How to Trade Forex in Nigeria

Trading forex can be challenging to learn, and without a guide, most traders lose money. This guide serves to help beginner traders from Nigeria understand all the important aspects of trading Forex.

Do you want to start trading Forex? Open an account on RoboForex!What is Forex Trading?

Forex, short for Foreign Exchange, is a global currency marketplace. Trader’s Union defines Forex as a system of foreign economic relations between banks of all countries and smaller players participating through banks.

Forex is a virtual market where banks, multinational corporations, large brokers, and holding companies are constantly buying/selling currencies, precious metals, securities, and other resources.

To learn more about Forex, please explore the video guide.

Is Forex Trading Legal in Nigeria?

Is Forex legit?Forex trading is legal in Nigeria, and the Central Bank of Nigeria regulates it. Brokers are expected to meet laid-out requirements to operate in the country. Also, earnings from forex trading activities are taxed in Nigeria and must be declared. However, Nigerian residents should trade with trustable brokers in tier1 regulations like Australia, the UK, and the EU.

How Much Money Do I Need To Begin?

How to trade with $100?Typically, brokers have a minimum deposit of $10. However, with a low deposit, you will need a high margin, which might be too risky for a beginner. When starting, you want to avoid using large margins. Also, starting with a high capital is not advisable due to the risk factor and low experience level. Most traders and brokers say the recommended amount to start with is $200 - $5000, the golden mean.

Nigerian Forex Brokers Minimum Deposit Amount Comparison

| FXTM | IC Markets | |

|---|---|---|

Minimum Deposit |

$50 |

$200 |

How to Begin to Trade Forex in Nigeria? A Step by Step Guide

Beginning your forex trading journey in Nigeria can be complicated. In this section of the article, you will learn the steps to take in trading forex in Nigeria.

Step 1. Choose A Reputable Forex Broker

To start, you will need to find out which broker to work with. The most important factor to consider when making your choice is to ensure that Nigeria or any other reputable country regulates your broker. Individual regulatory bodies have diverse rules and guidelines depending on the country they operate in. They compel all brokers to get licenses and register in their countries of operation, according to the laws and legislation of the country.

Regulation is important because it protects clients or traders by building trust between traders and brokers. Most traders can't go through individual trades or investments, and regulation helps prevent stealing clients' funds.

Also, you should ensure you look out for the different commission sizes offered by each broker and the possibility of earning passive income.

Step 2. Try a Demo

As a beginner in forex trading, it is advisable to limit your risk, and the best way to do this is to start with a demo account. One of the most important advantages of starting with a demo account is that it allows you to watch and learn how price action develops and the risks that come with leverage. Another advantage of starting with a demo account is that it gives you an understanding of how the platform works. Also, you will better understand the brokers trading conditions. You can learn how to place orders, find out the different contract sizes, the margin to use depending on the leverage, and the configuration of different types of charts for technical analysis.

Also, with the demo account, you can develop your trading strategies or test automated trading strategies with historical data.

Step 3. Explore Forex Strategies

Your preferred forex strategy will depend on the amount of free time you have and the level of initial knowledge you possess. As a beginner, it is advisable to utilize low activity trend strategies that do not necessarily involve using a large number of trades and large leverage.

Choosing the best forex trading strategy can be a daunting task, and you should stick to simple strategies. A few of these simple strategies for beginners are Price action trading, Range trading strategy, Trend trading strategy, Swing trading, Carry trade strategy, Position trading, Day trading strategy, Scalping strategy, Breakout strategy, News trading, Retracement trading, and Grid trading. A further study and practice of each trading strategy will help narrow down your preferable strategy.

However, the primary trading skill is risk management.

Step 4. Explore Copy Trading and PAMM

As mentioned earlier, developing a trading strategy as a new trader can be challenging because of the ever-volatile and changing market. However, you can consider copy trading, allowing you to copy trades done by professionals in real-time. You can earn money with them and learn from their experience.

Another good option is a PAMM account. PAMM, known fully as percentage allocation money management or percentage allocation management module, is a form of forex trading that involves money pooling. Here, an investor has the opportunity to allocate their money to a qualified trader of their choice in the proportion they want. These skilled traders can manage multiple forex trading accounts using both their capital and pooled money from investors.

The primary participants in PAMM are the Forex broker/ forex brokerage firm, the Investor, and the Trader/ money manager.

Step 5 Learn, Learn, Learn

As a beginner, your primary task is to not lose at the beginning of your trading journey. However, more important than not losing, you should endeavor to learn as much as you can, learn about the different brokers and their trading conditions, learn about the different strategies, and try various earning options. It is only through consistent learning that you can achieve success.

Best Time to Trade Forex In Nigeria

Although the forex market is open 24 hours, not all trading sessions and hours have the same opportunities. As a beginner forex trader in Nigeria, your success will depend on your ability to take advantage of the best trading times in Nigeria. You have to fully understand the right currencies to trade at each time, and you also have to grasp how each session operates.

Also, while each country has different trading times, forex trading is usually done between 8 am and 4 pm in each time zone. To maximize your profits as a forex trader, you need to look out for when the markets of different countries overlap. When the markets overlap, there is a greater chance for more activity in rate fluctuations.

According to the research conducted by Trader’s Union, the best day to trade Forex in Nigeria is on Wednesday, followed by Thursday. Also, the best time to trade Forex in Nigeria is between 1 pm and 7 pm (Nigerian time). This is because the largest trading sessions in the world, London and New York markets overlap at this time, creating opportunities for high liquidity and greater profits for traders.

Best Nigerian Forex Brokers For Beginners

As a beginner, to find the best forex broker for Nigeria, you have to analyze the different brokers based on their features. We compiled a list of these brokers to cut the work for you.

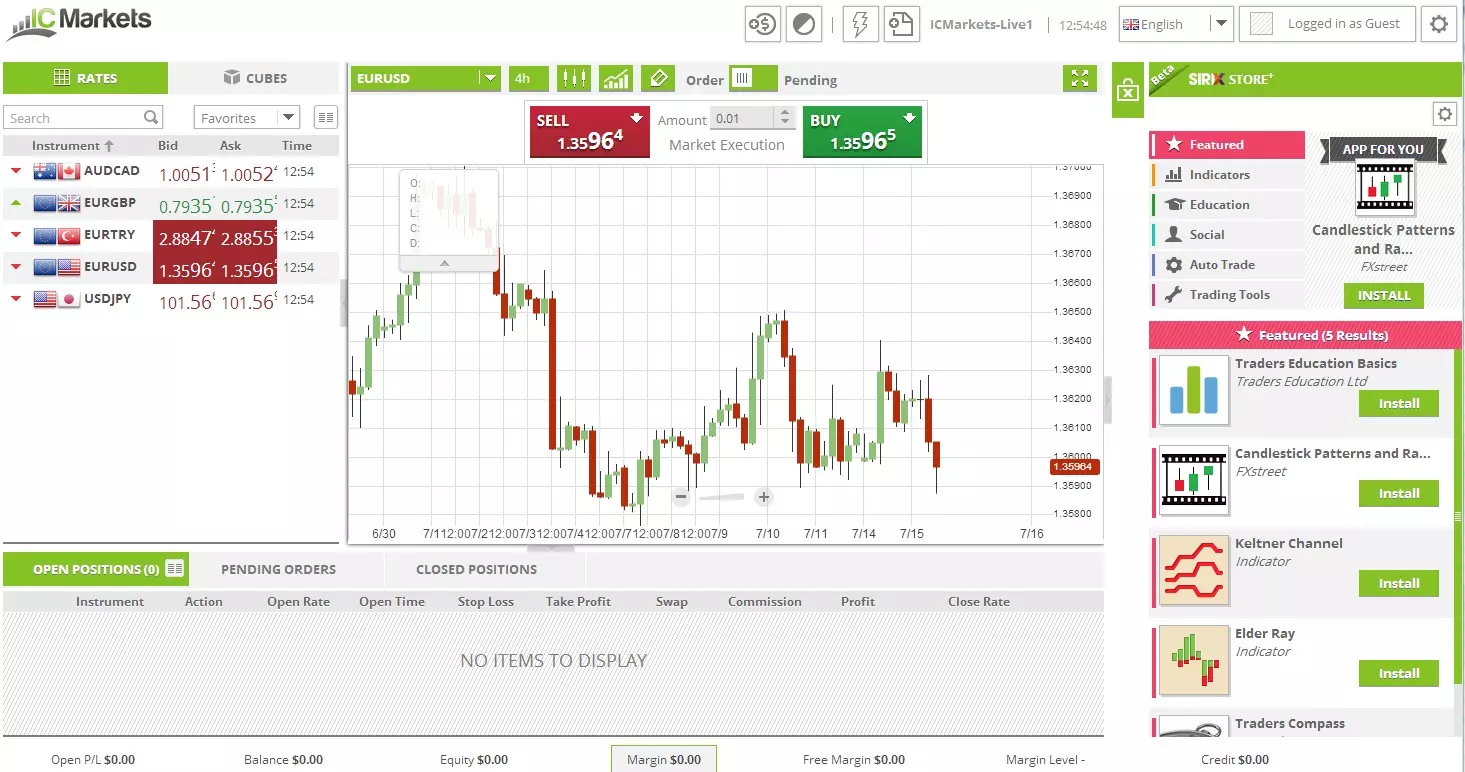

IC Markets - Extra Low Fees for Active Trading

IC Markets platform

IC Markets was founded in 2007 and is average risk, safe broker for trading forex. It is an Australia-based global forex broker with various branches worldwide. IC Markets is regulated by the Seychelles Financial Supervisory Authority (FSA), and two other regulatory bodies.

Nigerians prefer IC markets because it has low forex fees. The process of opening an account is fast and easy, with free and user-friendly deposits and withdrawals. Also, IC markets do not charge inactivity fees.

The minimum amount you can deposit on IC markets is $200, and it takes a day to open an account. IC markets support deposits with bank cards and electronic wallets while providing demo accounts for Forex reading beginners.

IC Markets has three account types; the standard account, a raw spread account, and a cTrader account. For beginners, the preferable account is the standard account which charges no commission fees on trades, rather has larger spreads. Also, the standard account uses the MetaTrader 4 forex trading platform.

Also, IC markets offer an Islamic account type, following Sharia law. The Islamic account comes with standard and raw account pricing that does not carry interest-based swap fees.

Halal investment guideThere are various opportunities to earn passively on IC markets, and they are;

Investment manager: This program offers the clients who operate the MAM and PAMM accounts exclusive access to the raw pricing program, which supports low spread and high liquidity.

IC Markets copy trading reviewWhite Label

The white label program is specifically geared for already established brokerage and Financial Management companies with a large customer base and revenue of at least USD500, 000 monthly. It is also accessible to traders with corporate clients and large transaction volume.

IC Markets affiliate program

The IC markets affiliate program is open to any customer, the volume of transactions and experience notwithstanding. This program aims to bring in new customers, and payments are made on a percentage of profits. Also, the commissions are paid out in real-time to the customers' trading account.

Introducing Broker

Here, customers earn by referring new customers. It differs from the affiliate program in that the trading volume of referred customers does not affect earnings.

IC Market provides a training section on their website for beginners. Through the training section, beginners can get conversant with trading at the foreign market and using trading instruments.

RoboForex - Best Forex Broker for Beginners

If you’re a beginner trader, you need to work with a broker who’s well-regulated and offers a user-friendly web-based platform. RoboForex qualifies in all these aspects.

Over the past decade, RoboForex has been dedicated to serving over 7,300 clients throughout the world with the best features and prices. They connect their clients using only the latest software trading platforms. Read more in Roboforex reviews from clients in Nigeriа.

RoboForex has built a name for itself as one of the brokers that serve clients in some of the areas with strict regulations while still providing excellent services. It is regulated by the International Financial Services Commission (IFSC). This regulatory body ensures traders remain safe even if the company faces financial problems.

RoboForex has amazing features that make it perfect for beginners as well as advanced traders. Some of the benefits of working with this broker include the following:

Good Trading Conditions

RoboForex offers unique trading conditions found at R StocksTrader accounts, Prime, and RoboForex’s ECN. Their tight spreads starting from 0 pips with low commission. Its MetaTrader 4 and 5 platforms also offer fast order execution.

R Mobile Trader

This feature allows you to trade as you go with RoboForex. With the Android app, you can close and open accounts, make deposits and withdrawals, and invest using CopyFX. You can also monitor news with the app to know where the market is heading and do everything you can do with a desktop.

Stock Investing

With RoboForex, you have access to a real range of stocks to invest in. You get over 3000 stocks listed in NASDAQ and the NYSE. With the R Stock Trader platform, you get as low as $0.0045 commission fees per share. Spreads start from 0.01. R trading also gives you access to over 8000 stocks.

RoboForex fees vary with the type of account. If you have a Prime account, your commission per trade fee will be around $10-$15 per $1 million trade volume. The fee for the ECN account is $20 per $1 million trade volume. The fees for the R StocksTrader account start from $0.0045 per share. Finally, the popular Pro account offers 0 commission fees.

Do I Pay Taxes for Forex Trading in Nigeria?

As a Forex trader in Nigeria, you’re not subjected to any special requirements, and you can legally participate in Forex trading. However, you need to pay taxes for all your earnings in Nigeria according to the laws. The law requires you to report and pay taxes for all your local and foreign incomes.

Funds received from trading Forex are considered capital gains, and Nigerian law requires you to pay a 10% tax on all acquired gross profits. So, to avoid getting into problems with the law, you must report your Forex trading when filing tax returns and pay your dues on time.

Can I Trade with Internationally Regulated Forex Brokers?

Yes, you can trade Forex in Nigeria with internationally regulated brokers. One of the reasons why this is possible is because there’s no authority in Nigeria that deals with foreign traders.

While Nigeria is still working on developing a regulatory body, you have a chance to work with internationally regulated bodies. The best regulatory bodies come from Europe (FCA UK, CySec Cyprus), Australia, and South Africa.

You have to find a broker that accepts Nigerian clients to work with. If the broker has an office in the country, working with them will be even easier. Some brokers with offices in Nigeria include RoboForex, IC Markets, InstaForex, and AvaTrade.

Do Forex Brokers Accept Naira (NGN)?

Yes, some Forex brokers accept Nigerian Naira (NGN) Currency. Working with brokers who accept Naira is more convenient and provide easy transactions.

You will not experience limitations in terms of deposits or withdrawals if you work with a broker that accepts the local currency. Some brokers that accept Naira include FXTM, Alpari, and Exness.

If you work with a broker that doesn’t accept Naira, you’ll need to convert the currencies and pay the conversion fees.

Can I Trade Forex with Minimum Investment in Nigeria?

Yes, you can start trading Forex in Nigeria with minimum investment. The minimum amount to start forex trading in Nigeria is usually as low as $10. You need to start with low capital that you’ll be willing to lose.

When you’ve chosen your broker, the next step will be to fund your account. You don’t need a large sum for this. You can confirm with your broker to know their minimum deposit amount.

Here are some of the best ways to make money from Forex in Nigeria with minimum investments:

Active Trading Using Forex Bonus from RoboForex

When you sign up for RoboForex, you qualify for their bonus feature, which is available for all new members. The $30 no-deposit bonus allows you to start active trading with no limitations.

Another great bonus for active trading in RoboForex is the classic deposit bonus. You qualify for this bonus in the ratio to the amount you’ve deposited into your account. You can qualify for a 25%, 50%, 100%, and 120% Classic Bonus from your deposited sum.

Copy trading

When you’re new in Forex, you can still make huge profits with your investments through copy trading. This means copying what another trader is doing into your account.

CopyFX and IC Markets allow you to make money through copy trading by helping you find successful traders with minimal amounts. You can then receive your fixed commission for every profit you make as a copy trader.

Broker’s affiliate programs

You can also make a good income by becoming a forex broker’s affiliate marketer. All you have to do is refer people to the broker and make good passive income.

All forex traders offer opportunities for their members to refer other traders. The process is very simple and straightforward. When your trader makes a deposit, you get your commission, which can be pretty high compared to other affiliate programs.

Top 12 Forex Affiliate ProgramsHow Much Can I Earn?

There is no cap on the amount you can earn in Forex trading. Your earning potential depends solely on your actions and ability to learn. Some traders earn hundreds of millions, like George Soros. However, as high as your potential to earn is, so is the possibility to lose.

FAQs

How can I trade Forex in Nigeria?

To start trading Forex in Nigeria, you will need to register with a broker that operates in Nigeria.

Is trading forex a crime in Nigeria?

No, trading forex is not a crime in Nigeria. Forex trading is legal in Nigeria.

Who is the best forex broker in Nigeria?

The best Forex broker for Nigerian traders is FXTM.

Do forex traders pay tax in Nigeria?

Yes, forex traders in Nigeria pay a 10% capital gains tax on their earnings.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.