Forex Scammer List in Philippines

Forex Scammer List in Philippines:

Forex-Metal — earned negative reputation, because it lied about being regulated;

BFSforex — as a bait, offers a demo account as well as special offers and contests;

MaxFX — has a lot of negative reviews, refuses to withdraw funds;

NAS Broker — based on the most recent reviews, the broker turned into a scam;

Panteon Finance — financial extortion, issues with withdrawals and non-fulfillment of obligations.

The foreign exchange market, popularly known as forex, offers tremendous opportunity for profit but also risks from fraudulent brokers seeking to scam unsuspecting traders. As forex trading grows in popularity in the Philippines, so too do efforts by scammers looking for their next victim.

To help investors avoid getting duped, Traders Union has compiled this forex scammer list focusing specifically on problems reported among Philippine traders. Drawing from reviews and complaints, this blacklist names brokers with a track record of deception, failed payouts, manipulated trading platforms and other unscrupulous activities. With care and diligence, forex profits await - but vigilance is required to trade safely.

-

What tactics do Philippines forex scammers use to find victims?

Common tactics include online ads promising easy income, presentations at hotels falsely claiming successful trading strategies, developing fake friendships to gain trust, and using multi-level marketing structures.

-

Can I get my money back if I was scammed by a Filipino forex scammer?

It is very rare for victims to ever get back money lost in forex scams. The best recourse is prevention. If funds were recently deposited, freezing assets through legal channels quickly may allow some recovery.

-

Can forex scammers in the Philippines be arrested and prosecuted?

Philippines authorities have begun trying to be more aggressive in going after large fraudulent operations. However, regulation and enforcement remain difficult. Scams still clearly outpace enforcement efforts.

-

What forex scam awareness and prevention resources are available in the Philippines for potential victims?

Some consumer protection groups offer warnings online. Mainstream news has also increasingly highlighted major fraud cases. Simply searching “[Scammer name] scam” can surface key details.

Is Forex legit in the Philippines?

Forex is an international currency exchange market that is considered the largest market in terms of trading volume and profits of participants. The daily turnover amounts to trillions of US dollars. Largest banks, large investment companies and transnational corporations, hedge funds and private investors participate in transactions with various assets (currency pairs, stocks, commodities, etc.). Private investors can access Forex through brokerage organizations. Speculating on the price differences is how you make money on Forex. At the same time, one must keep in mind that trading is a high risk activity, and in the case with an organization from the Forex Scammer List, the chances of earning a profit are zero!

When choosing a financial intermediately, it is important to keep in mind that all purchases financed with local currency (Philippine Peso) are subject to the Foreign Exchange Guidelines. Forex trading in the country is controlled by the Bangko Sentral Ng Pilipinas (BSNP).

Brokers providing services to Philippine traders must hold the license of either the local regulator or any other recognized regulators. Choosing a reliable and honest financial partner is 50% of success. A company like that will provide comfortable and secure trading conditions, help you grow your capital and will bear responsibility for undertaken obligations.

Forex Broker Blacklist in Philippines

Not all companies that claim to be honest and reliable are indeed honest and reliable. Often, financial scammers claim to be legal brokers. Working with them won’t bring your profit, but rather may cause you to lose all your savings.

The table below features the Forex Scammer List. These are scam brokers that have earned distrust of traders due to various reasons: non-fulfillment of obligations, extortion of money, problems with the execution of transactions and payment discipline. We will detail the main facts that we discovered about these illegal brokers, as well as signs of fraud. Don’t fall for the tricks of scammers!

| Name | Date of establishment | Minimum loss |

|---|---|---|

Forex-Metal |

2005 |

$10 |

BFSforex |

2013 |

$10 |

MaxFx |

2015 |

$200 |

NAS Broker |

2012 |

$10 |

Panteon Finance |

2010 |

$10 |

SunbirdFX |

2005 |

$100 |

Tradaxa |

2011 |

$10,000 |

Vertical Markets |

2015 |

$30 |

XGLOBAL Markets |

2012 |

$500 |

ZarFx |

2013 |

$500 |

Calibur |

2020 |

$1,000 |

MidasGlobe |

2019 |

$500 |

CircleForex |

2016 |

$100 |

Fx Options24 |

2019 |

$250 |

Aduno Capital |

2011 |

N/A |

Forex-Metal

Forex-Metal is a company registered in the territory of Panama that has been providing services since 2005. Traders are promised access to trading Forex/CFDs. Among the key benefits, the broker specified zero fees, access to leverage, storage of funds on segregated accounts. The broker earned negative reputation, because it lied about being regulated (it claims to have licenses issued by CySEC and FCN), and also offices in several countries, failure to fulfill its obligations and financial extortion.

The key signs of this scam:

There is no legal basis for legal operation;

Manipulation of the trading process;

A lot of negative reviews confirming that the broker lied;

Issues with withdrawals;

Impossible conditions for using bonuses;

Expansion of spreads to incredible rates;

Draining of user deposits without trader’s participation;

Blocking of accounts without a reason.

BFSforex

BFSforex claims that it has been providing services since 2013 and that it operates in many countries. The broker offers the universal MT4 platform for trading, although users complain that the software is manipulated and used to drain deposits. As a bait, the scammer offers a demo account as well as special offers and contests. The minimum loss in the project is USD 10, but many people have lost much bigger amounts due to fantastic leverage of up to 1:2000.

The key signs of this scam:

There is no legal documents for legal operation;

Controlled trading software;

False trading advice;

Rigged technical failures and draining of user deposits;

no customer support.

MaxFX

MaxFX brand was established in 2015. TOPFX Ltd. is the parent company. It is a Cyprus organization that is officially registered and regulated, although it only has www.topfx.com listed as controlled domains. Nothing is mentioned about MaxFX. The platform offers a wide selection of assets, including currency pairs, stocks, indices, precious metals, energies.

The key signs of this scam:

A lot of negative reviews;

Purposeful drainage of funds during algorithmic trading and PAMM;

Imposition of the services of a personal manager who gives false advice;

Abnormal widening of spreads;

Refusal of withdrawal requests.

NAS Broker

NAS Broker is an offshore company from St. Vincent and the Grenadines. It has been providing services since 2012, but has never obtained a license for legal operation. The organization enticed beginners by telling them about a unique software infrastructure for providing liquidity quotes directly, offering good trading conditions and no particular requirements for deposits. Based on the most recent reviews, the broker turned into a scam.

The key signs of this scam:

Offshore registration;

Abundance of negative reviews on independent forums;

Unreasonable account blocking;

Unrealistic withdrawal fees and hidden fees;

Empty promises of high returns;

Non-refundable investments;

Manipulation of the trading platform and rigged technical failures;

No legal grounds for providing services.

Panteon Finance

Panteon Finance is a broker from Belize that has been providing services since 2010. The company is officially registered by the IFSC and initially honestly fulfilled its obligations. Recently, however, negative reviews about this brokerage organization have been posted on many independent forums. Traders complain about financial extortion, issues with withdrawals and non-fulfillment of obligations.

The key signs of this scam:

Growing pool of negative reviews;

Drainage of funds and refusal from financial obligations (specifically through PAMM);

No understanding from customer support;

Unrealistic leverage, driving traders into debt;

Issues with payment discipline;

Technical failures, lack of guarantees for the stable operation of the platform.

SunbirdFX

SunbirdFX is a broker providing access to trading Forex and CFDs. The company promises its users a wide range of professional instruments for growing capital, and strict compliance with international rules and regulations, although its real clients say that the company is blatantly lying. It does not allow traders to earn money, and also refuses to give back trader’s own deposits. The minimum loss in the project is USD 100.

The key signs of this scam:

Imposition of the services of a personal manager who acts solely in the interests of the company;

Issues with order execution: requotes, slippages, technical failures;

Issues with withdrawals;

Willful change of the fee schedule;

Fake platform;

A lot of negative reviews.

Tradaxa

Tradaxa was established in 2011. According to the legend, it was created by professional Forex traders, although their names are not disclosed. The platform claims to be registered in New Zealand, although there are no documents confirming this fact. The platform does not provide the incorporation certificate and the license. Judging by the reviews, this fake broker has been swindling funds from naïve traders for years, driving them into debt.

The key signs of this scam:

No brokerage license;

A lot of negative reviews;

Anonymity of the project creators;

Impossibility of withdrawing funds;

Refusal of financial liability;

Problems in the operation of trading software.

Vertical Markets

Vertical Markets is a brokerage company registered in the Seychelles. It operates without regulation. The company has been providing online services since 2015. It entices users with a diversity of trading instruments, availability of the universal MT4 trading platform and low entry threshold.

The key signs of this scam:

Issues with regulation;

Enslaving conditions: the company waives financial liability, can unilaterally terminate the agreement, etc.;

Cheat rating;

Refusal of withdrawal requests for made-up reasons;

No technical and customer support;

False trading advice;

Financial extortion;

Rigged technical failures to drain deposits.

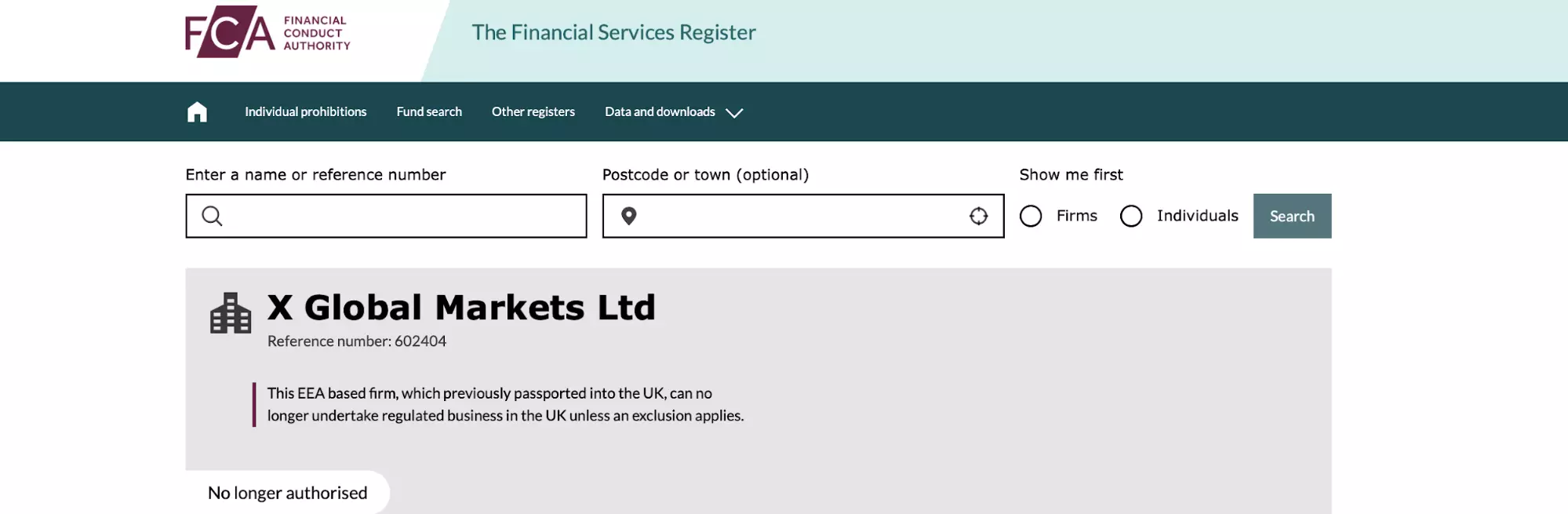

XGlobal Markets

XGlobal Markets was established in 2012. The company claims to be registered in Cyprus, and to hold several licenses: CySEC, BaFin, FCA. The licenses were indeed issued in the past, but due to numerous complaints of users and violations of the financial law, the licenses were revoked. Here are the results of a check in the database of the British regulator FCA:

The results of a check in the database of the British regulator FCA

XGlobal Markets hides this fact and continues to operate under the “red flag”. Traders are lured by ultra-narrow spreads, diversity of trading instruments and payment methods, margin trading (leverage up to 1:200). The minimum deposit is USD 500.

The key signs of this scam:

License extension was rejected;

Full absence of legal protection;

Issues with payment discipline;

Quote manipulations;

Reputation spoiled by negative reviews.

ZarFx

ZarFx positions itself as a leading broker in the global Forex market. The company began working with retail investors in 2013. Initially, the reviews about this financial partner were positive, but then it seized being honest. There is no information about a license; there is no legal protection. At that, the broker promises the best prices, competitive spreads and quick withdrawal. Traders complain that the company does not fulfill its obligations.

The key signs of this scam:

False promises of high returns;

No legal documents;

Problems with customer support;

Controlled platform to drain user deposits;

Full absence of payment discipline;

Negative reviews of clients;

Transactions are not taken to the real market.

Calibur

Calibur Capital is a broker specializing in forex and CFD trading. The company presents customers with a selection of five distinct account types, all of which are compatible with the widely-used MetaTrader4 platform. Notably, Calibur Capital offers a Compensation Fund, designed to safeguard investments, alongside a commendable level of account management service. This service ensures that clients receive comprehensive guidance on trading-related matters and associated risks. It is worth mentioning, however, that Calibur Capital operates without regulation. Calibur Capital has been accused of being a clone firm, which is a type of scam where a company pretends to be a legitimate business to trick people into investing money.

Key Signs of this Scam

Lack of regulation

Suspicious business practices

Calibur Capital has been accused of being a clone firm

Unrealistic promises such as guaranteed profits or high returns on investment

Wide bid-ask spreads certain currency pairs

Lack of transparency

MidasGlobe

MidasGlobe is a forex broker that provides an extensive range of trading options, including over 30 currency pairs, energy commodities, futures, and CFDs. Established in 2014, the company supports the widely utilized MT4 and Mobile top forex trading platforms. However, it is crucial to recognize that MidasGlobe operates as an offshore entity and lacks the necessary license from a reputable financial regulator. Consequently, engaging in trading activities with MidasGlobe poses inherent risks, as offshore brokers often fail to offer reliable financial investment services.

The key Signs of This Scam

Lacks a proper license from a reliable financial regulator

Fraudulent practices

Traders have experienced financial losses and difficulties withdrawing funds

Involvement in higher-risk, low-priced securities

Association with dangerous scammers who fool traders

Reported to be a 100% fraud company

Negative reviews from traders who have lost their money

Circleforex

Circleforex, a forex broker established in 2016 in New Zealand, provides online trading services to individuals interested in the forex market. With a remarkably low account opening threshold of merely $100 and the option of high leverage, Circleforex aims to cater to a wide range of traders. The platform offers an array of trading possibilities, including currency pairs and precious metals. However, it is essential to acknowledge that Circleforex lacks the necessary license from recognized forex regulatory authorities worldwide. Circleforex has also faced allegations of facilitating clients in falsifying documentation to pass risk assessments, resulting in the liquidation of their accounts. These accusations further emphasize the inherent dangers associated with engaging in trading activities with Circleforex.

The Key Signs of this Scam

Circleforex is unregulated

The company behind Circleforex remains undisclosed, raising transparency concerns

Pyramid scheme complaints

Circleforex allegedly aids clients in fabricating material to pass risk tests

Traders have left negative reviews about Circleforex

FX Options24

FX Options24 is a forex broker that claims to be registered in Vanuatu and Cyprus. It's an unregulated broker that offers a diverse range of trading options encompassing forex, commodities, indices, cryptocurrencies, bonds, ETFs, ETNs, and physical stocks. The broker asserts compatibility with both the MT4 and MetaTrader 5 trading platforms, while also advertising leverage of up to 1:400. However, it's important to note that the company lacks a financial dealer license from the Vanuatu authorities. Furthermore, the absence of FX Options24's terms and conditions, a crucial document in forex trading, on their website raises concerns.

Key Signs Of This Scam

Unregulated broker

No license listed

Unclear corporate information

Has been flagged by various review sites as a scam

No authorization or registration of the address

No terms and conditions

Aduno Capital

Aduno Capital emerged as an online Forex broker in 2019, touting an extensive selection of 50,000+ financial instruments, including Forex pairs and various CFDs. However, it is crucial to note that Aduno Capital operates without regulation, leading to multiple reports of fraudulent activities and exploitation of unsuspecting investors. The company lacks authorization, and registration, and its unverified address raises concerns about its legitimacy. Aduno Capital falsely claims affiliation with Aduno Capital Group Ltd, a German-based firm, and deceitfully presents counterfeit licenses from entities like FCA, CySEC, MFSA, and SFC. This illicit behavior has prompted blacklisting by reputable regulatory bodies such as Germany's BaFIN and Austria's FMA.

Key Signs Of This Scam

It's an unregistered broker

Fakes licenses of various jurisdictions like FCA, CySEC, MFSA, and SFC

Has been blacklisted by German regulator BaFIN and the Austrian financial regulator FMA

Provides no substantial information about its working conditions

Has been identified as a full-fledged scam broker that rips off investors

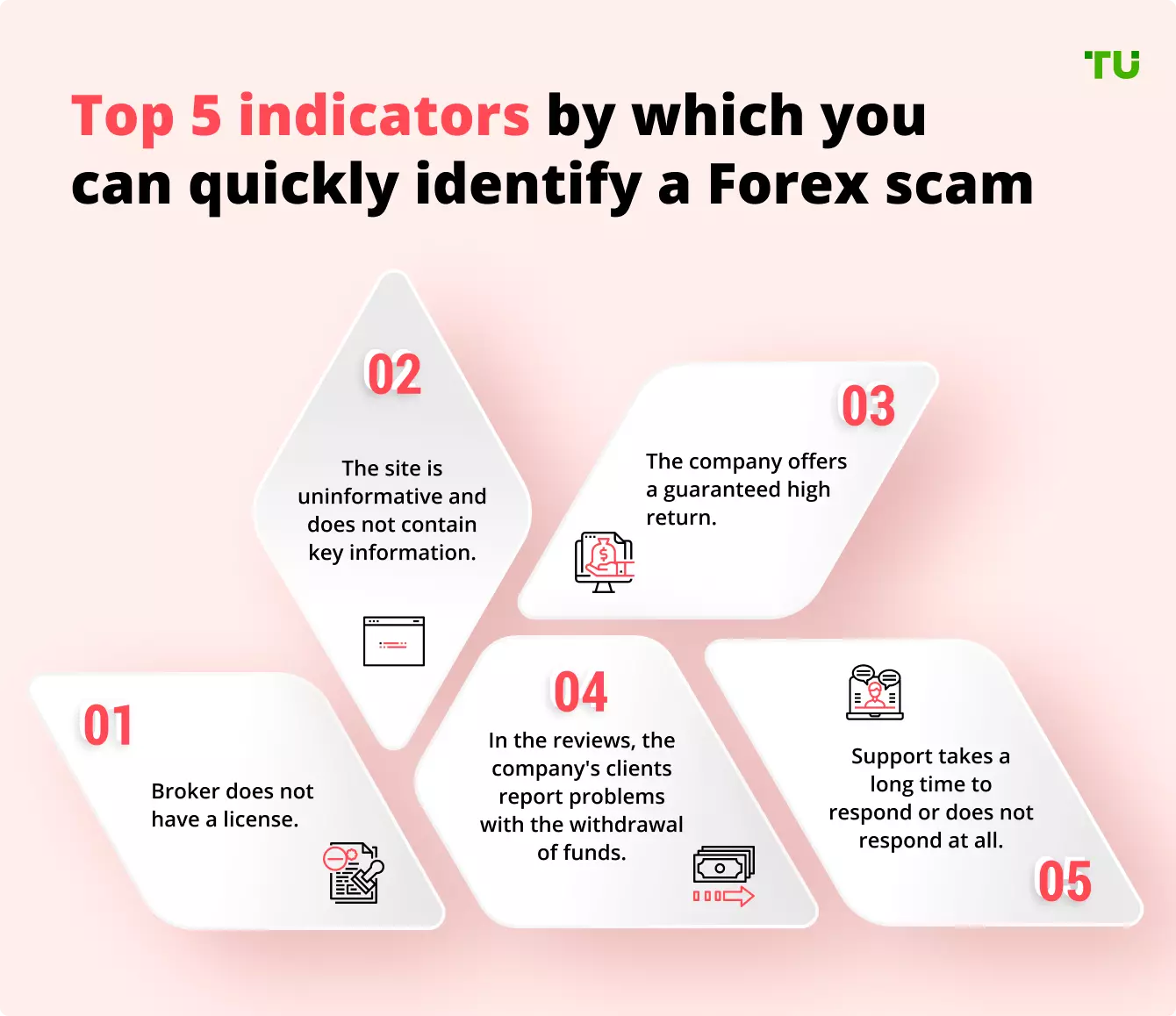

How to check if a Forex Broker is legit in 5 steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in Philippines. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not.

3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5. Read customer reviews

Reviews of real clients can tell you a lot about a broker. If a company has many negative reviews (traders point to extortion, manipulation of trading process, issues with withdrawals and failure to perform obligations), it is best not to go with such a broker. You can find reviews of real clients on the Traders Union website, where users actively share their personal opinions and tell the truth about financial companies.

How To Avoid Forex Scams Companies?

Avoiding Forex scam companies is crucial to protect your investments and ensure a safe trading experience. Here are five essential tips to help you navigate the Forex market securely:

Work with regulated brokers

Choose brokers that are regulated by reputable financial authorities. Regulatory bodies provide oversight and enforce strict standards, reducing the risk of fraudulent activities.

Avoid high-risk brokers

Be cautious of brokers promising unusually high returns or employing aggressive marketing tactics. Research their reputation, read reviews, and opt for brokers with a solid track record and a transparent business model.

Watch out for false promises

Exercise caution if a broker guarantees consistent profits or claims to have insider information. Forex trading involves inherent risks, and no legitimate broker can guarantee consistent success.

Don't choose a broker that offers automatic trades

Be wary of brokers who offer automatic trading systems that claim to generate substantial profits with minimal effort. Automated systems can be manipulated or poorly designed, resulting in significant losses.

Verify that the broker's website is secure

Before sharing personal and financial information, ensure the broker's website is secure. Look for the padlock icon in the browser's address bar, indicating a secure connection (https://). Additionally, verify the broker's contact information and conduct an online search for any reported scams or issues.

Best Forex Brokers in Philippines

There are many brokers in Philippines market ready to provide intermediary services. Choosing the best option is rather a challenge. Here is a brief review of the Top 3 trusted brokers in Philippines that are regulated in this country and in other jurisdictions. These companies provide truly good trading conditions, perform their obligations in good faith and have received positive reviews.

| Name | Minimum deposit | Learn more |

|---|---|---|

eToro |

$200 |

|

Exness |

USD 10 |

|

XM |

USD 5 |

|

eToro

eToro is a broker that is popular not only in Philippines, but also in many other countries (with geographical coverage of over 140 jurisdictions). The company was established in 2007 and is positioned as a social trading platform. The broker is regulated, with offices in different countries and licenses of the CySEC and FCA.

Key benefits:

-

Demo account to test your capabilities risk-free;

-

Actively developing trading community in Philippines;

-

Regulated in UK, AU, South Africa and EU Broker;

-

-

User-friendly functionality for passive investing;

-

Many positive reviews;

-

The minimum copy trading amount is USD 1.

Exness

Exness is a trusted broker for trading a wide range of assets. The company was established in 2008 and enjoys popularity thanks to operating in good faith, having a client-oriented policy and an entry threshold that is comfortable even for beginners. You will never say that Forex is a scam if you work with this company.

Key benefits:

-

A physical office in the country;

-

Regulated in UK and EU Broker;

-

Segregated accounts that provide high security level for user funds;

-

Narrow spreads and low minimum deposit;

-

Demo account;

-

Several trading platforms to choose from.

XM

XM was established in 2009. The company provides services to traders from 190+ countries, including Philippines. The broker has earned trust thanks to a client-oriented approach and concern for comfortable and safe trading. XM is constantly working to improve the quality of service. The company operates legally, and holds licenses of several reputable regulators.

Key benefits:

-

Regulated operation;

-

Demo account;

-

Competitive spreads;

-

More than 1,000 trading instruments;

-

No requotes; 99.35% of orders are executed instantly;

-

Multilingual support operating 24/5;

-

Zero deposit/withdrawal fees.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.