Best Social Trading Platforms For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best social trading platform for 2025 is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- A wide range of tools

- Fast execution speed

The best social trading platforms for 2025 are:

- Pepperstone - Best for scalping strategies (spread from 0 pips)

- OANDA - Best for trading with advanced technical analysis tools (TradingView charts support)

- FOREX.com - Diverse range of tradable assets (80+ currency pairs)

- IG Markets - Favorable Forex trading conditions (0 fees, avg. EUR/USD spread - 0.8)

- Thinkorswim - Best for trading based on technical analysis (most advanced charting platform)

Social trading (copy trading) platforms offer a solution to several issues a novice trader may have. Firstly, they provide an opportunity to start earning money in the financial markets without having extensive knowledge and experience. Secondly, as you are copying trades of experienced traders, you also learn from indicative examples of the masters of their craft.

As an additional bonus, this is a very promising type of passive investment. You can copy other traders’ transactions, dedicating only a small part of your time to trading. Sounds appealing? Then let's take a closer look at the top copy trading platforms and how to start earning profit using them.

Best social trading platforms

We have compiled a list of best brokers, working with which you will be able to copy trades of successful traders. Noteworthy, a number of brokers have proprietary social trading platforms, while others offer developments of one or several third-party providers.

| Copy trading | Demo | Min. deposit, $ | Investor protection | Negative balance protection | Max. Regulation Level | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | Yes | No | £85,000 €20,000 €100,000 (DE) | Yes | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | £85,000 SGD 75,000 $500,000 | Yes | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | £85,000 | Yes | Tier-1 | Study review | |

| Yes | Yes | 1 | £85,000 €100,000 SGD 75,000 | Yes | Tier-1 | Study review | |

| Yes | No | 2000 | $500,000 | Yes | Tier-1 | Study review |

What is social trading and copy trading network?

Social trading enables traders to collaborate and invest, with beginners replicating professional strategies through copy trading. Copy trading links accounts, allowing trades to be mirrored automatically or manually, with investments starting from $1 to $5,000. You can also learn information about сollective trading pros/cons

While it offers great potential, even experienced traders can incur losses, and overused strategies may lose effectiveness. Careful consideration is key to maximizing benefits and managing risks.

To sum it up, copy trading:

Allows to merge knowledge and experience of thousands of traders.

Provides a safer entry to the market for the beginners without knowledge and experience.

Provides a source of passive income, which is higher than average in the market.

Low entry threshold.

However, it is important to remember that:

Even experienced traders are not immune to losses.

As the popularity of a strategy grows, its efficiency often decreases.

How does social trading work?

Using the features of the social trading platforms, you can link a part of the funds on your account to the accounts of a professional trader. From then on, all actions taken by the professional trader will be automatically copied on your account.

To start investing in the social trading networks, you need to take several important steps:

Find a reliable broker that offers this type of service.

Select one or several managers, whose traders you will be copying. For this, you will need to perform analysis of their financial results over a long period of time (the longer the better).

The next step is to study conditions of working with the traders and distribute your investment capital among them at the required ratio.

Customize the social trading platform to fit your needs. Many systems offer in-depth customization of risk criteria; it is also possible to select fully automatic copying or partial.

Regularly view the results of performance of your managers in the statistics and adjust the size of your investment.

Below, we will take a closer look at how social trading works at each of the steps.

You will also have an opportunity to familiarize yourself with the lists of the best brokers for copy trading, best providers of social trading platforms and learn in detail how to choose a trader for copying trades.

How to choose a good broker for social trading

To select the best broker for social trading, follow these steps recommended by Traders Union experts:

Check reliability and regulation. Opt for brokers regulated by authorities like FCA (UK), CySEC (EU), or ASIC (Australia) to ensure credibility.

Evaluate trading conditions. Review commissions, instrument variety, and order execution. Be cautious of brokers adding extra costs to spreads for copy trading services.

Assess network size. A larger social trading network offers more managers to choose from and better opportunities for capital growth.

Ensure transparency. Look for brokers providing accessible, audited manager statistics for informed decisions.

Review technological features. Choose platforms with advanced filters and risk management tools to enhance your success chances.

How to choose traders to copy

Previously, we discussed Linda’s process of choosing traders to copy, but the selection requires careful attention, as your financial results depend on it. We suggest focusing on key criteria. Let’s understand through an example.

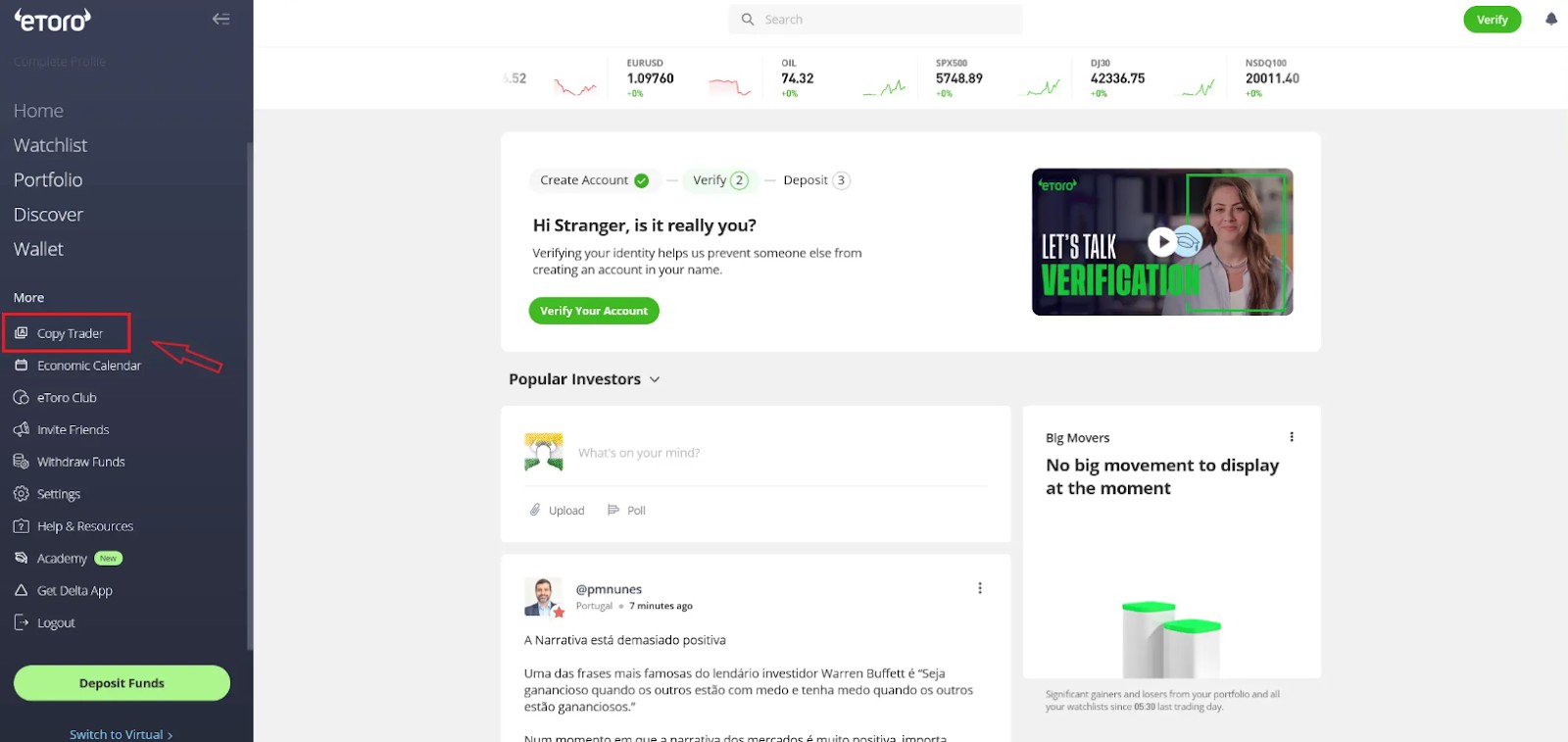

On eToro, you can explore filters without registering. Simply go to the Top Markets tab on the website, select an option, and open the Copy People menu in the web terminal to begin exploring traders.

Now, let’s go directly to the selection criteria:

Assess trader’s performance

The longer a trader maintains positive results, the more likely their success reflects skill rather than luck.

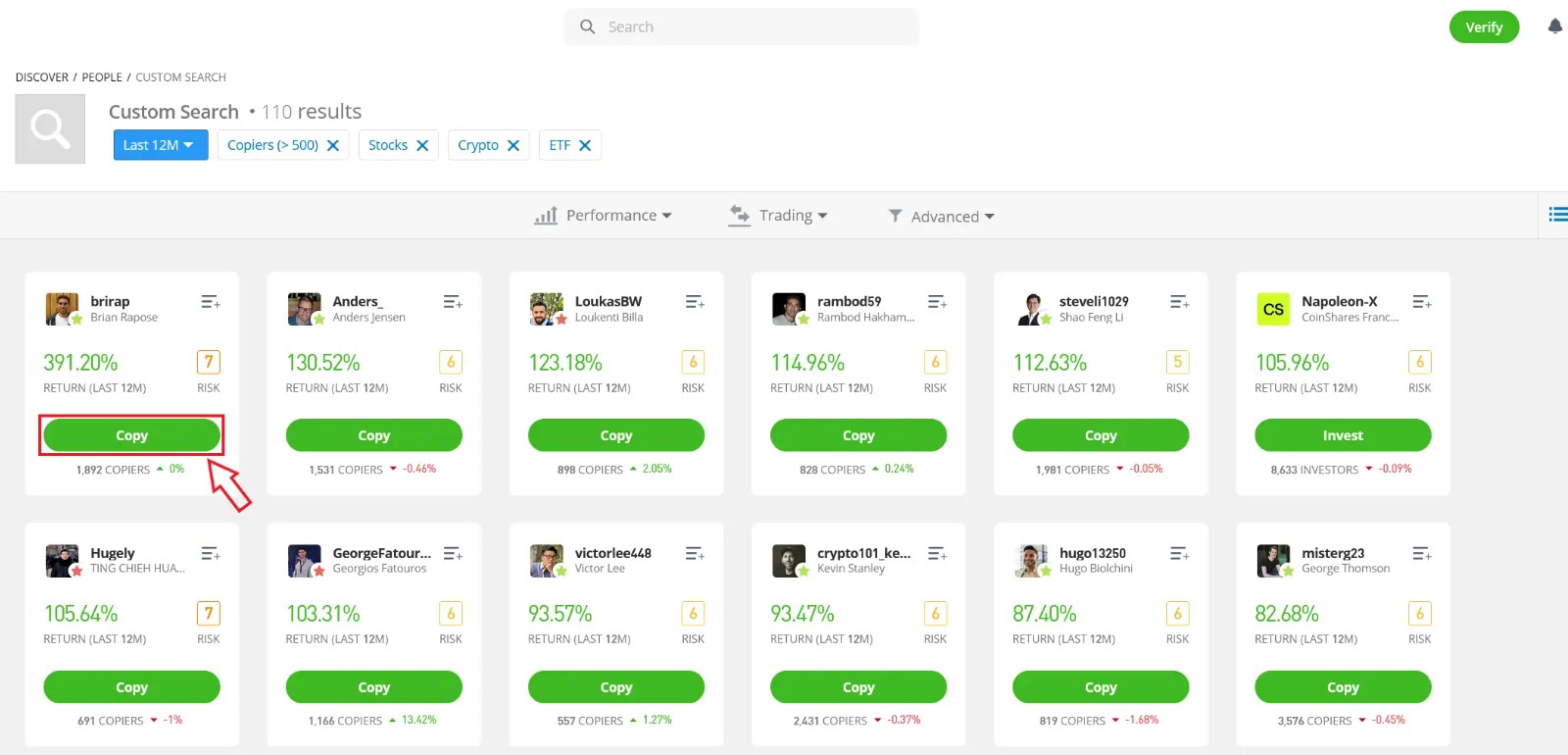

On eToro, you can filter traders by performance over periods ranging from one month to two years. For example, setting filters for returns over the last two years and assets traded yielded 1,438 results, indicating the need for further refinement.

Assess the risks

Riskier trading strategies can yield higher returns but also come with significantly increased risks. Striking a balance between risk and potential reward is essential. Key metrics like historical maximum losses and the number of closed orders can help in this assessment.

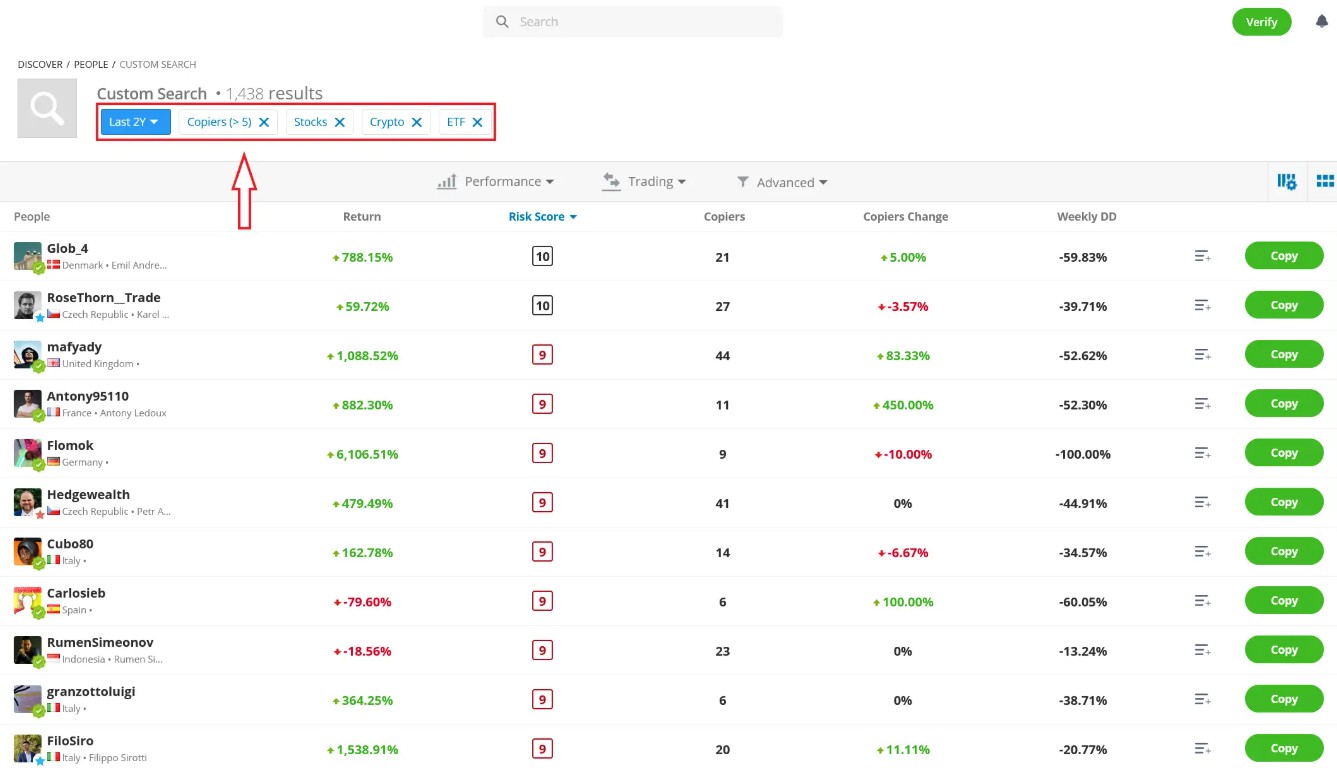

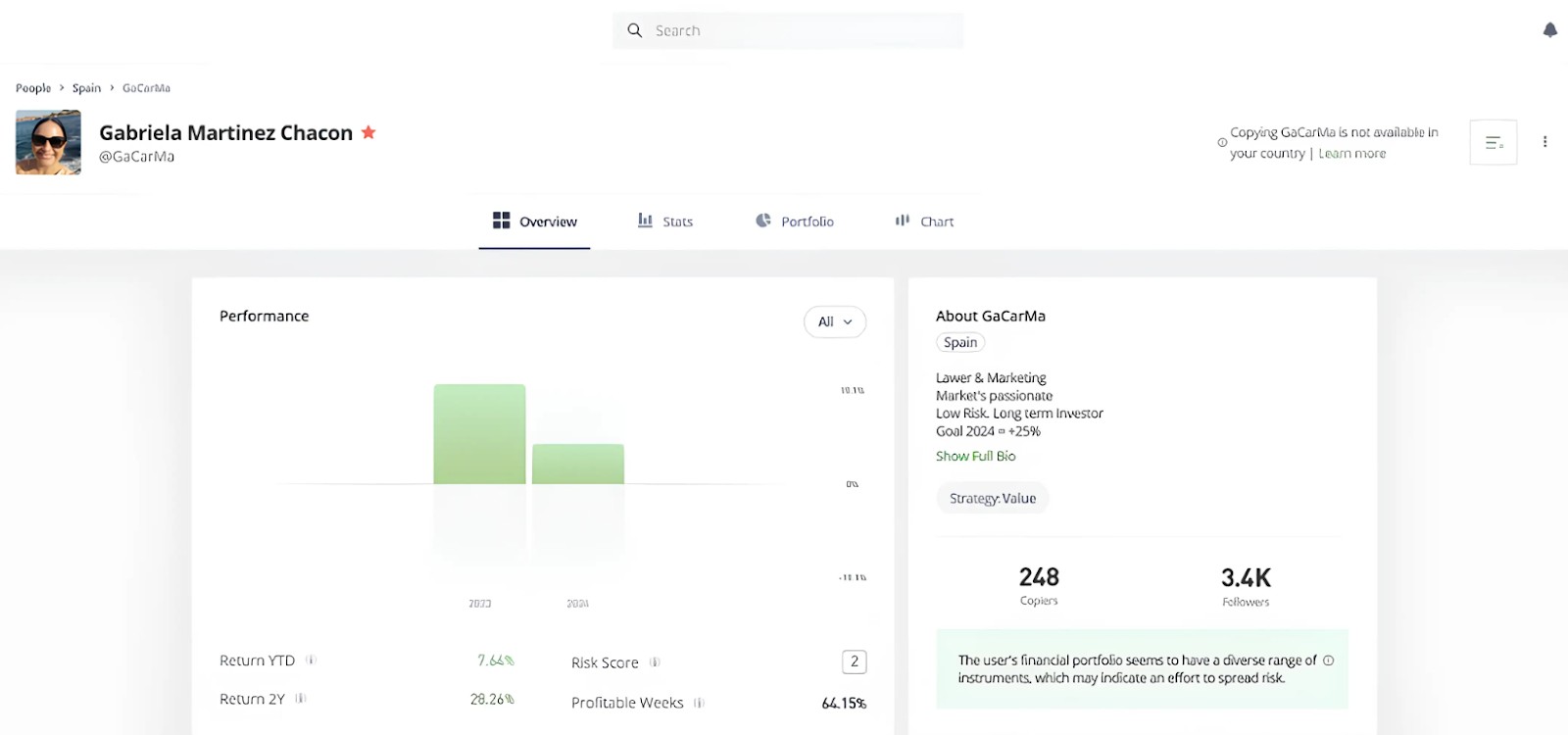

eToro simplifies this process with its risk assessment algorithm. Traders are categorized by risk level: low (0-2), medium (3-6), and high (6+). A general guideline is to allocate smaller portions of your portfolio to higher-risk traders. By using the Performance-Risk Score filter, you can set conservative criteria, such as a risk level of 2 to 3, for better portfolio management.

This allowed us to narrow down the criteria of the ideal trader for copying. Instead of 1,438 results, we got 32 managers with strategies that meet two criteria:

Have an acceptable risk score.

Show stable positive financial results.

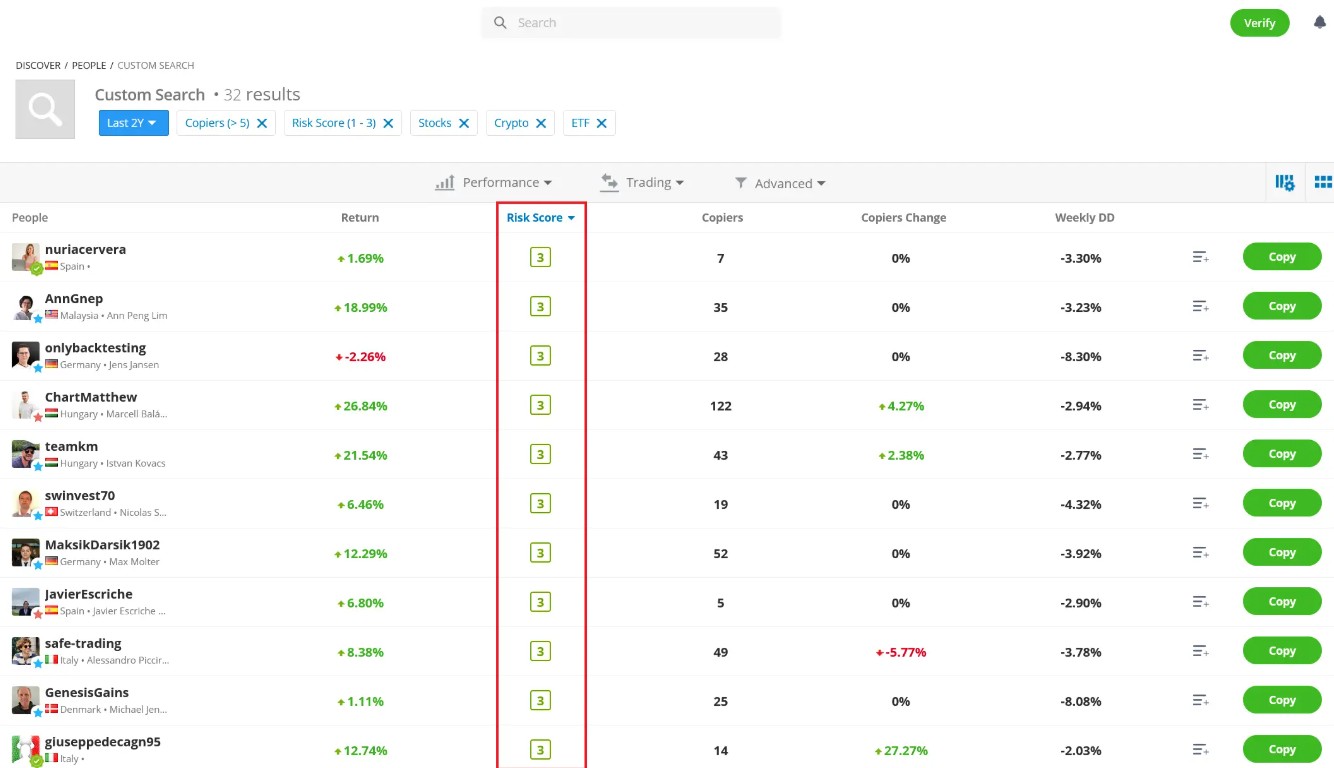

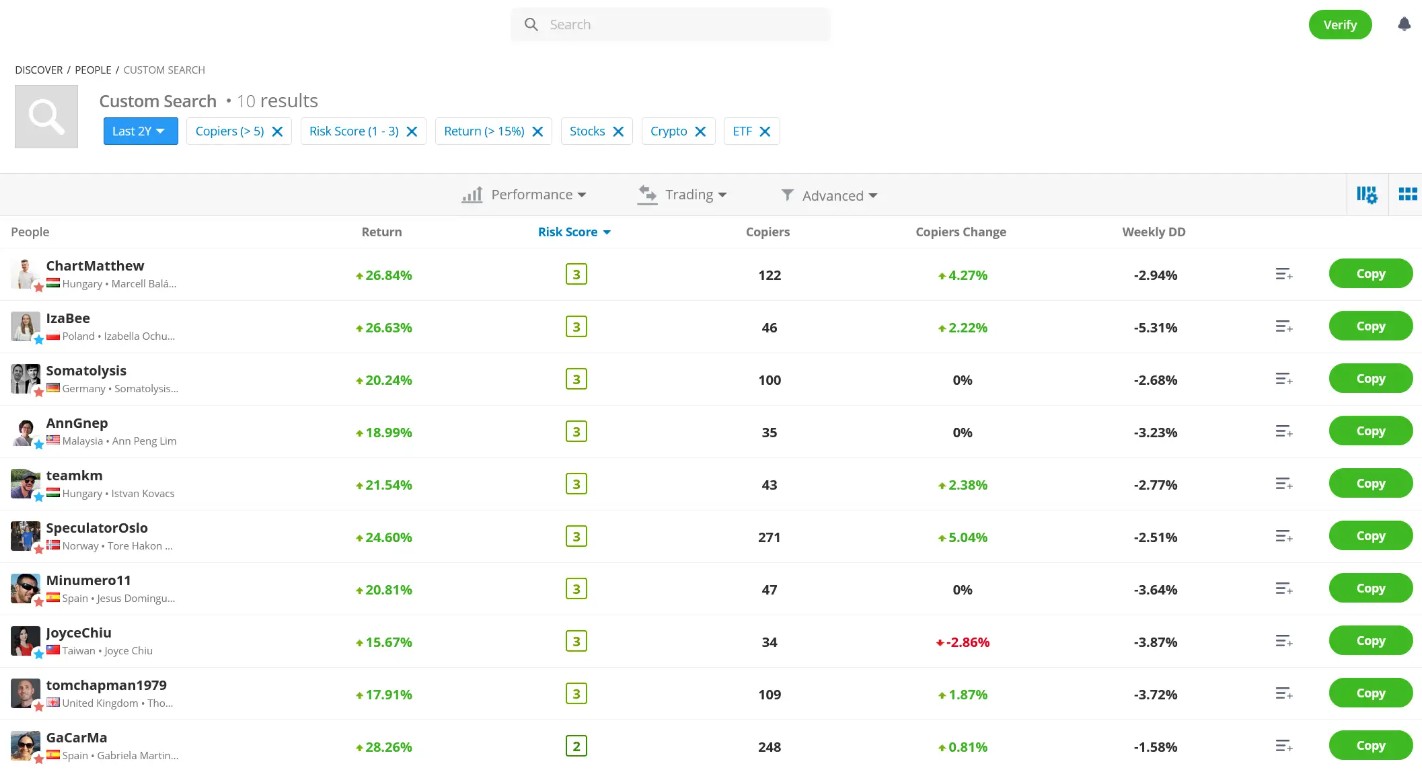

eToro offers even deeper settings. In particular, you can select traders that meet the same strict risk criteria, but with higher return rate, setting it at over 30% using the Advanced-Return filter. Even after this very strict selection, we have a choice of 10 managers.

On the trader’s personal page, you can review his statistics and portfolio.

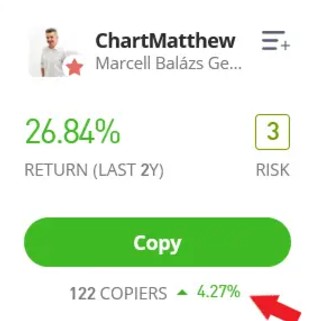

The next factor you need to take into account is the number of copiers. If there is no interest towards the trader, there is a reason to be cautious. Maybe he is not as good as it seems.

As we can see, 122 people copied trades of the trader featured below, and in the past 2 years he earned 26.84%.

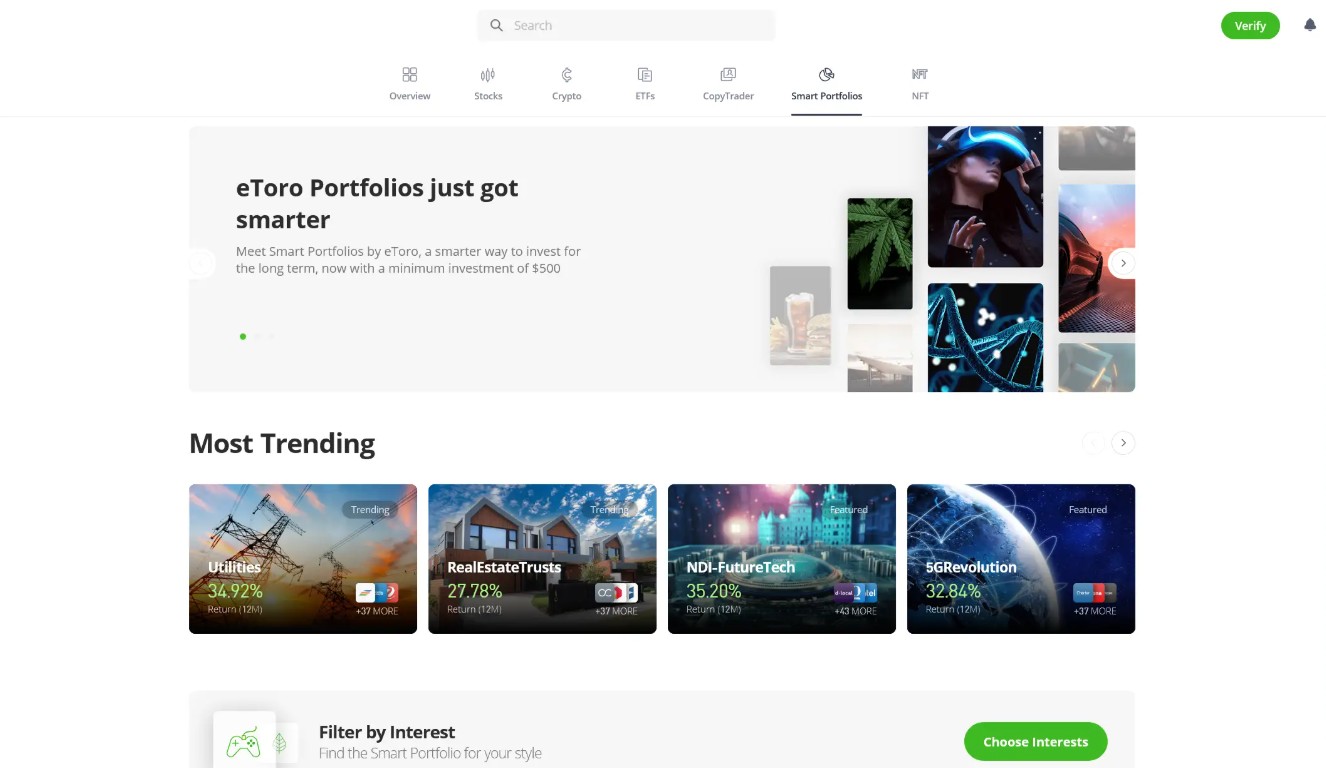

As an alternative, eToro also offers already diversified and balanced portfolios in different markets. A portfolio is a balance set of assets of several successful managers. The return rate can also be quite impressive, but the entry threshold increases from $200 to $5,000.

Example of social trading: how to start copy trading with eToro

From the earlier selected traders, choose several to start copying.

Choose the amount you are prepared to spend. It is desirable to diversify your portfolio and start copying trades of at least 3-5 traders. For this, you will need at least $600-1,000.

Click “COPY” on the trader’s preview.

If you are a registered user on eToro and have deposited the required amount to your account, the system will allow you to select criteria of copying. If you were only testing the system, the registration page will open for you.

eToro offers a demo account with $100,000 in virtual funds, perfect for testing the platform. Registration is quick, requiring only your email, username, and password.

When using the demo or live account, clicking "COPY" opens a settings window where you can define the amount to invest and set a maximum loss limit to stop copying automatically. Once configured, click "COPY" again to start.

You can also invest in portfolios via the web app. Each portfolio displays detailed statistics, asset composition, and price trends. A minimum investment of $5,000 is required, with a setup window for customizing criteria.

Track your performance, adjust investments, or unsubscribe from traders in the Portfolio tab. While results may appear quickly, it’s advisable to monitor for at least a month for accurate performance evaluation.

eToro also provides filters, editorial recommendations, and algorithms to help you choose traders or portfolios effectively.

Main risks of social trading platform

When copying trades on social trading platforms, be aware of these key risks:

Past performance uncertainty. A trader's previous success doesn’t guarantee future results — they may improve or incur losses.

High-risk strategies. Higher returns often come with greater risks.

Fees and expenses. Some platforms charge management fees (10%-50%) or higher spreads (e.g., AxiTrader adds 0.6 pips). Always account for these costs when calculating net earnings.

Risk disclaimers. Review each broker’s disclaimer for detailed explanations of the risks involved in automated copying.

Choosing the right trader to copy is the most important decision

When you're starting out with social trading, resist the temptation to follow the crowd. It’s tempting to copy the top traders who have the most followers, but their strategies might not suit your risk tolerance. Instead, focus on traders who have consistent, steady growth and are transparent about their approach to risk.

A successful trader isn’t always the one with the biggest gains, but the one who knows how to protect their investments during tough times. Look for traders who are methodical, use stop-loss orders, and have a well-thought-out plan for managing market fluctuations.

Additionally, don’t just blindly copy trades. Instead, choose a platform that gives you clear, honest insights into a trader’s past performance — how they’ve handled tough markets, their wins, and even their losses.

Platforms that show real-time trade histories and how traders manage risk can help you understand their mindset. Start small, pay attention to how they adjust to changing conditions, and see if their strategies feel right for you. This will help you learn more while minimizing potential risks.

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Summary

We’ve explored the key factors to evaluate when selecting a social trading platform. The choice of whether to start copying trades is entirely yours. Remember, while social trading is a valuable option within the financial market, it’s not a guaranteed path to endless wealth — it’s a tool, not a treasure trove. Use it wisely.

FAQs

Are social trading platforms free to use?

Many platforms have no upfront costs but may charge spreads, performance fees, or commissions based on the trades executed or profits earned.

Can I lose money copying other traders?

Yes, as all investments carry risks. Higher-risk strategies can result in larger losses but may also offer the potential for higher returns. It’s essential to assess the trader’s risk profile before copying their trades.

How can I improve my chances of earning profits?

Adopt a realistic approach, avoid taking excessive risks, and follow best practices for diversification and risk management. This can increase the likelihood of consistent gains while minimizing losses.

What are the key features to look for in a social trading platform?

Look for a user-friendly interface, robust copy trading tools, performance transparency of traders, social features (like forums or chats), and integration with trusted brokers.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.