Leeloo Trading Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $26

- Ninja Trader

- R Trader Pro

- 17 account types are available

- One-time or monthly payments

- The challenge is of average complexity

- Profit split is 80%/20% or 90%/10% except for Leeloo Entry

- Wide pool of diverse assets.

- No

Our Evaluation of Leeloo Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Leeloo Trading is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.27 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Leeloo Trading clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company.

Leeloo Trading provides a wide range of account types and relatively favorable conditions for completing the challenge. The initial deposit on the Leeloo Express account is refundable upon successful completion of the challenge. Real trading implies fair profit splits. The most popular deposit and withdrawal methods are available. Unfortunately, the withdrawal conditions are not very convenient. The firm’s clients can contact technical support only via email, while non-clients can use tickets on the website. The most significant disadvantage of Leeloo Trading is its insufficient transparency.

Brief Look at Leeloo Trading

Leeloo Trading offers futures on currency pairs, stocks, metals, agricultural commodities, energies, and cryptocurrencies. Its clients can choose among 17 account types with a one-phase challenge. Account types differ in the initial deposit, profit target, total drawdown, and other parameters. Upon successfully completing the challenge, traders can get funded with $25,000 - $300,000. The profit split is 80%/20% or 90%/10%, but traders keep 100% of their first earned $8,000 or $12,500. Trading is conducted on R Trader Pro, NinjaTrader, and other platforms. Also, the prop firm has developed a proprietary mobile app. There are almost no restrictions on strategies and methods, so traders can scalp, hedge, and transfer positions overnight. The only restriction is copy trading.

- Wide range of account types with universal parameters is provided;

- Traders make a one-time payment or sign up for a monthly subscription;

- Free demo account is available for 14 days;

- Client’s profit share is 80% - 90%;

- There are 15 trading platforms available, including NinjaTrader and R Trader Pro;

- Wide range of futures is provided;

- Profitable partnership program and weekly contests with the opportunity to win good cash prizes.

- There is much information on the prop firm’s website, but important details on trading fees of the partnering broker, maximum leverage, etc, are not provided;

- The ratio of the initial deposit to the provided funding is not the best on the market;

- To withdraw first profits, it is required to trade for at least 30 days; further withdrawals on most account types are available once a month.

TU Expert Advice

Financial expert and analyst at Traders Union

Leeloo Trading was incorporated in 2020 and is located in the U.S. It works with thousands of traders from 114 countries. The reviews of it on the internet are mostly positive. There are no confirmed facts of the firm’s non-fulfillment of its obligations to its clients.

The main peculiarity of the prop firm is a wide choice of account types: 8 Foundation accounts, 7 Leeloo Entry accounts with a simplified entry, and 2 Investor Weekly accounts with special conditions. Moreover, there are Leeloo LB packages that consist of three accounts. Each account type is unique and has its advantages and disadvantages. In particular, Entry accounts require small initial deposits and payments upon completion of the challenge. However, the profit split is less profitable for traders. Holders of Investor Weekly accounts are eligible for weekly withdrawals and a 100% profit share when withdrawing their first earned $12,500. Yet, these account types are more expensive.

The complexity of the challenge is an important detail for traders who want to get funded by the prop firm. Leeloo Trading’s challenge is rather difficult, but the requirements for profit target, drawdown, and available number of traded contracts are reasonable.

Unfortunately, the prop firm doesn’t provide information on its partnering broker, which is why unregistered traders can’t know trading fees in advance. Moreover, Leeloo Trading doesn’t specify the available leverage. Thus, Traders Union can’t consider Leeloo Trading’s offer completely transparent.

Among the advantages are a wide range of diverse assets, the absence of trading restrictions, no withdrawal fees, and the availability of a 14-day demo account and a partnership program. The prop firm often holds contests with significant cash prizes. Technical support is competent, but it is available only via email.

The disadvantages of Leeloo Trading are hardly critical, but its advantages are quite significant. Thus, TU recommends the firm for review.

Leeloo Trading Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | R Trader Pro, NinjaTrader, and 14 more platforms |

|---|---|

| 📊 Accounts: | Foundation, Leeloo Entry, Investor Weekly, and Leeloo LB |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, Visa, Mastercard, PayPal, and Stripe |

| 🚀 Minimum deposit: | $26 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Futures on currency pairs, stocks, metals, agricultural commodities, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

17 account types are available; One-time or monthly payments; The challenge is of average complexity; Profit split is 80%/20% or 90%/10% except for Leeloo Entry; Wide pool of diverse assets. |

| 🎁 Contests and bonuses: | Rebates from Traders Union |

Initial deposits of all prop firms are influenced by the required capital and the challenge conditions. To receive $25,000 - $300,000 from Leeloo Trading on Foundation accounts, it is required to deposit $77 - $675. The required initial deposit on Entry accounts is $26 - $169, but the profit split is less profitable. Investor Weekly accounts require depositing $250 - $295 to receive funding of $25,000 - $50,000. Finally, to get funded with $25,000 - $250,000 for packages of three accounts, deposit $250 - $625. Leeloo Trading doesn’t provide information on available leverage, so traders only know its value when they start trading. The only information provided on its website is that leverage is subject to the used capital. Technical support is available 24/7 via email for registered users and via tickets on the firm website for non-clients.

Leeloo Trading Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Leeloo Trading provides access to funding up to $—, with challenges requiring at minimum of 10 trading days. The entry-level plan starts at $26, and the fee is refundable if the challenge is successfully completed.

- Low entry cost — from $26

- Free demo account available

- Limited funding — up to $—

- Minimum trading period required

Leeloo Trading Challenge fees and plans

We compared Leeloo Trading’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Aspire |

|

|

|

|

|

| LB Bundle Aspire |

|

|

|

|

|

| LB Bundle Launch |

|

|

|

|

|

| LB Bundle Climb |

|

|

|

|

|

| LB Bundle Cruise |

|

|

|

|

|

| LB Bundle Burst |

|

|

|

|

|

| LB Bundle Explode |

|

|

|

|

|

| Leeloo Entry LE Aspire |

|

|

|

|

|

| Leeloo Entry LE Launch |

|

|

|

|

|

| Leeloo Entry LE Climb |

|

|

|

|

|

| Leeloo Entry LE Cruise |

|

|

|

|

|

| Launch |

|

|

|

|

|

| Leeloo Entry LE Burst |

|

|

|

|

|

| Leeloo Entry LE Explode |

|

|

|

|

|

| Leeloo Entry LE Glide Micro |

|

|

|

|

|

| Aspire WK |

|

|

|

|

|

| Launch WK |

|

|

|

|

|

| Kickstart |

|

|

|

|

|

| Leeloo Express |

|

|

|

|

|

| Climb |

|

|

|

|

|

| Cruise |

|

|

|

|

|

| Burst |

|

|

|

|

|

| Explode |

|

|

|

|

|

| Glide/Micro |

|

|

|

|

|

What’s the minimum trading period for Leeloo Trading’s challenge?

A minimum of 10 trading days is required, regardless of how quickly you reach the profit target.

Does Leeloo Trading offer a free evaluation?

No, Leeloo Trading does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at Leeloo Trading?

No, Leeloo Trading does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

Leeloo Trading outlines the main rules for funded accounts, including a max. loss of 0,625% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- Trading bots (EAs) allowed

- News trading allowed

- Scalping allowed

- Strict leverage rules

- Copy trading not allowed

Leeloo Trading trading conditions

We compared Leeloo Trading’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Leeloo Trading | Hola Prime | SabioTrade | |

| Max. loss, % | 0,625 | 5 | 6 |

| Max. leverage | — | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

Leeloo Trading earned a Low score based on how smoothly and conveniently traders can deposit and withdraw funds.

Leeloo Trading's limited selection of payment methods and supported currencies may reduce its convenience and global accessibility.

- Bank сard deposits and withdrawals

- PayPal supported

- Wise not supported

- Limited deposit and withdrawal options

Deposit and withdrawal options

To help you evaluate how Leeloo Trading performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Leeloo Trading Payment options vs Competitors

| Leeloo Trading | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | No | Yes | Yes |

| PayPal | Yes | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Leeloo Trading with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Leeloo Trading | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | No | Yes | No |

| Biweekly | Yes | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Leeloo Trading offers the following base account currencies:

Trading Account Opening

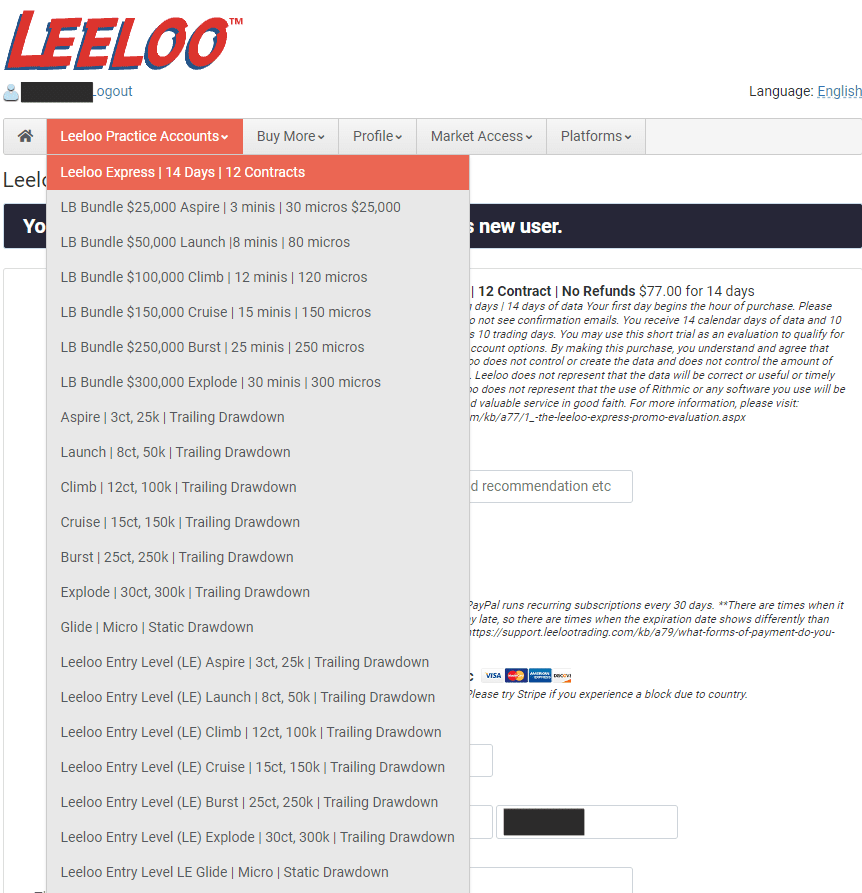

To start working with Leeloo Trading, go to its website, choose the account type, and pay the initial fee. TU experts have prepared a step-by-step guide for all stages and described the main features of the user account.

Go to the prop firm’s website, choose the language in the upper right corner, and click the “Log In” button.

Enter your registration data to sign in. If you are not registered yet, click the “Signup here” button.

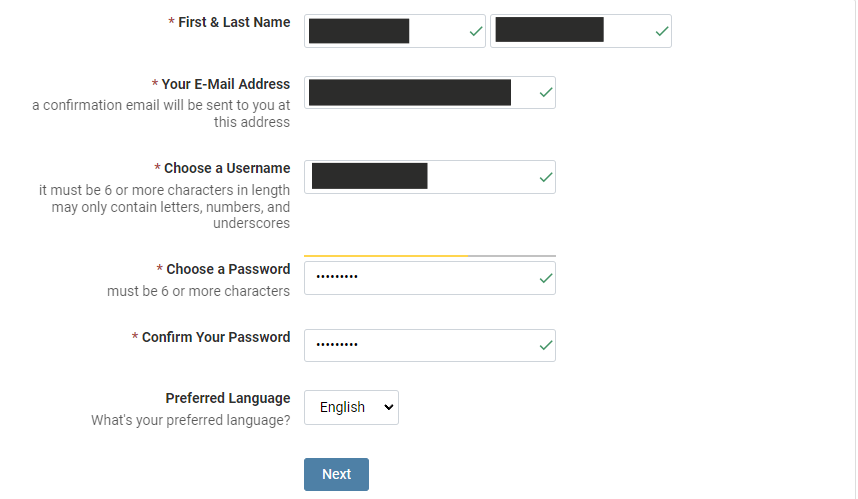

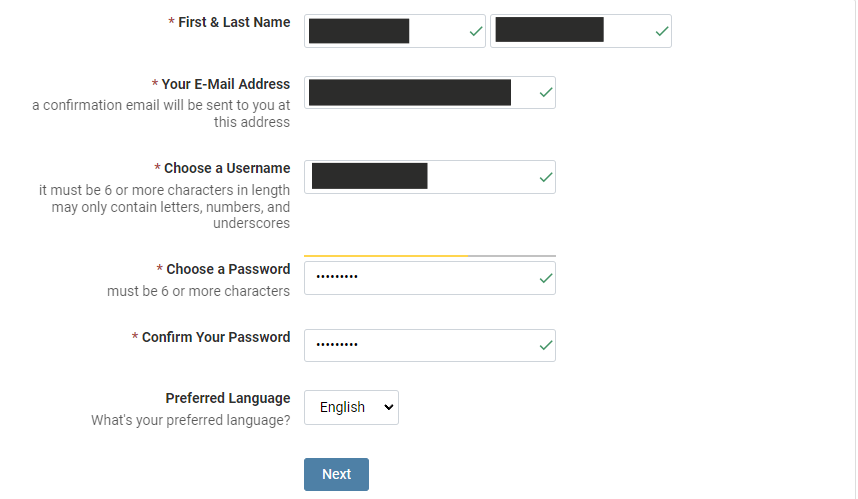

Specify your first and last names, and email. Choose the username, make a password, and enter it twice. Click the “Next” button.

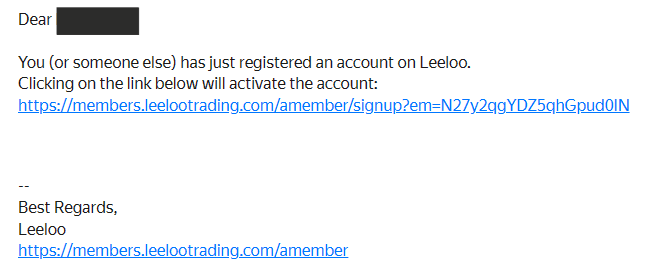

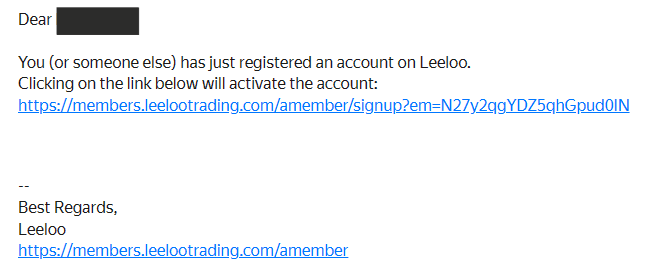

Activate your user account by following the link from an email sent to you.

Now, you are in your user account. Choose the account type and carefully study its conditions. Also, provide requested data, including residence address, postal code, telephone number, etc. Agree to the terms and conditions and make a deposit by a preferred method.

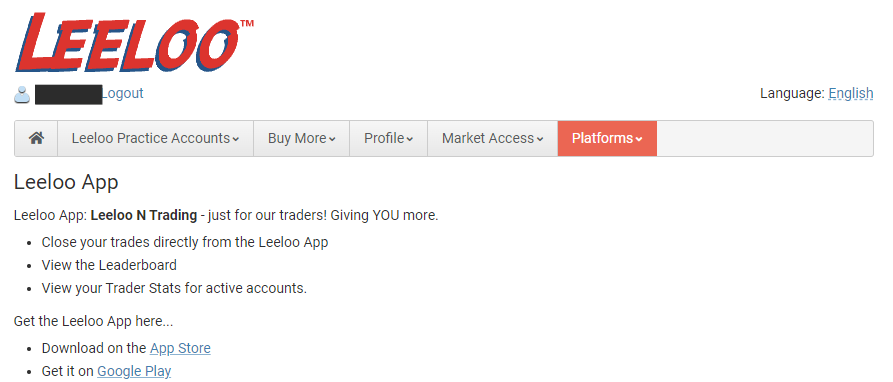

Go to the Platforms section and choose the Leeloo App subsection. Download and install the Leeloo N Trading app. Launch it and enter your registration data. Now, you can start trading. You can download the NinjaTrader platform and use its free license key provided by the prop firm.

Features of Leeloo Trading’s user account that allow traders to:

-

Open any of the available account types;

-

Make the one-time or monthly payments, pay for the challenge reset or other options, and view the payment history;

-

Submit withdrawal requests;

-

Change a password or personal data;

-

Register in the partnership program;

-

Download Leeloo N Trading and get a free personal NinjaTrader license key.

Regulation and safety

Prop firms have to be registered as financial organizations. However, they don’t require regulation, unlike brokers. Also, client reviews are important. Leeloo Trading is officially registered in the U.S.; its user reviews are mostly positive.

Advantages

- The prop firm is reputable

- It is officially registered

Disadvantages

- No information on the partnering broker

- Other necessary information is not provided

Markets and tradable assets

Leeloo Trading has a score of 9.5/10, reflecting a strong variety of markets and assets available for trading.

- Forex trading supported

- Futures available

- CFDs offered

- Stock trading not allowed

- Options not supported

Tradable markets

We compared the range of tradable instruments offered by Leeloo Trading with two leading competitors to highlight the differences in market access.

| Leeloo Trading | Hola Prime | SabioTrade | |

| Futures | Yes | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | No | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Prop firms primarily provide capital for trading in global markets, while some partner with brokers to offer PAMM or copy trading options. Leeloo Trading offers a partnership program, which is described below. This is not a passive income option, but it requires no financial investments from traders. They invest their time promoting the program, particularly if they have established an online presence through websites, blogs, or social media profiles. In these cases, the income potential can be significant.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program

The prop firm’s existing clients apply for partnership and receive unique links upon approval. They can place their links online and send them via messengers and emails. Users who follow these links to the Leeloo Trading website, register there, and pay the initial fee, bring 10% of the deposited amount to partners. For the next three months, partners receive the same interest of all referrals’ payments, but not resets. The number of referrals is not limited. Overall, this is a typical partnership program that allows socially active traders to receive good profits.

Customer support

Traders often have questions about trading conditions, and they can find answers to them by studying information available on the firm’s website. However, certain important details are not provided there. If you have any difficulties or you need advice, contact technical support 24/7 via email.

Advantages

- Support is available 24/7

- Client service is highly competent

Disadvantages

- No call center or live chat

- Responses are not always prompt

Clients and unregistered users can contact technical support via the following communication channels:

-

Email;

-

Tickets.

Leeloo Trading has official profiles on Facebook, X (Twitter), Instagram, YouTube, and Discord. Traders can also contact managers there. Sometimes, this option is more prompt.

Contacts

| Registration address | 260 NUMBER 4 ROAD, ROUNDUP, MT 59072; United States |

|---|---|

| Official site | https://www.leelootrading.com/ |

| Contacts |

Education

Prop firms don’t often focus on education for traders. They believe that if traders deposit their funds, they already have certain trading experience. Leeloo Trading offers some analytical materials and also plans to hold webinars. The Knowledge Base section provides information on the firm’s working conditions, challenges, and profit split. The Tutorials section provides videos explaining registration details, the Leeloo app, deposits, resets, etc.

Prior to paying for the challenge, novice traders should get some knowledge on third-party resources. Though the challenge is not too difficult, it is not easy to complete, as the prop firm wants professionals to manage its funds.

Comparison of Leeloo Trading to other prop firms

| Leeloo Trading | FundedNext | Hola Prime | SabioTrade | The Trading Pit | Lark Funding | |

| Trading platform |

R Trader Pro, Ninja Trader | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER | cTrader, DXTrade |

| Min deposit | $26 | $32 | $48 | $119 | $99 | $60 |

| Leverage | No |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | No | 110% / 100% |

| Order Execution | Market Execution | N/a | Market Execution | Market Execution | No | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Leeloo Trading

Leeloo Trading has been on the market for only 3 years, but it has already managed to become one of the leaders of the futures trading industry. It offers traders worldwide fair and mutually beneficial conditions. Its clients can trade through the firm’s proprietary app and 16 trading platforms. Moreover, a free NinjaTrader license key is provided. Traders can test the firm’s conditions on a demo account. Major details and requirements important to complete the challenge are provided in the Knowledge Base section of the firm’s website. Some important details are additionally provided on the main pages of the website.

Leeloo Trading by the numbers:

-

17 separate account types and 4 account packages are provided;

-

The minimum initial deposit is $26;

-

Funding is up to $300,000;

-

400+ assets from 6 groups;

-

Profit split is 80%/20% or 90%/10%.

Leeloo Trading offers a wide range of trading instruments

A wide pool of diverse assets is very important for at least two reasons. The first reason is that it expands traders’ strategic opportunities and provides flexibility when trading. Leeloo Trading doesn’t set any restrictions, so traders can scalp, hedge, trade on news, and transfer their positions overnight. The second reason is risk diversification — in a well-built investment portfolio, a negative trend of one position is successfully compensated with the stability and progress of others. Thus, Leeloo Trading clients trade in conditions as comfortable, free, and secure as possible.

Useful services offered by Leeloo Trading:

-

Three account types. Foundation, Entry, and Premium account types provide for the most individual offers. Some traders are ready to deposit small amounts, for some the most beneficial profit split or simplified challenge conditions are important, or some traders want to withdraw their funds more often. Leeloo Trading claims that every trader can find the best account type.

-

Demo account. Prop firms rarely offer demo accounts. Leeloo Trading provides a 14-day demo account with virtual $100,000. It helps traders prepare for the challenge and study all risky moments.

-

Partnership program. Traders can use their banner links and receive 10% of attracted referrals’ deposits. Partners receive up to $77.5 for every referral’s account.

Advantages:

The firm constantly introduces new account types, thus offering more profitable conditions;

Maximum drawdown is significant, and profit target requirements are simple;

Wide range of trading instruments and the functional Leeloo app are available;

Almost all trading strategies and methods, except for copy trading, are allowed;

The client’s profit share is up to 90%. They can participate in the prize draw.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i