Long-Term Forex Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

For long-term investors, Forex trading can serve as a strategic avenue for portfolio diversification and capital growth. Unlike short-term trading, which focuses on quick gains from market fluctuations, long-term Forex investing involves holding currency positions over extended periods, often years, to benefit from macroeconomic trends and stable growth.

Forex trading, the exchange of currencies on the global market, is often associated with fast-paced, short-term strategies. However, long-term investment in Forex can be equally, if not more, rewarding. Unlike short-term trading, which involves frequent buying and selling, long-term Forex trading focuses on holding positions for extended periods, ranging from weeks to years. This approach requires patience, discipline, and a comprehensive fundamental and technical analysis understanding.

In this article, we will look into the details of long-term Forex trading, the best currency pairs to invest in, effective strategies, and key points for both beginners and advanced traders.

Differences between short-term and long-term trading

| Aspect | Short-Term Trading | Long-Term Trading |

|---|---|---|

| Time Horizon | Seconds to a few months | Several months to years |

| Risk and Volatility | Higher risk due to market volatility | Lower risk; smooths out volatility over time |

| Strategies and Goals | Quick gains from short-term movements | Steady growth and income over the long term |

| Frequency of Trades | Frequent transactions | Fewer transactions, long holding periods |

| Analysis Methods | Technical analysis | Fundamental analysis |

| Psychological Aspects | Can be stressful; requires constant monitoring | Requires patience and a long-term perspective |

Long-term Forex trading strategies

Long-term Forex trading strategies differ significantly from short-term tactics. Here are some effective strategies for long-term investors:

Swing trading

Swing trading involves holding positions for several days to weeks. This strategy aims to capture price swings within a larger trend. Swing traders often use technical analysis to identify entry and exit points.

Supply and demand strategy

This strategy involves analyzing the supply and demand zones on a Forex chart to identify potential price movements. Traders look for areas where price reversals are likely to occur based on historical supply and demand levels.

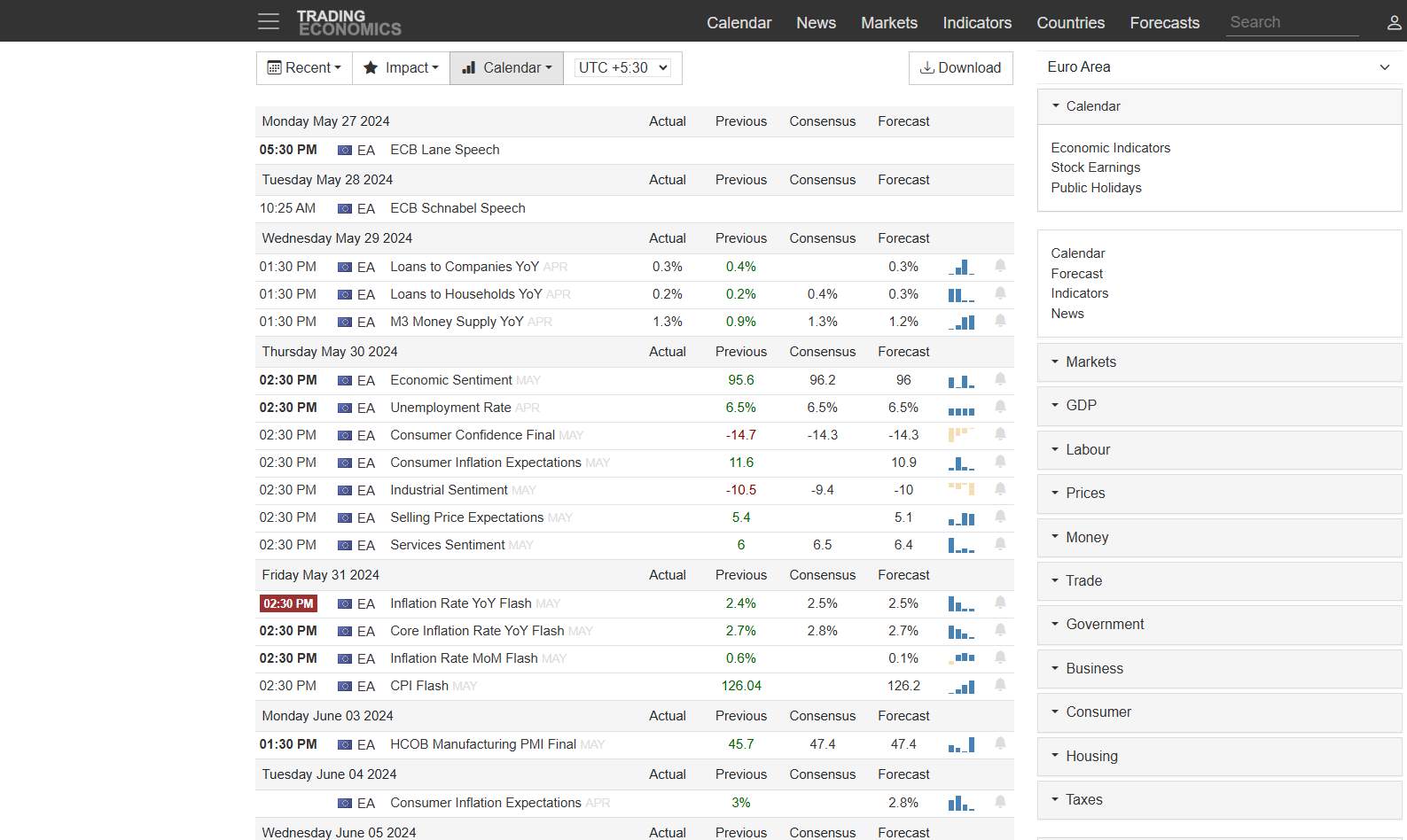

Fundamental analysis

Fundamental analysis involves evaluating economic indicators such as interest rates, inflation, and GDP to predict currency movements. Long-term traders use this analysis to make informed decisions based on the overall economic health of a country.

Technical analysis

Technical analysis focuses on chart patterns and technical indicators to predict future price movements. Long-term traders use indicators like Moving averages and RSI to identify long-term trends.

Choosing the right broker is crucial for long-term Forex trading and implementing above strategies. Look for brokers that offer favorable trading conditions, low fees, and excellent customer support.

We have compared brokers for you according to long-term trading and offer you to familiarize yourself with their conditions in the table below:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Currency pairs |

60 | 90 | 68 | 80 | 100 |

|

ETFs |

Yes | Yes | No | Yes | Yes |

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Deposit fee, % |

No | No | No | No | No |

|

Withdrawal fee, $ |

No | No | 0-15 | No | Yes |

|

Withdrawal fee, % |

No | No | No | No | Yes |

|

Investor protection |

€20,000 £85,000 SGD 75,000 | £85,000 €20,000 €100,000 (DE) | £85,000 SGD 75,000 $500,000 | £85,000 | $500,000 £85,000 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Advantages and disadvantages of long-term Forex trading

- Advantages

- Disadvantages

- Reduced Stress: Long-term trading avoids the constant monitoring required for short-term strategies, leading to less stress.

- Less Market Noise: Focuses on broader trends, reducing the impact of short-term fluctuations.

- Potential for Larger Profits: Aims to capture significant market movements over time.

- Reduced Transaction Costs: Fewer trades mean lower costs from spreads and commissions.

- Fundamental Analysis: Utilizes economic indicators and policies for informed decisions.

- Increased Risk Exposure: Longer holding periods increase exposure to market risks and unexpected events.

- Patience and Discipline: Requires enduring short-term volatility and sticking to a long-term strategy.

- Lower Trading Frequency: Fewer trading opportunities compared to short-term trading.

- Opportunity Cost: Capital tied up in long-term positions can't be used for other opportunities.

- Overnight Risk: Positions held overnight face risks from economic events that occur when markets are closed.

List of top Forex pairs for long-term investors

When choosing currency pairs for long-term investments, consider factors like economic stability, geopolitical influences, and market correlations. Diversifying your investments across different pairs can also help manage risks and enhance potential returns.

Investing in Forex long-term requires careful analysis and strategic planning, but with the right approach, it can be a highly rewarding endeavor.

Here are some of the best pairs for long-term investors:

EUR/USD (Euro/US Dollar)

GBP/USD (British Pound/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

USD/CAD (US Dollar/Canadian Dollar)

AUD/USD (Australian Dollar/US Dollar)

| Currency Pair | Liquidity | Stability | Historical Performance |

|---|---|---|---|

| EUR/USD | High | Stable | Consistent |

| GBP/USD | High | Moderate | Volatile |

| USD/JPY | High | Stable | Consistent |

| USD/CAD | High | Moderate | Correlated with oil |

| AUD/USD | High | Moderate | Commodity-influenced |

EUR/USD (Euro/US Dollar)

The EUR/USD pair is the most traded in the Forex market due to its high liquidity and stability. It's influenced by the economic policies of the European Central Bank (ECB) and the Federal Reserve (Fed). In recent years, factors like the US budget deficit and trade balances have played significant roles. The Fed's interest rate policies and the economic performance of both the Eurozone and the US heavily impact this pair. Long-term investors look at these macroeconomic factors to gauge future movements.

GBP/USD (British Pound/US Dollar)

The GBP/USD pair offers high liquidity but is known for its volatility, which is influenced by economic data from the UK and the US, as well as geopolitical events like Brexit. The UK's monetary policy and economic health play crucial roles in determining the pair's value. Investors often monitor UK's GDP growth, inflation rates, and political stability to make long-term investment decisions.

USD/JPY (US Dollar/Japanese Yen)

USD/JPY is known for its stability, making it suitable for long-term trading. The pair is influenced by the Bank of Japan's (BoJ) monetary policy and is considered a safe haven during economic uncertainty.

USD/CAD (US Dollar/Canadian Dollar)

The USD/CAD pair particularly appeals to long-term investors due to its correlation with oil prices. Canada is a major oil exporter, and the value of the Canadian dollar is closely tied to oil market fluctuations.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD pair is influenced by commodity prices, particularly gold and copper. Australia's economy is commodity-driven, making this pair sensitive to global economic trends. Movements in this pair are also influenced by China's economic performance, given Australia's trade relationship with China.

Practical tips for long-term Forex trading

Develop a strong understanding of fundamentals - long-term Forex trading relies heavily on fundamental analysis. This includes understanding macroeconomic indicators such as GDP growth, employment rates, inflation, and central bank policies. Familiarize yourself with how these factors influence currency values over time.

Diversify your portfolio - just as with other investment forms, diversification can help mitigate risks. Consider holding positions in multiple currencies and different types of trading assets to spread your risk. This approach can protect your portfolio from adverse movements in a single currency pair.

Focus on major currency pairs - major currency pairs like EUR/USD, GBP/USD, and USD/JPY tend to have lower spreads and are more stable, making them suitable for long-term investment strategies. These pairs are also more liquid, allowing for easier entry and exit points.

Use a reliable broker and trading platform - ensure that your broker is well-regulated and provides a robust trading platform. This will not only protect your funds but also give you access to the necessary tools and resources for effective long-term trading.

Stay informed and adapt by following financial news, economic reports, and analysis. Be prepared to adjust your strategy in response to changing market conditions.

Patience and discipline - long-term Forex trading requires a patient approach and the discipline to stick to your strategy. Avoid being swayed by short-term market noise or emotional reactions to market movements. Focus on the bigger picture and your long-term goals.

Risk management - implement robust risk management practices, such as setting stop-loss orders and determining acceptable risk levels per trade. This will help protect your investments and ensure that you don't incur losses that are difficult to recover from.

Forex trading for long-term investors is a strategic and rewarding approach

I can attest that Forex trading for long-term investors is a strategic and rewarding approach. Unlike short-term trading, which often hinges on quick decisions and rapid market fluctuations, long-term Forex trading involves a deep understanding of macroeconomic trends and a disciplined investment strategy. This method allows me to leverage broader economic movements and political events that influence currency values over months or even years.

In my journey, I've found that long-term Forex trading demands a rigorous analysis of economic indicators such as GDP growth, interest rates, and employment data. These elements are critical in predicting the future strength of a currency. For instance, when a country demonstrates consistent economic growth and stability, its currency typically appreciates over time. By focusing on such fundamentals, I can make informed decisions and position my investments to benefit from these trends.

Risk management is another cornerstone of successful long-term Forex trading. It involves setting precise stop-loss orders and diversifying investments across multiple currency pairs to mitigate potential losses. Personally, I've always adhered to the principle of never risking more than a small percentage of my total investment on a single trade. This strategy has helped me withstand the inevitable market volatility without jeopardizing my overall portfolio.

Summary

Long-term Forex trading offers a balanced approach to investing in the Forex market. By focusing on stability, leveraging comprehensive analysis, and practicing disciplined trading, investors can achieve significant returns over time. Continuous learning and adaptation are key to staying successful in the ever-evolving Forex market.

FAQs

What are the benefits of Forex trading for long-term investors?

Long-term Forex trading capitalizes on macroeconomic trends and currency movements, yielding significant returns, diversifying portfolios, and hedging against other investments. It also reduces the impact of short-term market volatility.

How can I manage risk in long-term Forex trading?

To manage risk, diversify across different currency pairs, use leverage cautiously, and set stop-loss orders.

What factors should I consider when choosing currency pairs for long-term Forex trading?

Consider the economic stability and growth consistency of the countries involved, interest rate differentials, and political stability.

How does fundamental analysis apply to long-term Forex trading?

Fundamental analysis evaluates economic indicators, central bank policies, and political events.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.