Is Liquidity Mining Halal Or Haram

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Liquidity mining and participation in liquidity pools may be considered halal when certain conditions are clearly met. These include ensuring that any returns come from genuine trading activity and not from interest-based mechanisms, maintaining full transparency in how the smart contracts operate, and steering clear of any assets that are considered haram. Each DeFi protocol must be reviewed on a case-by-case basis to determine whether it aligns with Islamic financial guidelines and whether liquidity mining is halal under those standards.

Liquidity pools and liquidity mining are designed to distribute trading activity across users in decentralized finance ecosystems. When someone adds assets to a smart contract, they receive a portion of the fees collected from token swaps. This setup offers a way to earn without actively trading, but it introduces elements of uncertainty, shared profit, and potential risk. From a Shariah standpoint on crypto and blockchain, each of these elements demands thoughtful review. This article primarily answers the question, “is liquidity mining halal?”, exploring how income is generated, how returns are calculated, and what must be evaluated to determine if from an Islamic finance perspective. It places special emphasis on the nature of the assets involved and the sources of revenue within the contracts themselves.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Is liquidity mining halal?

Decentralized exchanges operate through liquidity pools, which allow users to swap cryptocurrency tokens smoothly and efficiently. In return for providing your funds, you receive a portion of the trading fees and may also earn tokens that give you a say in how the platform is managed. The following sections explore how this system functions, the types of returns it may offer, and the risks involved.

A key question in Islamic finance today is whether liquidity mining is halal, particularly when the structure adheres to Sharia-compliant principles. Sharia forbids practices involving riba, gharar, and maysir. Riba refers to any predetermined gains not tied to risk or actual economic activity. Gharar covers structural ambiguity such as hidden terms or unclear duties. Maysir relates to earnings rooted in luck, excessive risk, or speculation without real value creation. Platforms that offer fixed income, guaranteed appreciation of assets, or unclear smart contract terms fall outside Islamic principles.

When earnings are drawn from trading fees that change with market activity, “is liquidity mining halal?” becomes a valid consideration if the protocol ensures clear rules, does not promise set returns, and openly addresses the risks of token devaluation.

Conditions for halal and haram status of liquidity mining

Liquidity mining isn’t clearly halal or haram from the start. It all depends on how the pool is set up or which tokens it uses. If the pool connects with interest-based assets or gives fixed returns without real risk-sharing, it drifts into haram territory. What makes it tricky is that many smart contracts auto-stake into income sources that involve interest, and most users don’t even know their money is doing that in the background.

One major thing scholars look at is whether the liquidity provider shares risk fairly. In Islam, you can’t earn profit unless you’re also exposed to possible loss. But when platforms guarantee returns and shield providers from downside, that contradicts the principle of uncertainty-sharing that Islamic finance is built on. That’s why even platforms that look ethical sometimes trigger concerns among Islamic scholars.

Something most people miss is how liquidity gets moved across different platforms or stored in hidden vaults. If the DeFi system ends up rerouting funds into interest-bearing loans through platforms like Aave or Compound, then where the income really comes from becomes a problem. This issue is one of the core reasons why scholars still question whether liquidity mining is halal or haram, especially when code transparency is lacking.

It’s also crucial to check what tokens are being paired in the liquidity pool. If you’re adding funds to a pool that links a halal token with a coin from a gambling platform or a synthetic debt protocol, the whole structure could be considered haram. That’s why the question “is liquidity pool halal?” needs more than a yes-or-no answer. You have to know how tokens are connected and what kind of platforms they come from.

Finally, how you earn your rewards matters just as much. If you’re being rewarded based on how much others use your liquidity, that could be a legitimate form of value-sharing. But if the rewards are time-based or tied to fixed percentages, it starts looking like interest. That’s why scholars are now calling for ongoing Shariah reviews that adapt to how the code changes, because a one-time ruling isn’t enough for the way DeFi keeps evolving so quickly.

Once you’ve added halal cryptocurrencies to a liquidity pool or earned rewards through halal-compliant liquidity mining, the next step is to make those assets work for you. This usually means withdrawing or trading them on a reliable exchange. Below, we’ve listed some of the top crypto platforms that support halal tokens and allow you to exit or rotate your position with ease. Check if your token is supported and compare features before making a move.

| Foundation year | Crypto | Coins Supported | Spot Fee Tier | Min. Deposit, $ | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 2017 | Yes | 329 | No | 10 | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | Yes | 278 | No | 10 | Yes | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | Yes | 250 | No | 1 | Yes | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | Yes | 72 | Level 0 (Regular Fee) | 1 | Yes | 7.41 | Open an account Your capital is at risk. |

|

| 2004 | No | 1817 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

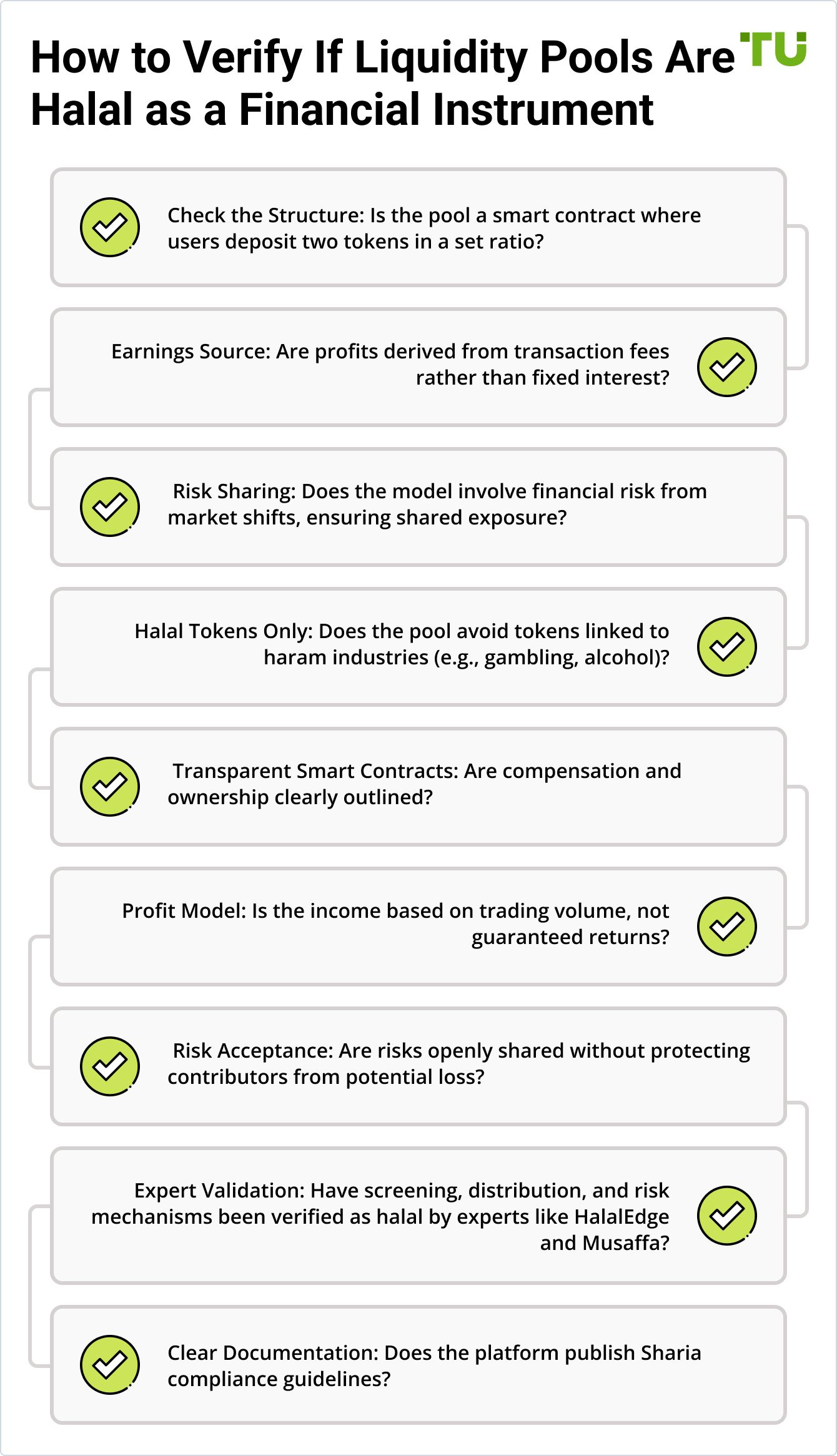

Are liquidity pools halal as a financial instrument?

A liquidity pool is a smart contract where users deposit two tokens in a predefined ratio. These assets are then made available for exchange by other participants, and the contract adjusts prices automatically based on the balance within the pool. Contributors do not engage in direct trading but instead support the infrastructure of decentralized protocols. They are compensated with a portion of the transaction fees generated through real-time usage.

This arrangement does not offer any guaranteed, interest-based returns. Instead, participants earn from the pool’s fluctuating activity. In this structure, the liquidity pool is halal when the compensation results from active trading volume and not from fixed profits. The model involves risk from market shifts, which meets Sharia principles of shared financial exposure and variable outcomes.

A Sharia-compliant example includes joining pools that avoid tokens linked to restricted industries. Transparent, open-source systems with traceable transactions, like those on Uniswap and other decentralized exchanges, allow Muslims to control their pool content responsibly.

Permissibility is also tied to how clearly the smart contract outlines compensation and ownership shares. There are still risks, including potential loss from market movements during automated swaps. By accepting these risks without any guaranteed income, the investor is entering a model similar to musharaka, a profit-and-loss sharing partnership endorsed in Islamic finance.

Based on analysis from HalalEdge and Musaffa, it is derived that using a liquidity pool may be considered as halal when screening mechanisms, distribution models, and risk exposure are all clearly defined. While each case must still be reviewed individually to confirm compliance, the underlying structure of liquidity pools, when configured correctly, can be compatible with Sharia guidelines.

How to identify a halal liquidity pool

One of the most debated topics within Islamic finance today is: liquidity mining is halal or haram? To make an informed judgment, it’s crucial to evaluate the project’s structure, the nature of returns, and the transparency of its operations. Below are key factors to consider:

Halal DeFi isn’t just about avoiding interest - it requires fairness and transparency in the project’s structure.

Decentralization must be genuine - if one team holds admin keys or can freeze funds, it violates shared risk principles.

Check how returns are generated - if they come from lending with guaranteed profits, it might involve riba, which is haram.

Look beyond the business model - the token itself should have real utility, not just speculative price movements.

Pay attention to AMM pools - if they allow any token, including haram ones, it questions the pool’s permissibility.

Halal-only token pairs matter - projects that filter out haram tokens offer a more compliant environment.

Always verify certification claims - don’t just accept “halal” labels; look for documented fatwas and credible signatories.

Transparency is key - real halal DeFi projects openly share their rules and compliance measures.

Deciding whether liquidity mining is halal or haram requires a deeper look into how the earnings are structured. Scholars emphasize that liquidity mining is halal only if the rewards come from actual trading activity rather than interest or speculative setups.

"Those who consume interest will stand [on Judgment Day] like those driven to madness by Satan’s touch. That is because they say, 'Trade is no different than interest.' But Allah has permitted trade and has forbidden interest."

Other forms of crypto activity that may affect halal status

When evaluating whether liquidity mining is halal, it is also important to consider how other crypto practices are treated under Islamic finance. For example, staking crypto may be permissible when it avoids interest-like structures, while yield farming often blurs that line due to fixed returns.

Similarly, activities like crypto day trading or crypto leverage trading are highly debated, as they may involve speculation or borrowed funds, both of which can violate Shariah principles. Even seemingly straightforward actions like crypto spot trading require scrutiny depending on the asset and the terms.

Newer areas such as hype-driven meme coins are also under review.Their halal legitimacy depends on utility, risk profile, and user intent, which are far from being halal for most meme coins.

Finally, even mining, whether traditional or mobile-based, such as in Pi Network, is debated. Some scholars see it as valid work, others question whether crypto mining is halal due to the reward structure and energy usage. Each activity needs to be screened for transparency, risk sharing, and whether it truly avoids riba and gharar. And if you have made gains, knowing your obligations, such as zakat on crypto, is key to staying compliant.

Impermanent loss and unchecked token pairs make liquidity mining haram

Everyone talks about whether liquidity mining involves interest, but they miss a huge risk. The kind of tokens you add into a liquidity pool can quietly turn the whole process haram. Even if the system doesn't pay interest, if one of your tokens is tied to alcohol, gambling, or debt-based lending, you've just stepped into non-permissible territory. These platforms don’t screen anything, you have to do that. Before you provide liquidity, take time to dig into what each token supports. That simple step decides whether your income is halal or not.

There’s also a hidden issue no one warns you about. When a pool auto-balances, it might sell one token into another to keep the ratio stable. If that trade ends up converting your funds into something haram, you could be responsible for a non-compliant transaction without even knowing it. This is why blindly trusting DeFi tools is risky. Stick to pools that list only halal tokens or use a screened pair list. High returns aren’t worth it if you lose the ethical foundation of your earnings.

Conclusion

Before adding funds to a pool, make sure to evaluate three critical factors: how the income is generated, what type of assets support the pool, and the underlying contract structure. If the profit is issued automatically or without any actual trading activity, it falls under what is considered haram. Pools that involve tokens with a credit-based or interest-linked background are also deemed impermissible. Likewise, if the smart contract includes any form of built-in protection against loss, that too is classified as haram.

These conditions answer the question many ask, is liquidity pool halal under Islamic principles? Participation is not allowed in such cases, even if a platform interface displays a fatwa. Proper due diligence must be carried out manually by reviewing the contract code, token origin, and the method used to calculate rewards.

FAQs

Can the same pool be halal for some participants and haram for others?

Yes, if participants use different tokens or interfaces. One may select a permissible asset pair and manual entry, while another connects through an automated route that involves prohibited conditions.

Is zakat required on income from liquidity mining?

Yes, if the income has been realized as actual profit, not just an on-paper share. Zakat applies to the portion that is accessible and usable.

Is a protocol halal if the contract is transparent but the terms are vague?

No. Code transparency doesn’t override ambiguous profit structures. If the payout can be interpreted as fixed gain, it violates permissibility regardless of open-source status.

How do you distinguish impermanent loss from haram risk in pools?

Impermanent loss is allowed if it results from market activity. Haram risk arises when those losses are artificially covered by internal reserves or fixed bonuses.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.