What Currency Is Worth More Than USD?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Some currencies are worth more than the U.S. dollar:

Kuwaiti Dinar (KWD). Most valuable currency in the world

Bahraini Dinar (BHD). Pegged to USD, strong financial sector

Omani Rial (OMR). Fixed rate, backed by oil exports

Jordanian Dinar (JOD). Stable policy despite no oil wealth

Gibraltar Pound (GIP). Equal to GBP, UK-linked economy

British Pound (GBP). Oldest major currency, globally trusted

Cayman Islands Dollar (KYD). Strong Caribbean currency, finance-driven

Swiss Franc (CHF). Safe-haven currency, low inflation

Euro (EUR). Second most traded globally

The U.S. dollar is used just about everywhere, but it’s not the most valuable. Several currencies trade for more than the U.S. dollar, so you can buy more with them. These currencies come from places with solid economies and steady leadership, and often, natural resources to back them up. In this article, we’ll look at the world’s most powerful currencies, why they matter and hold value, and why the U.S. dollar isn’t at the top of the list. Understanding these currencies can help you choose smartly when you travel, invest, or deal across borders.

Top currencies that are worth more than the U.S. Dollar

While the U.S. dollar is a powerful currency, several others surpass it in value. Here are the top strongest currencies based on exchange rates.

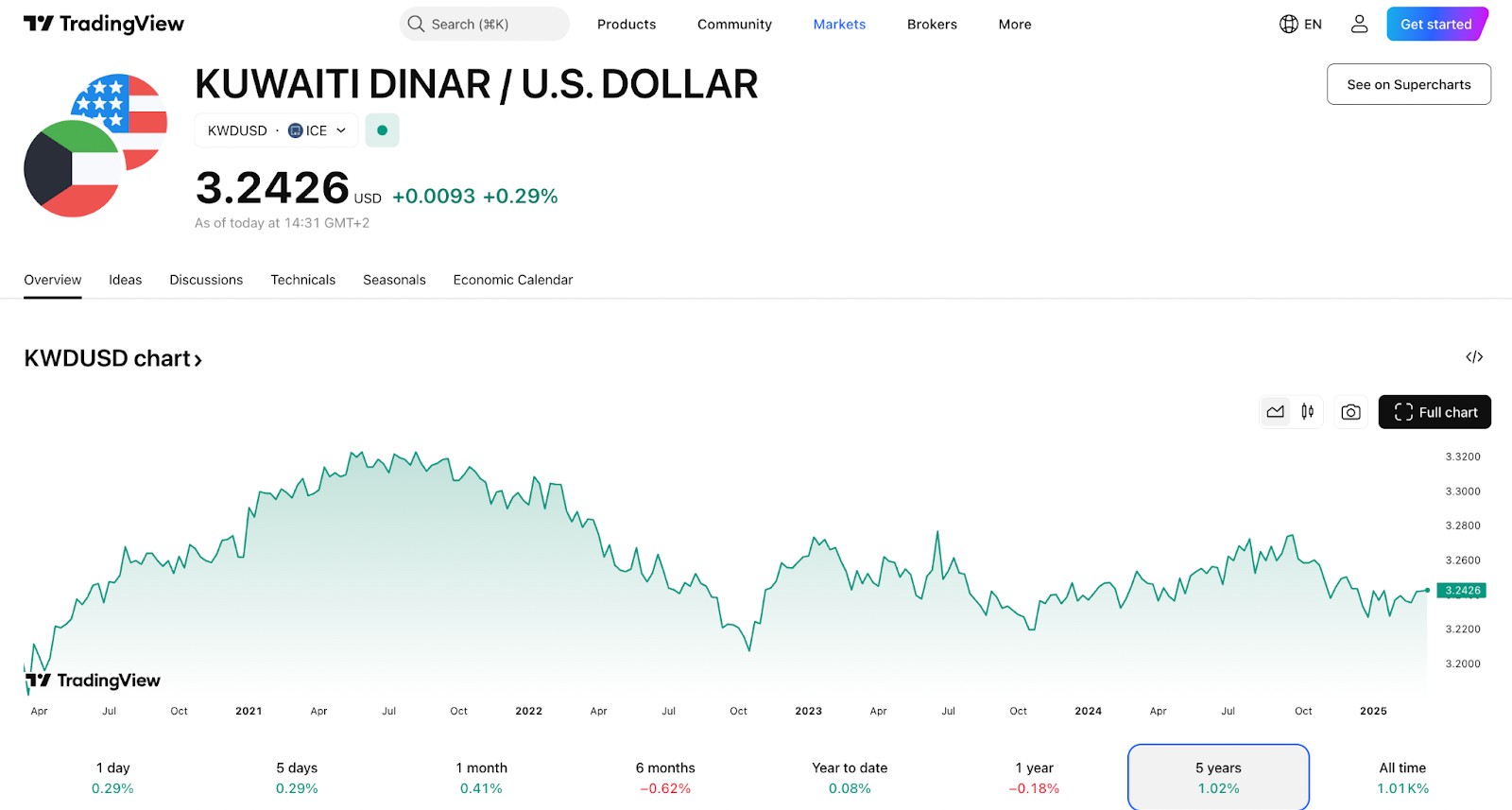

1. Kuwaiti Dinar (KWD)

The Kuwaiti dinar is the highest-priced currency worldwide. Kuwait, a small yet wealthy country, has vast oil reserves, which help keep the economy solid. The currency is linked to a group of major currencies, keeping it steady.

Kuwait has a small population of around 4.3 million, but its huge savings and high income make the dinar exceptionally strong. However, it faces challenges such as dependence on oil exports and the need for economic diversification.

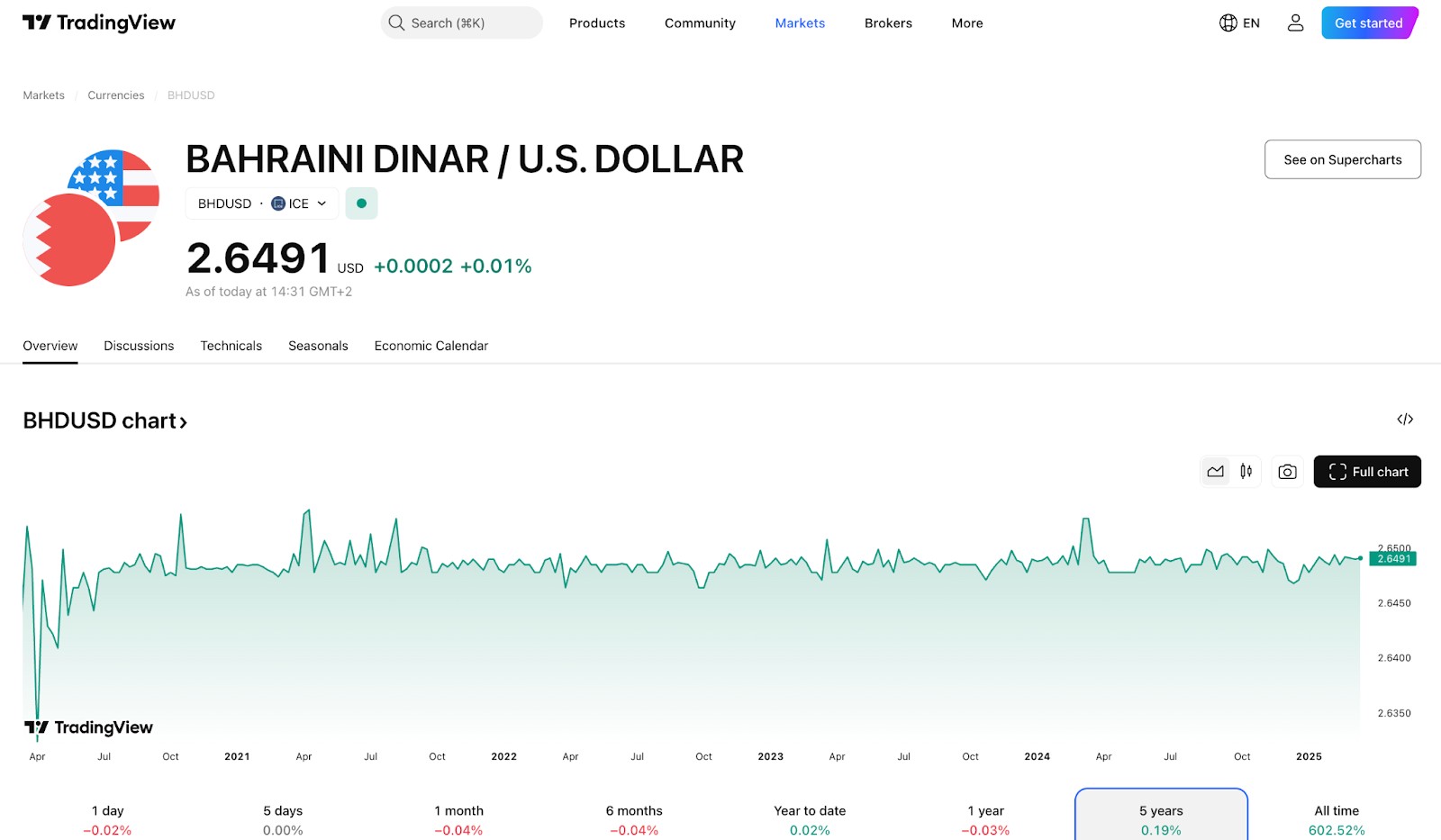

2. Bahraini Dinar (BHD)

The Bahraini dinar is another high-value currency, tied to the U.S. dollar at a rate of 1 BHD = 2.65 USD. Bahrain is a major financial hub in the Middle East, with a reliable banking system that earns trust.

Despite its small population of about 1.5 million, Bahrain has a strategic location and a diversified economy. However, it faces challenges when oil prices swing and an increase in debt levels.

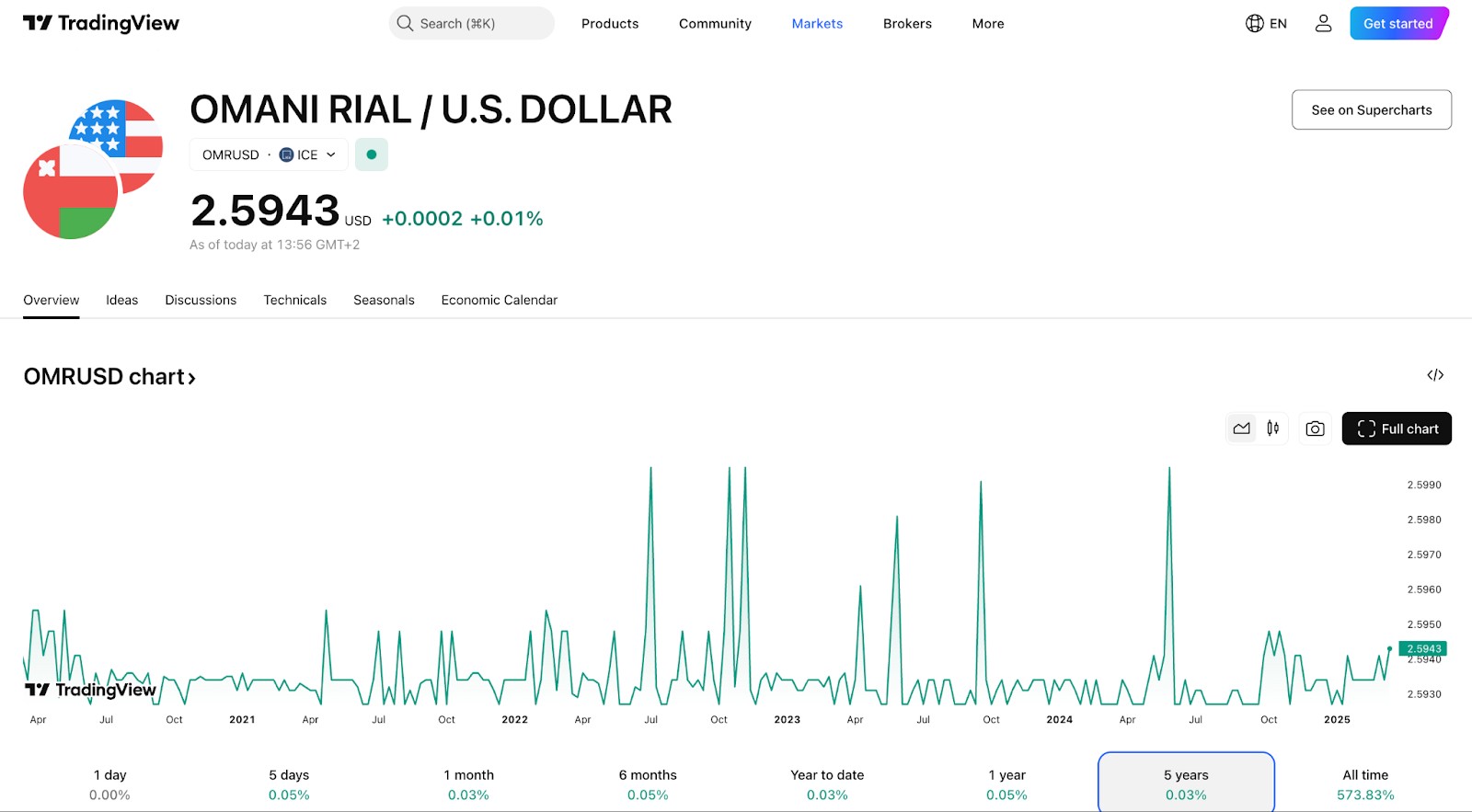

3. Omani Rial (OMR)

The Omani rial is worth more than the U.S. dollar, with a steady rate that helps keep its value high. Oman’s economy relies heavily on oil and gas exports, which support the rial’s strength.

With a population of around 4.5 million, Oman follows solid financial strategies. The country is working on economic diversification, but challenges include reliance on hydrocarbons and regional competition.

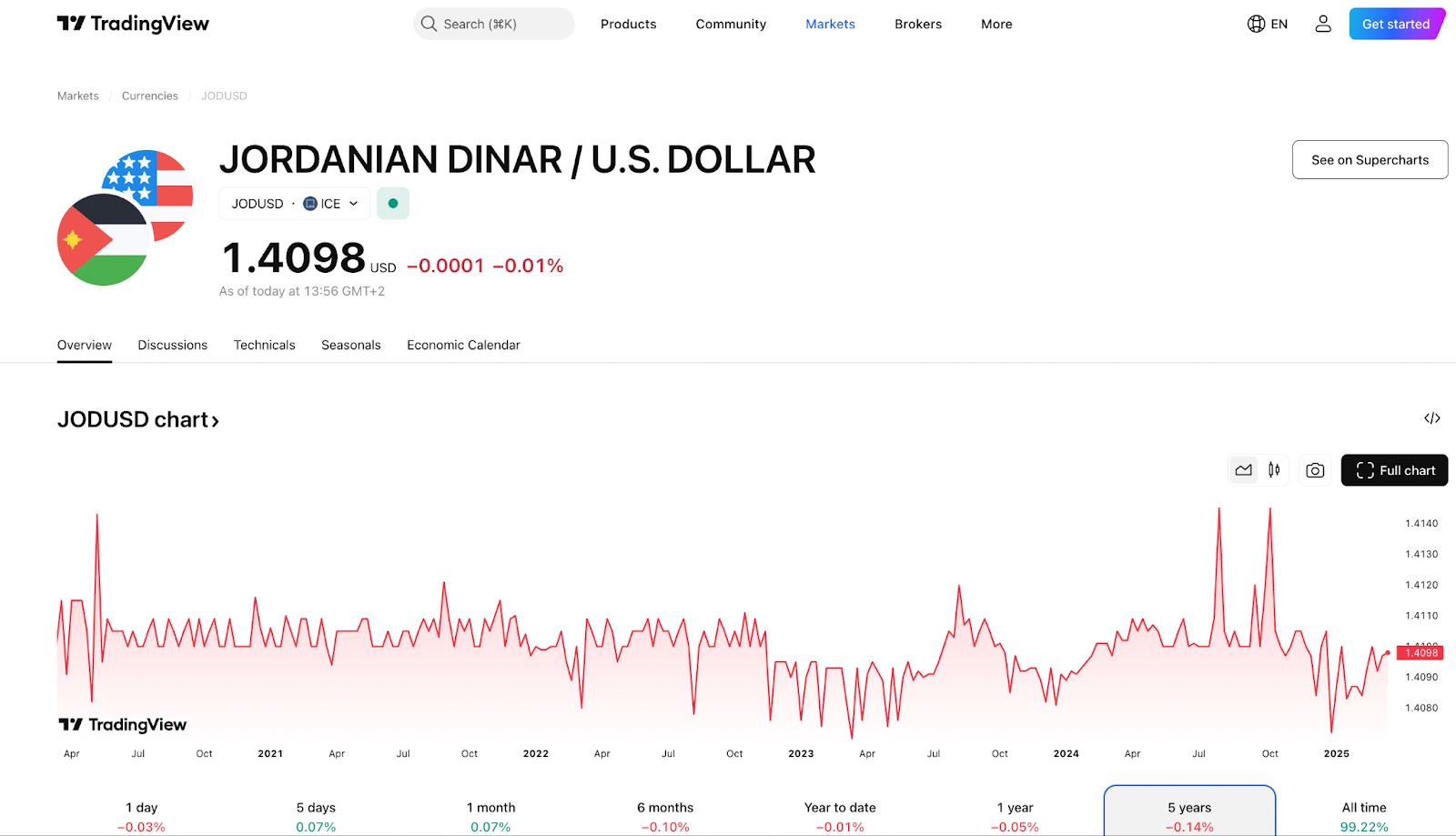

4. Jordanian Dinar (JOD)

The Jordanian dinar is not backed by vast oil reserves but stays strong thanks to its steady exchange rate and reliable economic plans. Jordan has a reliable banking system that earns trust.

Despite a population of about 11 million, Jordan faces economic struggles such as high public debt and unemployment. However, its strategic location and strong trade partnerships help keep its currency steady.

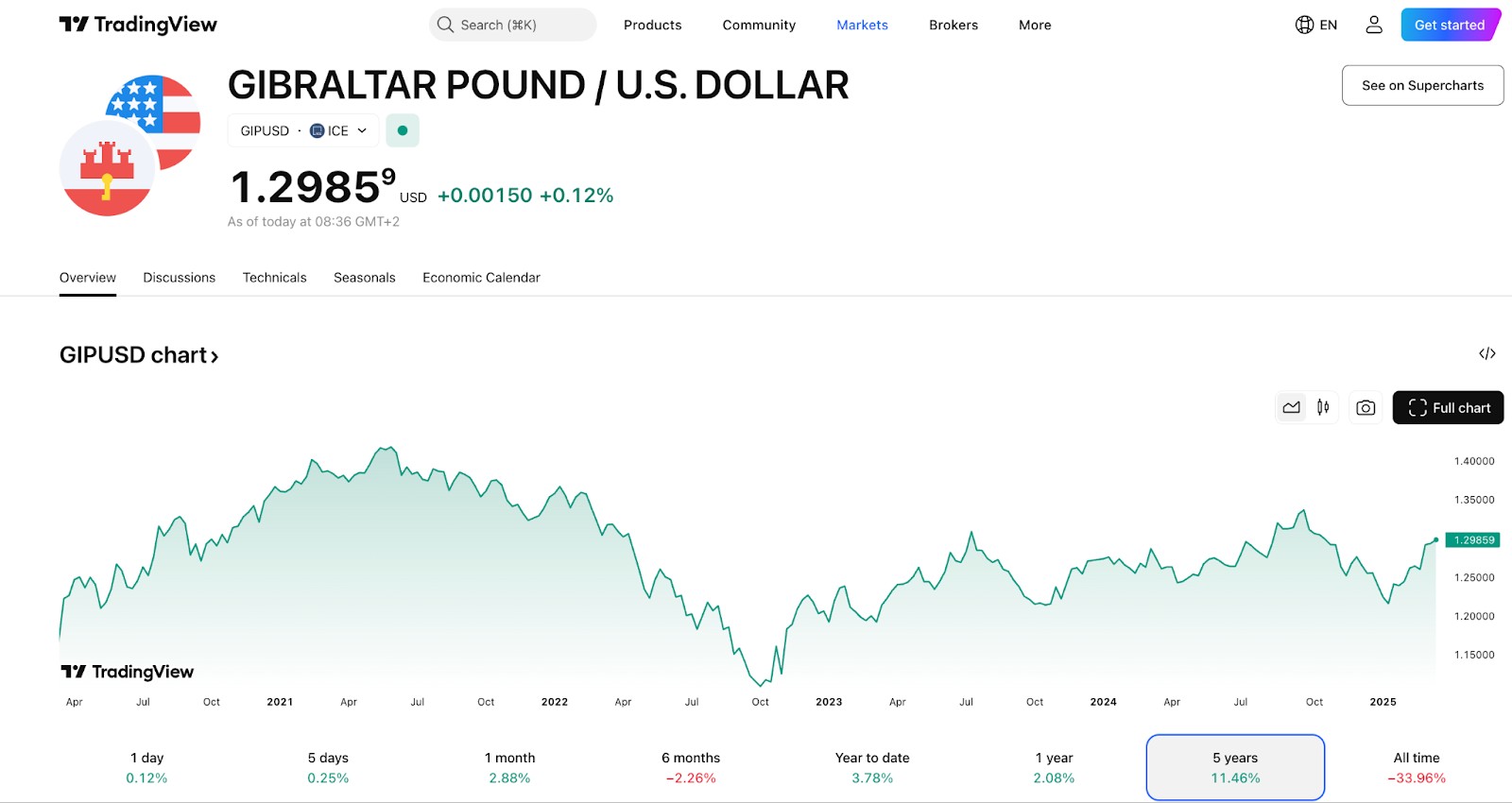

5. Gibraltar Pound (GIP)

Gibraltar’s currency is tied to the British pound at a 1:1 ratio, making it just as valuable. Gibraltar has a small but stable economy based on tourism, shipping, and financial services.

Although the population is only about 34,000, its strong connection to the UK and controlled monetary policy keep the currency stable.

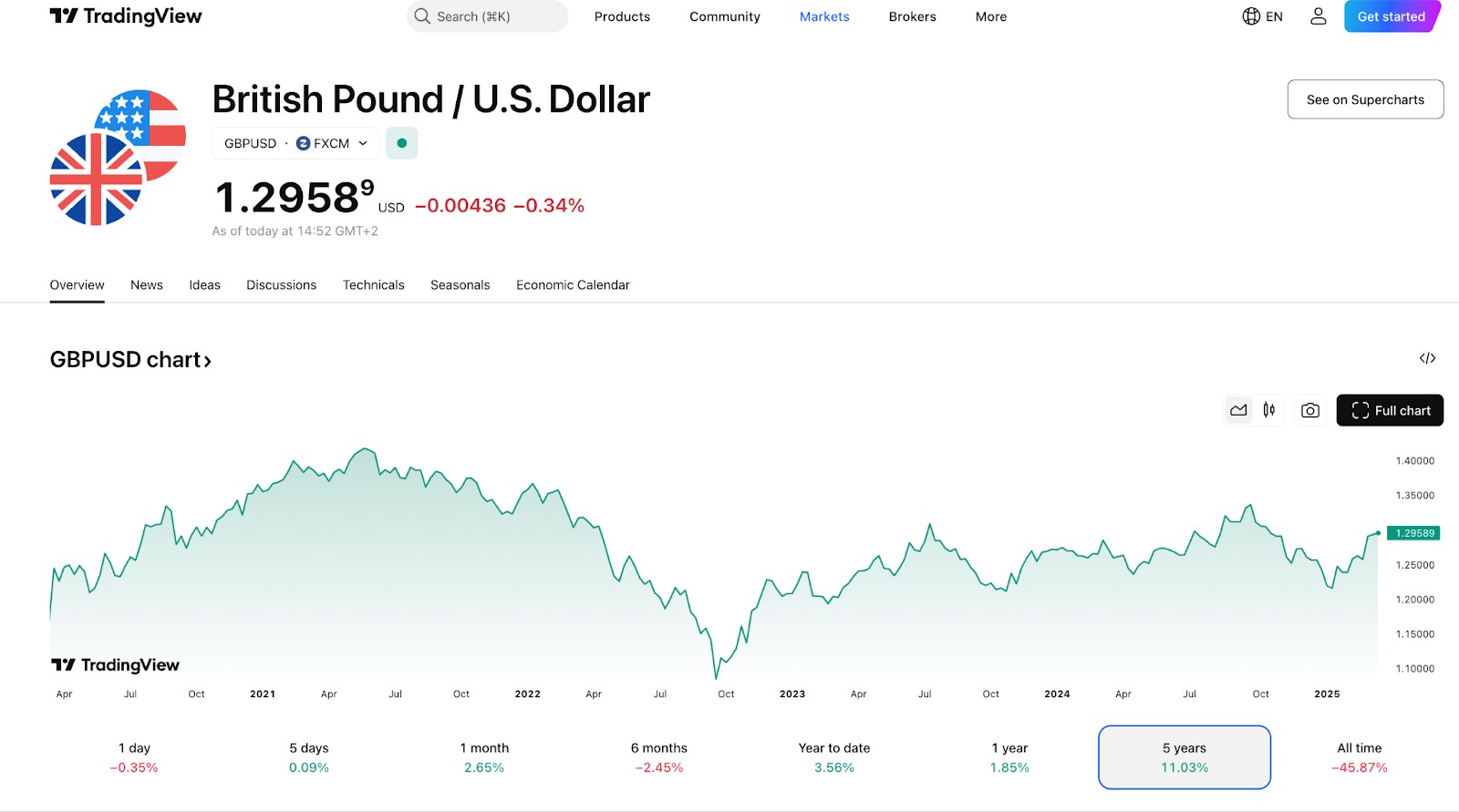

6. British Pound Sterling (GBP)

The British pound is one of the oldest and most traded currencies in the world. The UK has a broad economy, a major finance hub, and global reach, making GBP valuable.

With a population of over 67 million, the UK maintains strong financial markets. However, challenges such as Brexit-related economic shifts and inflation have affected the pound in recent years.

7. Cayman Islands Dollar (KYD)

The Cayman Islands dollar is one of the strongest currencies in the Caribbean, mostly because of finance and offshore banking.

With a population of around 70,000, the Cayman Islands’ economy gains an edge from its tax setup. However, reliance on financial services can be hit by global rules.

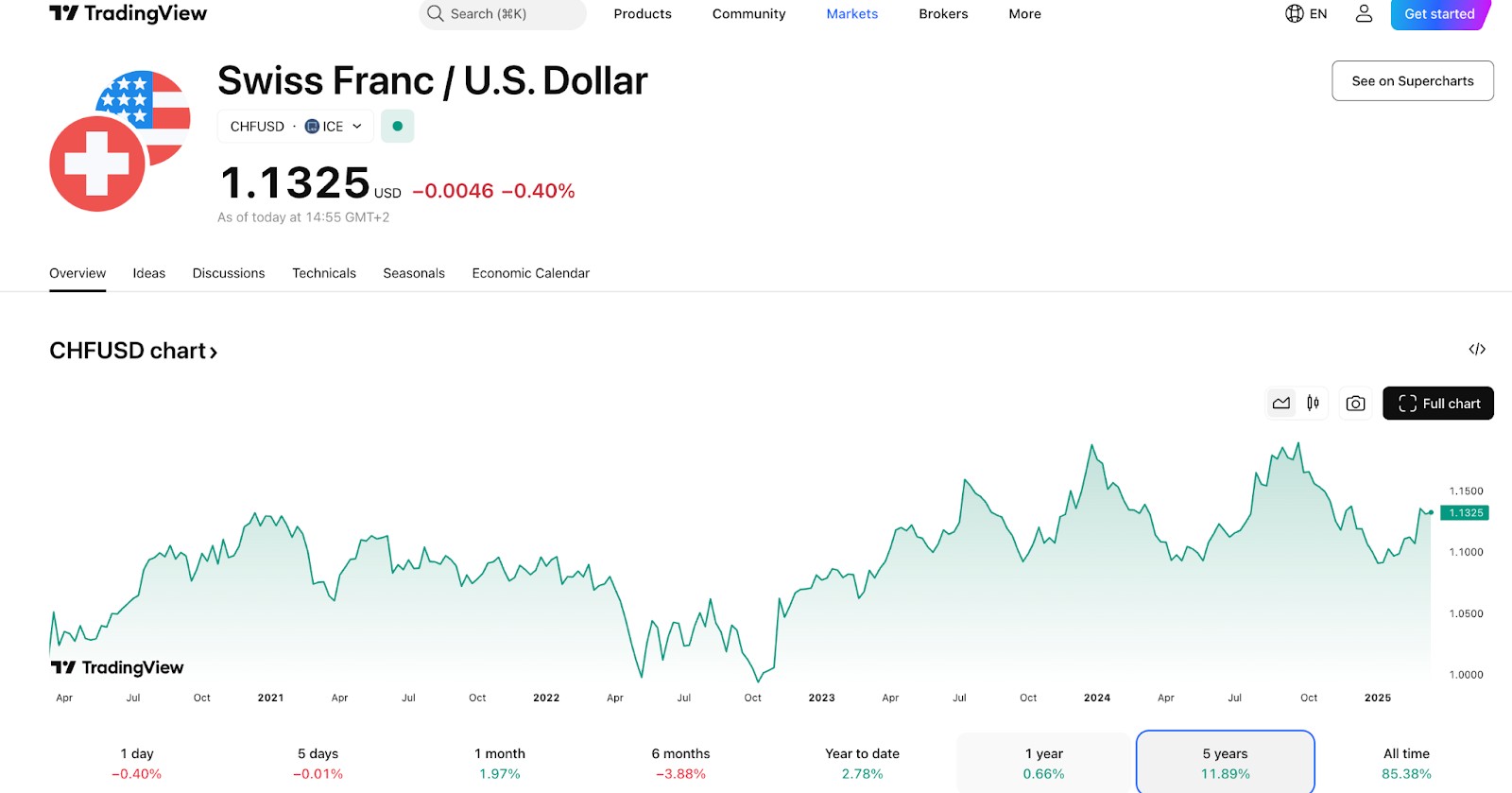

8. Swiss Franc (CHF)

Switzerland’s currency is trusted as a safe option because of its strong economy, reliable banks, and low inflation.

With a population of about 8.7 million, Switzerland keeps its buying power strong. Challenges include negative interest rates and export competition.

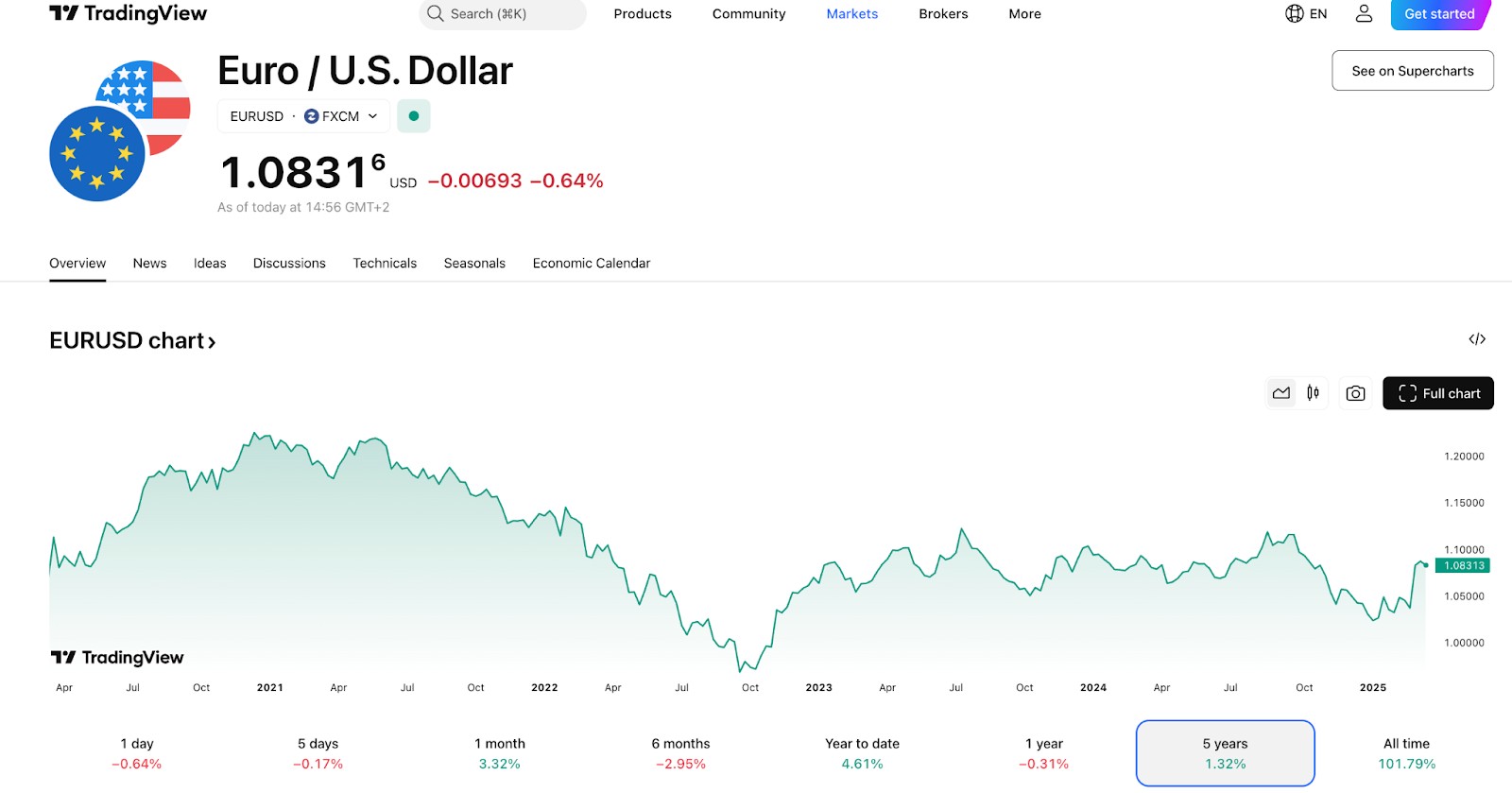

9. Euro (EUR)

The euro is used by 20 countries and is the second most traded currency globally. The European Central Bank manages its monetary policy, which helps keep things steady.

With a combined population of over 340 million, the euro still plays a big role. Economic differences among member countries can be tough to manage.

What makes a currency strong?

A strong currency has a high exchange rate compared to others, remains stable over time, and is backed by a country with a strong economy, high demand, and controlled inflation.

During the 2008 financial meltdown, the Swiss Franc (CHF) gained over 20% against the euro as investors fled to safety. Why? Because Switzerland’s central bank held one of the highest ratios of foreign reserves per capita in the world — more than $80,000 per citizen at the time. That kind of buffer gives a currency real-world credibility when things get shaky. In fact, strong currencies often act as a proxy for trust — they rise not because their country is booming, but because everyone else looks riskier in comparison.

Another surprising factor? Export pricing power. The Japanese Yen (JPY), despite low interest rates and decades of slow growth, maintains strength because Japanese companies often price goods in yen — especially in tech and automotive sectors. When a country can set the pricing currency in global trade, it creates a built-in demand for its currency regardless of short-term economic conditions.

According to BIS data, over 50% of Asia-Pacific trade is invoiced in yen or yuan, even when neither is the destination currency. That kind of “currency stickiness” in global trade adds invisible strength that most traders overlook.

Why isn’t the U.S. Dollar the strongest?

While the U.S. dollar dominates global trade and is the most widely held reserve currency, its actual exchange rate value is far from the highest. One of the main reasons lies in deliberate undervaluation for strategic competitiveness. The U.S. relies on a weaker dollar to support its massive export sectors — especially tech, agriculture, and energy.

A stronger dollar would make American goods more expensive abroad, hurting global demand. Between 2010 and 2020, the U.S. consistently ranked among the top countries for trade deficits, peaking at a $916 billion goods deficit in 2022. That imbalance reflects long-term policy preference: competitive exports over a currency that flexes purely on paper.

Another overlooked reason is the U.S.'s debt-driven economic model. With over $34 trillion in national debt as of early 2024 and interest payments crossing $1 trillion annually, maintaining a too-strong dollar would strain debt repayments. Countries like Kuwait or Switzerland, whose currencies are stronger, have either far smaller economies or low external debt.

The U.S., meanwhile, uses treasury bond sales to fund obligations — many of which are purchased by foreign investors expecting long-term dollar stability, not short-term strength. A dollar that rises too much could cause foreign holders to pull back, destabilizing bond markets. So ironically, being too strong could make the dollar weaker in the long run.

Does a stronger currency mean a stronger economy?

The idea that a stronger currency always signals a stronger economy doesn’t hold up when you dig deeper. Take Switzerland and Japan — both have strong currencies, but their reasons are totally different.

The Swiss franc (CHF) is considered a "safe-haven" currency, meaning global investors buy it during times of uncertainty — not because Switzerland’s economy is booming, but because it’s stable. Japan, on the other hand, has had a relatively strong yen (until recently) despite chronic low growth, ultra-low interest rates, and sky-high debt-to-GDP ratios (over 260%). In both cases, currency strength has more to do with external investor behavior than internal economic health.

Now flip that idea and look at a booming economy like India. Its GDP growth has often exceeded 6–7% per year for the last decade, but the Indian rupee has steadily depreciated against the dollar. Why? Because rapid growth brings rising imports, energy needs, and inflationary pressures that weigh on the currency. A weaker currency, in this case, actually reflects the demands of a fast-growing economy balancing trade, capital flows, and domestic challenges. Bottom line: currency strength isn’t a scoreboard — it’s a signal, and it only makes sense when read in context.

The future of global currencies

One trend that’s flying under the radar is how central bank digital currencies (CBDCs) are quietly becoming a geopolitical chess piece. As of 2024, over 130 countries — representing 98% of global GDP—are exploring or developing a CBDC. But here’s the kicker: countries like China aren’t just testing digital yuan domestically—they’re embedding it in cross-border pilot programs with Belt and Road Initiative partners.

The goal? Bypass SWIFT and reduce dependency on the U.S. dollar in global trade. This isn’t just innovation — it’s a strategy to redraw financial power lines. If this continues, currencies backed by major economies may no longer rely on traditional clearing systems, creating entire trade loops that exclude Western infrastructure.

Another under-discussed shift is the rise of commodity-tied digital currencies — not stablecoins like USDT, but sovereign-backed digital units tied directly to oil, gas, or even carbon credits. Russia, Iran, and members of BRICS have floated the idea of settling energy trade through such tokens. Imagine a world where barrels of oil are priced and traded using a token backed by a BRICS coalition, not USD.

That could fundamentally change how countries store value and hedge inflation. If even a small percentage of global oil trade shifts to these systems, demand for the U.S. dollar could decline significantly, breaking long-standing assumptions in Forex markets.

If you’re looking to trade Forex, you may do so using one of the best brokers listed below. These are currently the best out there in terms of features.

| Demo | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | No | No | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | No | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | No | 0-15 | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | No | No | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | 1:30 | No | Yes | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA | 6.9 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

High-value currencies can trap beginners in low-yield, hard-to-exit trades

Here’s what most beginners get wrong: they assume that a currency worth more than the U.S. dollar seems more secure to trade. But some of the world’s highest-valued currencies — like the Kuwaiti dinar or Bahraini dinar—are closely managed by governments, so they barely move and offer few chances to profit.

This kind of stability sounds safe, but it also means less action. If you're jumping into Forex hoping to make gains from movement, these currencies can trip you up. A lot of new traders put their money here to play it safe and end up stuck in trades that go nowhere.

Another curveball is liquidity. Currencies like the Omani rial or Brunei dollar aren’t traded much worldwide. Even though they’re technically worth more than the dollar, not many people actually trade them, so it’s hard to buy or sell quickly — especially outside of peak hours.

That leads to big gaps between prices and extra fees. If you’re not prepared for delays and bad pricing when trading, you might lose more than you expected. Just because it’s expensive doesn’t mean it’s worth trading — especially when the market’s that thin.

Conclusion

While the U.S. dollar remains one of the most influential currencies in the world, several others surpass it in value. The strength of a currency depends on multiple factors, including economic stability, inflation control, and global demand. High-value currencies like the Kuwaiti dinar and Bahraini dinar benefit from strong financial policies and resource-backed economies, but they are not necessarily the most widely used or accessible.

Understanding currency strength is crucial for making informed financial decisions, whether you’re investing, traveling, or conducting international business. Exchange rates fluctuate due to market dynamics, and stability often matters more than raw value. By considering both exchange rates and economic resilience, individuals and businesses can better navigate the global financial market.

FAQs

What is the highest-valued currency?

The Kuwaiti dinar is the most valuable, with 1 KWD worth more than 3 USD.

Why is the USD not the strongest?

The SD follows a floating exchange rate, influenced by supply and demand.

Does a stronger currency help the economy?

It helps with imports but can make exports less competitive.

What affects currency strength?

Economic stability, inflation, interest rates, and trade balances influence currency strength.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.