A Complete Guide To ESG Investing And Sustainable Investments

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

ESG investing, or Environmental, Social, and Governance investing, is a strategy that evaluates companies based on sustainability, ethical business practices, and corporate responsibility. Research suggests ESG-focused investments often outperform traditional ones, offering competitive returns with lower risk. With growing investor interest and regulatory support, ESG investing is now a mainstream approach to building sustainable and profitable portfolios.

For those who still see ESG (Environmental, Social, and Governance) as a niche concept, it’s time to look at the numbers. Companies with strong ESG practices are proving to be more than just ethical choices — they're often the smarter financial ones. The real debate isn’t whether ESG matters for stock performance, but rather how it plays out in different market conditions.

Does it help stocks outperform, or does it simply act as a safety net in downturns? And perhaps more crucially, are investors correctly valuing ESG factors, or are there overlooked opportunities for those who dig deeper? These are the questions that separate informed investors from those just going along with the trend.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding ESG investing

ESG investing, which stands for Environmental, Social, and Governance investing, is about looking beyond just profits. Investors consider how a company affects the environment, treats people, and manages itself. The idea is that businesses that do well in these areas are often more stable and successful over time.

Environmental factors look at things like carbon emissions, waste management, and sustainability efforts. Social factors focus on employee treatment, workplace diversity, and community relations. Governance factors relate to leadership decisions, transparency, and business ethics.

This type of investing isn’t just about doing the right thing. Many companies with strong ESG practices have been found to manage risks better, operate more efficiently, and attract more investor trust. Because of this, more people — from big institutions to everyday investors — are including ESG considerations in their investment choices.

Definition and components of ESG

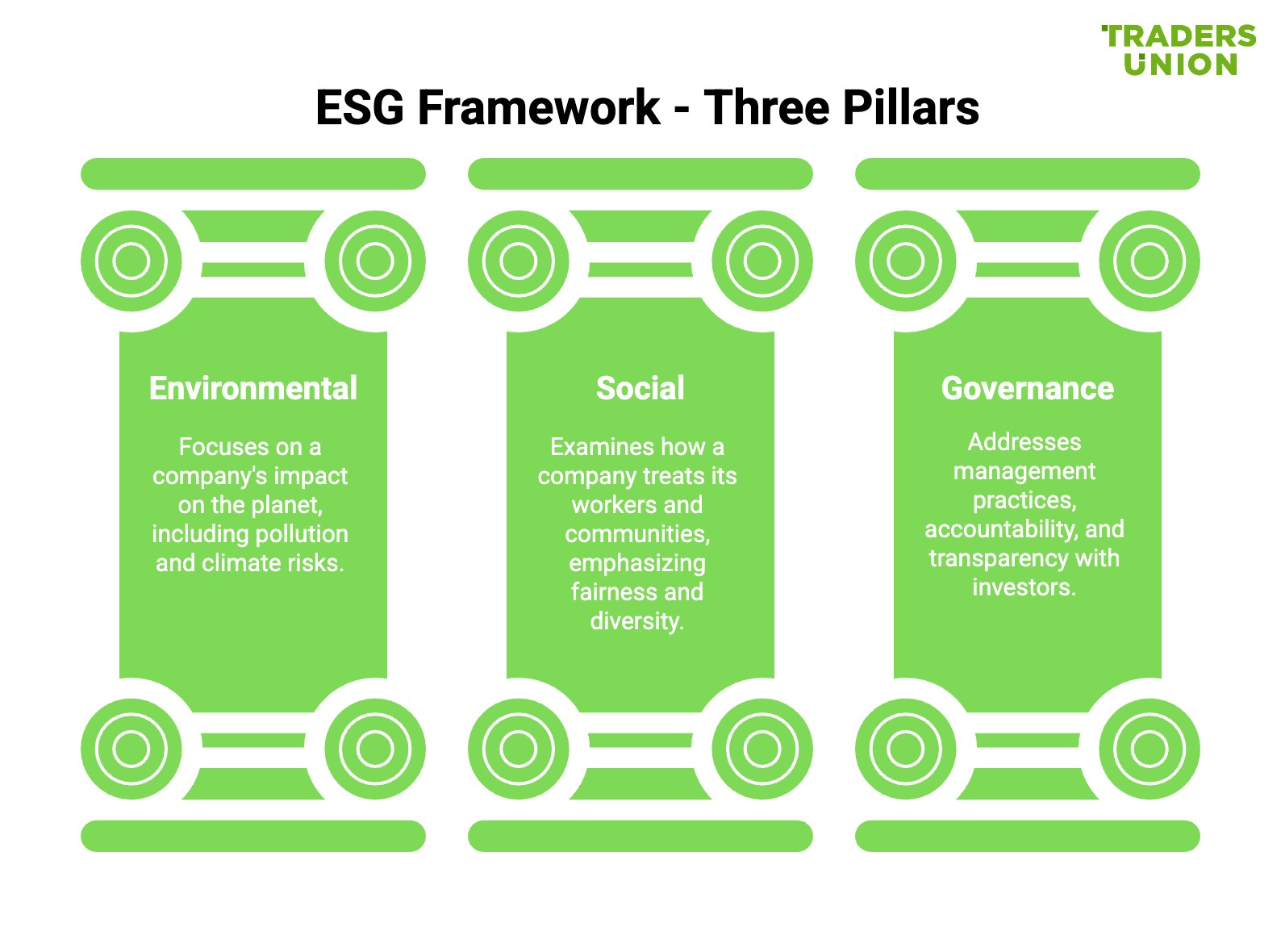

ESG refers to three key areas — Environmental, Social, and Governance — that help investors see how responsible a company is in its business practices.

Environmental (E) looks at how a company affects the planet. This includes pollution, energy efficiency, waste management, and how well it handles climate risks.

Social (S) covers how a company treats its workers, customers, and communities. It considers fair wages, diversity in hiring, and ethical supply chains.

Governance (G) is about how a company is managed. It looks at leadership decisions, accountability, fair pay for executives, and whether the company is honest with its investors.

When a company scores well in these areas, it shows that it operates with responsibility and transparency, which can make it a more trustworthy investment. Learn with our guide to ESG trading in Forex how to align your strategies with environmental, social and governance principles when trading the global markets.

Historical performance of ESG investments

There has been ongoing discussion about whether ESG investments perform as well as traditional investments. Some investors used to think that focusing on environmental, social, and governance factors might limit financial gains. However, looking at past trends, ESG-focused investments have often kept up with or even outperformed regular investments.

Comparative analysis with traditional investments

A key question for investors is whether ESG funds perform as well as traditional investments. Some worry that ESG criteria limit options, but past trends show that ESG-focused funds have often matched or even outperformed traditional funds, especially over time.

How ESG compares during market ups and downs

Holding up in downturns. ESG funds have often been more stable when markets fall. During the 2020 crash, many ESG funds lost less value than the overall market, likely because they focus on companies with strong leadership and lower risks.

Faster recovery. Aftermarket disruptions, ESG stocks and funds have often bounced back more quickly, as companies with sustainable business models are better prepared for long-term shifts.

Risk and return differences

Lower risks. Companies with good ESG practices face fewer legal and regulatory issues, making them less likely to run into financial trouble.

Returns over time. In industries like technology and healthcare, ESG investments have performed as well as or even better than traditional investments. On the other hand, industries like oil and mining have struggled because of increasing regulations and changing investor preferences.

This comparison suggests that ESG investing is not just about ethics. It can offer competitive returns, lower risks, and more stability than traditional investment strategies.

Case studies of ESG funds and indices

Looking at real-world examples helps show how ESG funds and indices have performed compared to traditional investments.

MSCI ESG Leaders Index vs. Traditional Markets

The MSCI ESG Leaders Index tracks companies with high ESG ratings. Over the years, it has performed as well as or slightly better than the MSCI World Index, which represents global markets. This is because:

ESG-focused companies tend to handle crises better.

The index avoids companies with major legal or regulatory risks.

It includes more technology and healthcare firms, which have grown faster than other sectors.

S&P 500 ESG Index vs. Standard S&P 500

The S&P 500 ESG Index removes companies with poor ESG scores. Over time, it has delivered returns similar to the S&P 500, sometimes doing slightly better. Many investors prefer ESG stocks because they tend to be more stable and attract long-term investment.

Recent megatrend shows that ESG fund has slightly overperformed the S&P 500 index.

ESG Fund Example – Parnassus Core Equity Fund

The Parnassus Core Equity Fund is a well-known ESG-focused mutual fund that has regularly outperformed standard equity funds. It invests in companies with strong ESG values while avoiding industries that have negative environmental or social impacts. The fund has:

Beaten many traditional funds over five- and ten-year periods.

Experienced fewer losses during economic downturns.

Focused on businesses with stable, long-term growth potential.

These examples show that ESG-focused funds and indices do not just compete with traditional investments. They often deliver strong returns while also supporting sustainable and responsible business practices.

Factors influencing ESG stock performance

The performance of ESG stocks depends on several key factors. Unlike traditional stocks, ESG investments are shaped not only by financial metrics but also by a company’s sustainability efforts, regulatory environment, and investor sentiment. Understanding these influences can help investors assess the long-term potential of ESG-focused companies.

Corporate sustainability initiatives

A company’s commitment to sustainability can have a direct impact on its stock performance. Investors often prefer businesses that take environmental and social responsibility seriously because these efforts can lead to better efficiency, a stronger reputation, and steady growth.

Ways sustainability efforts influence stock value:

Cutting costs. Companies that use less energy, recycle materials, or reduce waste often save money, improving their bottom line.

Stronger customer loyalty. Many consumers support businesses that care about sustainability, which can lead to higher sales.

New business opportunities. Companies that invest in green energy, ethical supply chains, or waste reduction can tap into emerging markets.

Fewer legal troubles. Businesses that stay ahead of environmental laws and labor standards are less likely to face penalties or public criticism.

While sustainability efforts do not always lead to immediate stock growth, they often make companies more resilient and valuable in the long run.

Regulatory and policy impacts

Government rules and policies have a big impact on ESG stock performance. As laws change to promote sustainability, companies that follow them can benefit, while those that ignore them may struggle.

How regulations shape ESG investing:

Pollution limits and carbon taxes. Some governments charge companies for pollution or set strict emission limits. Businesses that invest in cleaner operations can avoid extra costs.

Mandatory ESG reporting. In many countries, companies must now disclose how they manage environmental and social risks. Investors tend to trust businesses that are transparent about these issues.

Industry-specific rules. Certain industries, like manufacturing and energy, face tougher environmental laws. Companies that embrace cleaner technology often get government incentives.

Global agreements. International policies, such as the Paris Climate Accord, set sustainability goals that push businesses worldwide to adopt greener practices.

New regulations can create both risks and opportunities for ESG stocks, so investors should keep an eye on policy changes.

Market perception and investor behavior

How investors feel about ESG stocks plays a big role in their performance. As more people become aware of environmental and social issues, interest in ESG investing has grown. But investor perception can change quickly based on market trends and news.

What influences investor decisions in ESG investing:

Public awareness. Climate disasters or corporate scandals can make people rethink where they invest.

Big investors leading the way. Large firms and pension funds are putting more money into ESG stocks, driving up demand.

Long-term vs. short-term focus. Some investors buy ESG stocks for steady growth, while others jump in and out based on hype.

News and media impact. Positive coverage of a company’s ESG efforts can attract investors, while negative headlines can cause stock prices to drop.

Even if a company has strong ESG practices, its stock price depends on how the market sees it. Investor behavior and trends play a big part in ESG stock performance.

Strategies for incorporating ESG into investment portfolios

There are many ways to bring ESG investing into a portfolio, depending on an investor’s financial goals and personal values. Whether choosing individual stocks, ESG funds, or actively influencing corporate decisions, investors can balance sustainability with solid financial returns.

1. ESG screening methods

One of the simplest ways to invest with an ESG focus is by filtering companies based on their sustainability and governance practices.

Ways to screen investments:

Exclusion-based investing. Avoids industries like fossil fuels, tobacco, or weapons manufacturing that do not align with ESG values.

Targeted ESG investing. Focuses on companies leading in sustainability, such as those using renewable energy or ethical labor practices.

Industry leaders approach. Chooses the most responsible companies within each sector rather than avoiding entire industries.

Screening helps investors match their investments with their personal beliefs while keeping their portfolios diverse.

2. Including ESG factors in financial decisions

Instead of only picking stocks based on ESG scores, many investors now look at ESG risks and opportunities as part of their overall financial research.

How this approach works:

Identifying risks. Looking at how a company handles environmental and social challenges, such as climate policies or workplace ethics.

Spotting growth opportunities. Investing in companies benefiting from ESG trends, like electric vehicles or plant-based food companies.

Long-term stability. Companies that follow strong ESG practices often have better leadership and fewer legal or ethical issues.

3. Investing in ESG funds and ETFs

For those who prefer a hands-off approach, ESG-focused funds and ETFs provide an easy way to gain exposure to sustainable investments.

Types of ESG funds:

General ESG funds. Invest in a mix of companies with strong ESG practices across different industries.

Theme-based ESG funds. Focus on areas like clean energy, diversity, or water conservation.

Impact-driven funds. Invest in projects designed to make a positive social or environmental impact.

4. Pushing for change as a shareholder

Investors can also influence corporate ESG decisions by using their rights as shareholders.

Ways to engage with companies:

Voting on key issues. Investors can vote on policies related to the environment, executive pay, or workplace diversity.

Direct conversations with leadership. Large investors sometimes meet with company leaders to encourage stronger ESG efforts.

Proposing ESG-related resolutions. Shareholders can introduce initiatives that push for more sustainable business practices.

5. Investing for direct impact

Impact investing is for those who want their money to directly support projects that drive positive change while still earning returns.

Examples of impact investing:

Supporting renewable energy projects like wind and solar power.

Investing in companies that build affordable housing or improve education access.

Funding sustainable farming initiatives that protect the environment.

The real key to identifying ESG assets

A common pitfall for beginners in ESG investing is assuming that a high ESG score automatically means a stock is a solid buy. In reality, ESG ratings often reflect past actions rather than future potential.

Many ESG funds are built around historical data, which doesn’t always capture whether a company is actually set up for long-term success. Smart investors dig deeper. They ask whether a company’s ESG efforts genuinely strengthen its business or if it’s just good PR. For example, a company with a top ESG score but declining market position may not be as strong an investment as a competitor with a lower score but a clear roadmap for sustainability-driven growth.

Another key factor that many investors overlook is the role of government policies. ESG performance isn’t just about what a company is doing today — it’s about how upcoming regulations will shape its future. Policies like carbon pricing, stricter sustainability reporting, and new tax incentives can create major winners and losers.

Take the EU’s carbon border tax. It’s already pushing companies to rethink their supply chains, yet many investors are still focused on current ESG ratings rather than anticipating these shifts. The real advantage comes from staying ahead of policy changes and understanding which companies will benefit before the market reacts.

Conclusion

ESG investing isn’t just about doing the right thing — it’s about making better financial choices. Instead of blindly trusting ESG scores, the best investors take a critical look at what really drives long-term value. They focus on companies that aren’t just checking boxes but are actually integrating sustainability into their business in a way that strengthens their bottom line.

The smartest investments come from spotting opportunities that the broader market hasn’t fully recognized yet. By understanding how ESG fits into financial performance and policy trends, investors can position themselves ahead of the curve — not just for short-term gains, but for lasting success.

FAQs

How ESG affects stock performance?

ESG factors can influence stock performance by affecting risk, reputation, and investor sentiment. Companies with strong ESG practices may see long-term benefits, while poor ESG performance can lead to higher risks.

How are ESG investments performing?

ESG investments have shown mixed performance, with some outperforming traditional assets and others facing volatility. Market conditions, regulatory changes, and investor preferences play a crucial role.

Does ESG investing outperform?

ESG investing can outperform in certain market conditions, especially when sustainability risks are priced in. However, returns depend on sector exposure, strategy, and time horizon.

Are ESG investors underperforming?

ESG investors may underperform in the short term due to sector biases and exclusions. Over the long run, performance varies based on economic cycles and corporate ESG integration.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.