How To Buy Solana Meme Coins: A Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

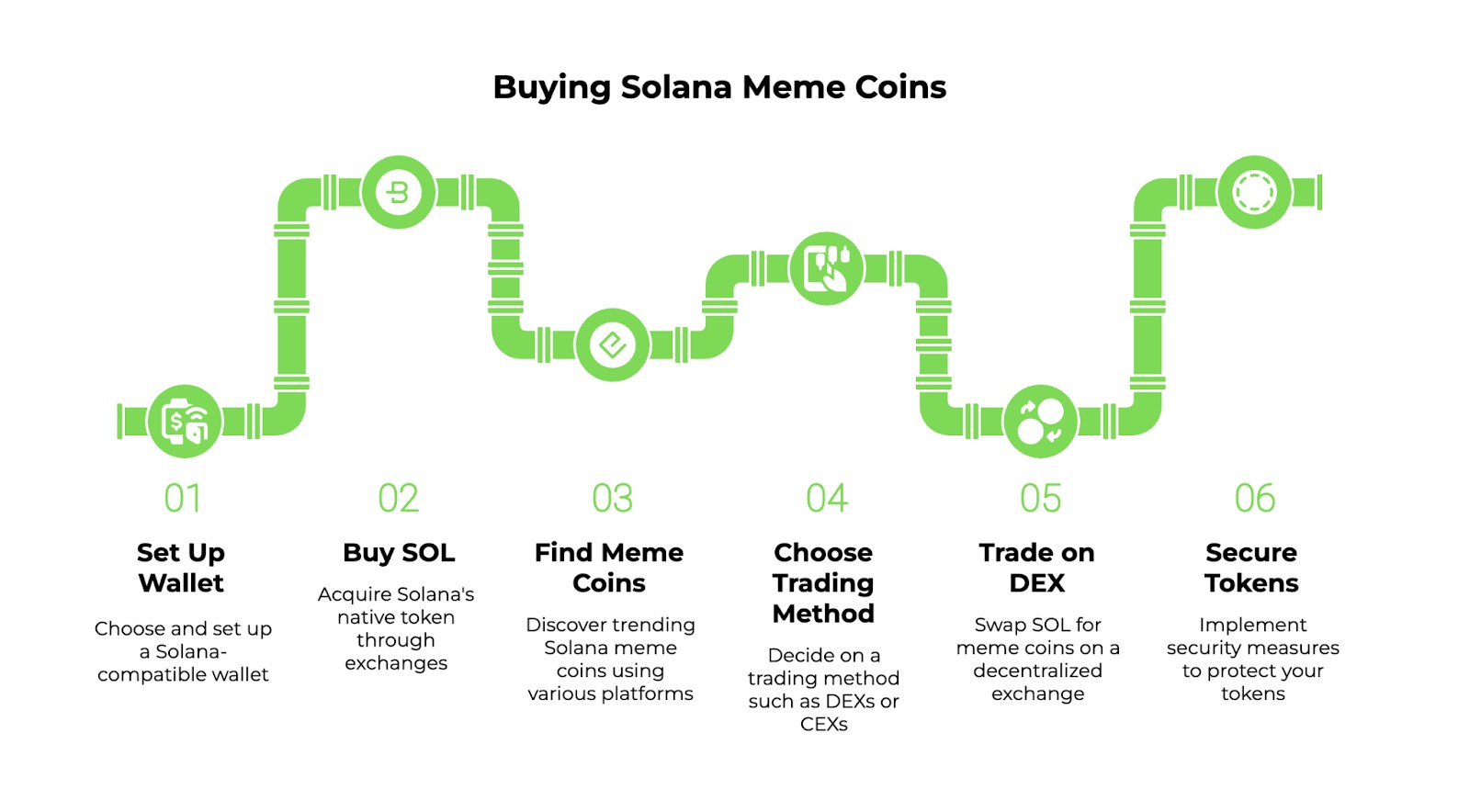

Buying Solana meme coins is simple with the right steps:

Step 1. Set up a wallet: use Phantom, Solflare, or Trust.

Step 2. Buy SOL tokens: get Solana from any reputed exchange.

Step 3. Find a meme coin built on Solana blockchain: check CoinGecko, DEXTools, or X.

Step 4. Choose a DEX: swap SOL on Raydium or Orca.

Step 5. Verify contract: confirm token details on Solscan.

Step 6. Make the swap: connect wallet and trade SOL.

Step 7. Secure tokens: store safely and avoid scams.

Solana meme coins are fun, community-driven tokens built on the Solana blockchain. They often take inspiration from viral trends, animals, or pop culture. Thanks to Solana’s fast and low-cost transactions, buying and selling these coins is quick and affordable. While some traders enjoy the hype, these coins can be unpredictable, so it’s smart to understand the risks before jumping in.

This guide breaks down how to buy Solana meme coins step by step. You’ll set up a wallet, get SOL for trading, and explore platforms where you can swap tokens safely. It also shares practical tips to keep your funds secure from scams and hacks.

How to buy Solana meme coins - Step-by-step guide

Here’s how you can buy Solana meme coins:

Step 1: Set up a Solana-compatible wallet

To keep your Solana meme coins safe, you’ll need a reliable wallet. Here are some solid options:

Phantom. Easy to use and great for beginners.

Solflare. Offers staking and extra security.

Trust wallet. Works with multiple blockchains.

Ledger. A hardware option for top security.

How to create a Phantom wallet

Here’s how you create a Phantom wallet:

Download Phantom. Get the Chrome extension or mobile app from Phantom.app.

Create a wallet. Click "New Wallet" and follow the setup.

Store your recovery phrase. Write it down somewhere safe.

Set a password. Choose a strong one and finish setup.

Step 2: Buy SOL (Solana’s Native Token)

You can buy SOL through exchanges, peer-to-peer trades, or other crypto platforms. Start by signing up on a reliable exchange and finishing the ID check if needed. Add funds using a bank transfer, card, or crypto deposit. Once the money is in, buy SOL through regular trading or a quick buy feature. After that, move your SOL to a Solana wallet by entering your wallet address carefully.

We have researched and curated a list of the top crypto exchanges for buying Solana. You can refer to it if required:

| Solana coins | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Yield farming | Staking | Foundation year | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 10 | 329 | 0,1 | 0,08 | Yes | Yes | 2017 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 10 | 278 | 0,4 | 0,25 | Yes | Yes | 2011 | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 1 | 250 | 0,5 | 0,25 | Yes | Yes | 2016 | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 1 | 72 | 0,2 | 0,1 | No | Yes | 2018 | 7.41 | Open an account Your capital is at risk. |

|

| Yes | No | 1817 | 0 | 0 | No | No | 2004 | 7.3 | Open an account Your capital is at risk. |

|

| Yes | 10 | 249 | 0,5 | 0,5 | Yes | Yes | 2012 | 6.89 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Step 3: Find Solana meme coins to buy

To discover trending meme coins, use:

DEXTools.io. Tracks trending Solana tokens.

CoinMarketCap & CoinGecko. Lists new Solana meme coins.

Solscan.io. Verifies contract addresses.

Twitter (X) & Discord. Follow meme coin communities.

Step 4: Choose a trading method

Ways to buy Solana meme coins:

DEXs (Most common). Raydium, Orca.

Automated bots. Used for early entries.

Initial DEX offerings (IDOs) & presales. Buy before public release.

Airdrops & giveaways. Free tokens from projects.

Step 5: Buy Solana meme coins on a DEX (Raydium example)

To swap SOL for a meme coin, go to a DEX like Raydium and tap on the swap feature. Link your Solana wallet, then copy the token’s contract address from a reliable site like CoinGecko or Solscan.

Choose how much SOL you want to trade, confirm the swap, and approve it in your wallet. After the transaction goes through, check your wallet to see your new meme coins.

Step 6: Secure and store your tokens

Never share your wallet’s recovery phrase — it’s the key to your funds. For bigger holdings, a hardware wallet adds extra protection. Stay away from shady websites and random links to avoid scams and hacks.

Step 7: Monitor & trade your meme coins

Keep an eye on your meme coin’s value using tools like Solscan or DEXTools. If you want to cash out, trade your tokens for SOL on a DEX. If you believe in the project, you might also hold or stake for future gains.

What are Solana meme coins?

Solana meme coins are community-driven tokens that gain popularity through social media buzz and speculation. Unlike regular cryptocurrencies that focus on utility, these coins move fast, with prices often driven by trends and influencer hype. Because Solana’s network is cheap and fast, meme coins here are much easier to trade than those on Ethereum. One well-known example is Bonk (BONK), which exploded in value after a huge airdrop gave it exposure. While most meme coins live or die by hype, some developers are now adding staking rewards, play-to-earn features, or NFT utilities to keep them relevant.

What makes Solana meme coins different is how anyone can launch them instantly on decentralized exchanges (DEXs) without waiting for major exchange listings. Since launching on Solana is affordable, even small teams or individuals can create their own meme coins with little investment. This freedom has led to unexpected success stories, like DogWifHat (WIF), which became a hit just through memes spreading on Twitter (X). However, this also means the space is filled with risky projects — some pump quickly and disappear just as fast.

Because meme coins rely so much on hype, traders need to keep an eye on social trends. Prices can swing wildly in just hours based on a viral post, making timing everything. Platforms like Pump.fun allow anyone to create meme coins instantly, leading to dozens of new coins appearing daily. Some traders make big profits by jumping in early, but others lose money when projects crash. A smart approach is to check Solscan for large transactions, watch community activity on Telegram and Discord, and always verify token details before buying in.

Where to trade Solana tokens

Here’s where to trade Solana tokens:

Decentralized exchanges (DEXs)

DEXs like Raydium, Orca, and Serum let users trade Solana meme coins directly from their wallets, skipping middlemen. This keeps full control over assets and allows instant swaps. Smart contracts handle trades automatically, reducing the need for trust.

Liquidity pools help keep trades smooth by ensuring enough tokens are available. Users who add liquidity can earn a share of trading fees, but market swings can lead to losses. Since DEXs don’t need sign-ups, they offer a quick and private way to trade.

Centralized exchanges (CEXs)

Some Solana meme coins later make it to big exchanges like Binance, KuCoin, or Gate.io. These platforms let beginners trade easily with simple interfaces, card payments, and support teams. But since they need KYC verification, users lose some privacy.

CEXs have more liquidity and quicker trades than DEXs. They also offer tools like stop-loss orders and margin trading. While they’re more convenient, users have to trust the exchange to keep their funds safe, which can be risky if the platform gets hacked.

Sniping and trading bots

Sniping bots like SolSniper let traders grab new meme coins the second they launch, often beating manual buyers to the punch. These bots scan transactions in real time and place orders instantly, making it easier to buy before prices move.

Though they can help traders profit, sniping bots have downsides. Some tokens have built-in protections against bots, and jumping in too early can backfire if the coin flops or turns out to be a scam. It’s important to understand the risks before relying on them.

How to research Solana meme coins before buying

Before jumping into Solana meme coins, knowing how to separate hype from real opportunities can save you from costly mistakes.

Check early liquidity movements. Track initial liquidity deposits on Solscan — low liquidity or rapid withdrawals often signal a potential rug pull.

Analyze developer wallet activity. Use Solscan or Birdeye to see if developers are constantly dumping tokens; frequent sell-offs mean they might be cashing out at your expense.

Monitor unusual social trends. Look beyond Twitter and Telegram — check unexpected forums like niche Discord groups or even Reddit meme stock communities where early hype sometimes starts.

Evaluate locked liquidity duration. A longer liquidity lock period on platforms like Unicrypt means the project is less likely to disappear overnight.

Compare price action with SOL movements. If a meme coin’s price rises only when SOL pumps, it might be riding market momentum instead of having real demand.

How to avoid scams when buying Solana meme coins

Buying Solana meme coins can be risky, especially with so many scams in the market. Here’s how to spot red flags and protect your investment.

Verify the liquidity lock. Check if the token’s liquidity is locked using tools like Solscan or Mudrex to prevent rug pulls where developers pull out all funds.

Look for manual token approvals. Avoid tokens with unrestricted contract permissions, as they can drain your wallet without additional approvals. Verify this using Solana Explorer.

Analyze bots activity in pools. If a token’s trading volume is inflated by bots making rapid buy/sell orders, it’s likely a manipulation tactic. Cross-check real user engagement on platforms like X (Twitter).

Inspect past token launches. Research the team’s history by looking at their previous token projects. If they’ve launched and abandoned multiple tokens before, it’s a clear red flag.

Check token tax mechanisms. Some meme coins have hidden transaction taxes that drain your balance on every trade. Review the contract terms before buying to avoid unexpected losses.

Are Solana meme coins a good investment?

Solana meme coins can offer massive returns, but only under the right conditions. Unlike major cryptocurrencies, their value relies more on community hype and market momentum than on actual utility. What most beginners overlook is the role of automated trading bots in these markets. Many meme coins experience artificial price pumps driven by bots that buy and sell at lightning speed, making it difficult for manual traders to catch profitable entry and exit points. If you’re considering investing, learn how to identify bot-driven rallies versus organic growth by tracking unique wallet addresses and trading volume patterns.

Another critical factor is liquidity depth. Many Solana meme coins launch with very limited liquidity, meaning a single whale can crash the price in seconds. While traders focus on price charts, they often ignore liquidity pools, which determine whether you can even sell your tokens at a fair price. Always check the liquidity-to-market cap ratio before investing. If the liquidity pool is too small compared to the total market cap, selling even a modest amount can trigger a price collapse, leaving you stuck with worthless tokens.

Security is also a major concern, but not just in the way most beginners think. Rug pulls are common, but more sophisticated scams involve hidden mint functions in smart contracts. Developers can insert backdoors that let them mint unlimited tokens after the initial hype, crushing the price overnight. Always read the contract before investing — if you don’t have the technical skills, use blockchain scanners or community audits. Look for signs like renounced contracts and locked liquidity to reduce the risk of falling into a well-planned scam.

Tips for trading Solana meme coins safely

Trading Solana meme coins can be risky, but knowing how to navigate the market with precision can give you an edge. Here are expert tips that go beyond basic advice.

Watch liquidity pool trends. A high liquidity pool doesn’t always mean safety — track inflows and outflows to spot sudden exits by insiders or developers dumping their holdings.

Check token unlock schedules. Some meme coins have large portions of supply locked, but if these tokens unlock too soon, early investors may dump them, crashing the price.

Use multiple wallets for trading. Instead of keeping all your funds in one wallet, use different wallets for buying, holding, and testing new tokens to minimize risk.

Monitor bot activity on DEXs. Front-running bots manipulate prices by buying before retail traders and selling right after. Spotting unusual trade patterns can help avoid bad entries.

Be cautious of “community takeovers.” Some abandoned meme coins get revived by new groups, but these takeovers often serve as exit liquidity for old holders instead of benefiting new buyers.

Tracking early buys and using sniper bots to dominate Solana meme coins

Solana meme coins are more than just speculative hype — they’re a playground for traders who know how to read on-chain patterns before the masses catch on. Instead of blindly following trending tokens on social media, dive into Solscan and Birdeye analytics to identify wallet activity of early adopters. Look for clusters of fresh wallets making coordinated buys within seconds of a token launch — this often signals involvement from insiders or dev teams who are about to start marketing the coin aggressively. Another key move is tracking low-follower but high-impact Twitter accounts that have historically shilled early gems. These micro-influencers often have inside access but fly under the radar, unlike big-name crypto influencers who pump coins after they’ve already spiked.

Another overlooked tactic is leveraging Solana-based liquidity sniper bots like Hadeswap’s auto-buy features. Manually sniping meme coins is slow and risky, but sniper bots can front-run regular buyers by milliseconds, getting you in before massive slippage eats profits. Set buy parameters based on pre-determined liquidity thresholds — if the contract starts with ultra-low liquidity, wait for a gradual ramp-up instead of aping in immediately. Also, analyze tokenomics deeply — avoid coins where the deployer owns more than 5-10% of supply, as these often end in rug pulls. Mastering these strategies gives you an edge over the casual meme coin gambler, letting you ride the wave instead of drowning in it.

Conclusion

Buying Solana meme coins can be exciting and profitable, but it also comes with risks. Since these tokens are mostly driven by community hype and market trends, it’s important to do thorough research before investing. Using a secure Solana-compatible wallet, buying SOL for transactions, and trading on trusted platforms can help make the process safer.

Always verify token contracts to avoid scams, and don’t invest money you can’t afford to lose. Meme coins can see huge price swings, so having a clear trading strategy and secure storage is essential. Whether you’re in it for fun or profit, staying informed and cautious will give you the best chance at success.

FAQs

What is the best platform to trade Solana meme coins?

Raydium and Jupiter are the most popular decentralized exchanges (DEXs) for trading Solana meme coins. They offer deep liquidity, low fees, and easy swaps. Some meme coins also get listed on CEXs like Binance and KuCoin.

How can I track the price of Solana meme coins?

You can monitor meme coin prices using platforms like CoinGecko, CoinMarketCap, and DEXTools. Solscan and Birdeye also provide real-time price updates and trading data. Always check liquidity and trading volume before investing.

Are Solana meme coins affected by Solana’s network congestion?

Yes, when the Solana network experiences congestion, transactions may take longer to confirm, and fees can rise. This can impact trading and liquidity for meme coins. Always check network status before making large transactions.

How do I add a Solana meme coin to my Phantom wallet?

Copy the token’s contract address from a trusted source like Solscan, then manually add it to Phantom. Some popular tokens auto-detect, but always verify details to avoid scams. Be cautious of fake contract addresses.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.