How to Legally Start Trading Forex in Nigeria

Best Forex broker for beginners in Nigeria - RoboForex

With Nigeria's growing appetite for Forex trading, many aspiring traders wonder about its legality and how to participate safely. This article includes the following:

-

Forex trading is not directly regulated in Nigeria, with light touch oversight by the CBN

-

Traders must vet brokers carefully, as there is less protection against scams

-

Prioritize brokers regulated internationally by FCA, CySEC, and ASIC

-

Compare broker fees, platforms, account options, and customer support

-

Top brokers like RoboForex and Exness offer global regulation

-

Start trading small and manage risk prudently as a beginner

-

Use brokers offering education and market research tools

-

Ensure convenient deposit/withdrawal methods and Naira accounts

-

With caution, Forex is accessible to Nigerian traders despite vague regulations

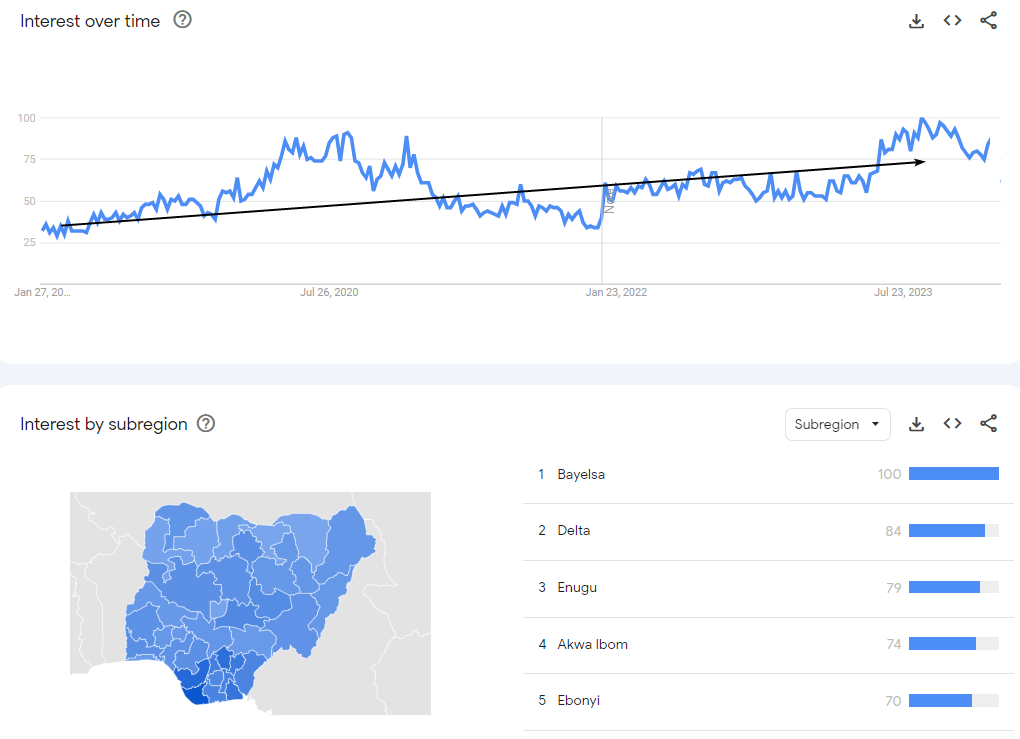

Forex trading has exploded in popularity across Nigeria in recent years. With promises of wealth and independence, it's an alluring opportunity for Nigerians seeking additional income streams.

The popularity of forex trading in Nigeria is on the rise

However, vague regulations and potential scams raise questions about Forex trading's legality and safety. This article clarifies the status of Forex trading in Nigeria, recommends best practices for beginners, and shares guidance for selecting regulated brokers to trade securely under local laws.

-

Can I start Forex trading on my own?

An individual retail trader can open a Forex trading account directly with a brokerage and start trading independently using their trading platforms and tools. However, given Forex's steep learning curve, beginners should get substantial education before risking capital.

-

How can I fund my Forex account in Nigeria?

Nigerian Forex traders have several options to fund trading accounts, such as bank wire transfers, debit cards, credit cards, and electronic wallets like Neteller or Skrill. Compare funding options from brokers to choose the one that works best based on processing times, fees, and convenience. Start with small deposits and scale up as you gain experience.

-

Is Forex taxed in Nigeria?

The Federal Inland Revenue Service (FIRS, firs.gov.ng) is responsible for tax collection in Nigeria. Profits generated from Forex trading are categorized as capital gains, subject to capital gains tax of 10% on the gross profit amount.

-

How much to start trading Forex?

The Forex market has become increasingly accessible for small retail traders, with brokers now allowing account openings with minimal initial deposits as low as $50. However, aspiring Forex traders should carefully weigh the pros and cons of starting with such a small balance.

Rules and Regulation

Licensing in Nigeria

Nigeria's regulation of Forex falls under the purview of the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN):

- Forex trading itself is legal for Nigerian residents.

- Unlike Malaysia, Nigeria doesn't have a central body solely dedicated to Forex regulation.

- There's some debate on the involvement of regulatory bodies like the Securities and Exchange Commission (SEC) or the Central Bank of Nigeria (CBN) in overseeing Forex brokers.

- Requirements and process for obtaining a Forex broker license in Nigeria are unclear. Information about "ready-made licenses" you might find online should be approached with caution.

Investor protection in Nigeria

Investors in Nigeria are protected by the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). Forex investor protection is a complex issue due to the absence of a well-defined regulatory framework.

Taxation in Nigeria

Forex traders are required to report their trading income to FIRS (The Federal Inland Revenue Service) and pay income tax on their profits at the applicable tax rates. Nigeria operates a progressive income tax system, with tax rates ranging from 7% to 24% for individuals, depending on their total taxable income.

Best Forex brokers in Nigeria?

Your location is United States

If you would like to learn about the best brokers in your region, please use the “Find my broker” service.

How can I start Forex trading in Nigeria?

Even with limited regulation, Nigerians can still trade Forex safely by being careful and informed:

-

Choose a Broker Carefully. Be cautious of local brokers who promise a lot but don’t have much proof of success. Look for brokers who are regulated by well-known international bodies. To carefully select the platform, you can refer to this article - Best Online Trading App In Nigeria for 2024 - Top 5 Comparison

-

Learn About Forex. Before you start trading with real money, take time to learn about Forex. Use online courses, ebooks, and practice accounts to understand the basics, like reading charts, managing risk, and knowing how global events affect currencies

-

Only Invest What You Can Lose. Forex trading can lead to considerable losses because of high leverage. Only use money you can afford to lose and always set stop losses to limit potential losses

-

Watch Out for Scams. Some people might try to trick new traders. Avoid anyone who promises quick and easy money in Forex trading. Real success takes time and learning

Tips for Beginner Forex Traders in Nigeria

Remember the following tips before risking capital:

-

Learn solid technical analysis skills: Spot trends, support/resistance, chart patterns, and indicators. Practice extensively on demo accounts

-

Master prudent risk and money management: Limit position sizes, stop losses, and take profits to protect capital

-

Trade Patiently: Wait for high-probability setups. Don't overtrade. Adopt longer time horizons aligned with major trends

-

Keep a trading journal: Track all trades and analyze mistakes and successes to improve continually

It should also be realized that Forex trading is a popular but not the only approach for making profits. Here are some alternatives worth considering for potential traders from Nigeria:

-

Stocks: Many thousands of companies' stocks are traded on the stock market - far more than currency pairs. Try your hand at being a stock trader by starting by reading this article: Best Stock Brokers In Nigeria - TOP 5

-

Binary Options: They can be an alternative because of their dynamism and special simplicity in decision making. Read more in the article: Binary Options Trading In Nigeria: A Full Beginner's Guide to get more insights into binary options

-

Diversify your efforts: Not everyone has the ability to become a trader. You may be able to achieve greater success in other ways. Check out this article: Top Ideas For Extra Income In Nigeria while you are in your learning phase

Summary

Forex trading in Nigeria operates in a gray regulatory area without explicit oversight. While the Central Bank of Nigeria has some high-level authority, specific trading rules and protections for individual traders are limited. As such, Nigerians participating in Forex must take care in selecting reputable brokers and developing their trading skills.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.