Best Copy Trading Apps In The Netherlands

The best copy trading platform in the Netherlands - eToro

Best copy trading platforms in the Netherlands:

eToro (Copy Trader) - best copy trading platform for all traders

RoboForex (CopyFx) - best copy trading platform for beginner traders

Tickmill copy trading - best for offering analytical instruments for Forex trading and copy trading

IC Markets - provides traders with three supported social trading networks with extra low fees

AvaTrade (AvaSocial) - best copy trading app for novice traders

There are many ways to earn money from Forex trading without stress or creating any trading strategy yourself; copy trading and PAMM accounts are top examples. With copy trading platforms in the Netherlands, you can start making money from Forex trading without having the necessary trading knowledge. As long as a trader chooses the experts they will be copying their trades from carefully, this method of making money with Forex is not challenging.

This article will specifically assist traders in identifying the best Copy trading platforms in the Netherlands, especially beginner traders who do not know much about Forex trading. Read on to discover them.

Copy trading platforms in the Netherlands - Comparison

Before you decide which of these copy trading platforms in the Netherlands is best, compare each broker's copy trading features. The table below summarizes the minimum deposit requirements and available trading options for the best copy trading app in the Netherlands.

| Minimum Deposit | Markets | ||

|---|---|---|---|

eToro (Copy Trader) |

$200 |

US Stocks, Forex, Crypto, ETFs |

|

RoboForex (CopyFx) |

$100 |

Over 12.000 assets: Forex, stocks, ETFs, crypto |

|

Tickmill |

$100 |

Forex, Stocks, Crypto, Bonds |

|

IC Markets |

$200 |

Forex, CFDs, commodities, Crypto, Stocks, Bonds |

|

AvaTrade (AvaSocial) |

$100 |

Crypto, Forex, Stocks, ETF, Bonds, commodities, and CFDs |

eToro (Copy Trader) - best copy trading platform for all traders

eToro is a multi-asset investment platform that offers market analysis, comprehensive tools, and impressive copy-trading capabilities. Through the eToro CopyTrader feature, users can explore the profiles of successful traders and copy their trades. eToro also offers CopyPortfolios, which group assets based on a specific market approach, providing diversified investments. The platform has a user-friendly interface, educational resources, and innovative trading tools.

👍 Pros

• Well-regulated platform

• User-friendly interface and copy trading features

• Innovative trading tools

👎 Cons

• Limited educational resources

• Wide spreads resulting in higher trading costs

RoboForex (CopyFx) - best copy trading platform for beginner traders

RoboForex's CopyFX is an investor-friendly platform that allows users to copy the trading strategies of professional traders without needing prior experience. With complete control over their investments, users can subscribe to professional traders, copy their transactions, and benefit from the Forex market. The platform offers user-friendly tools and a transparent interface, making it an excellent opportunity for both investors and traders.

👍 Pros

• Convenient tools for investors

• Transparent trading control

• Options for Traders on Profits/Commissions

• All-in-one trading account

👎 Cons

• Limited filters

• High commissions

• Registered offshore

Tickmill - best for offering analytical instruments for Forex trading and copy trading

Tickmill is a platform that offers various analytical instruments for Forex trading and copy trading. It partners with MyFxBook to provide copy trading services, and users need accounts on both platforms. Tickmill has a high entry threshold for copy trading, with a minimum investment of $1,000. The platform is licensed by respected regulators such as FCA, CySec, and FSCA, ensuring safety and regulation.

👍 Pros

• Partnered with MyFxBook for copy trading services

• Licensed by respected regulators

👎 Cons

• High entry threshold for copy trading

IC Markets - provides traders with three supported social trading networks with extra low fees

To copy trades with IC Markets, users can link their account to ZuluTrade, an innovative copy trading platform that allows duplication of successful traders' positions. With over 90,000 signal contributors, ZuluTrade provides access to a wide range of traders worldwide. The platform offers advanced features like ZuluGuard for capital protection and a user-friendly interface. Additionally, Myfxbook Autotrade allows traders to copy trades directly into their MT4 account.

👍 Pros

• Fast and easy connection with top brokers

• All-in-one trading account

• Dedicated crypto copy trading area

👎 Cons

• ZuluRank algorithm could be improved

AvaTrade (AvaSocial) - best copy trading app for novice traders

AvaTrade is another leading trading platform offering social and copy trading services. The platform provides secure investments with high regulations, including the Central Bank of Ireland and ASIC. Users can access the AvaSocial mobile trading platform to copy top traders easily. With collaboration with top copy trading providers like ZuluTrade, DupliTrade, and MQL5, users gain access to thousands of signal providers and investors.

👍 Pros

• User-friendly mobile social trading platform

• Collaboration with top copy trading providers

• Wide range of instruments and markets

👎 Cons

• High minimum deposit

Rules and Regulation

Licensing in the Netherlands

Forex trading in the Netherlands is regulated by the Authority for the Financial Markets (Autoriteit Financiële Markten, AFM) and the Dutch Central Bank (De Nederlandsche Bank, DNB).

The Netherlands has a two-side approach to licensing for businesses:

- general business registration

- specific permits and licenses

Investor protection in the Netherlands

The Netherlands implements Forex investor protection measures through a combination of regulations and membership in European Union (EU) directives. Investors are protected by the Authority for the Financial Markets (Autoriteit Financiële Markten, AFM).

Taxation in the Netherlands

The income tax rates in the Netherlands are progressive and range from 37.1% to 49.5% for individuals, depending on their total taxable income.

What is Copy Trading?

Copy trading is an increasingly popular kind of social trading. This strategy allows new traders to either automatically or manually copy the trades of professional traders on the Forex and other financial markets.

In 2010, eToro was the first major broker to provide a copy trading platform. The creators combined the features of a social network for traders with a platform for copying trades.

Modern copy trading platforms have features that let users subscribe to traders and start copying their trades, either with a small amount of money or their whole account balance. Each position created by the copied trader, including stop-loss and take-profit orders, is immediately executed on the account of the copier. It is also possible to generate a portfolio analogue from multiple signal providers.

How to choose a copy trading broker in the Netherlands

Making covert evaluations of the services a copy trading broker provides is necessary for the trader to select the best copy trading platform in the Netherlands. Before registering with a copy trading platform in the Netherlands, a trader should take account of the following variables.

You should start by researching whether the Forex broker accepts clients from this part of the globe

Next, check the broker's dependability and regulatory standing. At this stage, your goal should be to register with a broker governed by a reliable financial organization

When investigating the broker's trading conditions, find out about the commissions, spreads, selection of trading instruments, and order execution quality. Traders can improve their profitability by finding a broker with a competitive cost structure

You should research the network size, because, in social trading, copy trading platforms in the Netherlands with a larger network offer their clients better opportunities since there are more traders to copy trades from

Each broker employs a unique trading platform. Learn about the options for choosing traders, risk management standards, and payment options. Before you start copying the trades of experts, use demo accounts to get familiar with the platform's specifics

Because copy trading platforms occasionally experience problems and copiers require assistance using the menus, copy traders should ensure that support is available 24/7

How can I find good traders to copy?

It is essential to conduct thorough research on the leading copy trading platforms in the Netherlands in light of the current Forex trading risks. Since integrating these strategies will involve risking your money, you should be certain of the trader you are copying. Therefore, if you copy a poor strategy, you will undoubtedly lose money.

You will be one step closer to discovering the best trader-to-copy trading strategies if you can locate the best copy trading platforms in the Netherlands. But it takes work and talent to identify the best of these traders.

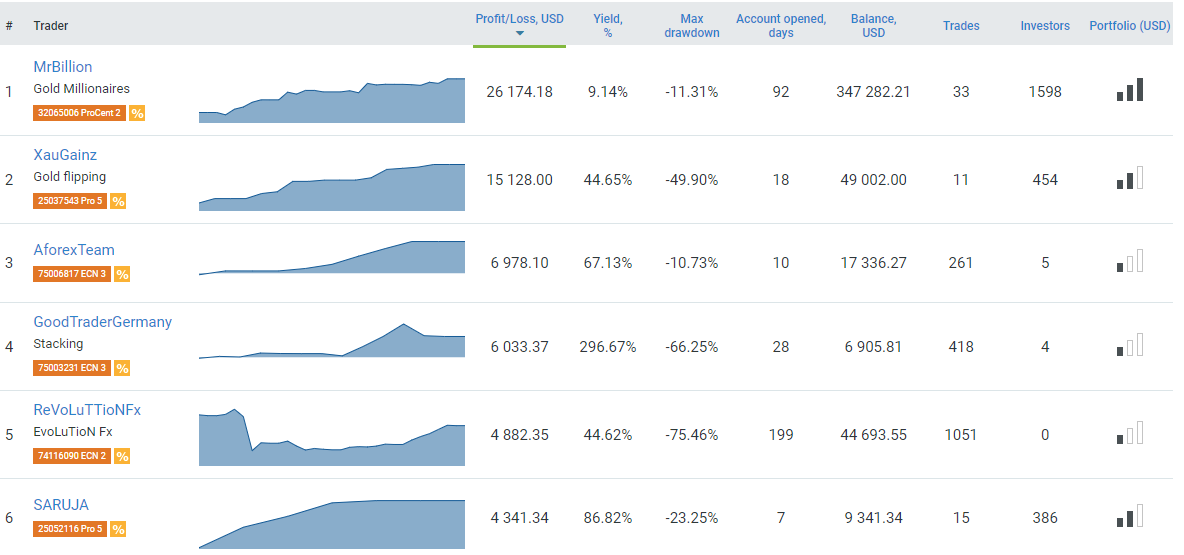

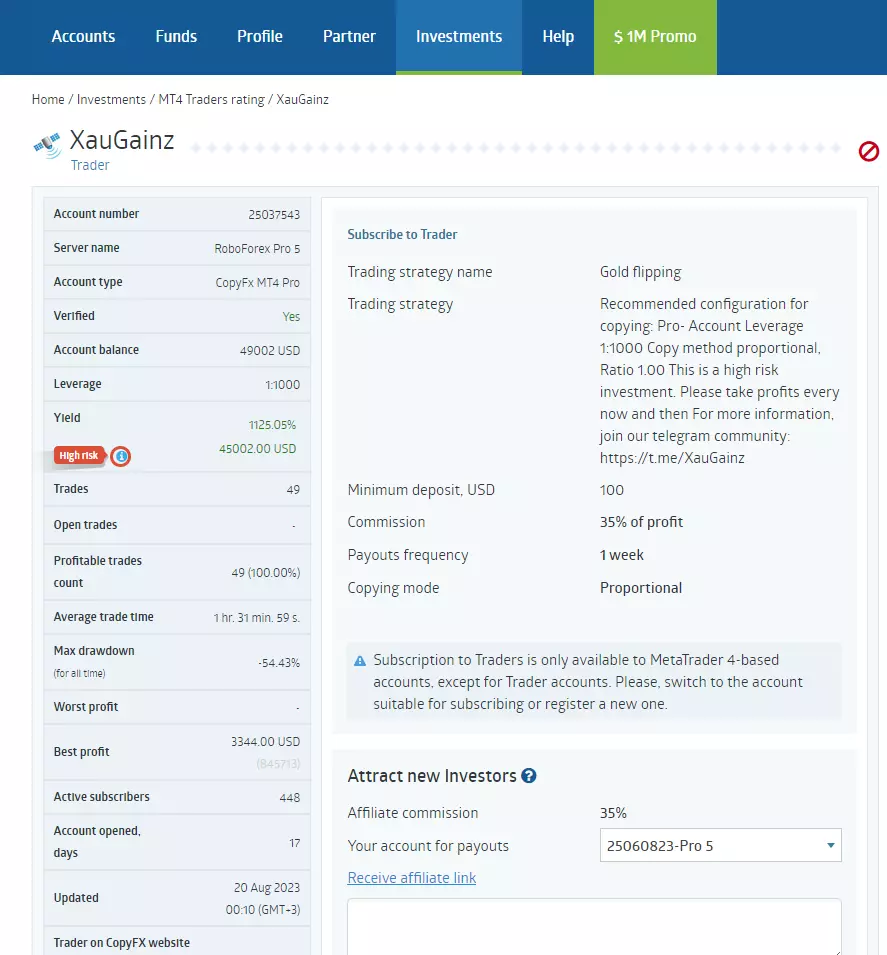

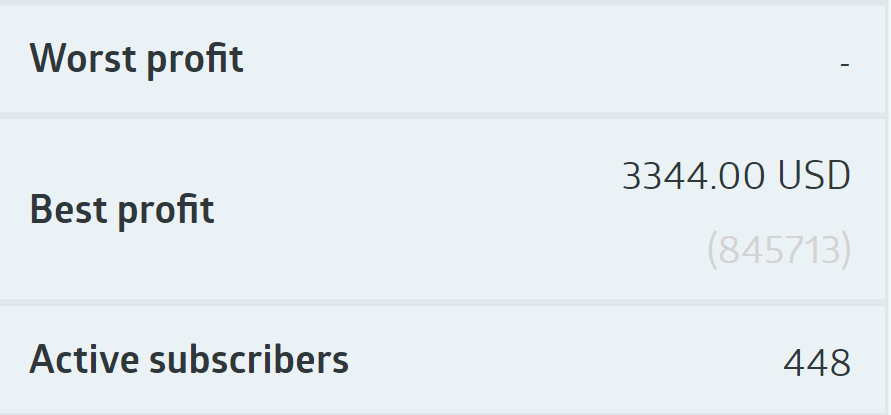

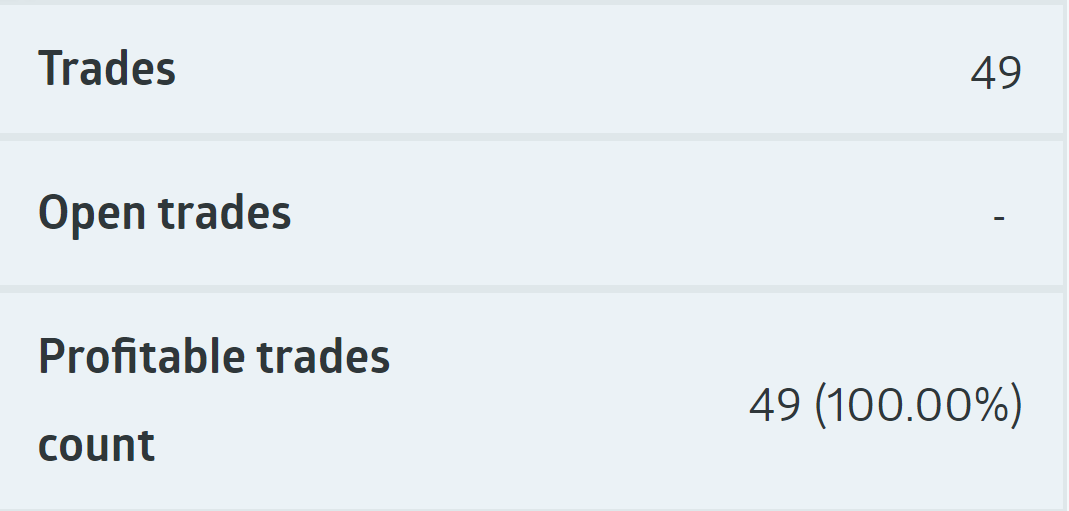

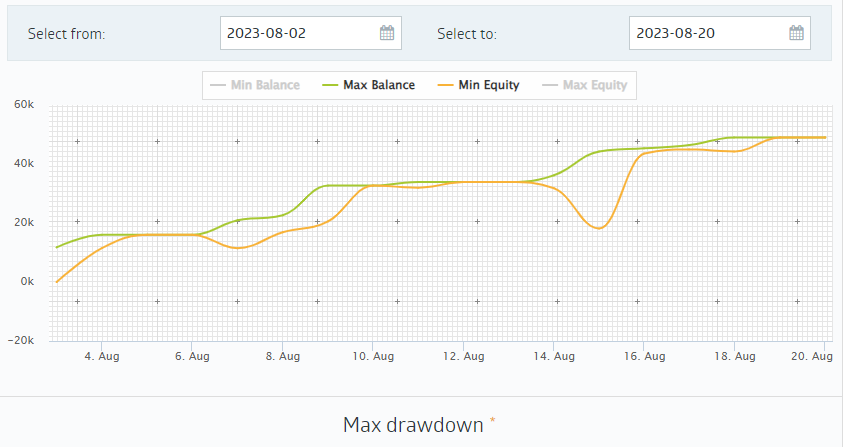

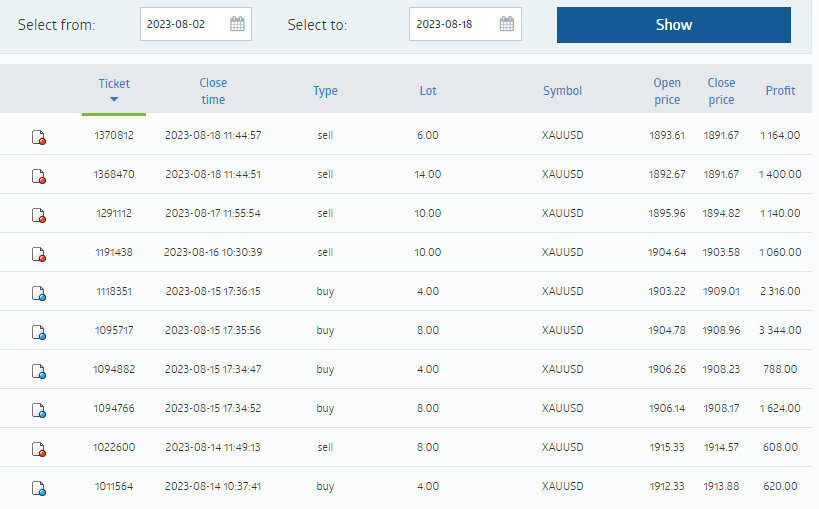

We will use RoboForex CopyFx to show you what to look for when choosing the best traders to copy. To view trader profiles and copy their trading methods, open RoboForex CopyFx and register.

RoboForex CopyFx

Select the trader whose profile grabs your attention to see a customized view of that trader's profile.

RoboForex CopyFx

These guidelines or pointers can help you when you are looking for copy trading platforms in the Netherlands to use when you want to copy trading strategies.

1. Determine the level of trust that the trader's followers have in the assumed expert trader

How to Find Good Traders to Copy

The quickest way to identify a great social trader is to look at how much trust their followers have in them. Take a look at the benefits for the signal provider's followers by following in the trader's footsteps. See how much other people have invested with them using real money (not practice accounts) to get trader signals.

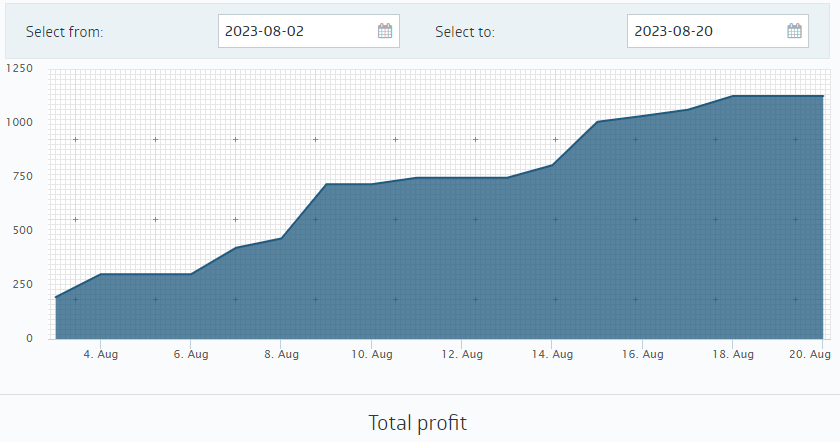

2. Determine the trader's annual or monthly returns

How to Find Good Traders to Copy

Negative returns can be a red flag, but extremely high returns, while appealing, should be carefully examined. Analyzing the monthly returns to ascertain whether the performance is attributable to a specific month or months will help you make an accurate assessment. You can avoid dealing with traders who have erratic graphical displays by glancing at their profit charts, which will reveal how consistently profitable the traders are.

Dealing with traders who achieve 97% to 100% returns or higher requires extra caution.

3. Determine how many transactions the signal provider makes

How to Find Good Traders to Copy

Another factor you must consider while examining a trader's profile on a copy trading platform in the Netherlands is how many transactions the signal provider makes. A high value may be an indication of a trader's expertise and the fact that their success is not accidental.

4. Determine the trader's highest drawdown

How to Find Good Traders to Copy

The amount of money a trader lost before realizing a profit again is referred to as a drawdown, so become familiar with it. This can be calculated by subtracting a relative capital peak from a relative capital trough and then expressing the result as a percentage of the trading account.

5. Examine the trader's past transactions

How to Find Good Traders to Copy

View the trader's prior dealings for a specific period. This sector includes information on the typical order types used by traders, trading lots, symbols, open and close prices, and profits. The use of the stop-loss function is a key risk management principle, so confirm that the trader is utilizing it.

How much can I earn?

Your earnings as a copy trader can depend on various factors. As a beginner, you will find it difficult to copy the trades of professional traders, hence, you may end up making low earnings. However, after choosing and copying professional traders, you might earn more.

As it said above, usually the best professional traders can make from 5% to 30% per month, however such a range is not constant. Remember that the risk of loss remains in any kind of investment.

Is Forex copy trading risky?

Yes, Forex copy trading could be risky if you happen to register with an unregulated Forex broker or fail to properly investigate the performance of an expert trader before copying their trades. Hence, your choice of broker and the trader you trade with could make or break your chances of having a profitable trading session.

The disadvantage of copy trading is that even experienced traders can experience losses. There is no guarantee that any trading strategy you copy will be profitable; remember that no trader is immune from losing money. Trading success cannot be guaranteed when you copy the trades of even the best Forex trader, whose profile shows a 97 percent trading success rate.

Summary

The opportunity to copy the trades of savvy and successful Forex traders is a feature many Forex brokers are integrating on their copy trading platforms. Therefore, not every broker may have the best copy trading features. Hence, traders should take the assignment of researching copy trading platforms in the Netherlands seriously, as it determines how much profit they will make in the long run.

Copy trading in the Netherlands is profitable for new traders, as they can learn Forex trading strategies quickly and efficiently by copying the trades of a more seasoned trader.

FAQs

Can you make a living from copy trading?

Yes, you can make a living from copy trading. But you need to copy trades from the best trading platforms.

How much money do I need to start copy trading?

The broker's minimum deposit is enough for you to start copying trades.

How risky is copy trading?

Copy trading is risky if you copy trades from unregulated brokers or without examining the expert trader's performance.

Can I lose in copy trading?

Yes, but the trader from whom you copied these trades also lost money, so you are not the only loser.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).