How To Launch Your Own Meme Coin On Solana

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to launch a meme coin on Solana:

Creating your own meme coin on Solana might sound tough, but it’s surprisingly simple. With Solana’s speed and super low costs, it’s the go-to place for anyone who wants to turn a fun idea into a real project. This guide is for anyone — techie or not — who wants to see their meme coin become a reality. Whether it’s just for laughs, a group project, or a small community, we’ll show you everything from making the coin to getting it traded on Solana’s platforms. By the end, you’ll have your very own meme coin and a solid grip on how to keep it going strong.

How to launch your own meme coin on Solana

Step 1: Setting up a Solana wallet

One of the most popular and convenient wallets for working with Solana is Phantom. This wallet is available as a browser extension and a mobile app for iOS and Android, which makes it universal and accessible to users with different devices.

How to create a Phantom wallet:

Installing a wallet. For browsers: go to the Phantom website, select your browser (Chrome, Firefox, Brave, or Edge), and add the extension. For mobile devices: on the same page, select the app store for your device (App Store for iOS or Google Play for Android) and download the app.

Creating a new wallet. Once installed, open the Phantom extension or app and select the "Create a new wallet" option. Phantom will generate a 12-word seed phrase. This step is extremely important: write the phrase down on paper and keep it in a safe place. Never take screenshots or store it online, as access to this phrase means access to your funds.

Set up a password. Next, you will be asked to create a password to lock and unlock your wallet. Make sure it is a strong password. This is an extra layer of security that helps prevent unauthorized access to your wallet.

Complete setup. Click “Continue” and complete the installation, after which your wallet will be ready to use. You can also pin the Phantom extension to your browser bar for quick access.

Private key security

One of the most important aspects of working with cryptocurrency wallets is security. The secret recovery phrase is the only way to regain access to your wallet in case of loss or reinstallation of the application. Never share this phrase with others or store it online, as any third party with access to your secret phrase can steal all your funds.

Depositing funds

To start using Phantom, you will need to deposit SOL cryptocurrency, which is used to pay for transactions on the Solana blockchain, into your wallet. You can buy SOL through exchanges or directly through your wallet using third-party services.

Step 2: Defining tokenomics

Properly designing tokenomics helps ensure the long-term success and attractiveness of the coin to investors and the community.

Key parameters of tokenomics:

Total supply. Determine the total number of tokens that will be issued at the outset. For example, many meme coins set the supply in the billions or even trillions of tokens to create the impression of high availability. Successful examples such as BONK or SAMO used large volumes to build large communities and popularity for the coin.

Token distribution. Transparent distribution is the key to trust. Popular meme coins often use fair launch models, where all tokens are released into circulation at once, eliminating advantages for insiders or early investors. It is also important to consider distribution mechanisms such as airdrops or liquidity incentives through mining.

Burn and distribution mechanisms. These systems help create a deflationary economy that reduces the total supply of tokens and increases their scarcity. This approach is widely used to increase the value of the remaining tokens in circulation.

Step 3: Using launchpad on Solana

The entire process of launching a meme coin on the Solana platform can be simplified by using specialized platforms such as Moonshot and Pump.fun. These platforms allow users without deep programming knowledge to create and issue their meme coin with minimal time and resources.

Using the Moonshot platform

The Moonshot platform by DEX Screener allows users to create tokens with a fixed issuance of 1 billion. The launch process is simple: after the project raises 500 SOL (about $64,000), a liquidity pool is automatically created on the Raydium decentralized exchange. All smart contracts on Moonshot are carefully audited to avoid risks associated with insider trading.

Creating a token. You enter the basic token details (name, symbol) and launch it with a fixed volume of 1 billion tokens.

Reaching the liquidity threshold. Once users invest 500 SOL, a liquidity pool is automatically created on Raydium and a portion of the tokens (150-200 million) is burned to create a deflationary mechanism, which can positively affect the token price.

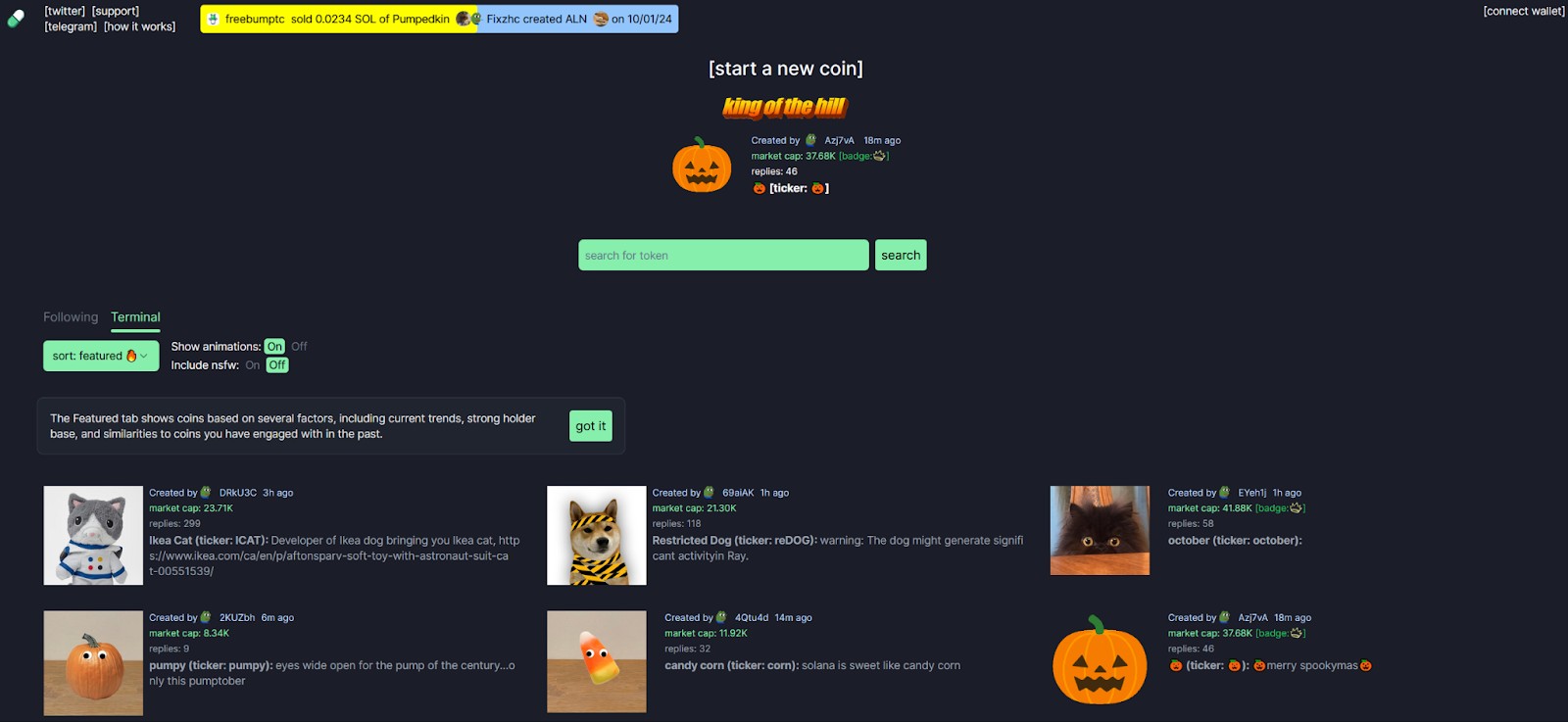

Using Pump.fun

Pump.fun is another popular platform for launching meme coins on Solana. It offers fast automation of the token creation process. The platform focuses on fair token distribution and eliminates the possibility of pre-sales for insiders, which makes it attractive to retail investors. When the token market value reaches $69,000, $12,000 is automatically added to the liquidity pool on Raydium and a portion of the tokens is burned.

Step 4: Smart contract audit

Smart contracts can be vulnerable to various types of attacks, including code errors, overflows, and the ability to manipulate external programs. Conducting an audit helps identify these weaknesses and prevent potential hacking attacks that can lead to loss of funds and undermine user trust.

Platforms like DEX Screener use fully audited smart contracts for their launches, which adds an extra layer of protection for users. Audits reveal critical vulnerabilities, such as improper input validation or calculation errors, that can be exploited by attackers.

In addition, companies like Vibranium Audits and ShellBoxes provide professional smart contract auditing services on Solana, offering detailed reports on the issues found and recommendations on how to fix them. It is important not only to conduct an audit before launching a project, but also to repeat it regularly with each code update to maintain a high level of security.

Step 5: Community building

A successful meme coin launch is not possible without an active and engaged community. This is what helps the meme coin grow and become popular among investors. Community building strategies include the use of social media, engaging influencers, and viral content.

Community building strategies. To build a strong community around a meme coin, it is important to create engaging content based on humor and memes. Examples include meme contests or video clips that keep participants interested and increase engagement.

Use of social media. Social media platforms like Twitter, Reddit, and Telegram play a key role in promoting meme coins.

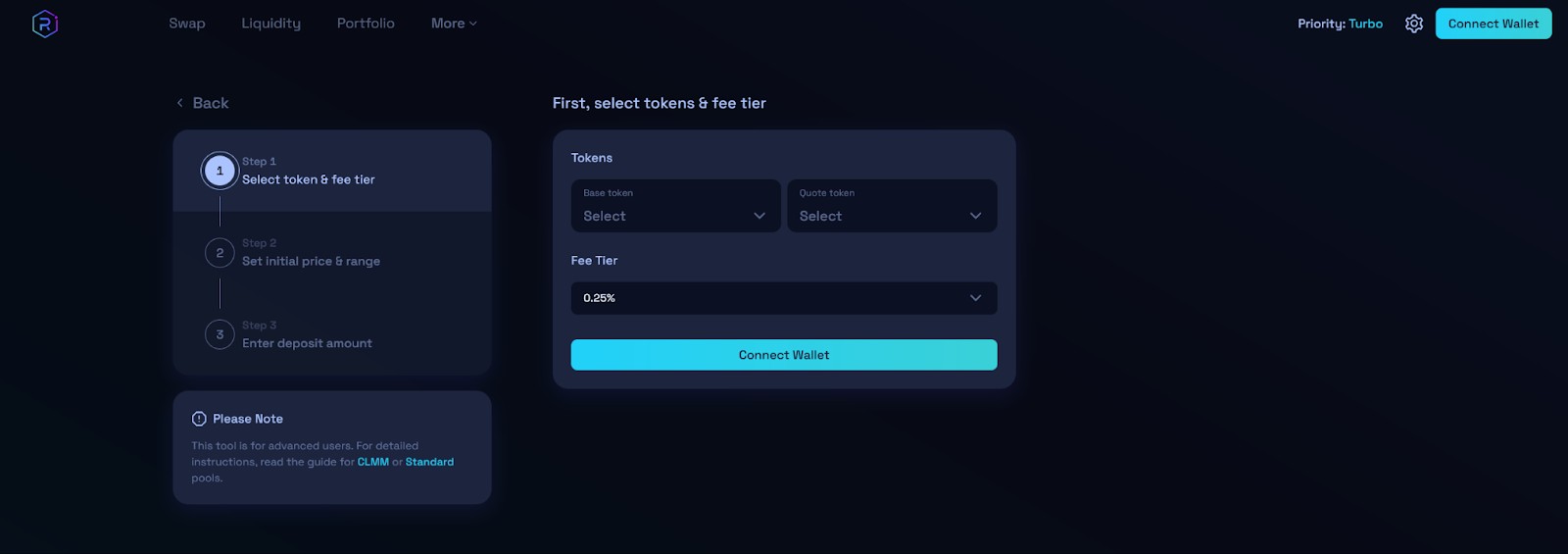

Step 6: Listing on decentralized exchanges

Creating a liquidity pool and listing on an exchange makes your token tradable, attractive to investors, and maintains price stability. Take Raydium, for example. It operates as an automated market maker (AMM) on the Solana blockchain, allowing you to quickly and cost-effectively list and trade tokens. Below, you will learn how to list your meme coin on Raydium and create a liquidity pool.

How to List a memecoin on Raydium

Creating a liquidity pool. Go to the Raydium Pool Creation page. To do this, you will need your token address on Solana and a partner token (usually SOL or USDC). Enter the details and set the initial price of your token. This price will determine the initial price of the token on the market.

Add liquidity. After creating a pool, you need to add liquidity in equal shares of the value of the two tokens (your token and the partner token). For example, if you add 100 SOL tokens, you should add the equivalent amount of your token in USD. This will help avoid large price fluctuations when trading.

Confirm the transaction. After setting up the pool, you will confirm the transaction in your wallet (e.g. Phantom ) and your pool will be activated. You will then receive LP tokens - these represent the share of your liquidity in the pool, and can be used to manage the pool or reimburse funds.

For long-term appeal, you can also set up reward farms, where users will receive additional tokens for providing liquidity, which incentivizes them to participate and maintain the pool.

Apart from Raydium, we have researched some other options as well for you to make a choice. Here are some other exchanges where you can launch your token:

| DEX | CEX | Min. Deposit, $ | Coins Supported | NFT | iOS | Android | Open account | |

|---|---|---|---|---|---|---|---|---|

| No | Yes | 10 | 329 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| No | Yes | 10 | 278 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| No | Yes | 1 | 250 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| No | Yes | 1 | 72 | No | Yes | Yes | Open an account Your capital is at risk. |

|

| No | No | No | 1817 | No | Yes | Yes | Open an account Your capital is at risk. |

Step 7: Marketing and coin development

Effective meme coin marketing involves using viral strategies and strong audience engagement through meme culture. Meme coins like Dogecoin or Shiba Inu have proven that success is often based on user appeal rather than technological value.

Meme Coin promotion strategies

One of the key promotion methods is the use of memes and humor. It is important to create a unique brand with bright and memorable content that can be easily shared across social media. Platforms like Twitter, TikTok, and Reddit play a central role in the spread of meme coins, and the right content can quickly go viral.

Regular contests and airdrops can motivate users to engage with the project and share information about it on their social networks. These activities not only increase brand awareness, but also strengthen community loyalty.

Before launching a memecoin, develop a clear strategy

Launching a meme coin on the Solana platform is a promising but competitive task. My advice is to make sure you have a clear strategy for promotion and audience retention before you start. Even if you have an innovative idea, it will not succeed without an active community. Take advantage of platforms like Telegram and Discord to build discussions and interact with users. Regular AMA (Ask Me Anything) sessions or participation in cryptocurrency discussions can increase the level of trust and loyalty to your project.

Also, pay attention to regulatory aspects. Meme coins can face legal challenges, especially if they are perceived as speculative instruments. It is important to understand the current rules and laws in the cryptocurrency space, especially if you plan to attract investors from different countries. Bringing the project into compliance with local regulations, such as KYC and AML compliance, can build investor confidence and prevent legal issues in the future.

Finally, do not forget about innovative elements in your project. A simple meme coin can quickly lose its relevance if there is nothing new to offer. Consider adding useful functionality or integration with other projects, whether in the field of decentralized finance (DeFi) or NFT.

Conclusion

Launching your own meme coin on the Solana platform is a multi-step process that requires careful preparation and a competent approach. Proper wallet setup, thoughtful tokenomics, and the use of launchpad platforms will help create a stable foundation for the project. It is also good to ensure security through smart contract auditing and actively work with the community to maintain interest in the project. Listing on decentralized exchanges and effective marketing strategies will attract attention and increase the liquidity of the token. The success of a meme coin depends on a combination of technical literacy and a creative approach to promotion.

FAQs

What are the potential risks of launching a meme coin on the Solana blockchain?

Launching a meme coin on Solana, like any other platform, comes with risks such as market volatility, possible smart contract bugs, and low liquidity at the initial stage. It is equally important to consider regulatory risks and the possibility of attracting attention from regulators, especially if the project is aimed at an international audience.

How to calculate the initial liquidity for a pool?

To successfully create a liquidity pool, it is important to determine the initial token supply based on the expected demand and the number of users willing to support the project. We recommend maintaining a balanced token ratio to avoid strong price fluctuations at the start. Initial liquidity can be increased through incentive programs for participants who add funds to the pool.

How to increase the liquidity of a meme coin at the start?

To increase liquidity, you can offer users reward programs for participating in liquidity pools. Another effective way is to attract strategic partners or early investors who are willing to invest in the pool at the initial stage. This will increase trust in the project and ensure sustainable growth from the very beginning.

What are some additional ways to stimulate interest in the meme coin at the start?

In addition to viral marketing, you can organize airdrops to distribute some of the tokens to early users or active community members. It is also important to participate in discussions on thematic forums and crypto communities to get feedback and increase recognition. Non-trivial collaborations with other crypto projects will also help attract attention to your token.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.