According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- VFSC

- 2020

Our Evaluation of Rallyville Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Rallyville Markets is a broker with higher-than-average risk and the TU Overall Score of 4.51 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Rallyville Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Rallyville Markets is a quite typical broker. It has a lot of assets from different groups, moderate leverage, and a copy trading service. At the same time, there is only one live account type with spreads starting from 0 pips. These conditions seem to be advantageous, especially when there are no withdrawal fees. A free demo account is available to explore the site and develop strategies, but this is not a unique advantage. This broker does not offer educational programs or comprehensive analytical tools, but these disadvantages are not crucial. The advantages are the availability of MT4, daily signals and regular expert reports, and prompt technical support.

Brief Look at Rallyville Markets

Rallyville Markets is a Forex and CFD broker. There are several dozens of currency pairs and CFDs on indices, precious metals, and crude oil. There is a demo account and a Real account. On Real, spreads start from 0 pips with no fee. Only MetaTrader 4 (MT4) is available for trading. This broker’s proprietary copy trading service is the only passive income option. There is no training, no special tools for technical and fundamental analyses, and no promotions for new clients. However, this company's experts provide free signals, as well as weekly and monthly reports with a review of current trends. Rallyville Markets is regulated and licensed by the Vanuatu Financial Services Commission (VFSC).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Demo account is free, while to open a live account, a deposit of $100 is required;

- Traders do not need to choose the best account type, as this broker offers transparent and understandable conditions;

- Dozens of assets from several groups provide for forming a diversified portfolio, and leverage of 1:400 increases the profit potential;

- Traders work through MT4, which can be easily and quickly customized using plug-ins;

- Spreads start from 0 pips, and, in general, traders’ costs are much lower than those of most brokers;

- Copy trading service provides for passive income;

- Technical support can be contacted 24/5 by phone or via tickets.

- Deposits are made only using a bank account, wire, and some crypto wallets;

- There is no economic calendar, calculators, Autochartist, and other tools on this broker's website;

- Residents of a number of countries cannot become clients of this broker.

TU Expert Advice

Author, Financial Expert at Traders Union

Rallyville Markets offers Forex and CFD trading via MetaTrader 4, with currency pairs, indices, precious metals, and crude oil. The company provides a single live account type with a minimum $100 deposit requirement, spreads starting at 0 pips, and no trading or withdrawal fees. Leverage is available up to 1:400, and a free demo account allows users to explore the platform. Copy trading is available for passive income, complemented by technical support accessible 24/5 via phone and ticket system.

Despite these advantages, Rallyville Markets has notable drawbacks, such as limited payment methods and the lack of educational resources and advanced analytical tools like economic calendars and calculators. Regulation is provided by VFSC, which may concern those prioritizing high-tier regulatory oversight. Rallyville Markets may be suitable for experienced traders familiar with MetaTrader 4 and seeking low-cost trading options, but it may not suit those who prioritize extensive research tools and varied deposit methods.

Rallyville Markets Trading Conditions

| 💻 Trading platform: | МetaТrader 4 |

|---|---|

| 📊 Accounts: | Demo and Real |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, wire, and crypto wallets |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,4-0,8 pips |

| 🔧 Instruments: | Currency pairs, CFDs on indices, precious metals, and crude oil |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

One live account plus free demo; Minimum deposit is $100; Tight spreads start from 0 pips; No trading fees; No withdrawal fees; Only MetaTrader 4 is available; Copy trading service with daily signals and weekly and monthly reports. |

| 🎁 Contests and bonuses: | Yes |

If a broker offers multiple account types, their conditions can vary greatly. Rallyville Markets only has one live account type, which requires a minimum deposit of $100. Leverage depends on the traded instrument. It can also depend on the account type with some companies. Rallyville Markets’ trading leverage ranges from 1:1 to 1:400. It is also possible to trade without leverage. The maximum leverage is available for currency pairs. This broker's technical support is rated as prompt and competent and is available 24/5. There are two communication channels, such as a call center and tickets on the website, with a response by email. Unfortunately, there is no live chat.

Rallyville Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with this broker, register on its website, go through verification, and open a live account. Next, make a minimum deposit, download the trading platform, and start trading. TU experts have prepared the below step-by-step guide on registration, and also briefly describes the features of the user account.

Go to this broker's website. In the upper right corner, select the interface language and click the “Open Account” button.

Enter your first and last names, phone number, and email address. Create a password. Enter a promotion code, if any, and click the “Next Step” button.

Click the “Send” button. An email with a code will be sent to the provided address. Enter the code in the appropriate field on the website and click the “Register” button.

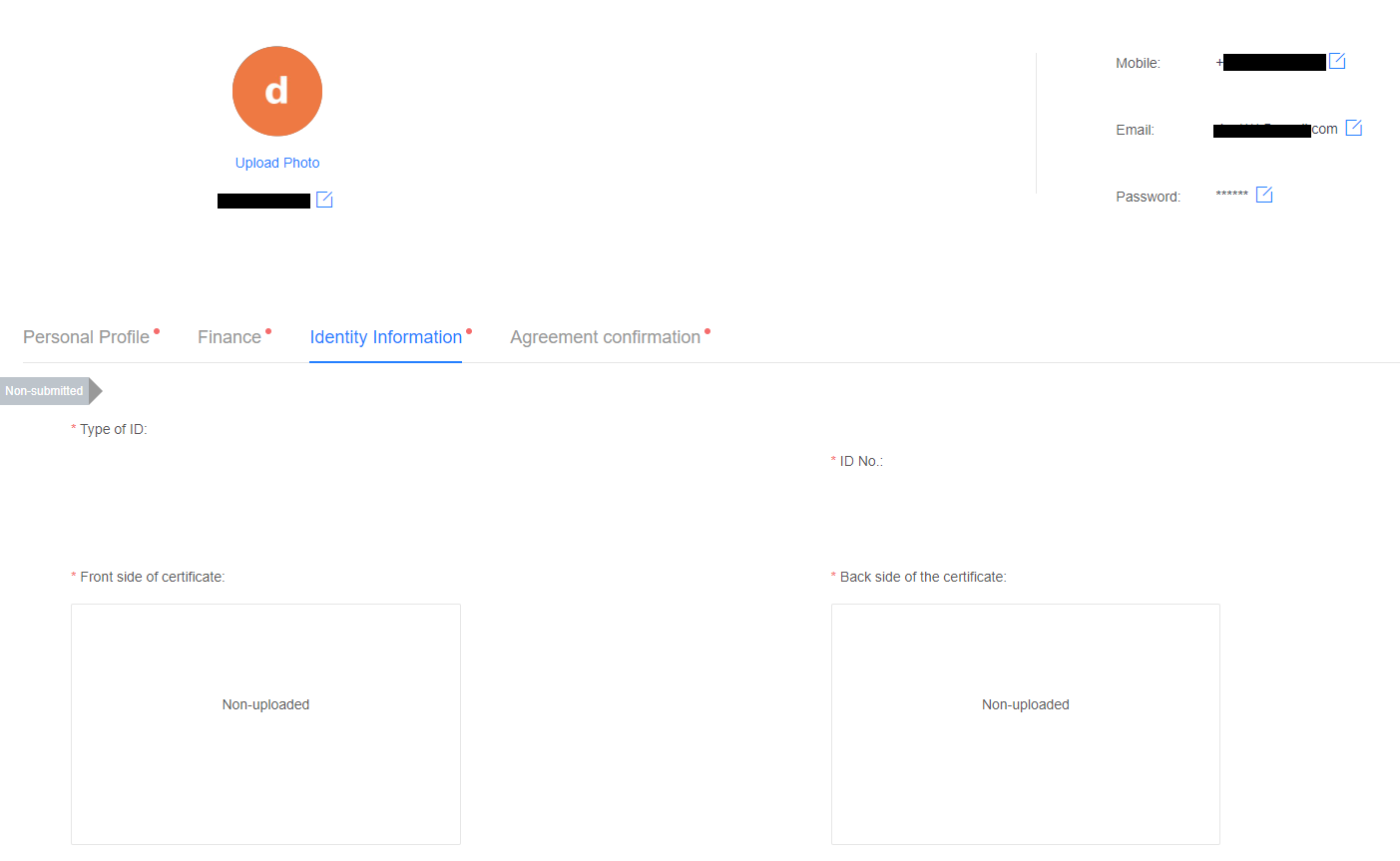

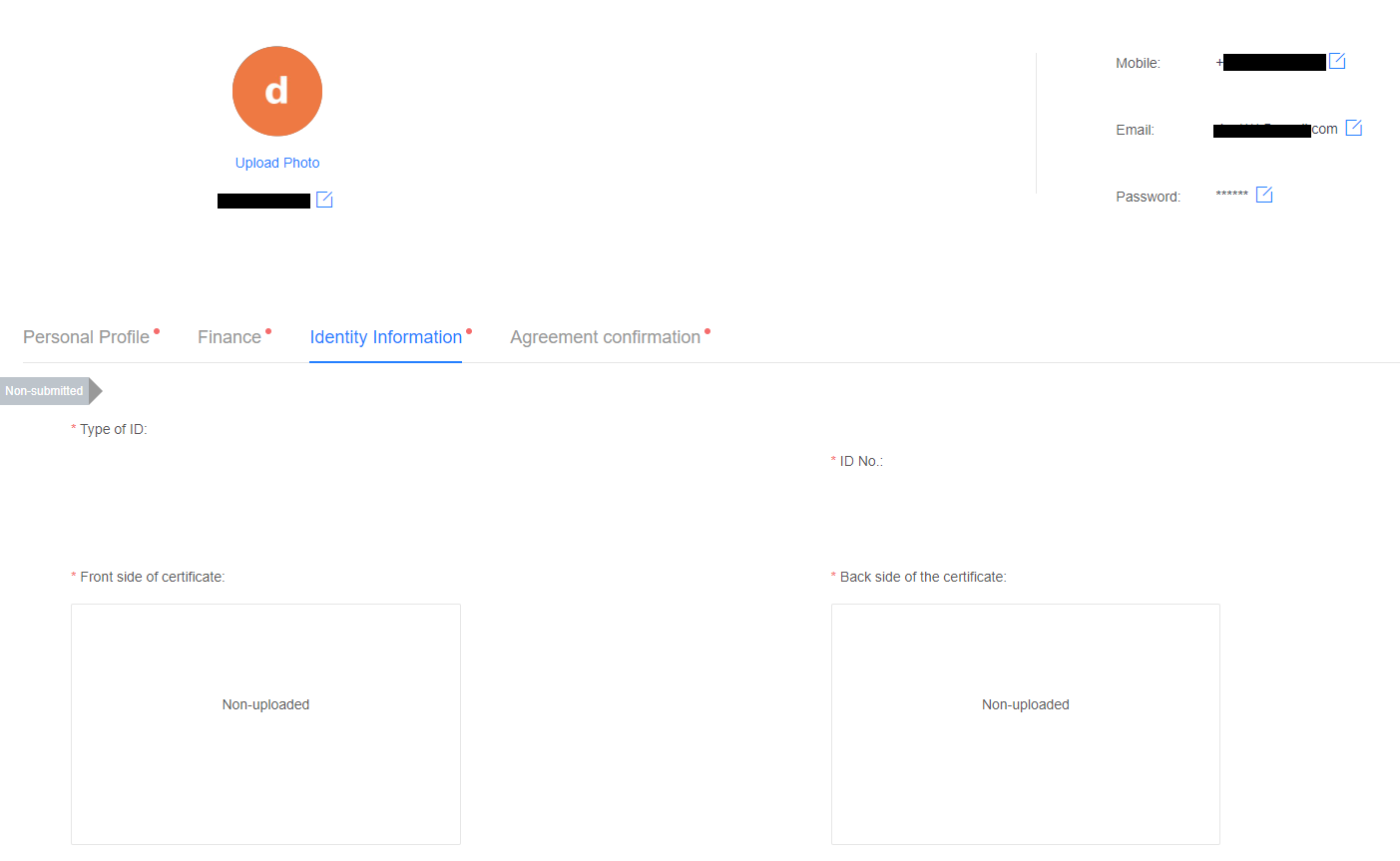

Enter your verified email and password. Go to the “Personal Profile” block. Fill in all fields, including verification data. Scans/photos of supporting documents are required.

Go to your user account. The Real Account block is located at the bottom of the screen. Select your account options and follow the on-screen instructions to open it.

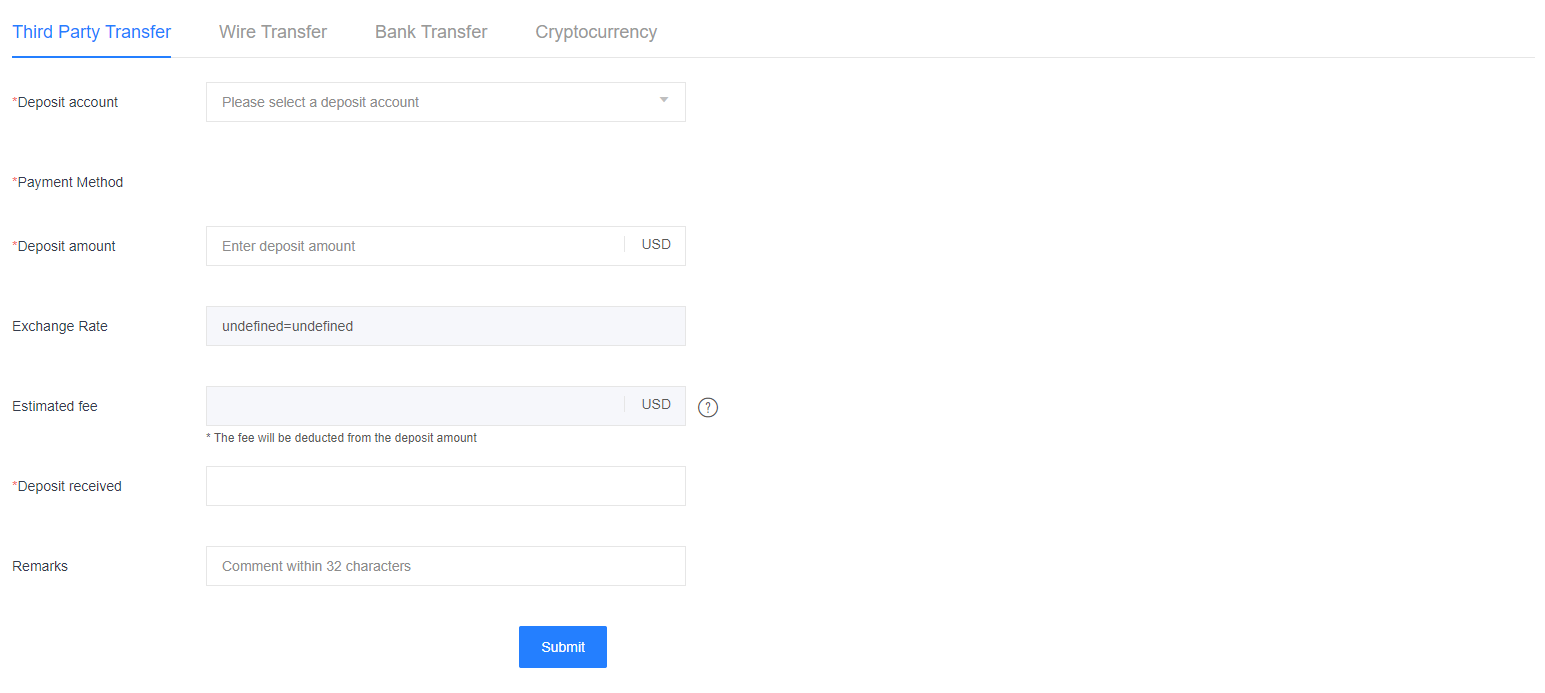

Now go to the “Deposit” section. Select a deposit channel (further instructions depend on it). Fund your account to start trading.

Go to the “Download” section. Choose the appropriate distribution of the trading platform. Download and install it on your device. Launch the platform and start trading.

Main features of the user account:

-

Home page. It provides for making a deposit, withdrawing funds, opening/closing a live or demo account, and getting a summary of active accounts;

-

Trading. Here you can view open positions, pending orders, transaction history, and other information on open and closed accounts;

-

Personal Profile. This section provides for filling and editing personal data, verification, and entering information for the deposit/withdrawal of funds;

-

Notifications. Here traders can view this broker’s alerts for important matters;

-

Download. In this section you can download MetaTrader 4 distributions;

-

Ticket. It provides for contacting technical support, tracking the status of requests, and receiving responses from managers.

Regulation and safety

Rallyville Markets has a safety score of 4.2/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

Rallyville Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

Rallyville Markets Security Factors

| Foundation date | 2020 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Rallyville Markets have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Rallyville Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Rallyville Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Rallyville Markets Standard spreads

| Rallyville Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

Does Rallyville Markets support RAW/ECN accounts?

As we discovered, Rallyville Markets does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Rallyville Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Rallyville Markets Non-Trading Fees

| Rallyville Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Usually, if a broker offers several trading account types, traders should be very attentive when making a selection. Rallyville Markets offers only one account type with comfortable and equally favorable conditions for all its clients. This broker also provides only MetaTrader 4. This platform is functional, time-proven, and receives only the best ratings. So, the only thing a trader must focus on is the asset pool. Currency pairs, indices, precious metals, and crude oil are enough to trade according to most personal preferences and helps to form diversified investment portfolios. Moderate leverage is a big plus, which helps increase profit potential and make good money even with a small budget.

Account types:

If a trader has never worked with Rallyville Markets before, the best practice would be to open a demo account first. It provides for exploring the site and its potential. Moreover, this is a good opportunity to test your strategies. There are no financial risks, because users work with virtual currency. Further, if traders are satisfied with the conditions, they should open a Real account and begin to execute full-fledged trades in international financial markets.

Deposit and withdrawal

Rallyville Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Rallyville Markets offers limited payment options and accessibility, which may impact its competitiveness.

- No withdrawal fee

- Bank wire transfers available

- Minimum deposit below industry average

- Low minimum withdrawal requirement

- Limited deposit and withdrawal flexibility, leading to higher costs

- USDT payments not accepted

- PayPal not supported

What are Rallyville Markets deposit and withdrawal options?

Rallyville Markets offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making Rallyville Markets less competitive for those seeking diverse payment options.

Rallyville Markets Deposit and Withdrawal Methods vs Competitors

| Rallyville Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Rallyville Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Rallyville Markets supports the following base account currencies:

What are Rallyville Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Rallyville Markets is $100, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Rallyville Markets’s support team.

Markets and tradable assets

Rallyville Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Copy trading platform

- Indices trading

- Futures not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by Rallyville Markets with its competitors, making it easier for you to find the perfect fit.

| Rallyville Markets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | No | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Rallyville Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Rallyville Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

There can be situations when traders miss something or do not notice some important information. If a question arises, traders call or write to technical support. If specialists respond quickly and solve the problem, traders continue to work with a company. If a broker's managers give a slow answer or are not able to resolve the issue, traders may become disappointed and go to a competitor. Rallyville Markets’ client service works around the clock on weekdays. You can contact managers by phone or using the ticket system on the website.

Advantages

- Several communication channels are available

- Technical support is highly competent

- Managers are available round the clock on weekdays

Disadvantages

- Support is not available on weekends

Whether you are Rallyville Markets’ client or just intend to become one, contact support by:

call center;

tickets on the website.

Note that the response to the ticket will be sent to the specified email or to the user account, if the ticket is generated there. The call center is multichannel. Calling the support is the best option if you need a prompt response.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address |

Level 30/201 Elizabeth St, Sydney NSW 2000 Hong Kong: RM C, 13/F, Harvard Commercial Building, 105-111 Thomson Road, Wan Chai, Hong Kong |

| Regulation | VFSC |

| Official site | https://rallyvilleglobal.com/ |

| Contacts |

+61 2 9261 2979

|

Education

Some brokers offer training materials. These can be eBooks, video guides, or audio podcasts. There are companies that hold free webinars with experts. However, in most cases, brokers are limited to FAQs and articles. There are no educational resources on the Rallyville Markets website. And this is normal, because the website is simple, having all the necessary information on its main pages. MT4 is well known, so this broker does not consider it necessary to talk about it. This broker could provide other materials, but it does not. In fact, this policy cannot be called a disadvantage, because if traders come to this broker, they must already have certain knowledge, and then they further develop their skills by practicing regularly.

Thus, it does not matter whether you are a novice, mid-level, or professional trader. Rallyville Markets will not offer you any theoretical knowledge, believing that since traders have come to the site, they are ready to trade independently. However, there is the copy trading service, which many market participants consider to be the best teacher. After all, investors monitor all the actions of signal providers. And if providers are professionals, the analysis of their decisions is priceless.

Comparison of Rallyville Markets with other Brokers

| Rallyville Markets | Bybit | Eightcap | XM Group | TeleTrade | Vantage Markets | |

| Trading platform |

MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, MT5, TradingView, ProTrader, Vantage App |

| Min deposit | $100 | No | $100 | $5 | $10 | $50 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of Rallyville Markets

Rallyville Markets Ltd is relatively new to the global market, but it has an excellent technological stack that meets today’s standards. This broker also works with tier-1 liquidity providers. Order execution does not exceed 30 ms. This company has a proprietary copy trading service. Transactions are made as quickly as technically possible. For example, withdrawals take 1-3 days, which is standard for banks. This broker uses virtual servers, allows its clients to trade around the clock, and does not impose any restrictions on them. It uses the SSL protocol, which ensures the data that is transferred between a client and a server remains private. Clients' money is held separately from this company's operating funds. Thus, protection of funds and data is at the proper level.

Rallyville Markets by the numbers:

Minimum deposit is $100;

Minimum spread is 0 pips;

Trading fee is $0;

Withdrawal fee is $0;

Maximum leverage is 1:400.

Rallyville Markets is a universal broker with great opportunities

If a broker offers many assets from different groups, this is always a plus, because the more trading instruments available to traders, the wider their strategic opportunities. And it also provides for forming a diversified investment portfolio, in which a loss in one asset is counterbalanced by the stable and progressive positions of others. Leverage of 1:400 increases profit potential, but is less risky than leverage of 1:1000 and more. The combined low trading costs and the absence of withdrawal fees are attractive conditions. Finally, MetaTrader 4 is easy to learn, functional, and convenient. But the main thing is that MT4 is easily customizable and adapts to a specific user through hundreds of free plug-ins.

Useful features of Rallyville Markets:

Copy trading service. Signal providers earn on fees charged from investors. In their turn, investors trade with reduced risk, and receive passive income and unique experience;

Since this broker has only one live account type, all users receive equally favorable conditions, such as tight spreads, no trading and withdrawal fees, and leverage up to 1:400;

This broker does not have analytical tools, but free signals for MT4 are available to traders every day. Also, they are provided with a report with trend analysis and forecasts several times a month, which makes trading a lot easier.

Advantages:

This broker provides transparent conditions. There are no hidden fees and everything is known in advance;

A demo account is free, while to open a live account, only $100 plus standard verification is required. The entry threshold is quite low;

Costs are minimized. Spreads start from 0 pips, there are no trading and withdrawal fees;

Traders work through MT4, which is considered the top solution. It is equally convenient for users with any level of trading experience;

This broker's technical support is highly rated by its users. There is a call center and tickets on the website. Support is available 24/5.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i