According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MT4 TrioXtend

- CySEC

- FSC (Mauritius)

- DFSA

- CySEC

- 2019

Our Evaluation of TrioMarkets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TrioMarkets is a broker with higher-than-average risk and the TU Overall Score of 4.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TrioMarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

TrioMarkets positions itself as a broker for traders with any experience, however, an analysis showed that its conditions are more focused on experienced market participants.

Brief Look at TrioMarkets

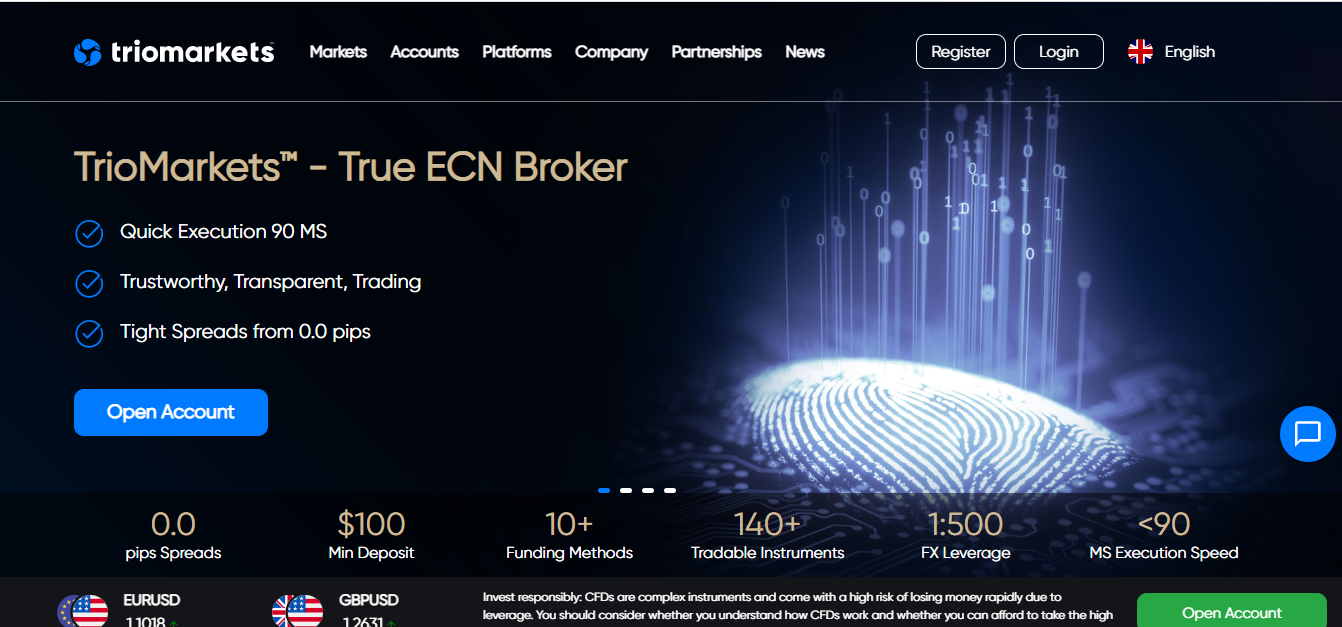

TrioMarkets is an STP (straight-through processing) and ECN (Electronic Communication Network) broker that works on the NDD (No Dealing Desk) protocols. It has been offering its services since 2014. It has several licenses, including those from the Financial Services Commission (FSC) of Mauritius and the Cyprus Securities and Exchange Commission (CySEC), and it partners with major European banks and developers of trading applications. TrioMarkets offers 60 currency pairs and CFDs on cryptocurrencies, stocks, metals, indices, and energies for trading. The broker's software provides for independent trading, investing in MAM and PAMM accounts, and copying trades of other traders.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Good choice of trading assets, especially currencies, and CFDs on stocks;

- Leverage for currency pairs is 1:30-1:500 depending on the client's country of registration;

- Reliable regulation: the broker is licensed by the European and International Financial Supervision Commissions;

- Choice of STP and ECN technologies, and different versions of MT4 for comfortable trading conditions;

- Bonuses for new and existing clients, including trading fee cash backs;

- 10+ deposit and withdrawal methods;

- Many channels for communication with technical support.

- High spreads on accounts with deposits up to $5,000;

- Absence of cent accounts and full-fledged training for novice traders;

- Withdrawal fees are charged for all payment methods.

TU Expert Advice

Financial expert and analyst at Traders Union

TrioMarkets has been providing its services for almost 10 years, regularly adding new assets and payment methods, and adjusting its conditions of trading, partnership, and bonus programs. Representative offices of the company are open in more than 10 countries, and all of them work under the strict control of local regulators. TrioMarkets’ client funds are held with Swissquote Bank, which is the Swiss leader in online banking.

The company offers two VPSs, provided by HokoCloud and ForexVPS.net. Both servers provide for trading without breaks, weekends, and a constantly running platform. TrioMarkets allows automated trading through expert advisors, so for clients using this strategy, a VPS is mandatory. Clients who trade on their own can also use virtual hosting for faster order processing and efficient trading without platform freezing.

TrioMarkets is loyal to its clients. For example, a minimum withdrawal amount is $50-$100 depending on the chosen payment method. You can also trade with a micro lot, which is equal to 0.01 of a standard lot. Clients have access to mobile trading and a web platform for trading from any device. The broker offers solutions for novice traders and passive investors, bonuses, and partnership programs with high rewards.

TrioMarkets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МetaТrader 4 (desktop, mobile, and web versions) and MT4 TrioXtend |

|---|---|

| 📊 Accounts: | Demo, Basic, Standard, Advanced, and Premium-ECN |

| 💰 Account currency: | USD and EUR |

| 💵 Deposit / Withdrawal: | Bank transfers, Visa, Mastercard, Neteller, cryptocurrencies, online payment systems |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 1,0-1,4 pips |

| 🔧 Instruments: | Forex, cryptocurrencies, stocks, indices, metals, and commodities |

| 💹 Margin Call / Stop Out: | 120%/50% |

| 🏛 Liquidity provider: | Swissquote Bank and other major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Trading without requotes and order rejection |

| 🎁 Contests and bonuses: | 10% Credit to Cash Bonus, Cash Back Bonuses, and Refer a Friend |

Trading more than 140 financial instruments with variable conditions is available on MT4 which is provided by TrioMarkets. There is a choice of account types, payment methods, and bonuses. The maximum leverage for all account types is 1:500. In some countries (for example, in the CySEC regulated area), trading leverage for retail traders is limited to 1:30. To start trading, make a deposit of $100, $5,000, $25,000 or $50,000, depending on the account type selected.

TrioMarkets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

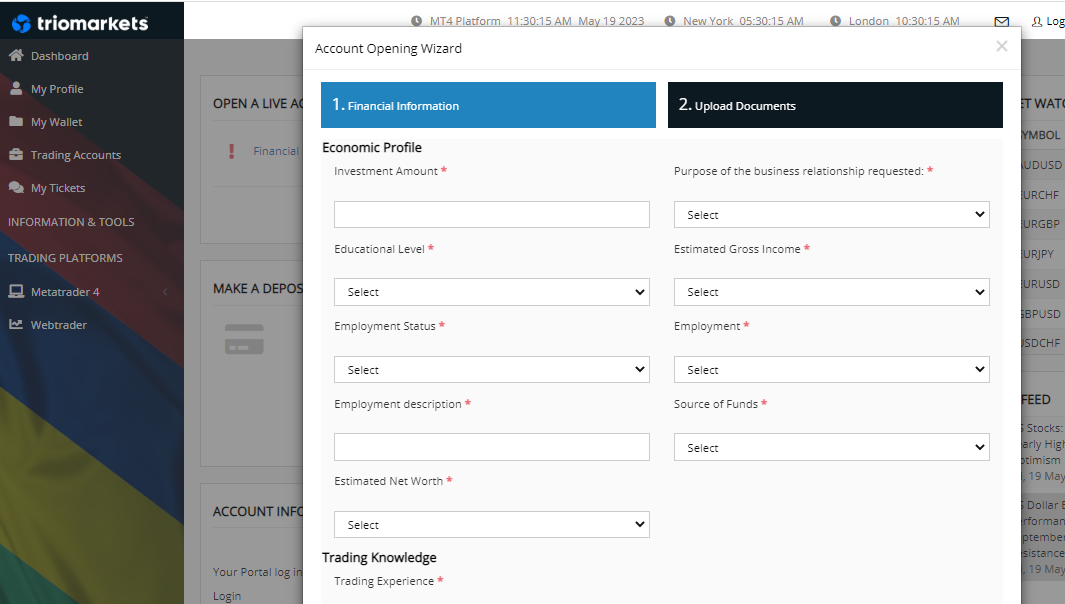

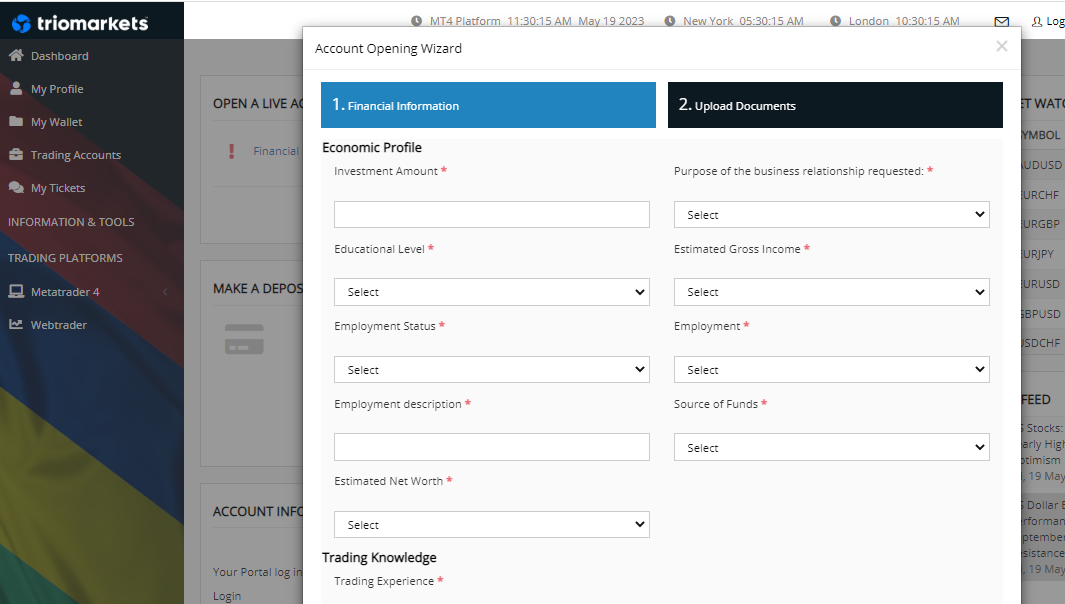

To access TrioMarkets’ user account, register on its official website. To receive spread compensation from Traders Union, go to the broker's website using TU’s referral link. Brief instructions for registration are as follows:

Find the “Register” or “Open Account” buttons and click either of them.

Complete the registration form for an individual client. The company requests a minimum of personal data, namely your first and last names, phone number, and email. Mandatory steps during registration are creating a reliable password and confirmation of email. After that, you can access your user account.

Features of TrioMarkets’ user account:

Other features of the user account:

Withdrawal of funds and internal transfers between accounts;

Open a demo account or additional trading accounts;

Transaction history;

Create a new support ticket and view responses to previously created ones;

Download desktop MetaTrader 4;

Switch to WebTrader;

Market reviews, newsfeeds, economic calendars, and real-time currency quotes.

Regulation and safety

TrioMarkets has a safety score of 9.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

TrioMarkets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BaFin BaFin |

Federal Financial Supervisory Authority | Germany | Up to €20,000 | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

CNMV CNMV |

Comisión Nacional del Mercado de Valores | Spain | Up to €100,000 | Tier-1 |

TrioMarkets Security Factors

| Foundation date | 2019 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TrioMarkets have been analyzed and rated as High with a fees score of 3/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

- Inactivity fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TrioMarkets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TrioMarkets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TrioMarkets Standard spreads

| TrioMarkets | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

Does TrioMarkets support RAW/ECN accounts?

As we discovered, TrioMarkets does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TrioMarkets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TrioMarkets Non-Trading Fees

| TrioMarkets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 1-1,5 | 0 | 0 |

| Withdrawal fee, USD | 5 | 0 | 0-15 |

| Inactivity fee ($, per month) | 30 | 0 | 0 |

Account types

TrioMarkets offers STP and ECN accounts. All provide for trading currency and cryptocurrency pairs, stocks, indices, metals, and commodities. The minimum trading volume is 0.01 lots. Account currencies are USD and EUR.

Account types:

Before opening a trading account and depositing real money, you can test the broker’s conditions on a demo account with a virtual deposit.

TrioMarkets specializes in the Forex market but also provides an opportunity to trade CFDs on commodities, stocks, and cryptocurrencies.

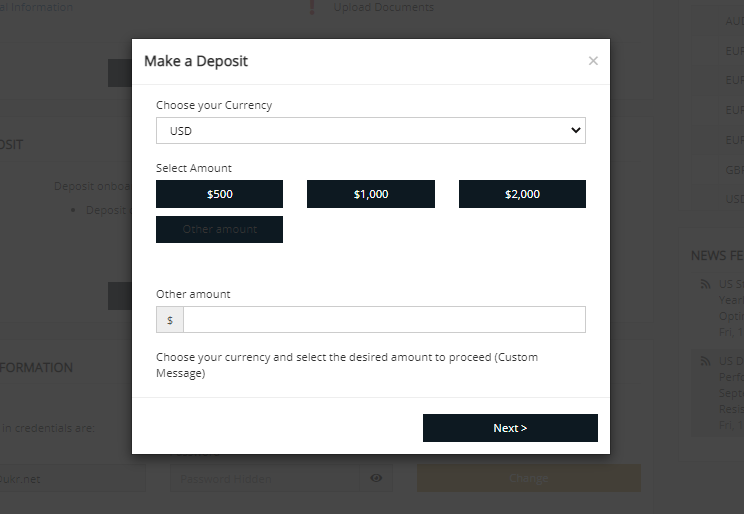

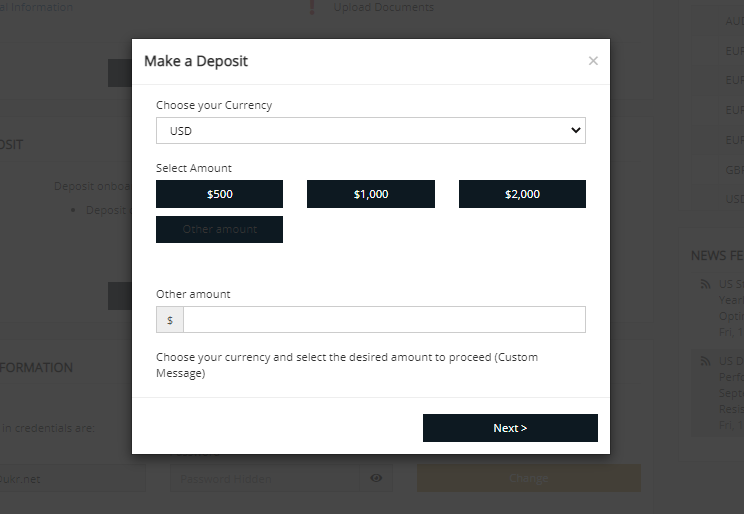

Deposit and withdrawal

TrioMarkets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

TrioMarkets offers limited payment options and accessibility, which may impact its competitiveness.

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- BTC available as a base account currency

- Low minimum withdrawal requirement

- Withdrawal fee applies

- Only major base currencies available

- Limited deposit and withdrawal flexibility, leading to higher costs

What are TrioMarkets deposit and withdrawal options?

TrioMarkets offers a limited selection of deposit and withdrawal methods, including Bank Card, Neteller, BTC. This limitation may restrict flexibility for users, making TrioMarkets less competitive for those seeking diverse payment options.

TrioMarkets Deposit and Withdrawal Methods vs Competitors

| TrioMarkets | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are TrioMarkets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TrioMarkets supports the following base account currencies:

What are TrioMarkets's minimum deposit and withdrawal amounts?

The minimum deposit on TrioMarkets is $100, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TrioMarkets’s support team.

Markets and tradable assets

TrioMarkets offers a limited selection of trading assets compared to the market average. The platform supports 500 assets in total, including 60 Forex pairs.

- Indices trading

- 60 supported currency pairs

- Crypto trading

- No ETFs

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by TrioMarkets with its competitors, making it easier for you to find the perfect fit.

| TrioMarkets | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 500 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TrioMarkets offers for beginner traders and investors who prefer not to engage in active trading.

| TrioMarkets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

Traders can get 24/5 support. Communication with the broker is not available when markets are closed.

Advantages

- Support is available round the clock on weekdays

- Online support, including popular instant messengers, is available

Disadvantages

- Emails are answered within 1 business day

- Responses of technical support are not always comprehensive

Communication channels with TrioMarkets are:

-

telephone;

-

email;

-

live chat on the website;

-

email and phone feedback forms;

-

WhatsApp and Telegram;

-

ticket system in the user account (only for registered clients).

Traders can contact support in English, French, Italian, German, and Arabic by calling the local phone numbers.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | BENOR Capital Ltd, The Catalyst, Level 2, Suite 201, Plot 40, Silicon Avenue, Ebene, Mauritius |

| Regulation |

CySEC, FSC (Mauritius), DFSA, CySEC

Licence number: 268/15, C118023678 |

| Official site | https://www.triomarkets.com/en/ |

| Contacts |

+442037699474, +35725030056

|

Education

TrioMarkets does not have a comprehensive training course for people who want to make money on trading. In the Company section of the website, there is a Glossary with terms from financial markets and FAQs on starting Forex trading through TrioMarkets. The Markets section briefly describes all the trading instruments available with the broker.

To gain practical trading skills, use a TrioMarkets demo account. It has the same trading conditions as a live account, but on a demo, no funds are required to execute trades.

Comparison of TrioMarkets with other Brokers

| TrioMarkets | Eightcap | XM Group | RoboForex | TeleTrade | FxPro | |

| Trading platform |

MetaTrader4, MT4 TrioXtend | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $100 | $100 | $5 | $10 | $10 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 1.4 point | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

120% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 25% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of TrioMarkets

TrioMarkets works on ECN/STP/NDD technologies, which allows its clients to trade without a conflict of interest with the broker, trade with the highest execution speed, and the best prices from liquidity providers. For retail, corporate, and institutional clients, TrioMarkets offers solutions customized to their profile, needs, and requirements. All the solutions are based on powerful technologies, a wide range of assets, and high-quality technical support.

TrioMarkets by the numbers:

-

Almost 10 years as a Forex intermediary;

-

Average order execution speed is 0.1 seconds;

-

140+ trading instruments;

-

10+ deposit and withdrawal methods.

TrioMarkets is a broker specializing in Forex and various types of CFDs

TrioMarkets offers a fairly extensive choice of trading instruments. These include 60 currency pairs, metals (gold, silver, platinum, and palladium), gas, and Brent Crude oil. The broker also offers USD/BTC, USD/LTC, USD/XRP, and USD/ETH pairs, 9 stock indices, and more than 60 CFDs on stocks. The maximum leverage for currencies is 1:500, for indices and metals it is 1:100, for energies it is 1:50, for stocks it is 1:5, and for cryptocurrencies it is 1:2. Some assets have positive swaps, but not for all positions. For example, there is a positive swap short for gas, and swap long for USD/CHF, CAD/CHF, and AUD/CHF pairs. Zero swaps are also available for USD/DKK (long position) and on swap-free accounts.

TrioMarkets’ clients trade on desktop and mobile MetaTrader 4, as well as on WebTrader. МТ4 TrioXtend is an updated and extended version of MetaTrader with more trading and analytical capabilities.

Useful services offered by TrioMarkets:

-

Market Review. It is a real-time broadcast of bid, ask, low, and high prices for major currency pairs and gold, available in the user account;

-

Newsfeeds. They publish reviews of important economic and financial events that may affect the value of assets in the short term;

-

TrioXtend. This is an advanced toolkit for MT4, which provides for tracking important information on financial instruments and market sentiment, conducting analysis, and receiving news and trading signals;

-

Economic calendar. The calendar from investing.com is available on the TrioMarkets website. It provides important news and events, and economic and financial indicators in real-time.

Advantages:

Client funds are held in segregated accounts with major banks separately from TrioMarkets capital;

The broker offers favorable conditions to traders who prefer trading on the ECN network;

A choice of virtual servers with different characteristics is available;

TrioMarkets uses negative, positive, and zero swaps (for some instruments);

Passive income options are available.

TrioMarkets offers favorable trading and working conditions to both experienced market participants with a reserve of funds, and novice traders with minimal experience who want to succeed in Forex.

Latest TrioMarkets News

Articles that may help you

User Satisfaction i