Introduction To White Label Crypto Exchange

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A white-label crypto exchange is a ready-made platform enabling businesses to launch their cryptocurrency trading services. It offers customizable features, robust security, and faster deployment, allowing startups and enterprises to enter the crypto market cost-effectively without extensive technical development.

Building a crypto exchange from scratch can be both costly and time-consuming. This challenge has led to a growing demand for crypto exchange white label solutions. These ready-made platforms allow businesses to launch customized exchanges quickly and efficiently, providing an ideal way to save on development time and expenses.

In this guide, we’ll explore key aspects of white-label cryptocurrency exchange development, including essential features, pricing considerations, and top white label provider options available in the market. Whether you're interested in white label decentralized exchange software or complete cryptocurrency exchange software solutions, this guide will help you make informed decisions for your business.

What is a white label crypto exchange?

A white-label crypto exchange is a pre-built platform designed for customization and branding. Businesses can tailor the exchange to their specific needs, incorporating unique features, branding elements, and third-party integrations. These solutions eliminate the need for extensive in-house development, enabling rapid market entry.

White-label cryptocurrency exchange development offers a cost-effective alternative for entrepreneurs and enterprises looking to capitalize on the cryptocurrency boom. By choosing a white label provider, businesses can bypass technical complexities and leverage a scalable infrastructure managed by a third-party company. This allows them to focus on user acquisition, marketing, and business growth without the burden of building an exchange from scratch.

If you're considering launching a trading platform, understanding the benefits of crypto exchange white label solutions is key to making informed decisions about your platform’s success.

Benefits of white label crypto exchanges

Rapid deployment. Launching an exchange is faster compared to building one from scratch. With pre-built crypto exchange white label solutions, businesses can enter the market quickly, sometimes within weeks, enabling them to capitalize on current trends.

Cost savings. Development and operational costs are significantly reduced. White label cryptocurrency exchange development eliminates the need to build a platform from scratch, saving expenses related to hiring developers, infrastructure, and maintenance.

Customization. Businesses can integrate tailored features to suit their user base. This can include branded interfaces, API integrations, and additional security layers, ensuring the platform stands out from competitors and meets user expectations.

Scalable infrastructure. Most white-label decentralized exchange software solutions are designed with scalability in mind. This makes it easier for businesses to handle growing user demand, increasing transaction volumes, and evolving market requirements as they expand.

Minimal technical expertise required. One of the biggest advantages of white label crypto exchanges is that they minimize the need for deep technical knowledge. The cryptocurrency exchange software is managed by a third-party white label cryptocurrency exchange development company, handling backend processes, security protocols, and software updates.

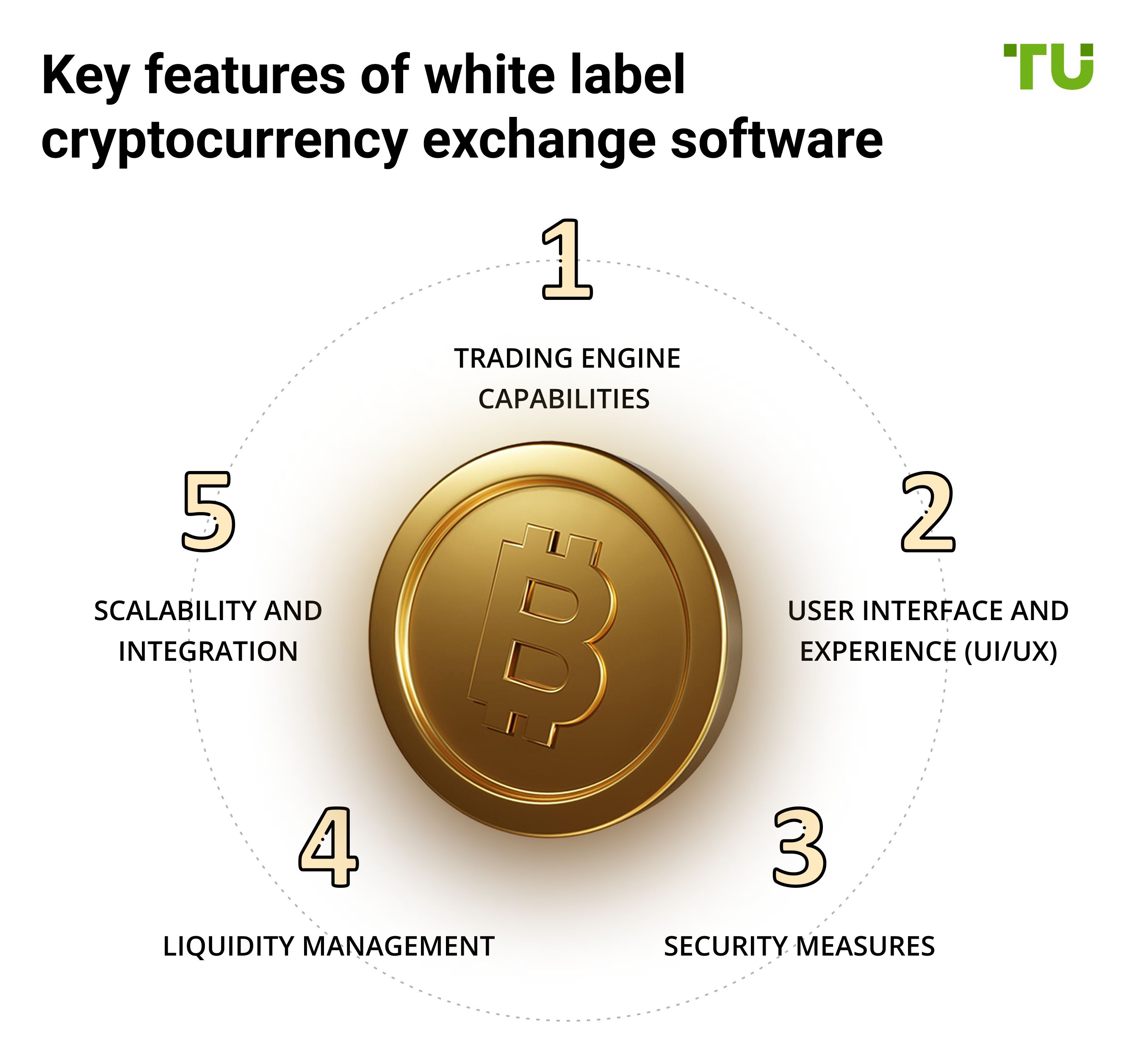

A white-label crypto exchange relies on robust software to deliver seamless trading experiences. Here's an overview of the essential features:

Trading engine capabilities

The trading engine is the heart of an exchange. It processes transactions, matches buy and sell orders, and ensures accuracy. A high-performance engine supports low-latency trading and handles high volumes efficiently, making it crucial for successful crypto exchange software solutions.

User interface and experience (UI/UX)

A customizable UI/UX design ensures the platform aligns with the brand's identity. A user-friendly interface attracts traders and simplifies navigation for both beginners and experienced users. A strong white label provider offers UI/UX customization options to improve engagement and retention.

Security measures

Security is critical for protecting user data and funds. Key features include:

AML/KYC Compliance. Ensures regulatory adherence by verifying user identities.

Two-factor authentication (2FA). Adds an extra layer of login protection.

Cold wallet storage. Secures funds offline to mitigate hacking risks.

Liquidity management

Liquidity integration is essential for smooth trading experiences, reducing slippage, and maintaining market stability. Leading white label cryptocurrency exchange development companies often connect their platforms to global liquidity pools to ensure reliable trading environments.

Scalability and integration

A robust white label decentralized exchange software must support business growth. API integrations with payment gateways, digital wallets, and third-party tools enhance platform functionality and ensure scalability for future expansion.

These features ensure that white label crypto exchange solutions meet market demands while remaining flexible enough to adapt to unique business needs. Understanding the white label crypto exchange cost and partnering with a reliable white label provider can help businesses enter the market quickly and efficiently.

Top white label crypto exchange providers

Selecting the right provider is critical to launching a successful white-label cryptocurrency exchange. Here’s an overview of the leading options:

HollaEx

HollaEx offers open-source crypto exchange white label software tailored for flexibility. Its cloud hosting options enable businesses to scale quickly. Key features include customizable UI, multi-asset trading support, and integrations with global liquidity providers. This makes it an attractive choice for startups and enterprises seeking cost-effective white label cryptocurrency exchange development.

AlphaPoint

AlphaPoint is renowned for its scalability and institutional-grade features. The platform supports high trading volumes and provides tools for regulatory compliance, such as AML/KYC integration. With customizable branding options and robust crypto exchange software solutions, AlphaPoint caters to businesses with specific technical needs while ensuring regulatory alignment.

Antier Solutions

Antier Solutions offers robust white label decentralized exchange software with end-to-end customization options. It’s designed for enterprises prioritizing high security and scalability. Key features include multi-layer encryption, cold wallet support, and rapid transaction processing. Their solutions also emphasize flexibility for businesses seeking bespoke cryptocurrency exchange software.

White label crypto exchange vs. major exchanges

| Feature | White Label crypto exchange | Normal crypto exchange |

|---|---|---|

| Definition | A pre-built, customizable exchange platform offered by a third-party provider. | Proprietary exchange developed and managed by the operator. |

| Customization | High level of customization; allows branding, feature selection, and integration of specific tools. | Limited or no customization as features are determined by the platform owner. |

| Time to market | Quick deployment; typically ready in weeks with minimal development time. | Longer development cycle, often taking months or years to launch. |

| Cost | Lower upfront costs; providers charge a setup fee and ongoing subscription or revenue share. | Higher development costs due to in-house design, infrastructure, and maintenance. |

| Technical expertise | Requires minimal technical expertise; the provider handles backend development and updates. | Requires in-depth technical knowledge for building and maintaining the platform. |

| Target audience | Entrepreneurs, startups, and businesses looking to enter the crypto space quickly and affordably. | Established businesses or companies with the resources to build proprietary solutions. |

Why is it better for a regular trader to choose large exchanges?

Major exchanges provide security, liquidity, convenience, and a wide range of features.

White-label exchanges are better suited for companies looking to launch their own platforms rather than for active trading.

The risk on smaller or lesser-known exchanges is significantly higher due to the potential for fraud, hacking, and poor-quality services.

If you want to trade safely and minimize costs, choose reputable, well-established exchanges.

| CEX | DEX | Coins Supported | Demo | Min. Deposit, $ | Spot leverage | Spot Maker Fee, % | Spot Taker fee, % | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | No | 329 | Yes | 10 | 1:10 | 0,08 | 0,1 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | No | 278 | No | 10 | 1:5 | 0,25 | 0,4 | 8.48 | Open an account Your capital is at risk. |

|

| Yes | No | 250 | No | 1 | 1:3 | 0,25 | 0,5 | 8.36 | Open an account Your capital is at risk. |

|

| Yes | No | 72 | Yes | 1 | 1:5 | 0,1 | 0,2 | 7.41 | Open an account Your capital is at risk. |

|

| No | No | 1817 | No | No | No | 0 | 0 | 7.3 | Open an account Your capital is at risk. |

How much does white label crypto exchange cost?

The cost of developing and operating a white label crypto exchange depends on multiple factors, including the provider, features, and customization level. Here’s a detailed breakdown:

Initial setup costs

Licensing fees. Most crypto exchange white label providers charge a one-time or annual fee for the exchange license. This can range from $10,000 to $50,000 based on the platform and its included services.

Customization. Tailoring the platform to your branding and functional requirements can cost between $5,000 and $20,000, depending on the extent of modifications to the white label cryptocurrency exchange software.

Integration costs. API integrations for payment gateways, liquidity providers, and wallets can add $2,000 to $10,000 to the total setup cost, particularly for enterprises looking for comprehensive crypto exchange software solutions.

Ongoing operational expenses

Maintenance. Regular software updates, server maintenance, and upgrades usually cost $1,000 to $5,000 per month, depending on the level of support from the white label cryptocurrency exchange development company.

Support services. Providers often offer technical support packages ranging from $500 to $2,000 monthly, ensuring the white label crypto exchange runs smoothly and securely.

Security enhancements. Implementing advanced security measures like penetration testing, DDoS protection, and fraud prevention can add additional costs for ongoing protection.

Factors influencing costs

Feature set. Advanced features such as margin trading, staking options, or DeFi integrations can significantly increase the overall cost.

Compliance needs. Implementing AML/KYC processes and meeting local regulatory requirements can require further investments.

Scalability. If the exchange is expected to handle high transaction volumes, infrastructure costs related to additional servers and database performance enhancements will increase accordingly.

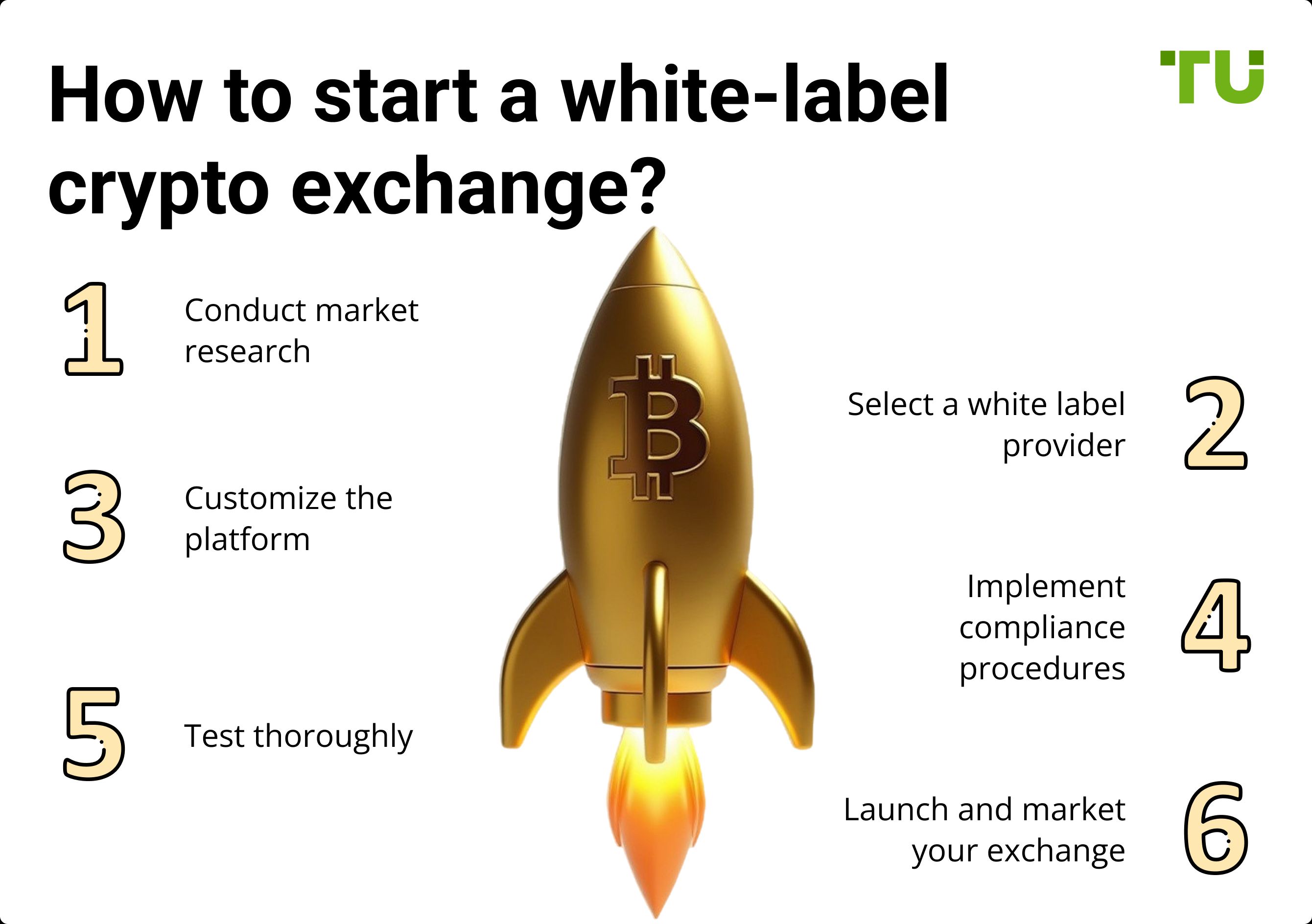

Launching a white label crypto exchange requires a strategic approach. Here’s a step-by-step guide to help you get started:

1. Conduct market research

Identify your target audience.

Analyze competitors and their offerings.

Study the regulatory environment in your intended markets to ensure compliance.

2. Select a white label provider

Choose a white label cryptocurrency exchange development company that aligns with your business goals. Key factors to consider:

Customization options.

Security features.

Scalability and support services.

3. Customize the platform

Brand the exchange with your logo, colors, and theme.

Tailor features like trading pairs, user interface, and transaction limits.

4. Implement compliance procedures

Set up AML/KYC protocols to meet regulatory requirements.

Ensure data protection measures are in place to secure user information.

5. Test thoroughly

Conduct extensive platform testing to identify and resolve bugs.

Simulate high transaction volumes to assess the scalability and performance of your crypto exchange software solutions.

6. Launch and market your exchange

Deploy the exchange to your target audience.

Use marketing strategies like SEO, social media campaigns, and referral programs to attract users.

Challenges and considerations

While white-label cryptocurrency exchange development offers many advantages, it comes with challenges that require careful planning and management.

Regulatory compliance

Navigating the legal landscape is a primary hurdle. Cryptocurrency regulations differ across countries and often change. To ensure compliance:

Stay updated on local laws.

Implement robust AML/KYC systems.

Work with legal advisors to mitigate risks.

Security concerns

Cryptocurrency platforms are prime targets for hackers. Ensuring user data and asset safety is crucial. Best practices include:

Using cold wallets for fund storage.

Regularly conducting penetration tests.

Implementing two-factor authentication and encryption.

Liquidity management

Low liquidity can lead to poor trading experiences. Partner with liquidity providers or integrate with global liquidity pools to maintain smooth trading operations.

Market competition

The crypto exchange market is saturated with established players. To compete effectively:

Offer unique features.

Provide excellent customer support.

Focus on user-friendly design and seamless functionality.

A secure platform and informed users enhance exchange resilience to security risks

When launching a white label crypto exchange, don’t just focus on the platform’s design and functionality — prioritize liquidity partnerships from day one. Most beginners overlook the fact that even the most advanced exchange can struggle without sufficient liquidity, leading to poor user experience and low trading activity. Instead of relying solely on your provider's default liquidity pool, consider integrating with global liquidity networks and multiple APIs to ensure users face minimal slippage and optimal order matching. This builds user confidence and attracts professional traders who depend on quick, reliable trade processing.

Another overlooked factor is custom security enhancements. While your white label provider may offer a standard security package, invest in additional layers such as advanced fraud detection tools that learn from user patterns, frequent system reviews to catch potential vulnerabilities, and cold wallet protocols. These proactive steps can significantly reduce the risk of hacks and safeguard user assets. Additionally, offering educational resources — like simple tutorials on avoiding phishing attempts — can foster trust and retention among your user base. A secure platform and an informed community make your exchange more resilient to security risks.

Conclusion

Launching a cryptocurrency exchange has become more accessible than ever, thanks to white label crypto exchange solutions. These platforms offer a cost-effective and efficient way for businesses to enter the growing cryptocurrency market without building from scratch.

With benefits such as rapid deployment, customizable features, and scalable infrastructure, crypto exchange white label solutions lower entry barriers while providing the flexibility needed to create a unique and competitive platform.

However, success in this space requires strategic planning. Conduct in-depth market research, select a trusted white label cryptocurrency exchange development company, and address challenges such as regulatory compliance, security, and liquidity management. By partnering with the right white label provider and ensuring robust security measures, businesses can confidently navigate the evolving crypto industry and thrive.

FAQs

What is a white-label crypto exchange?

A white-label crypto exchange is a pre-built, customizable platform that businesses can brand as their own and quickly deploy without extensive development.

How much does it cost to build a white-label cryptocurrency exchange?

The cost typically ranges from $10,000 to $50,000 for setup, with additional expenses for customization, integrations, and ongoing maintenance.

Are white-label crypto exchanges secure?

Yes, white-label crypto exchanges include robust security features such as 2FA, cold wallet storage, and AML/KYC compliance to protect user data and funds.

What are the advantages of using a white-label crypto exchange over building one from scratch?

White-label exchanges offer faster deployment, lower costs, and easy customization, allowing businesses to enter the market quickly without extensive technical expertise.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.