Corporate Scandals And Stock Market Crashes

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Corporate scandals can trigger sharp stock declines, legal troubles, and long-term reputational damage. Financial fraud, data breaches, and executive misconduct often lead to regulatory investigations and investor sell-offs. While some companies recover by improving transparency and leadership, others struggle with lawsuits and declining consumer trust. Investors should analyze whether a scandal signals deep financial instability or a temporary issue that can be fixed before making investment decisions.

When a company gets caught in a scandal, it’s not just about bad headlines — it’s about real money disappearing. Some stocks crash the moment the news breaks, while others take months to lose value as lawsuits pile up and customers walk away. An accounting fraud that exposes fake profits can crush a company instantly, while a data breach might lead to a slower but steady decline as people lose confidence in the brand. The bigger question for investors isn’t just how far the stock will fall, but whether the company can ever win back trust — and how to spot the signs that it’s starting to turn the corner.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding corporate scandals

Corporate scandals can shake investor confidence, damage reputations, and lead to legal consequences for businesses. These scandals come in different forms, from financial fraud to security breaches, and they often reveal deeper issues within a company’s culture or governance. By understanding why they happen, investors and businesses can spot potential red flags before they lead to major crises.

Definition and types of corporate scandals

A corporate scandal happens when a company or its leadership is involved in fraud, corruption, or misconduct that harms shareholders, employees, or the public. Some scandals involve financial fraud, while others are linked to data security failures, bribery, or workplace misconduct.

Common types of corporate scandals:

Financial fraud and accounting scandals

Some companies manipulate their financial reports to make their earnings look stronger than they actually are.

Example. Enron (2001) hid its debts through complex accounting tricks, leading to one of the biggest corporate failures in history.

Insider trading and stock manipulation

Executives and insiders sometimes use private company information to make unfair stock trades.

Example. Raj Rajaratnam (Galleon Group case, 2009) was convicted of making millions from illegal stock trades based on confidential business information.

Bribery and unethical business deals

Some companies bribe government officials or business partners to secure contracts or favorable treatment.

Example. Siemens (2008) paid massive fines for using bribes to win deals in different countries.

Data breaches and privacy failures

When companies fail to protect customer data, it can lead to massive leaks of personal information.

Example. Equifax (2017) suffered a breach that exposed sensitive data of more than 140 million people.

Executive misconduct and leadership failures

Scandals can also emerge from workplace harassment, abuse of power, or poor management decisions.

Example. WeWork (2019) saw its valuation collapse after its CEO was accused of reckless spending and poor financial oversight.

Environmental and safety violations

Companies that ignore safety regulations or environmental laws can cause harm to people and the planet.

Example. BP Deepwater Horizon (2010) led to a major oil spill due to safety lapses, resulting in billions in fines.

Causes of corporate scandals

Corporate scandals do not happen by accident. They are often the result of poor leadership, weak oversight, and an unhealthy corporate culture.

Why companies fall into scandal:

Greed and short-term profit pressure

Some companies cut ethical corners to meet financial targets or boost their stock prices.

Executives sometimes chase quick profits at the expense of long-term stability.

Weak oversight and poor governance

If company boards and auditors are not paying attention, fraudulent practices can go unnoticed for years.

Regulatory loopholes and poor enforcement

Some companies exploit weak regulations to avoid accountability or hide unethical practices.

Conflicts of interest

Executives may make decisions that benefit them personally rather than the company or its investors.

Toxic corporate culture

Workplaces that reward aggressive risk-taking and secrecy increase the likelihood of fraud.

Lack of transparency

When companies are not open about their finances and operations, it becomes easier for misconduct to grow.

Impact of corporate scandals on market capitalization

When a corporate scandal comes to light, stock prices often react immediately. Investors lose confidence, legal and regulatory actions follow, and in many cases, the company’s market value takes a serious hit. While some businesses recover, others struggle with long-term losses that impact their growth and financial stability.

Immediate effects

The moment a corporate scandal is revealed, investors respond quickly. Stocks can drop sharply as fear spreads, and companies face legal scrutiny and public backlash.

What happens right after a scandal breaks:

Panic selling by investors

Shareholders rush to sell their stock, worried that the company’s financial health will suffer.

Example. Wells Fargo (2016) lost investor confidence when it was exposed for creating fake customer accounts, leading to a stock decline.

Regulatory investigations and lawsuits

Government agencies often step in to investigate companies accused of fraud or misconduct.

Example. Volkswagen (2015) faced a major stock drop when its emissions cheating scandal triggered legal action worldwide.

Institutional investors pulling out

Large investment funds and pension funds may sell their shares to avoid risk, driving prices lower.

Example. Meta (formerly Facebook, 2018) saw its market value plunge after the Cambridge Analytica data scandal raised concerns about data privacy.

Media coverage fueling volatility

News coverage and social media discussions can amplify investor fears, making stock price swings more severe.

These immediate reactions often lead to billions in market value being wiped out in just a few days. While some companies recover, others continue to struggle long after the initial crisis fades from the headlines.

Long-term consequences

A corporate scandal does not just affect stock prices in the short term. Many companies experience long-lasting reputational and financial damage that can keep their market value suppressed for years.

How scandals impact companies over time:

Loss of investor trust

Once trust is broken, many investors hesitate to return, leading to lower stock valuations.

Example. Enron (2001) collapsed entirely because years of financial fraud left it with no credibility, forcing it into bankruptcy.

Expensive legal settlements and fines

Companies involved in scandals often have to pay massive penalties, reducing future profits.

Example. BP (2010) paid billions in legal fees and settlements after the Deepwater Horizon oil spill, which hurt its stock price for years.

Leadership shakeups and instability

CEOs and top executives are often forced to step down, creating uncertainty about the company’s direction.

Example. Uber (2017) lost several key executives after workplace misconduct allegations, delaying its public listing.

Competitors taking advantage

Brand damage and lost customers

If a scandal affects a company’s reputation, customers may stop buying its products, hurting sales in the long run.

Case studies of notable corporate scandals

Corporate scandals have led to huge financial losses, investor panic, and increased regulatory scrutiny. Some of the worst cases involved companies hiding debt, inflating profits, or misleading investors about their financial health. These scandals not only caused stock prices to crash but also forced regulators to implement tougher rules.

Enron scandal

Enron was once one of the largest energy companies in the world, but accounting tricks and financial deception caused its downfall.

What happened?

Executives used complicated financial structures to hide debt while making the company look profitable.

They created off-the-books entities to keep liabilities out of financial reports.

When the truth came out, investors lost confidence, and the company unraveled.

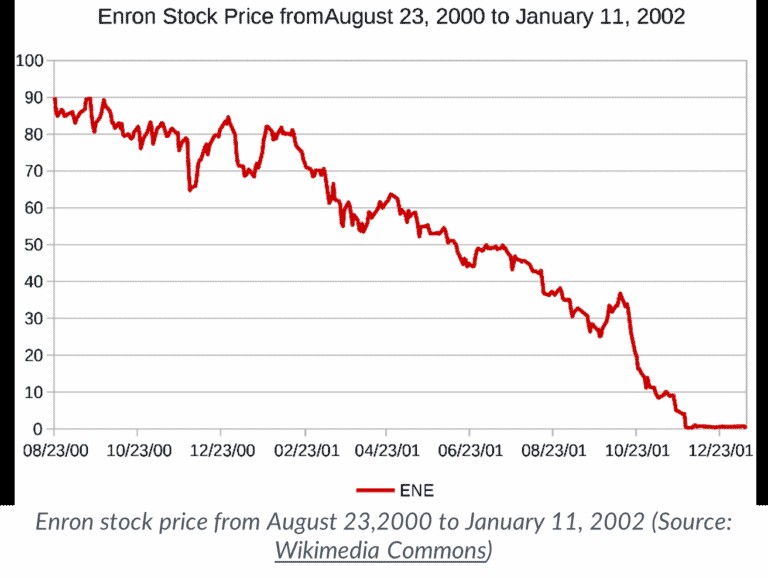

How the market reacted

Stock price collapse. Enron’s shares dropped from nearly 90 dollars to under 1 dollar, wiping out billions.

Investors suffered huge losses, especially pension funds and retirement accounts.

Legal action followed. The company went bankrupt, and executives were convicted of fraud.

Why this mattered

The scandal led to major financial reforms, such as the Sarbanes-Oxley Act.

It showed how weak auditing and corporate governance could allow fraud to continue for years.

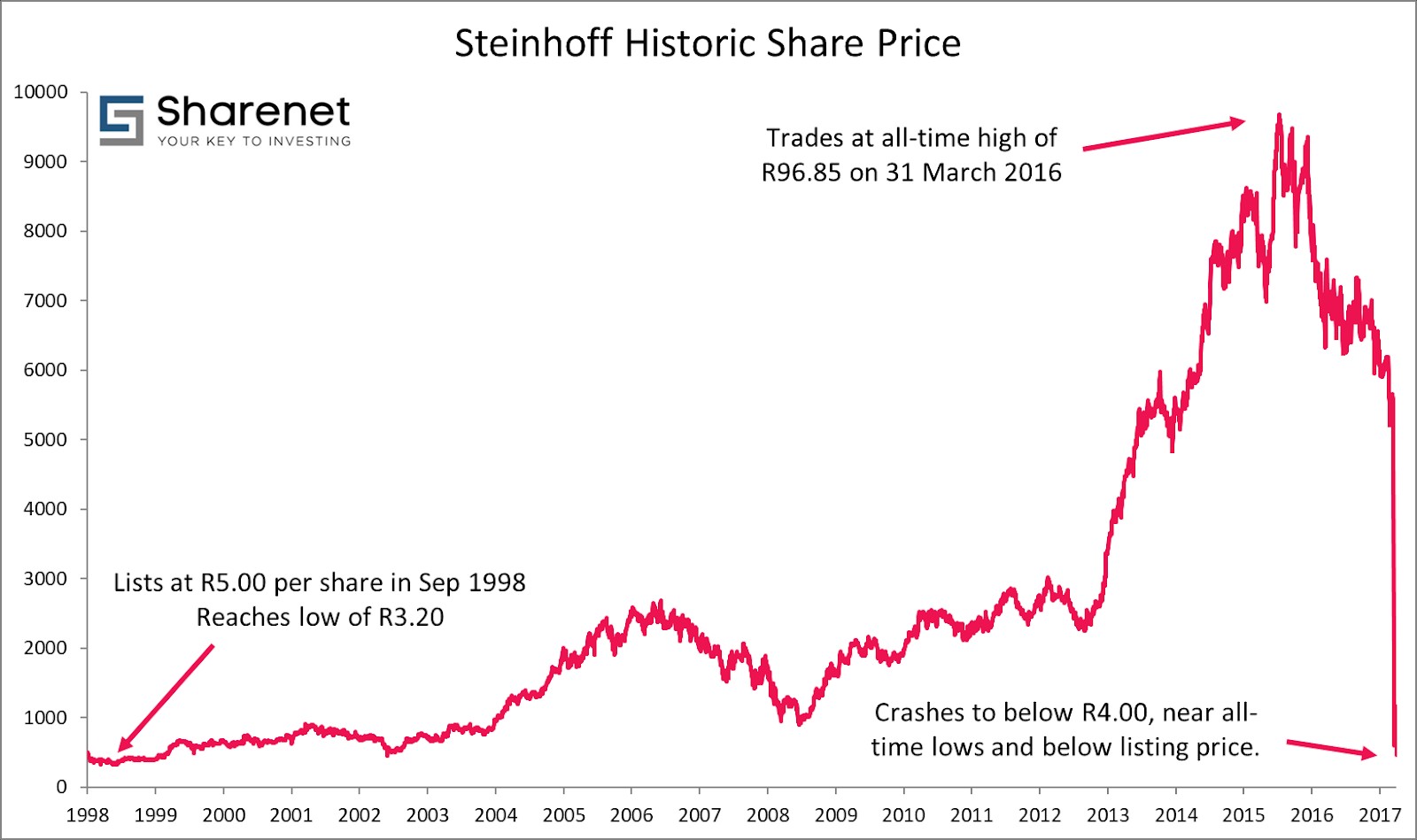

Steinhoff International

Steinhoff, a multinational retail company, collapsed due to years of misleading financial statements and hidden losses.

What happened?

The company overstated earnings and asset values, making its financial health look stronger than it was.

It hid billions in liabilities, deceiving investors and regulators.

When the fraud was exposed, the company faced lawsuits and regulatory investigations.

How the market reacted

Stock price fell over 95 percent, wiping out billions in investor wealth.

The company had to sell assets and restructure its debt to survive.

Why this mattered

The scandal damaged trust in South Africa’s corporate sector.

It exposed serious failures in financial auditing and oversight.

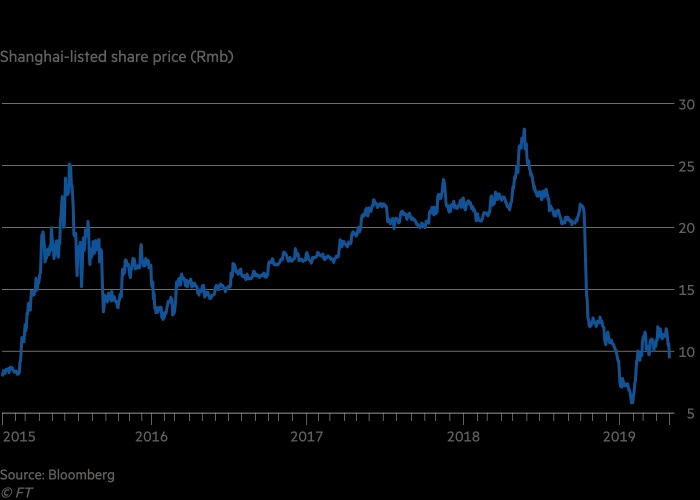

Kangmei Pharmaceutical

Kangmei Pharmaceutical, a major drug company in China, was caught inflating its cash reserves by billions while executives misused company funds.

What happened?

The company falsified financial reports, reporting more cash than it actually had.

Executives used corporate funds for personal stock trading, breaking regulatory rules.

How the market reacted

Stock price plunged, causing massive losses for investors.

Regulators imposed heavy fines and bans on executives.

Why this mattered

It exposed weak financial controls in Chinese-listed companies.

It led to stricter regulatory oversight for corporate fraud.

Reputational risk and investor trust

A company’s reputation can have a huge impact on its stock price and long-term success. Investors tend to trust companies that are seen as ethical, transparent, and well-managed. However, when a corporate scandal occurs, that trust can disappear quickly, leading to falling stock prices, legal troubles, and lasting financial damage.

Role of reputation in market valuation

Investors do not just look at a company’s financial numbers. They also consider its reputation, leadership, and business ethics when deciding whether to buy or sell shares. A strong reputation can help a company attract investors, maintain stable stock prices, and recover faster from market downturns.

Why reputation matters for stock valuation

Investor confidence and stock price stability

Companies with good reputations attract more investors, keeping their stock prices steady.

A strong public image can also reduce stock price volatility, as shareholders feel more secure.

Consumer trust and steady revenue

If people trust a company, they will keep buying its products, helping to support stock prices.

Example. Apple’s strong brand reputation keeps investor confidence high, even during economic slowdowns.

Ability to recover from crises

Companies with positive reputations often bounce back faster from financial downturns.

Example. Johnson & Johnson responded transparently to the 1982 Tylenol crisis, maintaining long-term investor trust.

Premium valuations for ethical companies

Investors are willing to pay more for stocks of companies known for ethical business practices.

Businesses that focus on transparency, sustainability, and strong governance often trade at higher valuation multiples.

A company’s reputation acts like a safety net during uncertain times. However, once damaged, rebuilding trust can take years.

Mechanisms of trust erosion

When a company is involved in fraud or misconduct, trust can disappear overnight. Scandals lead to stock selloffs, lawsuits, and long-term reputational damage that can take years to fix.

How scandals break investor trust

Stock price crashes

Investors panic and sell shares quickly, causing stock prices to drop.

Example. Boeing (2019) lost billions after the 737 MAX safety crisis led to flight bans and regulatory probes.

Media backlash and negative public perception

News coverage keeps a scandal in the public eye, making it harder for companies to rebuild trust.

Legal action and government investigations

Companies involved in fraud face heavy fines, lawsuits, and regulatory crackdowns.

Example. Volkswagen (2015) had to pay billions in penalties after its emissions fraud was exposed.

Leadership changes and management instability

Scandals often result in CEO resignations and boardroom shakeups, creating uncertainty for investors.

Example. Uber (2017) struggled to regain investor trust after its CEO was forced to step down amid workplace misconduct allegations.

Long-term damage to company reputation

Even after legal cases are settled, some companies never fully regain consumer and investor confidence.

Not every stock drop means doom

One of the biggest missteps investors make when a company gets caught in a scandal is assuming every stock drop means the business is doomed. Some companies never recover, but others come back even stronger after major changes. The real question is whether the scandal exposes a fundamental problem — like fake financials — or if it’s something the company can fix.

If a company has been lying about its earnings, that’s usually a sign of deeper issues that won’t go away. But if the problem is a leadership scandal or a data breach, it might not damage the company’s long-term value if management acts quickly. Stocks often fall too much in the heat of the moment, so knowing when panic has created a buying opportunity can make all the difference.

How the company responds also plays a huge role in whether it can recover. If management drags its feet, denies wrongdoing, or shifts blame, the stock is likely to keep sliding. But if leadership immediately takes responsibility, fires those involved, and lays out a clear plan to fix the damage, there’s a much better chance the company can regain investor confidence. It’s also worth watching how big investors react.

If major funds start selling off their shares, it’s often a warning that more trouble is ahead. But if they hold steady — or even buy more — it’s a sign they see a way forward. The companies that survive scandals aren’t just the ones with strong businesses — they’re the ones that take control of the situation before it spirals further out of hand.

Conclusion

Corporate scandals can shake investor confidence, wipe out billions in market value, and leave companies fighting to regain trust. While some businesses never recover, others manage to rebuild by taking swift action, improving transparency, and implementing stronger leadership. The key for investors is not just reacting to bad news but analyzing how the company handles the crisis.

Stocks often drop sharply after a scandal, but not all declines signal a permanent downfall. The companies that survive are those that take responsibility, enforce corrective measures, and reassure investors with a clear recovery plan. Smart investors monitor major shareholders, institutional reactions, and long-term fundamentals to determine if a stock is oversold or facing deeper structural problems. Understanding these signals can help traders avoid losses and identify opportunities before the market corrects itself.

FAQs

What are corporate scandals?

Corporate scandals involve unethical or illegal activities by companies, such as fraud, financial misreporting, or corruption. These scandals damage reputations, cause financial losses, and may lead to legal actions.

What are the top 10 accounting scandals?

Some of the biggest accounting scandals include Enron, WorldCom, Lehman Brothers, Wirecard, and Satyam. These cases involved fraud, misreporting, and corporate governance failures, leading to huge financial collapses.

What is an example of a company scandal?

The Enron scandal is a well-known example where the company used fraudulent accounting practices to hide debt. It led to bankruptcy, legal action, and regulatory changes in corporate governance.

What are the different types of scandals?

Scandals can be financial, ethical, legal, or political, affecting businesses, governments, or individuals. They often involve fraud, corruption, data breaches, or workplace misconduct.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Stock fraud, also known as securities fraud, refers to a range of illegal activities or deceptive practices related to stocks and securities markets. These fraudulent activities can harm investors, undermine market integrity, and are often subject to legal penalties.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.