Is Investing In Stocks Halal Or Haram? Halal Investment Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Investing in stocks is halal in Islam when done in accordance with Shariah law. To be considered halal, the company must operate in a permissible industry, earn less than 5% of its income from haram sources (such as alcohol or interest), and maintain low levels of debt. Stock trading becomes haram when it involves speculation, short selling, margin trading, or investment in prohibited sectors. Many Muslim investors use halal stock screeners and Islamic (swap-free) brokerage accounts to ensure compliance.

Many Muslims today are turning to the financial markets to build wealth without compromising Islamic investing principles. However, a key question still stands: is investing in the stock market halal or haram in Islam when modern financial instruments and global companies are involved? The answer depends on both the nature of the investment and how it is conducted. This guide breaks down the conditions under which stock market activity can be permissible in Islam, outlines industries to avoid, and provides ways to stay aligned with Shariah.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is investing in stocks halal or haram?

Investing in stocks can be halal, if the companies follow Islamic finance rules. Most scholars agree that owning shares in a halal business is permissible, as it means you own part of a real business that generates value through lawful trade or services.

However, investing becomes haram under specific circumstances:

The company operates in a prohibited (haram) industry such as alcohol, gambling, or interest-based banking.

It derives a substantial portion of its income from interest (Riba), usually more than 5% of what the company earns.

It holds high levels of conventional debt, uses derivatives, or involves unethical or risky behavior.

Traders should also be cautious of companies that might not fully meet halal standards—those that mix halal and non-halal practices. These may engage in permissible core activities but also maintain interest-bearing accounts or have minor ties to prohibited industries such as alcohol or conventional finance. For those asking if the share market is halal or haram in Islam, this gray area is often at the center of the discussion. While some scholars permit investment in such companies under the 5% rule—as long as the haram portion is purified—others advise avoiding them altogether to remain on the safer side.

One lesser-known but important area to consider is stock lending. This is a practice where investors or institutions lend their shares to other traders (often short sellers) in exchange for a fee. While it may seem passive, stock lending can involve earning income through interest-bearing collateral or support trades that conflict with Islamic principles—especially if the borrowed shares are used for short selling. Muslim investors should understand whether the companies they invest in participate in stock lending programs, and how the income from such activity is handled. This often-overlooked detail may affect the halal status of a portfolio more than many realize.

What makes a stock halal?

For a stock to be considered halal, it must meet several conditions:

The company’s core business must align with Islamic law (e.g., manufacturing, logistics, healthcare).

The company must not earn more than 5% of its revenue from haram sources (the "5% rule").

The company’s debt levels must be within acceptable limits.

Its operations should avoid interest-based finance.

These criteria are especially important for Muslim investors asking whether the stock exchange is halal or haram in Islam, as they help determine whether participating in public markets aligns with Shariah principles.

| Criteria | Requirement for halal compliance | Explanation |

|---|---|---|

| Industry Sector | Must be in a halal industry | Avoid alcohol, gambling, pornography, riba-based finance, etc. |

| Revenue from Haram Sources | Less than 5% of total income | Known as the 5% rule — above this threshold, the stock is considered haram |

| Debt-to-Asset Ratio | Should be below 30%–33% | Excessive debt (riba-based) makes a company non-compliant |

| Interest Income (Riba) | Minimal or none | Avoid companies that earn significant income from interest |

| Speculative Activity | None | Derivatives, short selling, and high volatility behavior are not allowed |

| Ethical Business Conduct | Must align with Islamic ethical values | Fair labor, environmental responsibility, transparency |

| Shariah Certification (optional but ideal) | Reviewed by a recognized Islamic financial board (e.g., AAOIFI) | Adds credibility and ensures ongoing compliance |

However, you can also choose to go beyond the basic checks by placing a focus on the following things:

Go beyond industry filters. Most people only remove obvious haram industries, but halal investing means checking how companies operate, earn, and behave overall.

Study the debt-to-asset timeline. A company may seem okay debt-wise on paper, but if it keeps borrowing heavily every quarter, that’s a red flag — even under the limit.

Watch for earnings from non-core activities. Some businesses seem fine in their core business but quietly earn from interest or shady deals — dig into the fine print or hidden income areas.

Use purification calculators wisely. Don’t blindly apply the 5% rule. Use trusted tools that separate dividend and price gain issues so you know exactly what needs purifying.

Check corporate behavior, not just compliance. A company might pass halal screens but exploit nature, treat staff unfairly, or sideline shareholders — all of which go against Islamic ethics.

Learn fatwa variations by region. Different countries have different rulings. Stick to scholars and filters that match your beliefs and always ask locally if you’re unsure.

Halal industries include

If you're looking to invest in halal industries, here are some industries that you can invest in:

Ethical tech is a hidden gem. Many Muslims ignore this space, but privacy-first software firms and Islamic fintech startups like Wahed Invest or Muslim Pro’s parent company are both ethical and scalable.

Halal tourism is booming. Invest in companies offering halal-certified resorts, airlines with prayer accommodations, or startups building Muslim-friendly travel apps.

Takaful insurance is growing quietly. Most people ignore Islamic insurance, but global demand is rising. Look at public firms backing Takaful operations in Southeast Asia or Africa.

Organic farming meets halal ethics. Beyond meat, companies producing organic, pesticide-free produce with fair labor policies align deeply with Islamic environmental values.

Islamic media is underestimated. Companies creating animation, podcasts, or storytelling with Islamic values (like MiniMuslims or One4Kids) have strong engagement among young Muslim families.

Halal logistics is overlooked. From cold-chain supply for halal meat to firms tracking compliance in shipping halal goods, this backend sector is full of potential.

Waqf-backed startups are emerging. Some startups are now funded by digital Waqf (endowment) models, especially in Malaysia and Turkey, blending innovation and Islamic philanthropy.

Haram industries include

When you're starting halal investing, it’s not just about avoiding alcohol and gambling — here’s a look at specific haram industries and red flags that often go unnoticed by beginners.

Buy-now-pay-later platforms. These fintech startups often profit from interest-based late fees and revolving credit, making them non-compliant despite their modern appeal.

AI surveillance and predictive policing. Investing in firms that develop mass surveillance tech or profiling software for authoritarian regimes raises serious ethical and Shariah concerns.

Music streaming companies. Many scholars flag music income as impermissible; companies like Spotify or Universal Music often rely heavily on this core revenue.

High-frequency trading firms. These companies thrive on ultra-short speculation and derivatives — practices that resemble gambling and violate gharar (uncertainty) principles.

Cannabis companies in recreational markets. Medical use may be debated, but recreational cannabis firms clearly fall into haram territory, even if legalized in some regions.

Insurance and reinsurance corporations. These often operate on conventional risk transfer and interest-based models, which makes investing in them problematic under Islamic law.

Companies selling pork-based pharmaceuticals. Even respected pharma companies may derive income from gelatin or enzymes sourced from pigs, which slips under the radar of many Muslim investors.

Adult gaming and virtual content platforms. Not just adult sites — VR adult gaming, NFT-based adult collectibles also breach Islamic ethical boundaries.

Can muslims invest in stocks?

An Islamic swap-free account is a specialized type of trading account meant for Muslims following Shariah. These accounts eliminate rollover interest (swaps) on overnight positions, keeping them aligned with Islamic rules. This is especially relevant for traders who often wonder about broader questions like whether buying stocks is halal or haram in Islam, since interest (riba) is one of the key concerns in both investing and trading. The trading conditions and features of these accounts are nearly identical to standard ones, except they remove all forms of interest. Brokers such as AvaTrade and others offer these options for trading that respect Islamic rules.

Shariah investing supports growing wealth but bans interest or unethical gains. It is advisable to:

Research companies’ financials through annual reports.

Check stocks using halal filters.

Choose brokers that offer Islamic (swap-free) accounts.

Below, we have presented a list of the top brokers that offer Islamic accounts. You may use it to compare and choose one for yourself, if required:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 40 | 50 | ASIC, FCA, FSCA, VFSC | 8.25 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 57 | 5 | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | 9 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 60 | 10 | SVGFSA | 8.6 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 70 | 100 | FCA, CYSEC, FSCA, SCB, FSA (Seychelles) | 7.9 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 55 | 100 | ASIC, FSCA, FSC Mauritius | 8.69 | Open an account Your capital is at risk. |

For more guidance, remember that some institutions, such as the AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions), provide Shariah standards to evaluate investments.

Is stock trading halal or haram?

Most beginners overlook important facts when understanding halal stock trading — it’s not just about riba, it’s about structure, discipline, and purpose.

Don’t just screen, study balance sheets. Relying only on halal screening apps isn’t enough — read company reports and understand how they really earn.

Avoid companies with fluctuating compliance. Some companies shift between compliant and non-compliant each quarter. Stick to those that stay consistent.

Look for purpose-driven businesses. Shariah isn’t just about riba — choose companies with a clear moral purpose, not just profits.

Beware of “halal” brokers with hidden swaps. Some “Islamic accounts” charge hidden fees in other ways. Always check how they really make money.

Short-selling is not always haram — context matters. Some scholars allow it if full borrowing is involved and it’s done in closely watched environments with strict rules.

Is day trading stocks halal?

Day trading is a debated topic among scholars. While it can be halal if all trades involve halal assets and are conducted hand-to-hand without interest or excessive speculation, many scholars view the practice as too close to gambling. To learn more, read our dedicated guide: Is Day Trading Halal or Haram?

Example: Investing in a company like Unilever, which mainly deals in permitted products and maintains low debt, is usually seen as acceptable under Hanafi rulings. In contrast, investing in a highly leveraged financial firm like Goldman Sachs is generally not approved.

Religious references and expert opinions

Islamic scholars like Mufti Taqi Usmani and organizations such as AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) have laid the foundation for modern halal investing standards.

Mufti Taqi Usmani, a leading Islamic finance scholar, affirms in Available via Darul Isha’at that "investment in shares is permissible as long as the company's core business is halal, and it does not engage significantly in interest-based transactions or impermissible activities."

The AAOIFI Shariah Standard No. 21 sets specific rules for investing in shares, including the 5% rule on haram income, permissible debt ratios, and screening requirements.

Islamic Finance Guru (IFG), a respected UK-based educational platform, also provides detailed stock screenings and Shariah compliance guidelines. Their approach balances traditional jurisprudence with practical investing.

Quranic principles underpin ethical investing. For example:

"O you who believe! Devour not usury, doubled and multiplied; but fear Allah that you may prosper." — Surah Al-Imran 3:130

Prophetic hadiths emphasize ethical trade:

"The honest merchant will be with the prophets, the truthful, and the martyrs." — Tirmidhi 1209

Whether you're trading currencies or equities, halal investing depends not just on what you trade, but how you do it — with transparency, real ownership, and ethical structure at its core.

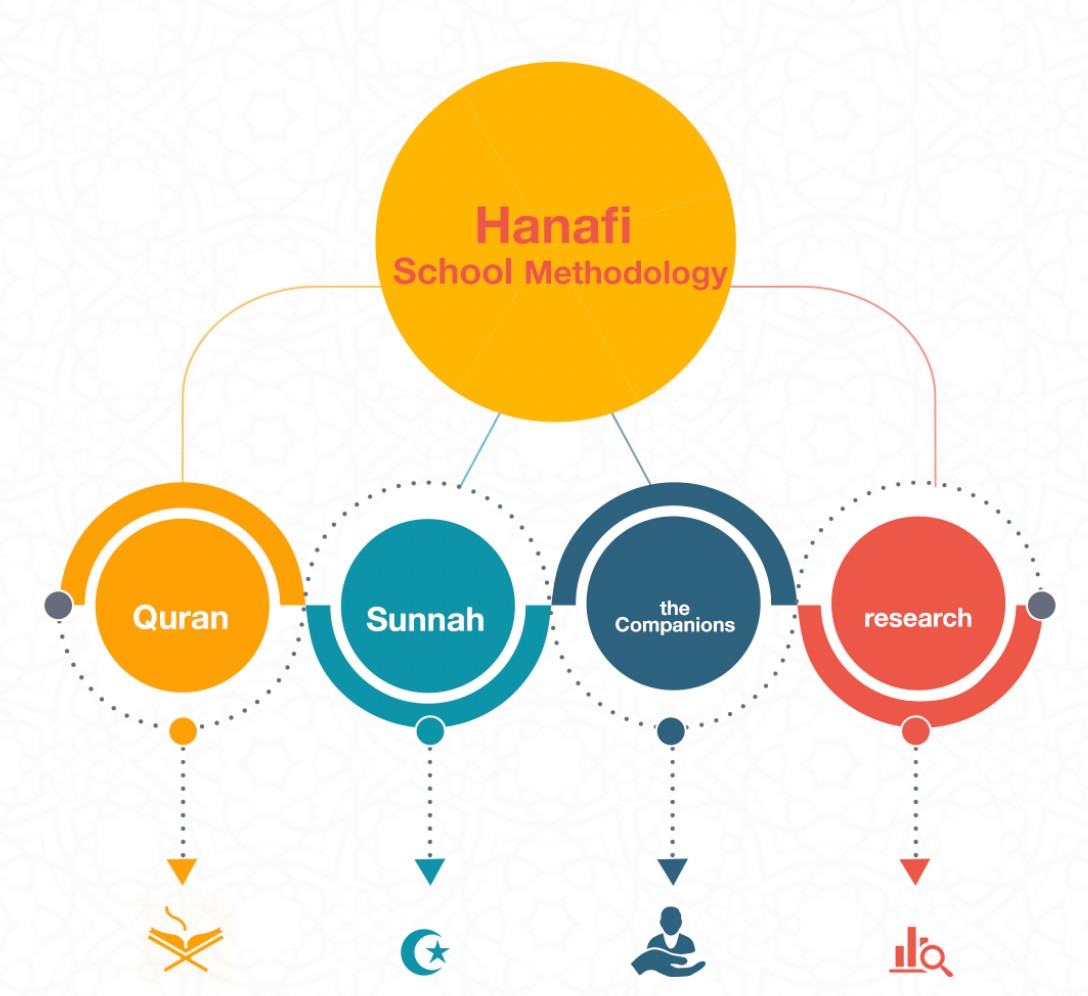

Since Islamic rulings can vary depending on the school of thought, let’s pause and take a closer look at how one of the most influential and widely followed traditions — the Hanafi School — approaches stock trading. As one of the oldest and most respected Sunni schools of Islamic jurisprudence, the Hanafi perspective provides detailed criteria for what makes an investment halal or haram, especially when it comes to public markets, mutual funds, and modern financial products.

Is stock trading halal in the Hanafi School?

In the Hanafi school of Islamic thought, owning shares is halal when the company’s core activity is allowed and there is actual ownership of tangible assets or equity. The Hanafi view permits trading in company stocks, as long as shares aren’t based on loans or risky contracts and the business itself is aligned with Islamic guidelines.

However, the Hanafis are especially cautious about:

Gharar (unclear contract terms) in contracts, which includes tools like derivatives that are used for betting.

Riba (interest), which means avoiding companies that earn or pay interest through lending, investments, or bank deposits.

Leverage and margin trading, as borrowing money with interest to buy stocks is not permissible.

Trading is only halal if it’s conducted with transparency, tied to actual business assets, and clear and timely transfer of ownership. This implies:

Avoiding high-frequency speculative trading.

Not trading on margin or using interest-based loans.

Ensuring trades involve real assets or ownership.

Scholars in the Hanafi view suggest added checks such as using Shariah-compliant filters and avoiding companies with large income from forbidden sources.

When it comes to broader investment vehicles like the S&P 500, index funds, or ETFs, the Hanafi school urges deeper scrutiny. While these instruments offer diversification, they often include companies involved in non-compliant sectors — like conventional finance, alcohol, or high-interest debt.

From a Hanafi perspective, investing in such funds may only be permissible if Shariah-compliant screening is applied and the majority of underlying holdings meet Islamic criteria. There’s also concern around how ETFs are structured — some may involve derivatives or non-transparent ownership layers, which could introduce elements of gharar or riba.

Finally, mutual funds and bonds raise even more concerns under the Hanafi school. Most conventional mutual funds pool investor money into interest-bearing instruments or companies that don’t pass Shariah screening, making them problematic unless explicitly marketed as Islamic or Shariah-compliant.

Halal investment and Forex

Under Islamic law, Forex investments are considered halal when certain conditions are met. Stock trading follows the same logic — it's permissible if the company’s core business is Shariah-compliant. Just as a Muslim trader avoids currencies linked to unethical sectors, they also avoid stocks tied to alcohol, gambling, or conventional finance.

So why mention Forex in a discussion about halal stocks? Because both raise similar concerns: ownership, interest (riba), speculation (maysir), and ethics. Understanding what makes Forex trading halal or haram helps clarify the same filters used in stock investing — from contract structure to hidden income sources.

For instance, swap-free Forex accounts avoid riba. That’s relevant when assessing stock brokers or ETFs engaged in stock lending, where interest-based income may be involved. The key question remains: Am I indirectly earning from riba?

Whether you're trading currencies or equities, halal investing depends not just on what you trade, but how you do it — with transparency, real ownership, and ethical structure at its core.

Screening business models, not just financials, makes stock investing truly halal in 2025

Most beginners obsess over the debt ratio or whether a company earns less than 5% from haram sources. But that’s just surface-level. In 2025, a deeper filter is business model screening — is the company’s core purpose aligned with Islamic values? A tech firm enabling gambling apps may pass financial filters, but still fail ethically. Some halal investors now audit not just financial reports but also API usage, patents, and partnerships to avoid indirect exposure. That’s next-level Shariah due diligence — and it’s needed today.

Another underrated move is to use purification funds strategically, not just reactively. Most Muslims give away haram gains as charity, but few think ahead. If you invest in a stock with borderline halal income, create a parallel zakat/purification plan before profits hit your account. This forward-planning transforms a passive cleanse into an intentional ibadah (act of worship). A few halal robo-advisors even automate this process now. You're not just avoiding sin — you’re structuring your entire investing flow around taqwa.

Conclusion

Investing in stocks is halal when it follows Islamic finance principles. Avoiding haram industries, limiting exposure to interest, and ensuring ethical operations are key to compliant investing. Tools like Islamic accounts, stock screeners, and Shariah certifications support ethical growth.

With research and guidance, Muslims can invest confidently, maintaining both financial health and religious integrity.

FAQs

Is it halal to invest in a company with some haram revenue?

Not if haram revenue exceeds 5%. The "5% rule" is the accepted threshold.

Are dividends from stocks halal?

Yes, if the company operates in a halal manner.

Is investing in tech companies considered halal in Islam?

Yes, tech companies can be halal if their revenue is not derived from haram sources like interest or gambling.

Are ESG or socially responsible stocks automatically halal?

Not necessarily. While ESG stocks focus on ethics, they still need Shariah screening for revenue sources and financial compliance.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.