How Do Interest Rates Affect Forex?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Interest rates are a fundamental component of the financial markets, significantly influencing the Forex market. Higher interest rates attract foreign investments seeking better returns, strengthening the currency. Conversely, lower interest rates often lead to a weaker currency as investors look for higher yields elsewhere.

Understanding how interest rates affect Forex trading is crucial for both beginner and advanced traders. This article provides a comprehensive overview of the impact of interest rates on Forex trading, enriched with practical examples, expert advice, and visual aids for enhanced understanding and engagement.

How do interest rates work and affect Forex?

Interest rates are the cost of borrowing money, typically expressed as an annual percentage. Central banks, such as the Federal Reserve in the U.S. or the European Central Bank, set benchmark interest rates to influence economic activity. These rates directly impact the cost of borrowing and the return on savings.

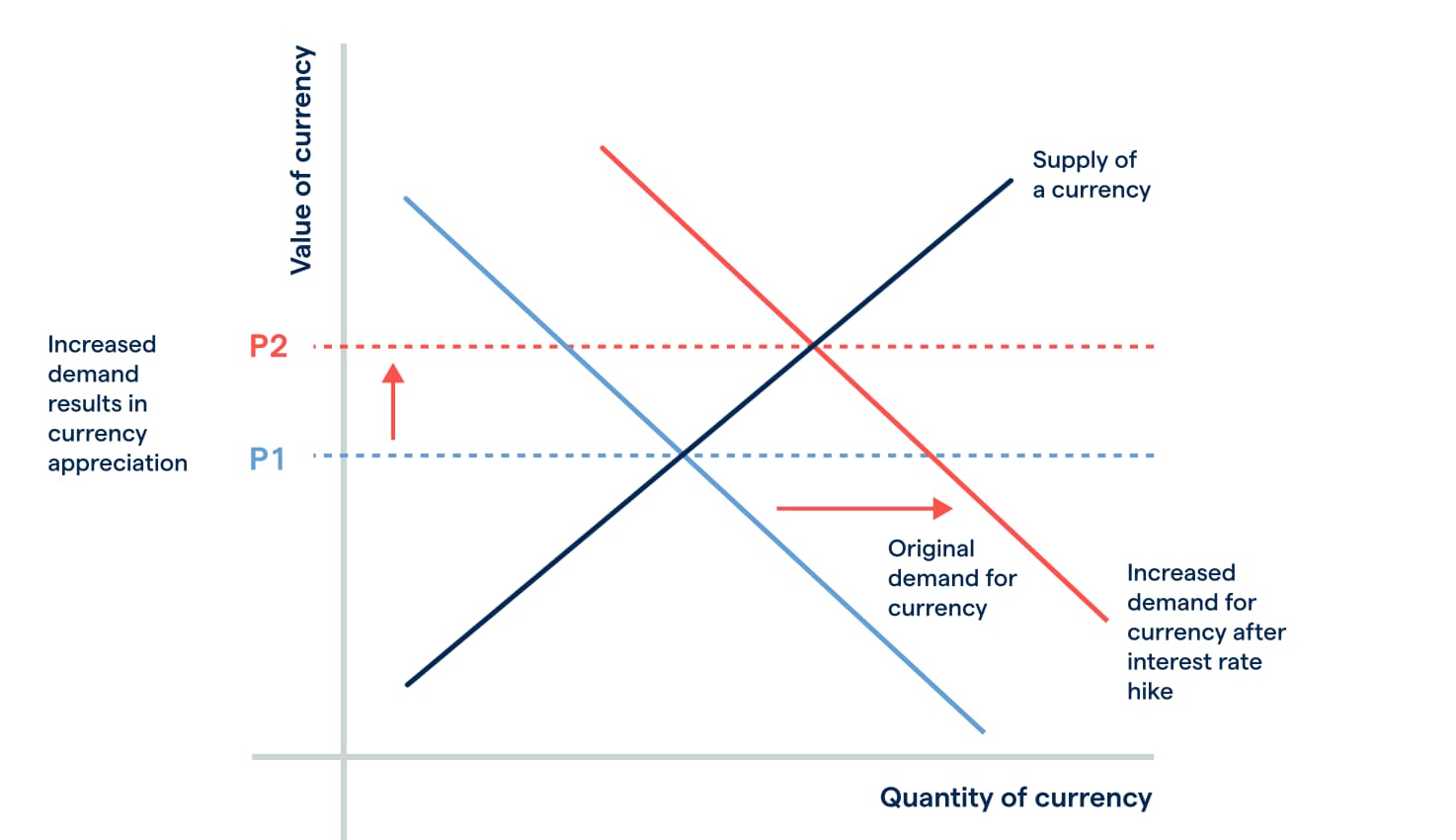

Interest rates have a profound impact on currency value. Higher interest rates typically attract foreign investors seeking higher returns, increasing demand for that currency and causing its value to appreciate.

Money will shift from currencies in economies with less attractive investment opportunities to a currency with more promising prospects, positively influencing its exchange rate. This capital flow will increase demand for the more favorable currency, causing its value to rise. Conversely, currencies with declining demand will depreciate, which will negatively impact their exchange rates.

Increased demand results in currency appreciation, Source: www.ig.com

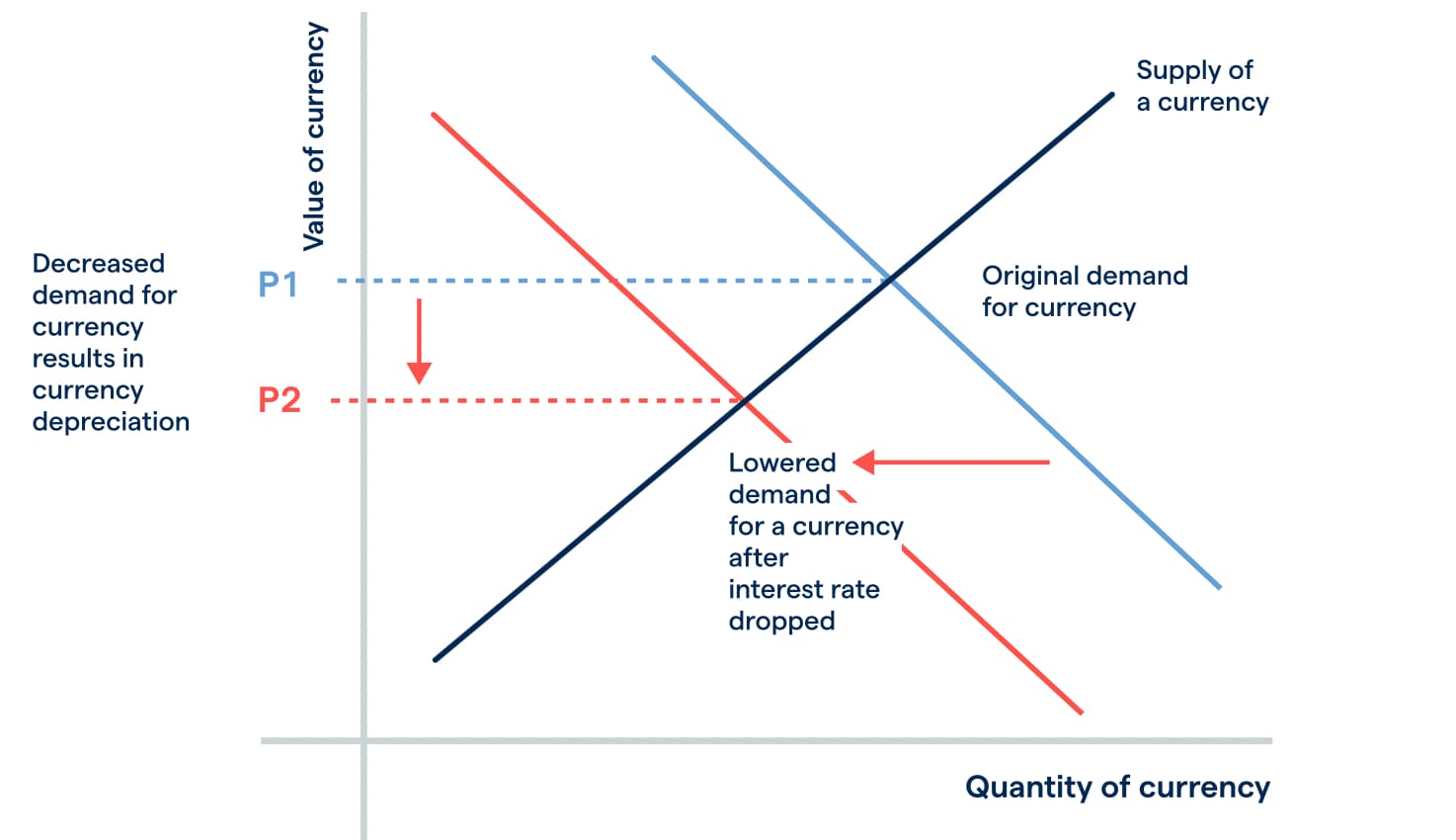

Increased demand results in currency appreciation, Source: www.ig.comConversely, lower interest rates can lead to currency depreciation as investors seek better returns elsewhere. As a result, demand for that particular currency will decrease because investment capital is redirected to more appealing destinations. This will cause the country's exchange rate to drop. Additionally, the increased supply of the domestic currency in the Forex markets will further drive down its value.

Decreased demand for currency results in currency depreciations, Source: www.ig.com

Decreased demand for currency results in currency depreciations, Source: www.ig.comCentral banks use interest rate changes as a tool to control inflation and stimulate economic growth. Their announcements can cause significant volatility in the Forex market.

Historical examples demonstrating the impact of interest rate changes on Forex trading

Here are some historical examples demonstrating the impact of interest rate changes on forex trading:

The US Federal Reserve and the US Dollar

Historical Context: In December 2015, the US Federal Reserve (Fed) raised interest rates for the first time in nearly a decade, increasing the federal funds rate from 0.25% to 0.5%.

Reaction of the S&P500 stock index to the Fed rate change

Reaction of the S&P500 stock index to the Fed rate changeImpact: The expectation and subsequent implementation of this rate hike led to a significant appreciation of the US dollar (USD). Investors anticipated higher returns on US assets, leading to increased demand for the USD. The EUR/USD pair, for instance, saw a marked decline as traders moved capital to the US to take advantage of the higher interest rates.

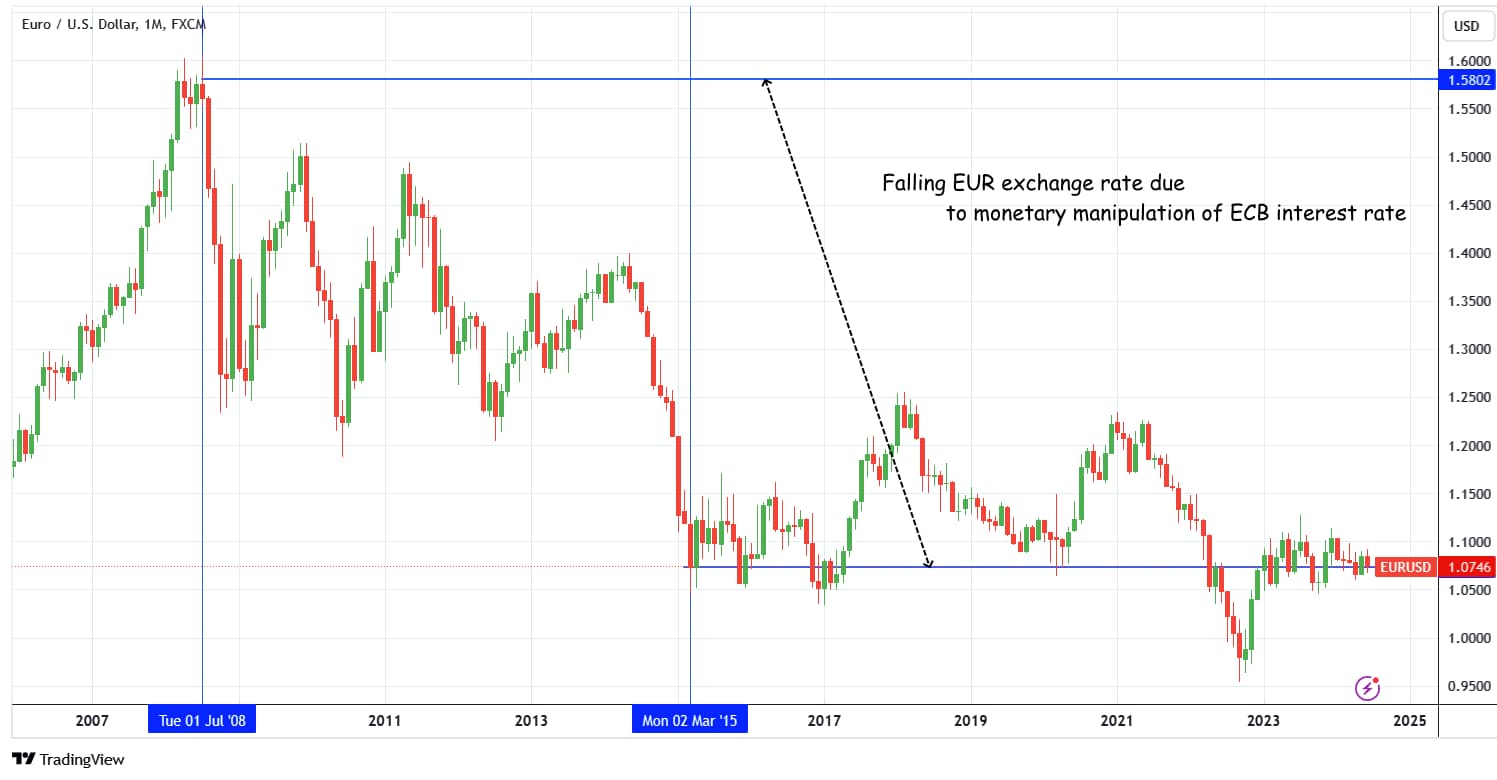

European Central Bank and the Euro

Historical Context: In the early 2010s, the European Central Bank (ECB) implemented a series of interest rate cuts to combat the Eurozone debt crisis and stimulate economic growth. By mid-2014, the ECB had cut its main refinancing rate to 0.05%.

Reaction to ECB rate change

Reaction to ECB rate changeImpact: These rate cuts led to a depreciation of the euro (EUR). Lower interest rates made euro-denominated assets less attractive, causing investors to seek higher returns elsewhere. Consequently, the EUR/USD exchange rate fell, reflecting the reduced demand for the euro.

Bank of Japan and the Japanese Yen

Historical Context: In the 1990s and 2000s, Japan experienced prolonged periods of economic stagnation and deflation. The Bank of Japan (BoJ) responded by maintaining very low or even negative interest rates.

Impact: The consistently low interest rates resulted in a weaker Japanese yen (JPY). Investors favored other currencies with higher returns, leading to capital outflows from Japan. This policy helped the JPY to stay relatively weak, aiding Japanese exporters by making their goods cheaper on the international market. The USD/JPY pair often moved higher as a result.

These examples illustrate how central bank interest rate policies can significantly impact currency values and forex trading dynamics. Traders closely monitor interest rate decisions and forward guidance from central banks, as these factors are key drivers of currency movements in the forex market.

Emergency rate cut in March 2020

In March 2020, the Federal Reserve cuts rates by 1.5 percentage points in two steps (to 0-0.25 percent) in an emergency in response to the economic impact of the COVID-19 pandemic.

Market Reaction:

Equities

Stock markets initially declined sharply as investors realized the magnitude of the economic impact of the pandemic. After the initial shock, markets began to recover due to stimulus measures and Fed support.

Bonds

U.S. Treasury yields fell sharply, hitting historic lows. Bond prices rose significantly as investors sought safe assets amid uncertainty.

Сurrencies

The U.S. dollar strengthened as investors sought refuge in safe assets such as the dollar and U.S. government bonds. Other currencies, especially emerging market currencies, weakened against the dollar.

Commodities

Gold prices rose as investors sought safe-haven assets. Oil prices fell sharply due to a sharp drop in energy demand and oversupply.

These examples illustrate how changes in Fed interest rates can affect different market assets and segments of the economy, emphasizing the importance of monetary policy to financial markets.

Influence on trading strategies

Carry trade strategy

The carry trade strategy involves borrowing in a currency with a low interest rate and investing in a currency with a higher interest rate, profiting from the interest rate differential. While potentially profitable, this strategy carries risks, including exchange rate fluctuations and changes in interest rates.

Interest rate parity

Interest rate parity (IRP) is a theory stating that the difference in interest rates between two countries is equal to the expected change in exchange rates between those countries. Traders use IRP to predict currency movements and inform their trading decisions.

To successfully implement trading strategies and generate income, it is important to find a reliable broker. We suggest you familiarize yourself with the comparison table with brokers offering the most convenient conditions for traders.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Currency pairs |

60 | 90 | 68 | 80 | 100 |

|

Trading platforms |

Mobile, Web, Desktop | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 | FOREX.com, MT4, MT5 | Trader Workstation, IBKR Mobile, APIs |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Leverage, 1: |

Up to 1:30 or up to 1:300 | Up to $400:1 retail, 500:1 Pro | Up to 1:200 | Up to 1:400 | Depending on the asset |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

How global economic factors influence interest rates and Forex markets?

Inflation and its relationship with interest rates

Inflation measures the rate at which the general level of prices for goods and services is rising. Central banks often adjust interest rates to control inflation. Higher inflation typically leads to higher interest rates to cool down the economy, while lower inflation can lead to rate cuts to stimulate growth.

Global economic conditions

Global economic conditions, including economic growth, political stability, and geopolitical events, also influence interest rates and Forex markets. For instance, during periods of economic uncertainty, investors might flock to safe-haven currencies like the U.S. dollar, regardless of its interest rates.

Central bank communication

Central banks use forward guidance to communicate future monetary policy intentions. Traders closely watch these communications for clues about future interest rate changes, which can significantly impact Forex markets.

Tips for beginners

Here are some key tips to help you benefit from Forex trading when interest rates change:

Understanding the basics: Beginners should grasp fundamental concepts such as interest rates, inflation, and the role of central banks. Monitoring key indicators like GDP, CPI, and employment data can provide insights into future interest rate changes and Forex market movements.

Common mistakes to avoid: Common mistakes for beginners include over-leveraging, ignoring broader economic conditions, and failing to manage risk properly. Avoid these pitfalls by adopting a disciplined approach to trading and continuous learning.

Practical advice: Starting with a demo account allows beginners to practice trading without risking real money. Keeping a trading journal helps track progress and learn from both successes and mistakes.

Advanced strategies: Advanced traders can combine interest rate analysis with other technical and fundamental setups to refine their strategies. Using derivatives like options and futures can help hedge against interest rate risks.

Risk management: Effective risk management is crucial in interest rate trading. Techniques include setting stop-loss orders, diversifying portfolios, and adjusting position sizes based on market conditions.

Interest rates can affect volatility, which may be seen as an opportunity for traders

From my perspective as a Forex trader, interest rates are a crucial factor in currency valuation. When central banks raise interest rates, it generally strengthens the currency because higher rates attract foreign investment seeking better returns. Conversely, when rates are lowered, the currency often weakens as investors seek higher yields elsewhere. However, it's not just the rate changes themselves but also the market's expectations and the broader economic context that influence currency movements. By staying informed about these factors, I can make more strategic trading decisions. Interest rates can affect exchange rates and cause volatility in the Forex market, which may be seen as an opportunity for traders. You just need to find a reliable broker and choose the right strategy.

Summary

Interest rates significantly influence Forex trading by affecting currency demand and valuation. Higher rates attract foreign investment, strengthening the currency, while lower rates tend to weaken it as investors seek better returns elsewhere. However, the impact of rate changes is complex, influenced by market expectations and broader economic conditions. Understanding these dynamics helps traders make informed decisions, leveraging interest rate changes alongside other economic factors.

FAQs

Why are central bank interest rate decisions important for Forex traders?

Central bank decisions on interest rates are crucial because they provide insights into a country’s economic health and monetary policy direction. These decisions can cause significant fluctuations in currency values, creating opportunities and risks for Forex traders.

What role do market expectations play in the impact of interest rate changes?

Market expectations significantly affect how interest rate changes impact currency values. If a rate hike or cut is widely anticipated, its actual implementation might have a muted effect, as the market has already priced in the expected change.

Can interest rate changes influence Forex trading strategies?

Yes, interest rate changes can influence Forex trading strategies by providing signals for potential currency strength or weakness. Traders might adjust their positions based on expected rate movements, using tools like carry trades to benefit from interest rate differentials between currencies.

How do interest rate changes interact with other economic indicators in Forex trading?

Interest rate changes interact with various economic indicators such as inflation, employment data, and GDP growth. A comprehensive analysis of these indicators alongside interest rate trends helps traders make more informed decisions, as these factors collectively influence currency values.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.