OspreyFХ Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- TradeLocker

- SVGFSA

- 2020

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- TradeLocker

- SVGFSA

- 2020

Our Evaluation of OspreyFХ

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OspreyFХ is a high-risk broker with the TU Overall Score of 2.4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OspreyFХ clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. OspreyFХ ranks 374 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

OspreyFX offers accounts for traders with varying levels of expertise and a proprietary platform compatible with many devices. However, in terms of reliability, OspreyFX falls behind regulated brokers.

Brief Look at OspreyFХ

The Forex and CFD broker OspreyFX has been providing services since 2018, yet it still operates without a license. In 2023, all MT4 and MT5 client accounts were migrated to the proprietary TradeLocker platform with TradingView technical analysis tools and one-click trading support. OspreyFX offers STP and ECN accounts differing in fees and deposit requirements. Their account lineup includes demo, cent, and Islamic accounts, with leverage reaching up to 1:500. The broker is registered with the St. Vincent and the Grenadines Financial Services Authority (SVGFSA).

- Operating with STP and ECN technologies;

- Liquidity from numerous providers, including major banks;

- Favorable minimum deposit requirements — starting from $25 for cent accounts and $50 for standard accounts;

- Different pricing models;

- Availability of demo and cent accounts;

- Leverage is up to 1:500;

- Regular trading contests with cash rewards and prizes.

- Unregulated operations and registration in an offshore zone with weak financial market oversight;

- Lack of proprietary offerings for investors and access to passive income services from third-party developers;

- Higher trading fees compared to its competitors.

TU Expert Advice

Financial expert and analyst at Traders Union

The OspreyFX website was established at the end of 2018, and after 7 months, the company was officially registered and began cooperating with traders worldwide. It offers its clients a choice of accounts and trading instruments, round-the-clock support, high-quality educational materials, and analytical data. OspreyFX's strengths include the availability of a demo platform and cent accounts with low trading fees, as well as the use of STP and ECN technologies for direct market transactions without the intervention of the dealing desk.

The minimum deposit in cryptocurrencies is only $10. Traders can also deposit funds from a card — either directly or through the intermediary service Instacoin (which allows purchasing Bitcoins with fiat currency from the card). For this deposit method, the minimum deposit is $25 or $50 (depending on the card type). The broker accepts all popular digital coins but still does not support transactions in Bitcoin Cash (BCH).

The main drawbacks of OspreyFX are the absence of a license and registration in an offshore zone where the Forex market is not regulated. Another downside for novice traders could be the lack of the option to copy others' trades, as the company's proprietary platform doesn't support social trading features.

- You prioritize speed and transparency. The broker claims lightning-fast ECN execution and STP (Straight Through Processing) for transparent trade execution, potentially appealing to traders who value swift and clear transactions.

- You are an experienced trader comfortable with high risk. The broker offers leverage up to 1:500, providing the opportunity to amplify both profits and losses significantly, suitable for traders who understand and can manage higher risk levels.

- Regulation is a critical factor for you. The broker lacks regulation from major financial authorities, such as the FCA or CySEC. This absence of oversight may raise concerns about the security of your funds and fair trading practices.

- You are cautious about negative reviews. While online reviews should be considered with caution, negative reviews and red flags should prompt you to conduct thorough research and consider the experiences of other users before choosing this broker.

OspreyFХ Summary

| 💻 Trading platform: | TradeLocker (web, mobile app) |

|---|---|

| 📊 Accounts: | Demo, Mini, Standard, Pro, VAR, Islamic |

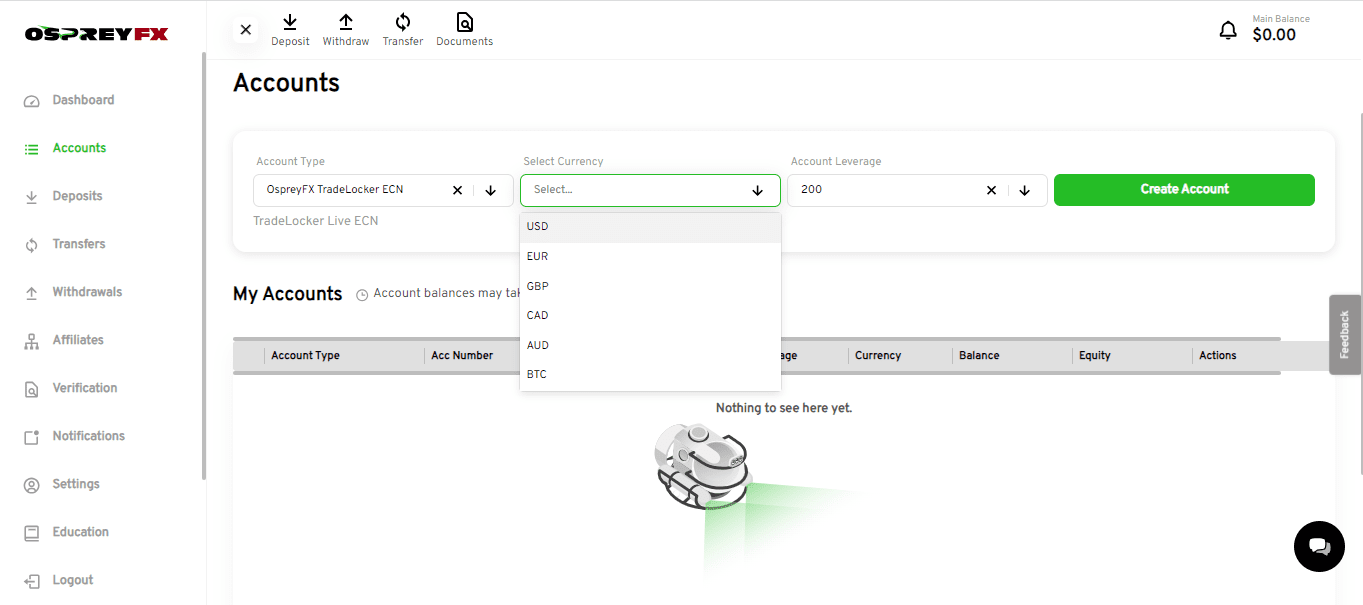

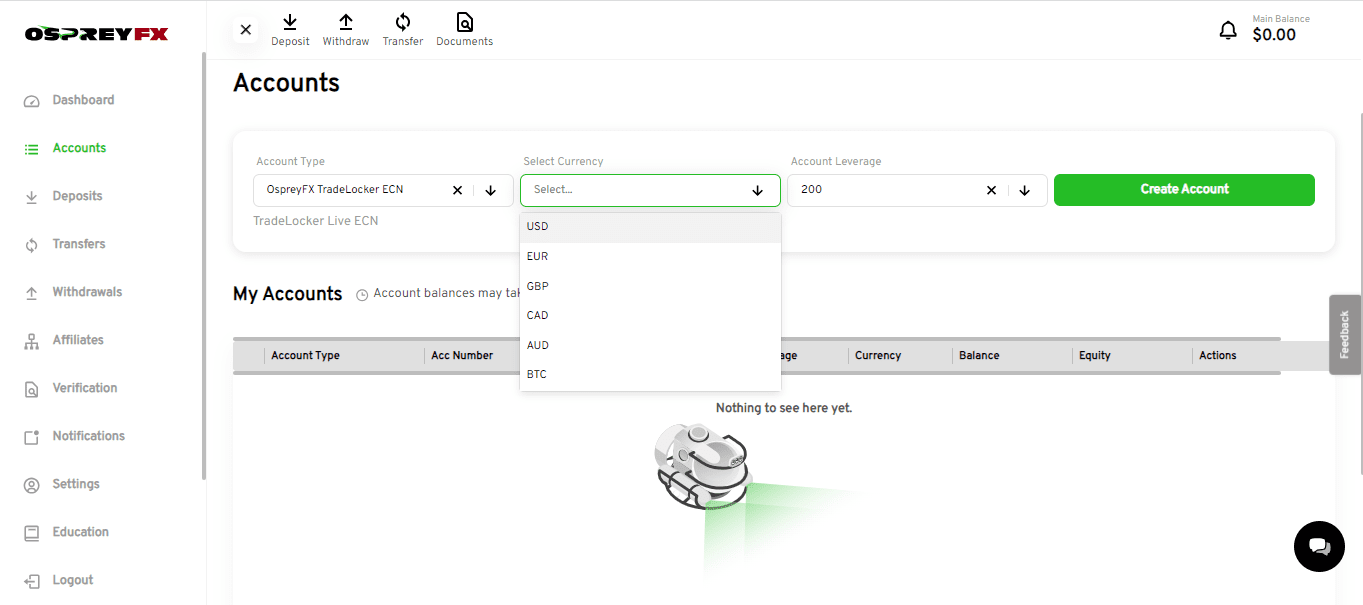

| 💰 Account currency: | BTC, AUD, GBP, EUR, USD, CAD |

| 💵 Replenishment / Withdrawal: | Credit/debit cards, AstroPay, QIWI wallet, PayRedeem, Sofort, iDeal, Postepay, Giropay, cryptocurrency payments, bank transfer, Bitcoins via Instacoin |

| 🚀 Minimum deposit: | $25 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating spreads from 0.4 pips for ECN and from 1.2 pips for STP accounts |

| 🔧 Instruments: | Forex (major currencies, crosses, exotics), metals, energy carriers, indices, cryptocurrencies, EU stocks, U.S. stocks, futures |

| 💹 Margin Call / Stop Out: | 100%/70% |

| 🏛 Liquidity provider: | Major banks (50+) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Scalping, position hedging, and trading during news releases are allowed |

| 🎁 Contests and bonuses: | Trading competitions, promotional offers for new and existing clients, account funding program |

The broker allows trading without verification for deposits not exceeding $2,000. OspreyFX offers a choice of accounts and base currencies, allowing traders to operate under the most comfortable and advantageous conditions. The TradeLocker platform supports leveraged trading and floating spreads but is designed specifically for active trading. OspreyFX clients can employ many trading strategies and styles, deposit/withdraw cryptocurrencies, and even open accounts in Bitcoins.

OspreyFХ Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

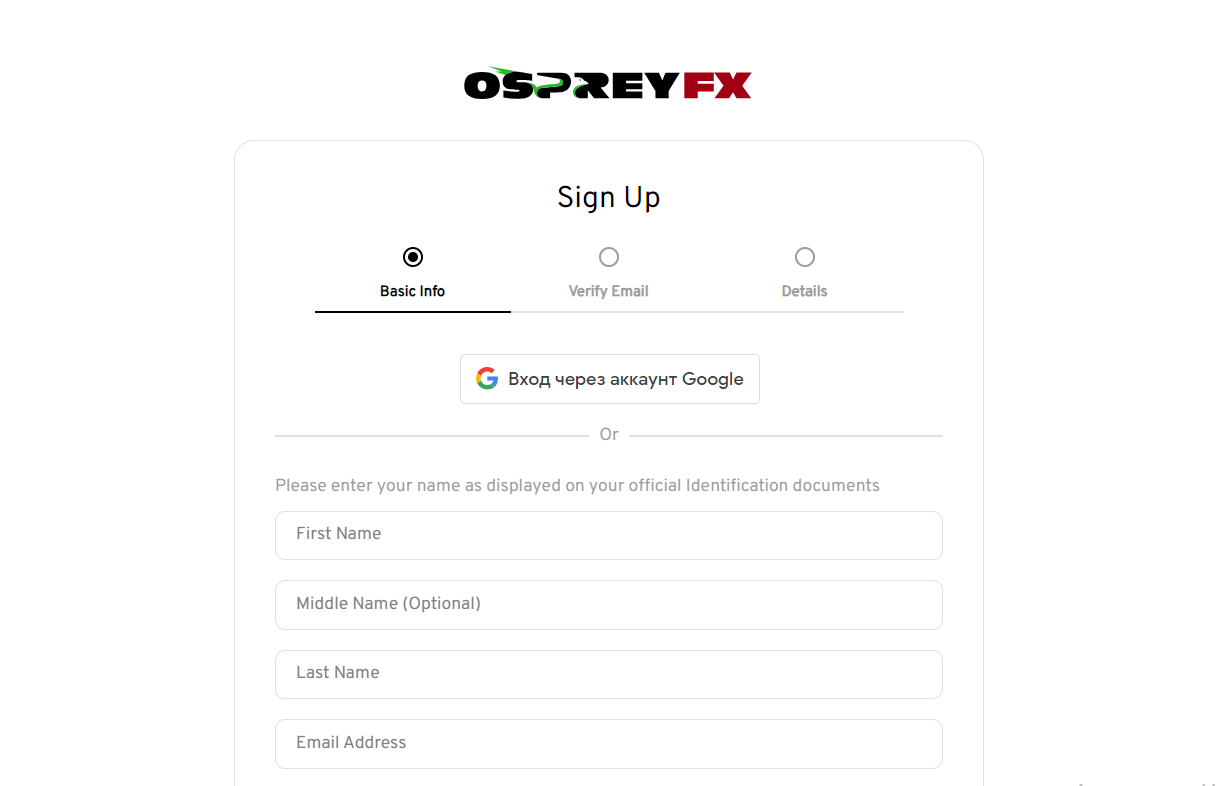

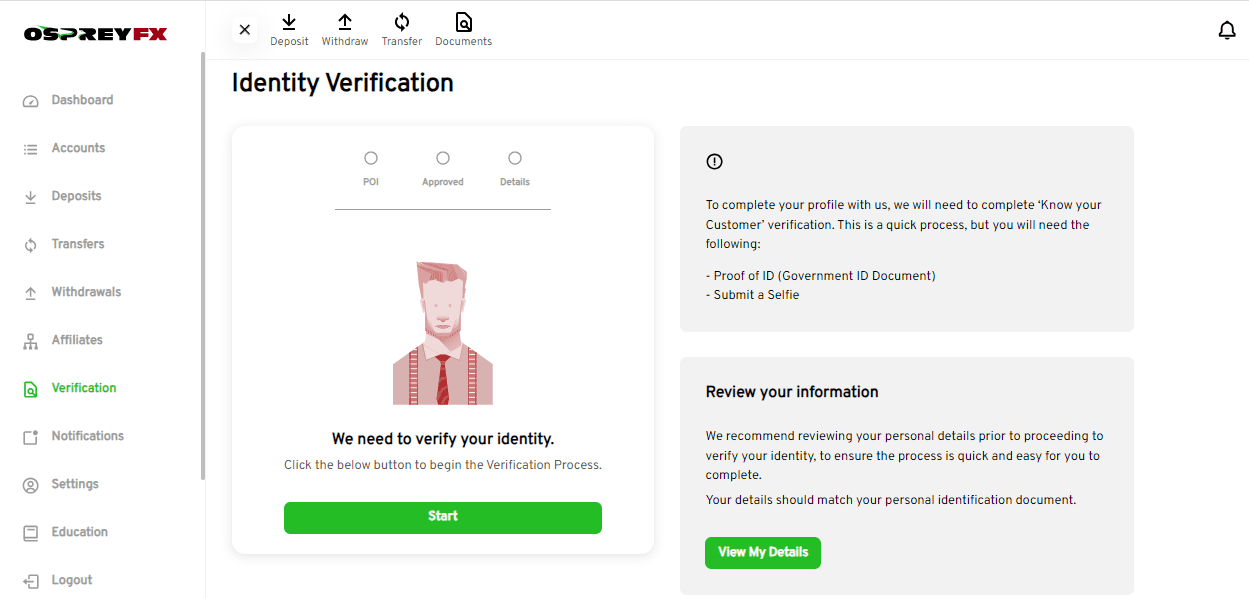

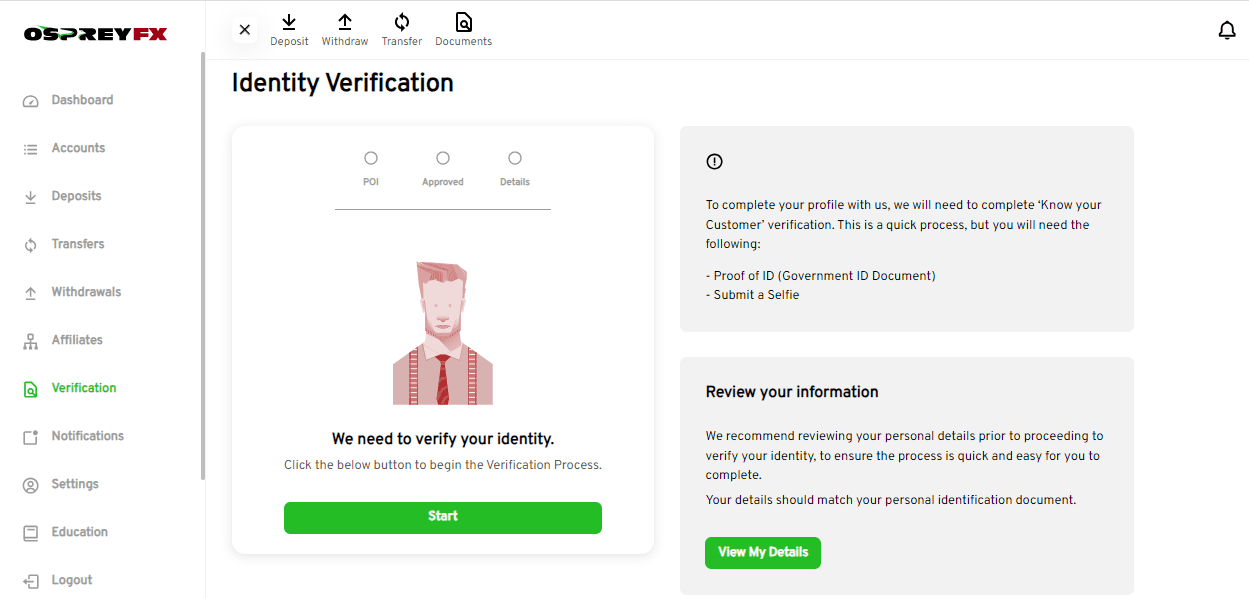

Access to the OspreyFX user account is granted after creating an account on its website. Briefly, this is an outline of the steps required for registration with the broker:

Similar to many brokerage firms, the registration at OspreyFX begins by clicking the Sign Up button.

Next, fill out the form that appears on the screen. The broker requests a minimum amount of information. The potential client must provide their name and surname, as well as a valid email. It's also necessary to generate a password for login and confirm being 18 years old. The final step of registration is clicking the link in the email from OspreyFX. The broker offers two-factor account protection, so to access it, you need to enter not only the email and password but also a 6-digit code. A new code is sent to the registered email during each login session.

The company's client can use the user account to:

Other functions of the client portal allow you to:

-

Fund management — deposit and withdraw funds, transfer money between accounts within one user profile;

-

Add additional accounts — open user and demo accounts, request an Islamic account;

-

Generate statistics for the referral program and request the withdrawal of partner rewards;

-

Register on a third-party platform with Forex Squad training;

-

View notifications from the company and communicate with technical support via chat;

-

Choose the method of receiving a one-time OTP code via SMS, email, or through authentication apps (e.g., Google Authenticator).

Regulation and Safety

The brand OspreyFX is owned by Osprey Ltd, registered as a Business Company (BC) with the regulator St. Vincent and the Grenadines Financial Services Authority (SVG FSA). Verification of the number 25288 BC 2019, as indicated on the OspreyFX website, confirmed the broker's active status.

The registration number in St. Vincent and the Grenadines is not a license number. The SVGFSA regulator does not oversee the activities of Forex and binary options brokers. Due to this, OspreyFX's financial indicators are not audited by third-party audit services, and its clients are not protected by any compensation programs.

Advantages

- OspreyFX offers higher leverage compared to its competitors

- Account access requires a login, password, and a one-time OTP code (2FA)

- Trading can start without the need for identity and address verification

Disadvantages

- OspreyFX operates without regulation

- Account balance can fall below zero with an improper strategy

- Clients of OspreyFX are not entitled to compensation in case of broker suspension

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Pro | From $4 | Broker's fee $0 or $25 + payment provider's fee |

| VAR | From $12 | Broker's fee $0 or $25 + payment provider's fee |

| Standard | from $8 | Broker's fee $0 or $25 + payment provider's fee |

| Mini | From $0.1 | Broker's fee $0 or $25 + payment provider's fee |

If a trader does not close a trade before the start of the next trading day, a special fee called a swap is applied. It does not necessarily result in a loss: if the asset's rate is positive, the trader will make a profit.

Traders Union experts have compiled a comparative table of fees for OspreyFX, RoboForex, and Pocket Option, illustrating the client-oriented approach of each broker regarding fees.

| Broker | Average commission | Level |

|---|---|---|

|

$6.3 | |

|

$1 | |

|

$8.5 |

Account Types

After creating an account on the OspreyFX website, traders can choose trading conditions based on the deposited amount. On the Mini cent account, traders can engage in transactions with 29 currency pairs, while on all other accounts, the number of pairs reaches 55. The maximum leverage is consistent for all account types and stands at 1:500 for all clients.

Account Types:

If a trader wishes to practice with virtual money, they can do so in the demo mode of the platform. The broker provides a virtual deposit of up to $10,000 and leverage of up to 1:3,000. OspreyFX offers a diverse range of accounts to meet the needs of both experienced CFD and Forex traders and newcomers to the market.

Deposit and Withdrawal

-

Traders can withdraw an amount equal to the deposit made using a card. OspreyFX processes trading profits in cryptocurrencies or transfers them to clients' bank accounts;

-

In addition, traders can request withdrawals in cryptocurrencies (BTC, ETH, LTC, XRP, Tether (ERC20, TRC20), DOGE, USD Coin) or transfer funds to electronic systems (options vary depending on the client's country). Withdrawals are not available for unverified users, in case of a negative account balance, and for prepaid cards;

-

The company processes withdrawal requests within one business day and notifies the client of the outcome via email. The time for fund crediting varies from a few minutes to 6 days. The fastest method for receiving funds is through electronic wallets, while the slowest is a bank transfer. Cryptocurrency transactions take up to 3 hours, but they can be faster with the necessary network confirmations (3 to 6);

-

The broker charges a fee ($25) only to cover expenses associated with bank transfers if a trader requests up to $5,000. Other withdrawals from OspreyFX are free of charge.

Investment Options

In 2023, the broker OspreyFX discontinued the use of MetaTrader platforms and migrated its clients' accounts to its proprietary platform, TradeLocker. Unlike MT4 and MT5, this platform isn't designed for algorithmic trading, which means traders lose the ability to use trading robots or advisors. Social trading is also not available for OspreyFX clients.

However, the company is interested in expanding its services and enhancing TradeLocker. It promises to add services for passive traders and investors. For instance, the website announced the development of PAMM and MAM systems, as well as tools for automating the trading process.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of OspreyFX:

-

The partnership program allows existing clients to earn profits by attracting new traders. The reward is not one-time but is paid after the referral closes a full lot. The minimum amount of partner fee is $7.5;

-

The White Label program is designed for setting up one's own brokerage business. OspreyFX provides a fully customized system: a trading platform, liquidity from its providers, and back-office services.

Another passive income option involves referring traders to the funded accounts program (prop services). If the referral receives real funds, the broker redirects 20% of its fees for their trading to the partner.

Customer Support

All available communication methods allow contacting OspreyFX at any time of the day, including weekends.

Advantages

- 24/7 technical support

- Quick response from chat operators

Disadvantages

- No phone support

- Limited communication channels

Both registered clients and unregistered traders have access to the same communication channels with the broker, namely:

-

Live Chat;

-

Email.

The contact section also features a feedback form allowing users to submit questions directly to OspreyFX via email.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | Osprey Ltd, Beachmont Business Centre, Suite 4, Kingstown, St Vincent and the Grenadines, K001 |

| Regulation | SVGFSA |

| Official site | https://ospreyfx.com/ |

| Contacts |

Education

The OspreyFX website offers educational content for traders of varying skill levels, from beginners to professionals. Additionally, there is training on audience expansion strategies for partners. Clients of the broker who have opened a user account and made a deposit gain access to the Forex Squad platform with over 70 trading lessons.

For those looking to familiarize themselves with the trading process without depositing money, demo accounts are available. These accounts simulate trading in the real market, but traders use the broker-provided virtual deposit instead of their own funds.

Comparison of OspreyFХ with other Brokers

| OspreyFХ | RoboForex | Pocket Option | Exness | Octa | Libertex | |

| Trading platform |

MT4, MT5, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | Libertex, MT5, MT4 |

| Min deposit | $10 | $10 | $5 | $10 | $25 | 100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | 1.00% | No | No | No | No | No |

| Spread | From 0.4 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.1 points |

| Level of margin call / stop out |

100% / 70% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 50% / 50% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of OspreyFХ

The brokerage firm OspreyFX offers an ECN/STP trading model, Market execution type, and liquidity from over 50 major banks. Clients are allowed to use popular strategies such as scalping, position hedging, and trading on newsfeeds, and can also engage in leveraged trading using credit leverage. While specializing in active trading, the broker plans to introduce PAMM and MAM services soon to attract investors and experienced fund managers.

OspreyFX by the numbers:

-

Over 2 million registered traders;

-

Over 25 partners in the White Label program;

-

More than 120 financial instruments;

-

Leverage up to 1:500 on user accounts and up to 1:3000 on demo accounts;

-

Maximum trade size is 1000 lots.

OspreyFX is a broker that offers trading on proprietary browser-based and mobile platforms

The conditions for providing leverage at OspreyFX depend on the trading instrument and the capital amount in the account. The maximum leverage for balances up to $500,000 is 1:500 for Forex; 1:200 for metals, indices, and energy resources; and 1:100 for cryptocurrencies. If the balance exceeds $500,000, the maximum leverage for these asset groups is 1:200, 1:50, and 1:50, respectively. The leverage for stocks reaches up to 1:20. In times of increased market volatility, the broker may reduce leverage to mitigate risks for its clients.

Previously, OspreyFX clients traded on MT4 and MT5. In May 2023, the company introduced the TradeLocker web platform, developed in-house and based on TradingView charts. Later, mobile applications for Android and iOS devices were launched. All platform versions support one-click trading, setting stop-loss and take-profit orders, and working with micro-lots. With customizable charts and a plethora of built-in indicators, high-quality technical market analysis can be conducted.

Useful Functions of OspreyFX:

-

Trading hours chart for currency markets, stock indices, energy resources, metals, and U.S. and EU stocks;

-

Real-time spreads for the most traded assets;

-

Three types of trading calculators plus an online currency conversion tool;

-

Funded (prop) accounts — accounts with deposits up to $200,000 for traders who have met the specified deposit amount and daily profit level requirements.

Advantages:

Wide range of payment systems for deposits and withdrawals, including cryptocurrencies;

Prop funding programs can kickstart professional trading;

Access to TradingView charts, over 50 technical indicators, market news, and analytics;

Partnership and bonus programs, and promotional offers for existing and new clients;

Client deposits are stored in first-tier bank accounts, completely segregated from OspreyFX's capital;

The company regularly conducts internal risk audits to avoid exceeding costs for cash operations and settlements with clients.

User Satisfaction