Best Ethereum ETFs In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best Ethereum ETFs in 2025 are:

- 21Shares Ethereum ETF (AETH)

- Bitwise Ethereum ETF (ETHB)

- BlackRock iShares Ethereum Trust (ETHA)

- Fidelity Ethereum ETF (ETHF)

- VanEck Ethereum ETF (ETHV)

- Franklin Templeton Ethereum ETF (ETHFT)

- Invesco Galaxy Ethereum ETF (ETHE)

Ethereum ETFs (Exchange-Traded Funds) are financial instruments that track the value of Ethereum, the second-largest cryptocurrency by market capitalization. These ETFs allow investors to gain exposure to Ethereum's price movements without directly holding the digital asset. Ethereum ETFs have become increasingly important as they offer a regulated and accessible way for traditional investors to participate in the growing cryptocurrency market.

Best Ethereum Spot ETFs

21Shares Ethereum ETF (AETH)

Managed by 21Shares, this ETF aims to provide direct exposure to Ethereum by tracking its spot price. Known for its low expense ratio and strong custodial services. It is designed to be a straightforward way for investors to gain exposure to Ethereum without dealing with the complexities of purchasing and storing the cryptocurrency directly.

Analysts predict significant inflows due to its simplicity and appeal to traditional investors. This ETF is expected to attract a broad range of investors, from retail to institutional.

Bitwise Ethereum ETF (ETHB)

Offered by Bitwise, this ETF tracks the spot price of Ethereum and aims to provide investors with a seamless way to invest in Ethereum. Bitwise is known for its robust security measures and transparency. The fund will not engage in staking, aligning with SEC regulations.

Bitwise projects substantial interest due to Ethereum's role in the broader cryptocurrency ecosystem, particularly its use in decentralized finance (DeFi) and non-fungible tokens (NFTs).

BlackRock iShares Ethereum Trust (ETHA)

Managed by BlackRock, this ETF is designed to offer exposure to Ethereum's price movements by holding the asset directly.

BlackRock brings significant institutional credibility and resources to the table. The fund is expected to have one of the largest asset inflows due to BlackRock's established investor base.

Fidelity Ethereum ETF (ETHF)

Fidelity’s ETF aims to track the performance of Ethereum and provide investors with direct exposure.

Fidelity is known for its extensive research and customer support services. The ETF is expected to attract both retail and institutional investors looking for a reliable entry into Ethereum investments. Fidelity has become an important player in the cryptocurrency investment space, offering a variety of digital asset services customized for retail and institutional investors. With Bitcoin and Efirium forming the backbone of its crypto portfolio, the firm continues to push for mass adoption.

VanEck Ethereum ETF (ETHV)

VanEck’s ETF offers direct exposure to Ethereum by holding the asset itself.

Known for its innovative financial products, VanEck’s ETF will likely appeal to investors looking for a trusted name with a history of successful ETF launches.

Analysts expect VanEck’s entry to bring competitive pricing and additional options for investors, potentially driving down costs across the ETF landscape.

Franklin Templeton Ethereum ETF (ETHFT)

Managed by Franklin Templeton, this ETF tracks Ethereum's spot price.

With a strong emphasis on security and regulatory compliance, Franklin Templeton’s ETF is designed to attract conservative investors seeking exposure to cryptocurrency within a regulated framework.

This ETF could draw significant inflows from risk-averse investors and those looking for a stable entry point into Ethereum.

Invesco Galaxy Ethereum ETF (ETHE)

A collaboration between Invesco and Galaxy Digital, this ETF provides direct exposure to Ethereum’s price.

It combines Invesco’s traditional financial expertise with Galaxy Digital’s cryptocurrency market knowledge. This partnership is expected to offer a unique blend of reliability and innovation.

How to invest in Ethereum ETFs: a step-by-step guide

When selecting an Ethereum ETF, consider factors such as fees, performance history, and liquidity. Diversification within your portfolio is also crucial to mitigate risks.

Step-by-step guide to investing in Ethereum ETFs:

Research and selection. Start by researching available Ethereum ETFs and comparing their features.

Opening a brokerage account. Choose a brokerage platform that offers Ethereum ETFs and open an account.

| ETFs | Demo | Min. deposit, $ | ECN Commission | Investor protection | Open account | |

|---|---|---|---|---|---|---|

| Yes | Yes | 100 | No | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 3 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | Yes | 100 | 5 | £85,000 | Study review | |

| Yes | Yes | No | 2 | $500,000 £85,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 1 | 2,3 | £85,000 €100,000 SGD 75,000 | Study review |

Placing your order. Decide on the number of shares you want to purchase and place your order through your brokerage account.

Monitoring your investment. Regularly review the performance of your ETF and make adjustments as needed.

Types of Ethereum ETFs

This section will explore the different types of Ethereum ETFs available, from spot and futures-based ETFs to leveraged and inverse ETFs, and highlight the key differences and benefits of each. Understanding these variations can help in making informed investment decisions and maximizing the potential of your Ethereum-related investments.

Spot Ethereum ETFs

Spot Ethereum ETFs directly track the price of Ethereum by holding the actual cryptocurrency. These ETFs provide the closest performance to owning Ethereum itself.

Futures-based Ethereum ETFs

Futures-based Ethereum ETFs track Ethereum's price through futures contracts rather than holding the cryptocurrency directly. These ETFs provide exposure to Ethereum's price movements but may not perfectly match the spot price due to the nature of futures markets.

Leveraged and inverse Ethereum ETFs

Leveraged Ethereum ETFs aim to amplify the returns of Ethereum by using financial derivatives, while inverse ETFs attempt to provide the opposite return of Ethereum. These are more suitable for advanced traders looking to capitalize on short-term price movements.

| Type of ETF | Description | Characteristics | Key differences |

|---|---|---|---|

Spot Ethereum ETFs | ETFs that hold actual Ethereum tokens, tracking the price directly. | - Direct ownership of Ethereum | - Closest performance to owning Ethereum |

Futures-based ETFs | ETFs that track the price of Ethereum through futures contracts. | - Uses futures contracts | - Potential for tracking errors due to futures market fluctuations |

Leveraged ETFs | ETFs that aim to amplify the returns of Ethereum, often by using financial derivatives. | - Uses leverage to enhance returns | - Can provide multiple times the daily performance of Ethereum |

Inverse ETFs | ETFs that aim to provide the opposite return of Ethereum's price movements. | - Uses derivatives to achieve inverse performance | - Designed to profit from Ethereum price declines |

Tips for traders

Beginners should understand basic investment principles, such as risk tolerance and market volatility. Starting small and gradually increasing investment can help manage risks. It's also essential to stay informed about regulatory developments.

Advanced traders might employ strategies such as hedging to protect against downside risk or leveraging to amplify gains. Understanding tax implications and maintaining a diversified portfolio are also important.

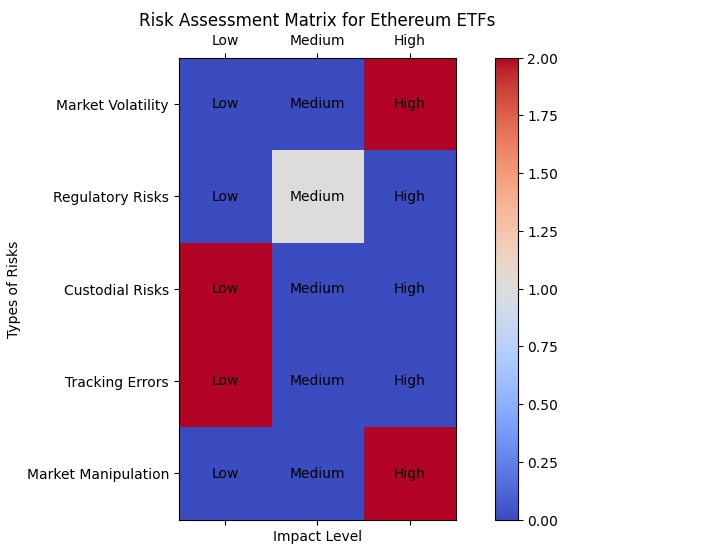

Risks and warnings

Investing in Ethereum ETFs comes with several risks, including market volatility, regulatory uncertainties, custodial and security risks, and potential tracking errors.

Market volatility. Cryptocurrency investments, including Ethereum ETFs, are highly volatile. Prices can fluctuate dramatically in short periods, leading to potential significant losses. Investors should be prepared for this volatility and consider their risk tolerance before investing.

Regulatory risks. The regulatory environment for cryptocurrency ETFs is still evolving. Changes in regulations or government policies can impact the value and legality of these investments. Staying informed about regulatory updates is crucial to managing these risks effectively.

Custodial risks. When investing in ETFs, custodial risks involve the safety and security of the underlying assets. If the custodian fails to safeguard the assets properly, it can lead to financial losses for investors. Ensure the ETF provider has robust custodial arrangements.

Tracking errors. ETFs aim to replicate the performance of their underlying assets. However, tracking errors can occur due to fees, market conditions, or management inefficiencies, leading to discrepancies between the ETF’s performance and that of the underlying asset.

Pros and cons

- Pros

- Cons

- Accessibility and liquidity. Easy to buy and sell on traditional stock exchanges.

- Diversification benefits. Adds a new asset class to your investment portfolio.

- Regulatory oversight. Provides a safer way to invest in cryptocurrencies under regulatory supervision.

- High volatility. Ethereum prices can fluctuate significantly.

- Fees and expenses. Management fees can erode returns.

- Potential for market manipulation. The cryptocurrency market is susceptible to price manipulation.

- Limited historical data. Ethereum ETFs are relatively new with limited performance history.

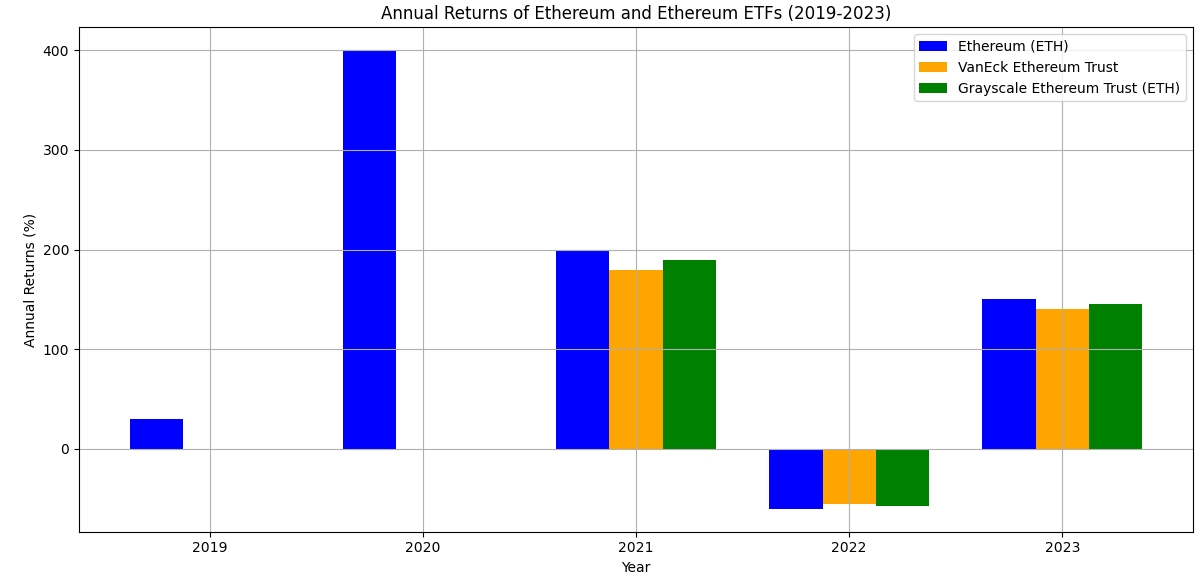

Above is a bar chart representing the annual returns of Ethereum and two of the earliest approved Ethereum ETFs from 2019 to 2023. The chart visually compares the annual returns of Ethereum with two prominent Ethereum ETFs, highlighting their performance over the years. This visual aids in understanding the volatility and potential earnings from investing in Ethereum ETFs.

Diversification is the key

As someone who has spent many years navigating the ups and downs of the trading world, I can tell you that Ethereum ETFs are an exciting but complex investment option. When considering Ethereum ETFs, it's important to understand that these financial instruments provide a regulated pathway to invest in Ethereum without directly holding the cryptocurrency. This can mitigate some of the security risks associated with digital wallets and exchanges. However, the volatility of the cryptocurrency market still applies, so be prepared for significant price swings.

One of the key strategies I recommend is diversification. Don't put all your eggs in one basket. While Ethereum ETFs can be a valuable addition to your portfolio, balance them with other assets to spread risk. Keep an eye on fees as well; high management fees can eat into your profits over time.

Staying updated on regulatory changes is important as well. The crypto landscape is constantly evolving, and regulatory decisions can have a big impact on your investments. Follow financial news, join trading forums, and consider subscribing to newsletters that focus on cryptocurrency and ETFs.

A mistake that most investors do is failing to set realistic expectations. While the potential for high returns exists, so does the risk of substantial losses. Start with a small investment and increase your exposure as you become more comfortable and knowledgeable about the market.

Conclusion

Ethereum ETFs offer a simple and regulated way to invest in one of the leading cryptocurrencies. They provide several benefits, including ease of access, liquidity, and diversification. For beginners, starting small and understanding the basics is key, while advanced traders can leverage sophisticated strategies to maximize returns.

Investing in Ethereum ETFs involves risks, such as market volatility and regulatory uncertainties, but the potential rewards can be significant. By choosing the right ETF and following market trends and regulatory changes, you can manage your investments effectively.

FAQs

How do Ethereum ETFs compare to direct Ethereum investment in terms of risk?

Ethereum ETFs generally carry less risk due to regulatory oversight, but they still reflect the volatility of the cryptocurrency market.

Can I use a Roth IRA to invest in Ethereum ETFs?

Yes, you can hold Ethereum ETFs in a Roth IRA, which can offer tax advantages for long-term investments.

What happens to my Ethereum ETF if the ETF provider goes bankrupt?

ETF assets are typically held separately from the provider's assets, so they should be protected even if the provider goes bankrupt.

Are Ethereum ETFs available in countries outside the U.S.?

Yes, Ethereum ETFs are available in several countries outside the U.S., but availability and regulations vary by country.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.