What Is Drawdown In Trading? A Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Drawdown in trading refers to the decline in an investment’s value from its peak to its lowest point over a specific period. It measures the loss experienced before the portfolio recovers and is a key metric for evaluating risk and performance.

If you want to trade successfully, managing risk is non-negotiable. One key part of risk management is understanding drawdown — how much your portfolio dips before recovering. Whether you're trading stocks, Forex, or other assets, keeping drawdowns under control can help you limit losses and keep your portfolio steady over time.

Let’s break down the essentials of drawdown — what it is, how to calculate it, and how to manage it like a pro with practical strategies to keep risks in check.

What is the drawdown in trading?

Drawdown in trading is the percentage or dollar amount decrease from the peak value of a trading account or investment portfolio to its lowest point during a specified period. It helps traders understand the extent of losses before recovery.

In trading, drawdown is a crucial measure of risk — it shows how much an account dips before bouncing back. For example, if your balance grows to $10,000 but then drops to $7,000, your drawdown is $3,000 or 30%. Knowing your drawdown helps you figure out if your strategy matches your comfort level with risk.

Markets are unpredictable, so every trader faces drawdowns at some point. A small drop might just be a market correction, while a major drawdown could signal issues with your strategy or too much risk. Keeping an eye on drawdowns helps traders see if their strategy can withstand market swings and adjust accordingly.

Traders also look at volatility and maximum drawdown alongside regular drawdowns to get a clearer view of their strategy’s risk.

Types of drawdown

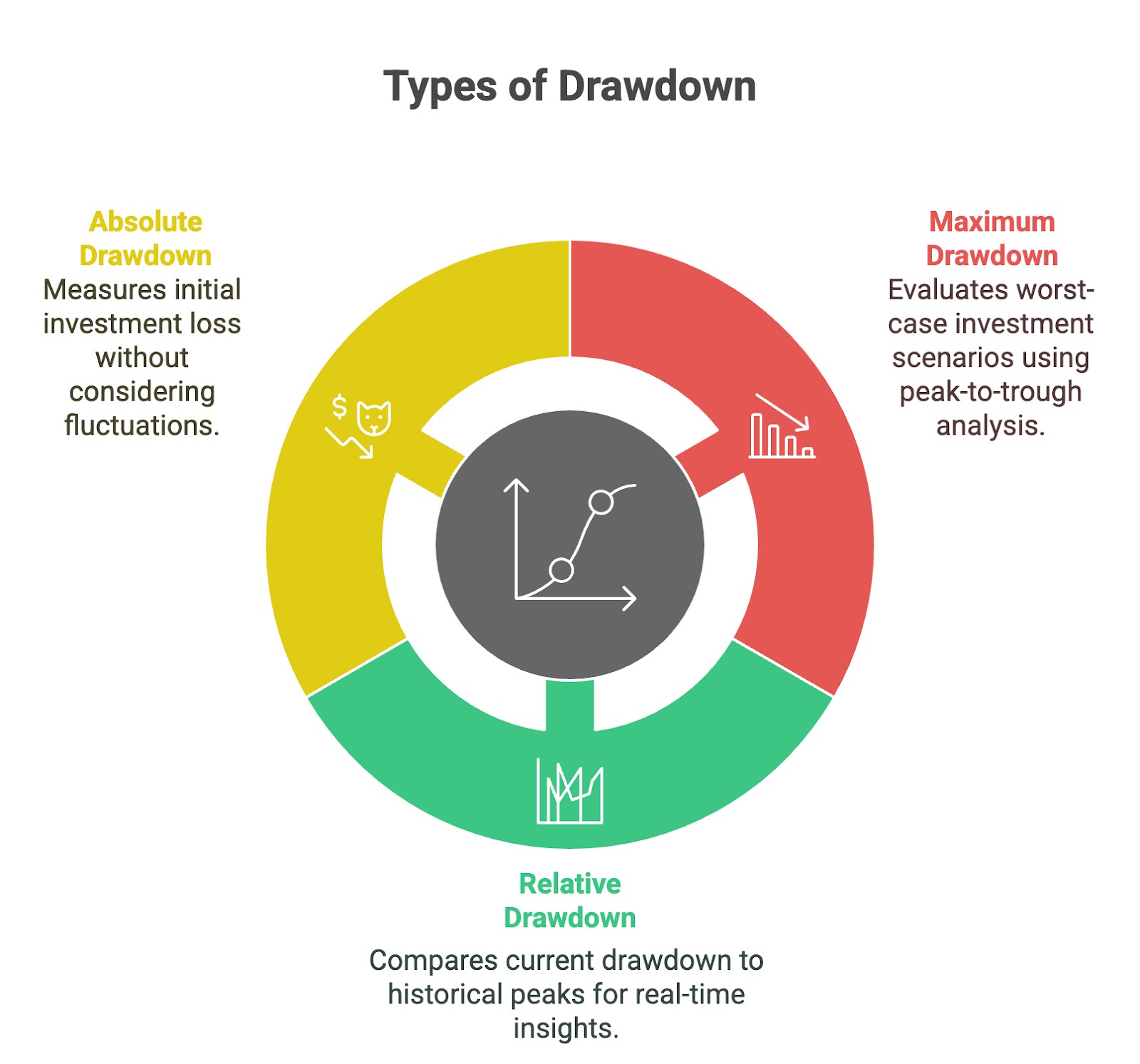

Maximum drawdown

Maximum drawdown (MDD) represents the largest loss from a peak to a trough before a new peak is achieved. It’s often expressed as a percentage and is used to evaluate the worst-case scenario for an investment.

Maximum drawdown helps traders assess the historical risk of a strategy. A high MDD may indicate that the trading approach involves significant risk, while a lower MDD shows better capital preservation.

Relative drawdown

Relative drawdown compares the current drawdown to the highest equity peak achieved. It is a more dynamic measure and can provide insights into real-time trading performance.

This metric is useful for active traders who monitor their account equity daily. By tracking relative drawdown, traders can adapt their strategies to changing market conditions.

Absolute drawdown

Absolute drawdown measures the difference between the initial investment and the lowest point of the account balance. Unlike relative or maximum drawdown, it doesn’t account for peaks, making it a simpler but less comprehensive measure.

Absolute drawdown is particularly useful for beginners who want to gauge their initial risk exposure without considering fluctuations over time.

How to calculate drawdown

Here’s how to calculate the drawdown:

Identify peak value. Determine the highest value of your account or portfolio over the period.

Identify trough value. Find the lowest value reached after the peak.

Calculate drawdown. Use the formula:

Drawdown (%) = ((peak value - trough value) / peak value) x 100

Example calculation

In the given chart, Apple Inc.'s stock price reached a peak of $260.10 before experiencing a decline to a trough of $219.38. This drop represents a drawdown of $40.72, or approximately 15.66%. The drawdown highlights the extent of the stock’s decline before stabilizing or rebounding, providing traders and investors with insight into the asset's volatility and risk.

Drawdown in Forex trading

In Forex trading, drawdown plays a crucial role because of the high volatility and leverage, which can amplify both profits and losses. Even a slight price swing in the wrong direction can wipe out a large portion of capital, especially when using high leverage. This makes managing drawdown essential for long-term success.

Monitoring drawdowns helps Forex traders prevent margin calls, manage risk exposure, and refine their trading strategies for long-term survival. A deep drawdown might signal poor risk management or an ineffective strategy, while a controlled drawdown suggests a trader is handling risks well.

Traders who stick to proper risk management — using stop-losses, controlling position sizes, and avoiding excessive leverage — can reduce drawdown risks and improve their chances of staying profitable over time. Additionally, diversifying across currency pairs, adjusting leverage based on market conditions, and keeping a trading journal to track drawdowns can help traders fine-tune their approach and build more resilient strategies.

How do you analyze drawdown in trading?

When assessing drawdown, traders look at how deep losses go and how long it takes to recover — both key indicators of a strategy’s risk and stability. The most important factors to track are maximum drawdown (the worst loss), how long it takes to bounce back, and how often these dips happen.

Looking at past trades can reveal patterns — like whether a strategy frequently faces sharp losses or takes too long to recover. A volatile strategy with frequent drawdowns might be riskier, while one that takes too long to recover may lack efficiency.

Beyond numbers, drawdowns can mess with a trader’s mindset. Knowing how much loss you can handle before panic kicks in helps you stay disciplined and avoid rash decisions that could make things worse.

Stacking up drawdowns across different strategies can highlight which ones are safer and which ones carry higher risk. This makes it easier to pick strategies that match your risk tolerance and financial goals, helping you trade with more confidence.

How to manage drawdown risks

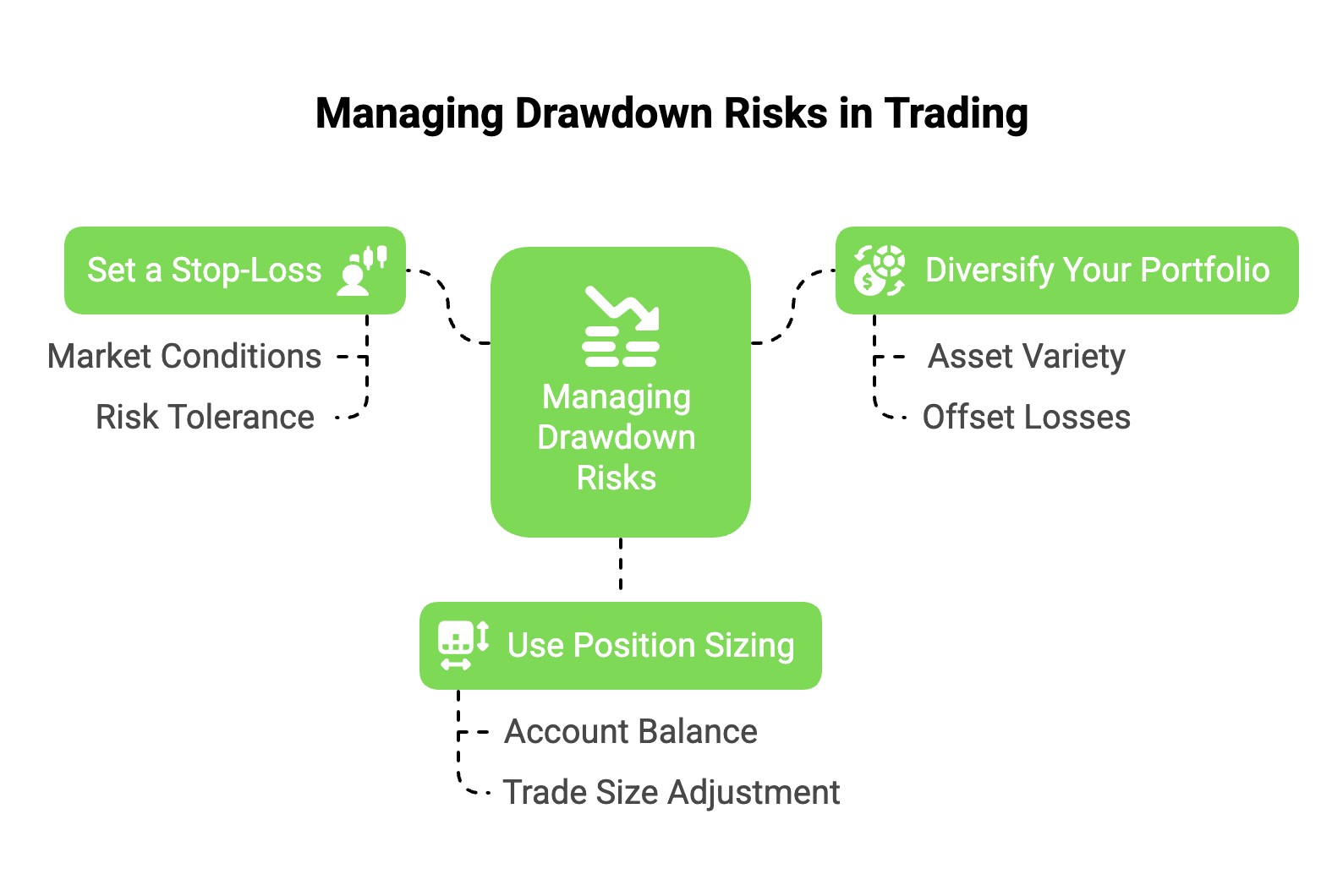

Set a stop-loss

Using stop-loss orders limits the maximum loss on any single trade. This simple yet effective tool ensures that a bad trade doesn’t snowball into a significant drawdown.

Traders should set stop-loss levels based on market conditions and their risk tolerance. For instance, in highly volatile markets, a wider stop-loss may be necessary to avoid premature exits.

Diversify your portfolio

Diversification reduces overall risk by spreading investments across different assets or strategies. Even if one asset experiences a drawdown, gains in others can offset the losses.

Avoid overexposure to a single market or currency pair. By diversifying, you can achieve more stable returns and minimize the psychological impact of drawdowns.

Use position sizing

Adjusting the size of your trades based on your account balance and risk tolerance helps control drawdown. For example, allocating a smaller percentage of your capital per trade can reduce the impact of consecutive losses.

Position sizing is especially important during periods of heightened market uncertainty. Scaling down trade sizes during volatile times can prevent large drawdowns.

Trade using a good broker

Your broker plays a big role in managing drawdowns — picking the right one can make all the difference. A good broker should have tight spreads, fast execution, and minimal slippage — otherwise, you might end up losing money even on a solid trade. In the table below, we have presented the top brokers that offer most of the features we discussed above, along with additional benefits. You may do your own due diligence and decide which one is the best for you:

| Tradable assets | Demo | Min. deposit, $ | Standard EUR/USD spread, avg pips | ECN Spread EUR/USD, avg pips | Max. Regulation Level | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 2800 | Yes | 100 | 0,7 | No | Tier-1 | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| 1200 | Yes | No | 0,6 | 0,1 | Tier-1 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| 129 | Yes | No | 0,3 | 0,15 | Tier-1 | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| 5500 | Yes | 100 | 1,0 | 0,2 | Tier-1 | £85,000 | Study review | |

| 30000 | Yes | No | 0,5 | 0,2 | Tier-1 | $500,000 £85,000 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Consider your psychological resilience when managing drawdown

As a trader, I’ve learned that managing drawdowns isn't just about numbers — it’s also about staying emotionally composed. One of the most overlooked aspects of handling drawdowns is maintaining your psychological resilience during tough periods. Experiencing a steep drawdown can test your patience and confidence, but it’s critical to stick to your strategy rather than make impulsive decisions. I recommend having a pre-defined plan for how you’ll respond to losses, whether it’s stepping back temporarily or revisiting your trading journal to stay grounded.

Also, avoid overanalyzing during recovery. Many traders fall into the trap of tweaking their strategy too frequently in reaction to temporary drawdowns. Instead, take the time to evaluate whether the losses are within the expected range of your trading plan. This disciplined approach allows you to see the bigger picture and avoid unnecessary changes that could hinder long-term performance.

I emphasize the importance of realistic expectations. Early in my career, I expected quick recoveries from every dip, which led to frustration and overtrading. Over time, I learned that recovery takes patience and consistency. Celebrate small wins as you recover, and remember that trading success comes from sustainable strategies, not short-term gains.

Conclusion

Drawdowns are an inevitable aspect of trading, but understanding and managing them can make a significant difference in your success. By calculating drawdowns, analyzing their patterns, and adopting effective risk management strategies, traders can minimize losses and build a more resilient portfolio

Whether you’re a beginner or an experienced trader, focusing on drawdown metrics is essential for achieving your financial goals.

FAQs

What is a good drawdown percentage in trading?

A good drawdown percentage varies depending on the strategy and risk tolerance. Generally, a drawdown below 20% is considered acceptable for most traders.

How does leverage affect drawdown?

Leverage amplifies both potential gains and losses. High leverage can lead to larger drawdowns, making risk management critical.

Can drawdown be completely avoided?

No, drawdowns are a natural part of trading. However, proper risk management can minimize their impact.

What is the difference between drawdown and loss?

Drawdown measures the decline from a peak to a trough, while loss refers to the result of an individual trade or a series of trades.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.