21 Best Forex Brokers Philippines for 2024

Best Forex broker in the Philippines - RoboForex

Top Forex broker in the Philippines in 2024:

-

RoboForex - Best Forex broker for beginners ($10 min. deposit, copy trading)

-

Eightcap - Best broker to trade directly from TradingView charts

-

Exness - Best raw spread account (avg. spread for major FX pairs 0.1-0.2 pips)

-

Pocket Option - Best for Social Trading (top rated service by customers)

-

FBS - A reliable broker with affordable offers (ASIC regulation, min. deposit 5$)

-

FreshForex - Best for occasional trading on-the-go (through proprietory Telegram bot)

Forex trading in the Philippines is starting to become increasingly popular. As the average Filipino becomes more aware of the investment options available to them, forex trading in the Philippines continues to increase.

However, it isn’t easy for many of those looking to start forex trading to know where to start. It’s even more challenging to find forex brokers that accept their currency, the Philippine Pese (PHP). That’s why we’ve made a list of the best Forex broker in the Philippines.

All forex brokers in the Philippines must abide by the regulations set by the Bangko Sentral ng Pilipinas (BSP), the main regulatory body.Traders in the Philippines can also trade with brokers that have international regulation and accept residents of the country.

Top 21 Best Forex Brokers Philippines Comparison

Here’s our list of the best forex broker Philippines for 2024. We came up with this ranking with the help of TradersUnion certified analysts. The criteria set looks at whether the forex brokers meet the FCA regulation and whether they offer clients favorable trading conditions.

All of the forex brokers on their list are a decent option. However, it's important to take into consideration the bonus features each platform offers and the minimum deposit requirement.

| Broker | Supported currency pairs | Regulation | Working with the Philippines residents | Advantages | Minimum Deposit | |

|---|---|---|---|---|---|---|

40 |

FSC |

|

10$ |

|||

40 |

ASIC, SCB, CySEC, FCA |

|

100$ |

|||

96 |

FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, FSC (Mauritius), CBCS, and CMA |

|

1$ |

|||

40 |

MISA |

|

5$ |

|||

72 |

CySEC |

|

5$ |

|||

70 |

|

|||||

120 |

BVI FSC |

|

||||

60 |

CySEC |

|

||||

70 |

FCA, CYSEC, FSCA, SCB |

|

100$ |

|||

55 |

ASIC, FSC, CySEC, DFSA |

|

5$ |

|||

80 |

FinaCom |

|

100$ |

|||

50 |

VFSC |

|

100$ |

|||

50 |

The Financial Commission |

|

10$ |

|||

90 |

ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec |

|

1$ |

|||

45 |

ASIC, CySEC, and FSA |

|

200$ |

|||

40 |

|

1$ |

||||

40 |

FSA, FSCA, CySEC (only for institutional traders), VFSC |

|

5$ |

|||

40 |

FSC |

|

50$ |

|||

80 |

MFSA, LFSA, VFSC, BVI FSC |

|

5$ |

|||

60 |

FSA, LFSA, FSCA, CySEC, FCA |

|

100$ |

|||

70 |

ASIC, VFSC, FSA |

|

10 Forex Brokers Philippines Trading Conditions

| RoboForex | Eightcap | Exness | Pocket Option | FBS | FreshForex | |

|---|---|---|---|---|---|---|

Trading platform |

MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader |

MT4, MT5 |

Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 |

Pocket Option, MT5, MT4 |

MT4, MobileTrading |

MT4, MobileTrading |

Accounts |

ProCent, Pro, ECN, Prime, R StocksTrader |

Standard, raw, demo |

Standard type: Cent, Standard, and Plus |

Quick Trading/QT for binary options, |

Standard account, cent account, demo standard account, demo cent |

Demo, Cent, Classic, Pro, ECN |

Instruments |

Forex (currency pairs), ETFs, index CFDs, oil CFDs, CFD on European and U.S. stocks, real securities |

CFDs on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals |

Forex CFDs on: cryptos, commodities, indices, and stocks |

Binary options and CFDs on currency pairs, cryptos, indices, stocks, and commodities |

Forex, indices, metals, futures contracts |

Forex currency, CFD for precious metals, shares, energy products |

Spread |

0 points |

0 points |

1 point |

1.2 point |

0.2 points |

0 points |

Leverage |

1:2000 |

Up to 1:500 |

1:unlimited for retail clients |

1:1000 for MT4/MT5; |

1:3000 |

Up to 1:2000 |

Trading features |

Negative Balance Protection; No swaps on Islamic accounts, a pleasant affiliate program: each market participant gets up to 20% loyalty; One Click Trading. |

Free 30-day demo account; |

Floating spreads; |

Free signals; |

Advisors; Hedging; Protection against a gap. |

Automated trading with advisers; Free analytical reviews; No commission is charged; Trade through Telegram. |

Replenishment / Withdrawal |

SEPA, Bank transfer, Skrill, Neteller, AdvCash, Perfect Money, Visa/Mastercard, AstraPay, NganLuong Wallet, JCB. | Visa, MasterCard, POLI, wire transfer, BPAY, UnionPay, Skrill, Neteller, BTC and ETH wallets, PayPal, WorldPay, FasaPay, PayRetailers, and PSP | Skrill, Neteller, Perfect Money, BTC, USDT, USDC, VISA, VISA Electron, Mastercard, Maestro, and internet banking | Bank transfers, bank cards, cryptocurrencies, Skrill, Neteller, AdvCash, Perfect Money, and other e-wallets | Cards: Visa, MasterCard; e-wallets: Skrill, Neteller, Wire Transfer, Rapid Transfer | Bank cards, electronic payment system, Internet-banks, mobile payment SMS |

RoboForex - Best Forex broker for beginners ($10 min. deposit, copy trading)

RoboForex is a brokerage company that was founded in 2009. RoboForex is a leading software developer in the Forex industry and one of the best Forex brokers based on client reviews.

RoboForex is recognized as a reliable partner by the most respected financial market experts. The company has won numerous prestigious awards. The RoboForex group of companies has an international license to provide services from FSC Belize (license No. 000138/437).

👍 Pros

• Availability of favorable trading conditions and a minimum deposit

• Unique investment program CopyFx

• Highest affiliate payments: up to 84% of the fee paid by the referral

• Market launch - STP and ECN

• Instant withdrawal of funds

• Minimum deposit - $10

👎 Cons

• A small number of currency pairs - 36, for accounts: Pro, Pro-Cent, ECN, Prime

• Lack of tools when trading on the R StocksTrader platform

Eightcap - Best broker to trade directly from TradingView charts

Eightcap offers more than 800 trading instruments, namely CFDs [contract for (price) differences] on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals. The broker has a minimum deposit of $100, a free demo account, and two live account types, which differ in trading costs. One account type has standard spreads without a fee, and the other has raw spreads that carry a brokerage fee. The maximum leverage is 1:500. Traders can use any strategy with minimal restrictions. Trading is carried out through MetaTrader 4, MetaTrader 5, and TradingView. Eightcap has two main features. First, the broker has a powerful training and analytical base. Second, the platform offers a number of unique tools, for example, Capitalise.ai, which provides automated trading with minimal risk. At the same time, there are no options for passive income, not even a referral program.

👍 Pros

• The broker is registered in the Bahamas and Seychelles, and is regulated by the Securities Commission of the Bahamas (SCB, SIA-F220), ASIC (391441), FCA (921296), CySEC (246/14). Also, it partners with many proprietary firms;

• Traders need to deposit only $100 to open a live account, and the broker imposes few trading limits on its clients;

• Hundreds of the most popular CFDs are available, and the pool is constantly expanding;

• Eightcap provides one of the most profitable trading costs with really tight spreads;

• Almost all options for depositing/withdrawing funds are available and the broker does not charge a withdrawal fee;

• The broker’s clients can work through any of the three top trading platforms, including mobile versions of the MetaTrader solutions;

• The company provides high-quality training, extensive analytics, and its own developments for automated trading.

👎 Cons

• No joint accounts, copy trading, referral program, or other options for passive income;

• Eightcap has some regional restrictions. For example, some services are not available in Australia;

• The broker's technical support is efficient and competent, but it is not available on weekends.

Exness - Best raw spread account (avg. spread for major FX pairs 0.1-0.2 pips)

The Exness brand is known worldwide due to its profitable trading conditions, high-security level, and wide range of financial instruments. It focuses on trading CFDs, especially currency pairs. Cryptocurrencies, commodities, stocks, and derivative stock indices are also available. Exness offers account types for novice traders, more experienced traders, and professionals. It allows traders to use a variety of strategies including passive ones, such as copy trading and algorithmic trading. The proprietary Exness platform for social trading is used by over 20,000 investors globally. The broker’s activities are legal and its services are available in over 130 countries. Exness is supervised by 8 financial commissions, including CySEC (Cyprus, 178/12), one of the strictest European regulators, and FCA (UK, 730729), FSA (Seychelles, SD025), FSC (BVI) SIBA/L/20/1133, CBCS (Curacao, 0003LSI), FSCA (South Africa, 51024), and CMA (Kenya, 162). The broker offers demo and cent accounts for novice traders, as well as standard and ECN account types for experienced traders.

👍 Pros

• Availability of 8 licenses and a membership in the Financial Commission with its own compensation fund to insure traders against losses;

• Wide choice of account types — Standard, Pro, Cent, Swap Free, and Demo;

• Wide range of CFDs, including over 100 currency pairs;

• Zero deposit and withdrawal fees;

• Proprietary platforms for active and social trading, as well as all versions of classic MT4 and MT5.

👎 Cons

• The broker’s website offers almost no educational materials;

• 24/7 support isn’t available in all languages.

Pocket Option - Best for Social Trading (top rated service by customers)

Pocket Option is an innovative Forex and binary options broker with over $500 million in trading volume. It offers active trading on financial markets, copy trading, and passive income on holding funds in dollar and cryptocurrency safes. The broker provides an in-house platform to trade binary options and MetaTrader platforms to trade CFDs on currencies, cryptocurrencies, stocks, indices, and commodities. Pocket Option was incorporated in 2017. The broker’s service is available in more than 95 countries and regions globally. Today, over 10 million users are registered with the broker, and 100,000 traders regularly use its services. In July 2023, it obtained a license from Mwali International Services Authority number T2023322.

👍 Pros

• MetaTrader provides for trading binary options and CFDs;

• A demo mode is available for all account types;

• To register, you may use your Google email or Facebook/Google account;

• Active, social, and algorithmic trading is available on MT4 and MT5 accounts;

• Spreads are from 1.2 pips for Forex and no fees per lot;

• Referral program for retail clients with rewards of up to 50%-80% of the referee’s income;

• “My Safe” service that provides for crediting 10% per annum on the account balance not involved in trading;

• Cash back and promo codes for binary option traders;

• 50% deposit bonus.

👎 Cons

• The broker offers neither cent accounts for novice traders to test strategies and advisors, nor ECN accounts with near zero spreads for professional traders;

• Real-time communication with operators is available upon funding the account.

FBS - A reliable broker with affordable offers (ASIC regulation, min. deposit 5$)

FBS (fbs.com) is an international broker operating in 190 countries. The brokerage company has been on the market for over 10 years, and during this time it has earned about 40 international awards. It is regulated by the CySEC under license number 331/17 and provides flexible conditions for Forex trading. In addition to classic currency pairs, the company's clients can trade indices, futures contracts, exotic currencies, and metals. FBS is especially popular in Asian countries such as India, Malaysia and Indonesia.

👍 Pros

• negative balance protection;

• a large selection of trading instruments;

• the support service works 24/7.

👎 Cons

• no cryptocurrency;

• auto copying is not available;

• no PAMM accounts;

• not suitable for short-term trading, such as scalping;

• the support service works in a limited number of languages;

• only two real accounts.

FreshForex - Best for occasional trading on-the-go (through proprietory Telegram bot)

FreshForex has been operating since 2004. The broker is registered in Kingstown, Saint Vincent, and the Grenadines. FreshForex has won more than 20 International awards and these achievements include Best Trading Conditions according to FXDailyInfo in 2016 and Best Bonus Program in 2017.

👍 Pros

• favorable trading conditions;

• work with the liquidity providers having a European license;

• 130 instruments for trading: Forex instruments, CFDs on precious metals, energy products, and indices, as well as corporate shares;

• spreads from 0 pips;

• the ability to replenish the account and withdraw funds quickly;

• bonuses and offers;

• easy to use the software that is available on your desktop computer, laptop, tablet, or smartphone.

👎 Cons

• customer service works 24 hours although not on weekends;

• no cryptocurrency for trading;

• no investment programs;

• access to the affiliate group is not available via the Traders Union.

Forex4you - Best cent account for beginners ($0 minimum deposit, spread from 0.1 pips)

The broker Forex4you started in 2007. The company provides a full range of active and passive trading services in the Forex market. The company runs its operations in the British Virgin Islands, under the license BVI FSC (license number SIBA/L/12/1027). Forex4you is committed to responsibility and professionalism. In 2018, according to Le Fonti, the company was awarded the ‘Best Broker’ which is the highest award achievable, and prior to this it has consistently won and received nominations for awards including ‘Forex Broker of the Year’ and ‘Best Service Quality’ nomination. Read more about Forex4You Available Countries.

👍 Pros

• best trading conditions for novice traders;

• no trading restrictions on scalping and algorithmic trading;

• the possibility of passive income - social trading platform Share4you;

• the broker has an insurance for $10 million on a contingency basis;

• there are cent accounts with a minimum transaction amount of 2 cents.

• customer support responds to customer inquiries within 8 hours, even on weekends.

👎 Cons

• Relatively high fixed fees on Pro accounts.

• Traders from the U.S, Canada, Japan, and EU countries cannot use services of the broker.

TeleTrade - Best for learning trading basics (a lot of educational and analytical materials)

TeleTrade was established in 1994. The company won 2018 Traders Union Awards as the Best Broker in Europe. The brokerage company is a member of the Association of Forex Dealers, a self-regulatory organization in the financial market. The company is also regulated by the Cyprus Securities and Exchange Commission (CySEC, 158/11). The European branch of TeleTrade has adopted the brand name Earn.

The broker provides access to trading various currency pairs, as well as metals, stocks, cryptocurrencies, indices, and energies.

👍 Pros

• detailed analytical section;

• informative educational section.

👎 Cons

• no PAMM accounts or other money management options;

• a small range of trading instruments;

• few withdrawal options;

• support is available 24/5;

• withdrawals delayed;

• technical support responds slowly;

• sometimes it takes a long time to verify data.

FxPro - Biggest choice of currency pairs (70+ FX CFDs)

The FxPro broker was registered in July 2006 in Cyprus. The company’s activities are licensed by financial regulators: CySEC, 078/07 (Cyprus), Bahamas SCB (SIA-F184), FCA, 509956 (UK), and South African FSCA (45052). FxPro is successfully operating in more than 170 countries for retail and institutional clients. The broker has received more than 85 awards, including “Best Forex Trading Platform” and “Best Trading Platform”. FxPro has become known for providing the best trading tools. With FxPro broker, traders can trade more than 70 currency pairs, futures and stocks (Twitter, Apple, Google). The broker has over 2,100 trading assets in its pool, including cryptocurrencies, which are subject to the account type. The basic set of assets is available on cTrader accounts, the full set is available on accounts opened on MT4 and MT5. FxPro sets high safety standards with the client's funds being kept in large international banks. They are insured and separated from the broker's equity.

👍 Pros

• Negative Balance Protection of a client on a real account is a unique broker service. It has an automated transaction monitoring and a risk management system, the capital is guaranteed not to go into a negative balance;

• insurance of client funds at the expense of the broker participation in an investor compensation fund;

• beginner traders will be able to access tested advisors;

• a full package of services is available to the client regardless of the balance of his account;

• VIP account holders are offered a personal manager and get a Free VPS;

• company capital exceeds 100 million euros;

• offers swap-free accounts for customers whose religious beliefs do not permit swapping eg. Islamic traders;

• the reliable trading environment provided by the competent educational and research department.

👎 Cons

• it is not the best choice for beginner traders who are looking for their first broker as the minimum deposit of $100 is considered high;

• difficulties registering in an affiliate program.

XM Group - Best Order Execution (99.35% of orders are executed nearly instantly)

XM Broker was founded in 2009. Initially, the company covered a narrow niche of the trader market, specializing exclusively in intermediary services at the foreign exchange market. It has since experienced considerable success and growth, has diversified and is now an international broker operating in almost 190 countries around the world. For over a decade XM Broker has attracted more than 5 million traders, offering unique technological solutions. The company is now being recognised as the Fastest Growing Broker, the Best Forex Service Provider and various other contributing achievements. The team at XM Broker is committed to continually working hard to improve the quality of the services provided every year as they are committed to continually providing the best service to their traders.

👍 Pros

• XM Broker guarantees 100% execution of orders, 99,35% of orders delivered nearly instantly. No requotes guaranteed;

• no “markup” on narrow market spreads (broker's margins over the spread);

• over 1,000 trading instruments. Available for trading are: more than 55 currency pairs, including CFDs on cross rates, metals (including palladium and platinum), commodities (cocoa, cotton, grain), stocks;

• no commission for replenishment and withdrawal of money. XM Broker incurs all commission costs of payment systems;

• around the clock support for 5 days a week in more than 30 languages.

👎 Cons

• passive investment services (social trading platform, PAMM accounts);

• expanding their limited choice of trading platforms. Despite the fact that the broker offers 16 terminals, all of them are modifications of MT4 and MT5 for desktop, browser and mobile trading.

Best Forex Brokers For beginners in the Philippines

For beginners, starting with a demo or cent account, or using copy trading, can be a great way to learn and gain experience. Demo accounts allow traders to practice trading strategies in a risk-free environment, using virtual money. Cent accounts, on the other hand, allow traders to trade with small amounts of real money, reducing the risk while still providing a real trading experience. Copy trading involves copying the trades of experienced traders, allowing beginners to learn from their strategies and decisions.

| Broker | Demo | Cent | Copy Trading | |

|---|---|---|---|---|

Is Forex Regulated in the Philippines?

Forex trades in the Philippines are regulated with the help of the Banko Sentral ng Pilipinas. This is the central bank of the Philippines that is responsible for monitoring the functioning of the Philippines economy. Nevertheless, given that widespread Forex trading is a relatively new phenomenon, the Philippines financial system is somewhat new to the global Forex markets. The country is forced into competition with neighboring countries such as Singapore, Japan, Hong Kong, and Malaysia.

Nevertheless, on the plus side, the Banko Sentral ng Pilipinas is highly revered by an array of Asian financial experts for being one of the most effective regulators on the planet. This is why BSP Forex brokers are bound by an array of regulatory guidelines implemented by the central bank on Forex transactions and the Peso Dollars.

What is SEC Philippines?

In case you’re unfamiliar, SEC Philippines or The Securities and Exchange Commission is the agency of the Government of the Philippines that is responsible for the registering and management of establishments and securities, as well as investing platforms and participants doing business in the Philippines. The organization heavily promotes investor protection in the Philippines, as a means of providing this supervision and protection.

Are there some Forex trading limitations in the Philippines?

Virtually every area places some sort of limitations on Forex trading, and the Philippines are no exception. For instance, in order to legally trade Forex in the Philippines, investors must purchase from authorized agent banks (AABs) and/or related foreign exchange corporations. They may also purchase from non-bank entities doing business as foreign exchange dealers (FXDs), as well as money changers (MCs) that are utilized to fund valid foreign exchange obligations.

Those trading Forex in the Philippines can receive maximum leverage of up to 1:500.

Do I Need to Pay Taxes for Forex Trading in the Philippines?

Yes, individuals involved in Forex trading in the Philippines are generally liable for taxes. The tax treatment can vary based on factors like whether you're classified as an individual trader, business entity, or investor. As an individual trader, profits from Forex trading might be seen as taxable income, requiring you to report these earnings when filing your annual tax return.

The tax rate can depend on your total income and the prevailing tax laws in the Philippines.

Consulting a tax professional or the Bureau of Internal Revenue (BIR) in the Philippines is crucial to ensure compliance with tax regulations and reporting requirements related to Forex trading. As tax laws can change, staying informed and seeking professional advice is essential to accurately fulfill your tax obligations.

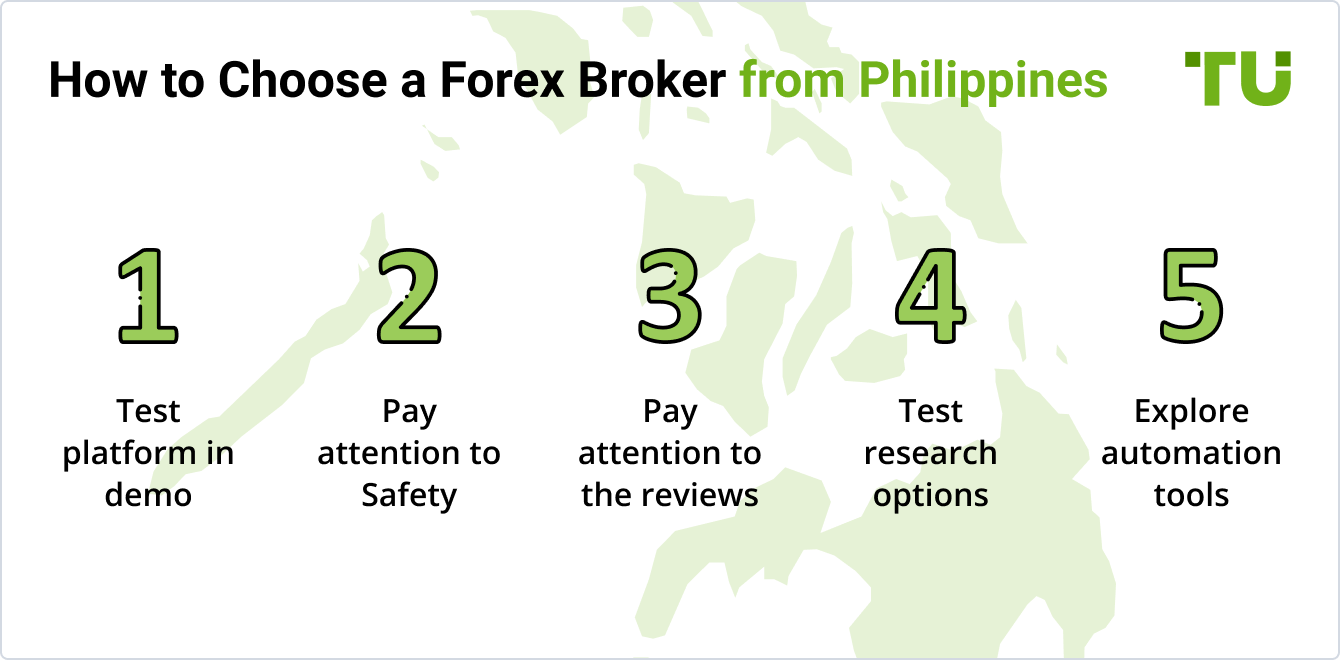

5 Tips for Choosing the Best Forex Broker in the Philippines

1. Demo Platform

Before you pick a forex broker in the Philippines, it’s essential to ensure that you can have a demo on the platform. The demo will allow you to view all the features the platform offers and test everything out.

2. Safety

When you’re just starting with forex trading, safety is crucial. Make sure that your forex broker falls under tier 1 jurisdiction.

3. User Reviews

Read through the user reviews as they can give you a proper idea of how the platform behaves.

4. Research Options

There’s no point in going for a forex broker that doesn’t offer a decent variety of research options. Make sure that you can have a demo of the research options before you make your final decisions.

5. Automation Tools

One of the best features of modern trading platforms is that they offer a variety of automation tools. Test out the automation tools and assess whether they meet your requirements.

Can I Trade with Internationally Regulated Forex Brokers in the Philippines?

Yes, trading with internationally regulated Forex brokers is possible in the Philippines. However, certain conditions must be met to ensure a secure and legally compliant trading experience. If a Forex broker is not registered in the Philippines, it should hold a license from a reputable international regulator, such as the Financial Conduct Authority (FCA) in the UK, the ASIC Australia, or other recognized regulatory bodies.

Trading with internationally regulated brokers offers several advantages, including access to a wider range of financial instruments, competitive spreads, and a higher level of investor protection. These brokers adhere to stringent regulatory standards and must comply with strict financial and operational guidelines.

Before trading with an internationally regulated Forex broker in the Philippines, it's essential to verify their regulatory status and ensure they meet necessary compliance requirements. This helps protect your investments and ensures you trade with a reputable and trustworthy broker in accordance with international and Philippine regulations.

Best Time to Trade Forex in the Philippines

Even though each exchange runs separately, they all deal in the same currencies. As a result, there are much more traders actively buying and selling a particular currency when exchanges in two markets are open. All open exchanges in the currency market are immediately affected by the bids and requests on one exchange. Because of this, market spreads are narrower and volatility is higher during the following windows:

3:00 AM to 4:00 AM EST, when both the Tokyo and London markets are open.

8:00 AM. to 12:00 PM EST, when both the New York and London markets are open.

7:00 PM. to 2:00 AM EST, when both the Tokyo and Sydney markets are open.

Can I Trade Forex with a Minimum Investment in the Philippines?

There is a technical minimum and a recommended amount to start forex trading. Technically, you can start trading with as little as $5-$10, but in practice it will be very difficult to achieve results, since you will have to trade on a cent account and with a large leverage. Such accounts are quite suitable for training, but not for professional trading. It is optimal to have at least $200-500 to start with, then you can trade micro-lots with a leverage of 1:2 - 1:5, which is already more justified from a risk management point of view.

Expert Opinion

Choosing the right broker is crucial for Filipinos, and it starts with ensuring they're authorized in the Philippines. This ensures you work with a reputable company that adheres to regulations.

Once you've confirmed that, the next step is to consider your trading style and goals. Are you a seasoned trader or just starting out? Experienced traders should look for brokers with tight market spreads and quality VPS (virtual private server) options. These features can be especially helpful for frequent trading and using automated bots. Beginner traders should focus on brokers that offer features to help them get comfortable in the market. Look for a demo account (with virtual money) to practice trading, cent accounts (where you can trade in smaller fractions of a currency), and high-quality educational resources. Additionally, having strong customer support from the broker's team is a big plus.

You might also consider copy trading services. While they can't guarantee profits, they allow you to copy the trades of more experienced traders, which can be a helpful strategy for beginners. Remember, copy trading doesn't mean guaranteed riches, but it can be a good way to learn and potentially increase your earnings over time.

Summary

Most of the world's popular Forex brokers operate in the Philippines. This country has a licensing mechanism for financial organizations; they can operate under the BSNP license. Traders in the Philippines offer a wide range of options for active trading and passive investing. Choosing a reliable broker will allow clients to trade in the financial markets without the risk of scam and money theft.

FAQs

What is the minimum deposit required to start trading with these brokers?

The minimum deposit amounts required to start trading with the brokers on this list ranges from $0 to $200. Most brokers require a minimum deposit of $10-100.

Which brokers offer the tightest spreads in the Philippines?

Brokers known for tight spreads include Roboforex, Exness, and IC Markets which offer spreads from 0 pips on major currency pairs.

Which brokers are best for beginners?

Brokers like Roboforex and InstaForex are considered beginner-friendly due to low account opening amounts, extensive educational resources and social trading features.

Can I open a demo account to practice trading without risking real money?

Yes, all of the brokers on this list offer demo trading accounts that allow you to practice and test out their platforms without any risk to your capital. This is highly recommended for beginners.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.