According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- SVG FSA

- LFSA

- 2022

Our Evaluation of WeTrade FX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

WeTrade FX is a broker with higher-than-average risk and the TU Overall Score of 4.83 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by WeTrade FX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

WeTrade’s terms and conditions are poised to captivate retail traders across the spectrum, catering to those actively engaged in currency and CFD (Contract for Differences) trading in the OTC (Over-the-Counter) market, as well as passive investors who lean toward copy trading or MAM accounts.

Brief Look at WeTrade FX

WeTrade is an international Forex broker offering STP (Straight-through-Processing) and ECN (Electronic Communication Network) accounts with high leverage and market order execution. Established in 2015, this broker maintains a global presence with numerous offices. Regulatory oversight comes from two financial commissions – the Financial Services Authority of St. Vincent and the Grenadines (SVG FSA) and theLabuan Financial Services Authority (FSA). Notably, WeTrade has garnered multiple accolades at local and international levels, including titles such as Best Trading Execution (2022), Best Local Consumer Service (2021), and The Most Praised Broker (2021).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A variety of account types including, ECN (Electronic Communication Network), MAM (Multi Account Manager), and a wide range of trading instruments;

- Proprietary social trading platform and the option to connect to the MQL4 (MetaQuotes Language 4) signals service;

- Clearly defined procedures for registration and verification;

- Round-the-clock multilingual client support;

- A rapid and transparent deposit and withdrawal system without concealed fees;

- A host of loyalty rewards, regular promotions, and bonus offers.

- Elevated spreads within STP to smaller deposits;

- The absence of Cent and Micro account options;

- A relatively less comprehensive educational section catering to novice traders.

TU Expert Advice

Author, Financial Expert at Traders Union

WeTrade FX offers STP and ECN account types with a focus on Forex and CFDs, utilizing the MT4 platform across mobile and desktop. Its clients can engage in copy trading or MAM accounts, and benefit from a diverse range of over 60 currency pairs. The broker boasts competitive spreads, starting at 0 pips for ECN accounts, and offers high leverage up to 1:2000. Multilingual client support and straightforward registration processes further enhance its appeal, complemented by transparent deposit and withdrawal protocols and various promotions.

However, WeTrade FX also presents certain drawbacks. The absence of cent and micro accounts could limit exposure for cautious investors, and the educational resources provided may fall short for novice traders. The lack of Tier-1 regulation and negative balance protection may deter those prioritizing security. Given these conditions, WeTrade FX may be suitable for experienced traders who are comfortable navigating higher-risk environments, but it may not be the best fit for beginners or those who prioritize strong regulatory oversight.

WeTrade FX Trading Conditions

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, STP, VIP, ECN, Affiliate |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Local Deposit (selected countries only), USDT, UnionPay, Bank Wire |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:2000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0,01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Forex, metals, energies, indices, stocks, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 200%/20% |

| 🏛 Liquidity provider: | UBS, BNP Paribas, Barclays, Bank of America, Credit Suisse etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Algorithmic trading and copy trading are available |

| 🎁 Contests and bonuses: | $50 trading bonus, deposit bonus |

Clients of WeTrade have the opportunity to engage in trading with currencies and a diverse selection of CFDs, all through the convenience of both mobile and desktop MT4 platforms. A choice of over 60 currency pairs is at their disposal, complemented by a broad spectrum of CFDs related to stocks. In relation to every asset, the availability of trading leverage varies from 1:30 to 1:2000, contingent upon the specific financial instrument and the balance within the trader's account. Trading activities are carried out with fluctuating spreads: the minimal value for ECN accounts stands at 0 pips, while for standard accounts, spreads start at 1 pip, without any additional fee.

WeTrade FX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

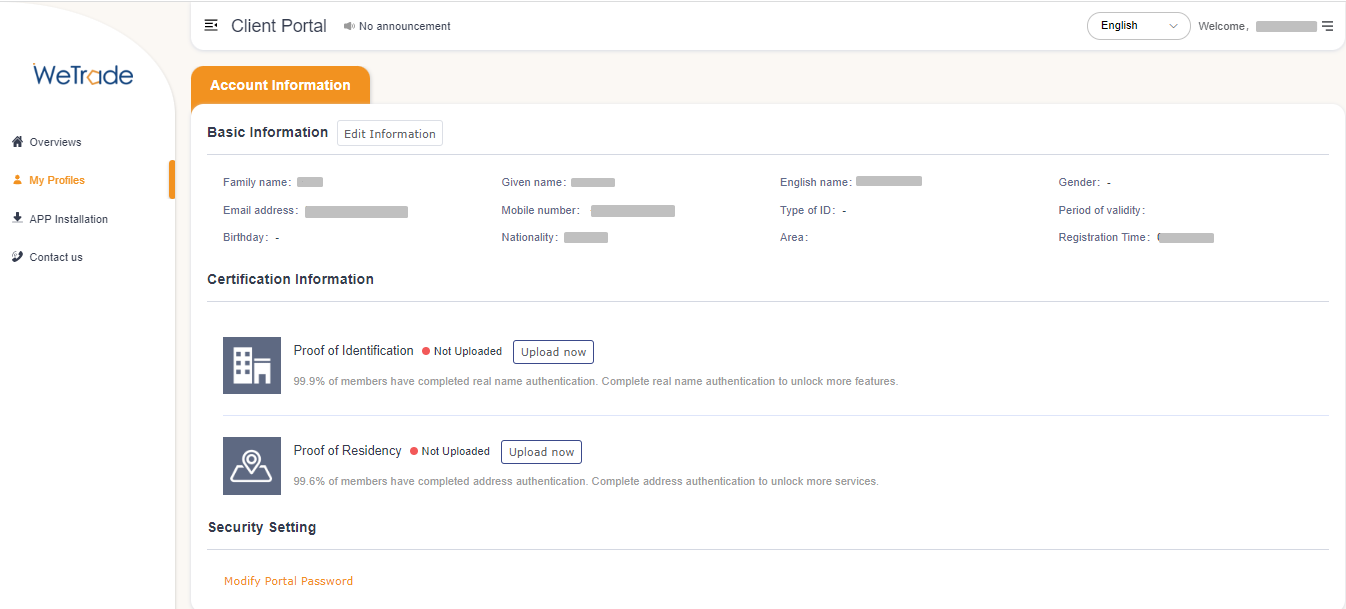

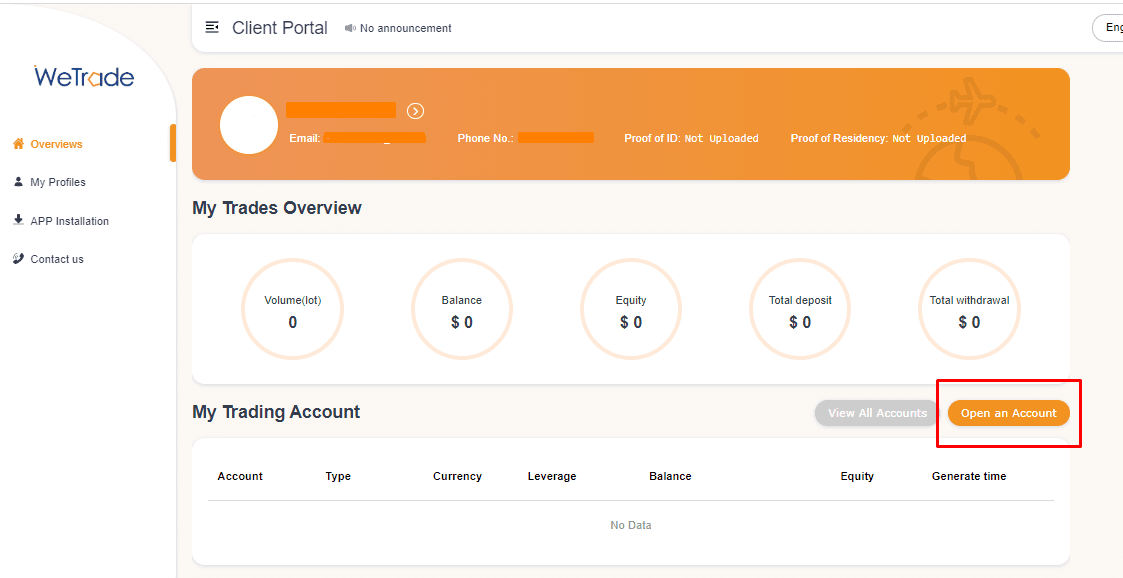

Trading Account Opening

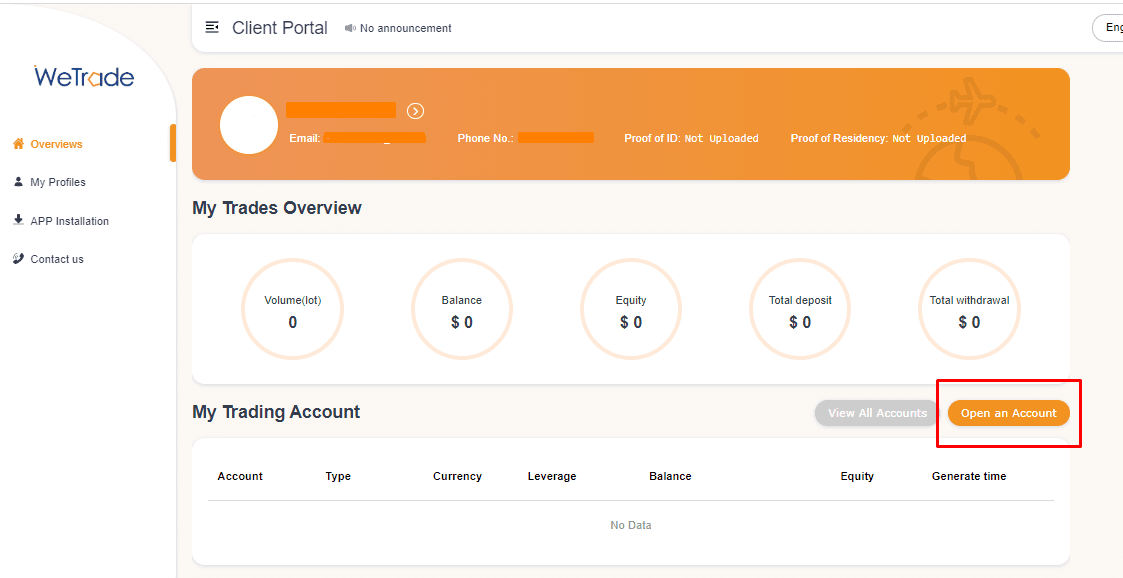

To access the user account on the WeTrade website, you need to create an account. The process of creating it follows these steps:

First, you need to initiate the registration process. To do this, click on "Register" on the main page of the official WeTrade website.

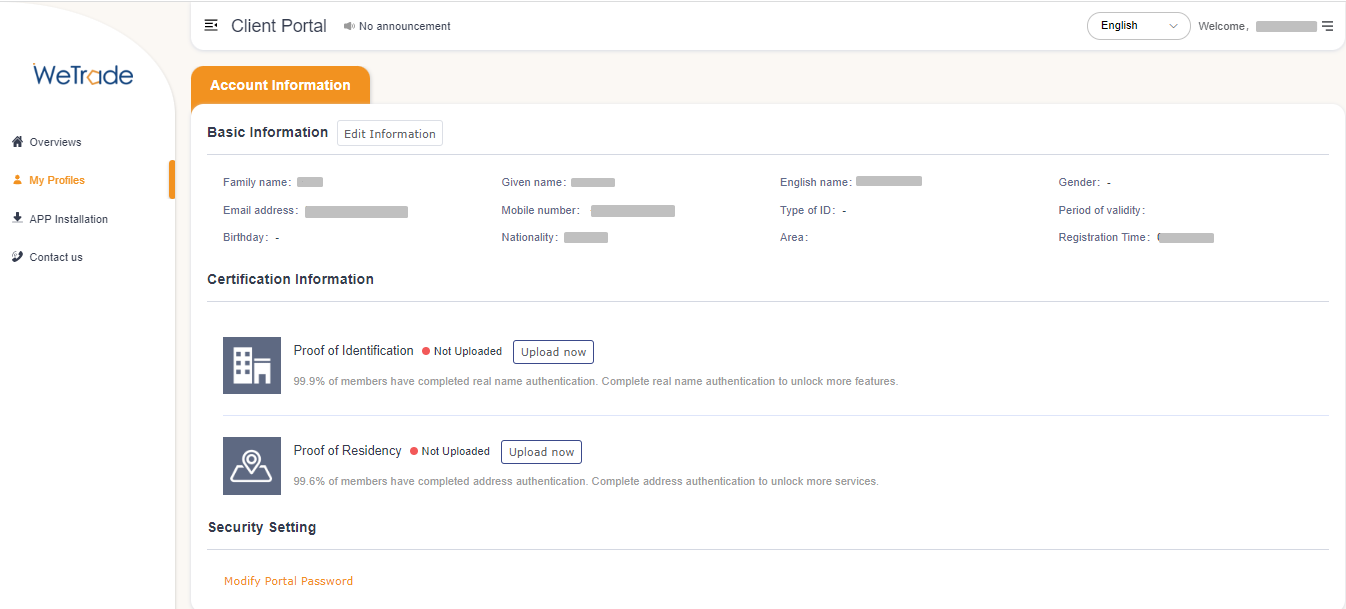

Provide personal information, phone number, and email. Password generation is a mandatory procedure. A confirmation code will be sent to your email, which needs to be entered in the registration form. To access the user account, use your email and the password.

WeTrade’s user account functions:

Other available actions in the WeTrade’s user account include:

-

Opening additional user accounts and registering a demo account;

-

Downloading trading platforms (desktop, mobile Android/iOS apps), multi-platform;

-

Installing software for managing MAM accounts;

-

Information about active accounts — balance, capital size, volume (in lots), total deposit and withdrawal amount;

-

Contact menu for communication with technical support and legal documentation;

-

Interface language selection and profile customization.

Regulation and safety

WeTrade FX has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

- No negative balance protection

- Track record of less than 8 years

WeTrade FX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

WeTrade FX Security Factors

| Foundation date | 2022 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker WeTrade FX have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of WeTrade FX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, WeTrade FX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

WeTrade FX Standard spreads

| WeTrade FX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,3 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

WeTrade FX RAW/ECN spreads

| WeTrade FX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with WeTrade FX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

WeTrade FX Non-Trading Fees

| WeTrade FX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

WeTrade provides four different types of user accounts that vary in terms of minimum deposit amounts, spread ranges, and the presence or absence of additional trading fees. All accounts offer market execution, floating spreads, and leverage of up to 1:2,000.

Account Types:

In addition to opening a trading user account, WeTrade also provides the option of a demo account, which serves as an educational tool for practicing and testing trading conditions. WeTrade offers a variety of trading accounts suitable for different trading styles, catering to both experienced traders and newcomers in the realm of trading financial assets.

Deposit and withdrawal

WeTrade FX received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

WeTrade FX offers limited payment options and accessibility, which may impact its competitiveness.

- No withdrawal fee

- No deposit fee

- Bank wire transfers available

- Low minimum withdrawal requirement

- No bank card option

- BTC not available as a base account currency

- BTC payments not accepted

What are WeTrade FX deposit and withdrawal options?

WeTrade FX offers a limited selection of deposit and withdrawal methods, including Bank Wire, USDT. This limitation may restrict flexibility for users, making WeTrade FX less competitive for those seeking diverse payment options.

WeTrade FX Deposit and Withdrawal Methods vs Competitors

| WeTrade FX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are WeTrade FX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. WeTrade FX supports the following base account currencies:

What are WeTrade FX's minimum deposit and withdrawal amounts?

The minimum deposit on WeTrade FX is $100, while the minimum withdrawal amount is $5. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact WeTrade FX’s support team.

Markets and tradable assets

WeTrade FX offers a limited selection of trading assets compared to the market average. The platform supports 120 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Crypto trading

- Indices trading

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by WeTrade FX with its competitors, making it easier for you to find the perfect fit.

| WeTrade FX | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 120 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products WeTrade FX offers for beginner traders and investors who prefer not to engage in active trading.

| WeTrade FX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

WeTrade's technical support operators speak five languages and work around the clock, including weekends.

Advantages

- Multilingual support 24/7

- Prompt operator response in online chat

Disadvantages

- Slow response time via email

- Support in popular messengers such as Telegram, WhatsApp, etc. is not available

If you need to get in touch with a WeTrade representative, you can use the following methods:

Online chat on the website

Email address

Contact form in the contacts section

Facebook

Additionally, you can contact this broker through the LINE messenger. This broker's website provides a QR code for downloading the application, which enables instant messaging with a WeTrade representative.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | WeTrade International LLC, Euro House, Richmond Hill Road, Kingstown, St Vincent and Grenadine. |

| Regulation | SVG FSA, LFSA |

| Official site | https://www.wetradebroker.com/ |

| Contacts |

Education

The WeTrade website features an Education & Support section; however, the information presented there is more analytical in nature rather than educational. It includes market forecasts and reviews from trading experts, both from within WeTrade's team and external analysts.

For learning how to trade, you can use the WeTrade demo account. Like a user account, it is opened in the MT4 platform, allowing beginners to thoroughly explore its functionality and learn how to correctly place orders of different types.

Comparison of WeTrade FX with other Brokers

| WeTrade FX | Eightcap | XM Group | RoboForex | NPBFX | Kama Capital | |

| Trading platform |

MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4 | MetaTrader5 |

| Min deposit | $10 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:200 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.4 points | From 0 points |

| Level of margin call / stop out |

200% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | No / 30% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of WeTrade FX

WeTrade has been operating since 2015, constantly evolving and implementing innovative solutions. Throughout its operation, the company has thrived to meet the demands of traders from all over the world. Because of this, it provides secure, rapid, and effective trading solutions, a wide choice of financial instruments, and continuous assistance available not only during weekdays but also over weekends. Traders have the option to select the pricing structure and execution method that align with their preferences, whether it's STP or ECN.

WeTrade by the numbers:

Liquidity from 12 international providers;

More than 90 types of trading instruments;

Over 8 years of brokerage service experience;

Regulated by 2 international authorities.

WeTrade – broker with dynamic leverage

The margin trading terms vary based on factors like the client's account balance, country of residence, financial instrument, and the volume of open positions. If the account balance is $4,999 or more, the highest leverage for currencies is 1:2000, and for metals, it's 1:1000. When equity equals or is higher than $5,000, the leverage for currencies is lowered to 1:500, and for metals, it's 1:250. The company can restrict the leverage for currency pairs to 1:200 if the total open position volume goes beyond $2,000,000, or to 1:100 upon reaching $5,000,000. The trading account's leverage can be changed only once within a 24-hour period.

Particular conditions are in place for traders from China: irrespective of the deposit amount, they cannot employ leverage exceeding 1:400 for Forex instruments and 1:200 for metals. The maximum leverage for other instruments across all countries is: up to 1:50 for indices and up to 1:30 for cryptocurrencies.

Useful functions of WeTrade:

Economic calendar. Real-time updates of financial events and macroeconomic data for 38 countries, along with historical asset data for the past 5 years;

Analyst Views. A tool that combines market research from trading experts with the application of automated algorithms. Data for 8,000 instruments is updated every 2 hours;

MT4 Indicators by Trading Central. These encompass vital price levels, market scanning using 16 candlestick patterns, both slow and fast indicators, and a MACD tailored for short-term strategies;

TC Web TV. Concise forecasts for various markets by Trading Central analysts. The average video duration is 1 minute.

Advantages:

Diverse selection of MT4 trading accounts;

Support for MAM and Multi platforms;

Analytics and market data sourced from credible origins;

Registration process completed in approximately 1 minute;

Almost negligible minimum spreads on ECN accounts.

This broker's objective is to offer clients optimal trading conditions, advanced platforms with an array of integrated functions, and dependable informational assistance.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i