How to buy/sell on Plus500

Plus500 is a well-known CFD broker, actively providing services in Europe and Asia. The company allows traders to work with contracts for differences, including CFDs on stocks, stock indices, commodities, currency pairs, etc. If desired, you can practice on a demo account. Plus, the demo account has no time limit. Traders highlight low spreads, a modern trading platform, and legal operation as key benefits. Plus500 is listed on the London Stock Exchange.

The company is officially registered in the UK, regulated by the United Kingdom Financial Conduct Authority (FCA) and also licensed by a number of other reputable regulators.

Plus500 takes a conservative approach to trading and focuses on active traders who do not use automated trading systems. Among the main disadvantages, users mention slow support and problems with withdrawal.

If you want to trade with Plus500 but are unsure how to get started, an article from Traders Union will help you understand basic aspects. TU experts will tell you about the key points that should be considered when registering and trading with this broker, starting with the available trading assets and ending with fees.

Available trading assets on Plus500

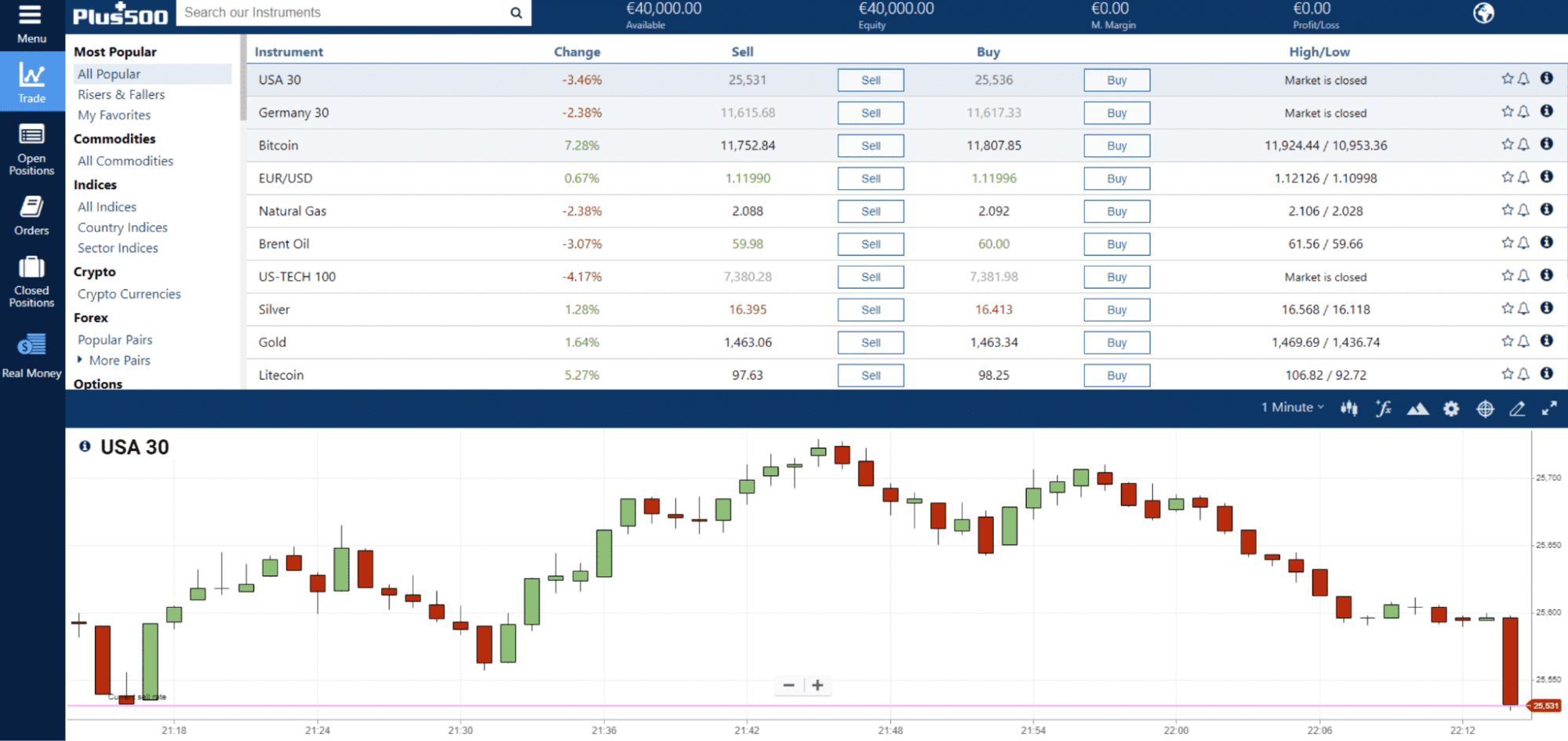

On the Plus500 platform, you can trade more than 2,000 CFDs in various markets, including currencies (Forex), stocks, indices, ETFs, commodities, cryptocurrencies, and options. The brokerage company is actively working to diversify its portfolio.

Forex CFDs

Plus500 provides access to CFDs on 60 currency pairs. Traders can use leverage of 1:30, which opens up wider opportunities for earnings. The broker recommends using stop loss, guaranteed stop, and stop limit orders to limit possible losses and make a profit. The company also offers free real-time quotes for detailed market analysis and making timely decisions.

Stock CFDs

Plus500 allows you to trade stocks from such popular markets as the USA, UK, and Germany. The broker offers up to 1:5 leverage and low spreads.

Index CFDs

With Plus500, traders can work with the most popular indices, such as the USA 500, US-TECH 100, and France 40 (25+ indices overall). The leverage for CFDs on indices is up to 1:20. The minimum deposit is 200 New Zealand dollars.

Plus500 has the following index categories:

country indices, which track the progress of national indices and reflect market trends within this jurisdiction;

global indices that are considered international and track the movements of the global market.

Commodity CFDs

The platform allows you to trade CFDs on 20+ commodities (gold, platinum, oil, and others). The leverage is up to 1:20. It is important to note that there is a high degree of risk when working with contracts for differences.

You do not become the owner of an asset by purchasing CFDs; rather, you speculate on its price. For example, you invest in gold CFDs, and if the price of gold rises, the value of the CFDs rises as well. Otherwise, you may lose money.

CFDs on ETFs

As a Plus500 client, you can trade CFDs on ETFs (exchange-traded funds) and make a profit. Trading with leverage up to 1:5 is available. To control income and losses, use free stop and limit orders.

Cryptocurrency CFDs

Bitcoin, Ethereum, Litecoin, and other popular cryptocurrencies are available for trading 24/7. To profit from CFDs on cryptocurrencies with Plus500, you do not need to have a special wallet or exchange account. Trading is possible in either direction (buy or sell). The broker offers leverage of up to 1:2.

CFDs on options

Call and put options on the Germany 40, Oil, and Meta are available for trading with up to 1:5 leverage. With Plus500, you will be able to profit from volatility and make a good return.

Plus500 provides CFDs on two types of options: calls and puts.

A call option is usually purchased if the trader believes that the underlying asset’s price will rise before the contract expires. Traders can also sell call options if they think the price will go down.

A put option is usually bought if the trader believes that the price of the underlying asset will fall before the expiration of the contract. Traders can also sell a put option if they believe the asset’s price will rise.

Platform & Features

Plus500 has a proprietarytrading platform that is accessible from any device (desktop, browser, and mobile versions are available). It is compatible with any operating system, including Windows, MAC, and Linux. Beginners can trade from a demo account to become learn about the platform's capabilities while taking no risks and testing various trading strategies. Some of the features include:

flexible elements that allow you to customize the trading platform to your needs;

the ability to filter assets to search for the right instruments on the market independently (or to take advantage of the broker’s offer, which automatically indicates the most popular assets);

quick buy and sell;

risk management via setting profit or stop loss orders;

it is friendly for beginners and has an intuitive interface;

multilingual (more than 30 interface language options).

Plus500

Plus500 also offers a mobile app for iOS and Android that allows you to trade anywhere and anytime.

Is Plus 500 legit? Is safe or Scam?Plus500 pricing

Plus500 offers clients most of its services for free, earning mainly from bid/ask spreads (starting at 0.5 pips). When a trader opens a position, they essentially pay for a spread that is already included in the Plus500 rates. For example, the average spread on EUR/USD is 0.7 pips. To view spreads for a specific asset, you need to log in to your user account on the platform, select the required asset, and click on the "Details" icon. This menu contains spread size information.

Unlike some other brokers, Plus500 does not charge trading fees, as it earns most of its income from spreads. Depositing funds on the platform is also free.

Additional fees charged by Plus500:

rollover fee (for holding a position overnight);

currency conversion fee for trades with assets denominated in a currency other than your account’s base currency (0.7% margin);

inactivity fee is $10 per month. Such a fee is charged if an account is inactive for more than 90 days.

How to start trading with Plus500

If you want to use Plus500, you need to follow the steps below:

sign up on the platform;

go through the verification procedure; to do this, confirm your identity by providing a supporting document (a copy of your passport, bank statement, etc.);

create a demo or a live trading account;

make a minimum deposit of $1 (this is the entry threshold);

choose a trading platform (desktop, browser, or mobile version);

start trading.

Beginners are recommended to start with a demo account to practice without depositing real funds.

FAQs

Is Plus500 a regulated broker?

The brand is managed by Plus500UK Ltd which is registered in the UK. The company has obtained a license from the Financial Conduct Authority (FCA).

Where can you use Plus500 services?

Plus500 is an international broker, but the main focus is on the markets of Asia and Europe. This is one of the fastest-growing companies that allow you to trade CFDs.

What are the Plus500 fees?

The main earnings come from spreads. Thus, there are no hidden fees. However, the company does charge the position rollover fee and inactivity fee..

What assets are available on the platform?

The company provides access to trading contracts for differences, including CFDs on stocks, stock indices, commodities, currency pairs, etc. If desired, you can practice on a demo account. Plus, the demo account has no time limit.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.