Euro (EUR) In The Forex Market | Key Facts To Know

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Euro (EUR) is one of the most significant and widely traded currencies in the Forex. Introduced in 1999, the Euro is the official currency of the Eurozone. The Euro itself is involved in more than 32% of daily Forex transactions, highlighting its importance in global trade and finance. EUR is part of the most traded currency pair in the Forex, the EUR/USD. This pair is known for its high liquidity and low spreads, making it a favorite among traders.

Given its pivotal role in global trade and finance, the Euro holds significant importance for Forex traders, impacting currency pairs, notably the EUR/USD, the most traded pair globally. In this article, we cover essential aspects of trading the Euro in Forex, including strategies, risk management, and key economic indicators.

Understanding the Euro (EUR)

History of the Euro

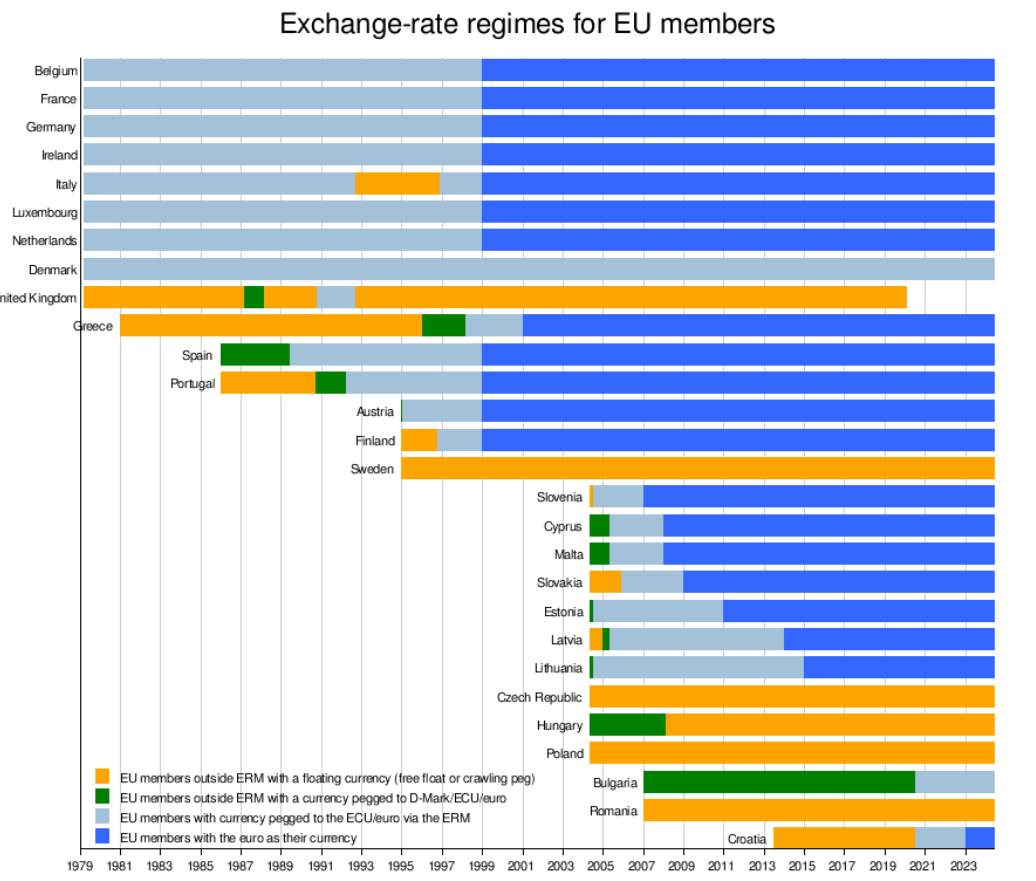

The Euro (EUR) was introduced on January 1, 1999, as a virtual currency for cashless payments and accounting purposes, marking a significant milestone in European economic integration. Euro is the official currency of 19 of the 27 European Union member states, collectively known as the Eurozone. This includes major economies such as Germany, France, Italy, and Spain. On January 1, 2002, physical Euro coins and banknotes entered circulation, replacing the national currencies of the initial Eurozone countries.

The currency is managed by the European Central Bank (ECB) and the Eurosystem, which comprises the ECB and the national central banks of the Eurozone countries.

Interesting facts about the EUR

High denomination banknotes - the Euro includes some of the highest denomination banknotes in circulation worldwide, including the €500 note, although the production of the €500 note was discontinued in 2019 to combat money laundering and terrorism financing.

Economic impact - the Eurozone's combined GDP is approximately $13.34 trillion, making it one of the largest economic regions globally. This economic strength underpins the Euro's significance in international finance and trade.

Euro symbols and design - the symbol for the Euro (€) was designed to be inspired by the Greek letter epsilon (Є), representing Europe, and also the first letter of the word "Europe." The two parallel lines signify stability.

Security features - Euro banknotes have advanced security features to prevent counterfeiting, including holograms, watermarks, microprinting, and ultraviolet ink. These features make Euro banknotes some of the most secure in the world.

Largest reserve currency - after the US Dollar, the Euro is the second largest reserve currency held by central banks globally. It accounts for approximately 20% of global foreign exchange reserves.

Economic integration - the introduction of the Euro has significantly facilitated trade and economic integration within the Eurozone, eliminating exchange rate risks and reducing transaction costs for businesses operating across borders.

Euro coins have a common reverse side that shows the denomination and a map of Europe. The obverse side has country-specific designs, allowing each Eurozone country to showcase its national symbols.

These facts highlight the Euro's role as a cornerstone of European economic policy and its impact on global finance.

Trading strategies for the Euro

Short-Term Strategies

Short-term trading strategies focus on making quick profits from minor price movements within a single day. Two popular short-term strategies are scalping and day trading:

Scalping: Scalping involves making numerous small trades throughout the day to take advantage of tiny price movements. Traders using this strategy typically hold positions for only a few seconds to a few minutes, aiming to accumulate small profits that can add up over time.

Day Trading: Day trading involves buying and selling the Euro within the same trading day, avoiding overnight positions. Day traders look for opportunities to profit from intraday price volatility, using technical analysis to identify entry and exit points.

Long-Term Strategies

Long-term trading strategies involve holding positions for extended periods to capitalize on significant price movements. Two common long-term strategies are swing trading and position trading:

Swing Trading: Swing trading involves holding positions for several days to weeks, aiming to profit from price swings or 'swings' in the market. Swing traders use a combination of technical and fundamental analysis to identify trends and potential reversals.

Position Trading: Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This strategy is based on the expectation that the Euro will move significantly in the trader's favor over time.

Pros and cons of trading Euro

- Pros

- Cons

- High liquidity - the Euro is one of the most traded currencies, ensuring high liquidity and tighter spreads.

- Strong economic backing - backed by the robust economies of the Eurozone, including Germany, France, and Italy.

- Diverse market opportunities - numerous financial instruments available for trading the Euro, including pairs like EUR/USD and EUR/GBP.

- Regulated market - trading the Euro is often done in highly regulated markets, offering security to traders.

- Wide availability of information - abundant analytical resources and economic data available for traders.

- Currency correlations - the Euro often correlates with other currencies, commodities, and stock markets. Understanding these correlations is crucial for risk management.

- Geopolitical risks - political instability in member countries can impact the Euro's value.

- Economic disparities - economic differences between Eurozone countries can create market unpredictability.

- Policy impact - ECB policies and decisions can cause rapid changes in the Euro's value.

- Complex interdependencies - the interconnected economies of the Eurozone mean that one country's issues can affect the entire region.

How to start trading EUR?

Starting to trade the Euro (EUR) involves several steps, from understanding the basics of Forex trading to selecting a broker and developing a trading strategy. Here’s a comprehensive guide to help you get started:

1. Learn the basics

Familiarize yourself with how the Forex market works, including key concepts like currency pairs, pips, leverage, and margin. The Euro is often traded against other major currencies like the US Dollar (EUR/USD), British Pound (EUR/GBP), and Japanese Yen (EUR/JPY).

2. Choose a reliable Forex broker

Ensure the broker is regulated by a reputable financial authority (e.g., FCA, ASIC, CySEC). Select a broker that offers a user-friendly and reliable trading platform (e.g., MetaTrader 4/5). Understand the leverage offered and use it cautiously, compare spreads, commissions, and other fees across different brokers.

Here are five top Forex brokers for trading the Euro (EUR) and their key features.

| Сurrency Pairs | Min. deposit, $ | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | ECN Spread EUR/USD, pips | Raw Spread EUR/USD, pips | Regulation | Open account | |

|---|---|---|---|---|---|---|---|---|

| 60 | 100 | 0,5 | 0,9 | No | No | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | Open an account Your capital is at risk. |

|

| 90 | No | 0,5 | 1,5 | 0,1 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | Open an account Your capital is at risk.

|

|

| 68 | No | 0,1 | 0,5 | 0,15 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | Open an account Your capital is at risk. |

|

| 80 | 100 | 0,7 | 1,2 | 0,2 | 0,1 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | Study review | |

| 100 | No | 0,2 | 0,8 | 0,2 | No | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA | Open an account Your capital is at risk. |

3. Open a trading account

Choose an account type that suits your trading style and capital (e.g., standard, mini, or micro account). Deposit funds into your trading account using a secure method (e.g., bank transfer, credit card, e-wallet).

4. Develop a trading plan

Define your trading goals, risk tolerance, and investment capital. Develop a strategy based on technical and/or fundamental analysis.

5. Practice with a demo account

Use a demo account to practice trading with virtual funds. This helps you get comfortable with the trading platform and test your strategy without risking real money. Also you can use copy trading or PAMM.

| Demo Account | Copy trading | PAMM | Open account | |

|---|---|---|---|---|

| Yes | No | No | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | Open an account Your capital is at risk. |

|

| Yes | Yes | No | Study review | |

| Yes | No | No | Open an account Your capital is at risk. |

6. Start trading live

Once you’re confident, start trading with real money. Use market, limit, and stop orders to execute trades. Implement risk management techniques such as stop-loss and take-profit orders to protect your capital.

7. Monitor and adjust

Regularly review your trades and performance. Analyze what worked and what didn’t. Keep up with news and developments that affect the Forex market, especially those related to the Euro and its major counterparts.

Risk management techniques for successfully trading EUR

Effective risk management will help to protect capital and ensure long-term success:

Diversification: This involves spreading investments across various currency pairs, asset classes, or markets to reduce exposure to any single risk. By diversifying, traders can mitigate the impact of adverse movements in any one asset.

Hedging: Hedging involves taking positions in different markets or assets that offset potential losses. For example, if a trader is long on EUR/USD, they might short another correlated pair to reduce risk.

Stop-Loss Orders: Stop-loss orders are set to automatically close a trade at a predetermined price level to limit losses. They are essential for maintaining discipline and preventing emotional decision-making during adverse market movements.

Euro is sensitive to political stability

Trading Euro for 15 years, I got some experience and tips to share with traders. When trading the Euro, keep a close eye on economic indicators from the Eurozone. Pay particular attention to the European Central Bank's (ECB) announcements, as they directly influence the Euro's value. For example, ECB interest rate changes and quantitative easing measures can significantly impact the market.

Stay informed about the economic health of major Eurozone countries, especially Germany and France. Indicators like GDP growth, employment rates, and consumer confidence are crucial. A decline in Germany's industrial output can lead to a weaker Euro.

Political events also play a significant role. The Euro is sensitive to political stability, so events like Brexit had a notable impact on its value. Elections in key countries or changes in EU leadership can introduce volatility.

Consider diversifying trading strategies. While EUR/USD is the most popular pair, exploring EUR/GBP, EUR/JPY, or EUR/CHF can provide additional opportunities. Each pair behaves differently, offering varied risks and rewards. Gather insights and tips from experienced Forex traders. Practical advice from experts can help refine your trading strategies and improve your chances of success.

Conclusion

To succeed in trading the Euro, it is important to stay informed about key economic indicators and events in the Eurozone. Paying close attention to GDP figures, employment rates, inflation, and ECB policy announcements is crucial, as these factors significantly impact the Euro’s value. Political events, such as elections and policy changes, can also introduce volatility.

FAQs

What is the importance of economic indicators in trading the Euro?

Economic indicators such as GDP, inflation, and employment rates significantly influence the Euro's value. Staying informed about these indicators helps traders anticipate market movements and make informed decisions.

How can risk management improve trading success?

Effective risk management involves setting stop-loss orders, determining appropriate position sizes, and diversifying investments. These practices help protect capital, limit potential losses, and ensure long-term trading success.

What strategies are commonly used for trading the Euro?

Common strategies include scalping and day trading for short-term gains, and swing trading and position trading for long-term profits. Advanced traders may use trend following, arbitrage, and algorithmic trading to optimize their trades.

Why is it important to use a demo account before live trading?

A demo account allows traders to practice strategies and become familiar with the trading platform without financial risk. It helps build confidence and refine approaches, making the transition to live trading smoother and more successful.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.