WCG Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- 2021

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- 2021

Our Evaluation of WCG Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

WCG Markets is a broker with higher-than-average risk and the TU Overall Score of 3.67 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by WCG Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

WCG Markets is a broker for traders from China with a limited choice of assets. Its clients are offered leverage up to 1:200, 24/7 support, and access to trading using MT4.

Brief Look at WCG Markets

WCG Markets offers trading currency pairs, precious metals, indices, and energies in the over-the-counter (OTC) market through MetaTrader 4 (MT4). The WCG brand was registered in 2018. Over 5 years, the company shifted from the Asian market to international business and opened representative offices in Canada, the UK, and St. Vincent and the Grenadines. WCG Markets provides qualitative brokerage services and has been awarded with many rewards, including Best Financial Technology and Solution on Foreign Exchange WikiFX-2024.

- The broker is regulated in several jurisdictions where it has its representative offices;

- It offers trading through classic MetaTrader 4 with important trading and analytical features;

- Partnership programs with various fee plans and working patterns are available;

- WCG Markets’ service charge is included in the spread;

- The broker offers bonus programs with the opportunity to withdraw bonus funds;

- A demo account is available;

- The company provides passive income services, such as copy trading, MAM, and expert advisors.

- Minimum deposit is $100 but without the opportunity to open a cent account;

- Limited choice of trading instruments, as compared to the broker's competitors;

- Accounts are restricted to citizens of China aged 18-65.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker does not withhold deposit fees. For free withdrawals, traders need to follow certain rules. Upon each deposit, a minimum trading volume is calculated. Traders can make withdrawals when the required volume is reached. Each deposited $1,000 requires trading volume of 1 lot. For example, if a trader deposits $3,000, it is necessary to close 3 lots to withdraw money for free.

All pending orders and stop loss/take profit settings are valid within a week. The broker cancels them automatically on Friday before the market is closed. Traders can update the settings when the market opens on Monday.

Trades held open for less than 5 minutes are abnormal for the company. It checks the trading statistics when traders submit withdrawal requests. In case of short position manipulation to delay quotes, a sudden increase in trading volume, or other violations, WCG Markets blocks accounts and initiates checking, which can take up to 3 hours. If violations are confirmed, a client account will be closed. The company returns a trader's deposit, but takes profits earned with abnormal trading.

WCG Markets Summary

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Demo and Real |

| 💰 Account currency: | CNY |

| 💵 Replenishment / Withdrawal: | Bank transfers and electronic payment systems |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:1 up to 1:200 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Forex, precious metals, oil (WTI and Brent), and indices |

| 💹 Margin Call / Stop Out: | Margin closeout: ≤ 30% |

| 🏛 Liquidity provider: | Selected major world banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Only citizens of China can trade with the broker |

| 🎁 Contests and bonuses: | Trading Bonus and Invite a Friend |

WCG Markets offers only 37 trading instruments, most of which are currency pairs. Floating spreads provide for trading at minimum rates. Trading leverage for currency pairs is up to 1:200 and it is up to 1:100 for indices. The base margin for metals is $800, and for USOIL and UKOIL it is $1,000. The minimum contract for gold is 100 oz; for silver, it is 2,500 oz; for oil, it is 1,000 barrels; and for currency pairs, it is 100,000 units of the base currency.

WCG Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

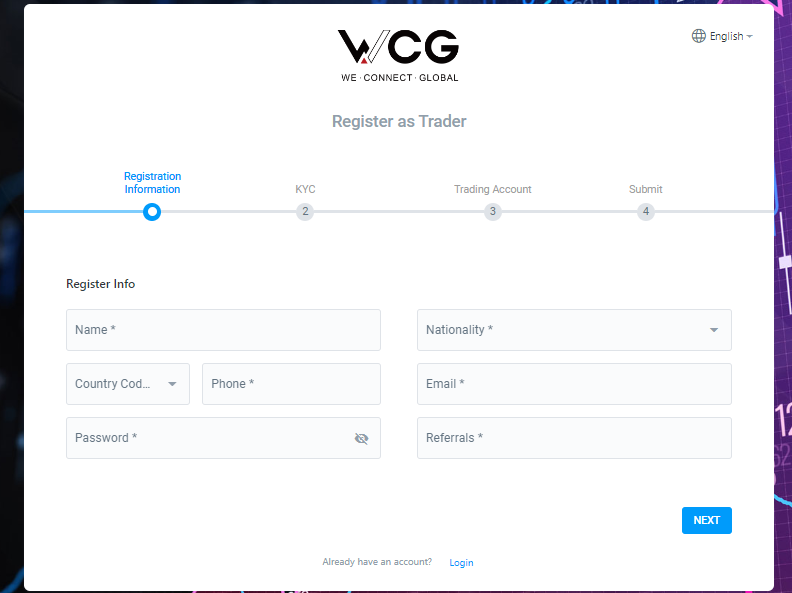

Trading Account Opening

Only traders registered on the WCG Markets website have access to user accounts. The broker provides its services only to citizens of China. To create a user account, follow the instructions below:

Click the “Open Real Account” button on the company's official website.

In the form, enter your name, country, phone number, and email. Also, create or generate a password to protect your user account.

Traders who reside in Mainland China only need to upload identification documents. Residents of other regions only need a passport and confirmation of address, such as a driver's license, permanent resident card, or utility bill for the last three months. Thereafter, you can open an account in your user account, make a deposit, and start trading on a pre-installed platform or in WebTrader.

Regulation and safety

WCG Markets is a brand name used by several companies to provide brokerage services. One of them is located in Canada and is controlled by the local FIU (the Financial Intelligence Unit) and FINTRAC (the Financial Transactions and Reports Analysis Center). The MSB (Money Services Business) license number is M20282836.

The second company is registered in St. Vincent and the Grenadines and operates according to international law. The company number, stated in the registry of SVGFSA (St. Vincent and the Grenadines Financial Services Authority), is 26087 BC 2020. Also, in 2024, WCG Markets was registered as a dealer in precious metals and gemstones in the Hong Kong Customs Department.

Advantages

- Regulators control WCG Markets’ activities and ensure its work according to the legislation of the country of registration

- The company implements the latest developments in data encryption

- Client money is held separately from WCG Markets’ capital

Disadvantages

- Restrictions on leverage are applicable

- The company licensed by FINTRAC doesn’t provide its services in all regions

- The broker opens trading accounts only upon the provision of comprehensive personal information and supporting documents

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | $1 | 0-3% subject to the trading volume rules |

A swap fee is charged on all instruments. The table below, compiled by TU experts, shows the average fees of different brokers. The most popular Forex brokers were used for comparison.

| Broker | Average commission | Level |

|---|---|---|

|

$15.5 | |

|

$1 | |

|

$8.5 |

Account types

Upon registration of the user account on the WCG Markets website, traders can choose one of two available account types.

Account types:

Currently, cent accounts are not available.

WCG Markets provides an opportunity to test trading conditions in demo mode before switching to the live account. The broker doesn’t provide micro accounts, which is a disadvantage for Forex novice traders.

Deposit and Withdrawal

WCG Markets processes withdrawal requests within one business day;

Clients receive their money within 2 hours upon request confirmation;

Withdrawal fee is 3% of the amount. It is charged when traders don’t comply with trading volume requirements and is withheld when making a transaction.

If a client doesn’t have enough money to cover the fee, the withdrawal is rejected.

Investment Options

WCG Markets offers a wide choice of standard investment opportunities. Yet, investors don’t need specific knowledge to start their activities. Additional software is required only to use experts advisors (EAs), but free apps and demo versions are available. Also, WCG Markets offers partnership programs with various reward accrual conditions.

Passive income with WCG Markets

Traders can start making passive income upon registration with WCG Markets and installation of MetaTrader 4. Available passive income options are:

MQL copy trading platform. When using it, one trader can copy trades of another. Both, a signal provider and an investor benefit from this service.

Expert advisors. EAs are special programs that can be bought and downloaded for free on the MQL.community website. Just as the case with copy trading, traders don’t trade themselves, but apps set to certain algorithms do the work.

MAM accounts. Traders can invest in trading of one of the managers. Five options of profit and loss distribution are available. Traders can invest in more than one manager, thus diversifying their portfolios and limiting their risks.

To invest in a MAM account, traders need to apply to technical support to connect to the platform. EAs and trading signals are available on the MQL.community website. Choose the ones suitable for you and pay a subscription fee if any. Thereafter, they will be automatically integrated in the trading platform.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from WCG Markets:

Introducing Broker (IB). It is an offer for minor brokerage companies, signal providers, teachers of trading, and marketing experts, to promote WCG Markets’ services. Rewards are paid from the company’s income from trading by clients referred by IBs.

Regional Representative. This is a program that provides an opportunity to become the only WCG Markets representative in a region. Income consists of a reward from each referral’s trade, income from sub-accounts, and agent fees.

White Label. WCG Markets provides all the necessary tools, from creating a website to comprehensive back office support, to start a new business. Unlike Regional Representatives and IBs, White Labels provide brokerage services under the new partner’s own brand.

Fund Manager. It is an offer for professional traders who are interested in additional income from managing multiple accounts.

The above programs are profitable for partners and for WCG Markets which benefits from a new client base. That’s why the broker provides comprehensive support to its partners, offering them individualized terms of cooperation and a full set of promo materials to expand a potential client base.

Customer support

WCG Markets provides multiple communication channels, which are available 24/5. The main languages are Chinese and English, but support operators use an online translator at the trader’s request.

Advantages

- Wide choice of communication channels

- Round-the-clock support on trading days on Forex

Disadvantages

- Chat operators’ responses are not always comprehensive

- Requests sent by email can be ignored

To contact the broker, use the following channels:

email;

live chat on the website (2 communication channels are available);

WhatsApp;

LINE;

Telegram;

WeChat;

Tencent QQ.

There is a feedback form in the Contact Us section. Specify your email and phone number, and the broker’s representative will contact you by one of the above channels. Communication with the broker is also carried out through the Users’ Center.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address |

WCG Markets Ltd, 150-10451 Shellbridge Way, Richmond BC V6X 2W8, Canada FINTRAC, SVGFSA, Hong Kong Customs Department |

| Official site | https://www.wcgmarkets.com/ |

| Contacts |

4001 203 612, 4008 428 912

|

Education

Novice traders can use the “Learn Trade” section of the website. The basics of trading in financial markets is provided in the Basic Trading course. More experienced traders can find useful information in the Intermediate Trading and Advanced Trading courses.

A demo account is another training instrument. The broker provides virtual $100,000 that can be used for training and gaining practical trading skills.

Comparison of WCG Markets with other Brokers

| WCG Markets | RoboForex | Pocket Option | Exness | IC Markets | InstaForex | |

| Trading platform |

MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $100 | $10 | $5 | $10 | $200 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 30% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of WCG Markets

On May 8, 2024, the broker introduced the updated user account with more comfortable management features and extended functionality. Now it’s called the Users’ Center 2.0. Partnering with the world-recognized liquidity providers that have significant market depth and the best prices, ensures high execution speeds and low latency. The company strives to apply the best technologies to reduce slippage and to provide 24/7 personal technical support.

WCG Markets by the numbers:

Over 5 years of experience in financial markets;

6 representative offices;

Leverage is up to 1:100-1:200.

WCG Markets is a broker for trading Forex on MT4

WCG Markets offers for trade 7 major and 21 minor currency pairs, 5 stock indices, gold, silver, and Brent and WTI oil. The minimum order for Forex, metals, and oil is 0.01 lots and the maximum is 20 lots. The minimum order for indices is 0.02 lots, and the maximum is 10 lots. Swaps are charged for transferring positions overnight. Swaps for indices can vary subject to ex-dividends on stocks included in them on a certain date. Special swap adjustments are provided on the official WCG Markets website.

The broker offers MetaTrader 4, which is the most popular platform for trading in OTC markets. MT4 is available for mobile apps and a desktop version for Windows. Mobile apps can be downloaded from stores for Android, iOS, and Huawei. The platform supports algorithmic trading using EAs, 9 time frames, 3 chart options, and over 50 technical indicators. MT4 is available in 39 languages.

Useful services offered by WCG Markets:

Announcements. This section provides important trading information, including special swap quotes for CFDs on indices and trading schedules on holidays;

Financial calendar. It provides important events by financial markets and can be sorted by importance, country, and date. The available language is Chinese;

Financial news. This section of the official broker’s website provides financial news in Chinese;

Online support. The broker offers many communication channels through popular instant messengers and social media. Communication is available in English. Other languages are available using an online translator.

Advantages:

Real-time quotes for trading instruments;

24/7 services for global trading of financial products;

Automatic order execution and transfer of orders directly to major liquidity providers;

Proprietary system of investing in MAM accounts with various capital distribution options;

24/7 access to market data that provides for conducting qualitative analysis.

Accounts are usually opened within 1 business day, however, the broker can confirm user accounts within several hours subject to provision of truthful information and qualitative scans of documents.

User Satisfaction