Best Crypto Copy Trading Software In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best crypto copy trading platform in 2025 is OKX. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- User-friendly Interface

- Advanced functionalities

Best crypto copy trading platforms in 2025 are:

- OKX - Best automated trading solutions (copy trading, easy bot integration)

- Kraken - Best for trading crypto-fiat pairs (supports 7 fiat currencies, simple trading platform)

- Crypto.com - Best mobile app for crypto activities (Visa card support, trading and passive earning)

- CoinMetro - Suited for conservative trading (simple UI and low leverage of up to 1:5)

- Ledger Wallet - Best for managing assets in a hardware wallet (15 apps to buy, swap, earn crypto and NFTs)

- Coinbase - Highest level of security (multiple regulations, high data protection standards)

Crypto trading has gained lots of popularity in the last few years, and so has copy trade crypto software and crypto trading bots. These software programs provide a great opportunity for beginning crypto traders to earn money without having extensive knowledge and experience.

The Traders Union experts have created a rating of the best crypto copy trading software in 2025 based on their reliability and copy trading capabilities to help novice crypto traders choose the best social trading cryptocurrency software.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Best crypto copy trading software to use

Copy trading has gained immense popularity in the crypto market, allowing investors to replicate the trades of experienced traders automatically. The right platform can help beginners navigate the complexities of crypto trading while providing seasoned investors with additional income streams. Choosing the best crypto copy trading software depends on factors such as supported exchanges, fees, leverage options, and available cryptocurrencies.

The table below compares leading crypto exchanges that offer copy trading services, helping users make an informed decision based on key features, costs, and overall usability.

| Copy trading | Coins Supported | Demo | Min. Deposit, $ | Spot leverage | Spot Maker Fee, % | Spot Taker fee, % | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 329 | Yes | 10 | 1:10 | 0,08 | 0,1 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 278 | No | 10 | 1:5 | 0,25 | 0,4 | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 72 | Yes | 1 | 1:5 | 0,1 | 0,2 | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 1000 | No | No | No | 0 | 0 | 6.57 | Open an account Your capital is at risk. |

|

| Yes | 474 | Yes | 10 | 1:1 | 0,08 | 0,1 | 5.65 | Open an account Your capital is at risk.

|

Top company reviews

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

What is crypto copy trading?

Crypto copy trading lets one trader follow and replicate the moves of a more experienced trader in real time. By using specific tools, the trades of a skilled trader are automatically copied into the accounts of those who choose to follow them. This method is convenient for beginners, as it removes the guesswork and allows them to adopt proven strategies without actively managing every trade.

The process involves platforms that connect users' accounts to a shared network, making it easy to allocate funds to follow the trades of their chosen expert. In the fast-paced crypto market, this approach saves time and gives less-experienced traders a chance to learn and grow by leveraging the knowledge of experts.

Main types of crypto copy trading software

There are three main types of crypto software:

Crypto exchanges software

This type of crypto copy trading software is offered by specialized crypto exchanges, which support multiple cryptocurrencies and crypto pairs. This allows beginner traders to profit from price increases of different cryptocurrencies while copying the trades executed by more experienced traders.

Copy trading bots

This type of software is usually created by third-party companies and can be integrated with certain crypto exchanges. This software is used to create trading bots that automatically execute trades based on specific instructions programmed into the bot.

The software also has a copy trading feature that enables traders to copy the trades initiated by the trading bot. The software can be free or paid.

Crypto broker’s software

This type of crypto trading software is offered by online brokers that support cryptocurrencies, and it has similar benefits to crypto exchange software.

How to choose a crypto copy trading software

Before you choose a copy trading software, you should pay attention to different criteria to make sure you choose the best one. Here are the most important aspects you should consider when choosing a crypto copy trading software:

The size of the trader’s network

When choosing a copy trading software, the size of the trader's network should be a key factor to consider. A big traders network usually indicates a wide choice of great traders that you can copy and is a good indicator of great software.

Costs

You should also pay attention to the costs charged by crypto copy trading software providers for using their services. It shows you how profitable it is to copy other traders using that software.

While crypto copy trading is free with certain software, some software or trader providers charge you a part of the profits made through copy trading. This is not always a bad thing, because it motivates the traders being copied to trade more profitably - but you should be alert for exaggerated costs.

Reliability

You should only use reliable crypto copy trading software if you want to have a good experience and make sure that your funds are safe while using the software.

The best way to check a software’s reliability is to read reviews from previous users. If software has too many negative reviews, it is probably because there is something wrong with it.

The crypto exchanges supported

When choosing a third-party crypto copy trading software, you should check to see if it can be integrated with the crypto exchange you are currently using or that you want to use. Usually, crypto copy trading software is only compatible with the biggest crypto exchanges.

Pros and cons of crypto copy trading

- Pros

- Cons

Access to expertise. Learn from seasoned traders and benefit from their strategies and risk management.

Reduced emotional bias. Automated trading minimizes emotional decisions like fear or greed.

Learning opportunity. Gain market insights by observing experts, and building confidence for independent trading.

Diversification. Reduce risk by copying multiple traders with different strategies.

Dependency on traders. Over-reliance can hinder your growth and leave you vulnerable during their downturns.

Limited control. You’re tied to the strategies and pace of the traders you copy.

Risk of overreliance. Prevents critical thinking and independent decision-making.

Potential for loss. Even top traders can make mistakes in volatile markets.

Lack of personal growth. Relies on others instead of building your own trading expertise.

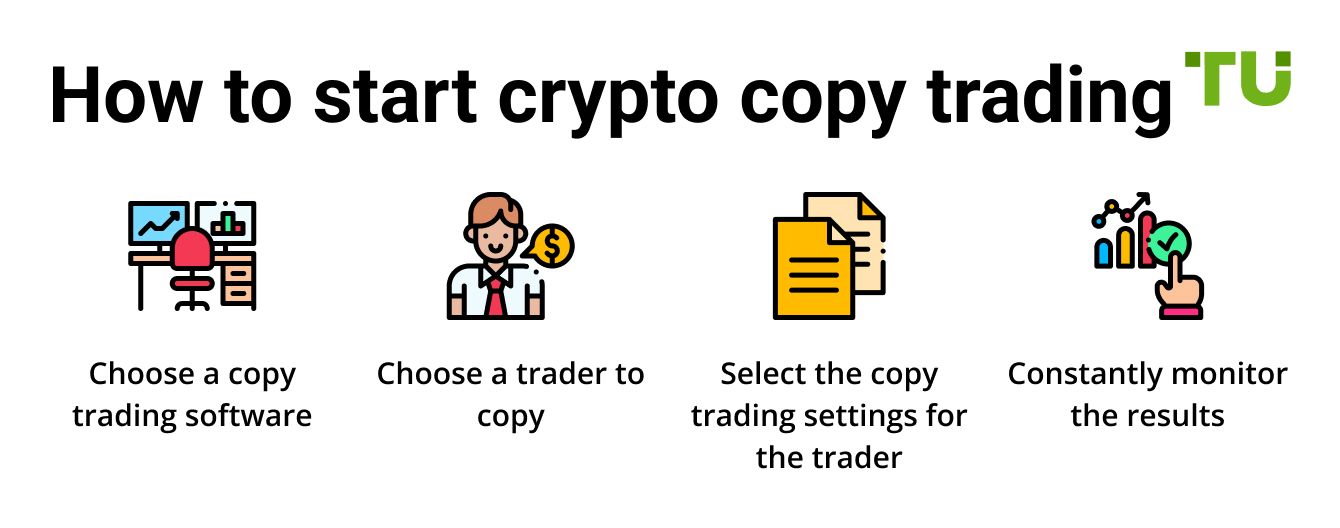

To start copying trade, follow these simple steps:

Choose a copy trading software

Choosing a copy trading software is the first step you have to take to be able to copy other traders. Depending on the type of software you choose, you will create a trading account with that crypto exchange or with an online broker or a crypto exchange that is compatible with third-party software.

Choose a trader to copy

Selecting the right traders to copy is crucial for making copy trading profitable. Most platforms allow you to choose traders based on criteria like profitability, number of followers, followers’ equity, trading experience on the platform, and more. While past performance doesn’t guarantee future success, it’s the most reliable metric for making informed decisions.

Select the copy trading settings for the trader

Depending on the copy trading software you have chosen, you can select different copy trading settings, such as the minimum/maximum amount of money to risk per trade, how much money you allocate for copying that trader, and, in some cases, when to stop copying that trader.

If you are a beginner, you should not select a maximum amount of your trading capital to risk per trade that is any more than one or two per cent of your total balance.

Constantly monitor the results

It is important to monitor the profits you have while copying other traders because that helps you determine if you should change the copy trading settings or stop copying their trades if they have made multiple losing trades and you’ve lost a lot of money.

Is crypto copy trading profitable?

Crypto copy trading can be profitable, but there are no guarantees of consistent returns. Success depends on selecting the right traders to copy, optimizing settings, and managing risk effectively. Like any investment, it involves both potential gains and risks.

To improve profitability, choose a reliable platform regulated by top authorities and used by a large number of traders. This ensures better flexibility, transparency, and trustworthiness. Be mindful of fees, as high commissions can significantly reduce profits. Effective risk management is essential — use settings like stop-loss limits to protect your investment if a trader's strategy underperforms. While past performance can guide your choices, market conditions can change, so cautious, informed decision-making is key.

Pick crypto copy trading software with clear fees and transparent trade histories

Choosing the best crypto copy trading software in 2025 isn’t just about picking platforms with good traders — you need to know how profit-sharing and extra charges affect your money. Some platforms take both types of fees, cutting into your profits fast. Look at what you’ll really earn after fees, and consider platforms with fixed monthly costs if you trade frequently.

Also, make sure trades are fully transparent. See past wins, trade times, and worst losses — not just flashy win rates. This helps you find traders whose strategies fit the amount of risk you’re comfortable with. Pick platforms that let you track your account live and get updates fast, so you can exit risky trades when needed.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

-

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Conclusion

As the cryptocurrency market continues to evolve, selecting the right crypto copy trading software becomes essential for maximizing returns and mitigating risks. Each platform offers unique features, from low trading fees to extensive coin support and leverage options. Traders should carefully evaluate security measures, ease of use, and community engagement when making their decision.

For beginners, a platform with a user-friendly interface and demo trading can provide a solid starting point, while experienced traders may benefit from advanced analytics and automation tools. Ultimately, the best copy trading software will depend on individual needs, trading goals, and market conditions in 2025. By staying informed and making well-researched choices, investors can take advantage of the opportunities that crypto copy trading offers.

FAQs

Can I copy trade from different traders at the same time?

Yes, most crypto copy trading platforms allow you to copy multiple traders simultaneously so you can diversify your portfolio.

How do I know which trader to copy?

Look at metrics like past performance, profit percentage, account size, and length of trading history to evaluate traders. Also, read social reviews from other copiers.

What fees do copy trading platforms typically charge?

Most charge 0-20% of your percentage profits made from copied trades. Some also charge monthly subscription fees.

Can copy trading be done with a low budget?

Yes, most platforms have minimum deposit requirements ranging between $0-$100, making it suitable for smaller traders too.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.