Best Copy Trading Platforms in the Philippines 2024

The Philippines is a country in South East Asia that's quickly becoming known for its thriving economy. A big part of this economy is fueled by the stock and forex markets. This has spurred a proliferation of traders eager to make a killing from these markets. However, for beginners in stock and forex trading, doing so is easier said than done.

Thankfully, with copy and social trading, anyone can trade like a pro. Copy trading allows you to copy the trades of more experienced and successful traders. Social trading, on the other hand, gives you the ability to connect with other traders, learn from their strategies, and even copy their trades.

Today, we'll be taking a deep dive into six of the best copy trading platforms available in the Philippines. We try to make our reviews as comprehensive as we possibly can. Our reviews of the best copy trading platforms are based on criteria like:

Opportunity to Work With Philippine Citizens

The best copy trades are those that come from people within your region. Our review looks at whether the platform in question provides an opportunity to copy trade with Philippine citizens. And whether you can interact with other citizens to maximize profits and hone your trading skills.

Reliability

We check out how long the platform has been in business and what its reputation is. Are they a reliable copy trading platform with a good track record? Is it a platform you can track? And what measures has the platform taken to ensure unmatched reliability?

Copy Trading Features

The features available on a copy trading platform will determine how successful you are as a copy trader. We take a look at what features are available and whether they're robust enough to give you an edge in the market.

Copy Trading Platforms in the Philippines - Comparison

| Copy Trading Minimum Deposit | Subscription Price | Markets | ||

|---|---|---|---|---|

|

$100 |

Free |

Forex, Stocks, ETF, Crypto, Commodities, CFDs |

||

|

$10 |

$10 |

Forex, Stocks, Crypto |

||

|

$200 |

Free |

Forex, CFDs, commodities, Crypto, Stocks, Bonds |

||

|

$1000 |

Free |

Forex, CFDs, commodities |

||

|

$100 |

Free |

Stocks, Cryptocurrencies, Commodities, CFDs, Bonds, ETF |

RoboForex (CopyFX)

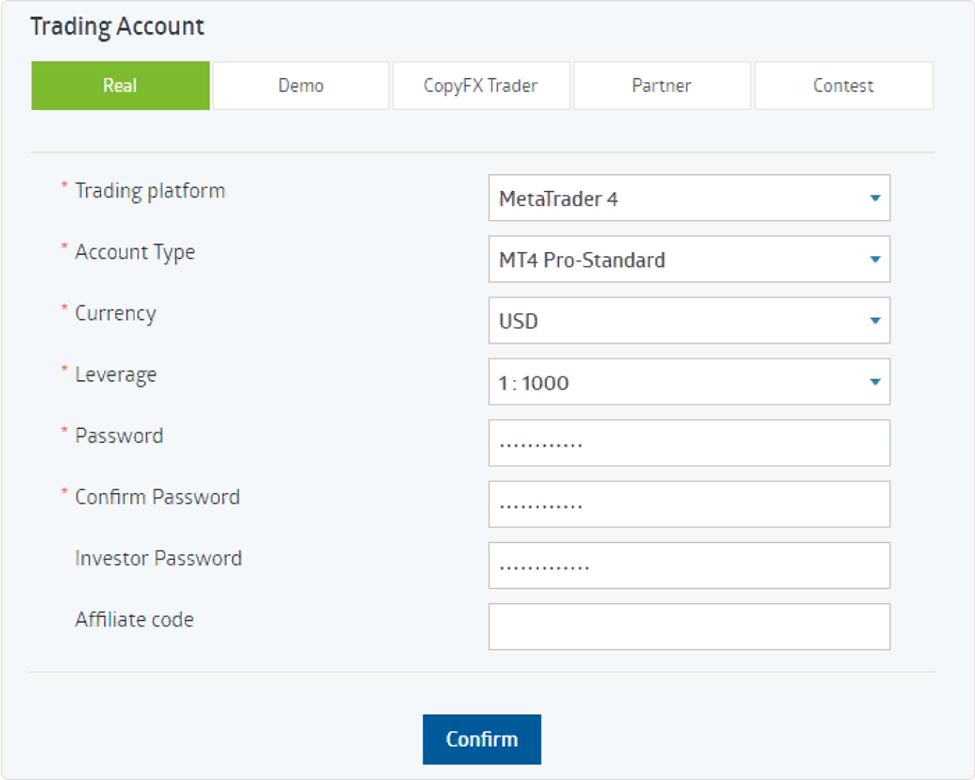

RoboForex lets traders earn passive income through automated trading. Offering over 12,000 instruments and eight asset types, RoboForex is the best copy trading platform in India for traders with minimal trading experience.

RoboForex copy trading

Usability

On RoboForex, you can specify the copy trading options based on your preferred functions. Thus, only the transactions pertaining to your specified parameters will be copied.

With a minimum investment of $10, you can invest in indices, commodities, stocks, Forex, and cryptocurrencies.

Safety and Regulation

Since RoboForex is registered in Belize, it has a license from IFSC, which is the local regulator. As compared to other brokers in this list, RoboForex is not as highly regulated.

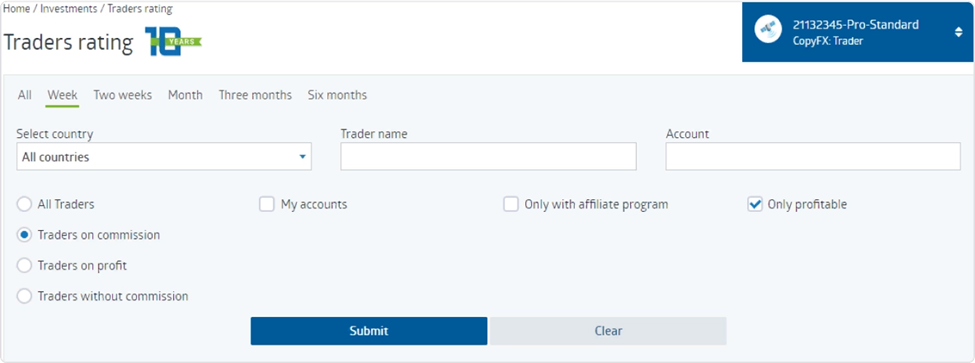

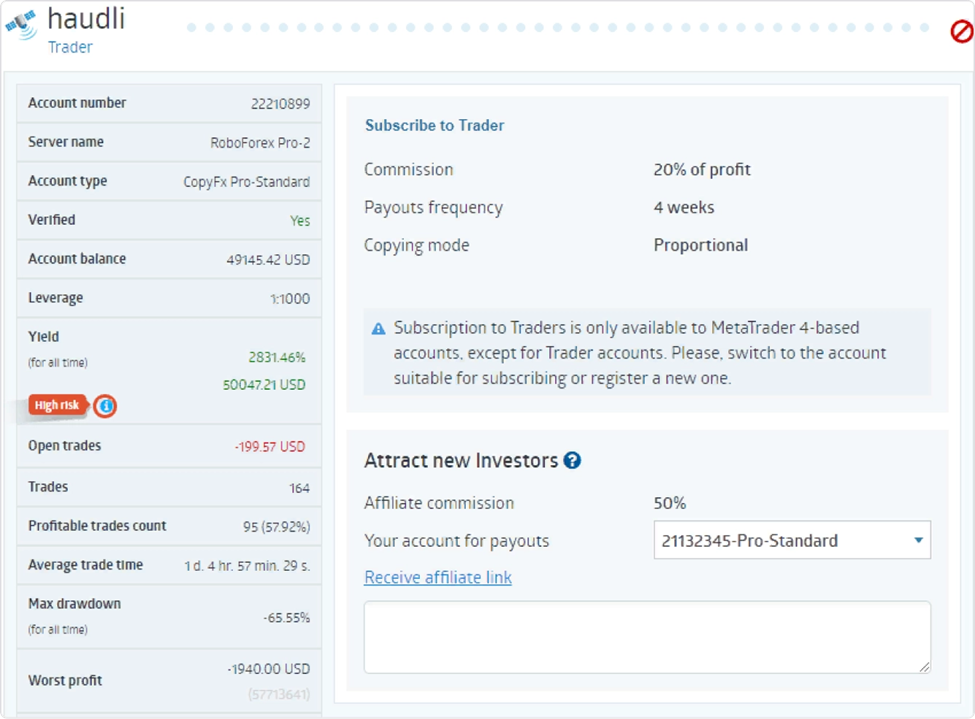

Copy Trading Features

RoboForex has a Traders Rating tab where you can find the top traders to copy. If you have any specific asset or instrument preferences, you can filter the results based on your desired factors.

RoboForex copy trading

The broker offers different search parameters, including the lifespan of the account, profitability, and risk level.

RoboForex copy trading

You can check a particular trader's transaction history and later their open transactions once you've subscribed to a signal provider.

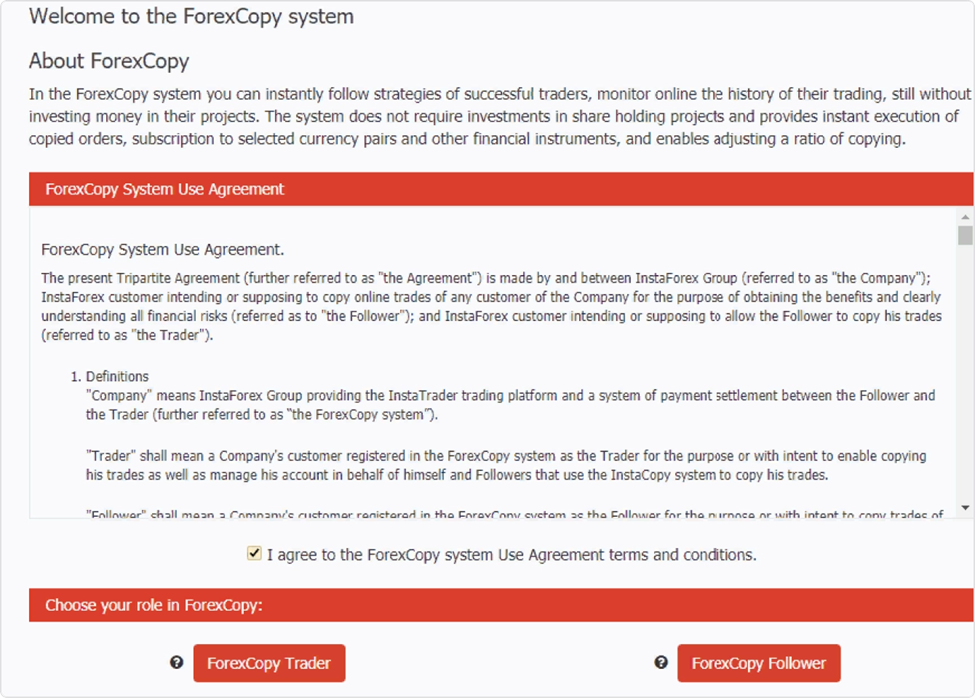

CopyFx Review - Is it Profitable? Is it Safe?InstaForex

InstaForex was among the first brokers to offer copy trading and remains a popular option for beginners since anyone can get started with a minimum deposit of $10.

InstaForex copy trading

Usability

InstaForex has been around since 2010 and offers a wide assortment of markets to copy, including indices, commodity futures, cryptocurrencies, commodities, CFDs on stocks, and currency pairs.

With more than 300 instruments and six types of commissions, the broker is ideal for traders with different experience levels. You can get started with just $10.

Safety and Regulation

InstaForex is regulated in these jurisdictions:

Instant Trading Ltd (Virgin Islands)

Insta Service Ltd (Saint Vincent)

Since these jurisdictions aren't transparent about their beneficiaries and are offshore, InstaForex isn't considered as reliable as some other options we've mentioned.

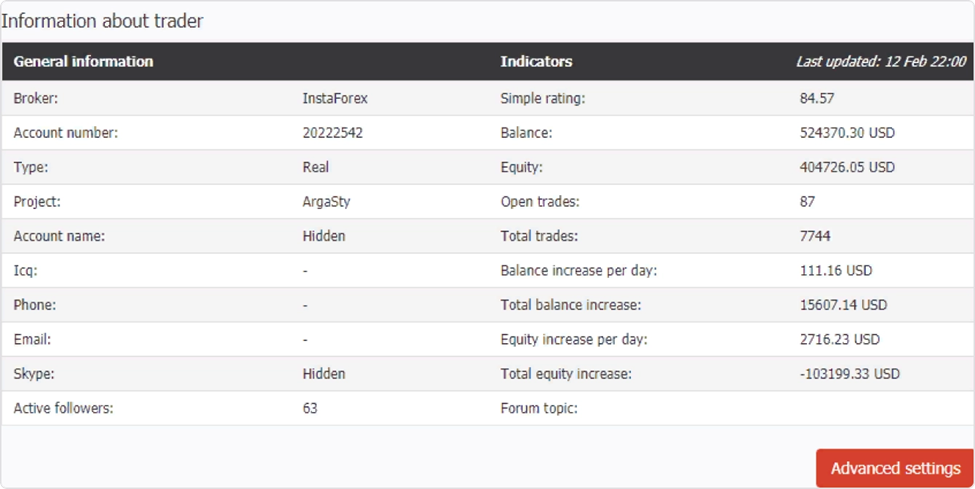

Copy Trading Features

When you're selecting an InstaForex trader to copy, you can see a lot of information about them to make a decision. InstaForex lets you see the trader's rating on the platform along with their capital, account balance, number of open trades, number of transactions, total balance gain, total capital gain, and average per day balance gain.

InstaForex copy trading

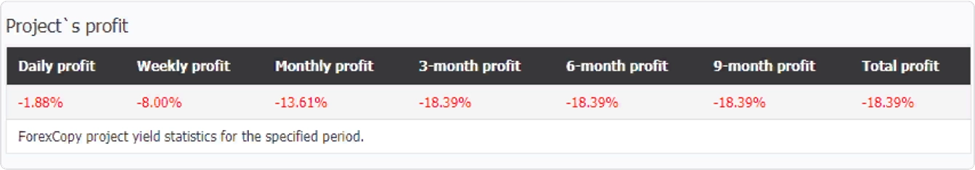

You can also check the profitability of the signal provider to determine if they're the best trader to copy.

InstaForex copy trading

Although you can see a lot of transactional information, the broker falls short in terms of showing risk indicators.

IC Markets

IC Markets is one of the most cost-effective trading platforms in the market due to its low commission rates. Plus, it has phenomenal order execution features and multiple opportunities for you to earn passive income.

It also offers additional copy trading services in partnership with Autotrade, MyFxBook, and ZuluTrade.

Usability

Since IC Markets does not have a proprietary copy trading platform, it partners with other social trading platforms, such as Autotrade and ZuluTrade.

With a minimum deposit of $200, you can invest in a wide range of trading instruments.

Safety and Regulation

IC Markets has licenses from top regulators in the EU and Australia. In Australia, it has a license from the Australian Financial Services License (AFSL No. 335692), while its EU license is from Cyprus Securities and Exchange Commission (CySEC License Number 362/18).

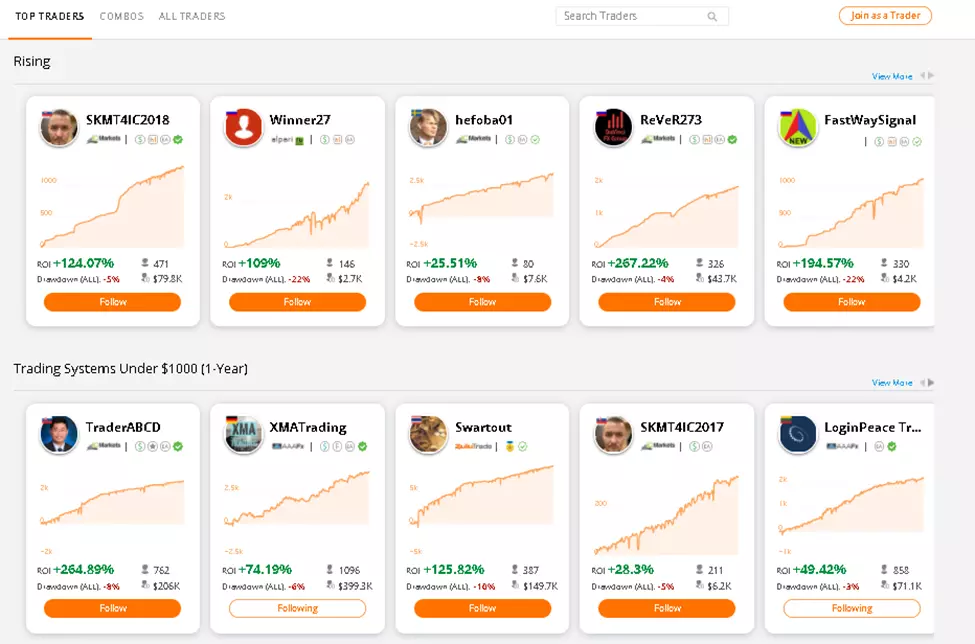

Copy Trading Features

The simplest way to copy trade on IC Markets is to use ZuluTrade's recommendations. The editors and algorithm regularly update the recommendations for top signal providers. You can find this information in the Top Traders section.

IC Markets copy trading

You can check the risk parameters and profitability of the signal providers to make an informed decision.

Tickmill

Tickmill is a trading platform slowly making a name for itself in the industry. It offers various analytical instruments for Forex trading and copy trading as an opportunity for additional income. Let's closely look at what it has to provide a user.

Usability

Tickmill doesn't offer its users a proprietary trading platform and relies on its partner's MYFxBook trading platform to offer services. You'll have to open accounts on both sites as the partner offers the signals.

The copy trading platform also has a high entry threshold, with the minimum investment for copying at $1,000. In addition, you'll have access to 162 strategy providers and markets such as Forex, CFDs on precious metals, indices, and bonds.

Safety and Regulations

The number of licenses held by Tickmill shows that it is safe, in our opinion. In addition, they have licenses from highly respected regulators such as FCA (UK), CySec (Cyprus) and FSCA (SAR).

Other jurisdictions where they are licensed include Labuan (Labuan FSA) and Seychelles (FSA), and the licenses held include:

FCA – 717270

CySec – 278/15

FSCA – FSP 49464

Labuan FSA – MB/18/0028

FSA – SD008

Copy Trading Features

You'll need a Tickmill and MyFxBook account to copy trade. First, open your MyFxBook account by providing the necessary information and link it to your Tickmill through the MetaTrader 4 option in the account section.

To find a trader to copy, use the search directly on MyFxBook. You can seek traders using the following indicators

Gain

Drawdown

Pips

Discussion (reviews)

Test ended

Modelling quality

Chart

You'll also access a trader's statistics to look deeper before copying their trade.

Tickmill Copy Trading ReviewAvaTrade

AvaTrade is a world-renowned name in the world of social trading and copy trading. It is regulated by the top seven global authorities, including the Central Bank of Ireland.

AvaTrade copy trading

Usability

AvaTrade works with three other copy trading platforms, namely MQL5, DupliTrade, and ZuluTrade. In this way, it gives the users access to thousands of investors and signal providers.

With a minimum investment of $100, you can invest in indices, cryptocurrencies, stocks, bonds, Forex, CFDs, and 1,250 other markets.

Safety and Regulation

AvaTrade is the best copy trading app in India in terms of regulation and safety since it has licenses from many top regulators worldwide, including:

British Virgin Islands Financial Commission

Financial Regulatory Services Authority (FRSA)

Japan FSA

South African Financial Sector Conduct Authority (FSCA)

ASIC

Central Bank of Ireland

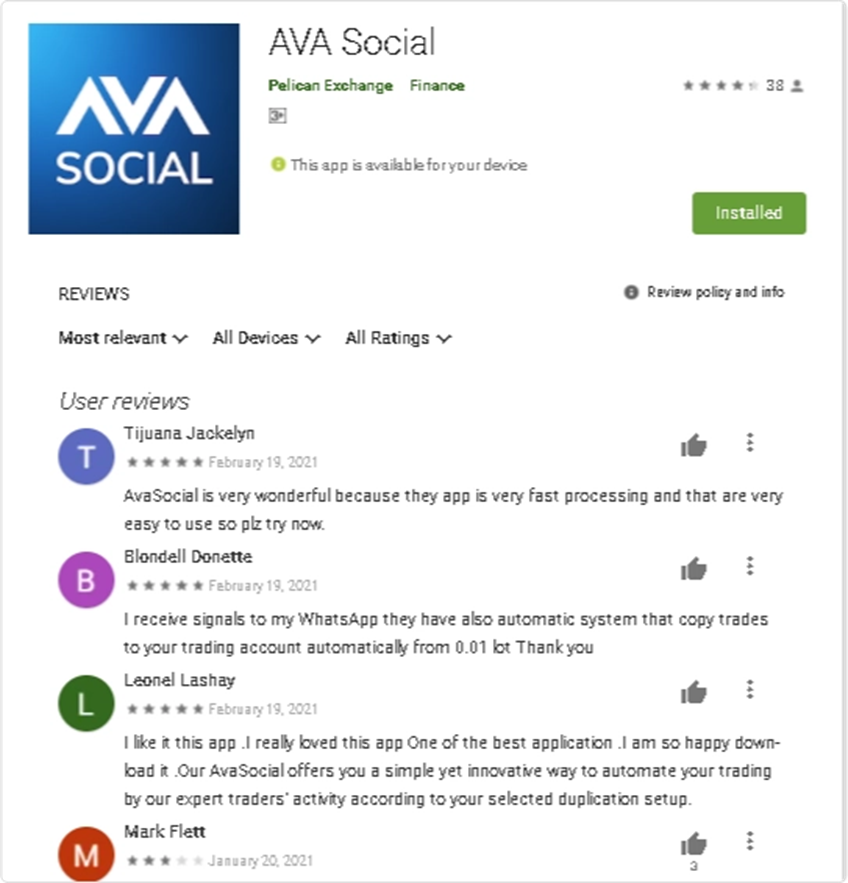

Copy Trading Features

Once you've registered on AvaTrade, you can check the ranking of each copy trading signal provider on the platform.

The broker lets you see the history of a user's trades and their approach to risk management.

You can then subscribe to your preferred trader's signals.

AvaTrade also lets you diversify your trade by subscribing to multiple signals. Depending on your risk tolerance, you can set the risk parameters at which copy trading will be stopped.

What is Copy Trading

Copy trading is a trading method in which you copy the positions managed and opened by other traders. It shouldn't be confused with mirror trading since that involves mirroring every action of the copied trader.

Meanwhile, in copy trading, traders can copy certain strategies of the investor they want to emulate. Modern copy trading platforms allow traders to earn money through this method by using the following features:

Showing the trade analytics of investors to be copied

Giving options to distribute equity among multiple traders with different trading instruments and strategies

Offering an option to stop trade copying when certain risk tolerance is reached

Setting maximum risk level for particular investments

How to Choose a Copy Trading Broker

Here are five steps you must take to choose the best trading broker:

Regulation and Reliability

You should avoid trading on platforms with a questionable or poor reputation. Instead, select a broker that has financial licenses from top regulators. It's best to select a copy trading broker that has regulations in Australia, European Union, the UK, and developed countries.

Network Scale

The scale of the trading network determines the extent of your profitability. The larger the network, the more trade opportunities you'll have. Plus, you'll be able to make money through a large number of instruments.

Trading Conditions

The trading conditions of a platform are determined by the number of trading instruments available, commissions, and order execution quality. Some platforms will charge you an extra amount in the spread. Others may have a small membership fee or high minimum deposits. You should consider all these factors, based on your preferences, before making a decision.

Transparency

If a broker is transparent about the managers' statistical data, it's deemed reliable. The data should be publicly accessible. It should also be auditable independently.

Technology Finesses

A technologically effective platform will give you more information about risk management and trader selection. Thus, it will allow you to be more profitable and make better financial decisions.

Rules and Regulation

Licensing in the Philippines

Forex brokers operating in the Philippines are required to obtain licenses from the Securities and Exchange Commission (SEC) or the Bangko Sentral ng Pilipinas (BSP), depending on the nature of their business activities.

Investor protection in the Philippines

The SEC and the BSP have implemented various measures to protect Forex investors in the Philippines:

- disclosure requirements

- client fund protection

- regulatory oversight

Taxation in the Philippines

Capital gains tax rates in the Philippines vary depending on the type of asset and the holding period. The tax rates applied to capital gains from the sale or exchange of capital assets:

- for gains from the sale of shares of stock not traded on the stock exchange and other capital assets not otherwise covered, a final tax rate is 5% of the net capital gains.

- for gains from the sale of shares of stock traded on the stock exchange and other similar transactions, a final tax rate is 0.60% of the gross selling price or gross value in money of the shares of stock sold, exchanged, or transferred.

- for gains from the sale of real property classified as capital assets, a final tax rate is 6% of the gross selling price or fair market value, whichever is higher.

- it's important to note that tax rates and regulations may be subject to change, so it's advisable to consult with tax authorities or financial professionals for the most up-to-date information.

Summary

Copy trading and social trading have been immensely beneficial to novice traders in the Philippines. These platforms have allowed even complete beginners to trade like pros and make a serious killing in the markets.

Now that you know the best copy trading platforms in the Philippines, we hope you're in a better position to make the right choice. Remember, you can always test the waters of all different platforms before settling on a single platform. Think of it as exploring your options.

Also, while copy trading is profitable, there's no guarantee of making a profit. So, don't risk more money than you're comfortable losing. It also doesn't mean that you should throw caution to the wind. A little bit of research and due diligence can go a long way in copy trading. Failure to do so could result in consistent losses. With that said, we wish you the best of luck in your copy trading journey.

FAQs

Can you make profits with copy trading in the Philippines?

Yes, it's possible to make profits with copy trading in the Philippines. However, there's no guarantee of making a profit. Risking more money than you're comfortable losing is a recipe for disaster. Plus, a considerable bit of stock and forex trading knowledge is necessary for you to succeed in copy trading.

How does copy trading work in the Philippines?

Copy trading in the Philippines works by allowing you to copy the trades of more experienced and successful traders. This means that you don't have to put in the same amount of research and effort as them. All you need is a good copy trading platform. Once you find one, you can start copy trading immediately and make some good money.

What’s the best copy trading platform in the Philippines?

The best copy trading platform in the Philippines depends on your needs and preferences. However, some of the best copy trading platforms available in the country include FXTM and AvaTrade. These platforms are all reliable.

How can I create a copy trading account and start trading?

The process is actually quite simple. All you need to do is create an account with a copy trading platform like FXTM or AvaTrade. To do so, you'll need to provide some personal information like your name, email address, and phone number. Once you've registered for an account, you can start copy trading immediately.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).