According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- XCritical

- 2009

Our Evaluation of MaxiTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

MaxiTrade is a broker with higher-than-average risk and the TU Overall Score of 3.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by MaxiTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

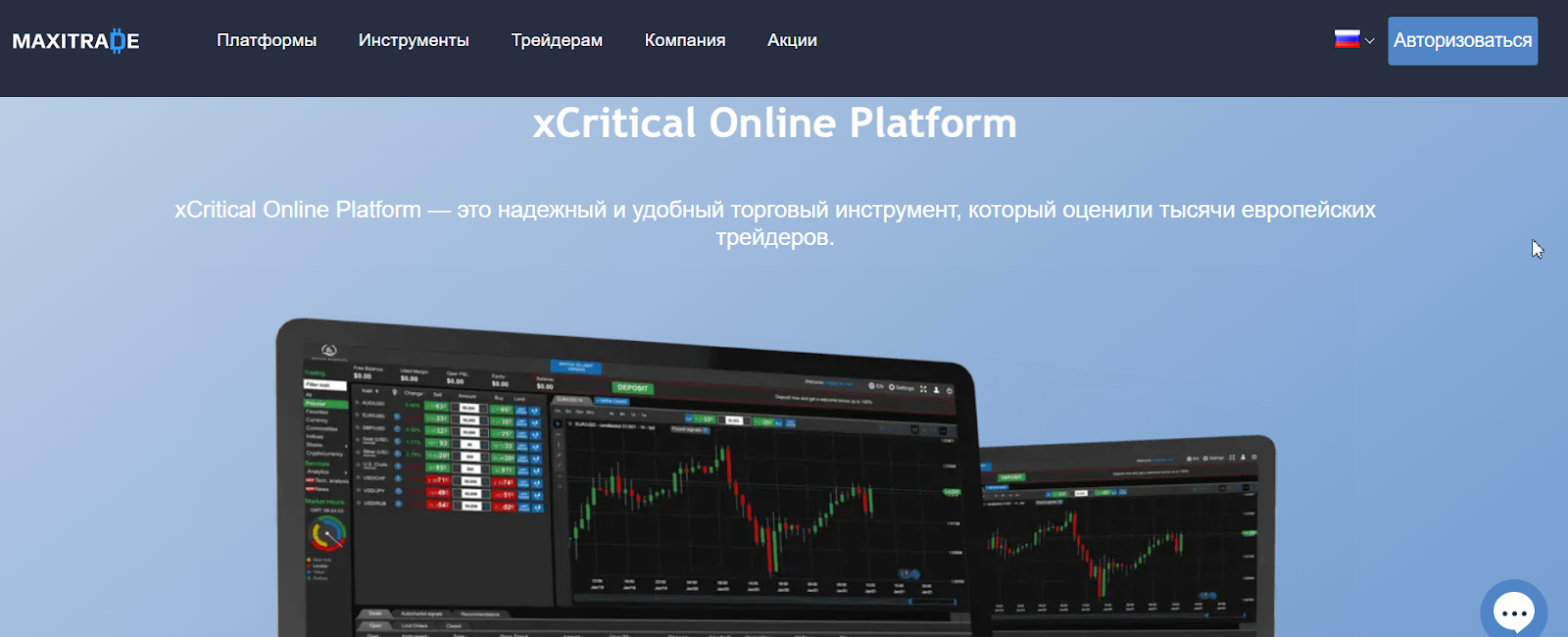

MaxiTrade is widely known in Europe for its favorable trading conditions. The main advantages of the broker are a large choice of assets, many useful instruments, low fees, and full transparency. As a special advantage, traders often mention the convenient XCritical trading platform, which has online and mobile versions. A welcome bonus allows the broker to actively attract users, making trading at the start more profitable. All MaxiTrade’s clients have access to deposit insurance when trading news. As a disadvantage, one can note the significant dependence of the available functions on the selected account.

Brief Look at MaxiTrade

The MaxiTrade broker works with tier-1 liquidity providers such as HSBC, the largest bank in the European Union, which is one of the broker’s partners. The company offers a modern trading platform called XCritical, available both in a browser and as an app. There are six account types with different conditions. The minimum deposit is $500. Spread depends on the account and its average is 1.6 pips. There is no trading fee. The maximum leverage is 1:200. Assets available for trading include currency pairs, cryptocurrencies, stocks, indices, and commodities. Overall, there are 180 assets. MaxiTrade offers a 30% welcome bonus and joint funding of up to 150%. The broker provides expert analytics, educational materials, and such instruments for technical analysis as an economic calendar, table of reporting seasons, market signals, etc. The website also regularly hosts webinars for novice traders and professionals. Users’ funds are insured. There is a referral program, but no investment options.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Traders can choose one of six accounts according to their trading preferences;

- The trading platform offered by the broker is assessed by experts as simple, reliable, and functional;

- A large pool of assets from different groups is available and traders work without any trading restrictions;

- Significant leverage increases profit potential while spreads are average or below average;

- The broker offers a welcome bonus as well as a joint funding program;

- There is no trading fee, but there is a competitive withdrawal fee, and the broker’s activity is 100% transparent;

- Client support is represented by a call center, email, live chat, and tickets. It is available 24/7.

- Spreads differ subject to the account type. On Starter accounts this indicator is quite high;

- The extended choice of instruments, including stocks and indices, is not available for all accounts;

- The broker does not offer passive income options, thus there is no copy trading or direct investment.

TU Expert Advice

Author, Financial Expert at Traders Union

MaxiTrade provides access to a variety of financial markets, including currency pairs, cryptocurrencies, stocks, indices, and commodities through the XCritical trading platform. The broker offers six account types, each with distinct features, starting at a minimum deposit of $500. Trading conditions include competitive spreads, leverage up to 1:200, and no trading fees. MaxiTrade also offers a 30% welcome bonus and various instruments for technical analysis, such as an economic calendar and market signals.

However, MaxiTrade's drawbacks include high minimum deposits for advanced accounts and the lack of passive income options like copy trading. Spreads vary significantly across account types, and the broker is not regulated by Tier-1 financial authorities, impacting investor protection. These factors may not suit traders seeking minimal deposit commitments or enhanced regulatory oversight. Overall, MaxiTrade may appeal to experienced traders who prioritize diverse asset offerings and advanced analytical tools.

MaxiTrade Trading Conditions

| 💻 Trading platform: | XCritical |

|---|---|

| 📊 Accounts: | Starter, Bronze, Silver, Gold, Platinum, and VIP |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfer, Neteller, and Skrill |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:200 subject to the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 1,5-2 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | HSBC and other tier-1 organizations |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Demo account and six live accounts; Competitive spreads; No trading fees; Many assets; Useful financial instruments; Welcome bonus; Proprietary trading platform; Education section |

| 🎁 Contests and bonuses: | Yes |

MaxiTrade has several account types and each of them has its own minimum deposit. A $500 deposit is needed for Starter accounts; for Bronze, it starts from $4,001; for Silver, the deposit starts at $15,001, and increases incrementally. The largest minimum deposit is $500,000 for VIP accounts. Leverage is determined by the asset and does not depend on the account type. The highest trading leverage for currency pairs is 1:200, but you can use less leverage or trade without it. You can contact technical support 24/7 via a call center, email, live chat, Skype, and tickets in the Disputes section.

MaxiTrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with this broker, create a user account. Then open a trading account and make a deposit. Below TU provides a step-by-step guide on registration.

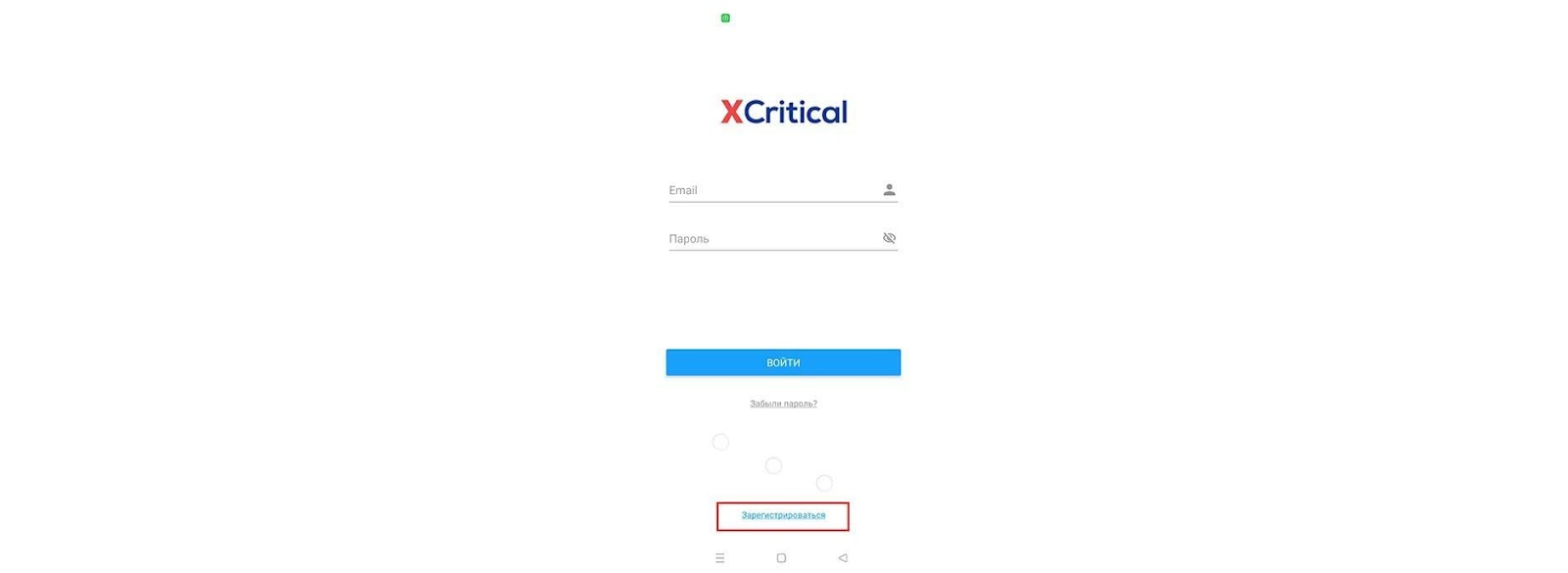

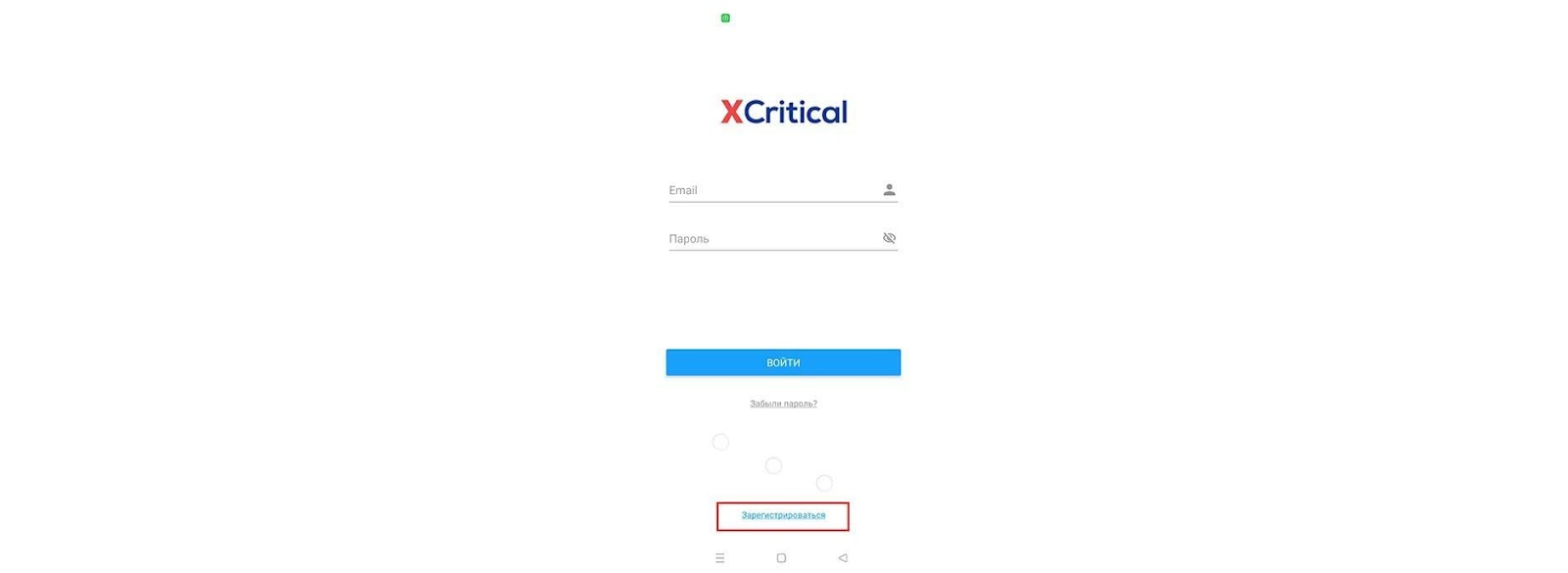

Go to your device's digital store, then to Google Play for Android or App Store for iOS. Enter "XCritical" in the search box and click the "Search" button. Open the application page and click the "Install" button. The application will automatically download and install on your smartphone.

After installing the application, launch it directly from the store or from a desktop shortcut. On the main screen, click the "Register" button (blue link at the bottom).

Enter your first and last names, email, and mobile phone number. Agree to the conditions of the broker by ticking the box and click the "Register" button. Log in and your new password will be sent to the specified email, which you can use to enter your user account through the application or on the broker's website.

In your user account, click the "Deposit" button or go to the "Account" tab and enter your payment details to deposit funds. Verification is not required. You can select the account type in the "Account" tab.

Services of MaxiTrade’s user account:

My trades. It displays open and closed trades, as well as limit orders with status details;

Account. In this tab, traders indicate their deposit and withdrawal details;

Instruments. This tab is a dashboard with information on assets available for trading;

Signals. The current signals are listed here, there is also a sub-tab with notifications;

More. This section contains account settings and additional instruments, technical support is also available here.

Regulation and safety

MaxiTrade has a safety score of 2.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Track record over 16 years

- Not tier-1 regulated

MaxiTrade Security Factors

| Foundation date | 2009 |

| Negative balance protection | No |

| Verification (KYC) | No |

MaxiTrade is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker MaxiTrade have been analyzed and rated as High with a fees score of 3/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of MaxiTrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, MaxiTrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

MaxiTrade Standard spreads

| MaxiTrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 2 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 2,2 | 1,4 | 0,5 |

Does MaxiTrade support RAW/ECN accounts?

As we discovered, MaxiTrade does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with MaxiTrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

MaxiTrade Non-Trading Fees

| MaxiTrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0,5-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If a broker offers several account types, the correct choice by a trader and how he uses it determines how the platform will develop in the future. This is because spreads, available financial instruments, and the priority of technical support depend on the account selected. MaxiTrade’s accounts also affect the extension of the trade duration, saving the user account program, and the ability to trade on the U.S. quarterly reports.

Accounts also differ in the availability of webinars, trading focus groups, and SMS notifications. Finally, the work of the analytical service and the availability of financial services are also determined by each account. For example, technical support on Starter accounts only helps on how to start trading, while on Gold accounts, experts select investment portfolios for you; and on VIP accounts, free monitoring of trading accounts is available.

Read the conditions carefully before making your choice. It is not necessary to aim for Gold or more expensive accounts if you do not know how to properly use the opportunities they offer.

Account types:

Note that in addition to live accounts, the broker also offers a demo account. It does not require a deposit. Trading is carried out with real quotes, but with virtual funds. A demo account is required to get acquainted with the platform and work out strategies.

Deposit and withdrawal

MaxiTrade received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

MaxiTrade offers limited payment options and accessibility, which may impact its competitiveness.

- No deposit fee

- Low minimum withdrawal requirement

- Bank card deposits and withdrawals

- Minimum deposit above industry average

- BTC not available as a base account currency

What are MaxiTrade deposit and withdrawal options?

MaxiTrade offers a limited selection of deposit and withdrawal methods, including Bank Card, Skrill, Neteller. This limitation may restrict flexibility for users, making MaxiTrade less competitive for those seeking diverse payment options.

MaxiTrade Deposit and Withdrawal Methods vs Competitors

| MaxiTrade | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are MaxiTrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. MaxiTrade supports the following base account currencies:

What are MaxiTrade's minimum deposit and withdrawal amounts?

The minimum deposit on MaxiTrade is $500, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact MaxiTrade’s support team.

Markets and tradable assets

MaxiTrade offers a limited selection of trading assets compared to the market average. The platform supports 180 assets in total, including 67 Forex pairs.

- Crypto trading

- Indices trading

- Copy trading platform

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by MaxiTrade with its competitors, making it easier for you to find the perfect fit.

| MaxiTrade | Plus500 | Pepperstone | |

| Currency pairs | 67 | 60 | 90 |

| Total tradable assets | 180 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products MaxiTrade offers for beginner traders and investors who prefer not to engage in active trading.

| MaxiTrade | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical (client) support is an important part of the activity of any organization. Brokers may offer the best FAQs and the simplest website interface, but traders will still have questions that they cannot answer on their own. Therefore, it is necessary that the company's clients receive competent assistance at any time. Thus, MaxiTrade offers 24/7 technical support, which is represented by many communication channels, such as a call center, email, live chat, Skype, and tickets on the website.

Advantages

- Non-registered users can contact technical support

- Managers are available for communication 24/7

- All communication channels respond quickly

Disadvantages

- There are accounts with priority support

It is difficult to single out the disadvantages of MaxiTrade’s client support team. However, there is one moment, that the priority level of your application depends on the account type. On Starter accounts you will be served in order of receipt, while on Gold accounts you will be one of the first to receive an answer.

Below is the list of communication channels relevant for all account types:

-

call center;

-

email;

-

email for claims;

-

Skype;

-

live chat on the broker's website and in the user account;

-

tickets.

Keep in mind that responses by phone and live chat are always faster than by email. If you create a ticket on the website, the answer will come to your email.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands |

| Official site | https://maxitrade.com/ |

| Contacts |

+48 221 530 624

|

Education

Traders must improve by exploring new trading methods and learning from the experience of their colleagues. Otherwise, they stagnate, fail to keep up with the market, and the number of unsuccessful transactions increases. Brokers are well aware of this, which is why many platforms provide their clients with educational programs. These programs range from basic FAQs to full-fledged academies. MaxiTrade also offers its traders a training system, which is considered one of the best.

In fact, MaxiTrade provides comprehensive training for every level, ranging from the Forex market novice traders to professionals who work with large investment portfolios. But it all depends on the chosen account. Starter accounts offer only the basics, thus work with other assets, except for currency pairs, is not described. But Gold accounts and all subsequent ones offer more in-depth and comprehensive education.

Comparison of MaxiTrade with other Brokers

| MaxiTrade | Eightcap | XM Group | RoboForex | NPBFX | Kama Capital | |

| Trading platform |

XCritical | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4 | MetaTrader5 |

| Min deposit | $500 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:200 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1.6 point | From 0 points | From 0.8 points | From 0 points | From 0.4 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | No / 30% | 20% / No |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of MaxiTrade

MaxiTrade is officially registered and has been offering its services to traders worldwide (with a few exceptions) for many years. The company meets modern standards from a technical point of view. A special advantage is the trading platform, which is considered one of the fastest and most innovative. The company offers everything you need for comfortable work, namely an economic calendar, a table of reporting seasons, a table of spreads, and a calendar of futures contract expirations. The trading platform can display a variety of charts; also, there is a wide choice of timeframes. It is possible to insure the deposit while trading news, this function has no analogs. All accounts, except for Starter, offer a personal manager who provides up-to-date analytics. The amount of information and its customization are determined by the account type.

MaxiTrade by the numbers:

-

The minimum deposit is $500;

-

30% welcome bonus;

-

180 financial instruments;

-

The maximum leverage is 1:200;

-

Deposit insurance is 100%.

MaxiTrade is a convenient broker for trading on popular markets

There are platforms that focus on a specific group of financial instruments, but most offer several groups. Usually, these are currencies, stocks, and indices. Cryptocurrencies have recently been often included in the list of assets available for trading. Of particular note are brokers who work strictly with contracts for difference (CFDs). One way or another, most traders prefer to have access to as many markets as possible. MaxiTrade is one of the leaders in this sense, as currencies, cryptocurrencies, indices, stocks, and commodities are all available to its clients. Of course, there are platforms that also offer commodities, precious metals, etc. However, 180 assets from 5 different groups are more than enough to make a diversified investment portfolio. In addition, the wider the pool of instruments available to traders is, the less they limit themselves, and the more strategies they can apply.

Useful services offered by MaxiTrade:

-

Economic calendar. Many brokers have this service. It is a list of the most important political and economic events for the current year that could potentially affect the quotes of certain assets;

-

Reporting season. This is an interesting addition to the economic calendar. The service is presented in the form of a table adjusted by timeframes, which displays the positions of large companies for the previous reporting season with a forecast for the current season;

-

Spread table. This is an extremely useful service with real-time data changes. Traders can select any asset from the list and find out what spread they are currently trading on the selected live account.

Advantages:

A wide range of accounts, each of which offers its own trading conditions and is designed for certain groups of traders;

Full transparency of the platform, thus all fees are known in advance and you can consult your manager at any time;

Leverage of up to 1:200, 180 assets from 5 groups, no restrictions on trading strategies, and many useful instruments are available;

The broker has a welcome bonus, 100% deposit insurance, and a profitable referral program;

The broker's XCritical trading platform is rated by users and experts with the highest score due to its simplicity and functionality.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i