Warren Buffett's Portfolio: Holdings, Investments, And Perspectives

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here’s a breakdown of Warren Buffett portfolio, investments, and views:

No direct crypto holdings.

Criticized Bitcoin as worthless.

Invested in crypto-exposed firms.

Owns stakes in Nubank.

Prefers stocks over digital assets.

Believes crypto lacks intrinsic value.

Warren Buffett, the billionaire investor, has openly criticized cryptocurrencies. Following a strict value investing approach, he has repeatedly rejected digital currencies like Bitcoin, believing they are risky and lack real worth.

Even though he distrusts crypto, Berkshire Hathaway has some indirect exposure to the digital finance space. Over the years, his views on blockchain and cryptocurrencies have led to mixed reactions from investors. In this article, we take a look at Buffett’s views on crypto, whether he owns digital assets, his blockchain-related investments, and what investors can learn from his carefully thought-out investment philosophy.

Overview of Buffett's crypto investments

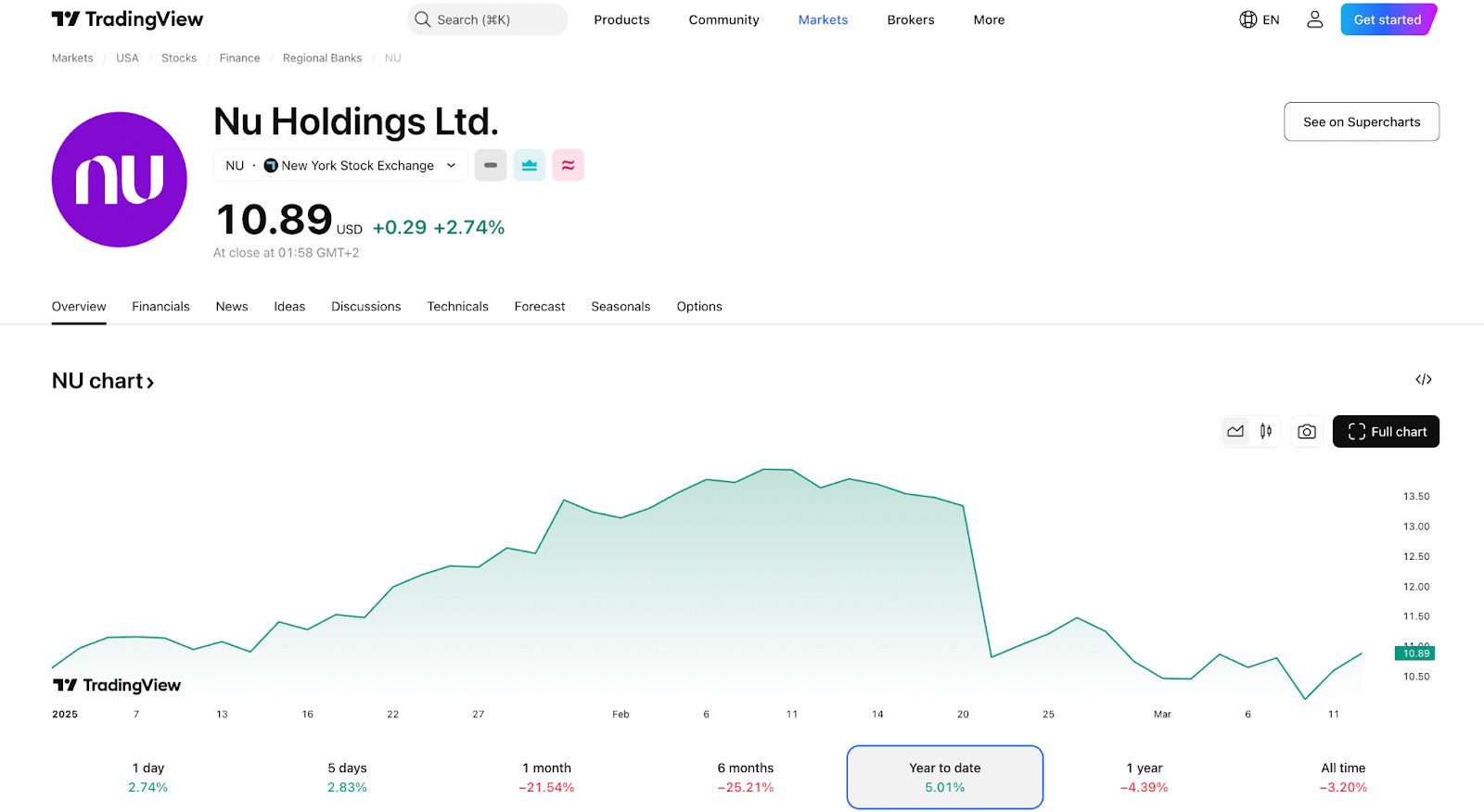

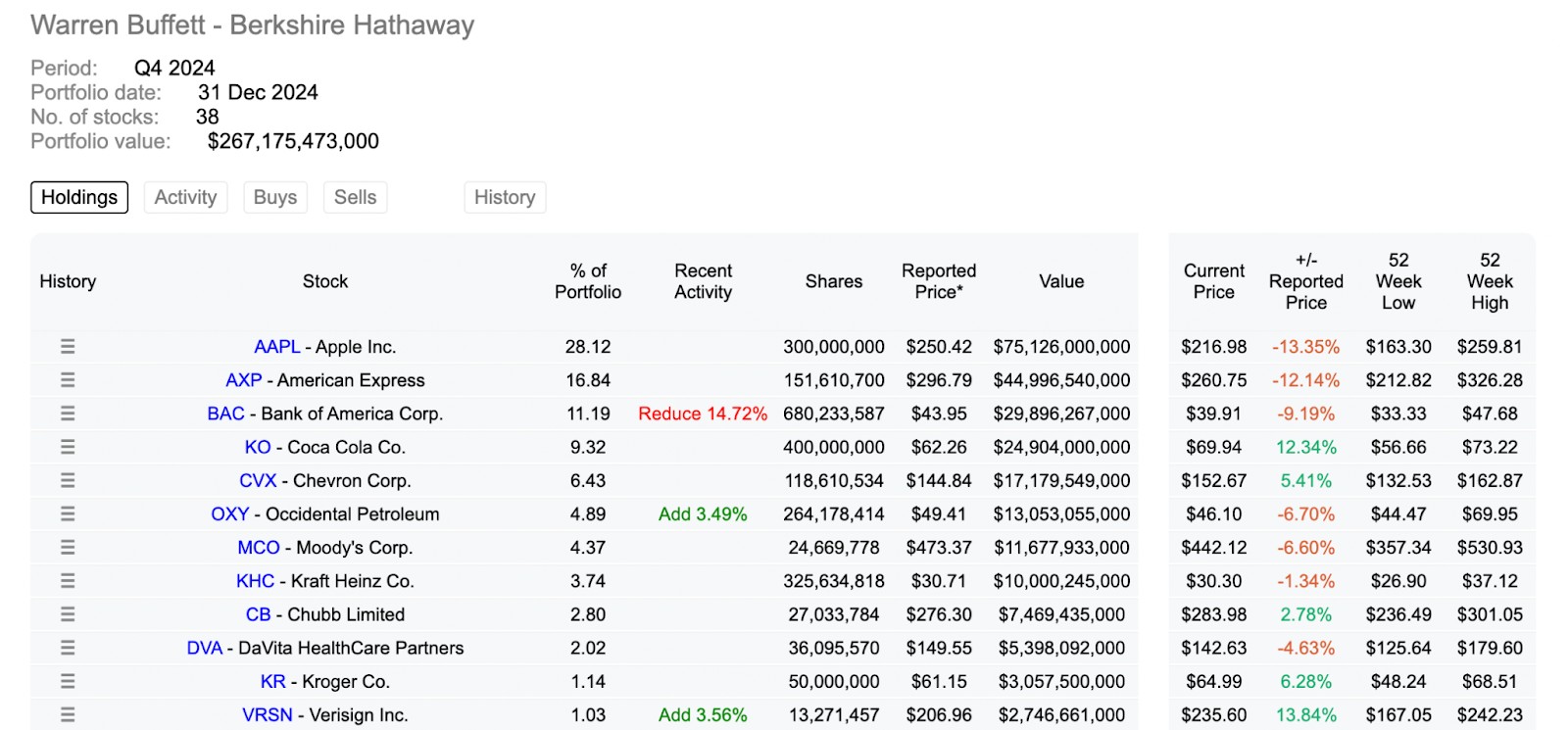

While Warren Buffett has never directly invested in cryptocurrencies, Berkshire Hathaway’s portfolio includes indirect exposure to the digital finance sector. A key example is its $500 million investment in Nubank, a Brazilian fintech giant that actively promotes crypto trading through its platform. Following the successful stock listing, Berkshire Hathaway increased its investment by an additional $250 million.

Unlike traditional banks, Nubank integrates blockchain-based solutions, allowing millions of users to access crypto markets seamlessly. Buffett’s willingness to back a bank that facilitates crypto transactions raises questions about whether his stance is softening or if he simply sees fintech as a lucrative sector.

Another lesser-known angle is Buffett’s indirect stake in Bitcoin mining through his long-term holdings in companies like TSMC (Taiwan Semiconductor Manufacturing Company). While TSMC is primarily a semiconductor giant, it plays a crucial role in producing chips used in high-performance Bitcoin mining rigs. The growing demand for efficient mining hardware has boosted TSMC’s revenue from blockchain-related activities, making Berkshire Hathaway an unintentional beneficiary of crypto mining’s growth. This demonstrates how Buffett, despite his aversion to speculative assets, still profits from the industry’s infrastructure.

A surprising but overlooked detail is Berkshire Hathaway’s past investment in Visa and Mastercard, companies that have pivoted towards crypto-based payment solutions. Mastercard’s Crypto Secure program and Visa’s crypto payment integration make it clear that legacy financial players are embracing digital assets. Buffett’s historical bet on these companies means he has indirectly supported blockchain adoption while publicly dismissing cryptocurrencies. His strategy suggests that instead of rejecting the space outright, he positions himself to profit from its infrastructure while avoiding direct exposure to volatile digital assets.

An issue in following this strategy is that the investment required is quite high. And to start off, investing directly in currencies is way more accessible. If you wish to do the same, we have researched the market and presented the top crypto exchanges for beginners that offer access to crypto investments through a low minimum deposit. You can compare them using the table below and make your own choice:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Warren Buffett's stance on Bitcoin and cryptocurrencies

Warren Buffett believes digital currencies are speculative investments. He has expressed his view that Bitcoin lacks inherent value and does not produce anything tangible, making it an unreliable store of wealth.

Critique of Bitcoin

Buffett thinks Bitcoin is just hype. He believes people are chasing hype, not real value. Bitcoin and other cryptos don’t create anything since they don’t produce income or have real use.

He only invests in things that grow in value, like businesses that make money or assets like gold. Buffett often says, "If you don’t understand it, don’t buy it," which shows why he avoids risky bets like crypto.

Buffett doesn’t see Bitcoin as real wealth. He thinks Bitcoin is too unstable and speculative, though he isn’t against blockchain itself. He sees crypto as a gamble, not a real asset.

Skepticism toward digital assets

Buffett isn’t just skeptical about Bitcoin — he doubts the value of crypto in general. He thinks crypto is just hype and says its price is based on speculation, not real worth. He compares them to things like art and trading cards, which only hold value if someone is willing to pay more for them.

Even though he thinks crypto is risky, Buffett admits blockchain could be useful. He thinks blockchain might help in banking and logistics, offering potential real-world applications.

Still, he sees crypto as unstable and speculative. He doesn’t believe it can function as a reliable financial asset in its current form.

Does Warren Buffett own cryptocurrency?

Warren Buffett has consistently stated that he does not own any cryptocurrencies, maintaining his skepticism toward the digital asset class. Despite the growing popularity of Bitcoin and other cryptocurrencies, Buffett has remained steadfast in his belief that they do not offer any real value or long-term stability.

Direct ownership

Buffett has said many times that he doesn’t own Bitcoin or any crypto. He calls it a gamble with no real worth and is firm that crypto doesn’t belong in his portfolio. He sticks to businesses that create actual value, like companies that produce goods and services.

His portfolio shows zero interest in crypto. Other billionaires are buying Bitcoin, but not him. Buffett refuses to take the risk because he thinks Bitcoin is too risky and unpredictable.

For an investor who focuses on real profits, crypto doesn’t make sense. Its volatility and speculative nature go against everything he believes in.

Key principles of Warren Buffett's investment philosophy

Warren Buffett’s investment philosophy isn’t just about buying undervalued stocks — it’s about mastering patience, psychology, and long-term decision-making. Here are some advanced yet beginner-friendly insights that go beyond the usual advice.

Think of stocks as ownership, not tickers. When you buy a stock, you’re not just betting on its price movement — you’re becoming a partial owner of a business. Before investing, ask yourself if you’d be comfortable owning the entire company at its current valuation. If not, reconsider.

Study business models, not just financials. Many investors obsess over earnings reports, but Buffett looks deeper. He studies how a company makes money, whether its competitive advantage is sustainable, and if its industry will remain relevant decades from now. Numbers change, but a strong business model endures.

Avoid businesses that rely on constant reinvention. Buffett prefers companies that don’t have to continuously innovate just to survive. If a business must reinvent itself every few years to stay competitive, its moat is weak. Look for companies with products that sell themselves, even without disruption.

Patience isn't just about holding — it's about waiting. Many think Buffett’s success comes from holding stocks for decades, but a bigger secret is waiting for the right price. He often sits on cash for years, only deploying it when a truly undervalued opportunity appears. Investing isn’t about always being active — it’s about acting at the right time.

Buy businesses that can survive bad management. Great companies outlast bad CEOs, but weak companies collapse under poor leadership. Buffett invests in businesses so strong that even a mediocre leader can’t destroy them. If a company’s success depends on a genius running it, it's too risky.

Buffett profits from crypto without owning it

Despite Warren Buffett’s strong opposition to cryptocurrency, his investments still touch the digital asset space in ways most people overlook. Berkshire Hathaway’s stake in Nubank, a fintech giant offering crypto trading, proves that Buffett isn’t completely detached from the industry — he’s just investing in the infrastructure rather than the assets themselves. He has consistently avoided speculative investments, but by backing fintech firms integrating crypto, he profits from the ecosystem without holding a single coin. Beginners should take note: instead of chasing volatile digital assets, it may be smarter to invest in companies enabling crypto adoption rather than crypto itself.

Another overlooked aspect is Buffett’s indirect exposure through financial giants like Visa and Mastercard. While he has never endorsed blockchain, both companies are investing in crypto payment solutions, meaning Berkshire Hathaway indirectly benefits from crypto adoption. The key lesson for beginners? Sometimes, the best way to profit from a trend isn’t by investing in it directly but by identifying which traditional companies are capitalizing on it. Buffett’s strategy shows that you don’t need to own crypto to benefit from the industry’s growth.

Conclusion

Warren Buffett's views on cryptocurrency remain firmly skeptical, with his investment philosophy rooted in traditional value investing. His stance on Bitcoin is clear — he believes it is speculative and lacks intrinsic value. Despite this, Buffett recognizes the potential of blockchain technology, particularly for its ability to improve transparency and efficiency in various industries.

While Buffett has personally avoided cryptocurrencies, his firm, Berkshire Hathaway, has ventured into the digital finance space through investments in companies like Nubank, a digital bank offering crypto services. This reflects a subtle shift in Buffett's approach — he may not be ready to embrace Bitcoin, but he acknowledges the disruptive power of blockchain and fintech.

For investors, Buffett’s approach offers valuable lessons. His caution about speculative investments serves as a reminder to focus on fundamentals and long-term value. While cryptocurrencies may have a role to play in the future of finance, Buffett’s emphasis on traditional assets remains a guiding principle for his success.

FAQs

Does Warren Buffett own any cryptocurrencies?

Warren Buffett has repeatedly stated that he does not own any cryptocurrencies, including Bitcoin. Despite the increasing popularity of digital assets, Buffett has maintained his skepticism, labeling Bitcoin and other cryptocurrencies as speculative investments without intrinsic value.

Has Warren Buffett ever invested in crypto companies?

While Buffett himself avoids direct cryptocurrency investments, his firm, Berkshire Hathaway, has invested in companies related to the crypto space. Notably, Berkshire Hathaway invested $750 million billion in Nubank, a Brazilian digital bank offering cryptocurrency services, such as the ability to buy and sell Bitcoin.

What is Warren Buffett’s stance on Bitcoin?

Buffett has been one of Bitcoin’s most vocal critics, referring to it as "rat poison squared." He believes Bitcoin is a speculative asset with no underlying value and argues that it doesn’t serve a productive purpose in the economy. Buffett has cautioned investors against investing in cryptocurrencies, as he sees them as a risky and volatile market.

Does Warren Buffett support blockchain technology?

While Buffett is skeptical about cryptocurrencies, he recognizes the potential of blockchain technology. He believes that blockchain could have valuable applications in industries like supply chain management, healthcare, and financial services, improving transparency and efficiency.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.