What is a dividend growth strategy and how to earn from it

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A dividend growth strategy involves investing in companies that consistently increase their dividend payouts over time. This approach aims to generate a reliable and growing income stream while benefiting from long-term capital appreciation. Investors focus on companies with strong financial health and a history of dividend growth, often reinvesting dividends to maximize returns through compounding.

A dividend growth strategy is a long-term investing method that focuses on buying shares of companies that regularly increase their dividends. This strategy is attractive to investors seeking stable income and protection from inflation. The main benefit of the strategy is to create a reliable and growing source of income that can supplement retirement or serve other financial goals. This article will discuss this strategy in detail and teach you how to use it for wealth creation.

What is dividend growth strategy

The dividend growth strategy is built on the following key principles to help investors get the most out of their investments:

Investing in companies with a long-term history of dividend growth. Companies that have consistently increased their dividends over many years demonstrate their financial strength and commitment to rewarding shareholders. These companies typically occupy leading positions in their industries and have strong competitive advantages.

Assessing the financial stability of the company. It is important to analyze a company's financial condition, including its balance sheet, revenues, expenses and free cash flow. The company must be able to generate sufficient income to maintain and increase its dividend.

Portfolio diversification. Investing in different sectors of the economy helps reduce risks. Even if one industry is struggling, others can pick up the slack by providing a stable income.

Reinvestment of dividends. Automatic reinvestment of dividends received into additional shares of the company helps speed up the process of capital accumulation thanks to the effect of compound interest.

Long-term approach. A dividend growth strategy requires patience and discipline. Investing for the long term maximizes the benefits of dividend increases and capital growth.

How to use the dividend growth strategy?

Applying this strategy is basically clubbing the principles together into a game plan. To kickstart your journey, first, zero in on companies known for their long history of dividend hikes. Think about industry giants which have consistently rewarded shareholders with increased dividends. Use trusted financial resources like Yahoo Finance or Morningstar to dive into these companies’ financials. Look for indicators such as steady revenue growth, strong free cash flow, and a reasonable payout ratio (ideally below 60%) to ensure they can sustain and grow their dividends.

Diversification is your friend here. Don’t put all your eggs in one basket by sticking to a single sector. Spread your investments across different industries like tech, healthcare, and consumer goods to cushion against sector-specific downturns. Setting up a Dividend Reinvestment Plan (DRIP) can also help. It automatically reinvests your dividends to buy more shares, helping your investment snowball over time. While this strategy works well with those who have a long-term perspective, regularly checking in to tweak your portfolio is also recommended. This approach not only grows your investments but also keeps your financial future secure and steady.

Dividend strategy indicators

Difference Between Dividend Yield and Dividend Growth

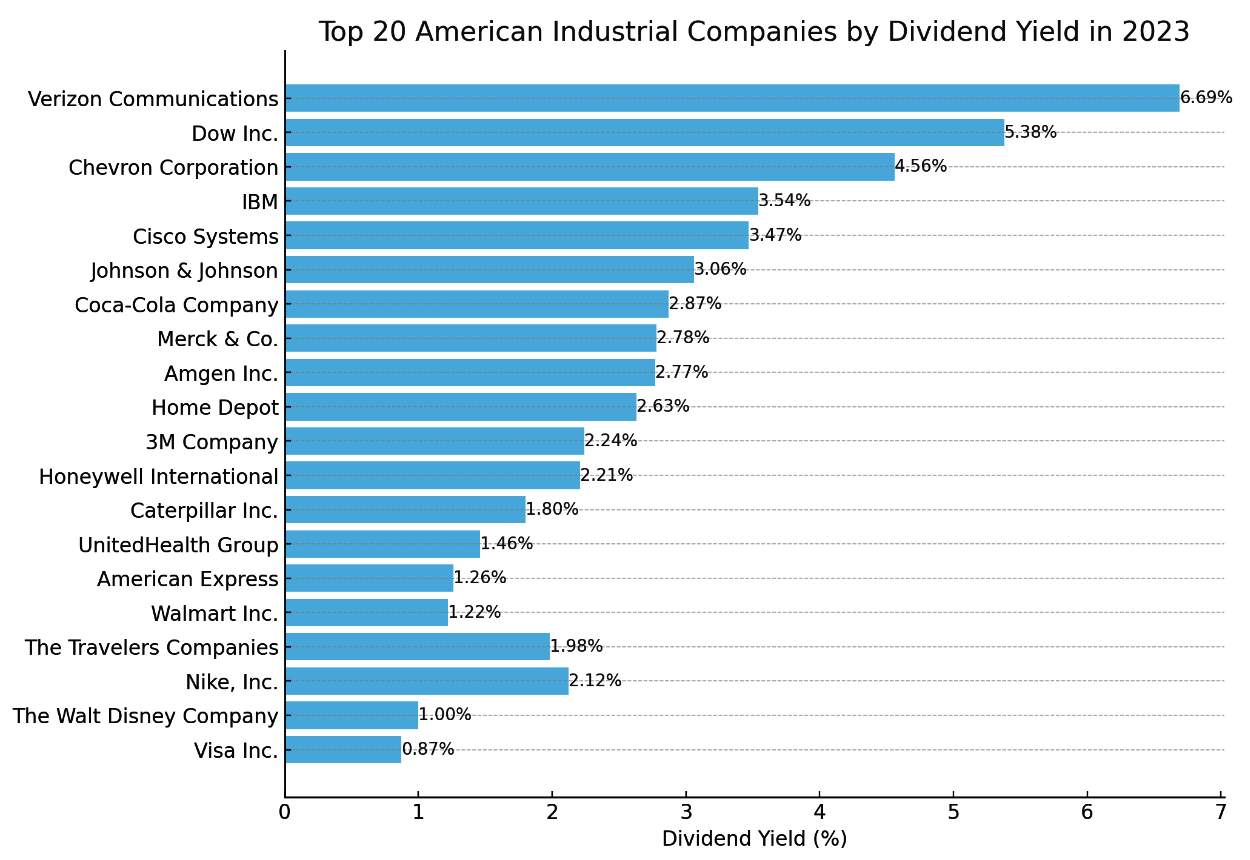

The dividend yield shows what percentage of the current stock price is paid out in dividends. While dividend growth shows how much dividend payments have increased over a certain period. A high yield may indicate the risk of dividend cuts in the future, while steady dividend growth most often indicates a company is stable.

Formula for calculating dividend growth rate

Here's an example to illustrate the calculation:

If a company's dividend was $1.00 per share last year and it is $1.10 per share this year, the calculation would be:

This formula helps investors determine the annual percentage increase in dividend payments, which is crucial for assessing the potential for income growth over time.This formula helps investors determine the annual percentage increase in dividend payments, which is crucial for assessing the potential for income growth over time.

Dividend reinvestment and dividend growth strategy

Reinvesting dividends is closely related to the dividend growth strategy and enhances its effectiveness. A dividend strategy is based on buying shares of companies that regularly increase their dividends. These companies, such as Procter & Gamble, Johnson & Johnson, and Coca-Cola, have shown consistent dividend growth for decades.

How dividend reinvestment strengthens a dividend growth strategy:

Capital raise. When an investor reinvests dividends received, he purchases additional shares. This increases the number of shares in the portfolio, which in turn increases future dividend payments. For example, if a company increases its dividend every year, reinvesting those payments allows you to take advantage of the compounding effect, which accelerates capital growth.

Increasing returns. Reinvesting dividends allows investors to increase their income on a long-term basis. For example, if an investor reinvested Procter & Gamble dividends from 1980, when the dividend was $0.10 per share, until 2023, when it reached $3.65 per share, then the investor's total return would increase significantly by purchasing additional shares as they would then be entitled to dividends on those shares as well.

Savings on fees. Many companies offer dividend reinvestment plans (DRIPs), which allow you to reinvest dividends without incurring fees. This makes the process more cost-effective and convenient for investors.

Stable earnings growth. Companies that consistently increase their dividends usually have stable financial performance and a strong market position. Reinvesting dividends in such companies allows investors to count on stable and growing income.

Companies that regularly increase their dividends

Procter & Gamble (P&G)

1980: Dividend per share - $0.10

2023: Dividend per share - $3.65

Procter & Gamble has increased its dividend for more than 67 consecutive years. This demonstrates its financial strength and ability to generate stable returns for shareholders (SmartAsset).

Johnson & Johnson

1980: Dividend per share - $0.08

2023: Dividend per share - $4.24

Johnson & Johnson has increased its dividend for more than 50 consecutive years. The company is known for its medical innovation and strong financial performance.

Coca-Cola

1980: Dividend per share - $0.07

2023: Dividend per share - $1.76

Coca-Cola has increased its dividend for over 50 years. Despite changes in consumer preferences and market conditions, the company continues to demonstrate consistent growth and profitability.

These examples illustrate how stable and resilient companies can provide investors with growing income over decades, making a dividend growth strategy an attractive long-term investment.

To put your dividend growth strategy into action, you need to choose a reliable broker.Moreover, it is advisable to have a broker that provides access to trading shares of companies that regularly and fully pay dividends. The key criteria when choosing a broker are low commissions, access to a wide range of markets, the convenience of the platform, the quality of analytical tools, as well as the reputation and reliability of the company. And, of course, access to trading dividend stocks.

| Stocks | Demo | Min. deposit, $ | Max. leverage | Investor protection | Open account | |

|---|---|---|---|---|---|---|

| Yes | Yes | 100 | 1:300 | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 1:500 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | 1:200 | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 1:50 | £85,000 | Study review | |

| Yes | Yes | No | 1:30 | $500,000 £85,000 | Open an account Your capital is at risk. |

Benefits and risks of a dividend growth strategy

Benefits of a dividend growth strategy

Wealth accumulation and passive income. Regular dividend increases promote wealth accumulation by providing investors with a stable and growing source of income.

Less volatility. Companies that consistently increase dividends tend to be less volatile than those that do not pay dividends.

Risks of the dividend growth strategy

Dividend cuts and share price declines. There is no guarantee that the company will not cut dividends in the future, which could negatively impact the share price.

Long-term nature of the strategy. Patience and a long-term approach are required to achieve significant results.

Dividend growth strategy is a quite useful

I find the dividend growth strategy quite useful, but with some key adjustments. First, there's the macroeconomic environment to consider—central banks, inflation rates, and economic growth all have a significant impact on companies' ability to increase dividends. By tracking economic events and forecasts, you can better understand when to expect dividend increases or decreases, and can make better investment decisions based on this. For example, during periods of low interest rates, companies can more easily service debt and increase distributions to shareholders.

Secondly, technological innovation plays a key role. Companies that actively invest in new technologies not only improve their products, but also increase their competitiveness, leading to sustainable earnings and dividend growth. Assessing a company's readiness for technological change and using it to its advantage is extremely important.

Finally, an assessment of the company's management and tax aspects are also critically important. Companies with experienced and transparent leadership manage finances more effectively and strategically plan for growth.

Conclusion

The dividend growth strategy is an effective long-term investment method aimed at generating stable and growing income. This strategy allows investors to take advantage of regular dividend increases and compound interest, resulting in accelerated capital growth. To successfully implement the strategy, it is important to carefully select companies with a strong financial position and a long-term history of increasing payments. Additional attention should be paid to the macroeconomic environment, technological innovation and management quality. By applying these principles, investors can create a reliable and profitable investment portfolio that provides financial stability and growth for many years.

FAQs

How does diversification help reduce risk when using a dividend growth strategy?

Diversification reduces risk by spreading investments across different sectors and regions, which reduces the impact of negative events in one area. Global dividend funds and ETFs make diversification easy by providing access to a wide range of high-quality dividend stocks around the world.

What company indicators are important to consider when choosing stocks for a dividend strategy?

It's important to consider the dividend payout ratio, free cash flow, earnings stability, and debt load. The optimal payout ratio should not exceed 60-70% so that there is enough money left for reinvestment and growth.

What tax considerations should be taken into account when reinvesting dividends?

Different countries tax dividends differently. Some jurisdictions offer lower rates for qualified dividends. Taking advantage of tax benefits through investment accounts such as an IRA or 401(k) in the US can reduce your tax burden.

What additional strategies can be used in conjunction with dividend growth to increase returns?

Along with dividend growth, you can use DRIP and option strategies. DRIP automatically reinvests dividends, accelerating capital growth. Selling covered options can provide additional income, although it carries risks.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.