Mining With Minimal Investment: A Practical Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Follow these steps to mine crypto with minimal investment:

Cryptocurrency mining has evolved from a hobbyist's endeavor to a sophisticated industry requiring significant investment in both hardware and energy. However, not everyone has the resources or the desire to dive into mining with large capital. For those looking to explore mining with minimal investment, the landscape is still full of opportunities—if you know where to look. This article aims to guide through the process of mining with minimal investment, helping you to start small, manage risks, and scale your operations effectively.

Mining crypto with minimal investment

1. Choosing a low-cost mining method

Cloud Mining: Rent hashing power from a third-party provider, which eliminates the need for hardware and maintenance. Choose reputable services to avoid scams.

Staking: Hold a cryptocurrency in a wallet to earn rewards without needing extensive hardware. Look for coins like Cardano (ADA) or Polkadot (DOT) that offer easy staking options.

2. Selecting the right cryptocurrency

Focus on coins that are easier to mine or stake with lower competition, such as Monero (XMR) or Ravencoin (RVN). Use tools like WhatToMine to assess potential profitability.

3. Setting up your mining operation

Utilize existing hardware - start with a laptop or older GPU you already own. Choose mining software for your hardware (e.g., XMRig for Monero, PhoenixMiner for Ravencoin). For staking, set up a compatible wallet.

4. Managing costs

Use energy-efficient settings and consider your local electricity rates. This helps maximize your profits. Keep track of hardware, electricity, and any mining fees to ensure profitability.

5. Monitoring and optimizing

Regularly monitor your hash rates and temperatures using mining management software. Fine-tune your mining software settings for better performance and stay informed about market trends to adapt your strategy.

Best platforms for mining with minimal investment

Mining with minimal investment is for those finding ways to participate in cryptocurrency mining without breaking the bank. The key here is to manage expectations and focus on gradual growth rather than instant profits.

1. Genesis mining

One of the most established cloud mining providers, Genesis Mining offers contracts for various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. It provides users with a choice of hash power and contract lengths, allowing flexibility.

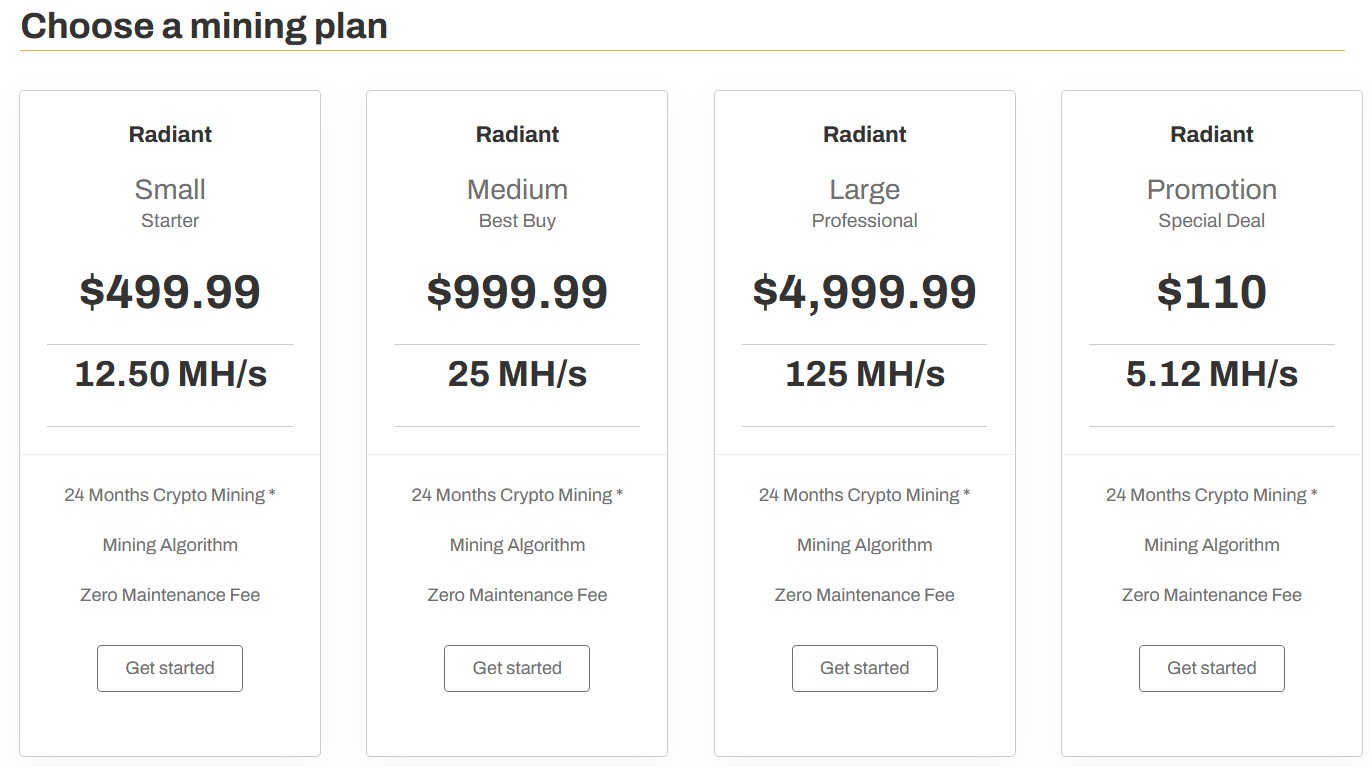

Costs: Genesis Mining offers the following plans

2. ECOS cloud mining

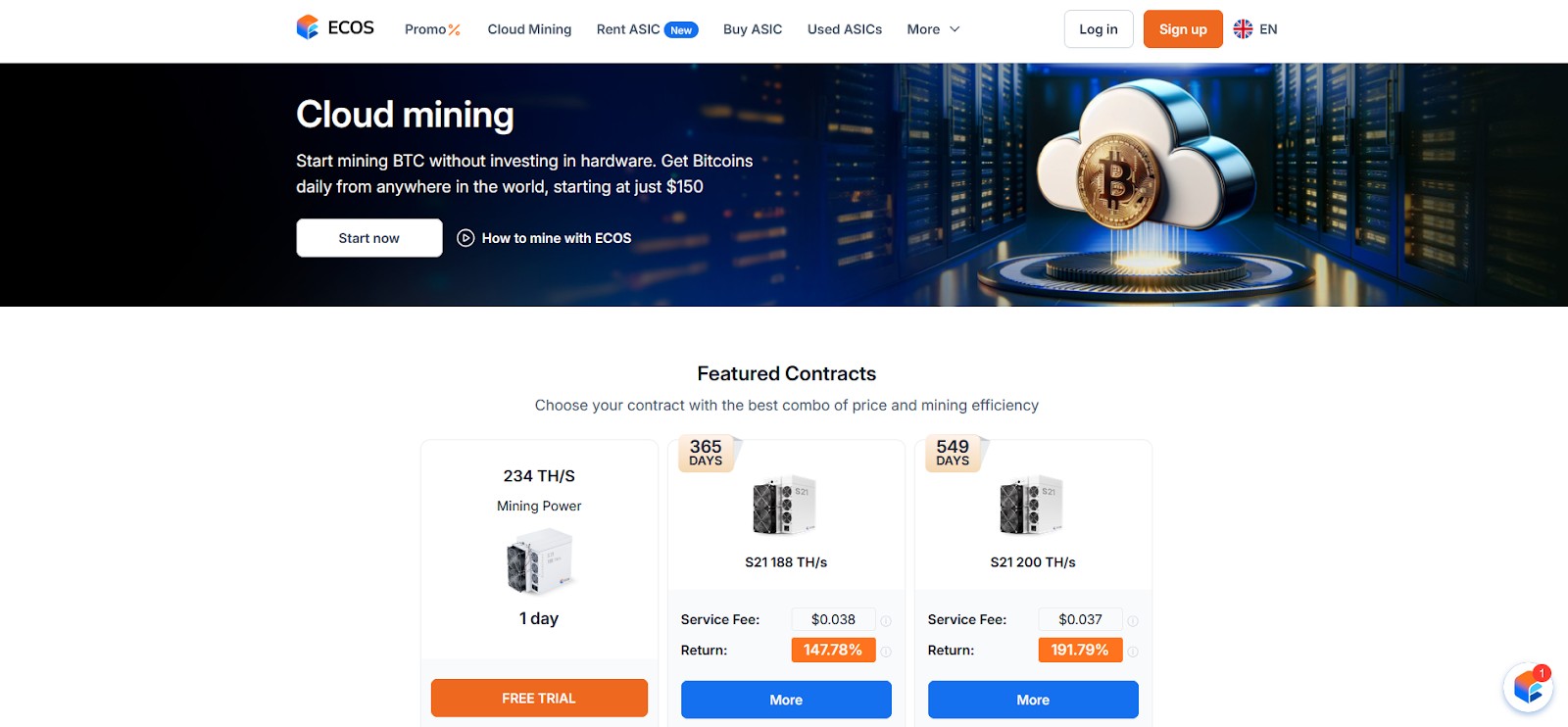

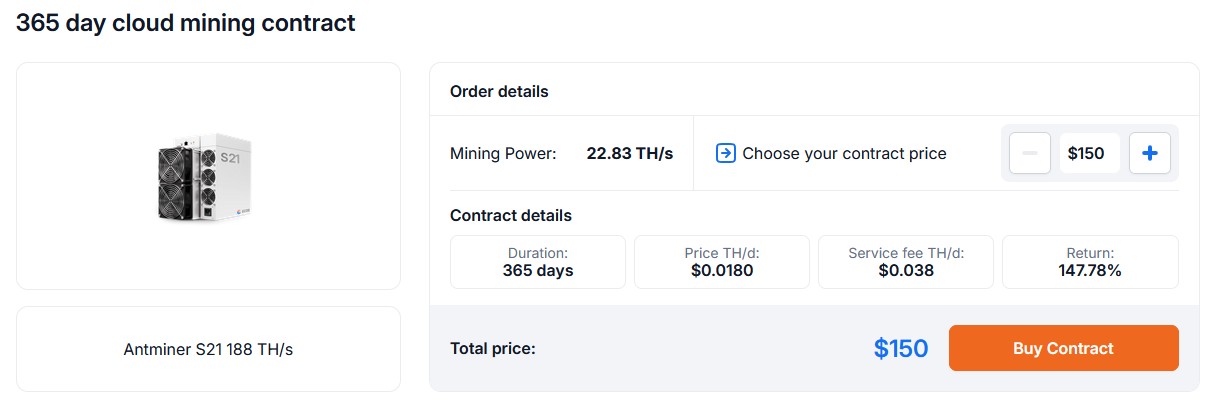

ECOS offers Bitcoin mining contracts with daily payouts. It also has a built-in wallet for managing your mining rewards and investments in different cryptocurrencies.

Costs: Bitcoin mining contracts start at $150. You can customize your contract options based on your budget and expected profitability. Additionally, ECOS offers a one-month free trial for new users to explore mining before committing long-term.

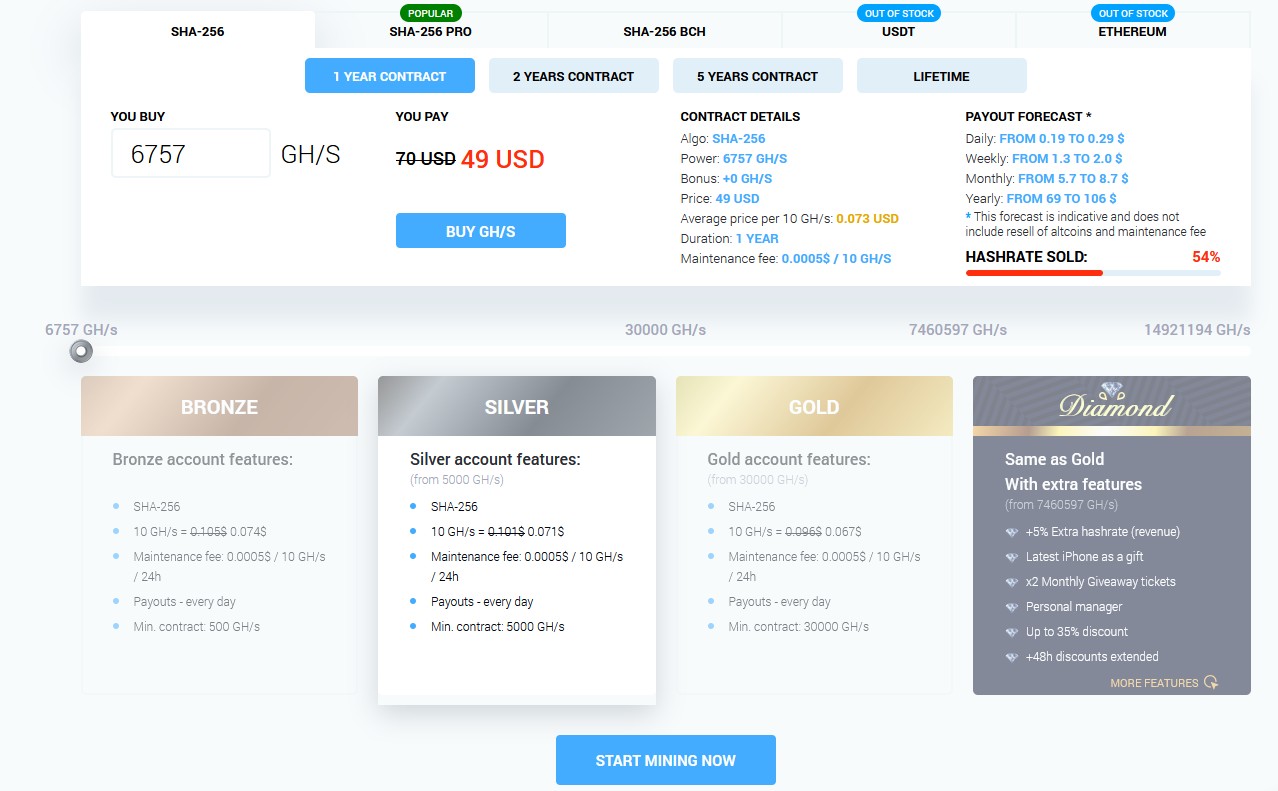

3. IQ mining

IQ Mining offers combined cloud mining and trading services. It provides contracts for Bitcoin and several altcoins, and users can switch between cryptocurrencies as market conditions change.

Costs: Prices start as low as $50 for a small contract, with payouts in Bitcoin, Ethereum, and other cryptocurrencies. See them in more detail by clicking here.

4. StormGain

StormGain provides a cloud mining solution integrated into its crypto trading platform, allowing users to mine Bitcoin and other cryptocurrencies directly from their smartphone or browser.

Costs: It offers free cloud mining with profits generated from a percentage of the mined coins being credited to users’ accounts.

Staking as an alternative to mining

Crypto staking can be used as an alternative to mining. It is a process where users lock up their cryptocurrency in a blockchain network to help validate transactions and maintain the network's security. In return, they earn rewards in the form of additional tokens. Unlike traditional crypto mining, which requires expensive hardware and high electricity consumption, staking is a more cost-effective way to participate in securing a blockchain, particularly on Proof of Stake (PoS) networks like Ethereum 2.0, Cardano, or Polkadot.

In the context of low-cost crypto mining, staking serves as an energy-efficient alternative. Instead of purchasing and maintaining mining rigs, users can simply delegate their coins to staking pools, earning passive income without the high overhead costs associated with mining hardware and electricity. This makes staking appealing to those looking for a lower-cost entry into crypto earning opportunities.

For those looking to get into crypto staking, the choice of the staking platform is an important one. We have compared the top staking platforms based on key parameters like supported coins, estimated annual returns, and minimum staking amounts below for your better understanding.

| Staking | Coins Supported | Demo | Min. Deposit, $ | Yield farming | Copy trading | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | 329 | Yes | 10 | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | 278 | No | 10 | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | 250 | No | 1 | Yes | No | Open an account Your capital is at risk. |

|

| Yes | 72 | Yes | 1 | No | Yes | Open an account Your capital is at risk. |

|

| No | 1817 | No | No | No | No | Open an account Your capital is at risk. |

Best cryptocurrencies to mine with minimal investment

Here are some of the most profitable coins to mine based on costs involved:

1. Litecoin (LTC)

Hardware: ASIC miners like Antminer L3 +

Cost consideration: Lower mining difficulty compared to Bitcoin, making it easier for beginners. However, solo mining profitability is low, so it’s recommended to join mining pools to increase rewards.

Profitability: Litecoin’s established reputation and faster transaction times make it a stable option, though rewards may be modest without a mining pool.

2. Zcash (ZEC)

Hardware: Best mined with ASIC machines (e.g., Antminer Z9)

Cost consideration: Privacy-focused with medium difficulty. Requires a higher upfront investment in hardware but remains profitable with the right equipment.

Profitability: Zcash’s privacy features and community support make it a strong contender, though profitability depends on your electricity costs and the mining setup.

3. Dogecoin (DOGE)

Hardware: ASIC miners or GPU mining with a mining pool

Cost consideration: Although originally a joke, Dogecoin has evolved into a profitable cryptocurrency to mine. ASIC miners increase chances of success due to medium difficulty, but solo GPU mining is no longer viable.

Profitability: With a high block reward (10,000 DOGE), Dogecoin’s popularity makes it a community favorite, though high competition limits profitability.

4. Ravencoin (RVN)

Hardware: CPU or GPU (ASIC-resistant)

Cost consideration: Ravencoin uses the KAWPOW algorithm, making it ideal for GPU mining. Its ASIC resistance keeps mining accessible for smaller operations.

Profitability: A good option for home miners with lower start-up costs and an engaged community, though its profitability depends heavily on electricity costs and token price.

5. Ethereum Classic (ETC)

Hardware: GPU or ASIC

Cost consideration: Easier to mine than Ethereum before its switch to Proof of Stake. ETC remains on Proof of Work (PoW), making it attractive to GPU miners. ASIC rigs can further optimize profitability.

Profitability: With lower difficulty and an established network, ETC offers good potential for GPU miners looking for a stable, long-term option.

Considerations for beginners

Starting small

The best way to start mining with minimal investment is to begin small. This reduces your financial risk and allows you to learn the ropes without the pressure of significant losses. Start with low-cost cloud mining contracts or small staking amounts.

Learning resources

Education is key to success in mining. Beginners should immerse themselves in online courses, forums, and YouTube channels dedicated to cryptocurrency mining. Websites like CryptoCompare and Reddit’s r/cryptomining offer valuable insights and community support.

Avoiding scams

The mining industry is rife with scams, especially targeting beginners. Be wary of promises of high returns with minimal effort. Always research the legitimacy of cloud mining platforms and staking pools before investing.

Patience and realistic expectations

Crypto mining with minimal investment is not a get-rich-quick scheme. It requires patience and realistic expectations. Set modest goals, such as breaking even within the first year, and gradually aim for higher profits.

Risks and warnings

Market volatility

Cryptocurrency prices are notoriously volatile, which directly impacts mining profitability. Be prepared for periods of low earnings and consider strategies like holding mined coins until prices recover.

Regulatory risks

The legal landscape for cryptocurrency mining is constantly evolving. Stay informed about changes in regulations, especially those related to energy consumption and taxation.

Security risks

Security is a major concern in mining. Protect your assets by using strong passwords, enabling two-factor authentication, and regularly updating your software. For cloud mining, choose platforms with robust security measures.

Pros and cons of mining with minimal investment

- Pros

- Cons

Lower financial risk. Starting small reduces the risk of significant financial loss.

Accessibility for beginners. Minimal investment allows newcomers to enter the market without substantial upfront costs.

Learning opportunity. Provides a practical learning experience in cryptocurrency mining.

Lower profit margins. Smaller investments typically yield smaller returns.

Longer time to see returns. It may take longer to break even or achieve significant profits.

Potential for scams. The minimal investment segment is particularly vulnerable to fraudulent schemes.

Start by choosing a mining method that suits your situation

One of the most important pieces of advice I can offer is to manage your expectations and think long-term. Mining with minimal investment is not going to make you rich overnight. It’s a slow, steady process that can pay off if you’re patient and consistent. Start by choosing a mining method that suits your situation — whether it’s cloud mining, staking, or even using a lower-end hardware setup. Don’t feel pressured to jump into the deep end with expensive equipment or large contracts. Begin with what you can afford to lose, and focus on learning the ins and outs of the process.

Security is something you should never take lightly. The crypto space, unfortunately, has its share of bad actors, and mining is no exception. Always do your due diligence before committing to any cloud mining service or staking pool. Look for transparency in how they operate, read reviews, and if something seems too good to be true, it probably is.

Conclusion

While low-investment crypto mining may not lead to immediate riches, with patience, careful planning, and a willingness to learn, you can build a sustainable and profitable mining operation. Forbeginner and advanced traders alike, the key is to start small, stay informed, and scale your efforts as you gain experience.

FAQs

Can I start mining with $100?

Yes, with cloud mining or staking, $100 can be a reasonable starting point.

Can I use a gaming PC for mining?

Yes, many people use gaming PCs with powerful GPUs for mining. However, you should be aware that continuous mining can put a significant strain on your hardware, potentially reducing its lifespan.

What happens if the cryptocurrency I'm mining drops in value?

If the cryptocurrency you’re mining drops in value, your earnings will decrease. It’s important to stay updated on market conditions and be prepared to switch to a more profitable coin if necessary.

Do I need to keep my computer on 24/7 to mine effectively?

Yes, to maximize your mining output, your computer or mining rig needs to run continuously. This will increase electricity usage and may require cooling solutions to prevent overheating.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.