Donald Trump's Crypto Portfolio: A Deep Dive Into His Holdings And Market Influence

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

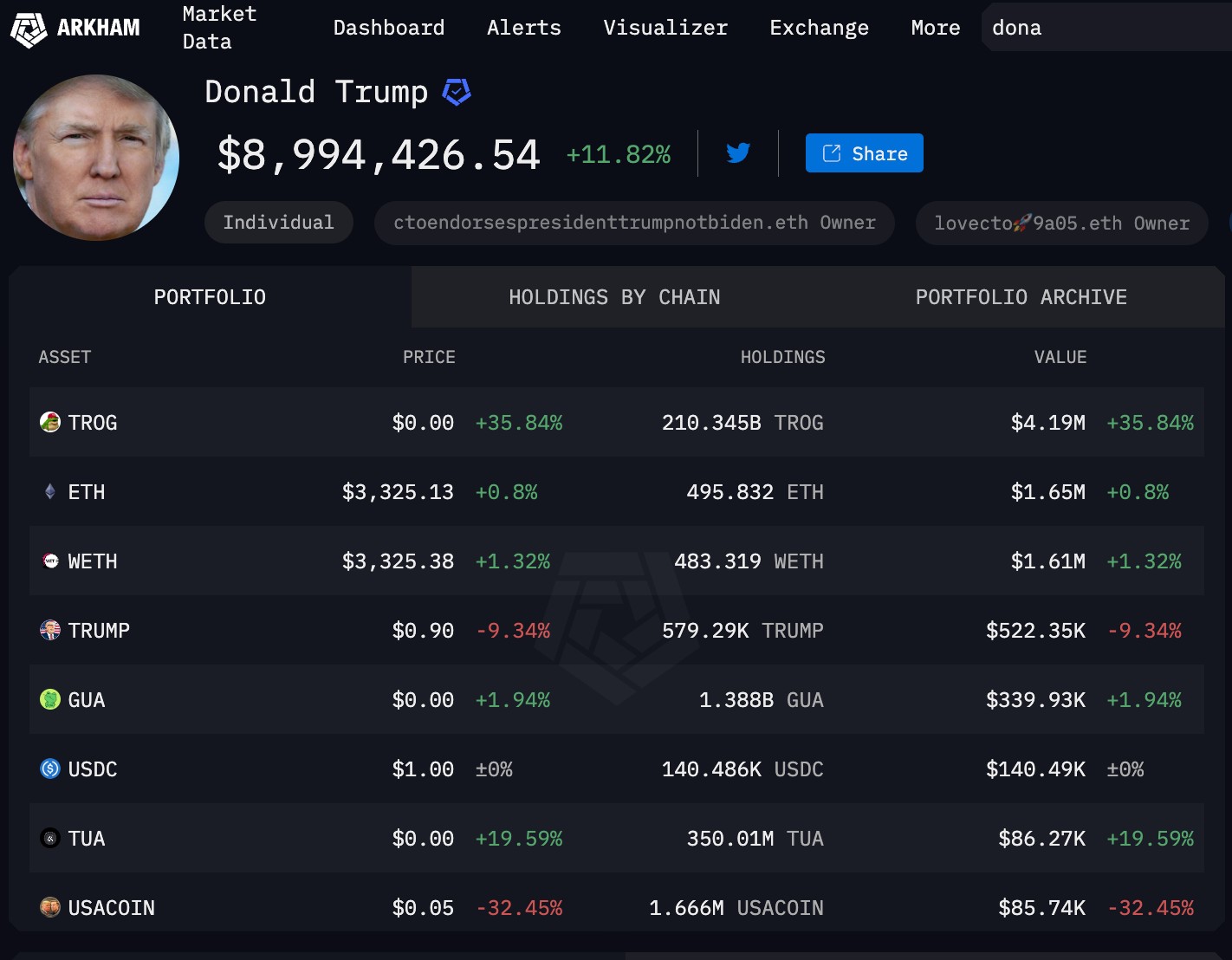

Donald Trump’s crypto portfolio includes Ethereum (ETH), Chainlink (LINK), Aave (AAVE), Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) through World Liberty Financial (WLF). His family also launched $TRUMP and $MELANIA coins, which reached billion-dollar valuations. Everything combined (including his stake in the $TRUMP coin), Trump’s crypto portfolio is worth at least $50 billion. His involvement with crypto has impacted Bitcoin’s price and fueled speculation, though regulatory scrutiny and market volatility pose risks.

Donald Trump, once a vocal critic of cryptocurrencies, has made a dramatic shift by becoming a significant player in the digital asset space. From launching his own meme coins to investing in blockchain projects, Trump crypto holdings have grown into a fascinating topic of discussion. His involvement has sparked debates over financial ethics, market manipulation, and the future of crypto regulations under his influence. In this article, we explore what cryptocurrency does Trump own, his strategic investments, and the broader impact of Trump’s crypto ventures.

Trump's crypto investments: An overview

Trump’s engagement with cryptocurrencies started with NFTs but has evolved into more direct investments. His transition from skepticism to active participation highlights the growing influence of digital assets in modern finance.

How Trump's crypto portfolio evolved over time:

Initially dismissed Bitcoin and other cryptocurrencies as "a scam."

Launched Donald Trump coins as NFTs, earning nearly $84 million from sales and royalties.

December 2024: Collectively, the Trump administration’s crypto holdings expanded as Trump-backed World Liberty Financial allocated $12 million into Ethereum (ETH), Chainlink (LINK), and Aave (AAVE).

January 2025: Launched $TRUMP and $MELANIA meme coins, making waves in the market.

Breakdown of Trump’s cryptocurrency holdings

Initially, Donald Trump was a vocal critic of cryptocurrencies, dismissing them as speculative assets lacking intrinsic value. However, his stance underwent a notable transformation, leading to direct involvement in the crypto sector through a mix of branded tokens, DeFi investments, and political crypto advocacy.

Trump’s known cryptocurrency investments extend beyond meme coins. Below is a breakdown of what we know so far.

The $TRUMP meme coin

Launched on the Solana blockchain with an initial supply of 1 billion tokens.

200 million tokens available to the public; the remaining 800 million held by Trump-affiliated entities.

Value peaked at $75.35 before stabilizing around $37.

Market capitalization exceeded $27 billion at its peak.

Controversy: Critics argue Trump’s control over a large portion of the supply raises concerns about price manipulation.

The $MELANIA coin

Launched by Melania Trump, separate from the $TRUMP token.

Initial price: $7, peaked at $13.73, later dropped to $4.30.

Designed as a tribute to Melania’s engagement with crypto and NFTs.

Performance has been volatile, with speculation surrounding its long-term value.

Ethereum (ETH)

Total holdings. Approximately 8,105 ETH, valued at over $30 million.

Accumulation strategy. Purchased in December 2024 as part of WLF's DeFi integration strategy.

Projected growth. Increasing institutional investments suggest a long-term hold.

Chainlink (LINK)

Total holdings. Approximately 78,387 LINK tokens, valued at over $2.26 million.

Accumulation strategy. Acquired in December 2024 to enhance WLF's DeFi services.

Projected growth. Integration with WLF's platform indicates strategic importance.

Aave (AAVE)

Total Holdings. Approximately 4,043 AAVE tokens, valued at approximately $1.5 million.

Accumulation strategy. Invested in December 2024 to leverage Aave's lending protocols.

Projected growth. Expected to play a crucial role in WLF's DeFi offerings.

Ethena (ENA)

Total holdings. Approximately 741,687 ENA tokens, acquired for $250,000.

Accumulation strategy. Purchased in December 2024 to diversify WLF's asset base.

Projected growth. Potential for significant appreciation as part of WLF's diversified portfolio.

Non-fungible tokens (NFTs)

Mugshot edition NFTs. Earned over 1,900 ETH, adding significant value to Trump's holdings.

Celebrity-driven sales. Trump's NFT drops have outperformed other political figures' ventures.

Potential expansion. Future releases may integrate virtual campaign funding mechanisms.

World Liberty Financial (WLF): Trump’s crypto venture

Trump’s entry into the DeFi sector came with the launch of World Liberty Financial (WLF), a platform facilitating lending, borrowing, and investing in crypto.

In a bold move amid the crypto market downturn in early February 2025, Trump’s World Liberty Financial has reportedly purchased 86,000 ETH at a discounted price, totaling approximately $220 million. This strategic accumulation follows the sharp decline in Ethereum’s price, allowing the firm to acquire assets at a lower valuation.

With this latest purchase, World Liberty Financial's total Ethereum holdings have now surged to $420 million, positioning the company as a significant player in the crypto market. The buy-up signals confidence in Ethereum’s long-term value despite current market volatility.

Potential conflicts of interest:

Trump’s political influence could affect crypto regulations while benefiting the Trump administration’s crypto holdings.

WLF’s business model allows Trump-affiliated groups to retain 75% of net revenues, raising ethical concerns.

SEC scrutiny: Will regulators step in to assess the legality of WLF’s operations?

Financial impact and market reactions

Trump’s active participation in the cryptocurrency market has led to notable financial outcomes and shifting market trends.

Portfolio valuation

Current estimated value. Surpassed $10 million (excluding $TRUMP holdings), fueled by memecoin surges and strategic holdings.

Growth factors. Political backing, institutional involvement, and speculative trading.

Market influence

Bitcoin surge. Peaked at $100,000+ due to anticipation of Trump’s pro-crypto policies.

Exchange response. Major platforms are reluctant to list $TRUMP and $MELANIA coins due to manipulation concerns.

Institutional interest. Hedge funds monitoring Trump-affiliated coins for potential trading opportunities.

Retail trading boom. Increasing adoption by retail investors speculating on Trump’s crypto influence.

Ethical considerations and regulatory scrutiny

Trump’s deepening involvement in the crypto sector has raised concerns regarding financial ethics and regulatory oversight.

Potential conflicts of interest

Policy vs. investment. Advocating for looser crypto regulations while holding significant assets in the space.

Regulatory concerns. Fear that Trump’s policies could benefit his own financial interests.

Opaque financial disclosures. Limited transparency on total crypto assets held by Trump-affiliated entities.

Regulatory developments

Crypto task force. The Trump administration launched a task force to shape the future of crypto regulation.

SEC oversight. Reviewing potential legal challenges regarding $TRUMP coin and market manipulation.

Congressional hearings. Lawmakers debating ethical boundaries of government figures investing in crypto.

Trump's cryptocurrency strategy

Despite criticisms, Trump’s crypto strategy appears well-calculated:

Long-term investment in DeFi and blockchain projects suggests a strategic financial move.

Public endorsement of crypto-friendly policies aligns with Trump’s crypto holdings.

Collaborations with influential investors hint at a broader plan for crypto integration into mainstream finance.

Future outlook: what’s next for Trump in crypto?

Trump's engagement with cryptocurrencies is expected to shape future market trends and influence federal policies.

Policy initiatives:

Executive orders. Plans to designate cryptocurrency as a national priority.

Crypto advisory council. Will bring industry leaders together to craft pro-crypto regulations.

Potential tax incentives. May introduce crypto-friendly tax policies to promote blockchain innovation.

Market dynamics:

Expansion of WLF. Expected to integrate more DeFi and cross-chain trading capabilities.

Introduction of a Trump stablecoin. Speculation around a USD-backed token to facilitate political fundraising.

Continued market influence. Analysts believe Trump’s role in crypto will continue to drive short-term price movements.

To be on a way see latest news On July 4, Brazilian financial institutions suffered significant disruptions due to a cyberattack targeting C&M Software, a service provider to the country’s central bank. The incident led to the theft of approximately $140 million, converted...Latest BTC News

Risks and warnings

Investing in Trump-affiliated cryptocurrencies and DeFi ventures carries significant risks. The high volatility of $TRUMP and $MELANIA coins makes them highly speculative assets, often subject to extreme price swings based on political events or public sentiment. Regulatory scrutiny also remains a major concern, as the SEC and other agencies continue to monitor potential manipulation and transparency issues surrounding Trump-related crypto ventures.

Additionally, liquidity risks are present in meme coins, where large holders—many of whom are Trump-affiliated entities—control significant portions of supply. There’s also the broader uncertainty of how political developments, legal challenges, or financial disclosure requirements could impact these assets. Investors should approach with caution, conduct thorough research, and consider diversification strategies to mitigate exposure to such unpredictable investments.

The $TRUMP and $MELANIA coins have high speculative value

While Trump’s involvement in the crypto space has undoubtedly created volatility, traders must separate hype from real opportunity. The $TRUMP and $MELANIA coins may be profitable in the short term, but they remain highly speculative assets driven more by sentiment than intrinsic value.

So if you’re trading Trump-related assets, treat them as short-term plays and secure profits early. For long-term positions, diversify into DeFi and blockchain projects with strong utility rather than pure speculation. The market is watching Trump, but smart traders look beyond the headlines to make informed decisions.

For those looking at World Liberty Financial’s holdings, the focus on Ethereum, Chainlink, and Aave suggests a long-term commitment to DeFi infrastructure. These assets have solid fundamentals and real-world applications, making them safer bets compared to politically influenced tokens.

Conclusion

Donald Trump's transition from a crypto skeptic to a leading figure in digital assets has had profound implications for the industry. His ventures, including branded meme coins, NFTs, and DeFi investments, have expanded his personal portfolio while influencing market trends and regulatory discussions. Moving forward, Trump’s crypto activities will remain a key factor in shaping the global crypto landscape, with potential policy shifts, ethical concerns, and continued speculation surrounding his influence.

FAQs

What cryptocurrencies are in the Trump crypto portfolio?

Trump's known holdings include $TRUMP, $MELANIA, Ethereum (ETH), Chainlink (LINK), and Aave (AAVE).

How much is Trump’s crypto portfolio worth?

Estimates vary, but many suggest a range of around $50-60 billion for Trump’s crypto portfolio.

Is the $TRUMP coin a good investment?

Its value has been volatile, making it a high-risk, speculative asset. So it should be treated as a short term play and not an investment.

What is World Liberty Financial?

World Liberty Financial is a Trump-backed DeFi platform focused on crypto lending and governance.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.