TNFX (Tiran Forex) Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- FSA

- 2019

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- FSA

- 2019

Our Evaluation of TNFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TNFX is a moderate-risk broker with the TU Overall Score of 5.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TNFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

TNFX is a broker for active trading and passive investing with low fees, popular trading platforms and a wide choice of Forex instruments.

Brief Look at TNFX

TNFX is a brokerage company with offices in the Middle East countries, St. Vincent and the Grenadines and Seychelles, providing services all across the world. Established in 2019, the broker provides access to trading currencies, stock indices, stocks and commodities as CFDs, including with leverage. The operation of TNFX is regulated by several financial commissions. Large banks and professional market players provide liquidity. At Forex Expo Dubai 2022, TNFX was recognized as the Best ECN Broker in the Middle East.

- Narrow spreads on all account types;

- Trading on MetaTrader trading platforms;

- High leverage for major currency pairs;

- Cent and demo accounts;

- Passive income options;

- Wide selection of currency pairs;

- Negative balance protection.

- Minimum initial deposit is $100, and the following deposits may start from $10;

TU Expert Advice

Financial expert and analyst at Traders Union

The TNFX broker offers a wide choice of trading accounts, which makes it suitable for traders with different trading experience. At the same time, the choice of financial instruments may not be satisfactory for professional market players, as the number of assets of certain classes is somewhat limited. For example, TNFX supports trading of only three cryptocurrencies, and oil, gas and precious metals are the only available commodities.

However, in terms of trading currencies, TNFX can compete with many popular Forex brokers. The broker offers access to trading more than 50 currency pairs with leverage up to 1:400. As for the software, classic MetaTrader trading platforms with support of Trading Central charts and AutoChartist are available. TNFX allows traders to use expert advisors and offers dedicated VPS hosting for their stable operation 24/7.

Despite the fact that the headquarters of TNFX is located in Iraq, the broker works with traders from all around the world, not just the Middle East countries. TNFX aspires to become an international broker, which is why it uses the U.S. dollar as the account currency. Also, the service is provided in English, not just Arabic and Kurdish. The broker’s website hasn’t been fully adapted to foreign clients yet, but the company is actively working on it.

- You are seeking tight spreads with zero or low fees. TNFX's most advantageous accounts are VIP and Zero, with spreads starting from 0.4 and 0 pips, respectively. VIP accounts have no trading fees, while a $5 fee (an average market rate) is charged on Zero accounts.

- You prefer not to use other online resources for market analysis. The broker's website features an economic calendar, calculators, news feeds, and current analytics. Most importantly, TNFX provides access to Trading Central and Autochartist, which are top-tier analytical solutions.

- You plan to start with a small deposit. Opening standard TNFX accounts will require a deposit of at least $100, while the most favorable accounts require a minimum deposit of $1,000.

TNFX Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo, Cent, Standard, Fix, Zero, VIP, PAMM, Islamic (Swap Free) |

| 💰 Account currency: | USD |

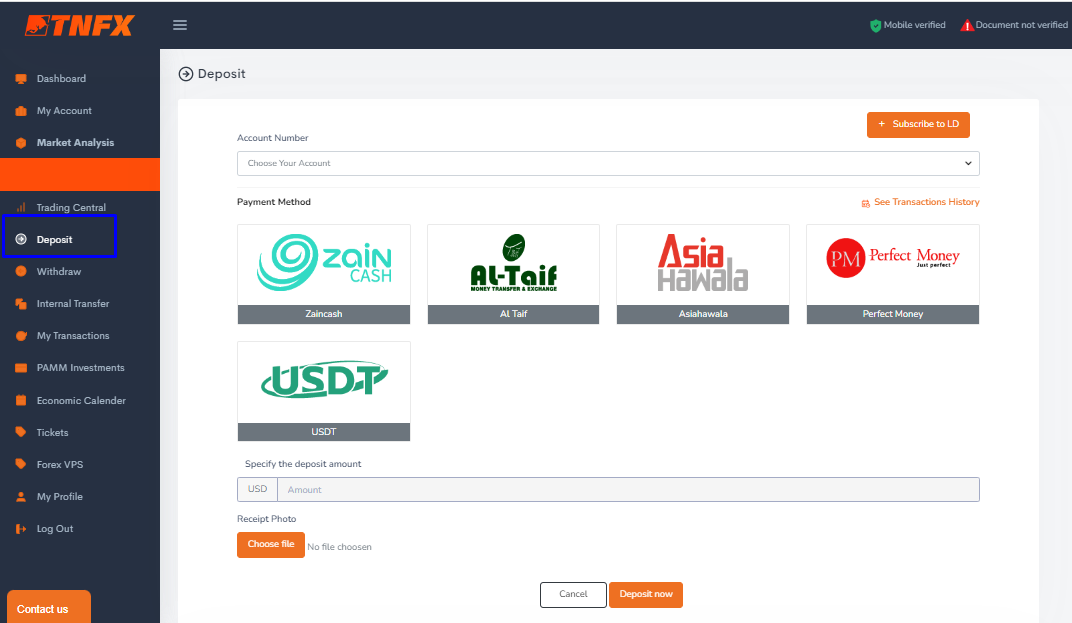

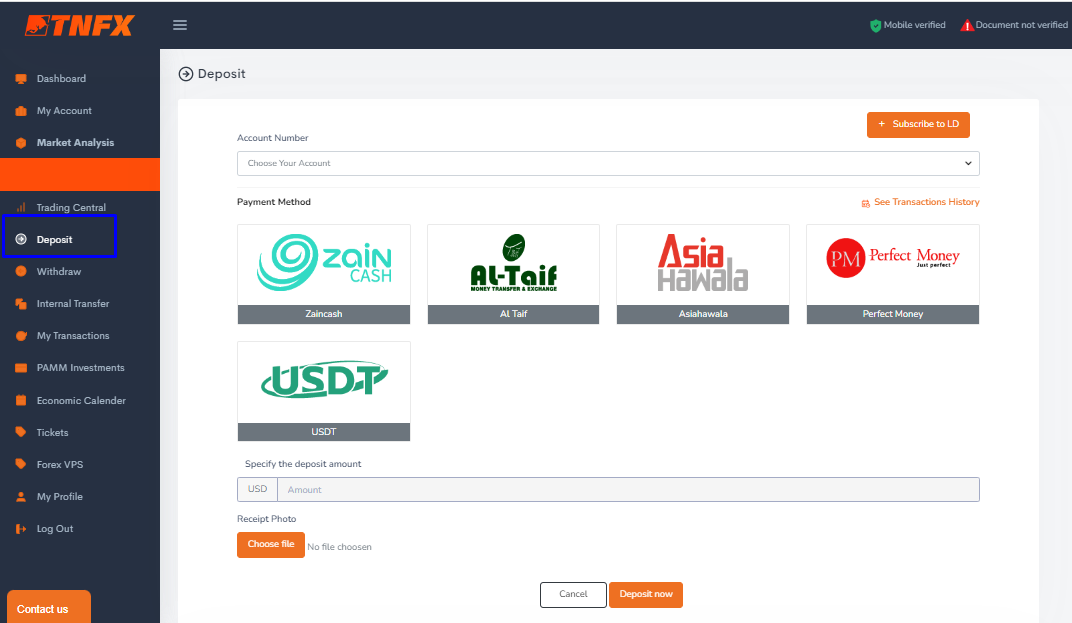

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, Bank Wire, Perfect Money, Zain Cash, AsiaHawala, Al Taif, USDT |

| 🚀 Minimum deposit: | $ 100 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 1 pips (Standard, Cent, Fix), from 0.4 pips (VIP), 0 pips (Zero) |

| 🔧 Instruments: | Currency Pairs, Options, CFDs, Crypto |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | Large banks and Forex market participants of all levels |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Direct Market Execution |

| ⭐ Trading features: | Automated trading by signals and with EAs is allowed; Ultra-fast order execution; Free analytics. |

| 🎁 Contests and bonuses: | Yes |

TNFX clients can trade by using their own funds and high leverage. The broker offers accounts with different types of fees, the amount of which also varies depending on the class of assets and trader’s deposit. The money is credited to the account balance within 24 hours, with some payment systems (for example, Perfect Money) supporting instant deposits. TNFX does not charge deposit and withdrawal fees.

TNFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

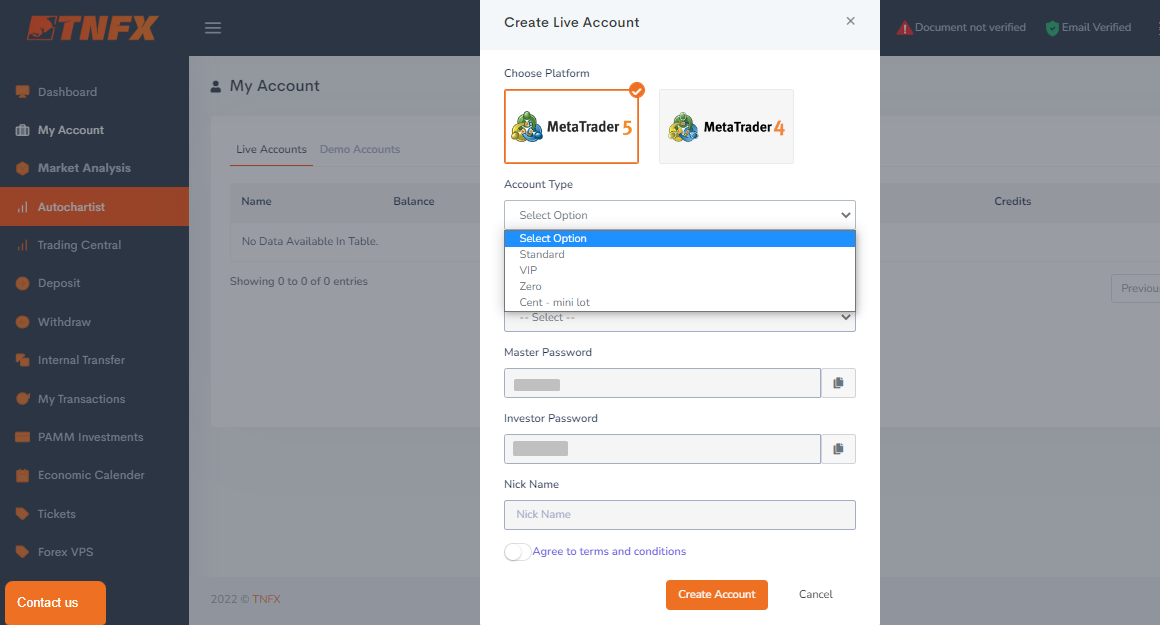

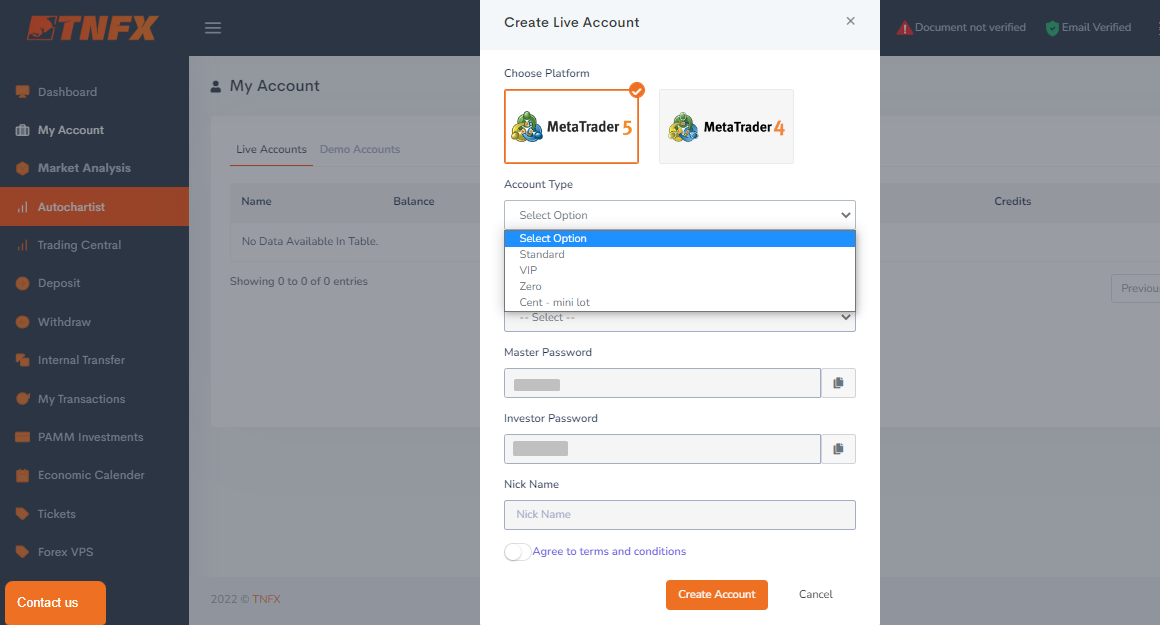

Trading Account Opening

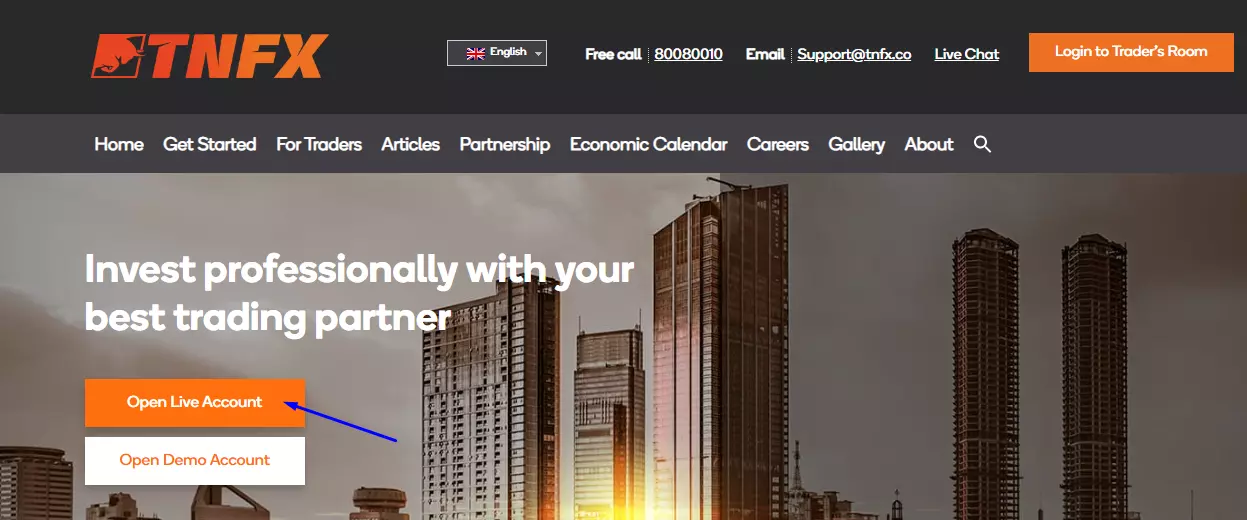

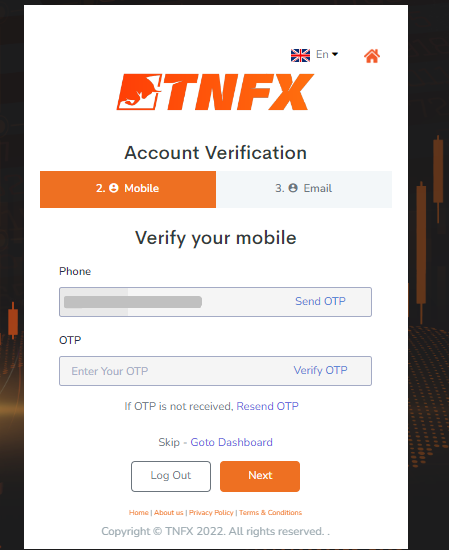

To create a user profile on the TNFX website, you need to take the following steps:

Click Open Live Account on the homepage.

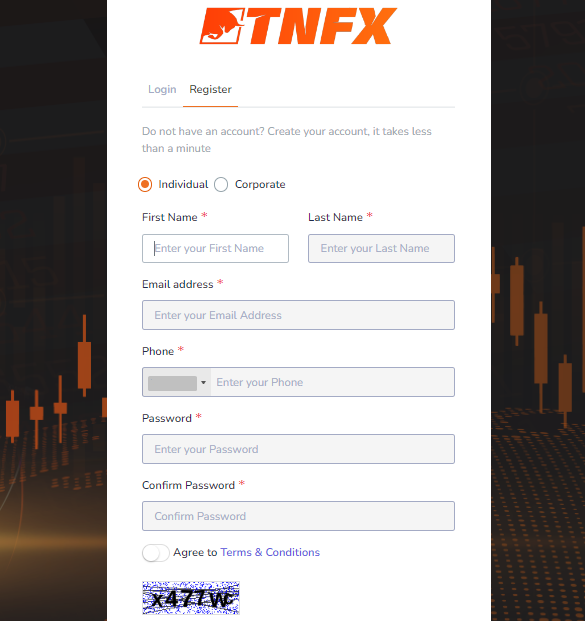

In the registration form that opens, choose an Individual account, specify your first name, last name, email, and phone. You also need to come up with a password, agree to Terms and Conditions and enter CAPTCHA.

Next, confirm your phone number. For this, you need to enter the OTP code sent to the specified phone number.

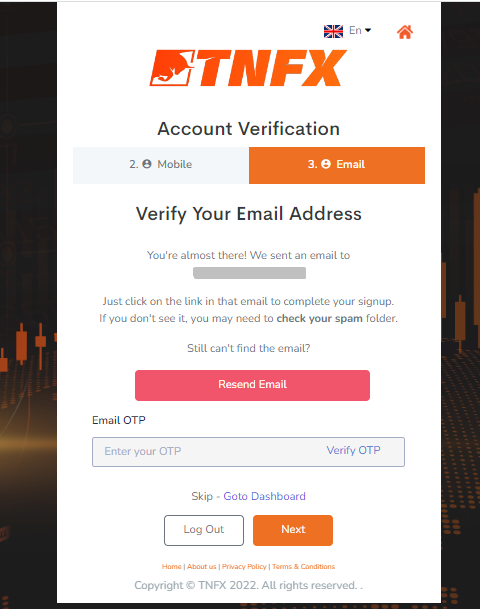

Email verification is the last step. There are two ways to do it: enter the OTP code or click on the link in the email message from the broker. After this, you can access your user account. For this, you need to enter your email and password in the authorization window.

To start trading with TNFX, you need to take the following steps in your user account:

User account features:

-

Financial transactions: making a deposit, requesting withdrawal, transferring funds from one account to another (within your user account);

-

Information on all competed transactions;

-

PAMM Investments tab for choosing the manager and monitoring profitability of his/her trading;

-

Economic calendar with fundamental data, daily Trading Central analysis, access to AutoChartist;

-

Registering a ticket for request for customer support;

-

The button for paying VPS server fee.

Regulation and Safety

TNFX has several representative offices, each regulated at the place of its registration.

In Seychelles, the company operates on the license SD133, issued by the Financial Services Authority of Seychelles. In the UAE, the operation of TNFX is regulated by the Dubai Economic Department in the United Arab Emirates (license No. 877670). Another office is registered in St. Vincent and the Grenadines. The regulator of this country does not issue licenses for international companies, but assigns them a number in the general register.

Advantages

- TNFX strictly follows the rules of financial regulatory authorities

- Negative balance protection

- TNFX regulators do not set restrictions on the use of cryptocurrencies and electronic payment systems

Disadvantages

- Provision of scanned copies of documents is a mandatory condition for gaining access to trading

- The broker is not a member of compensation funds

- In case of conflict of interests, a trader will have to file a lawsuit at the place of the broker’s registration

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Cent | from $0.1 | No |

| Standard | from $10 | No |

| Fix | from $10 | No |

| Zero | from $0 | No |

| VIP | from $4 | No |

If a trader leaves the position open overnight, Swap is charged.

TU analysts also calculated the average fee charged by TNFX and compared it with fees charged by other Forex brokers. The table below shows the results of the comparison with differentiation by fee levels.

| Broker | Average commission | Level |

|---|---|---|

|

$4.8 | |

|

$1 | |

|

$8.5 |

Account Types

TNFX offers 6 types of accounts, which can be opened on the MT4 or MT5 trading platform. The maximum leverage on VIP accounts with lowest fees and largest deposit is 1:100. On all other accounts, leverage is up to 1:400.

Account types:

Before opening a trading account, broker’s clients can test trading conditions using a demo account. It can be created on MT4 or MT5 trading platforms.

TNFX is an ECN broker with conditions suitable for traders of any religion, trading experience and available money for trading.

Deposit and Withdrawal

-

Only verified users who passed KYC can withdraw funds;

-

Money can be withdrawn to a bank account, credit card, electronic or cryptocurrency wallet;

-

Minimum withdrawal amount for all methods is $50;

-

The funds are credited to the account or card within 24 hours after the approval of the withdrawal request;

-

USD is the withdrawal currency.

Investment Options

There are several ways TNFX clients can earn passive income. The broker allows traders to copy trades of MQL5.community members, or, conversely, provide signals to other traders at a small fee. Traders can also invest in PAMM accounts of experienced managers and use EAs for algorithmic trading. Partnership program rewards are available only to institutional clients.

PAMM account mechanism

The PAMM account service allows investors to follow the trading strategy of a chosen manager. The broker acts as a middleman between the PAMM manager and investors, but does not interfere with trading and profit distribution. All conditions (percentage of the manager’s reward, assets available for trading) of a specific PAMM account are provided in its offer. You can start investing on TNFX with $100, but there are accounts that require investment amounts from $1,000 or even $20,000. The profile of each manager contains the following information:

Number of investors;

Total managed amount;

Free margin;

Leverage;

Minimum investment amount.

A manager can initiate liquidation of a PAMM account by sending a request to the broker via email, and also notifying investors thereof. In case of account liquidation, all pending orders are canceled and all open market orders are closed automatically at the current price, and the balance of funds is distributed among the account participants proportionally to their deposits. The liquidated PAMM account is removed from the PAMM rating.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TNFX Partnership Program:

Introducing Brokers is an offer for qualified entities and companies that want to represent TNFX interests in their country. IB reward is $5-10 per standard lot traded by referred clients.

White Label & Liquidity Provider is a program for institutional clients interested in providing brokerage services under their own brand, while employing TNFX technologies.

PAMM Manager is a solution for experienced traders willing to manage investor funds through PAMM accounts.

All partnership programs of TNFX are designed for experienced market players, companies and organizations. The broker does not offer a referral program for retail investors, which is why they cannot earn a little extra by referring new clients.

Customer Support

You can contact customer support via email on any day at any time, but the operators of the broker’s customer support respond only during their working hours: from Monday to Friday.

Advantages

- Toll-free phone numbers are available

- Chat operators respond in Arabic and English

- Support on weekdays, during working hours

Disadvantages

- The company does not communicate with traders on social media

There are several ways to contact customer support:

-

Live Chat;

-

Phone call;

-

request via email.

Traders who open an account with the broker can access tickets in their user profile.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | The Bay Gate 2201, Business Bay, Dubai |

| Regulation | FSA |

| Official site | https://tnfx.co/ |

| Contacts |

04 582 3376

|

Education

Education on the TNFX website is not systematized. Some materials for beginners are featured in the Articles section, and some – in the Get Started section. The website also features a library with videos, but some of them are not available, while others are not translated into English, and are only available in Arabic.

Iraq residents can participate in seminars in different cities of the country. TNFX does not hold webinars.

Comparison of TNFX with other Brokers

| TNFX | RoboForex | Pocket Option | Exness | TeleTrade | FreshForex | |

| Trading platform |

MetaTrader4, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading |

| Min deposit | $100 | $10 | $5 | $10 | $1 | No |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 20% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 40% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | Yes | Yes | No | No | No | Yes |

Detailed review of the broker

TNFX headquarters are located in Baghdad, but the broker has offices in other cities in Iraq, as well as in the UAE, Turkey, St. Vincent and the Grenadines and Seychelles. TNFX is an ECN broker that supports direct order processing by liquidity providers based on the STP model. This guarantees ultra-fast execution at best prices. TNFX offers different account types suitable for all strategies and trading styles, including Swap-Free Islamic accounts.

TNFX by numbers:

-

more than 3 years of operation in the securities and Forex markets;

-

representative offices in 5 countries;

-

over 100,000 followers on Instagram, and 320,000 followers on Facebook;

-

leverage up to 1:400 and 6 trading account types.

TNFX is a broker for trading currency pairs and CFDs with leverage

TNFX provides access to the Forex market, including major and minor global currencies. The broker’s clients can trade 350 financial instruments, including 50 currency pairs, popular indices, stocks, commodities and metals as CFDs. Also trading pairs with cryptocurrencies are available, but their choice is limited by BTCUSD, ETHUSD and LTCUSD. TNFX provides dynamic leverage up to 1:400 and up to 1:100 for experienced market participants with large deposits.

The TNFX brokerage company offers MetaTrader trading platforms, including mobile (for Android and iOS) and desktop (for Windows) versions of MT4 and MT5. Clients can also trade on the Web Terminal, which does not require installation.

Useful services by TNFX:

-

Economic calendar. It is an instrument of fundamental analysis that helps monitor important events and financial indicators of companies;

-

AutoChartist. It is a fully customizable and simple-to-use instrument of technical analysis that helps discover trading opportunities in different markets;

-

Trading Central data. Daily technical analysis on Forex, cryptocurrencies, indices, commodities and metals. Trading Central charts are compatible with MT4 and MT5 trading platforms.

-

VPS for MetaTrader 4/5. It is a virtual server for 24h operation of automated EAs. The monthly fee depends on available options: $20.99, $29.99, $49.99.

Advantages:

The broker provides free analytics and other instruments to improve trading results.

You can trade from any device (smartphone, tablet, laptop) by using mobile apps, desktop version or the Web Terminal.

Support of different deposit and withdrawal methods, no deposit/withdrawal fee charged by TNFX.

Potential clients can open demo accounts on MT4 and MT5 trading platforms.

Ultra-fast order execution thanks to direct order processing by STP.

Easy account opening and quick identity document verification.

TNFX has developed a convenient user account with the interface that allows users to perform payments, manage funds, view trading statistics and latest analytics.

User Satisfaction