6 Best Platforms for Copy Trading in India 2024

Best Copy Trading Platform in India 2024 - RoboForex (CopyFx)

TOP Copy Trading Platforms in India 2024:

-

RoboForex (CopyFx) – best app with minimum deposit only $10 and $30 bonus;

-

AvaTrade (AvaSocial) – best copy trading app for beginners;

-

IC Markets (ZuluTrade) – 3 supported social trading networks, extra low fees;

-

FXTM – the investor can connect to an unlimited number of strategy providers;

-

InstaForex (Forex Copy) – minimum deposit only $10.

Copy trading is becoming increasingly common as novice and less experienced traders are entering the market. Since copy trading allows traders to copy the positions taken by other more experienced traders, it allows you to make successful trades based on someone else's strategy.

In this guide, we've listed the six best platforms for copy trading in India. Our rating criteria include different aspects, including the ease of working with Indian citizens, the platform's reliability, and the copy trading features a platform offers.

By considering all these factors, we ensure that your experience with our recommended platforms is nothing but satisfactory.

Do note that you need to have a profile on each of these platforms to avail their services and features. Here's an overview of our favorites.

-

How much can I earn through copy trading?

Returns vary greatly depending on your brokers, chosen traders, risk tolerance, and market trends. However, most traders report average monthly returns between 5-15%.

-

How often do I need to monitor my copy trades?

Check in at least 2-3 times a week, and after major market events, to ensure copied traders are still performing well and you're comfortable with their strategies and risk levels. Adjust if needed.

-

How do I know which traders to copy?

Check traders' performance history, risk level, number of successful trades, and trading strategies to identify skilled traders you can safely replicate. Key aspects to consider are returns consistency, maximum drawdowns, and risk-reward ratios.

-

Is there a minimum capital required for copy trading?

The minimum balance usually matches the standard minimum deposit but can sometimes be slightly higher or require keeping a minimum equity balance in your account. However, investing higher capital diversified across multiple trading strategies is advisable.

Copy Trading Platforms in India - Comparison

The comparison table briefly showcases the highlighting features of each platform reviewed below.

Best Platform for Copy Trading in India| Broker | Minimum Deposit | Subscription Price | Markets | |

|---|---|---|---|---|

$10 to $100, depending on account type |

Free |

Forex, Stocks, ETF, Crypto, Commodities, CFDs |

||

$100 |

Free |

Stocks, Cryptocurrencies, Commodities, CFDs, Bonds, ETF |

||

$200 |

Free |

Forex, CFDs, commodities, Crypto, Stocks, Bonds |

||

$10 |

Free |

CFDs, stocks, and Forex |

||

$10 |

$10 membership fee |

Forex, Stocks, Crypto |

||

$1 |

Free |

Forex pairs, cryptocurrencies, commodities, indices, and stocks |

What is Copy Trading?

Copy trading is a trading method in which you copy the positions managed and opened by other traders. It shouldn't be confused with mirror trading since that involves mirroring every action of the copied trader.

Meanwhile, in copy trading, traders can copy certain strategies of the investor they want to emulate. Modern copy trading platforms allow traders to earn money through this method by using the following features:

Showing the trade analytics of investors to be copied

Giving options to distribute equity among multiple traders with different trading instruments and strategies

Offering an option to stop trade copying when certain risk tolerance is reached

Setting maximum risk level for particular investments

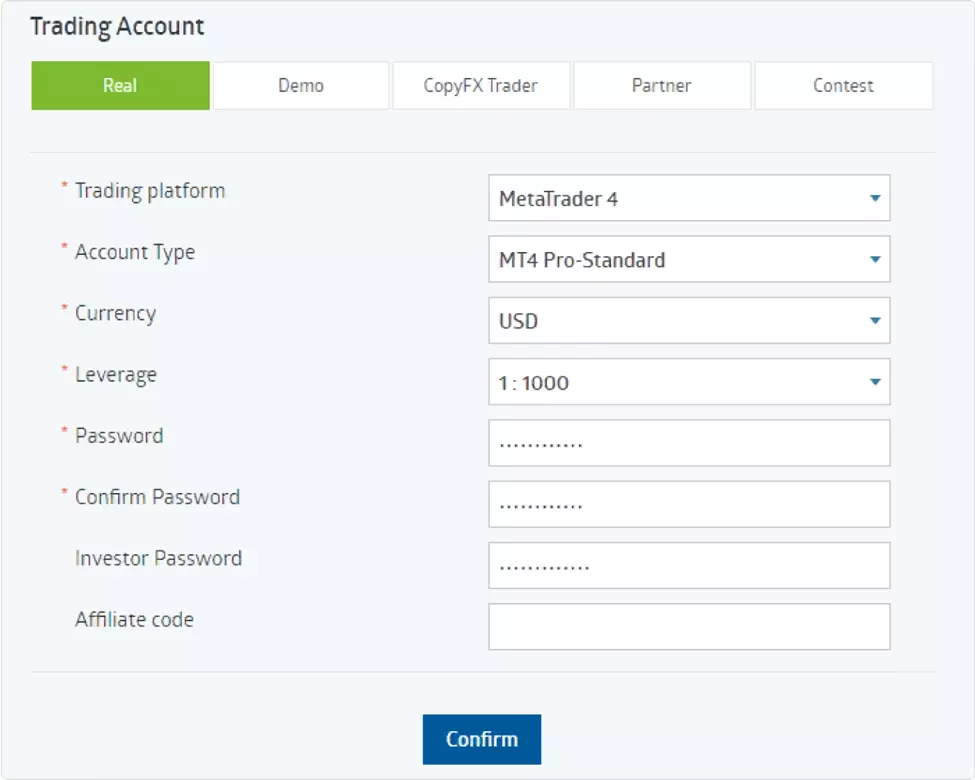

RoboForex (CopyFx) - Best Robo Broker for Copy Trading India

RoboForex lets traders earn passive income through automated trading. Offering over 12,000 instruments and eight asset types, RoboForex is the best copy trading platform in India for traders with minimal trading experience.

RoboForex copy trading

Usability

On RoboForex, you can specify the copy trading options based on your preferred functions. Thus, only the transactions pertaining to your specified parameters will be copied.

With a minimum investment of $10, you can invest in indices, commodities, stocks, Forex, and cryptocurrencies.

Safety and Regulation

Since RoboForex is registered in Belize, it has a license from IFSC, which is the local regulator. As compared to other brokers in this list, RoboForex is not as highly regulated.

Copy Trading Features

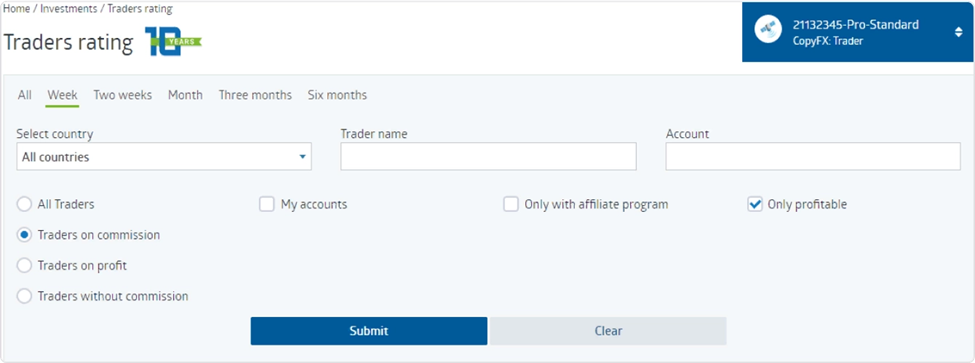

RoboForex has a Traders Rating tab where you can find the top traders to copy. If you have any specific asset or instrument preferences, you can filter the results based on your desired factors.

RoboForex copy trading

The broker offers different search parameters, including the lifespan of the account, profitability, and risk level.

RoboForex copy trading

You can check a particular trader's transaction history and later their open transactions once you've subscribed to a signal provider.

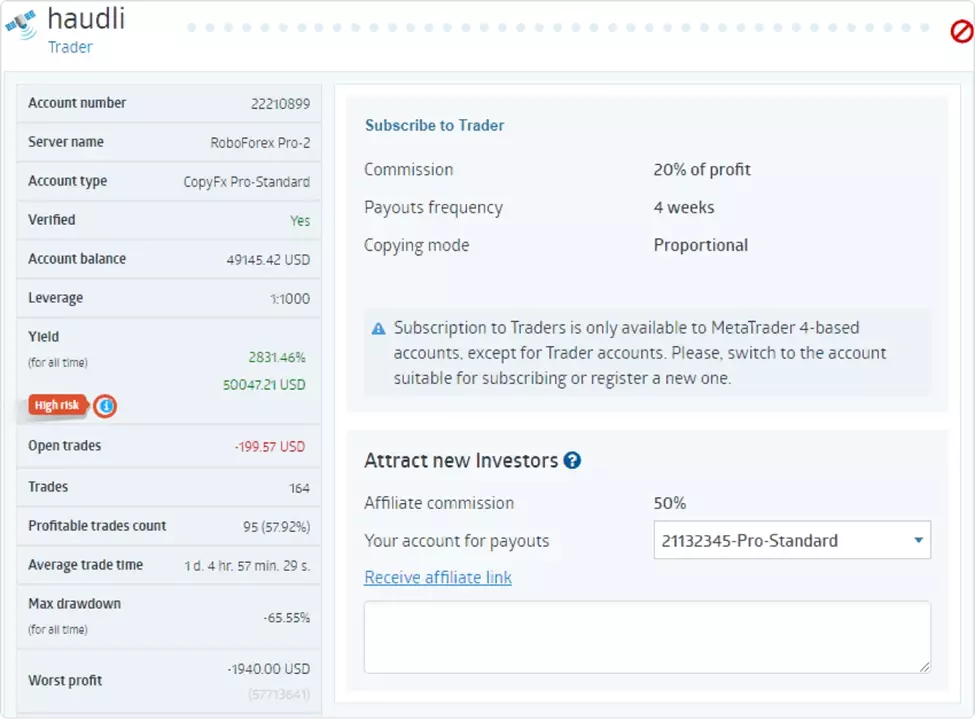

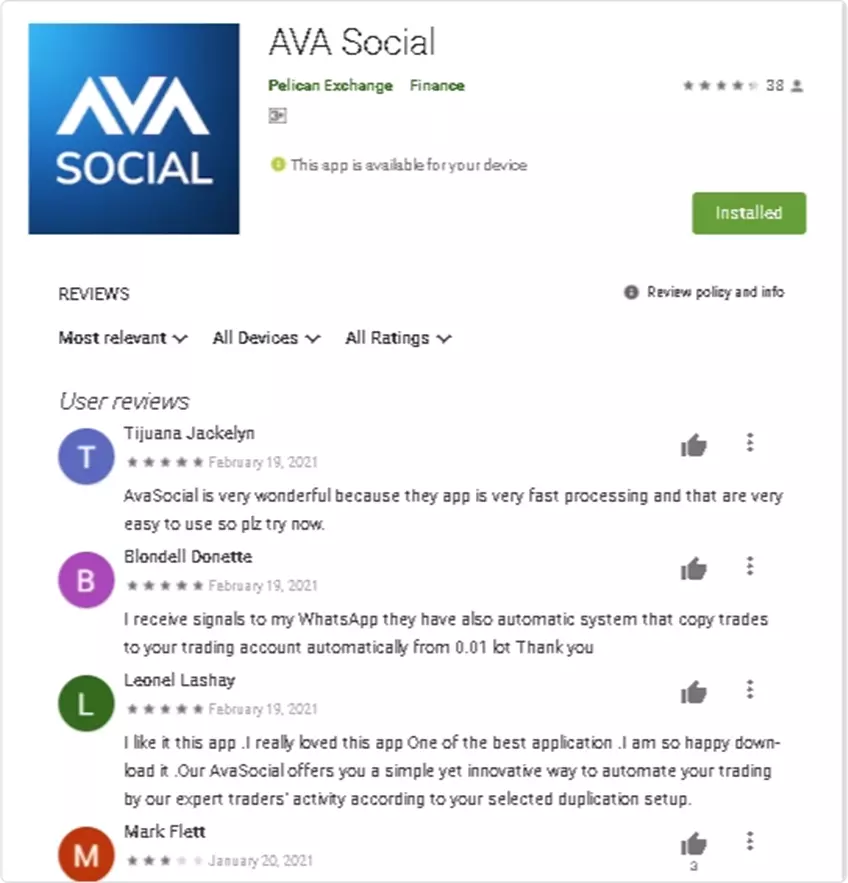

AvaTrade (AvaSocial) - Most Highly Regulated Copy Trading Platform

AvaTrade is a world-renowned name in the world of social trading and copy trading. It is regulated by the top seven global authorities, including the Central Bank of Ireland.

AvaTrade copy trading

Usability

AvaTrade works with three other copy trading platforms, namely MQL5, DupliTrade, and ZuluTrade. In this way, it gives the users access to thousands of investors and signal providers.

With a minimum investment of $100, you can invest in indices, cryptocurrencies, stocks, bonds, Forex, CFDs, and 1,250 other markets.

Safety and Regulation

AvaTrade is the best copy trading app in India in terms of regulation and safety since it has licenses from many top regulators worldwide, including:

-

British Virgin Islands Financial Commission

-

Financial Regulatory Services Authority (FRSA)

-

Japan FSA

-

South African Financial Sector Conduct Authority (FSCA)

-

ASIC

-

Central Bank of Ireland

Copy Trading Features

Once you've registered on AvaTrade, you can check the ranking of each copy trading signal provider on the platform.

The broker lets you see the history of a user's trades and their approach to risk management.

You can then subscribe to your preferred trader's signals.

AvaTrade also lets you diversify your trade by subscribing to multiple signals. Depending on your risk tolerance, you can set the risk parameters at which copy trading will be stopped.

IC Markets (ZuluTrade) - Most Cost-Effective Platform for Copy Trading India

IC Markets is one of the most cost-effective trading platforms in the market due to its low commission rates. Plus, it has phenomenal order execution features and multiple opportunities for you to earn passive income.

It also offers additional copy trading services in partnership with Autotrade, MyFxBook, and ZuluTrade.

Usability

Since IC Markets does not have a proprietary copy trading platform, it partners with other social trading platforms, such as Autotrade and ZuluTrade.

With a minimum deposit of $200, you can invest in a wide range of trading instruments.

Safety and Regulation

IC Markets has licenses from top regulators in the EU and Australia. In Australia, it has a license from the Australian Financial Services License (AFSL No. 335692), while its EU license is from Cyprus Securities and Exchange Commission (CySEC License Number 362/18).

Copy Trading Features

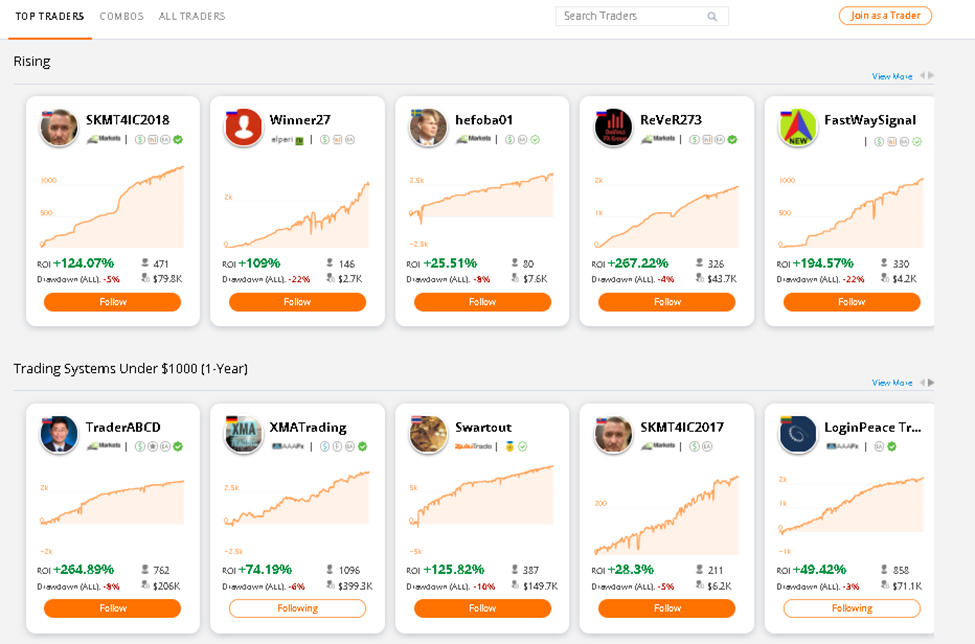

The simplest way to copy trade on IC Markets is to use ZuluTrade's recommendations. The editors and algorithm regularly update the recommendations for top signal providers. You can find this information in the Top Traders section.

IC Markets copy trading

You can check the risk parameters and profitability of the signal providers to make an informed decision.

FXTM (FXTM Invest) - Most User-Friendly Platform for Copy Trading India

FXTM released its copy trading services for traders in 2016 and has been a highly user-friendly option since then. Even beginners can grasp the mechanism of the platform quite easily.

FXTM copy trading

Usability

You need a minimum investment of $100 to get started on the platform. FXTM makes trading convenient for traders by offering a number of deposit and withdrawal options, such as wire transfer, debit and credit cards, Bitcoin, and payment services, like Neteller and Skrill.

It has more than 250 instruments and lets you copy trade in several markets, like CFDs, stocks, and Forex.

Safety and Regulation

FXTM is considered a safe broker since it has financial licenses from:

-

Cyprus – CySec No. 185/12

-

The UK – FCA No. 600475

-

South Africa – FSCA No. 46614

It is also safe for UK and EU users since it's a deposit guarantee fund member.

Copy Trading Features

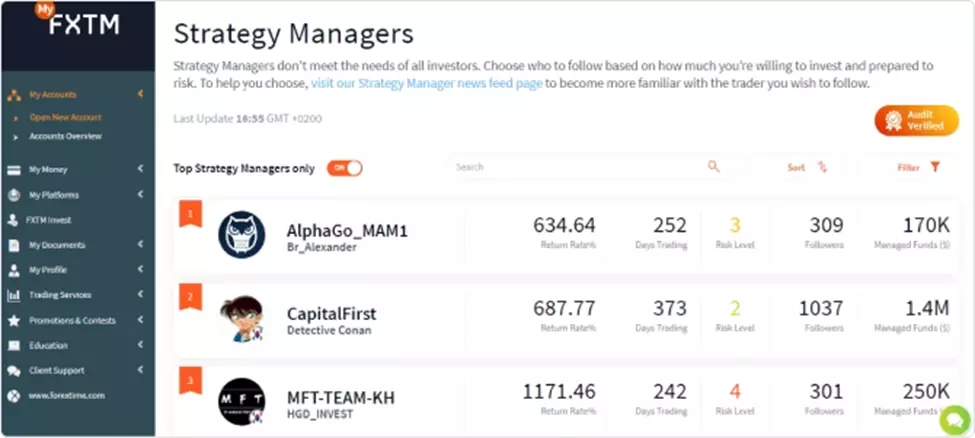

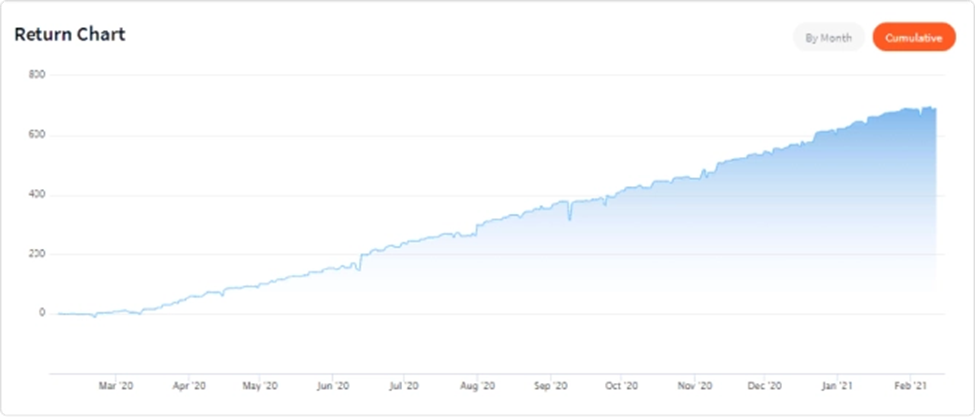

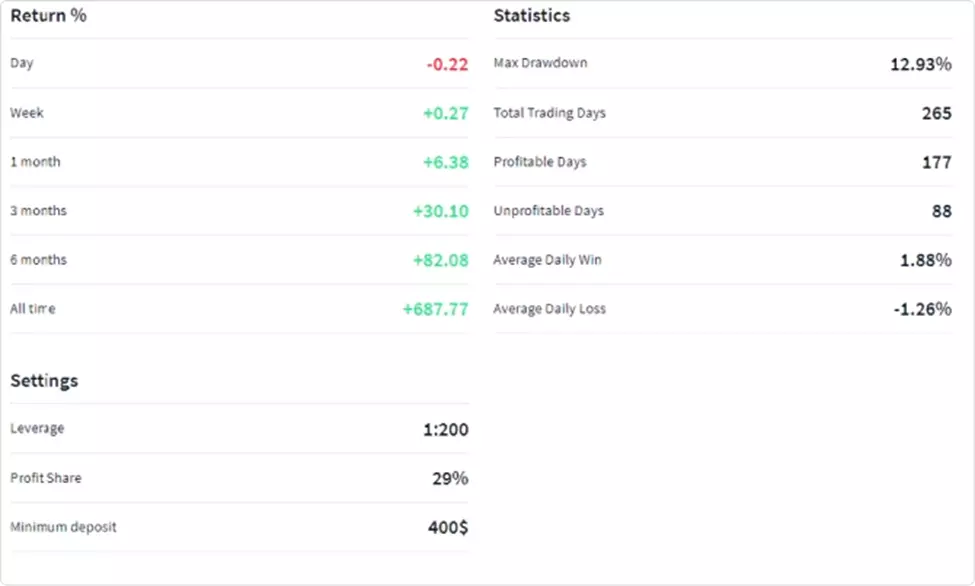

Copy trading on FXTM is made easier by the platform's comprehensive display of a trader's risk parameters and profitability. When you click on a trader's profile in FXTM, you can see their data.

FXTM copy trading

You can see the following parameters for each signal provider: average daily loss, average daily win, unprofitable days, maximum drawdown, profitable days, and total trading days.

FXTM copy trading

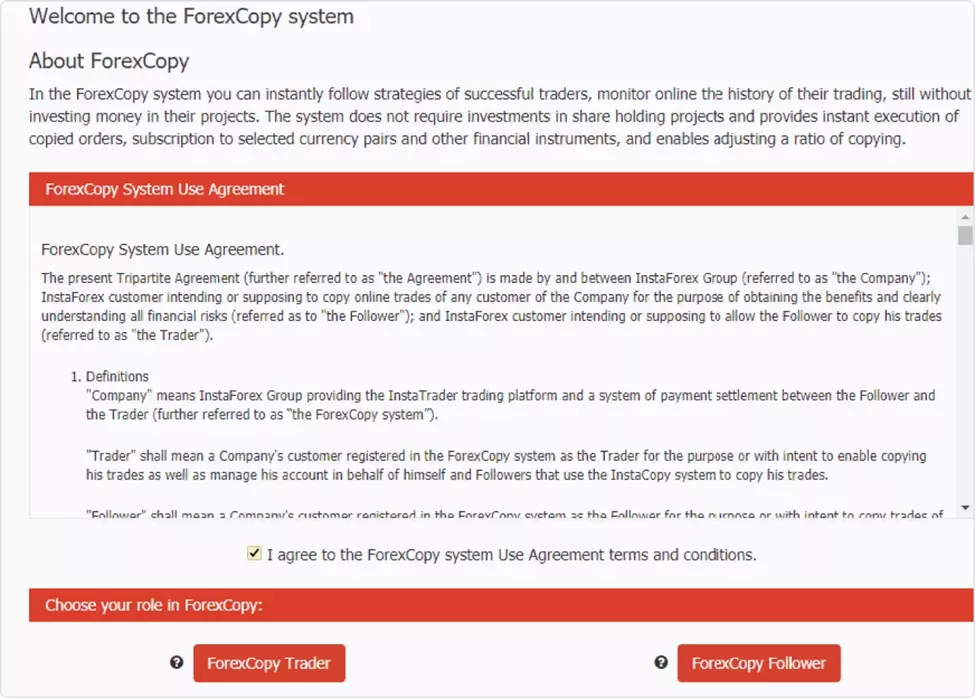

InstaForex (Forex Copy) - Best Copy Trading Platform in India for Beginners

InstaForex was among the first brokers to offer copy trading and remains a popular option for beginners since anyone can get started with a minimum deposit of $10.

InstaForex copy trading

Usability

InstaForex has been around since 2010 and offers a wide assortment of markets to copy, including indices, commodity futures, cryptocurrencies, commodities, CFDs on stocks, and currency pairs.

With more than 300 instruments and six types of commissions, the broker is ideal for traders with different experience levels. You can get started with just $10.

Safety and Regulation

InstaForex is regulated in these jurisdictions:

-

Instant Trading Ltd (Virgin Islands)

-

Insta Service Ltd (Saint Vincent)

Since these jurisdictions aren't transparent about their beneficiaries and are offshore, InstaForex isn't considered as reliable as some other options we've mentioned.

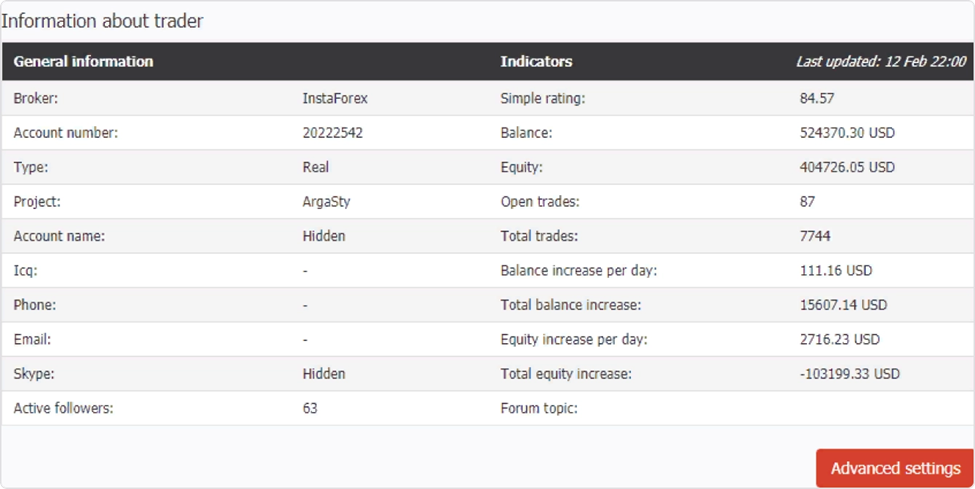

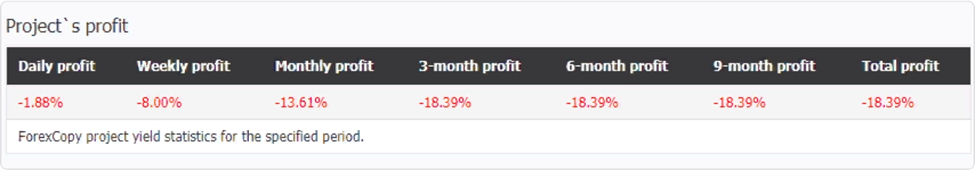

Copy Trading Features

When you're selecting an InstaForex trader to copy, you can see a lot of information about them to make a decision. InstaForex lets you see the trader's rating on the platform along with their capital, account balance, number of open trades, number of transactions, total balance gain, total capital gain, and average per day balance gain.

InstaForex copy trading

You can also check the profitability of the signal provider to determine if they're the best trader to copy.

InstaForex copy trading

Although you can see a lot of transactional information, the broker falls short in terms of showing risk indicators.

Exness

Exness is a well-regarded online broker that was established in 2008. This broker has grown significantly over the past years, gaining a reputation for its transparency, diverse trading instruments, and user-friendly platforms.

Usability

Exness provides access to a range of financial instruments, including Forex pairs, cryptocurrencies, commodities, indices, and stocks. The platform's interface is intuitive and easy to navigate, making it suitable for both beginner and experienced traders.

It offers MetaTrader 4 and MetaTrader 5 platforms, renowned for their advanced charting tools, automated trading systems, and compatibility with a wide range of devices. The minimum deposit on Exness varies depending on the type of account. The minimum deposit for copy trading is $500.

Safety and Regulation

When it comes to regulatory oversight, Exness is held to high standards. The broker is regulated by:

These regulations help ensure that Exness operates with transparency and integrity, protecting its clients' funds and maintaining fair trading practices.

Copy Trading Features

Exness offers a Social Trading feature that allows users to copy the trades of experienced traders. This is an ideal option for those who may lack the time or expertise to conduct their own market analysis.

Traders can search for successful investors to follow based on their performance, risk level, and type of investment. This copy trading feature integrates seamlessly with the Exness platform, with a straightforward setup process.

The platform provides comprehensive data about each trader, including their past performance, risk level, and trading strategy. This allows potential followers to make informed decisions about who to copy. You can also control your risk by specifying the amount of money you allocate to copy trading and setting a stop-loss limit.

How to Choose a Copy Trading Broker

Here are five steps you must take to choose the best trading broker:

Regulation and Reliability

You should avoid trading on platforms with a questionable or poor reputation. Instead, select a broker that has financial licenses from top regulators. It's best to select a copy trading broker that has regulations in Australia, European Union, the UK, and developed countries.

Network Scale

The scale of the trading network determines the extent of your profitability. The larger the network, the more trade opportunities you'll have. Plus, you'll be able to make money through a large number of instruments.

Trading Conditions

The trading conditions of a platform are determined by the number of trading instruments available, commissions, and order execution quality. Some platforms will charge you an extra amount in the spread. Others may have a small membership fee or high minimum deposits. You should consider all these factors, based on your preferences, before making a decision.

Transparency

If a broker is transparent about the managers' statistical data, it's deemed reliable. The data should be publicly accessible. It should also be auditable independently.

Technology Finesses

A technologically effective platform will give you more information about risk management and trader selection. Thus, it will allow you to be more profitable and make better financial decisions.

Is Copy Trading Legal in India? Is it Safe?

Is Copy Trading Legal in India?By now, you may have selected the best copy trading app in India. You must be wondering, is copy trading legal in India? Yes, copy trading is legal in India.

However, it's best if you choose regulated brokers for copy trading since it will ensure the safety of your investments. Plus, you'll have a pleasant trading experience when trading on a regulated platform.

How to avoid forex trading scams?Expert Opinion

Copy trading is not a guarantee of profit, but it can significantly improve the chances of success for beginners. To succeed in copy trading, it's crucial to choose both a trader with good trading indicators and a suitable platform. Pay attention to the regulation and reliability, trading conditions, policy transparency, and technological features. Also, consider the size of minimum investment. Beginners should avoid risking large sums and start with a small deposit, gradually increasing the trading volume.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.