Best Forex money management Rules and Tactics

The benefit of globalization is numerous and so is the risk. One of such is the window to trade currencies. Every financial decision you take can increase your financial stability or put it in disarray depending on how savvy you are in managing your money. In this article, you will discover intelligent money management techniques used by forex traders in managing the risks, minimizing losses, and maximizing gains.

Do you want to start trading Forex? Open an account on Roboforex!

Best Forex money management Rules and Tactics

Forex money management is the effort, cognitive skills, and trading strategies applied by persons to manage the available finance in their forex trading account simultaneously with the risk involved with the aim of conserving trading capital. Your ability to use information obtained to maneuver/handle the high frequency and risk in the forex market is what makes you a good forex money manager and increases the prospect of a high reward, usually profit/gains.

Is Trading profitable? Learn more information about itForex money management involves the implementation of forex trading rules and using tools such as a trading account. The forex money managers develop and use trading strategies to make gains from the risk of trading currencies. Forex trading strategies are practices used by forex traders to decide the best time to either buy or sell a currency pair. These strategies can be based on technical analysis, mathematical analysis, political economics, news-based events. To actively participate, currency traders follow up trading signals such as infographics, statistical-driven predictions that can sanction buy or sell decisions.

What is technical analysis? Read more about itWhat is money management in Forex?

Money management in forex is simply hot to invest your trading capital into the right positions after evaluating the risk. The right forex money management rules and strategies is used to ensure that each currency pair bought and sold is at a profit. Also, to successfully manage money in forex, use an optimal risk-reward ratio so that you can have a holistic view as to where best the money fits and when is the perfect time to sell out positions.

Best Forex Money Management Rules To Improve Your Trading Skills

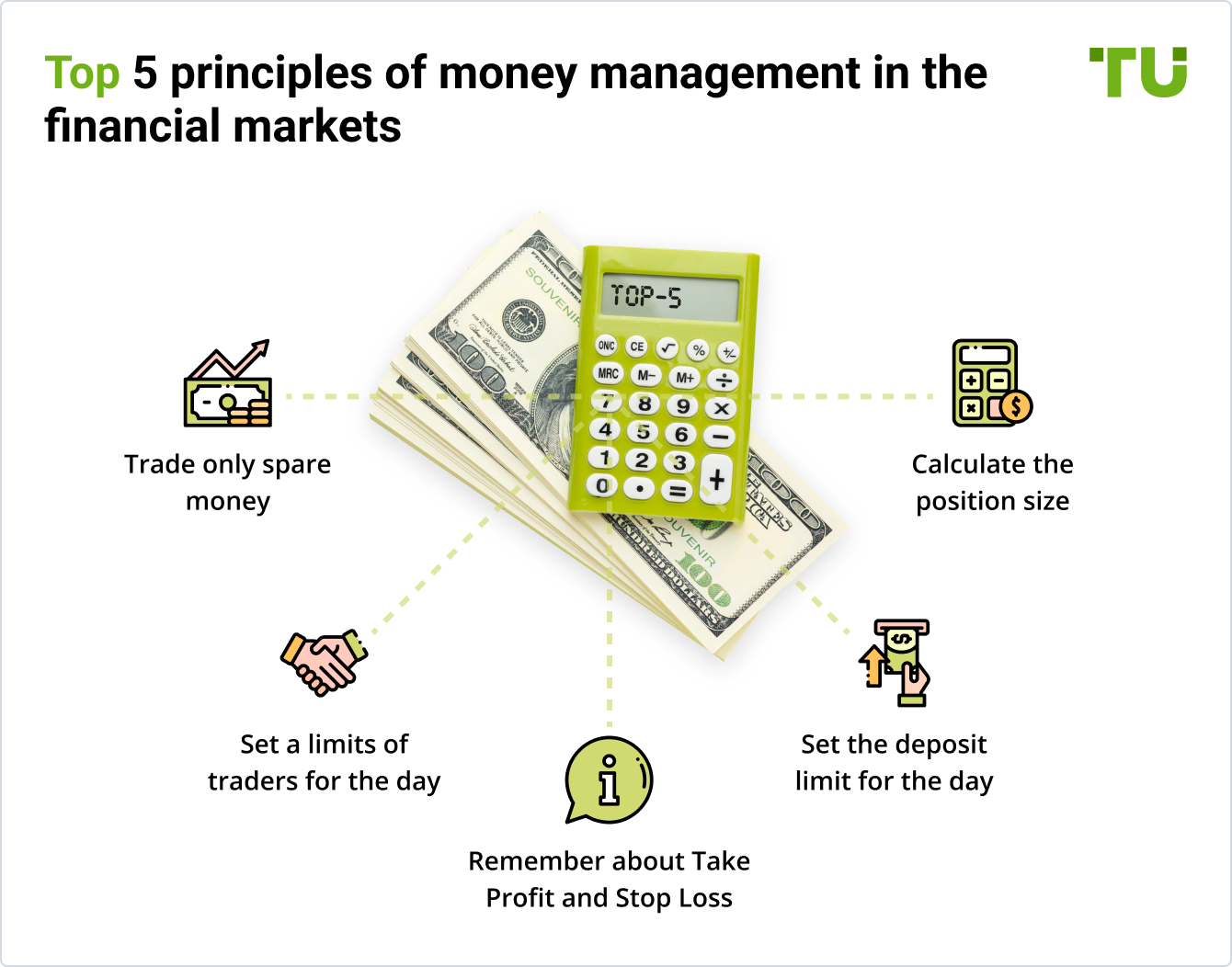

Your ability to implement these six money management rules in forex trading accurately determines the odds of being successful in the activity. These rules should be your template to follow before any trade is placed. They are:

Correct positioning sizing

Trading coaches often preach the 2% principle. It is the act of traders risking only 2%, a small percentage of their trading account on every trade. Experts suggest this to be a sound trading strategy and risk management plan. Considering how volatile the market is and openness to market shocks, traders should at all times keep the trade scope fairly small compared to the trading account size. This will ensure that they are protected from the impact of several losses and easy to recover from. For example, with a 10,000USD trading account, using this rule, the trader could risk 200USD per trade. However, the recent trading performance could be an incentive for the trader to increase the stake.

Determination of the optimal ratio to risk reward

The risk to reward is the prospective gain an investor can make for every penny they risk on an investment/trading. The ratio is used to determine the expected return for any amount risked. For example, an investment with a risk-reward ratio of 1:5 simply means that an investor faces the prospect of earning $5 for every $1 invested. This ratio is calculated by dividing the amount a trader will lose if the currency pair moves in a direction by the profit the trader is expected to make when the position is closed. The rule of thumb for trading suggest that traders should aim for trades that are on average twice as big as the losing trades. A risk/reward ratio of approximately 1:3 is considered ideal by many Currencies market strategists.

Always Trade with Funds You Can Afford to Lose

The ability of traders to maximize every trading opportunity professionally is key to successful business trading. A trade with so much emotion tends to increase the odds the trader will lose money.

The Practice of Using Stop Loss and Take Profit

Using stop-loss orders currency traders can directly manage the risk and rewards. Its mechanism allows traders to set a loss ceiling per trade whilst using a take-profit order to lock in the maximum amount the trader can gain. There are some demerits however in using these order types. One is seeing the stop-loss triggered only for a trade turnaround to the take-profit level.

Take currency correlation into consideration

Correlation in this instance refers to the relationship one currency has with another. If two currencies are positively related, they will move in the same direction. Thus, as a forex money management rule, avoid opening several positions that cancel each other and be aware of commodity currencies. The latter exposes your position to risk of commodity pricing. The country Nigeria is a large exporter of crude oil. Hence, as the price of the goods rise, the Naira strengthen and vice versa. Thus, to trade the Naira, your analysis must take these factors into consideration.

Keep a consistent risk level

As an amateur forex trader, you face the urge to increase the size of your position when the profit starts coming in. sadly, this is one of the trickiest way your trading account gets wiped out. Learn to keep your risk consistent. One way to do this is setting a 3% daily risk limit to protect the trading account and capital.

Forex Money Management Use Cases.

The six money management rules in forex trading highlighted above are made to help starters in the forex market as well as improve the insight of savvy traders. As a starter with an average trading account balance, always keep a consistent risk level. This can give you the room to harvest little profit from each position. However, this shortsighted approach to forex trade in not encouraged for the mid-term and long-term. Expert in forex trading concur with the daily 2% risk size of the trading account and that the risk-reward ratio should be 1:3. This is to minimize the shock from a loss on your trading account. Lastly, the stop-loss and take-profit option is available to low-risk appetite traders which give the computer command to carry out these functions automatically for them.

Learn more information about best Forex trading platform for beginnersHow does Money Management Can Help Me?

The benefits of money management are numerous. Beyond guaranteeing your financial stability, it does the following:

Financial security

Good money management implementation in forex trading always ensures that the actions you take are consistent with the forex money management principle- always preserving the capital. This keeps your liquid for the current and future time to take positions on prospective profitable sales.

Big financial losses prevention

The right attitude to money management entails actions that are professional, free of emotion and sentiments. Having this attitude will help to know the best time to stop loss, sell out a position and take profit. Money management matches your risk appetite to the best possible reward at a particular time.

Reduced mental stress

With an apt money management strategy, you have automatically reduced your stress level. Big losses cause mental stress to forex traders, increase pressure on them to look out for new trades. However, this pressure not managed well lead to a non-professional financial decision that is detrimental and so, their ability to conduct proper analysis and take meaningful financial decisions is relevant to how healthy they can be.

Learn more about what is Fundamental analysis and how it can help youEarn more money

Risk rewards are gains from managing your money and managing the risk when invested in the forex market. With good money management techniques, be sure to see more money to re-invest in new prospective positions.

Are Forex Money Management Different from Other Markets?

The rules applied in forex money management and other markets are the same to some degree. However, some differences still exist. They are:

Liquidity

Forex is the largest financial market in the globe. Considering the population of active players in the market, it’s easy to conclude that the forex market is very liquid. Other markets see fewer trades and hence they are less liquid. The larger the market size, the more exposed they are to economic shocks and so need apt money management skills to stay profitable.

Volatility

Price volatility in the forex market is very high and so traders take risks matched with the available facts at that time. However, they remain exposed due to domestic/international economic and social uncertainties that can impact positively or negatively your positions. The stock market they are more responsive to domestic issues only and so the risk is easier to manage.

Leverage

Leverage is helpful to control risk exposure. Products such as the contract for difference (CFDs) can be used to trade on margin across many markets. This is a feature of currency trading that allows you to magnify returns if you manage money in your trading account properly.

Best Forex Brokers to Consider

Read more about best Forex brokers in 2024To execute currency trading activities legally, professionally, and seamlessly, forex brokers have introduced useful financial technological services that goes beyond providing just a platform, but it provides information that help clients make a data-driven decision. Below are brokers whose services stand out and you can consider.

RoboForex

In 2009, RoboForex started operation. It set out to provide the best trading conditions by deploying advanced technologies. They are an international broker offering more than 12,000 instruments for trading and 8 categories of assets. Since the operation, it has gone to:

Introduce trading accounts in Gold, Chinese Yuan.

It Provides a web trader and mobile trader platform to trade oil, metal, and contract for difference (CFDs) instruments seamlessly.

Providing a web trader and mobile trader platform to trade real stocks of the largest American firms.

An Increase of the maximum leverage value allowed up to 1:1000.

An increase to 12,000 trading instruments on its platform.

The introduction of RoboForex wallet, a multi-currency payment service.

Admiral Markets

Founded in 2001, it’s a leading online trading service provider that provides investment services to trade with foreign exchange on agriculture, stocks, and bonds markets. It is a global firm with presence in top financial market destinations. Admiral markets give traders access to many trading accounts in dissimilar currencies at the same time. This allows for seamless internal transfer from the trader room- easy transfer and conversion of currencies from one trading account to another. Other benefits of using the admiral market include:

It has well-functional software that guarantees an excellent and transparent trading experience.

Admirals’ market has external auditors whose services are used to enhance its internal procedure and ensure regulatory compliance.

Their global reach extends to major financial hubs including the United Kingdom and Australia.

They also provide clients with the financial information needed to take a decision from an enlightened position and information about profitable financial opportunities available.

Summary

In this article, we have learned what money management is and its usefulness to forex trading. The article also highlights risk management, forex trading strategies, and how to maximize the reward from risk using the risk-reward ratio and other expert sanctioned metrics. There are too many forex brokers today. However, the excellence of a few that stand out such as RoboForex and Admiral markets give them a competitive edge. The services and market-reach benefits they offer clients through their web and mobile trader platform have made trading and money management easier simply because of the apt algorithm in place. In conclusion, the best forex traders are those who apply the forex money management rules mentioned in this article.

FAQs

What is forex money management?

Forex money management is a chain of processes forex traders use to reduce losses and increase profit potential on every currency pair trade.

What is a forex trading strategy?

A forex trading strategy is a practice used by forex traders to decide the best time to buy and sell a currency pair.

Where can I trade forex?

Foreign exchange can be traded over the counter (OTC) or using modern financial technologies that are seamless and user-friendly.

What is the risk/reward ratio?

This is a ratio used to ascertain the prospective profit that can be made from every one dollar invested.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.