Surge Trader Scaling Plan

Scaling is a crucial factor when investing in Forex trade or prop business. It is one of the major issues you should look into since it may assist you in lowering your total risk, securing your gains, or increasing the possibility for your profits to grow. This article reviews the Surge Trader Scaling Plan, including further details of how it works.

What Is the Surge Trader Scaling Plan

As a prop company, Surge's scaling plan allows its Traders to increase their account size to gain at least twice as much purchasing power. If you complete the Audition with a profit objective of 10%, you will be offered the choice to scale to the subsequent highest account.

For instance, traders on the $25K Beginner Account may grow their account 4 times to attain an account with a beginning balance of $500,000.

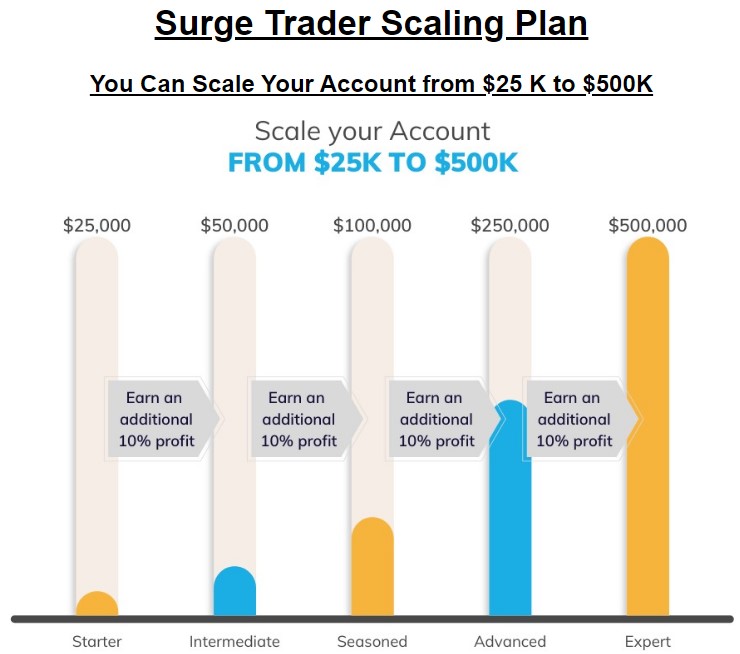

The figure below shows Surge Trader’s scaling plan:

Surge Trader’s scaling plan

Surge Trader Scaling Plan Packages

The Surge packages entail six different account sizes. Below is an illustration of each account size and the associated profit goals.

Surge Traders account sizes

Surge Traders has a starter account of $ 25,000 for beginners, with a profit share of up to 90%. There is a 10% profit target, which in this case amounts to $2,500. The daily loss limit for this package is 5%, with leverage of 20:1, and the maximum trailing Drawdown is at 8%. This starter package attracts an audition fee of $250.

The values are similar for all the other 5 packages, except for audition fees, which increase with the size of the account. The second level, which is the $50k intermediate package, has an audition fee of $400, and the third level ($100k seasoned package) attracts a $700 audition fee.

The $250k advanced account will charge $1,800 for auditions, while the $500k expert account will rise to $3,500 for its auditions. Finally, there is the $1 million master account, which is in the highest rank and has an audition fee of $6,500.

Evaluation Program Account Rules

The evaluation program account rules entail the following:

A profit target refers to a predetermined proportion of a trader's total profit that must be reached before the trader may move on to the next part of the assessment process, withdraw earnings, or scale their account. The evaluation programs are aiming for a 10% profit margin. Accounts that have been funded do not have predetermined profit goals.

Maximum daily loss refers to the most amount of money a trader may lose on a single trading day before the terms of their account are breached. The maximum daily loss that may occur across all account sizes is 5%.

Maximum trailing drawdown is the greatest decline corresponding to the distance traveled from the maximum account balance ever reached to the point when the drawdown was initiated. A maximum trailing drawdown is 8% is allowed across the board for all account sizes.

Stop-loss required indicates that for traders to enter a trade, they are obliged to first place a stop-loss order on each position they hold.

Lot size limit stipulates that traders must adhere to certain lot sizes when dealing with specific trading instruments. These are determined by looking at the beginning amount in the account that belongs to the brokerage business. At any moment, a trader can only have a maximum of one open lot for every $10,000 in the capital. This is regardless of which pairings they are trading.

The phrase "no weekend holding" refers to the prohibition on traders' ability to maintain open positions over the weekend.

Surge Trader Trading SignalsExample of Scaling Plan Surge Trader

Assuming the trader starts with a $25,000 Starter Account and chooses to scale up their account each time they pass the Audition with a 10% profit target, here is a possible scenario for the account balance and risk parameters:

The trader starts with a $25,000 account balance and a profit target of $2,500 (10% of the account balance). They also have a daily loss limit of 5% of the account balance, a maximum trailing drawdown of 8%, and a leverage of 20:1 (only applicable to Forex and Metals).

After successfully achieving a profit target of 10%, the trader can scale up their account to the next highest size. Let's assume they choose to do so, and their account balance is now $50,000. The profit target is now $5,000 (10% of the new account balance), and the daily loss limit and maximum trailing drawdown remain at 5% and 8%, respectively.

The trader continues to trade and successfully achieves the profit target of 10% again. They can now scale up their account to the next highest size, which would be a $100,000 account. The profit target becomes $10,000 (10% of the new account balance), and the daily loss limit and maximum trailing drawdown remain the same.

This process continues until the trader reaches the maximum account size of $500,000, which means they can no longer scale up their account. It's important to note that this is just one possible scenario, and the actual development of the account balance and risk parameters will depend on the trader's trading performance and decisions. It's also important to carefully consider the risks associated with trading and ensure that the trader understands risk management strategies.

FAQ

What Must I Do to Pass the Surge Trader Auditions?

To qualify for the Surge Traders Audition, you need to achieve a 10% return on your account without exceeding a 4% daily drawdown or a 5% maximum trailing loss. Take your time and go at your speed throughout the audition: No 30-day evaluation period. Zero minimum trading days

How is the Surge Trader Auditions like?

The audition consists of a single period and a single price. No further subscription fees or hidden costs. It has reasonable expectations and enables traders to apply any technique without time constraints. Surge auditions are among the simplest to pass compared to other prop businesses.

Does Surge Trader permit one to repeat the auditions?

No worries if you failed the first attempt of the auditions. You may retake it.

What are the trading rules for Surge Trader?

Surge Trader mandates that all its traders use a stop-loss order when executing a trade. Surge trader does not accept weekend trading, and all positions shut on Friday at 3:55 p.m. Eastern Standard Time. Other than that, you're good to go. You can even trade news events if you want to.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.