Earnings Reports And Stock Price Swings - How To Predict Market Reactions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Earnings reports can trigger massive stock price swings, often surprising investors when results don’t match expectations. Revenue, earnings per share (EPS), and future guidance are key factors influencing stock movements. A stock may rise despite weak earnings if a company provides strong future projections, while a stock with solid earnings can still drop if guidance disappoints. Smart investors analyze forward-looking statements, cash flow trends, and market sentiment to anticipate major stock moves ahead of earnings season.

Earnings reports can cause wild stock swings, but a 20-30% move in a single day means the market wasn’t just surprised — it was caught completely off guard. These extreme reactions happen when expectations and reality don’t match, often because investors are focused on the wrong numbers. A company might post strong revenue, but if management lowers its future outlook, the stock tanks. On the flip side, a weak earnings report can still send a stock higher if there’s a positive shift in its long-term strategy. Knowing which numbers and comments trigger these swings — and why analysts misread them — is what separates smart traders from those left scrambling.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding stock price volatility

Stock prices constantly move due to different factors that shape investor confidence. Some changes happen because of a company’s performance, while others are linked to the economy or overall market sentiment. Knowing what influences stock prices helps investors avoid emotional decisions and make better financial choices.

Role of earnings reports

Investors pay close attention to earnings reports because they show how well a company is doing. These updates give a snapshot of financial performance and often determine whether a stock moves higher or lower.

What investors look for in earnings reports:

Revenue and profits

A company exceeding revenue and profit forecasts often sees a surge in stock price as investors gain confidence.

If earnings fall short, investors may sell shares, leading to a price drop, even if the company remains profitable.

Company outlook

Even when earnings beat expectations, a cautious forecast for the next quarter can cause the stock to fall.

Conversely, a strong outlook can overshadow weak earnings, driving stock prices up.

Earnings per share (EPS)

An increasing EPS suggests improving profitability, making the stock more attractive.

A declining EPS can be a red flag, potentially signaling financial struggles.

Beating or missing expectations

Stock movements are often dictated by whether earnings results beat, meet, or miss analyst predictions rather than just raw numbers.

A company could report declining profits but still see its stock rise if the results are better than expected.

Special announcements

Share buybacks. Companies repurchasing shares reduce supply, often boosting stock prices.

Dividend increases. A rising dividend signals financial strength and can attract long-term investors.

Cost-cutting measures. Announcements of efficiency plans or layoffs can lead to short-term gains if investors see it as a path to higher profitability.

Metrics in earnings reports that trigger significant price movements

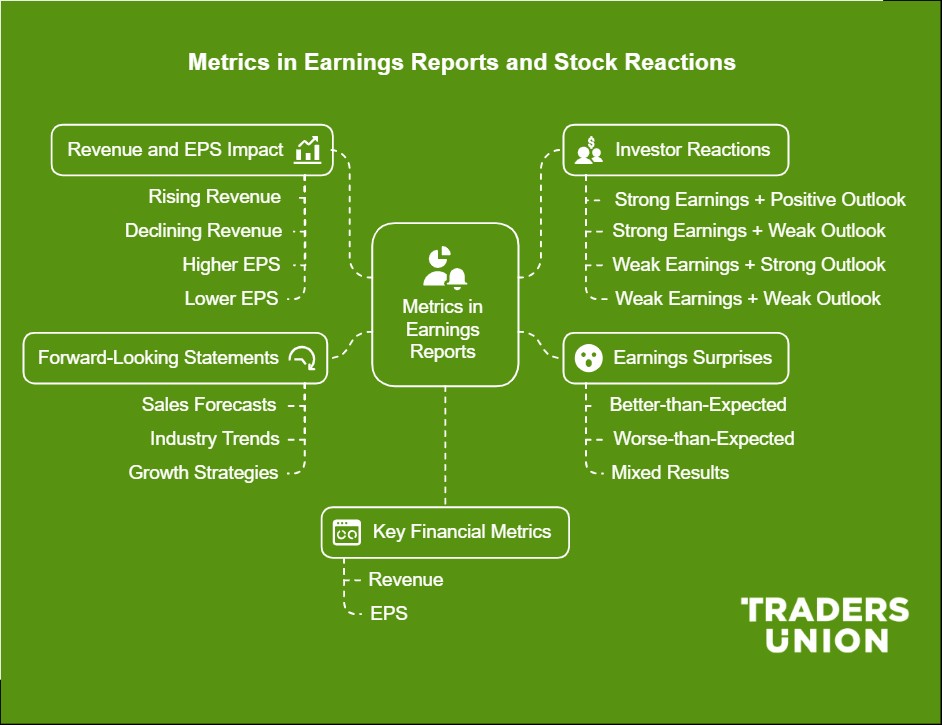

When companies release earnings reports, investors closely analyze certain numbers to decide whether a stock is worth buying or selling. Some of the most important metrics include revenue, earnings per share (EPS), how results compare to expectations, and what management predicts for the future. These figures can cause stock prices to rise or fall depending on how they align with investor expectations.

Revenue and earnings per share (EPS)

Two of the most watched figures in an earnings report are revenue and earnings per share (EPS). These numbers show whether a company is growing, making profits, or struggling.

Revenue (Total Sales)

Shows how much money the company made before deducting expenses.

If revenue is rising, it often means the company is expanding or increasing demand for its products or services.

A drop in revenue may indicate fewer sales, competitive pressure, or economic challenges.

Earnings Per Share (EPS) (Profit Per Share)

Measures the company’s net profit divided by the number of shares.

A higher EPS generally suggests stronger profits, while a decline may signal rising costs or slowing business.

How these numbers affect stock prices

If a company reports higher-than-expected revenue and EPS, its stock price often climbs.

If these figures fall short of expectations, even a profitable company may see its stock price drop.

Companies sometimes boost EPS by buying back shares, which reduces the number of shares in the market.

Earnings surprises

Investors and analysts set expectations for revenue and earnings before a company reports its results. If actual earnings are much higher or lower than expected, stock prices can move sharply.

Types of earnings surprises

Better-than-expected results

If a company posts higher sales or profits than analysts predicted, its stock usually rises.

For example, a retail chain that reports a strong holiday season when weak sales are expected may see a stock surge.

Worse-than-expected results

When a company earns less than expected, investors often sell shares, causing the stock price to fall.

For example, a technology firm that reports lower software sales than expected may see its stock decline.

Mixed earnings reports

Sometimes, a company beats revenue expectations but misses profit forecasts, or vice versa.

In these cases, the stock reaction can be uncertain.

Why earnings surprises move stock prices

If invest ors expect weak earnings but a company performs better, the stock can rise quickly.

If a company misses expectations, even by a small amount, investors may sell off shares.

Large investment firms and hedge funds often adjust their holdings after earnings reports, causing bigger stock movements.

Forward-looking statements

Even if a company reports strong earnings, investors want to know what will happen next. Forward-looking statements from company executives help investors understand expected revenue, profits, and business plans for the future.

Key parts of forward guidance

Sales and profit forecasts

Companies often give estimates for how they expect to perform in the next quarter or year.

If they raise expectations, investors may buy more shares, boosting stock prices.

If they lower expectations, even strong earnings may not stop a stock from falling.

Industry and economic trends

Executives often discuss challenges such as inflation, supply chain issues, or shifts in consumer demand.

If they express confidence in future growth, investors tend to react positively.

Business investments and strategy

Some companies use earnings reports to announce plans for new product launches, acquisitions, or market expansions.

These announcements can influence how investors feel about the company’s future growth.

How forward guidance impacts stock prices

If a company predicts strong future growth, its stock may rise even after a weak earnings report.

If a company warns of challenges ahead, its stock may fall even after posting good earnings.

Investors listen closely to executive commentary to gauge whether management is optimistic or cautious about the business outlook.

Case studies of significant stock price movements

Earnings reports often lead to big changes in stock prices. When companies perform better than expected, investors become more confident and buy shares, pushing prices higher. If earnings disappoint, stock prices can drop sharply as investors adjust their expectations. Sometimes, the market reacts too strongly in the short term, causing stock prices to move more than they should before settling.

Positive earnings surprise

When a company posts results that are better than expected, investors see it as a sign of strength. This often leads to a spike in the stock price as buyers rush in.

Case study. Nvidia’s stock jump after AI boom (2023)

What happened?

Nvidia, a major chipmaker, reported much higher revenue and earnings than analysts predicted.

The surge was driven by a growing demand for artificial intelligence (AI) chips, which power AI applications.

The company also raised its outlook for future sales, making investors even more optimistic.

How the stock reacted

Nvidia’s stock price rose more than 20 percent in one day, adding billions to its market value.

The excitement around AI kept the momentum going, leading to continued stock gains.

Why this was important

When a company beats expectations and gives strong future guidance, its stock can rise sharply.

Negative earnings surprise

If a company reports lower-than-expected earnings or gives a weaker outlook, investors may sell shares, causing the stock to fall.

Case study. Meta’s stock plunge after weak earnings (2022)

What happened?

Meta (formerly Facebook) reported disappointing revenue, partly due to lower ad spending and competition from TikTok.

The company also warned that future growth could slow, which raised concerns among investors.

How the stock reacted

Meta’s stock dropped nearly 25 percent in one day, wiping out billions in market value.

Many investors worried about the company’s ability to maintain strong ad revenue.

Why this was important

A weak earnings report combined with a poor outlook can lead to a major drop in stock price.

Market overreaction

Sometimes, stock prices move too much based on short-term news, creating opportunities for long-term investors who stay patient.

Case study. Netflix’s stock drop and rebound (2022)

What happened?

Netflix announced that its subscriber count had dropped for the first time in over a decade.

Investors panicked, fearing that the company’s best days were over.

However, Netflix still had strong revenue and planned to launch a new ad-supported subscription tier.

How the stock reacted

Netflix’s stock fell more than 35 percent in the days after the announcement as panic selling took hold.

Over time, as investors realized the company was still growing, the stock made a comeback.

Why this was important

The market sometimes reacts too strongly to short-term issues, pushing stock prices too low or too high before they stabilize.

Strategies for investors during earnings season

Earnings season can be unpredictable, with stock prices moving sharply after companies report their financial results. While some investors try to profit from these swings, others focus on long-term trends. The best approach is to analyze reports beyond the headline numbers, manage risk, and balance short-term market reactions with long-term investment goals.

Analyzing earnings reports

Earnings reports include more than just revenue and net income. Investors who dig deeper can better understand a company’s financial health and long-term potential.

What to focus on in earnings reports

Analyzing a company's earnings report helps investors assess its financial health and future potential. Key areas to focus on include:

Revenue and profit trends

Year-over-year (YoY) and quarter-over-quarter (QoQ) comparisons. Evaluating revenue and profit changes over time helps identify growth patterns or potential slowdowns. Consistent growth is a good sign, while declining trends may signal underlying issues.

Profit margins. Gross and net profit margins show how efficiently a company converts revenue into profit. Shrinking margins may indicate rising costs or pricing pressures.

Earnings per share (EPS)

EPS analysis. EPS measures profitability per share. An increasing EPS is positive, while a declining EPS may raise concerns about financial performance.

Future guidance

Management's outlook. Forward-looking statements on revenue, earnings, and strategy help investors understand a company’s direction. Positive guidance can boost confidence, while weak forecasts may lead to stock declines.

Cash flow and debt levels

Operating cash flow. Strong cash flow gives companies flexibility to invest in growth and handle downturns.

Debt-to-equity ratio. This measures financial leverage. A high ratio may signal excessive debt, while a lower ratio suggests stable finances.

Industry performance

Peer comparison. Examining how a company performs relative to competitors provides context. If other companies in the same industry are thriving while one struggles, it may be facing company-specific issues.

Risk management

Stock prices can move quickly during earnings season. Investors who plan ahead can reduce potential losses while still benefiting from market opportunities.

Ways to manage risk

Avoid putting too much money into one stock

Diversifying helps protect against large losses from a single company’s earnings miss.

Use stop-loss orders

A stop-loss automatically sells a stock if it drops below a set price, helping to control losses.

Consider options for protection

Some investors use strategies like protective puts to hedge against potential losses.

Wait for post-earnings stability

Stocks often move sharply right after earnings reports, but waiting a day or two can prevent emotional trading decisions.

Long-term vs. short-term perspectives

Earnings season often tempts investors to react quickly, but short-term price movements do not always reflect a company’s true value.

For short-term traders

Taking advantage of price swings

Some traders buy and sell stocks based on earnings news, aiming for quick gains.

Watching extended-hours trading

Stocks often move the most before and after the regular trading session, when earnings are announced.

Looking for special announcements

A major business deal or new product launch can influence a stock’s short-term momentum.

For long-term investors

Focusing on consistent growth

A single earnings report does not define a company’s future. Looking at long-term trends is more important.

Avoiding emotional reactions

Stock prices can move irrationally after earnings. Long-term investors focus on business fundamentals instead of short-term noise.

We have carefully selected a list of brokers that offer access to stocks aligned with such conditions. These brokers provide the tools and resources needed to invest strategically in stocks.

| Stocks | Foundation year | Account min. | Demo | Research and data | Basic stock/ETF fee | Deposit Fee | Withdrawal fee | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2007 | No | Yes | Yes | $3 per trade | No | $25 for wire transfers out | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| Yes | 2014 | No | No | Yes | Zero Fees | No | No charge | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | 2015 | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | No | No charge up to a limit | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | 1978 | No | Yes | Yes | 0-0,0035% | No | No | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

|

| Yes | 2011 | No | No | Yes | Zero Fees | No | $25 for wire transfers out | FINRA, SIPC, FinCEN | 7.33 | Study review |

One key signal? Pricing power

Many investors focus only on revenue and earnings per share (EPS) when reading earnings reports, but the biggest stock moves often come from details hidden deeper. Free cash flow, small shifts in profit margins, or even a subtle change in how management talks about the future can trigger massive moves.

One key signal? Pricing power. If a company suggests it can raise prices without losing customers, that’s a strong sign of future profit growth — even if this quarter’s numbers are weak. On the other hand, vague statements about “economic pressures” or “challenging conditions” often cause investors to dump shares, even if the company’s actual performance isn’t that bad. Understanding how to read between the lines in these reports can uncover big opportunities.

Another major factor is how investors are positioned before earnings are released. Stocks with a lot of short interest often see huge rallies if earnings aren’t as bad as expected, since traders betting against the stock are forced to buy it back. Meanwhile, stocks that have been hyped up before earnings can crash if the results don’t blow past expectations.

Looking at options activity, analyst reports, and short interest before earnings can give a sense of where the biggest risks — and rewards — might be. The most dramatic stock moves don’t happen just because of the numbers. They happen when market expectations collide with reality.

Conclusion

Big stock moves after earnings reports don’t happen by chance — they happen when the market gets caught off guard. While most traders focus on revenue and profit numbers, the biggest surprises usually come from cash flow trends, management’s comments, and how investors were positioned before the report. The best trades aren’t made by reacting after stock spikes or crashes, but by spotting the signs that a big move is coming ahead of time. Understanding which financial details and key phrases actually drive these moves can give investors an edge in navigating earnings season.

FAQs

Do stocks go up after an earnings report?

Stocks can rise after an earnings report if results exceed expectations, but they may also fall due to weak guidance or profit-taking. Market reaction depends on revenue, earnings, and future outlook.

What is the 7% rule in stocks?

The 7% rule suggests selling a stock if it drops 7% below the purchase price to limit losses. It is a risk management strategy used in technical trading.

Should you buy stocks before or after an earnings report?

Buying before earnings carries risk due to uncertainty, while buying after provides clarity but may miss initial price movement. Investors should consider volatility and risk tolerance.

What is the 10 am rule in stocks?

The 10 am rule suggests waiting until after 10 am to trade stocks, as early morning volatility tends to settle. This helps traders make more informed decisions based on stable trends.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.