Funded Trading Accounts Explained

The concept of funded trading accounts presents an enticing solution for traders with skills but need more starting capital. Funded trading accounts offer a solution for skilled traders with limited capital, allowing them to access larger funds and potential profits.

Talented traders often demonstrate exceptional abilities and consistent performance on demo accounts. They may be growing their virtual account by a substantial 20% each month, all while avoiding significant drawdowns. However, when it comes to transitioning to live trading with a limited starting capital, the financial reality can be disheartening.

Let's consider a scenario where a trader begins with just $1,000. In this case, their earnings, even if they maintain the same impressive 20% monthly growth, would amount to a mere $200. This limitation poses a significant problem for traders seeking to turn their skills and knowledge into a sustainable source of income.

Funded trading accounts emerge as a solution, offering traders the opportunity to access significantly larger capital, thus allowing them to amplify their trading activities and potential earnings. By providing access to funded accounts, trading firms effectively empower traders to unlock their full potential in the real financial markets, bridging the gap between their trading prowess and financial resources.

In the following sections, we will delve deeper into how funded trading accounts operate and why proprietary firms choose to provide them.

Fund your account with Topstep!Why do proprietary firms provide funded accounts?

Participants in the financial markets who possess significant capital reserves often seek alternative or additional avenues to invest their wealth. Proprietary trading firms, well-versed in the dynamics of financial markets, recognize the potential of novice traders as a valuable asset. But why do these firms find novice traders to be a good option?

-

Diversification of Investment - Large capital holders, whether they are institutional investors or individuals with substantial wealth, often look for ways to diversify their investment portfolios. By providing funded accounts to novice traders, proprietary firms can allocate a portion of their capital to a new and dynamic asset class

-

Access to Trading Expertise - Novice traders may lack the capital to access financial markets on a significant scale, but they often possess valuable trading skills and market insights. Proprietary firms can leverage the expertise of these traders to make informed trading decisions

-

Profit-Sharing Arrangements - Proprietary firms typically structure funded accounts with profit-sharing arrangements. This means that when novice traders generate profits through their trading activities, a portion of those profits goes to the proprietary firm

-

Minimized Risk Exposure - While proprietary firms provide capital to novice traders, they often implement risk management measures. These measures can include setting loss limits or requiring traders to pass a testing period to prove their competence

So how do funded accounts work

Funded trading accounts operate with a well-defined process, as proprietary trading firms have a vested interest in ensuring that their capital is placed in capable hands.

Here's a breakdown of how these accounts function:

-

Proof of Success - Prop trading firms do not distribute their capital haphazardly. They often require traders to demonstrate their trading prowess on a smaller scale before providing access to funded accounts. This involves showcasing consistent profitability and risk management skills, typically on a demo account or a smaller live account

-

Monthly Fee for Management - This fee covers various services, including access to trading platforms, market data, and risk management tools. It's a way for proprietary firms to recoup some of their costs

-

Testing Period - Some proprietary firms implement a testing period during which traders must prove their abilities. This period often includes trading specific objectives or meeting profit targets. Successfully completing the testing period is important

Once a trader satisfies these criteria, the proprietary trading firm will entrust them with capital to trade on a funded account.

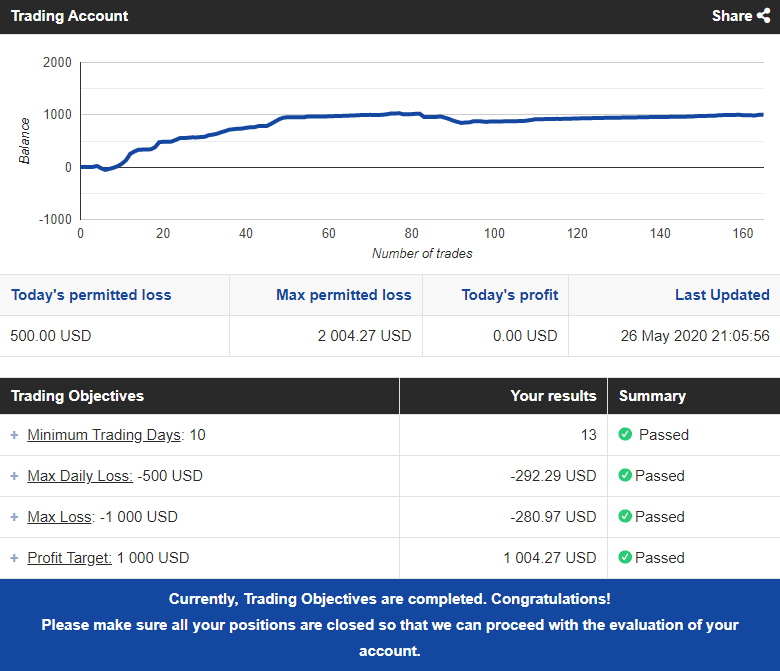

Here's what a challenge for accessing a funded account might look like:

Source: forexfactory.com

Pattern of Mutual Benefit

The relationship between private traders and proprietary trading firms follows a pattern of mutual benefit. Private traders benefit from funded accounts by gaining access to substantial capital, which allows them to trade larger positions and potentially earn significant profits. This arrangement empowers private traders to turn their skills and knowledge into a sustainable source of income.

On the other side, proprietary trading firms benefit in several ways. They tap into the expertise and trading strategies of private traders, potentially increasing their profits. Profit-sharing arrangements align the interests of both parties, creating a win-win situation.

Explore the world of funded trading further, discovering the best-funded trading accounts.

Funded Trading Account Features

Funded trading accounts can be different across various proprietary trading firms.

Here's a brief overview of how these accounts may differ in various aspects:

-

Rules for Obtaining a Funded Account - These criteria can include demonstrating a successful trading track record, passing tests or challenges, and potentially paying a monthly fee for account management services

-

Amounts of Capital Under Management - Some firms offer relatively small amounts, while others provide substantial capital for trading

-

Profit Targets - These targets can range from a fixed dollar amount to a percentage of the initial capital provided

-

Loss Limits - To manage risk, many firms impose loss limits on traders. If a trader's losses reach a predetermined threshold, they may face account restrictions or even account termination

-

Trading Platforms - Funded trading accounts may be associated with specific trading platforms or brokerage services

-

Available Trading Instruments - Some may offer access to a wide variety of markets, including stocks, Forex, commodities, and cryptocurrencies, while others may focus on a specific asset class

-

Fees - Traders should be aware of any fees associated with funded accounts. These fees can include monthly account management fees, profit-sharing fees, and other charges

-

Profit Sharing Percentage - The profit-sharing arrangement between traders and proprietary firms can differ. You should know what portion of your profits will be shared with the firm, as this can impact your overall earnings

-

Withdrawal Options - The ease and flexibility of withdrawing profits can vary. Some firms may allow traders to withdraw profits regularly, while others might have more stringent withdrawal policies

Here’s an in-depth exploration of Forex prop trading helping you to discover the best options in the Forex market.

To succeed in the world of funded trading accounts, read the terms of cooperation meticulously. Understanding the rules, conditions, and expectations set by proprietary trading firms is the foundation of trading well with funded accounts. Furthermore, remember that the goal is not just to obtain a funded account but to keep it active and thriving.

Maybe, you are also interested in information about key differences between Funded Account and Personal Forex Account

Best Forex Funded Accounts

FAQs

Is funded trading worth it?

Funded trading can be worth it for skilled traders who lack sufficient capital, as it provides an opportunity to trade with more substantial funds and potentially increase earnings.

Are funded accounts legit?

Yes, funded accounts are legitimate, provided you work with reputable proprietary trading firms that have transparent terms and conditions.

What is a funded account?

A funded trading account is one in which a proprietary trading firm provides capital to a trader to trade in real financial markets, typically with profit-sharing arrangements.

How much can I expect to earn with a funded account?

Earnings from a funded account vary based on factors like the amount of capital provided, your trading skills, and the profit-sharing agreement. Potential earnings can be significant but are not guaranteed.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Prop trading

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Private Trader

A private trader is an individual who doesn’t represent any institution and trades using their own capital.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).