by users with the highest score.

JFD Brokers by the numbers:

-

12 years on the market;

-

Over 1,500 instruments;

-

Leverage is up to 1:400;

-

4 account currencies;

-

Payment for webinars is $0.

JFD Brokers is great for working with different asset types

Some brokers focus on a specific group of assets, such as currency pairs. There are quite a few companies that work only with CFDs, and they are called CFD brokers. They may have many advantages, but the pool of financial instruments is definitely not a strong point for such companies. Why? Because the more assets there are, the less traders limit themselves. They work at their own pace and use almost any trading methods and strategies. Another important advantage of a wide choice of instruments is the opportunity to diversify risks. Let's say you can trade currencies, indices, and cryptocurrencies. This will allow leveling drawdowns in one market due to successful layouts in others. This is not about a universal algorithm of actions, but, with other things being equal, the more assets, the better. JFD Brokers offers currency pairs, stocks, precious metals, ETFs, and a wide range of CFDs on various assets for trading.

Useful services offered by JFD Brokers:

-

History Data Export. This option allows traders to see how this or that asset behaved in a selected period of time. The tool allows you to compare historical quotes with real ones in order to conduct a comprehensive technical analysis;

-

Market News and Analysis. The JFD Brokers feed differs from similar services of other brokers in that it is structured, has several sections, and publications can be filtered by various parameters. So, traders receive the maximum target summary;

-

Webinars and Live Events. The platform provides traders with the opportunity to join online broadcasts conducted by experts. There are up to 7 broadcasts per day, the exact schedule and topics of upcoming webinars can be found in the corresponding section.

Advantages:

The company is licensed and operates under the supervision of three regulators, which is a guarantee of reliability, transparency, and security;

The broker provides a choice of trading platforms, such as MetaTrader 4, MetaTrader 5, WebTrader, and Stock3 with the opportunity to connect plugins;

The single account with universal trading conditions eliminates the need to puzzle over which account to choose;

The broker uses advanced solutions such as VPS with Hyper-V architecture to provide its clients with the most comfortable trading conditions;

Traders are not limited in strategies and methods, they can trade news, hedge, scalp, and use advisors;

Spreads are average or below the market average, the same applies to trading and withdrawal fees;

The broker has no hidden fees, technical support works 24/5, and traders control their accounts in detail through their user accounts.

Guide on how traders can start earning profits

Usually, experts of Traders Union advise to start by choosing an account. However, JFD Brokers offers only two account types, namely demo and live. A demo account does not require a minimum deposit, it is used to get acquainted with the platform and work out strategies. This account can be opened very quickly, it uses data from the interbank market, but trading is carried out with virtual funds. Live accounts of JFD Brokers have universal conditions, such as over 1,500 financial instruments, leverage of up to 1:400, zero-fee stocks, and floating spreads. These parameters are suitable for the majority of traders, regardless of their experience, skills, and ambitions. That's why, when working with JFD Brokers, the only thing you need to understand at the beginning is which trading platform to use. The answer to this question can only be found through a comparison. Also, the broker has a separate page dedicated to supported trading platforms.

Account types:

Note that a demo account can be opened on any of the supported trading platforms, similar to a live account. This is a reasonable decision if you want to try the platform or have not traded on it for a long time.

Investment Education Online

Traders are only successful when they progress. They need to constantly trade, learn new methods, practices, and styles of trading, and communicate with colleagues and experts. Many brokers understand this and offer education systems. JFD Brokers is definitely at the top of the list in this regard, because its educational program is represented by expert articles, a smart newsfeed, and webinars that take place several times a day.

JFD Brokers offers a wide range of educational materials. It makes sense for novice traders to start with Trading Glossary, then go to the "Our Experts" section and read collections of materials from professionals. Experienced traders can go directly to the Market News and Analysis. Webinars will be of interest to everyone, you just need to look at the topic in advance.

Security (Protection for Investors)

The broker you select should be an officially registered financial institution. Registration, however , is not the same as regulation. Registration provides some protection against fraud and failure by the company to fulfill its obligations to clients. But this is not a 100% guarantee. A guarantee can only be given by regulation, which says that brokers voluntarily report to the authorized regulatory authorities. JFD Brokers operates under the supervision of the three largest regulators, namely CySEC, CNMV, and VFSC. All its licenses are valid, so traders can be sure that the declared conditions are met by this broker, it is reliable, has transparent working conditions, and pays out traders’ profits.

👍 Advantages

- Traders can contact the broker's lawyers

- Possibility to contact the regulators

👎 Disadvantages

- Traders cannot get assistance from regional financial control authorities, as international brokers are outside their jurisdiction

Withdrawal Options and Fees

-

Trading on a live account, subject to traders’ success, brings them real income;

-

All funds earned by traders are accumulated in their user accounts;

-

Traders can at any time submit a withdrawal request through their user accounts on the website;

-

Often the application is processed on the same working day, but sometimes it can take longer;

-

Upon processing the request, the broker transfers traders’ funds to specified bank cards or e-wallets;

-

Note that different assets and withdrawal channels have their own minimum limits, and fees also differ;

-

Fees can be found in the "Withdrawal" section, and they will also be indicated when traders submit their requests.

Customer Support Service

Technical support is critical for a broker because traders sometimes face situations that they cannot solve on their own. It doesn't matter how good the FAQs section is on the website. Even with the most understandable and simple interface, there may be moments when brokers’ clients do not understand something or miss something important. Then managers’ assistance is needed. It is in the interests of brokers to ensure that support is available 24 hours a day. JFD Brokers specialists work 24/5. That is, a request submitted during weekends will be processed on the next business day in order of priority. Also, it is not possible to contact support on public holidays in Cyprus.

👍 Advantages

- Non-clients of the broker can contact technical support

- Call center, live chat, and email are available

- Technical support responds in several European languages

👎 Disadvantages

- Technical support is not available on weekends

Thus, if you have a difficult situation, contact JFD Brokers’ client support using the following communication channels:

-

Global call center;

-

Regional call center (numbers are listed in the “Contact Us” section);

-

Email;

-

Live chat on the website and in the user account.

The broker has its official profiles on Facebook, Instagram, Twitter, YouTube, and LinkedIn. It makes sense to subscribe to them so as not to miss anything important, for example, fresh analytics and information about holidays when technical support is not available.

Contacts

| Foundation date | 2011 |

| Registration address |

Kakos Premier Tower Kyrillou Loukareos 70 4156 Limassol, Cyprus iCount Building, 1st Fl. PO Box 211, Kumul Highway Port Vila, Vanuatu Paseo de la Castellana 140 Floor 11 right Madrid, 28046, Spain Central Point, 6th fl. 54 Osmi Primorski Polk Blvd Varna, 9002, Bulgaria |

| Official site | https://www.jfdbrokers.com/ |

| Contacts |

Email:

support@jfdbrokers.com,

Phone: +49 40 87408688 |

Review of the Personal Cabinet of JFD Brokers

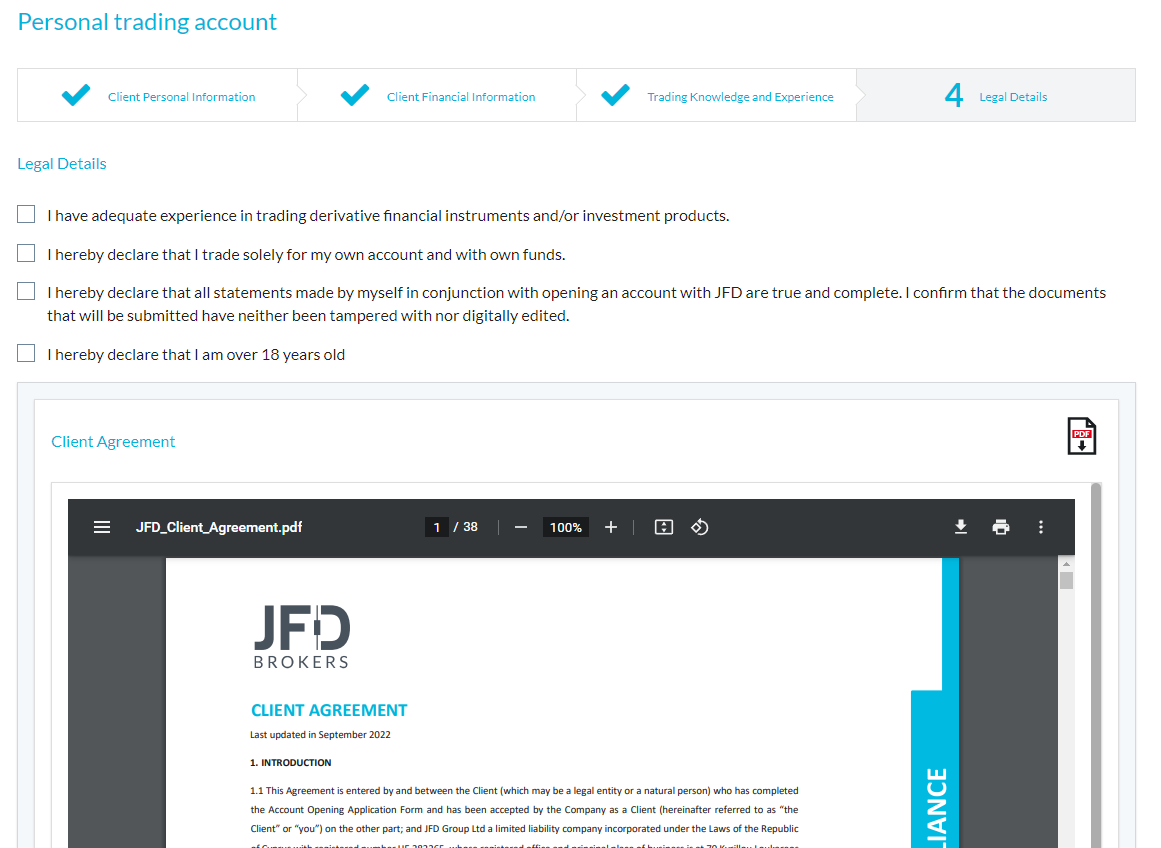

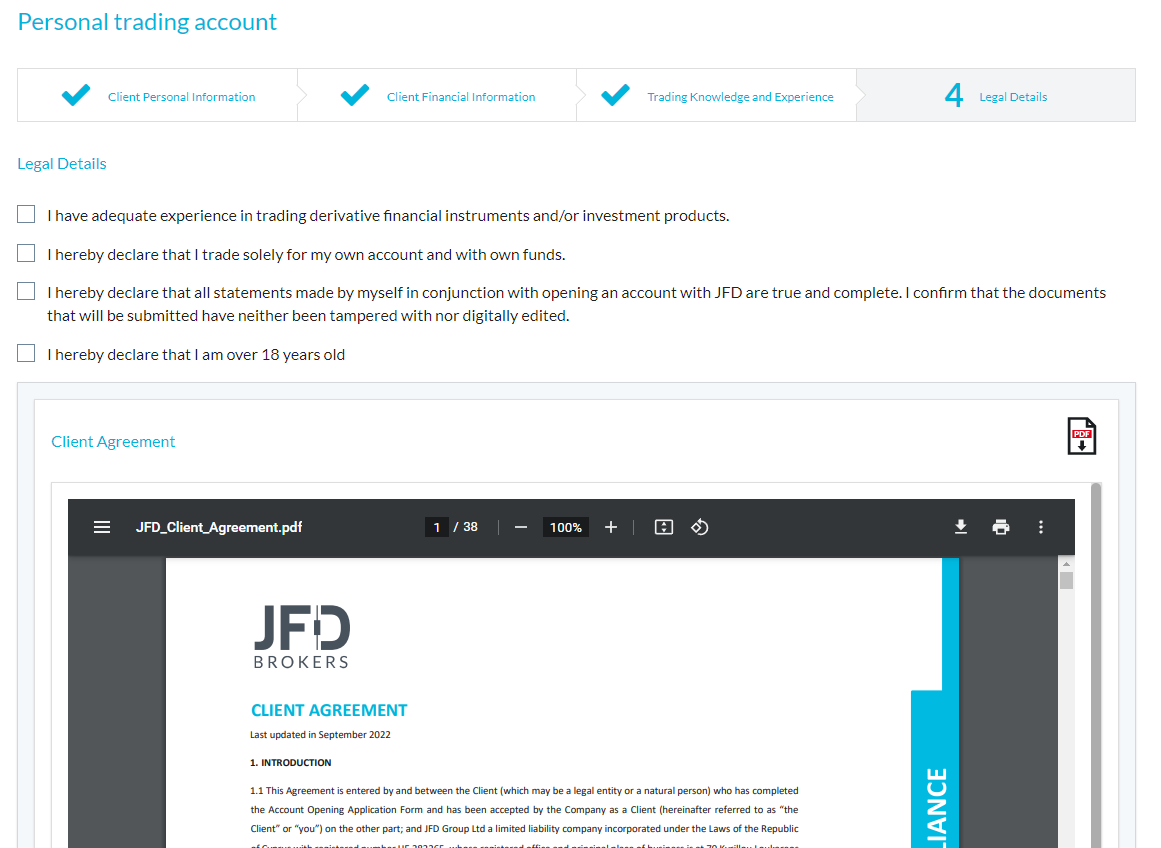

To start trading with the broker, go to its website, register, get verified, and make a deposit. No deposit is required for a demo account. Below is a step-by-step registration guide.

Go to the main page of the broker's website and select the interface language in the upper right corner. Then click the "Start Now" button.

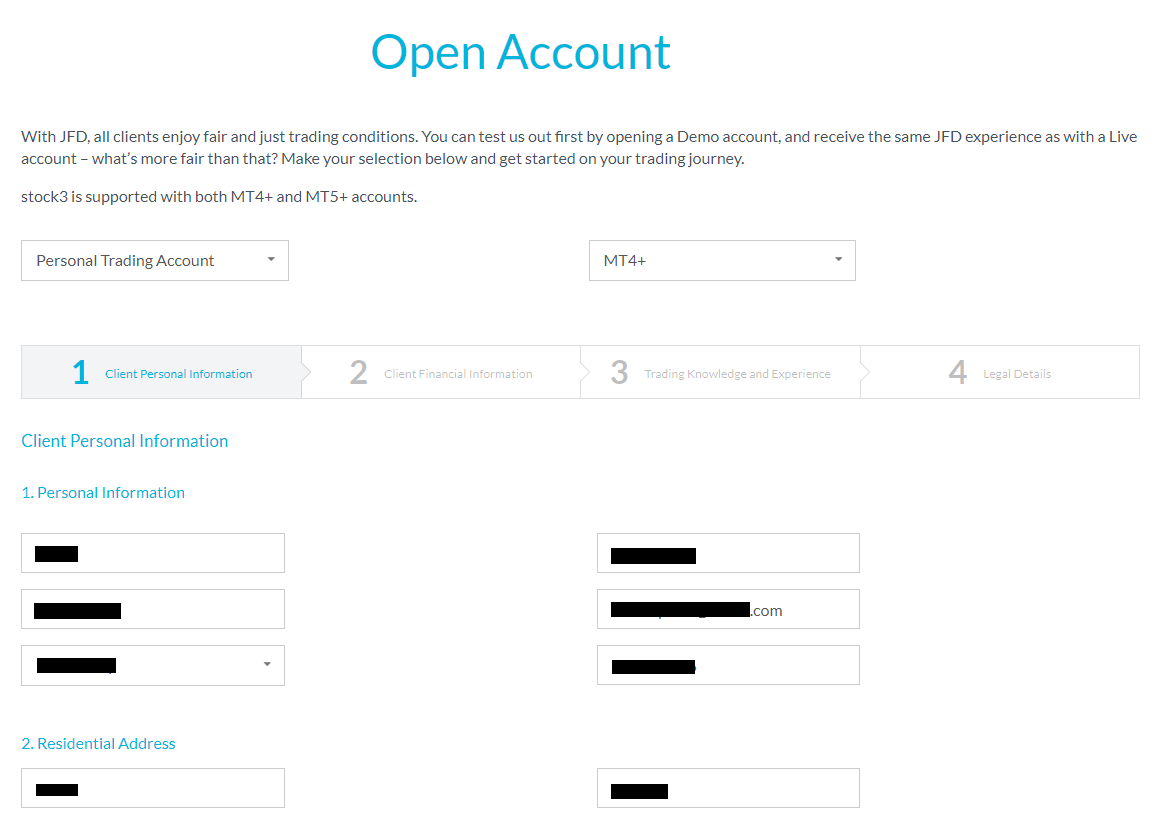

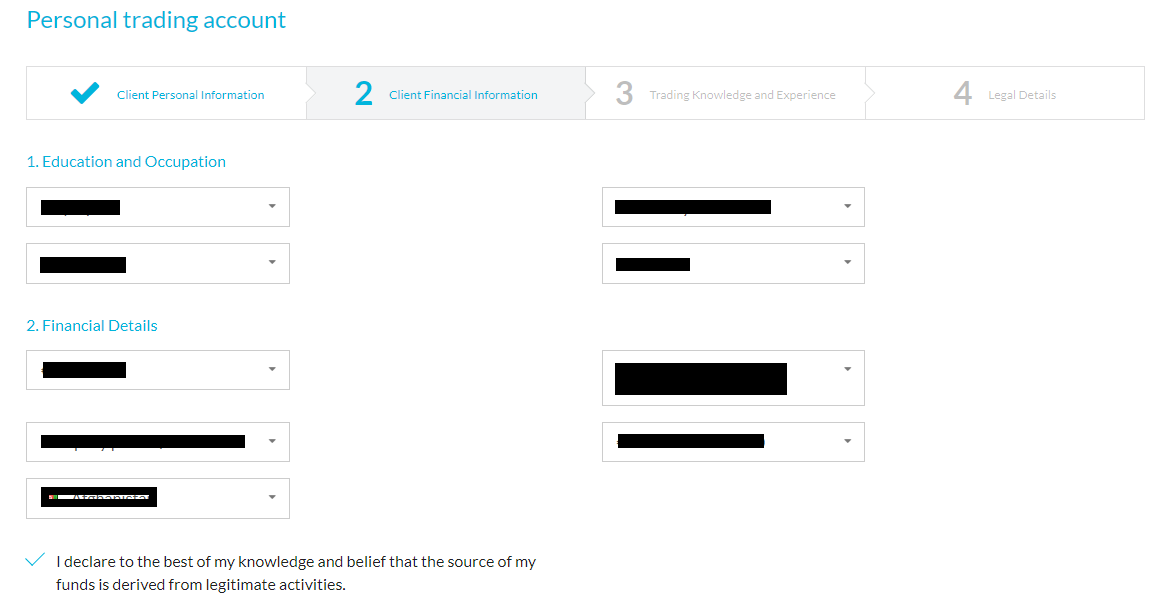

Select the account type (personal, demo, or corporate) and the trading platform. Enter your first and last names, nationality, date of birth, phone number, and email. Then enter the exact residential address and tax information. Answer a few questions in the yes/no format and click the “Next” button.

Next, provide information on your place of employment and income. Select the preferred deposit options. Click the “Next” button.

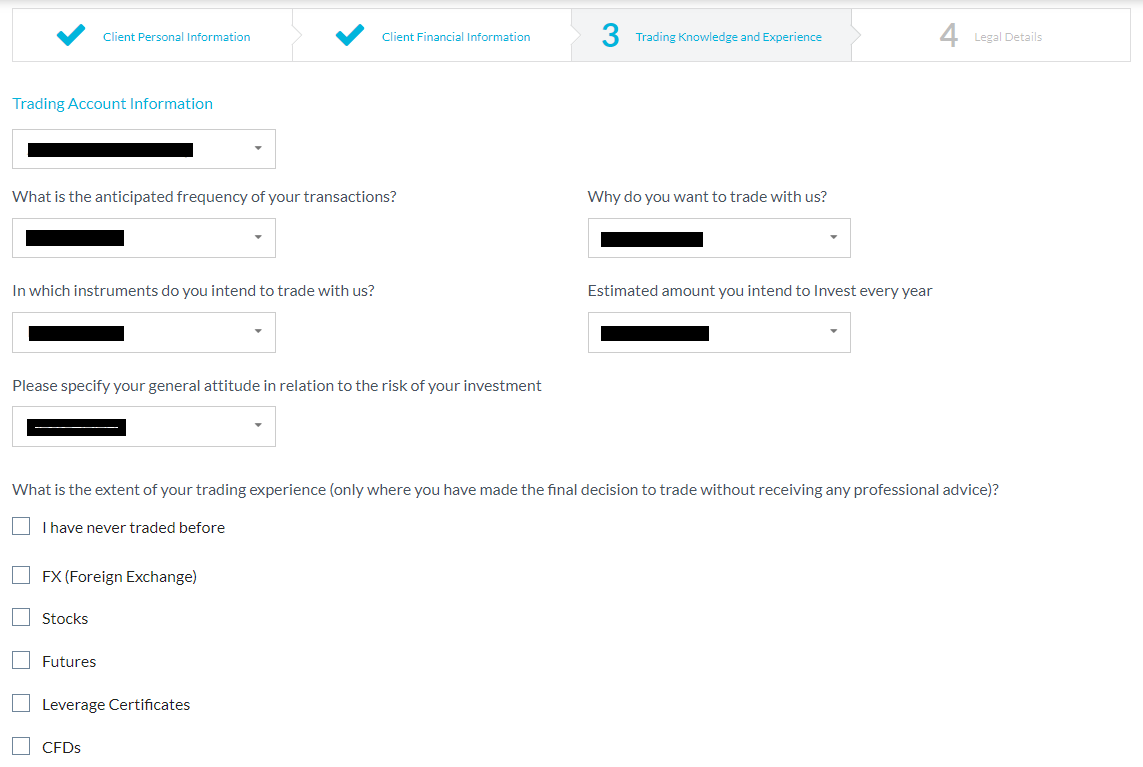

Specify the account currency, preferred financial instruments, and provide your trading experience by answering simple questions. Then click the “Next” button.

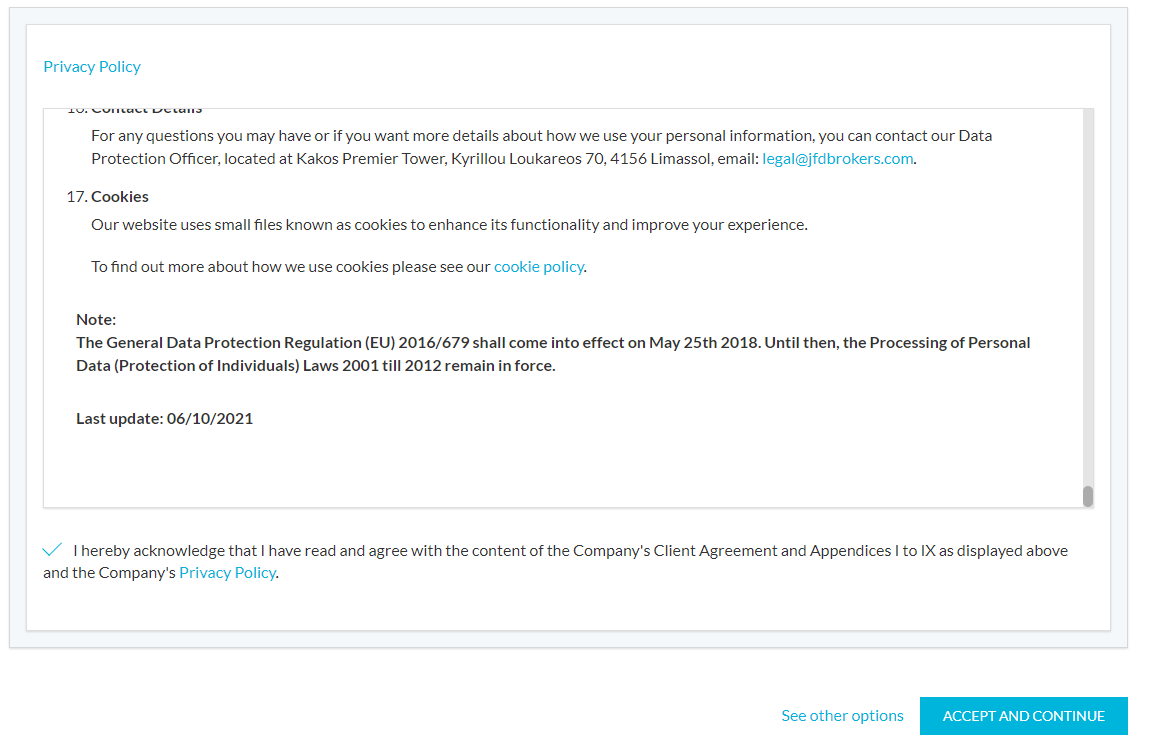

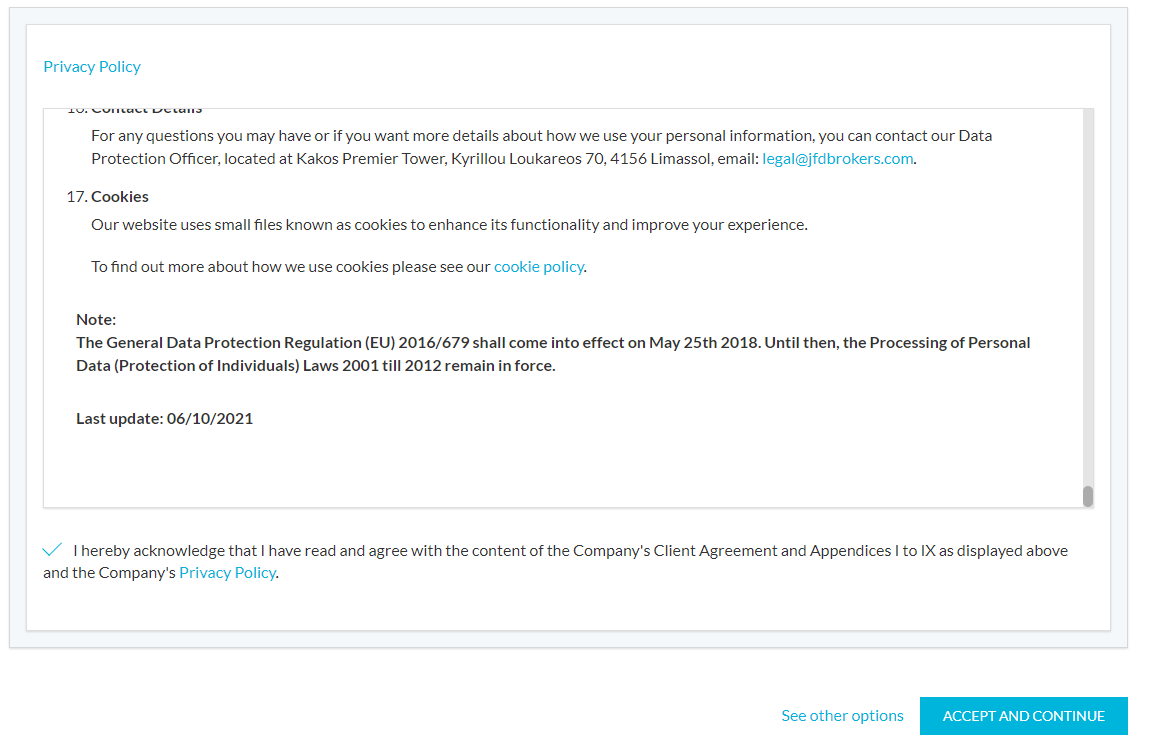

At the final stage of registration, read the terms of service and agree to them by ticking all the boxes. After that, click the "Next" button.

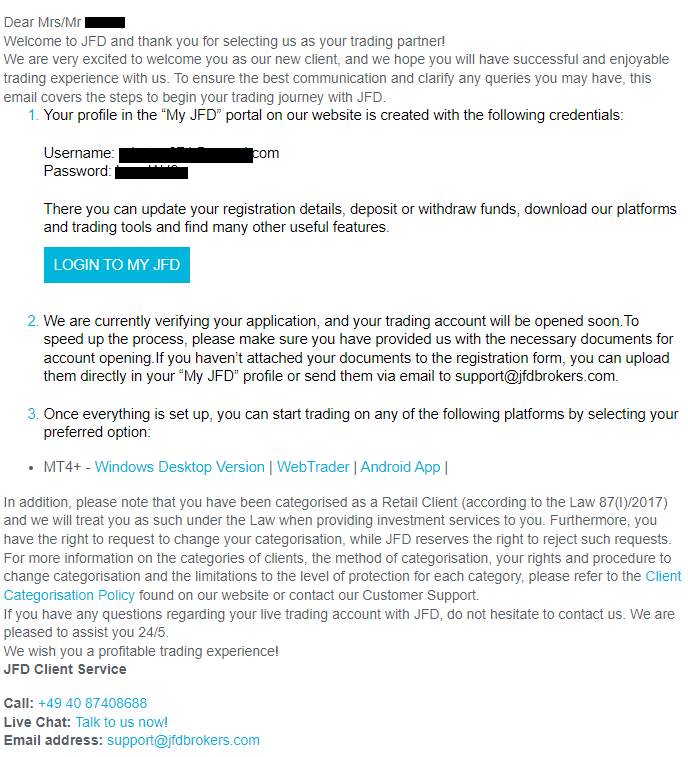

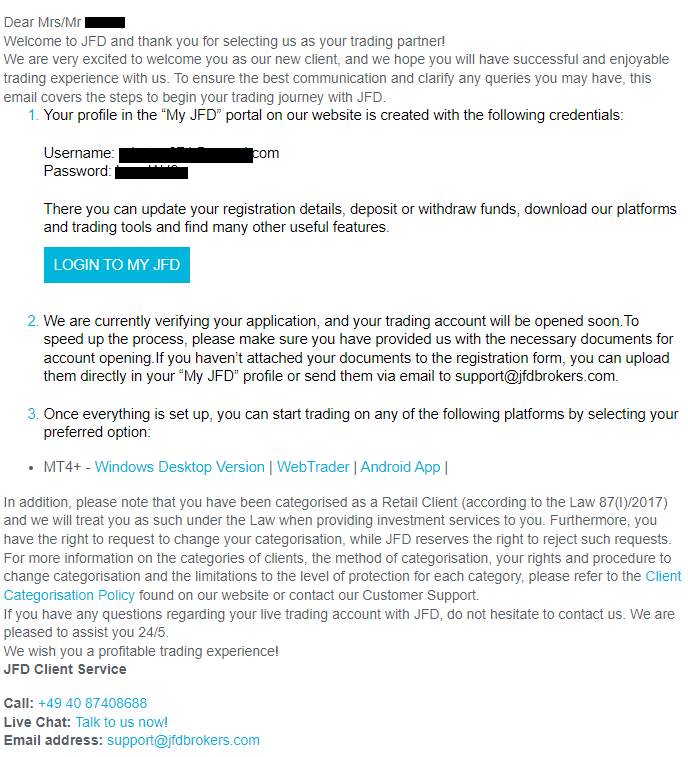

Follow the confirmation link which will be sent to the specified email. After that, an email with registration information will be sent. Open it and click the "Login to my JFD" button.

Go to the login menu on the broker's website. Enter your email and password, then click the "Login" button. Read the terms of cooperation again and agree to them by clicking the "Accept and Continue" button. To change the password: Enter the one that came in the email, then make a new password and enter it twice. After that, you will get access to your user account.

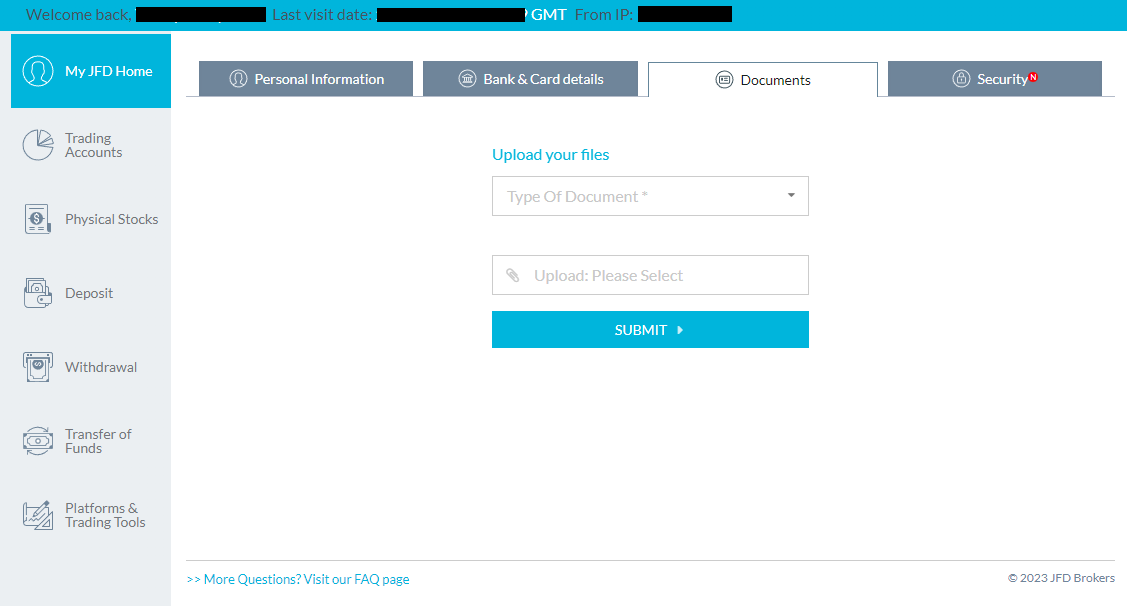

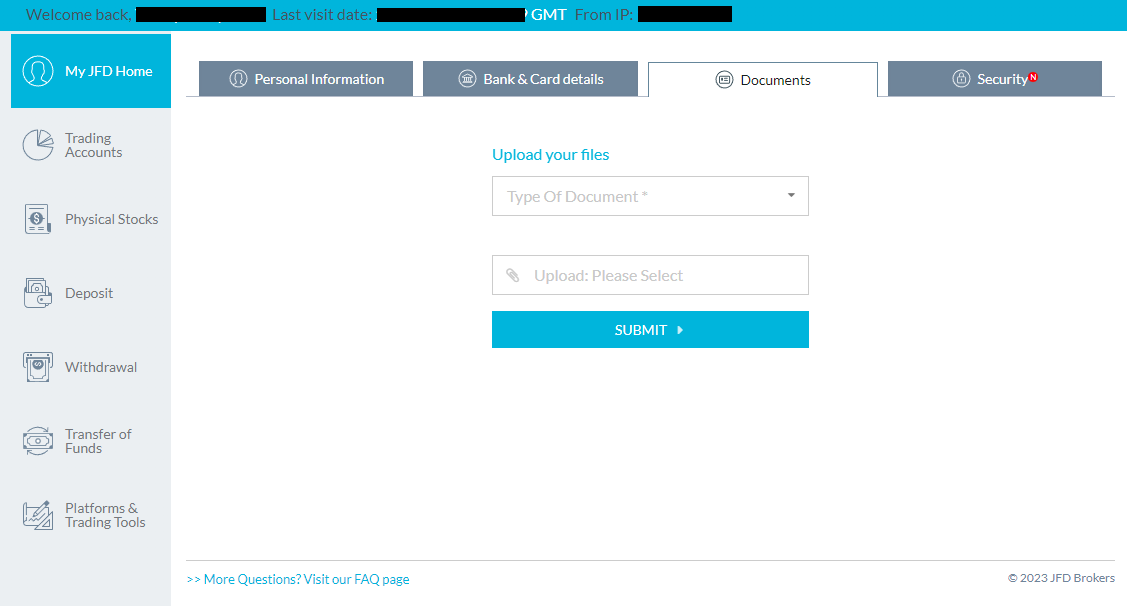

In the "Documents" menu, upload a scan/photo of a document confirming your identity. It could be a passport or driver's license. In the "Bank details" menu, specify the card for deposits and withdrawals. You can specify additional deposit/withdrawal channels. Wait for the broker's specialists to check your information. It takes 1-3 days. After successful verification, you can open a trading account in the "Trading Accounts" menu.

Features of JFD Brokers’ user account:

My JFD Home. Here traders upload documents, select deposit/withdrawal channels, and adjust personal information and security settings;

Trading Accounts. This menu allows traders to open and close accounts (demo or live), as well as track basic information on them;

Physical Stocks. Here traders can find information on their work with stocks, which are displayed in a separate menu of the user account;

Deposit. This section allows traders to select the deposit channel and its options;

Withdrawal. Here traders submit withdrawal requests and monitor them;

Currency Converter. This menu provides an integrated service for converting currencies available on active accounts;

Platforms and Trading Tools. Here traders can download the distributive kit of MT4 and MT5 and their extensions.

Articles that may help you

FAQs

Do reviews by traders influence the JFD Brokers rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about JFD Brokers you need to go to the broker's profile.

How to leave a review about JFD Brokers on the Traders Union website?

To leave a review about JFD Brokers, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about JFD Brokers on a non-Traders Union client?

Anyone can leave feedback about JFD Brokers on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.