Best TikTok Traders To Follow

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best TikTok traders:

Taylor Price (@pricelesstay). Makes Forex simple for Gen-Z traders.

Robert Ross (@tik.stocks). Explains market trends in everyday language.

Sara Finance (@sarafinance). Shares trade ideas and lessons from her own investments.

Nick Meyer (@nicktalksmoney). Covers smart ways to grow your money.

I'm Kamal (@tradewithkamal). Breaks down Forex moves with easy-to-follow advice.

Brian Richards (@theshareman). Teaches Forex trading through personal experience.

Tori Dunlap (@herfirst100k). Helps women take charge of their finances.

Mike Joyce (@flextrading). Shares quick, no-nonsense trading insights.

Conner (@optionstradingdaily). Makes options trading feel less complicated.

Stockmarket (@stocks_investc). Covers different ways to approach the markets.

TikTok isn’t just for viral dances anymore — it’s now a go-to place for real trading advice. More traders are using the platform to break down Forex strategies in quick, easy-to-follow videos.

This article highlights some of the best TikTok traders sharing real-world insights and practical tips. By following them, you’ll pick up smarter trading moves and stay on top of market trends without the confusing jargon.

Top TikTok traders to follow

TikTok traders post short, easy-to-follow videos about trading, covering Forex, stocks, and crypto. They share practical tips, market updates, and strategies to help beginners get started. Instead of using complicated jargon, they break things down in a way that makes sense, often using real-world examples.

Following TikTok traders is a great way to stay on top of market trends, pick up new strategies, and get quick updates on financial news — all in a few minutes.

Here are some of the top TikTok traders providing valuable Forex insights:

1. Taylor Price (@pricelesstay)

Taylor Price, known as @pricelesstay on TikTok, has built a following of over 1.1 million. At just 22, she calls herself a Gen-Z finance advocate, helping young people get smarter about money. She talks about real-life investing challenges, from handling market drops without panic to saving on taxes the right way.

2. Robert Ross (@tik.stocks)

Robert Ross, known as @tik.stocks on TikTok, has around 381,000 followers. He simplifies stock market trends, helping traders spot buying opportunities and understand fundamental analysis in a clear, practical way.

3. Sara Finance (@sarafinance)

With around 733,000 followers, Sara Finance talks about stock trading and market trends. She breaks down her favorite stock picks, gives honest updates on her portfolio, and explains how she spreads out investments.

4. Nick Meyer (@nicktalksmoney)

Nick Meyer, known as @nicktalksmoney, talks about managing money and smart investing. He breaks down finance in a way that makes sense, helping people make smarter money choices.

5. I'm Kamal (@tradewithkamal)

I'm Kamal, known as @tradewithkamal shares real-time market insights and practical trading tips, making it easier for traders to spot good opportunities and avoid mistakes.

6. Brian Richards (@theshareman)

Brian Richards, known as @theshareman, breaks down stock trading in a simple way and shares practical investing tips to help viewers spot better trade opportunities.

7. Tori Dunlap (@herfirst100k)

Tori Dunlap, known as @herfirst100k on TikTok, shares straightforward advice on saving, investing, and financial independence. She focuses on helping women take control of their money with practical, easy-to-follow tips.

8. Mike Joyce (@flextrading)

Mike Joyce, known as @flextrading, shares content on trading strategies and market insights, helping viewers understand various aspects of trading and investment.

9. Conner (@optionstradingdaily)

Conner, known as @optionstradingdaily, shares easy-to-follow tips and strategies on options trading, helping traders make smarter moves in the market.

10. Stockmarket (@stocks_investc)

@stocks_investc shares all kinds of stock market content, from investing strategies to market trends. Whether you're just getting started or already trading, you'll find useful tips to help you make smarter moves.Discover the best TikTok stock influencers, featuring top traders and finance creators sharing real-time tips, market insights, and smart investing strategies.

Following these TikTok traders can provide valuable insights and strategies to enhance your trading knowledge and skills.

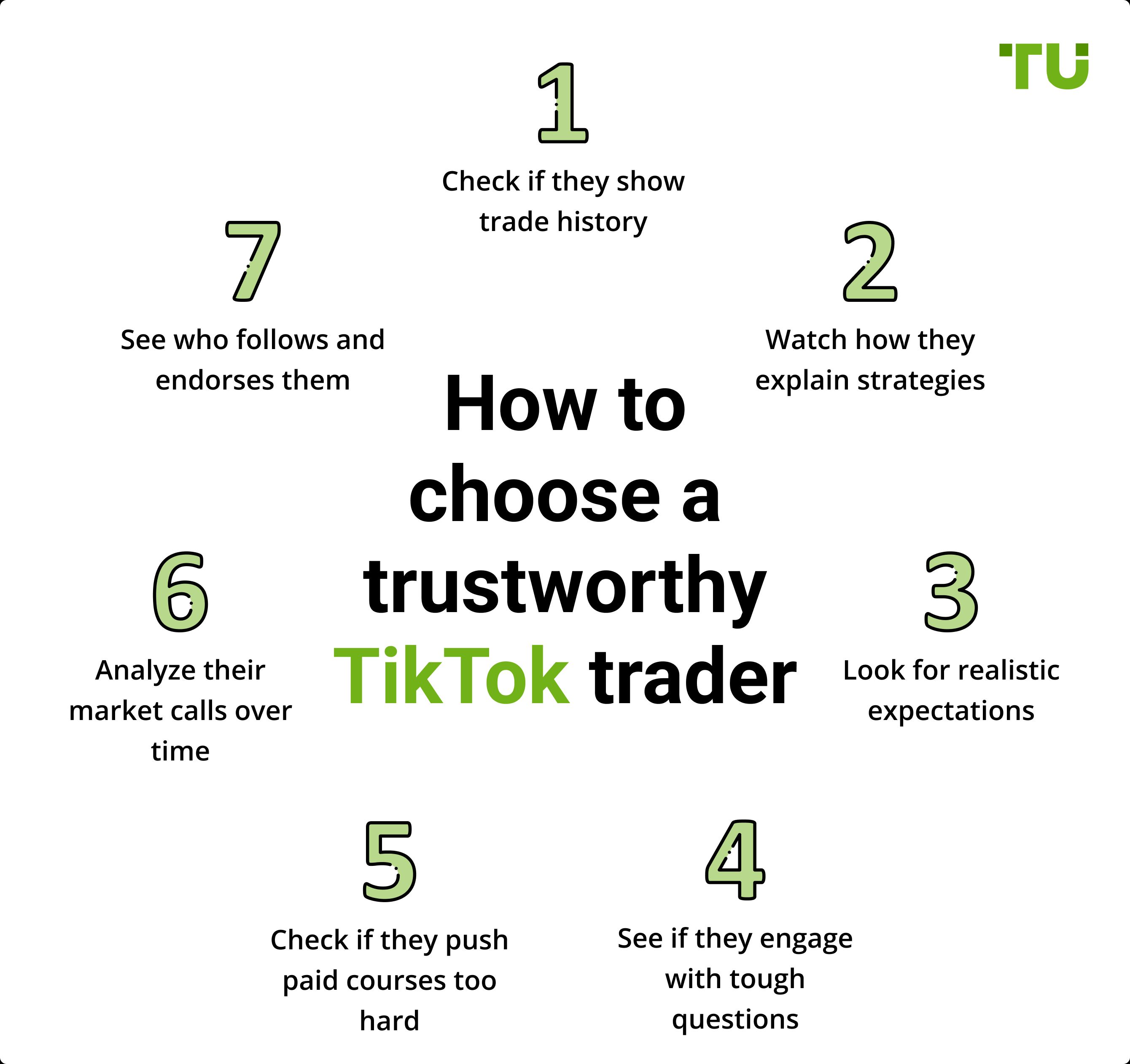

How to identify a reliable TikTok trader

TikTok is packed with trading advice, but not all of it is trustworthy. Here’s how to spot real traders who actually know their stuff.

Check if they show trade history. Anyone can talk big, but do they back it up? A reliable trader will share actual trading history — wins and losses included — through verified screenshots or brokerage statements. If they never show proof, be cautious.

Watch how they explain strategies. Good traders don’t just flash profits; they break down how they make trades. If someone is only hyping gains without explaining their process, they’re probably just after views, not helping real traders.

Look for realistic expectations. If they promise quick riches or say their strategy has “no risk,” run. Reliable traders talk about risks, losing streaks, and the discipline needed to succeed — not just easy money.

See if they engage with tough questions. Fake gurus avoid detailed questions, while real traders welcome challenges and explain their reasoning. If they delete comments asking for proof or avoid discussing losing trades, that’s a red flag.

Check if they push paid courses too hard. Education is great, but if someone constantly pushes expensive courses instead of sharing free, valuable insights, they may be more of a marketer than a trader. A legit trader teaches first and sells later.

Analyze their market calls over time. Don’t just judge by one or two viral videos. Follow their content for weeks or months — do their predictions hold up? Real traders are consistent, while scammers disappear after a few bad calls.

See who follows and endorses them. Trustworthy traders usually have respect from others in the finance space. If experienced traders interact with them, it’s a good sign. If only random followers hype them up, be skeptical.

Pros & cons of learning trading on TikTok

Here are some pros and cons of learning trading on Tiktok:

- Pros

- Cons

Bite-sized insights keep you engaged. TikTok’s short-form videos force creators to get straight to the point, making it easy to absorb trading concepts quickly without sitting through long lectures.

You get exposure to diverse strategies. Unlike traditional courses that often push one approach, TikTok introduces you to multiple trading styles, from technical analysis to algorithmic trading, all in a matter of minutes.

Real traders share real experiences. Many TikTok creators show live trades, profits, and mistakes, offering a raw, unfiltered look at what actually happens in the market — something textbooks don’t always cover.

Fast updates on trends and news. The platform’s real-time nature means traders share insights on market-moving events quickly, helping you stay ahead of the curve before the mainstream media catches up.

Oversimplified advice can be risky. Many TikTok videos leave out critical details, making strategies seem easier than they really are, which can lead to costly mistakes when applied in real markets.

Scammy "gurus" flood the platform. Some influencers fake profits or push expensive courses, preying on beginners who don’t yet know how to spot misleading claims.

No structured learning path. Unlike formal education, TikTok’s random content delivery makes it hard to build a step-by-step understanding, leaving gaps in your knowledge that can hurt your trading decisions.

Emotional hype can lead to FOMO trades. The fast-paced nature of TikTok often fuels impulsive decision-making, especially when viral videos hype up certain stocks or crypto coins without proper analysis.

Should you follow TikTok traders?

TikTok is full of traders sharing advice, but not all of it is reliable. Here’s what you should know before following financial advice from the platform.

Check if they show real trades. Anyone can talk about profits, but are they actually showing entry and exit points with real execution? Look for proof, like broker screenshots or live trades, not just flashy claims.

Watch out for overly simplified strategies. A 60-second video can’t possibly cover the depth of market analysis needed to trade successfully. If someone makes it sound too easy, they’re leaving out critical details that could cost you money.

Be cautious of “get rich quick” claims. If a trader is promising massive returns in a short time, they’re either misleading you or taking extreme risks. Real trading is about consistency, not overnight success.

Verify if they profit from trading or teaching. Many TikTok traders make more money selling courses than actually trading. Check if they show consistent profits from trading itself, not just from their followers.

See if they acknowledge risk. Good traders talk about losing trades, market uncertainty, and proper risk management. If all you see is "guaranteed" wins, they’re hiding the full picture.

Cross-check their strategies with real data. Before using any method from TikTok, test it on historical charts or in a demo account. Just because it worked in one clip doesn’t mean it works consistently.

Tips for investing in Forex

Forex trading isn't just about watching charts — it requires a deep understanding of market behavior, psychology, and risk management. Here are some lesser-known but powerful tips to improve your trading game.

Master one currency pair first. Instead of diving into multiple pairs, focus on just one, like EUR/USD. Learn its patterns, news influences, and liquidity behavior to gain an edge before expanding to other pairs.

Use economic divergence for smarter trades. Don't just check interest rates — compare the overall economic strength of two currencies. If one country's GDP, inflation, and employment data are thriving while the other struggles, the trend is likely stronger and more predictable.

Watch liquidity shifts at session overlaps. Many traders focus on price action but ignore liquidity. The most volatile and trade-worthy moments happen when two major market sessions overlap, like London-New York. Spotting these liquidity bursts can give you cleaner entries.

Use sentiment analysis beyond the charts. Forex isn’t just technical — traders react emotionally to news, fear, and hype. Track real-time sentiment indicators, such as COT reports and retail positioning data, to avoid being on the wrong side of the crowd.

Know how your broker makes money. If your broker profits from your losses (market maker model), they may manipulate spreads or execute stop-hunting strategies. Choose an ECN broker with transparent pricing to avoid unnecessary slippage and hidden fees.

Factor in central bank expectations. It’s not just about rate changes — Forex moves based on what traders expect central banks will do next. Follow central bank speeches, meeting minutes, and policy hints to anticipate shifts before they happen.

Here are some of the best Forex brokers to start investing and trading:

| Demo | Min. deposit, $ | Copy trading | Standard EUR/USD spread, avg pips | Deposit fee, % | Withdrawal fee, % | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 100 | No | 0,7 | No | No | Yes | 6.83 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 0,6 | No | No | Yes | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | No | Yes | 0,3 | No | No | Yes | 6.8 | Open an account Your capital is at risk. |

|

| Yes | 100 | Yes | 1,0 | No | No | Yes | 6.95 | Study review | |

| Yes | No | No | 0,5 | No | Yes | Yes | 6.9 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Top Forex traders exploit liquidity zones and market sentiment shifts

The real trick to trading Forex like a pro isn’t about memorizing charts — it’s about knowing where the big players are hiding their orders. Instead of just drawing lines for support and resistance, pay attention to where most traders are likely placing stop losses. These spots act like magnets for institutional traders, who use them to trigger big moves. If you watch how price reacts around these areas, especially during the busiest trading hours, you can ride the momentum instead of getting caught on the wrong side of the market.

Most traders only look at price charts, but reading the market is about feeling the shift in crowd behavior. When too many people are betting in one direction, things tend to flip. Instead of chasing trends, check reports like the Commitment of Traders (COT) or options market data to see where the money is really flowing. If everyone’s getting overly confident, it’s often the perfect time to expect a shakeout. Spotting these moments early can help you jump in before the herd catches on.

Conclusion

TikTok has become a valuable source for Forex insights, but not all advice is reliable. While many traders share useful strategies, always verify their credibility and cross-check information with trusted financial sources. Use TikTok as a supplementary learning tool rather than your primary source of trading education. The best approach is to combine insights from experienced traders with thorough research, risk management, and hands-on practice. Stay cautious of unrealistic claims and focus on long-term trading success. By following knowledgeable TikTok traders and applying smart strategies, you can enhance your Forex skills while avoiding common trading pitfalls.

FAQs

Can you trust TikTok traders?

Not all TikTok traders are reliable. Look for verified accounts, assess their background, and cross-check information from multiple sources before making investment decisions.

Is Forex trading on TikTok legit?

Forex trading itself is legitimate, but be cautious of misleading content on TikTok. Always verify trading strategies and consult professional financial sources.

How can beginners learn Forex trading?

Beginners should start with educational resources like books, online courses, and demo trading. TikTok can be a supplementary tool for quick insights.

What are the risks of following TikTok traders?

Risks include misinformation, over-simplification of complex strategies, and exposure to exaggerated success stories. Always conduct independent research and manage risk properly.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.