Why Do Traders Usually Fail?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

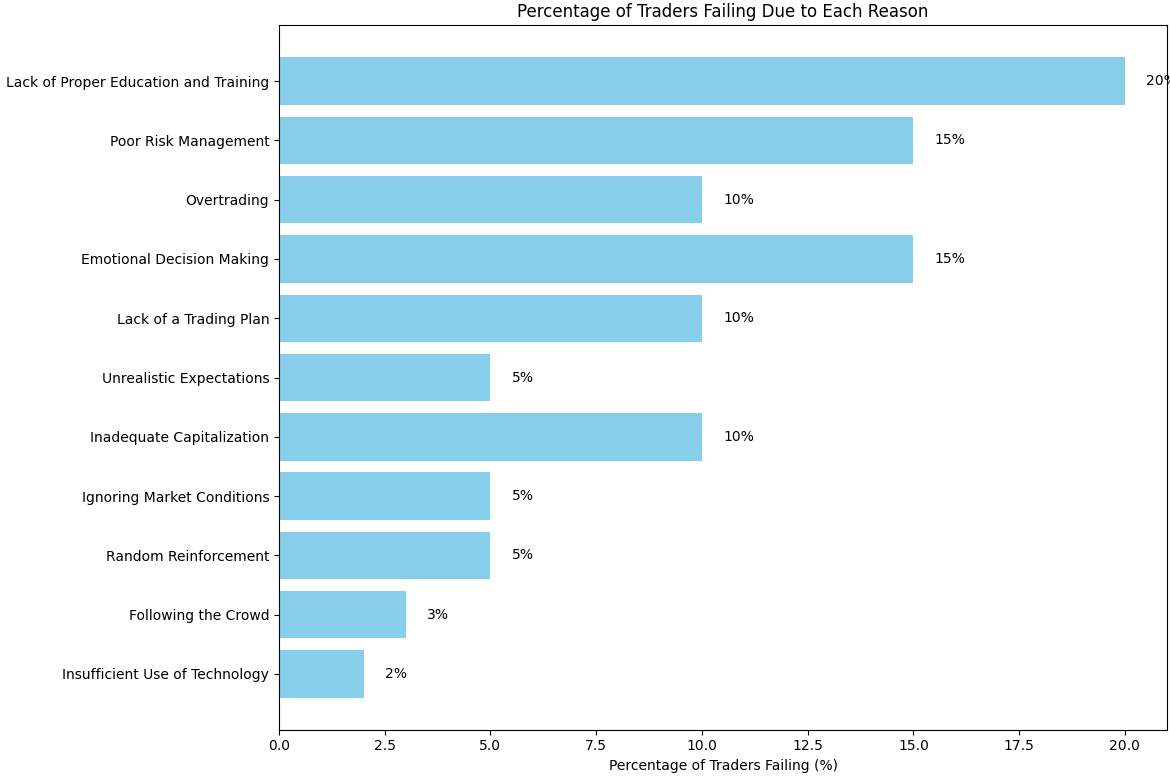

The main reasons why traders fail are:

Traders often fail due to various reasons. Learning from these mistakes can help traders improve their strategies and skills. In this article we discuss main reasons traders fail and some practical advice on how to avoid these mistakes.

Why do traders usually fail? The main reasons

Several factors contribute to the high failure rate among traders. These include lack of knowledge and experience, poor risk management, overtrading, emotional decision-making, lack of a trading plan, unrealistic expectations, inadequate capitalization, ignoring market conditions,spontaneous unreasonable deals, following the crowd, and insufficient use of technology. Understanding these reasons is the first step towards overcoming them.

Lack of proper education and training

Many traders jump into the markets without a solid understanding of how trading works. They often rely on tips from friends or social media rather than investing time in proper education. This lack of knowledge leads to poor decision-making and losses. For instance, only 10% of Forex traders are successful, highlighting the importance of proper education and preparation

How to avoid:

A trader should invest in his professional courses, study special literature and follow the analytics of experts to constantly improve his knowledge and skills.

Poor risk management

Risk management is crucial in trading. Traders who fail to manage their risk appropriately often experience significant losses. Common mistakes include not using stop-loss orders, risking too much on a single trade, and not diversifying their investments.

How to avoid: Risk management involves setting stop-loss orders, determining position sizes, and diversifying investments. Traders should never risk more than they can afford to lose and should always have a clear exit strategy. Statistics show that 72% of day traders end the year with financial losses due to inadequate risk management practices.

Overtrading

It is a common problem among traders, driven by the desire to make quick profits. This behavior leads to excessive transaction costs and poor decision-making, ultimately eroding their capital.

How to avoid: Overtrading can be mitigated by setting strict trading rules and adhering to a well-defined plan. Traders should focus on quality trades rather than quantity, avoiding the temptation to trade excessively.

Emotional decision making

Emotions such as fear, greed, and hope can cloud judgment and lead to impulsive trading decisions. Emotional trading often results in buying high and selling low, which is a recipe for failure.

How to avoid: Controlling emotions is critical in trading. Traders can use techniques such as mindfulness, setting predefined rules, and maintaining a trading journal to stay objective and disciplined.

Lack of a trading plan

Without a plan, traders often make random decisions based on market noise. A clear plan helps maintain discipline and make informed decisions.

How to avoid: Create a trading plan that includes entry and exit strategies, risk management rules, and criteria for evaluating performance.

Unrealistic expectations

Many traders enter the market with unrealistic expectations, believing they can double their money overnight. This mindset leads to high-risk trades and eventual losses.

How to avoid: Setting realistic goals is essential. Traders should aim for consistent, incremental gains rather than looking for quick riches.

Inadequate capitalization

Trading requires adequate capital to manage losses and maintain positions. Under-capitalized traders are more likely to take excessive risks and face margin calls, leading to failure.

How to avoid: Traders should ensure they have sufficient capital to withstand market volatility. This includes maintaining a buffer for unexpected losses and avoiding over-leverage.

Ignoring market conditions

Failing to consider market conditions and external factors can result in poor trading decisions. Traders need to stay informed about economic events, market trends, and geopolitical developments.

How to avoid: Staying informed about market conditions and external factors is crucial. Traders should follow economic news, monitor market trends, and be aware of geopolitical events that could impact the markets.

Random Profit

Random positive outcomes from bad strategies can reinforce poor trading habits. Traders need to understand that consistency is key, and relying on luck is not a sustainable strategy.

How to avoid: Traders should focus on developing a consistent strategy rather than relying on luck. Analyzing each trade and understanding the reasons behind its success or failure helps in refining trading strategies.

Following the crowd

Herd mentality can lead traders to make decisions based on popular opinion rather than sound analysis. This often results in buying at market tops and selling at bottoms.

How to avoid: Making independent trading decisions based on thorough analysis rather than following the crowd is key. Traders should develop their own strategies and not be swayed by popular opinion.

Insufficient use of technology

Modern trading relies heavily on technology. Traders who do not leverage trading platforms, analytical tools, and automated systems are at a disadvantage.

How to avoid: Using trading platforms, analytical tools, and automated systems can enhance trading efficiency and accuracy. Traders should stay updated with the latest technological advancements and incorporate them into their strategies.

Step-by-step guide to avoiding trading failures

Here is a step-by-step guide to help traders avoid the most common trading failures:

Educate yourself continuously

Start by building a solid foundation of trading knowledge. Read books, take courses, and stay updated with market news and trends. Continuous education helps you stay informed about new strategies and market conditions. Enroll in online trading courses, read financial news daily, and participate in trading forums.

Develop a robust trading plan

A comprehensive trading plan outlines your trading strategy, risk management rules, and goals. It serves as a roadmap and helps maintain discipline. Write down your trading plan, including entry and exit strategies, risk tolerance, and performance metrics. Regularly review and update it as needed.

Use a trading journal

Keeping a trading journal helps you track your trades, analyze your performance, and learn from your mistakes. It provides insights into your trading habits and areas for improvement. Record every trade you make, noting the reasons for entering and exiting, the outcome, and what you learned. Review your journal weekly or monthly to identify patterns.

Implement effective risk management

Managing risk is crucial to long-term success. Use stop-loss orders, limit the size of your trades, and diversify your portfolio to protect your capital. Set stop-loss orders for every trade, avoid risking more than 1-2% of your capital on a single trade, and diversify your investments across different assets.

Maintain emotional discipline

Emotional decision-making can lead to significant losses. Develop techniques to manage your emotions and stick to your trading plan. Practice mindfulness or meditation to stay calm. Set predefined rules for entering and exiting trades to reduce impulsive decisions.

Practice with demo accounts

Before risking real money, practice with demo accounts to refine your strategies and gain confidence. Use a demo account to test new strategies and simulate trading conditions without financial risk.

Here is a list of brokers that offer demo accounts, providing an excellent opportunity for traders to practice and refine their strategies without any financial risk:

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Open account | |

|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | 0,9 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | 1,5 | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | 0,5 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | 1,2 | Study review | |

| Yes | No | 1:30 | 0,2 | 0,8 | Open an account Your capital is at risk. |

Key tips how to avoid losses

As a seasoned trader with many years of experience, I've learned that avoiding losses hinges on a few fundamental principles. Education is paramount—continuously learning through books, courses, and staying updated with market news is essential. Developing a solid trading plan and adhering to it, even when the market is volatile, prevents impulsive decisions that can lead to losses. Effective risk management is critical; using stop-loss orders and limiting the risk to 1-2% of your capital per trade can protect your portfolio from significant damage.

Emotional discipline is another key aspect. It's crucial to remain calm and rational, accepting that losses are part of the game without letting them affect your confidence. Staying informed about market conditions, economic news, and geopolitical events helps in making well-informed decisions. Networking with other traders and seeking mentorship can provide valuable insights and keep you grounded. Lastly, regularly reviewing and adjusting your strategies ensures you stay ahead of market changes and avoid repeated mistakes. These practices have helped me minimize losses and achieve long-term success in trading.

Conclusion

Avoiding losses in trading is a multifaceted approach that involves continuous education, disciplined planning, effective risk management, emotional control, staying informed, networking, and regular strategy reviews. By incorporating these practices into your trading routine, you can significantly reduce your risk and enhance your chances of long-term success.

FAQs

Can I succeed in trading without any formal education?

While it's possible, having formal education or structured learning significantly improves your chances of success. It provides you with essential knowledge and strategies that are crucial for making informed decisions.

What are the best tools for tracking market news?

Reliable sources include Bloomberg, Reuters, and CNBC. Additionally, using financial news apps and subscribing to market analysis reports can keep you updated with relevant information.

Should I trade multiple assets or focus on one?

It depends on your expertise and risk tolerance. Diversifying across multiple assets can spread risk, but focusing on one asset allows you to develop deeper knowledge and expertise in that area.

How often should I review and adjust my trading strategy?

Regular reviews are essential. Aim to review your strategy weekly or monthly, adjusting based on performance, market conditions, and any new insights or data.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.