The Impact Of Token Unlocks On Altcoin Prices In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

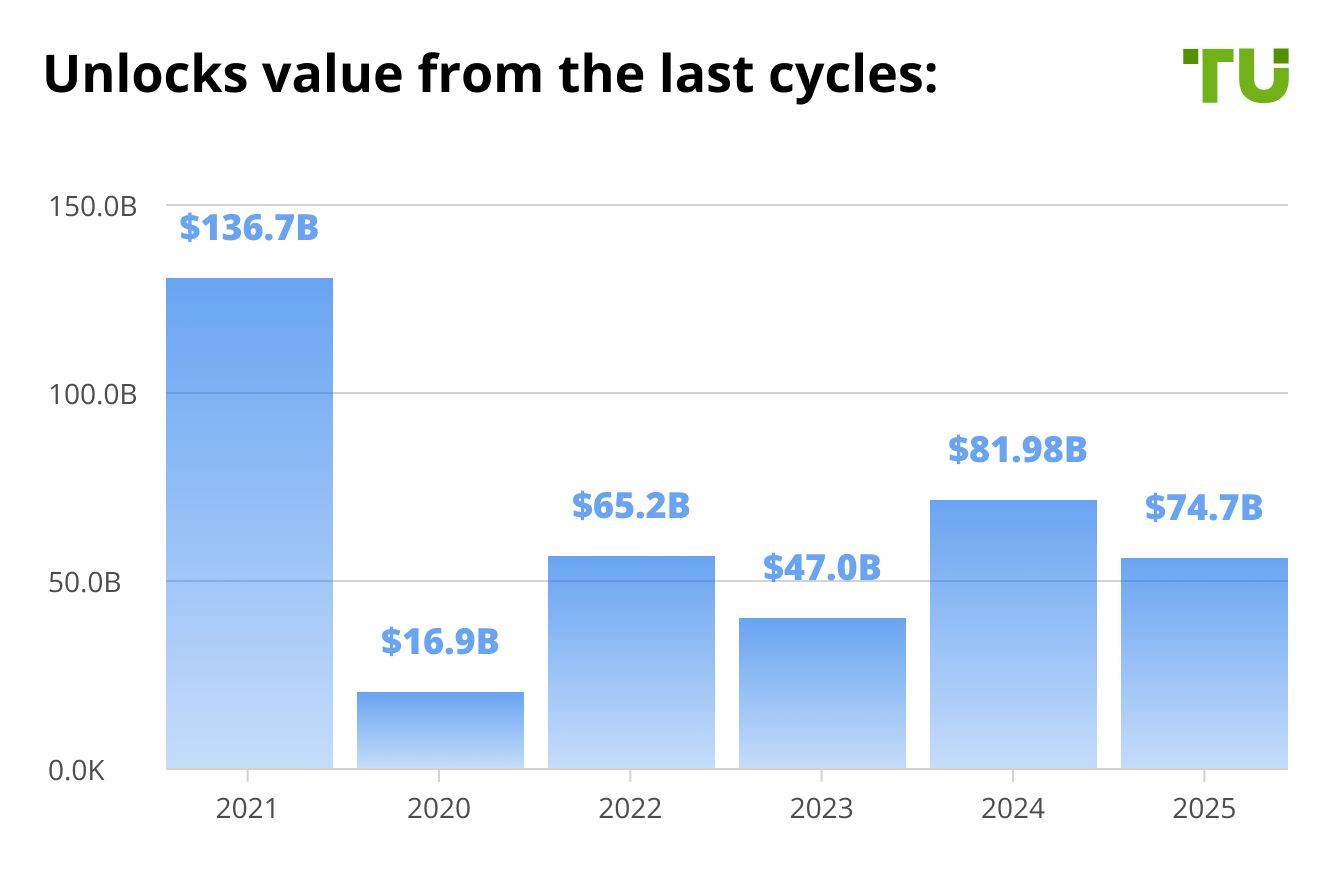

Crypto unlocks with a total estimated value of $74 billion in 2025 are set to play a crucial role in the market, with significant token releases expected to cause a ripple effect on altcoin prices. As the token unlock schedule grows more substantial, especially in the case of major projects like Solana (SOL), Worldcoin (WLD), and Sui (SUI), we can see dramatic shifts in price movements.

In this article, we'll explore what token unlocks are, what to expect in 2025, and how the increase in token supply could impact altcoin prices. We’ll also look at the risks and opportunities tied to these events, so you can be prepared for what’s ahead.

Understanding token unlocks

Token unlocks refer to the release of tokens that were previously held back or locked during the initial launch or during a vesting period. These tokens are usually allocated to project teams, early investors, and stakeholders.

The token unlocks schedule details when these tokens will be released into circulation, often in phases over several months or years. This phased release is part of a vesting process designed to prevent market destabilization.

Vesting bars team members and early investors from selling their tokens immediately, which could lead to a sudden drop in price. Instead, tokens are gradually made available to them, maintaining market stability.

In 2025, the token vesting period will continue as several major projects begin to unlock their tokens, introducing new dynamics to the market. These events are significant as they increase the total supply of tokens.

If demand does not rise correspondingly, this could exert downward pressure on prices. For investors, closely monitoring the timing of these unlocks is essential for strategizing around potential market movements.

Token unlocks in 2025: what to expect

The cryptocurrency market is set for major token unlocks in 2025, with a total estimated value of $74 billion. This could bring both opportunities and risks for investors and traders, as newly released tokens may impact supply, demand, and market stability.

Market impact

These unlocks can affect the market in several ways.

Increased supply. A rise in available tokens could lower prices if demand doesn’t grow at the same rate.

Investor sentiment. Depending on how these tokens are used — held, sold, or reinvested — market trends may shift.

Trading strategies. Traders who track these events can adjust positions to take advantage of expected price movements.

Tracking token unlocks

Investors can stay informed using platforms that provide real-time unlock data.

Unlocks.app. Tracks upcoming unlocks and their impact.

Tokenomist. Offers detailed supply data and unlock schedules.

The impact of token unlocks on altcoin prices

Token unlocks, the scheduled release of previously restricted tokens into the market, play a significant role in influencing altcoin price dynamics. Understanding their impact is crucial for investors aiming to navigate the cryptocurrency landscape effectively.

Immediate market effects

The introduction of a large number of tokens can disrupt the supply-demand balance, often leading to short-term price declines and increased volatility. For instance, when Arbitrum (ARB) unlocked approximately 1.11 billion ARB tokens on March 16, 2024, this substantial increase in circulating supply exerted significant downward pressure on its price.

Size of the unlock matters

The scale of a token unlock directly affects the market. Larger unlocks, especially those exceeding 5% of the total supply, tend to trigger more pronounced price drops and heightened volatility. In contrast, smaller, more frequent unlocks apply consistent but less severe downward pressure. For example, Sui (SUI) experienced a significant unlock on April 3, 2024, releasing approximately 1.1 billion SUI tokens, nearly doubling its circulating supply. This event led to a notable decline in SUI's price over the subsequent months.

Who receives the tokens matters

The impact of a token unlock also depends on who receives the unlocked tokens:

Team unlocks. Tokens allocated to project teams often lead to significant price drops, averaging around 25%. Team members may sell off their holdings upon receiving them, increasing selling pressure.

Investor unlocks. Early investors often use strategic approaches like over-the-counter sales and hedging, reducing the impact on the open market.

Ecosystem development unlocks. Tokens meant for ecosystem growth can have a stabilizing effect. These tokens are often used to enhance liquidity, incentivize user participation, and fund development, supporting long-term value.

How investors can manage token unlock risks

To navigate token unlock events effectively, investors should consider these strategies:

Monitor unlock schedules. Platforms tracking unlock dates help investors anticipate market movements and adjust positions accordingly.

Assess market sentiment. Evaluating broader market trends and project developments can provide insights into potential price shifts.

Use risk management strategies. Implementing stop-loss orders and diversifying portfolios can help mitigate potential losses from token unlock volatility.

Major сrypto tokens undergoing unlocks in 2025

In 2025, the cryptocurrency market is set to experience significant token unlocks, events where previously locked tokens are released into circulation. These releases can impact market liquidity, token valuations, and investor sentiment.

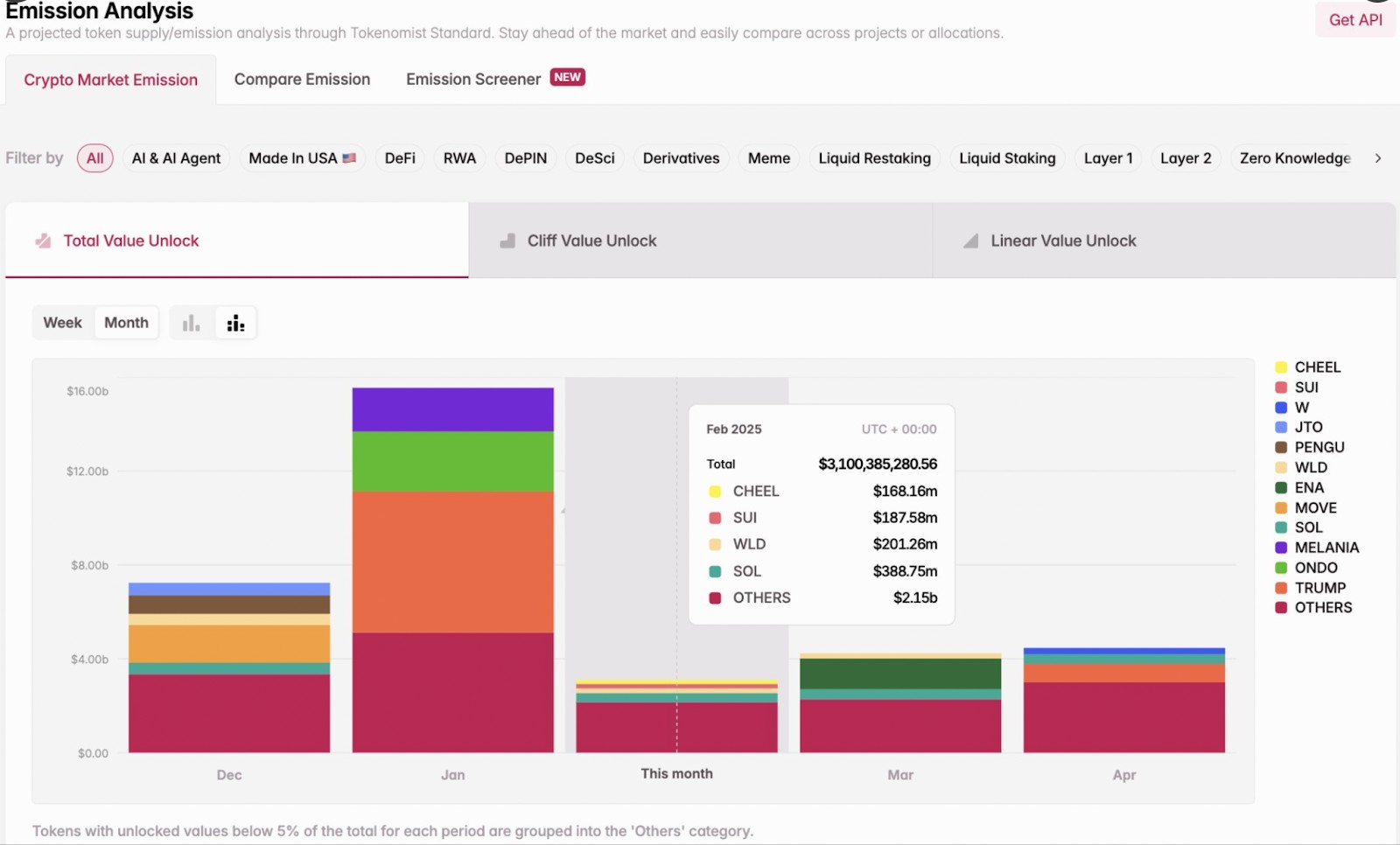

February 2025 token unlocks

February 2025 is notable for substantial token unlocks, with over $3.13 billion worth of tokens entering the market. Key projects include:

Ripple (XRP). Unlocked 400 million XRP tokens, valued at approximately $1.13 billion.

Sui Network (SUI). Released 64 million SUI tokens, worth about $51 million.

Jito Labs (JTO). Unlocked 11.3 million JTO tokens.

Galxe (GAL). Released 5.18 million GAL tokens.

TARS AI (TAI). Unlocked 26.7 million TAI tokens.

Neutron (NTRN). Released 9.96 million NTRN tokens.

These unlocks have the potential to influence liquidity levels and price trends in the market.

Upcoming token unlocks in 2025

Beyond February, several major token unlocks are scheduled for the remainder of 2025. Notable projects include:

Aptos (APT). Set to unlock 11 million APT tokens, valued at approximately $111.4 million.

Arbitrum (ARB). Scheduled to release 92.6 million ARB tokens, worth about $86 million.

Optimism (OP). Planning to unlock 32.21 million OP tokens, valued at $67 million.

Ronin (RON). Set to release 33.6 million RON tokens, worth approximately $66.8 million.

Immutable (IMX). Scheduled to unlock 24.5 million IMX tokens, valued at $35.6 million.

These upcoming unlocks are anticipated to impact their respective ecosystems, potentially affecting token prices and investor strategies.

Risks and opportunities of token unlocks

The large-scale token unlocks scheduled for 2025 present both risks and opportunities for investors. As millions of new tokens flood the market, price volatility can increase, potentially overwhelming demand and driving prices down for affected altcoins.

Risks of token unlocks

Market oversupply. A sudden influx of a large quantity of tokens can depress prices if it exceeds demand. If investors offload their newly unlocked tokens to capitalize on their holdings, it could exacerbate the price decline, especially for altcoins with low liquidity or limited demand.

Price volatility. The release of a significant number of tokens at once can lead to increased volatility in the market. This unpredictability can deter conservative investors and destabilize the price for extended periods.

Impact on investor confidence. Frequent or large-scale token unlocks can lead to uncertainty among investors, fearing dilution of value and potential price drops. This can erode trust in the token and its underlying project.

Regulatory scrutiny. As token unlocks increase the circulation of digital assets, they may attract more attention from regulatory bodies. Increased regulation could impose operational constraints or lead to fines, affecting the token’s market performance.

Triggering panic selling. If the market perceives the unlocks negatively, it may trigger panic selling, compounding the price decline and creating a difficult market condition for recovery.

Opportunities from token unlocks

Market timing strategies. Savvy traders can use unlock events to their advantage by planning strategic entries and exits. Purchasing tokens before an unlock when prices might be lower and selling after demand stabilizes and prices potentially rise can be profitable.

Identifying growth potential. Token unlocks might temporarily depress prices due to perceived oversupply. However, for projects showing genuine growth and adoption, this could be a buying opportunity. Investors who discern the long-term value of such projects could benefit from price appreciation once the market absorbs the new supply.

Enhanced liquidity. The release of locked tokens into the market increases liquidity, making it easier for investors to buy and sell large amounts of tokens without significantly impacting the price. This improved liquidity can attract more investors, potentially driving up the token's value over time.

Diversification opportunities. As tokens become unlocked, investors have the opportunity to diversify their holdings more effectively. By investing in different tokens at potentially lower prices, investors can mitigate risk and potentially increase returns as these tokens mature and grow in value.

The future of token unlocks and market trends

The cryptocurrency market in 2025 is set to undergo major shifts due to token unlock events and evolving market conditions. These developments will impact liquidity, investment strategies, and overall market trends.

The rise of token unlocks

The market expects around $74 billion worth of token unlocks in 2025. By April, unlocked tokens are projected to reach $17 billion, which could create price fluctuations if liquidity does not grow at the same pace.

How token unlocks impact the market

Token unlocks affect the market in different ways.

Increased supply. A surge in available tokens can lead to price declines if demand does not match the new supply.

Investor strategies. Tracking token unlocks helps investors adjust their portfolios to avoid sudden losses or take advantage of price swings.

Project development. Many unlock events are tied to project milestones, where tokens fund ecosystem growth, partnerships, or product expansions.

Trends shaping the market in 2025

Beyond token unlocks, several emerging trends will define the market this year.

Regulatory clarity. With a more defined approach to crypto regulations, investor confidence is expected to rise.

Growth of DeFi. Traditional financial institutions are exploring decentralized finance (DeFi), increasing mainstream adoption.

Expansion of stablecoins. The use of stablecoins in international transactions and everyday payments continues to grow.

Tokenization of real-world assets. Sectors like real estate and art are using blockchain technology to enable fractional ownership and better liquidity.

Integration of new technology. Blockchain continues to merge with advanced technologies, improving efficiency and opening new opportunities for digital assets.

How investors can prepare

To navigate these changes, investors should take the following steps.

Track unlock schedules. Monitoring major token unlock events can help manage risk.

Stay updated on regulations. Understanding new policies will help investors make informed decisions.

Diversify portfolios. Holding a mix of assets that benefit from new trends can reduce exposure to market swings.

Use risk management tools. Stop-loss orders and position sizing can help limit unexpected losses.

Smart traders don’t just react to unlocks

The cryptocurrency market in 2025 is facing a massive $74 billion wave of token unlocks, with $17 billion worth of tokens expected to be released by April alone. Many beginners overlook how these unlocks create artificial supply shocks that can drive altcoin prices down before the actual unlock happens.

Smart traders don’t just react to unlocks; they anticipate them by analyzing vesting schedules and whale wallet movements weeks in advance. Instead of panic-selling when a major unlock approaches, savvy investors hedge their positions by shorting or rotating into unaffected tokens, avoiding the predictable post-unlock dumps. Some projects use unlocks strategically, funding development or partnerships, so digging into how the team plans to use their released tokens can offer clues about price movements.

Beyond unlocks, the tokenization of real-world assets (RWAs) is set to be a game-changer, absorbing liquidity that would otherwise flow into speculative altcoins. While many focus on traditional cryptos, investors should start looking at projects tokenizing real estate, stocks, and commodities, as they may see lower volatility and stronger regulatory backing.

Meanwhile, DeFi is becoming more integrated with traditional finance, and smart investors are watching for partnerships between major institutions and blockchain-based financial services. The ability to predict where capital will flow next — whether into RWAs, DeFi, or alternative blockchain ecosystems — will separate profitable traders from those caught in outdated cycles.

Conclusion

Token unlocks in 2025 will be a defining factor in the cryptocurrency market, with $74 billion worth of tokens set to enter circulation. While increased supply can lead to short-term price drops, savvy investors can capitalize on these fluctuations by monitoring unlock schedules, analyzing market sentiment, and adjusting their strategies accordingly.

Beyond token unlocks, emerging trends such as real-world asset (RWA) tokenization, DeFi expansion, and institutional crypto adoption will shape the broader market. Understanding how capital flows between different sectors, tracking whale movements, and identifying projects with strong long-term fundamentals will be key to staying ahead in this evolving landscape.

As crypto markets mature, token unlocks will become predictable events rather than sudden shocks. Investors who position themselves strategically — whether through diversified portfolios, hedging strategies, or spotting growth opportunities in sectors like AI-driven blockchain solutions and DeFi integrations — will be better equipped to navigate volatility and maximize returns.

With the right approach, token unlocks can be an opportunity, not just a risk. Staying informed, adapting to market trends, and leveraging data-driven insights will help traders and investors thrive in 2025’s dynamic crypto environment.

FAQs

What are token unlocks, and how do they affect the crypto market?

Token unlocks are when previously locked tokens are released into circulation. They increase supply, which can lower prices if demand doesn’t rise.

Why are token unlocks scheduled for 2025 expected to have such a big impact?

In 2025, $74 billion in tokens will be unlocked. Major projects like Solana, Worldcoin, and Sui will add significant supply, affecting prices.

How can I take advantage of token unlocks as an investor?

Monitor unlock schedules. Buy before unlocks or wait for price stabilization after. Follow market trends closely.

Will token unlocks cause long-term damage to the value of altcoins?

Not always. The impact depends on the project’s fundamentals and demand. Some tokens may recover over time after an initial dip.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.