AvaTrade is one of the largest brokers in the world, providing its customers a wide range of social and copy trading services. The strong suits of AvaTrade feature regulation by 7 top authorities, including the Central Bank of Ireland and Australian Securities and Investments Commission (ASIC).

AvaTrade offers its proprietary mobile social trading platform AvaSocial enabling users to copy trades of professionals using a user-friendly app. We will focus on this platform in our review.

Also, AvaTrade works with top three copy trading platform providers – ZuluTrade, DupliTrade and MQL5. The broker therefore offers its clients one of the best choices for copying trades in the market. After all, these three platforms together feature thousands of signal providers and dozens of thousands of investors.

What does copy trading mean

Copy trading is an excellent opportunity for novice traders to start working in the financial markets without spending years learning and practicing. The idea of copy trading is based on uniting experienced traders and beginners on one platform. Traders do what they love most – develop strategies, perform trades, monitor risk management.

The task of the beginner is to find a manager on the platform who will show stable profit. After subscribing to him/her, the trader’s trades will be copied to the beginner’s account automatically or manually.

Copy trading solves several issues novice traders have:

-

1

It ensures easier access to the market for players without special knowledge and extensive experience;

-

2

It can potentially provide an income at the level of professional traders;

-

3

It offers a comparatively low entry threshold.

However, copy trading has not only advantages, but also drawbacks. In particular, excellent results of traders in the past do not guarantee the same outcome in the future. Also, the broker’s proprietary platform has been launched only recently and it is still developing.

AvaTrade copy trading pros and cons

👍 Pros

• Partnership with top three social trading platform providers

• Proprietary app for social and copy trading

• Wide selection of trading instruments

• Regulation in EU, Japan, Australia and South Africa

👎 Cons

• Proprietary copy trading platform AvaSocial has been launched only recently and still requires improvement

What is AvaTrade social trading network in 2024

Let’s look at the main features of AvaSocial social trading platform from AvaTrade as of 2023.

Regulation |

Broker - Central Irish Bank, ASIC, FSCA, Japanese FSA Platform developer - FCA |

Minimum investment |

$100 |

Trading platform |

MT4 |

Additional commissions for copying |

No |

Markets |

Forex, CFDs, Bonds, Indices, Stocks, Cryptocurrencies |

Number of instruments |

over 1,250 |

Average spread on EURUSD |

0.9 pips |

Size of the network |

Around 100 signal providers |

AvaSocial copy trading network review

AvaSocial operates as a mobile application, which was developed in partnership with social trading platform provider Pelican Trading, a company regulated in the UK (FCA).

The platform combines the features of a social trading and copy trading network. It allows to:

-

1

Exchange experience and create communities based on common trading interests;

-

2

Post messages, comment and rank posts of others;

-

3

Subscribe to experienced traders, copy their trades automatically or manually.

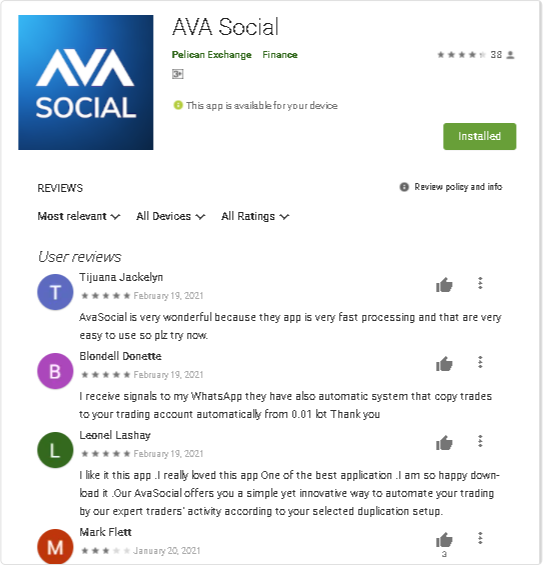

As of January 2023, the reviews about AvaSocial on Google Play Market were mostly positive. The average score of the app is 4.3, which is a rather good result. However, only 1,000+ downloads speaks for currently low popularity of the platform.

Noteworthy, in order to use the AvaSocial app, you need a live account or a demo on AvaTrade.

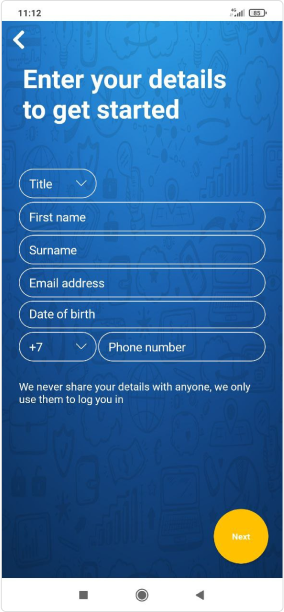

Registration on AvaSocial

Registration on AvaSocial is quite simple. However, to complete registration, you will need a Demo or live account on AvaTrade.

-

1

You need to provide your name, email address and your phone number, and then click Next.

-

2

Here, you need to specify your professional level, the markets you prefer to work on, investment amount and long-term goals.

-

3

Next, you need to provide an AvaTrade account number and password. After that the app’s main page will open. If you do not have an account on AvaTrade, you will have to register there first.

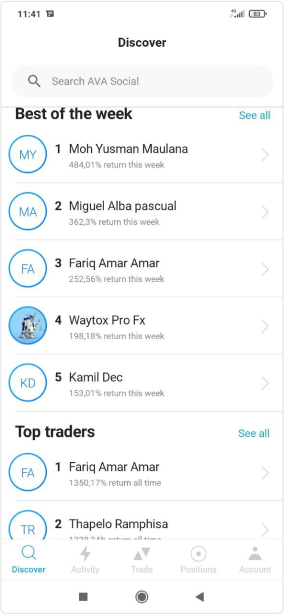

Trader rating

On the first page of the app, you will see the rating of the top managers, chosen by an algorithm. They are split by the following categories: Top Traders, Spotlight and Best of the Week. You can evaluate a trader’s performance already on the main page. It can be specified for the week for Best of the Week or for the entire period of work for all others.

Trader profiles

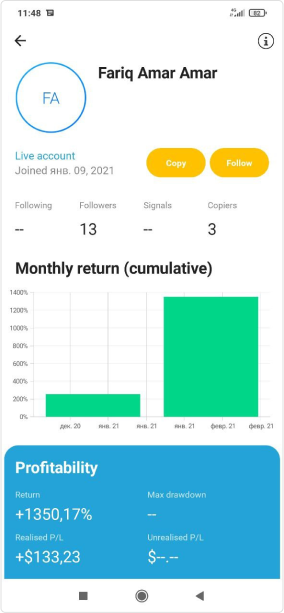

When you click on the trader’s page, you will see the following information:

-

1

The date when the trader joined the platform;

-

2

Number of copiers;

-

3

Number of users the trader follows (following);

-

4

Number of followers;

-

5

Below you can review the trader’s profitability results.

As you can see, even a trader who was included in the top traders list on the app has only three copiers and 14 followers. The most popular traders have over 100 copiers and followers. This proves that the app is still gaining popularity. For comparison, the top traders on the eToro platform have up to 20,000 investors. In addition, to evaluate a trader’s profitability based on 2-3 months of work is too premature. Very good results can be explained not by skills, but by luck.

You can also review the following data on the trader’s page: trading history, open positions, achievements in the community, the groups a trader is a member of, etc. It all strongly resembles trader profiles on the social trading platform eToro, only an abridged version of it. There is fewer personal data and the statistics is rather general.

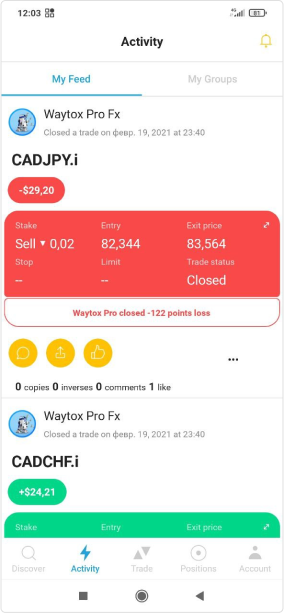

Activity

Activity shows social activity in the AvaSocial network. Everything here is as in a typical social network. After you subscribe to a trader or a group, their actions and updates will show in your feed. You can like, comment or share trader’s trades.

Trade Section

This section features the list of markets for trading. The features are extremely simple. You can monitor the charge only on 4 timeframes.

When you click on Buy or Sell, a window will open, where you can also specify the amount of the trade and the order type.

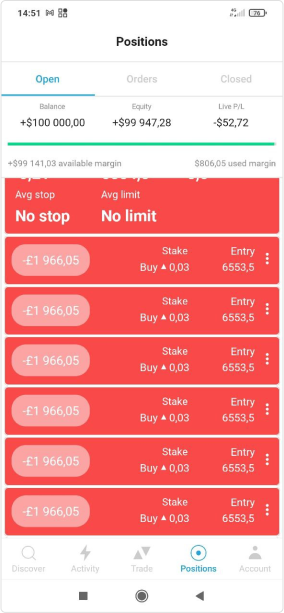

Positions

This section features the entire statistics on open positions and limits.

Account

This section features personal data, social activity, number of copied traders, monthly return, maximum drawdown of the portfolio.

AvaSocial pros and cons

👍 Pros

• Simple and user-friendly application

• No additional service fee charge

• Well-designed social features

👎 Cons

• Small history for performance analysis

• Only basic statistics on traders

• Low number of participants

How to find the right trader to copy?

At the time this review was being prepared, AvaSocial by AvaTrade did not have a big choice of options for searching traders to copy. The app does not have advanced filters yet, although there are not so many profiles, so the majority of them can be viewed by trial method.

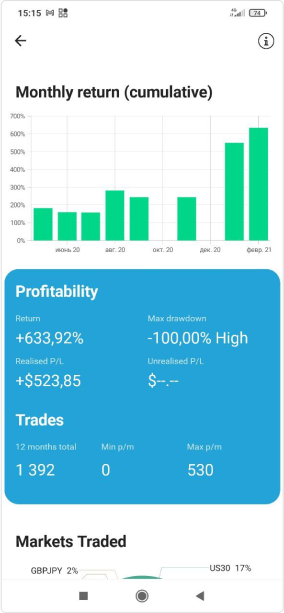

Since the app is rather new and features only a small statistical database, we recommend taking into consideration the following when searching for a trader to copy:

-

1

Pay attention not only to the general profitability, but also maximum drawdowns. The lower they are the better. For example, the trader on the example below has a return rate of 633%, however, the maximum drawdown reached 100%. This means that the risk of working with him is extremely high.

-

Look for traders with the longest history of trading on AvaSocial. The impressive results over short periods may be explained only by pure luck. Stability is the most important thing for traders.

2 -

3

Do not forget about the option of setting a maximum drawdown for each trader. If it is reached, copying of trades will stop, which could keep your capital away from trouble.

Also, look at the reviews of the subscribers and copiers about the trader. The purpose of the social platform is, after all, about sharing experience.

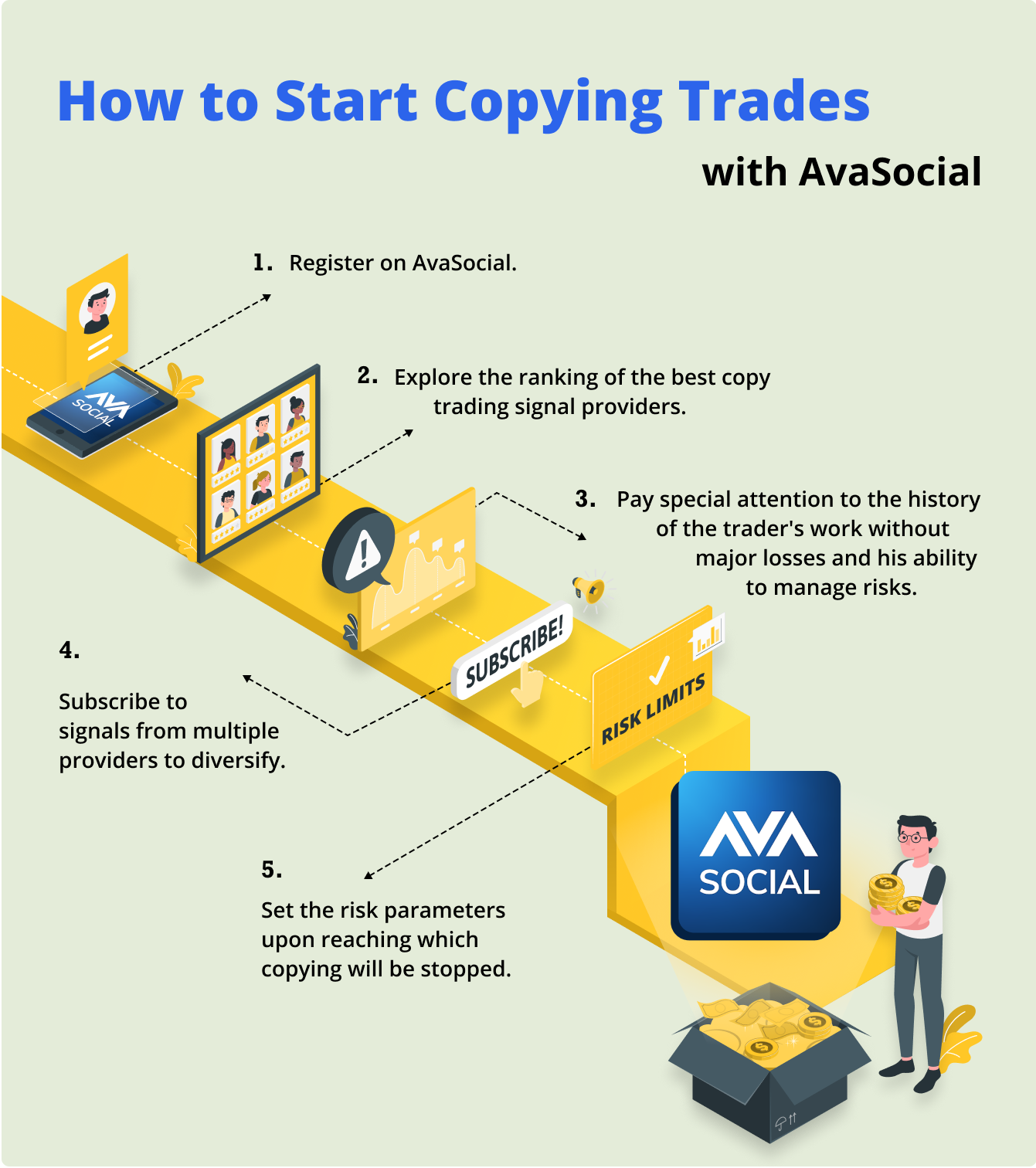

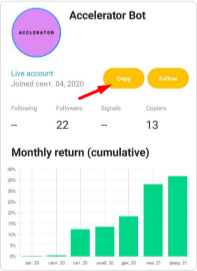

How to get started with copying trades on AvaTrade?

After you’ve made your choice about the trader, you can start copying trades. For this, on AvaSocial go to the page of the trader and click on the Copy button in his/her profile.

There is a hitch, however – in order to start copying you will need to register with AvaTrade’s partner Pelican Asset Manager. The registration screen will pop up when you click on the Copy button. The registration is an 8-step procedure that will take you about 10-15 minutes. The applicants are required to provide a rather impressive amount of personal data: National Insurance Number, profession and area of employment, financial status, income and even how the loss of investment will affect the applicant’s well-being.

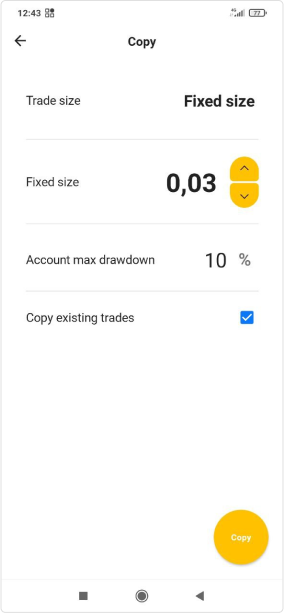

After all questionnaires have been filled out, you will finally be able to click on Copy to start copying the trader you’ve chosen. A window will pop up, where you have to fill out the following:

-

1

Trade size.

You can copy traders either fully or select a small share of the lot.

-

2

Maximum drawdown.

This one needs to be treated very carefully, and it is best not to allow the loss of more than 10-20%.

-

3

You can also tick the box in order to copy all existing traders of the trader.

Next, click on Copy once again and the trader will be added to the list of the copied traders. If for some reason, you no longer want to copy a particular trader, you can unsubscribe in his/her profile. You can also change copying criteria there.

You will be able to monitor all open and closed positions in the Positions tab of the app. There, you will also be able to manually close, edit any of the positions, view the instrument’s chart, and share the trade in a group.

Copying performance is shown in the Account tab.

ZuluTrade, MQL5 and DupliTrade platforms from AvaTrade

In addition to the proprietary, but still fresh and developing social trading platform, AvaTrade offers the services of three leading providers ZuluTrade, MQL5 and DupliTrade. In total, these copy trading platforms from AvaTrade have several thousand signal providers, feature advanced statistics and search filters.

We have dedicated reviews on copy trading using each of the platforms, which is why here we will list the key features of using them with AvaTrade in the form of a comparative table.

Copy trading platform |

|

|

|

|---|---|---|---|

Regulation |

Greece and EU (HCMC), USA (CFTC), Japan (KFB) |

Not regulated |

CySEC |

Minimum investment with AvaTrade |

$/€/£500. |

$1 |

$2,000 |

Trading platform |

MT4, MT5 |

MT4, MT5 |

MT4, MT5 |

Service use fee |

$30 monthly subscription |

No |

No |

Trader’s commission |

25% share of profits |

from $1 to $1,000 per month. $50 on average |

No |

Markets |

All AvaTrade markets |

All AvaTrade markets |

All AvaTrade markets |

Number of signal providers |

1,000+ |

1,000+ |

12 |

read ZuluTrade review |

read MQL5 review |

read DupliTrade review |

As you can see, AvaTrade has copy trading options to any taste and pocket. If you are interested in one of the social trading platform providers, read the detailed review with user comments.

Can I make money by copying traders on AvaTrade?

Most definitely yes. AvaTrade is one of the best brokers for social trading. It has all the options for successful work:

-

Licenses from several top regulators on 6 continents.

-

Proprietary social trading platform.

-

Over 1,250 instruments in the majority of top markets.

-

Three additional platforms from the world’s top copy trading platform providers.

Important!

However, one should keep in mind that excellent results of the traders in the past do not guarantee the same outcome in the future. Invest in copying traders rationally, applying caution and observing risk management rules.

How much does AvaTrade copy trading cost?

AvaTrade does not charge any additional fees for copy trading services on its proprietary platform AvaSocial and with third-party providers. Clients pay the usual spread in correspondence with the conditions of their trading plan. Commissions on AvaTrade are average. In particular, the typical spread in the EURUSD pair is 0.9 pips.

In addition, platform providers may have their own conditions:

-

1

ZuluTrade. $30 per month is the cost of subscription to the service. Also, a user will have to pay 25% of the profit to the manager.

-

2

Subscription fee to the signals on MQL5 ranges from $0 to $1,000, but on average is $50.

Is AvaTrade copy trading safe?

Yes, we believe that AvaTrade is a reliable broker. The broker holds licenses of a number or top regulators in the world:

Branch |

Regulator |

License number |

|---|---|---|

AVA Trade EU Ltd |

Central Bank of Ireland |

C53877 |

Ava Capital Markets Australia Pty Ltd |

ASIC |

406684 |

Ava Capital Markets Pty |

South African Financial Sector Conduct Authority (FSCA) |

45984 |

AvaTrade Japan |

Japan FSA |

1662 |

Ava Trade Middle East Ltd |

Financial Regulatory Services Authority (FRSA) |

190018 |

AVA Trade Ltd |

British Virgin Islands Financial Commission |

Not specified |

Every copy trading platform, except for MQL5, is regulated in Europe and the UK. Therefore, working with AvaTrade can be considered safe. The biggest risk is the trading itself.

Summary

AvaTrade offers both its proprietary copy trading service and the three services from the top global providers. This, without a doubt, makes it one of the best brokers for social trading.

If you are not satisfied with AvaSocial for the time being, you can always choose one of the leaders, be that ZuluTrade, MQL5 or DupliTrade, all of which have long earned recognition among the traders and investors.

We also recommend reading the review of the leader of our rating of copy trading platforms – eToro, which currently offers the most advanced and popular platform.

Expert Commentary

AvaTrade is, of course, the champion by the number of social trading options. Nobody will be surprised by MQL5, but in a company with a proprietary platform and such respected services as ZuluTrade and DupliTrade, that makes for one interesting offer.

The broker is also one of the leaders in the world both by reliability and by the quality of service. It has rather good commissions and a great choice of trading instruments.

As for the drawbacks, the broker’s proprietary platform still needs improvement and promotion. In terms of basics, the application is quite user-friendly. If the developer adds more advanced features to it and attracts new users, it will be able to compete with the copy trading service of eToro.

Antony Robertson

Traders Union Financial Analyst

AvaTrade Social and copy trading reviews

AvaTrade is simply heaven for the fans of passive investment. I am trading with ZuluTrade from this broker. On average, I manage to earn around 2-7% net income, which is rather good. I also already tried their AvaSocial services, but so far with no success. They show some crazy performance indicators of the traders on the home page, but in reality the trading is very unstable.

Mehmet Tucker, 45

Business Owner

Izmir, Turkey

I chose AvaTrade not for copy trading, but for independent investment. After all, this broker has a very good reputation, and offers great trading conditions. Guys on the forum recommended DupliTrade a year after I’ve been working here. I’ve been investing for three months now. The choice of managers is not big on this service, but they are real professionals. I’ve already added 25% to my account.

Miranda Bay, 33

Beginner Investor

London, UK

I’m still looking at AvaSocial. I tried it using the demo account and it did not work well. It would have been nice if the broker attracted more knowledgeable managers and expanded statistics on risk managers, added search filters like the ones eToro has. It is not a good thing when the leaders of the rating have only several subscribers.

Martin Gates, 24

Student

Belfast, UK

FAQ

Which copy trading platform should I choose on AvaTrade?

Everything depends on your preferences and financial situation. For starters, you can try to work with one of the top platforms – ZuluTrade or MQL5. Using them, you can gain valuable experience in searching traders and copying trades. However, you also need to monitor AvaSocial platform and see how well it develops.

Can I test AvaSocial in a demo mode?

Yes, you will need to open a demo account with AvaTrade and link it to AvaSocial when you register in the app. However, the broker has restrictions on the demo account – it is only valid for 21 days.

What is the minimum deposit for copy trading on AvaTrade?

Everything depends on the chosen platform. The basic minimum deposit of the broker is $100. The MQL5 platform does not have a specific minimum amount, but it is regulated by the conditions of the signal providers. On DupliTrade, the minimum deposit of the broker is $2,000, and on ZuluTrade - $500.

How much money can I make on copy trading?

There is no fixed amount. Just as with any type of investment, you can both earn a good income, and lose money. Everything depends on the choice of the strategy provider, market situation and your disposition to risk.