The AI Boom. How Artificial Intelligence Is Reshaping Tech and Investments

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The AI boom is fueled by rapid advancements in machine learning, deep learning, and computing power. Major companies like Nvidia, Microsoft, and Google are leading AI innovation, driving stock market growth. Investors are closely watching AI-driven stocks, but market volatility, regulatory challenges, and rapid technological shifts pose risks.

The AI boom is reshaping entire industries, but not every tech stock will come out on top. The best investments won’t necessarily be in companies making the most noise about AI, but in those with the resources and strategy to turn AI into real profits. Businesses that control the computing power, cloud storage, and enterprise AI tools are the ones quietly shaping this shift. Investors who focus only on flashy AI startups could overlook the companies actually driving this transformation behind the scenes. Knowing which stocks have real staying power versus which are riding short-term AI hype will make all the difference in the years ahead.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding the AI boom

Artificial intelligence (AI) is transforming industries, reshaping economies, and influencing daily life like never before. The rapid advancements in AI technology, combined with increased computing power and data availability, have led to an unprecedented boom. Understanding how AI has evolved, its key milestones, and current trends can help investors, businesses, and individuals navigate this transformative era.

Definition and evolution of artificial intelligence

Artificial intelligence (AI) refers to computer systems that can learn, recognize patterns, and make decisions — tasks that typically require human intelligence. AI is used in everything from voice assistants like Siri and Alexa to self-driving cars and fraud detection software.

There are different levels of AI:

Narrow AI. AI designed for specific tasks, such as speech recognition or online recommendations.

General AI. A still-theoretical form of AI that could think and reason like a human across all topics.

Super AI. The idea of AI surpassing human intelligence, which remains a concept rather than a reality.

How AI has changed over time

AI development has progressed in cycles, with periods of excitement and slowdowns.

1950s-1970s. Early AI relied on basic logic and rule-based systems, with limited success.

1980s-1990s. AI improved with machine learning, allowing computers to analyze data and make predictions.

2000s-present. Advances in deep learning and neural networks have led to AI systems that can process images, recognize speech, and even write human-like text.

Key milestones in AI development

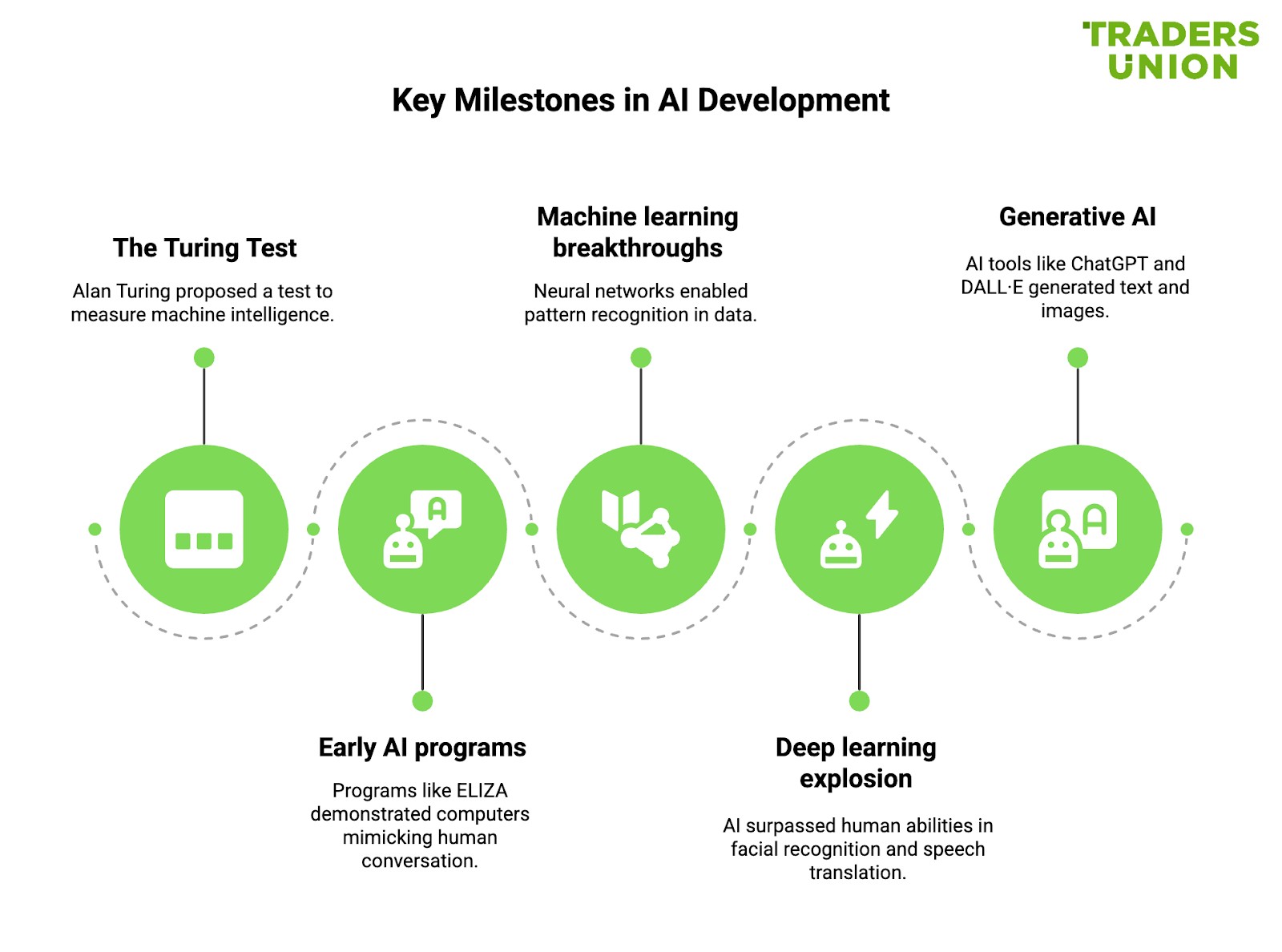

AI has progressed through major breakthroughs, each expanding what computers can do. Here are some of the most important moments in AI history.

1. The Turing Test (1950)

Alan Turing suggested a test to measure whether a machine could "think" like a human. His ideas laid the foundation for modern AI research.

2. Early AI programs (1950s-1960s)

Programs like ELIZA, which simulated human conversation, showed that computers could mimic human-like reasoning and responses.

3. Machine learning breakthroughs (1990s-2000s)

New ways of training AI, like neural networks, allowed computers to recognize patterns in data, making AI useful for real-world tasks.

4. Deep learning explosion (2010s)

With more computing power and access to big data, AI surpassed human abilities in areas like facial recognition and speech translation.

5. Generative AI (2020s)

Tools like ChatGPT, Deepseek, and DALL·E showed that AI could generate text, images, and even code, making AI more accessible and useful in everyday life.

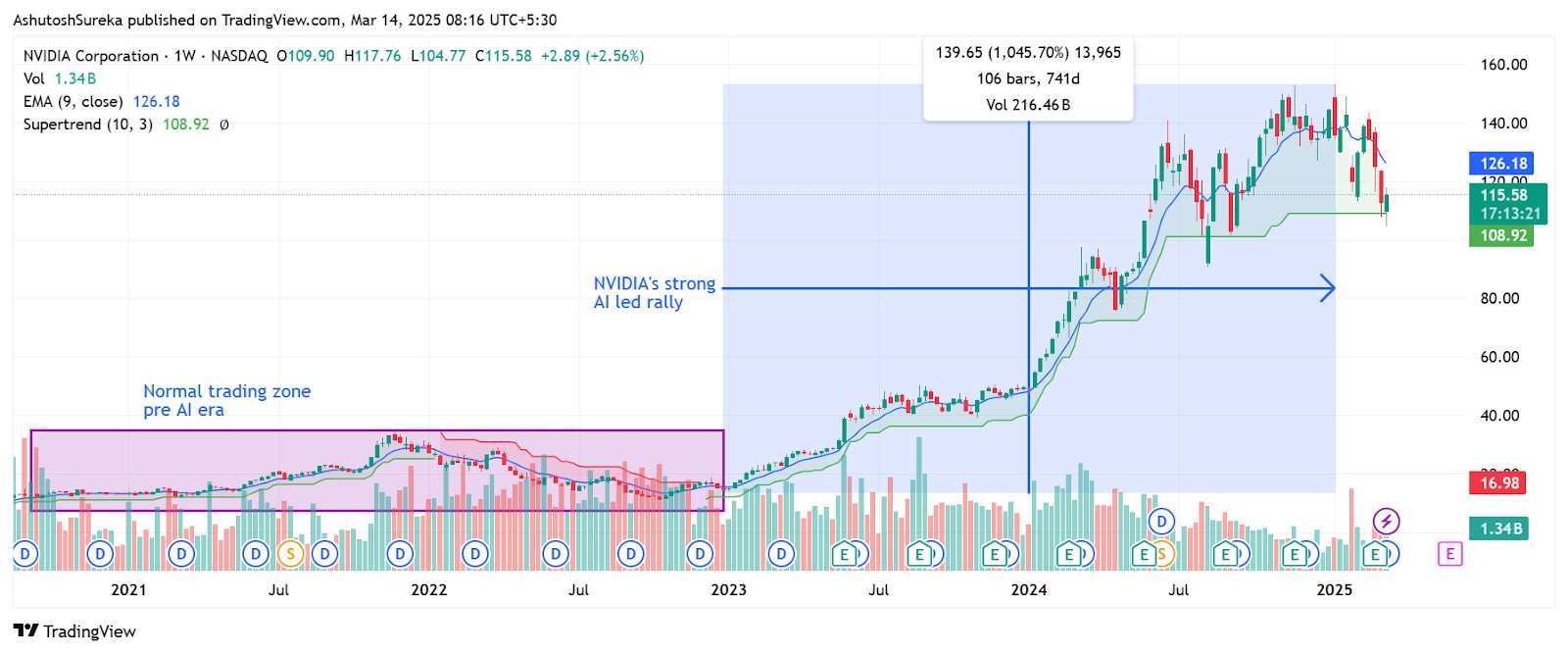

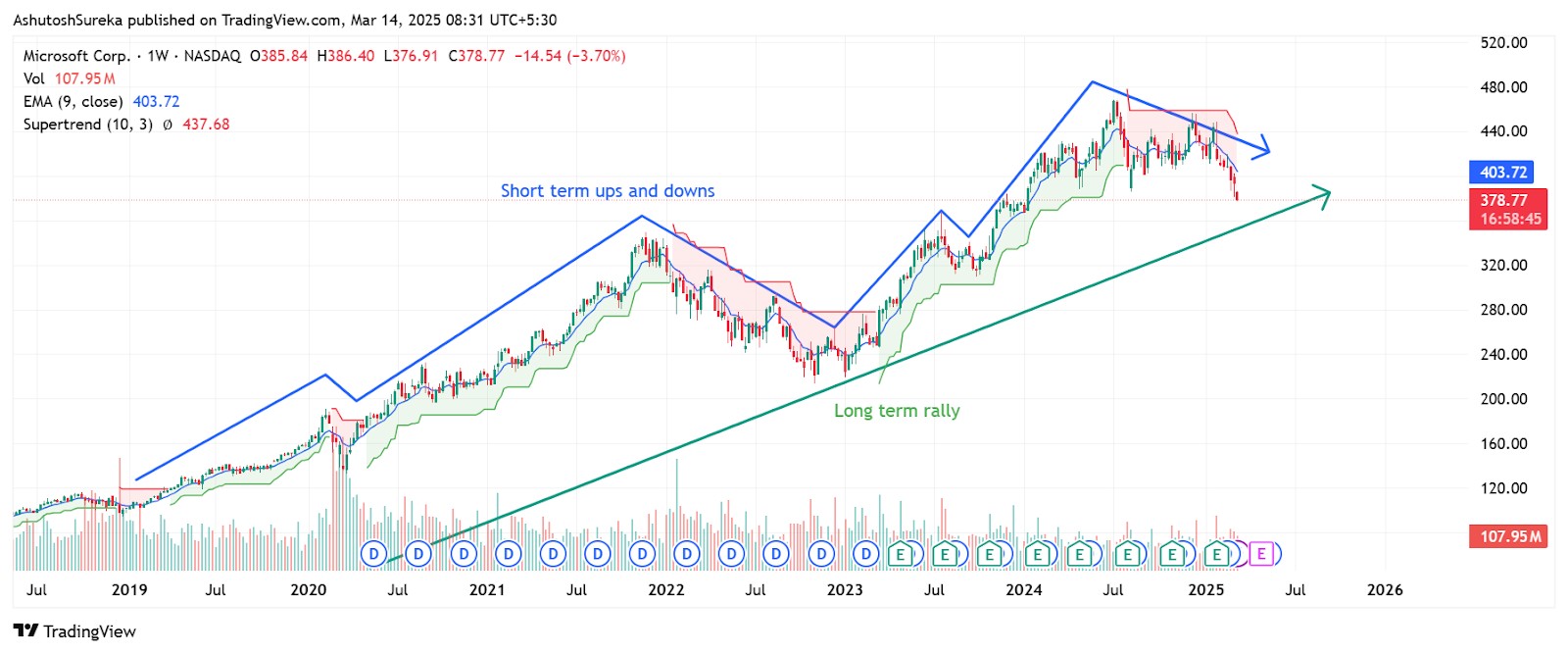

Performance of tech stocks amid the AI boom

The surge in artificial intelligence (AI) has significantly impacted the stock market, with major tech companies leading the charge. Companies investing heavily in AI are experiencing record growth, while traditional tech firms must adapt to remain competitive. Understanding which companies are benefiting, how the market is reacting, and how AI-driven companies compare to traditional tech firms can provide valuable insights for investors.

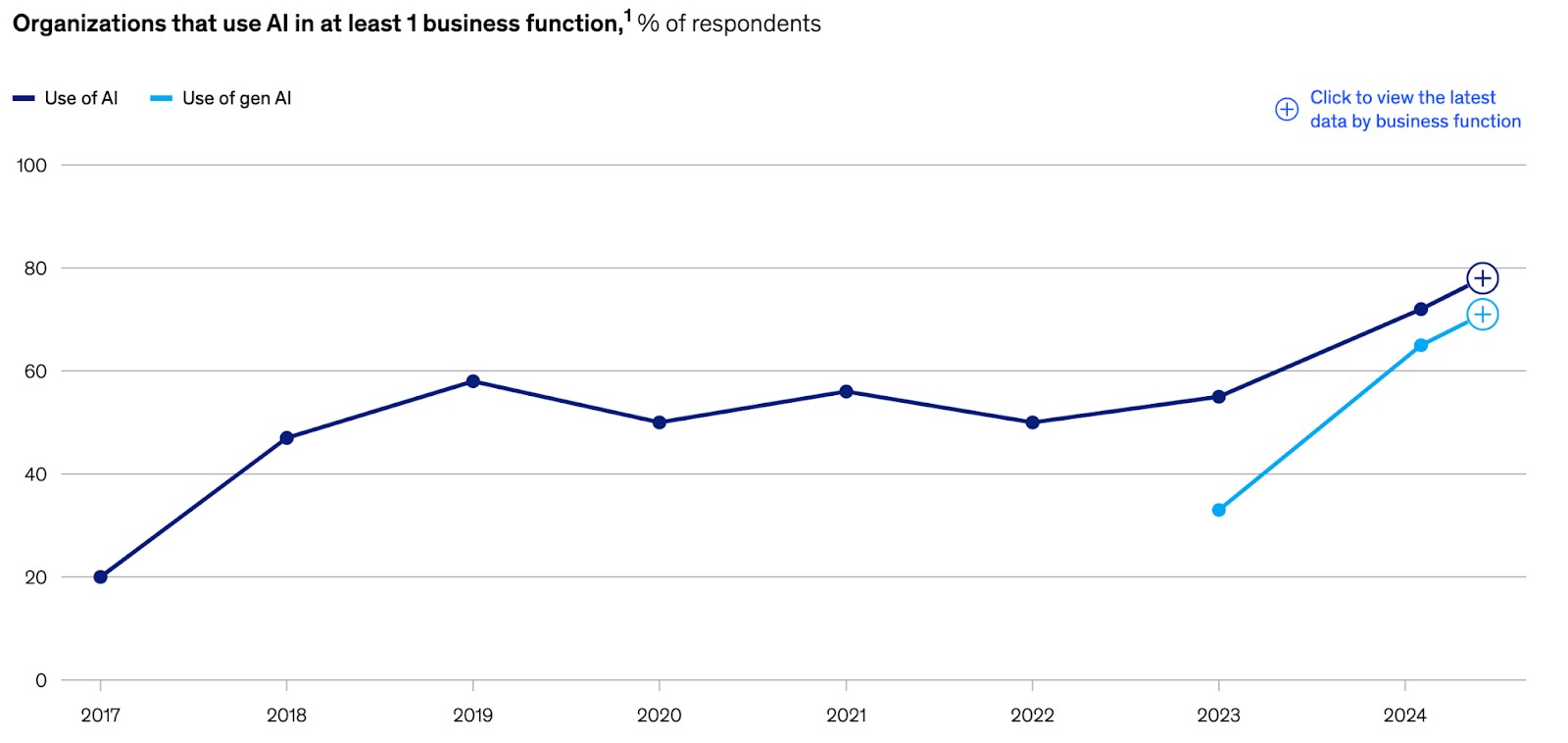

Stock market reactions to AI developments

AI breakthroughs have significantly influenced the stock market, with investor sentiment shifting toward companies that embrace AI.

1. AI-driven stocks outperform the market

Companies at the forefront of AI, such as Nvidia, Microsoft, and Alphabet, have seen massive stock price gains.

Investors are willing to pay premium valuations for AI-driven growth opportunities.

AI-related ETFs and tech funds have surged as more investors bet on the sector.

2. Market volatility and AI hype

AI stocks have seen sharp price swings, with excitement often leading to temporary overvaluation.

Some companies have used AI buzzwords in earnings calls to attract investor interest, even if they lack real AI revenue streams.

The challenge for investors is distinguishing between companies genuinely benefiting from AI and those riding the hype cycle.

3. Traditional tech stocks face pressure

Companies that have not integrated AI into their business models, such as legacy software firms, have seen slower stock growth.

Investors are rotating away from traditional tech and toward AI-driven stocks, leading to underperformance in some older tech names.

Comparison of AI-focused companies vs. traditional tech firms

1. AI-driven companies. Faster growth and higher valuations

AI leaders like Nvidia and Microsoft are seeing explosive growth due to AI demand.

These companies trade at higher price-to-earnings (P/E) ratios as investors expect strong future profits.

AI innovation is driving new revenue streams, such as AI-powered cloud computing and generative AI services.

2. Traditional tech firms. Slower adoption, lower investor interest

Older tech companies that have not embraced AI as aggressively are seeing slower stock price growth.

Many legacy software companies face pressure to incorporate AI into their products or risk losing market share.

Some hardware firms that do not specialize in AI chips have lagged behind Nvidia and other AI-driven players.

3. Hybrid companies. Adapting to the AI trend

Companies like Apple and Amazon are integrating AI into their ecosystems but have not fully transitioned into AI-first businesses.

These firms still see steady growth, but they have not experienced the stock surge that AI leaders have.

Investment strategies in the AI-driven market

As artificial intelligence reshapes industries, investors are looking for the best ways to capitalize on this technological revolution. Investing in AI stocks requires an understanding of how to identify high-potential companies, manage risk through diversification, and decide between long-term and short-term strategies.

Identifying promising AI tech stocks

AI is driving stock market growth, but not all AI-related companies will be long-term winners. Investors need to identify companies with strong AI development, competitive advantages, and financial stability.

How to pick strong AI stocks

Companies building AI technology

Businesses creating AI chips, cloud infrastructure, and machine learning models are leading the market. Examples - Nvidia (AI hardware), Microsoft (AI cloud services), Google (AI-powered search and data processing).

Businesses using AI to improve products

Companies applying AI to areas like self-driving cars, digital advertising, and automation can gain a strong edge. Examples - Tesla (AI-powered driving systems), Meta (AI-driven ad targeting), Adobe (AI-enhanced design tools).

High-growth AI startups

Smaller companies specializing in enterprise AI, data analytics, and automation may offer big returns. Examples - C3.ai (AI for businesses), Palantir (AI-driven big data solutions).

AI adoption and financial health

A good AI investment should have growing revenue, strong AI adoption, and a clear competitive advantage.

Long-term vs. short-term investment approaches

AI stocks can be held for long-term growth or traded for short-term gains. Each approach has pros and cons.

Short-term investing. Taking advantage of price swings

AI stocks move fast, especially after big announcements or earnings reports.

Traders buy AI stocks when excitement builds and sell when prices peak.

Nonetheless, AI stocks can drop suddenly if expectations aren’t met.

Long-term investing. Betting on AI’s future

AI is still evolving, and companies leading today could be the tech giants of the future.

Businesses with steady profits, strong research teams, and AI-driven strategies are likely to grow over time.

AI infrastructure providers like Nvidia, Microsoft, and Google are positioned for long-term success.

Risks and considerations for investors

While AI presents enormous opportunities for investors, it also comes with risks. Understanding them can help investors make informed decisions and build resilient AI-focused portfolios.

1. AI stocks can be volatile

AI-related companies have seen big stock price jumps, but they have also had sharp drops. Some investors buy in too quickly, hoping for fast profits, without realizing that AI is still developing.

Why do AI stocks move so much?

Big expectations drive prices up and down. A single AI breakthrough can send stocks soaring, but if expectations aren’t met, prices can fall just as fast.

High valuations make stocks vulnerable. Many AI companies are expensive compared to their actual earnings, which can lead to sharp corrections.

Speculation creates short-term swings. Some investors jump into AI stocks based on hype rather than long-term potential.

How to manage this risk?

Don’t chase stocks just because they are trending. Instead, look for companies with real revenue and long-term potential.

Use dollar-cost averaging, which means buying in small amounts over time instead of all at once.

Keep a balanced portfolio so you’re not overly dependent on AI stocks.

2. AI regulation and ethical concerns

Governments around the world are starting to regulate AI because of issues like data privacy, misinformation, and automation replacing jobs.

Potential risks from AI regulations

Privacy laws could limit AI companies. AI needs data to improve, but new laws could restrict how much data companies can collect.

Ethical concerns could slow AI adoption. If AI systems show bias or cause unintended harm, companies may face lawsuits or stricter regulations.

Government policies on automation. Some industries may face restrictions if AI is seen as threatening too many jobs.

How to manage this risk?

Invest in companies that focus on ethical AI development and data security.

Stay updated on AI regulations that could affect businesses.

Consider investing in industries that are less impacted by AI restrictions.

3. Fast-moving technology can change market leaders

AI is advancing rapidly, and today’s top companies might not stay on top forever. A new startup could introduce a breakthrough that disrupts existing AI businesses.

Why does this matter for investors?

New AI companies could take the lead. Smaller, more innovative firms may develop better technology than current industry giants.

Big tech companies are in a constant battle. Microsoft, Google, and Meta are investing heavily in AI, and competition could shift market leadership.

AI hardware and software evolve quickly. Businesses that can’t keep up with the latest AI trends may lose their edge.

How to manage this risk?

Invest in both established AI leaders and promising startups.

Watch AI trends closely to see where the industry is heading.

Look for companies with strong business models beyond just AI, such as cloud computing or diverse revenue streams.

4. Some AI stocks may be overhyped

Some AI stocks have surged in price, but not all of them have strong business fundamentals. If expectations outpace real growth, stock prices could drop.

How to spot an AI bubble

Companies with sky-high stock prices but little profit growth.

Overpromising on AI breakthroughs without real-world applications.

Too many investors are buying AI stocks just because they’re trending.

How to avoid overpaying for AI stocks

Look for companies with consistent revenue growth, not just AI buzzwords.

Be cautious about stocks that have jumped too quickly without strong financial backing.

Consider AI ETFs or funds to reduce risk instead of betting on just one company.

5. AI security risks

AI is powerful, but it also introduces new security threats. Companies developing AI need strong protections against cyberattacks, data breaches, and AI-generated fraud.

AI-related security concerns

Hackers could use AI to launch cyberattacks on businesses and governments.

AI models can be stolen or misused, reducing a company’s competitive advantage.

Fake AI-generated content could lead to stricter regulations, affecting AI business models.

How to manage this risk?

Invest in AI companies with strong cybersecurity practices.

Consider cybersecurity stocks that help protect AI-driven industries.

Stay informed on new AI security challenges that could impact the market.

Future outlook of AI in the tech industry

AI is growing at a rapid pace, and it will continue to change the tech industry in big ways. As AI becomes more advanced, it will create new business opportunities, shake up the stock market, and impact the global economy. Investors who understand these shifts can make better decisions for the future.

Predicted advancements in AI technology

AI is expected to improve in many areas over the next decade, making it faster, smarter, and more useful in everyday life.

What’s next for AI?

Smarter AI models that understand human language and emotions better.

More automation in healthcare, finance, and creative industries.

Better AI chips that run faster while using less energy.

The potential rise of AGI, though it’s still in the early research stage.

How to invest in AI’s future

Follow companies leading AI innovation, like Nvidia, Microsoft, and Google.

Invest in AI-driven industries such as automation, cloud computing, and software development.

Potential shifts in the tech stock market

As AI grows, some companies will benefit more than others.

AI-powered companies will lead, while tech firms that fail to innovate may lose value.

AI chipmakers like Nvidia and AMD will stay in demand.

AI automation could make some industries more efficient, while others struggle to adapt.

Cloud computing companies will expand as businesses rely more on AI.

How to invest wisely

Keep an eye on tech companies adapting to AI trends.

Diversify investments in AI hardware, software, and automation.

AI’s impact on the global economy

AI will boost productivity and help businesses save money.

Some jobs will disappear, but new ones will be created in AI development.

Countries leading in AI research will have a competitive advantage.

If you’re optimistic about the future of AI tech stocks and want to invest in them, you will need an account with a broker that supports stock trading. We have researched the market and prepared a list of the top stock brokers in your region. You can compare them below and choose the best one as per your requirements:

| Stocks | Foundation year | Account min. | Demo | Research and data | Basic stock/ETF fee | Deposit Fee | Withdrawal fee | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2007 | No | Yes | Yes | $3 per trade | No | $25 for wire transfers out | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| Yes | 2014 | No | No | Yes | Zero Fees | No | No charge | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | 2015 | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | No | No charge up to a limit | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | 1978 | No | Yes | Yes | 0-0,0035% | No | No | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

|

| Yes | 2011 | No | No | Yes | Zero Fees | No | $25 for wire transfers out | FINRA, SIPC, FinCEN | 7.33 | Study review |

Chasing hype vs spotting real winners

Many new investors assume the best way to profit from AI is by buying into every company claiming to be an AI leader. But the real money often lies with the companies enabling AI’s growth. Semiconductor giants, cloud service providers, and companies that supply the computing power behind AI are in a stronger position than many startups still figuring out their business models. Instead of jumping on every AI stock that gets media attention, take a step back and look at the companies providing the tools AI needs to function.

Another angle that investors often miss is how AI is quietly transforming traditional industries. Car manufacturers are using AI to automate production, logistics companies are improving efficiency with AI-driven supply chains, and healthcare firms are leveraging AI for faster drug development. Some of the most promising AI investment opportunities aren’t in the companies building AI from scratch, but in those integrating it into their operations to gain a competitive edge. Spotting these trends early can lead to strong long-term investments before the market catches on.

Conclusion

AI is reshaping technology and investing, but not every AI stock is a winner. The best investors aren’t the ones rushing into the latest AI trend — they’re the ones thinking about who actually profits from AI in the long run. Companies that build the computing power, supply the chips, or apply AI in ways that improve efficiency are the ones with staying power. Instead of jumping on hype-driven stocks, investors who carefully analyze how AI fits into a company’s business model will have a much better shot at long-term success.

FAQs

Which is the best AI stock to buy?

The best AI stock depends on factors like growth potential, financial health, and market trends. Companies like NVIDIA, Microsoft, and Alphabet are strong contenders in the AI space.

Which AI stocks will boom in 2025?

AI stocks with strong innovation and market adoption, such as NVIDIA, AMD, and Tesla, have growth potential. Startups and cloud-based AI firms could also see significant expansion.

Which tech company is leading AI?

Companies like NVIDIA, Google (Alphabet), Microsoft, and OpenAI are at the forefront of AI development. Their leadership comes from advancements in AI chips, software, and machine learning models.

What are the best 5 AI stocks to buy in India?

In India, top AI-related stocks include Tata Elxsi, Infosys, Wipro, L&T Technology Services, and HCL Technologies. These firms are investing in AI-driven solutions across various industries.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.