Changpeng Zhao’s Crypto Investments

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

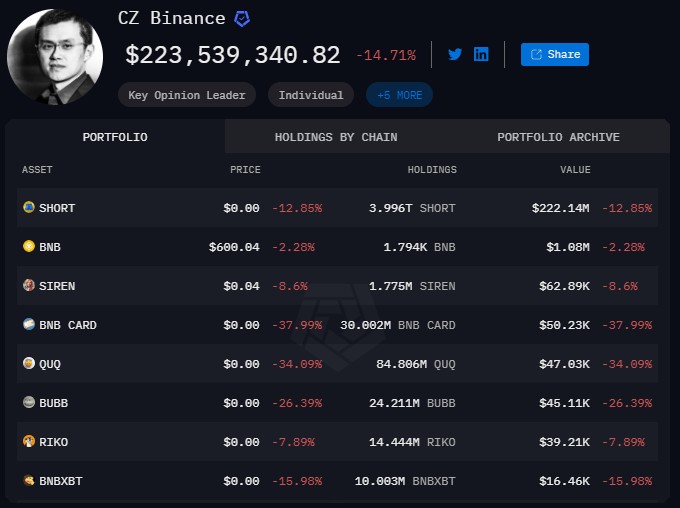

Changpeng Zhao’s crypto portfolio:

Mostly holds BNB. Around 98.48% of his portfolio.

Owns a bit of BTC. Roughly 1.32% is in Bitcoin.

Barely spreads assets. Almost no portfolio diversity.

Wealth depends on Binance. Directly tied to BNB's value.

Changpeng Zhao (CZ), the founder and former CEO of Binance, is widely regarded as a key figure in the world of cryptocurrency. Known for his active role in building crypto platforms, CZ has built significant wealth mainly from his stake in Binance-related tokens and leading cryptocurrencies. Unlike other crypto billionaires who spread their investments, CZ prefers a more focused strategy, keeping most of his assets in BNB (Binance Coin) with a smaller portion in Bitcoin (BTC).

Many traders and investors often examine Changpeng Zhao’s crypto portfolio, which serves as a clear case of how targeted investing works in the crypto world. His choices offer insight into how some investors back blockchain projects for the long haul.

Changpeng Zhao’s Crypto portfolio overview

Changpeng Zhao has publicly disclosed that his personal crypto portfolio is heavily weighted towards Binance Coin (BNB). Reports indicate that 98.5% of his holdings are in BNB, demonstrating his long-term confidence in the Binance ecosystem. The rest of his portfolio consists of Bitcoin (BTC), which accounts for approximately 1.3%, and smaller holdings in stablecoins or other assets that remain undisclosed.

| Asset | Holdings |

|---|---|

| Binance Coin (BNB) | 98.5% of total holdings |

| Bitcoin (BTC) | 1.3% of total holdings |

| Other Assets | <0.2% |

Changpeng Zhao’s crypto portfolio illustrates a strong belief in Binance’s long-term potential, with minimal diversification outside of BNB.

Changpeng Zhao’s crypto venture: Expanding market influence

Apart from his personal investments, CZ’s impact is felt throughout the wider cryptocurrency space. Under his leadership, Binance became a major force behind the spread of digital currencies worldwide. The company has supported several blockchain initiatives, including:

BSC (Binance Smart Chain). A network designed to host DeFi and NFT applications.

Trust Wallet. A mobile app focused on safe storage of digital assets.

Binance Labs. The investment division has funded a range of Web3 ventures, such as infrastructure, gaming, and DeFi.

PancakeSwap. A decentralized exchange built on BSC, known for being among the most used DEXs in the world.

Through these widespread investments, Changpeng Zhao’s crypto exposure also reaches many early-stage ventures and platforms supported by Binance Labs.

Financial impact and market reactions

When Changpeng Zhao (CZ) shared details about his crypto holdings, showing that 98.48% was in Binance Coin (BNB), the market had some ups and downs. Right after his announcement, BNB's price jumped 5% in a day, showing that investors trust CZ's dedication to Binance. But this also made big investors a bit uneasy about the dangers of keeping so much in one place.

Also, CZ's small Bitcoin stash — just 1.32% of his portfolio — got crypto experts talking. Some saw this as a smart play to make BNB stand on its own better, away from Bitcoin's price swings. Others thought it might be a mistake, since Bitcoin is such a big deal. These mixed opinions caused quick market changes, with traders tweaking their investments based on CZ's choices.

Ethical considerations and regulatory scrutiny

Changpeng Zhao (CZ), the founder and former CEO of Binance, has faced significant ethical and regulatory challenges that have shaped his actions and the cryptocurrency exchange's operations.

Guilty plea and substantial fines. In November 2023, CZ and Binance pleaded guilty to federal charges, including anti-money laundering violations, resulting in a $4 billion settlement.

Short prison sentence. Following his guilty plea, CZ received a four-month prison sentence in April 2024 for money laundering offenses.

Regulatory challenges in France. In January 2025, French authorities launched a judicial probe into Binance for alleged money laundering and tax fraud, intensifying scrutiny of the exchange's operations in Europe.

SEC lawsuit and policy shifts. The U.S. Securities and Exchange Commission sued Binance and CZ in June 2023 for alleged securities violations. However, in February 2025, both parties requested a 60-day pause in the lawsuit, reflecting potential shifts in U.S. crypto policy under the new administration.

Compliance investments post-penalties. In response to regulatory challenges, Binance invested approximately $213 million in compliance programs in 2023, a 35% increase from the previous year, aiming to strengthen its regulatory adherence.

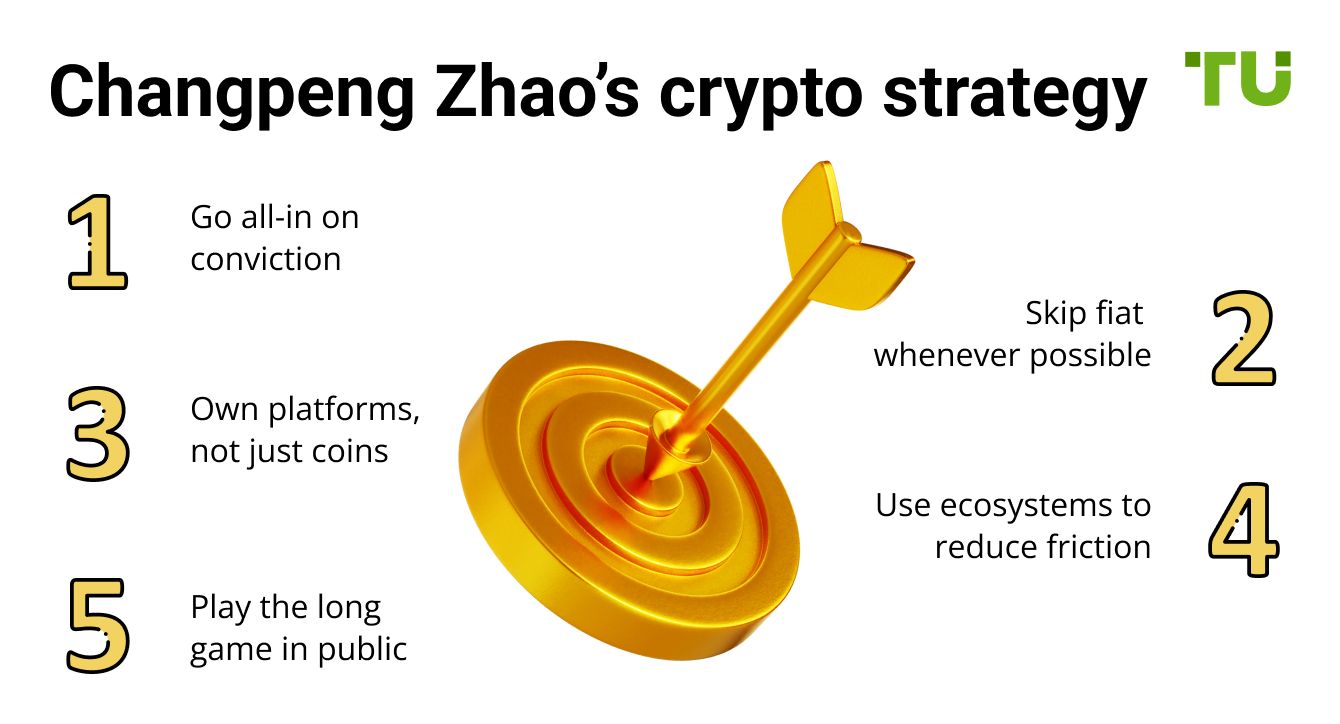

If you're just getting started in crypto, studying CZ’s personal strategies offers some surprisingly sharp lessons that go beyond the usual “buy and HODL” advice.

Go all-in on conviction. CZ famously holds over 98% of his portfolio in BNB — he doesn’t diversify just for the sake of it, and that signals insane conviction most investors avoid.

Skip fiat whenever possible. CZ has publicly said he converts nearly all his fiat income into crypto to reduce inflation exposure — something few beginners think about when holding cash.

Own platforms, not just coins. Instead of trading memecoins, CZ built Binance to own the infrastructure itself — he bets on rails, not passengers.

Use ecosystems to reduce friction. His ShapeShift/KeepKey integration shows how CZ prioritizes systems that eliminate unnecessary steps — less friction means fewer mistakes.

Play the long game in public. CZ never sold his BNB, even during bull runs — he uses visibility and consistency as long-term positioning, not short-term profit-taking.

If you wish to begin your crypto investing journey, the first step is to open an account with a reputed crypto exchange. We have researched the market and prepared a list of the top crypto exchanges for beginners. You can compare them through the table below and choose one for yourself:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Future outlook: What’s next for Changpeng Zhao in crypto?

Changpeng Zhao (CZ), the founder and former CEO of Binance, is charting a new course in the crypto world. Here's what you should know:

Investing in AI and biotech. CZ is channeling funds into artificial intelligence and biotechnology sectors, recognizing their potential to revolutionize industries.

Launching Giggle Academy. He's established this nonprofit to offer free, gamified education globally, aiming to make learning accessible and engaging.

Engaging with meme coins. CZ acknowledges the creativity in meme coins but advises caution due to their speculative nature.

Predicting investor challenges. He warns that 95% of crypto investors may not succeed long-term, emphasizing the need for informed decision-making.

Advocating for decentralized exchanges. CZ believes decentralized platforms will become mainstream, highlighting the importance of understanding them early on.

Risks and warnings

While CZ’s crypto portfolio is impressive, traders should consider several risks:

Extreme exposure to Binance Coin (BNB). If BNB faces a regulatory crackdown, his holdings could suffer significant losses.

Regulatory uncertainties. Binance continues to navigate legal challenges worldwide.

Market volatility. Even though CZ has held through bear markets, the volatility of BNB and BTC remains a risk factor.

Centralization risks. Despite being promoted as a decentralized ecosystem, Binance’s control over BNB and BSC raises concerns for traders.

These risks highlight why investors should take a diversified approach rather than mirroring Changpeng Zhao’s crypto portfolio strategy.

Build influence through conviction coins and ecosystem cashflows like CZ

Most beginners think success in crypto is about holding dozens of trending tokens — but CZ (Changpeng Zhao) flips that idea. His portfolio is aggressively concentrated in core holdings like BNB, BTC, and ETH. That’s not laziness — it’s strategy. By aligning deeply with a few ecosystems, CZ controls not just exposure, but influence.

Beginners should learn to build conviction portfolios: pick 2–3 ecosystems where they’re active, stake assets, join governance votes, and build visibility in that community. Instead of juggling 40 tabs of altcoins, become a power user in one.

Here’s a lesser-known trick inspired by CZ’s playbook: mirror strategic exposure without direct ownership. CZ doesn’t just hold coins — he builds infrastructure around them (Binance Launchpad, Smart Chain, DEXs). As a beginner, replicate that thinking by using tools that benefit from network activity, not just price action. For example, hold Liquid Staking Derivatives (like stETH or rETH) or DeFi protocol tokens like GMX that earn from usage, not speculation. You’re not just riding hype — you’re tapping into cash flows the same way Binance does.

Conclusion

Changpeng Zhao’s crypto portfolio is one of the most concentrated among major industry leaders, with 98.5% in BNB. While this high-risk, high-reward strategy aligns with his belief in the Binance ecosystem, it may not be suitable for all investors. Traders should carefully evaluate market risks, regulatory challenges, and diversification strategies before making investment decisions.

FAQs

Why doesn’t CZ diversify his crypto portfolio like other billionaires?

CZ isn’t chasing diversification — he’s betting on control. By focusing on BNB, he’s aligning his financial interests with Binance’s growth. This gives him more influence over the ecosystem than spreading out across random altcoins ever could. It’s less about safety and more about leverage.

Does CZ’s portfolio strategy work for small retail investors?

Not exactly. CZ’s concentration works because he built the platform. For everyday users, that kind of exposure could be risky. Instead, think like CZ but scale it down: focus on one or two ecosystems where you’re active, then explore yield or governance participation from there.

How can beginners mimic CZ’s strategy without owning BNB?

You can copy the blueprint without copying the coin. CZ earns from the infrastructure — not just price jumps. You could hold tokens like stETH, GMX, or RPL, which generate yield from usage. That way, you benefit from ecosystem activity without being glued to BNB.

What happens if CZ ever sells his BNB?

If CZ dumps his BNB, the market would panic. His reputation is tied to never selling, and that stability builds trust. A sell-off would likely spark a price drop and signal doubt in Binance’s future. For now, his HODL approach acts like an unofficial anchor.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.